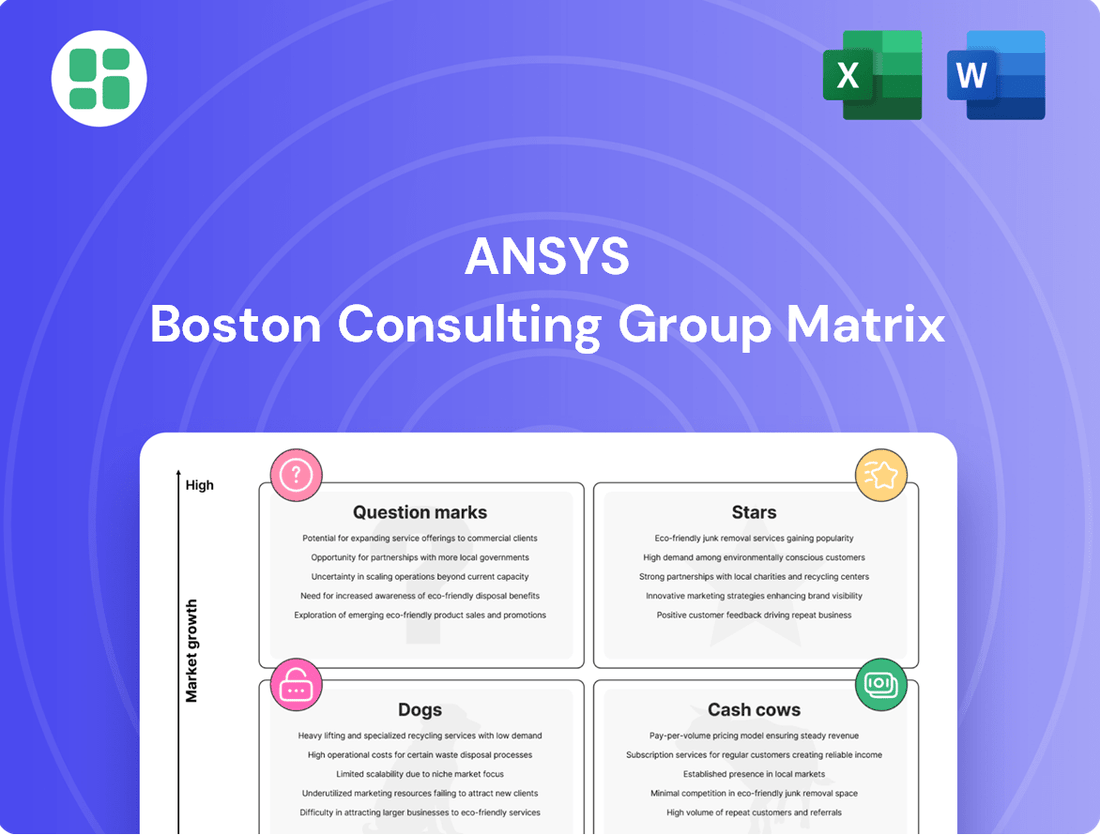

Ansys Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ansys Bundle

Uncover the strategic positioning of this company's product portfolio with our insightful Ansys BCG Matrix preview. See where your investments are generating the most value and where potential challenges lie. Purchase the full BCG Matrix for a comprehensive analysis, including actionable strategies to optimize your product mix and drive future growth.

Stars

Ansys is experiencing robust growth in its High-Performance Computing (HPC) and cloud-based simulation offerings. These solutions are crucial for tackling increasingly complex engineering challenges, particularly in the burgeoning fields of artificial intelligence and digital twins, by providing the necessary computational power and scalability. For instance, Ansys's cloud revenue saw a substantial increase in 2023, reflecting the market's strong adoption of these on-demand simulation capabilities.

Ansys is making significant strides in incorporating AI into its simulation offerings, evident with tools like Ansys SimAI and the recently launched Ansys Engineering Copilot in the 2025 R2 release. These advancements are designed to boost precision, speed up workflows, and automate tasks, enabling engineers to test a wider array of designs and shorten product development cycles.

The market for AI within the simulation sector is experiencing robust expansion, with projections indicating substantial growth in the coming years. This trend strongly positions Ansys as a key player in this rapidly developing and high-potential market segment. For instance, the global AI in simulation market was valued at approximately $1.5 billion in 2023 and is expected to reach over $10 billion by 2030, growing at a CAGR of over 30%.

Ansys is a powerhouse in semiconductor simulation, commanding a significant portion of its revenue from this sector, around 30%. This makes it a key player in the broader simulation market, where it holds over 25% market share.

The company's position is further strengthened by its ongoing acquisition by Synopsys, a leader in Electronic Design Automation (EDA). This strategic move is particularly relevant given the escalating complexity of chip designs driven by AI and high-performance computing demands.

Digital Twin Technology and Predictive Maintenance

The digital twin market is on a remarkable growth trajectory, with projections indicating compound annual growth rates (CAGRs) between 30% and over 40% from 2025 through 2030. Ansys plays a pivotal role in this expansion, offering advanced simulation tools that are fundamental to creating and leveraging digital twins.

Ansys's commitment to this sector is evident through solutions like Ansys TwinAI and its strategic integrations with cloud platforms such as Microsoft Azure Digital Twin. These capabilities are instrumental for real-time asset monitoring, enabling highly accurate predictive maintenance, and driving operational efficiencies across diverse industrial landscapes.

- Digital Twin Market Growth: Expected CAGRs of 30-40%+ from 2025-2030.

- Ansys's Role: Key provider of simulation tools essential for digital twin development.

- Ansys TwinAI: Facilitates real-time monitoring and predictive maintenance.

- Industry Impact: Optimizes operations across various sectors through advanced simulation.

Multiphysics and Integrated Simulation Platforms

Ansys's prowess in multiphysics simulation is a cornerstone of its market position, enabling engineers to model intricate interactions across structural, fluid dynamics, electromagnetics, and thermal domains. This holistic simulation capability is crucial for developing advanced products that must perform reliably under diverse real-world stresses.

The integrated nature of Ansys's platforms streamlines the design and validation process, reducing the need for costly physical prototyping and accelerating time-to-market. This efficiency directly translates into strong financial performance for the company.

Ansys is projected to achieve consistent double-digit Annual Contract Value (ACV) growth for FY 2025, underscoring the increasing demand for its comprehensive simulation solutions. This growth is fueled by industries requiring sophisticated analysis for complex engineering challenges.

- Core Strength: Comprehensive multiphysics simulation capabilities.

- Key Benefit: Predicts design behavior under diverse physical conditions (structural, fluid, electromagnetics, thermal).

- Market Driver: Vital for complex product development, ensuring reliability and performance.

- Financial Outlook: Expected consistent double-digit ACV growth for FY 2025.

Ansys's leadership in high-performance computing and AI-driven simulation places it firmly in the "Stars" quadrant of the BCG matrix. Its cloud offerings and AI tools like SimAI and Engineering Copilot are driving significant revenue growth, with cloud revenue seeing a substantial increase in 2023.

The company's strong position in semiconductor simulation, representing about 30% of its revenue, and its market share exceeding 25% further solidify its Star status. This dominance is amplified by its critical role in the rapidly expanding digital twin market, which is projected to grow at CAGRs of 30-40%+ from 2025 to 2030.

Ansys's multiphysics simulation capabilities are a core strength, enabling complex product development and contributing to its projected double-digit Annual Contract Value (ACV) growth for FY 2025. The ongoing acquisition by Synopsys also signals a strategic alignment with future industry demands.

| Ansys BCG Matrix: Stars | Key Offerings | Market Position | Growth Drivers | Financial Indicator |

|---|---|---|---|---|

| High-Performance Computing (HPC) & Cloud Simulation | AI-driven simulation tools (SimAI, Engineering Copilot) | Leader in semiconductor simulation (30% revenue) | Digital twin market expansion (30-40%+ CAGR) | Double-digit ACV growth (FY 2025 projection) |

| Multiphysics Simulation | Integrated design and validation platforms | Over 25% overall simulation market share | Increasing complexity in AI and HPC chip design | Strong cloud revenue growth (2023) |

What is included in the product

The Ansys BCG Matrix provides a strategic overview of Ansys's product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This analysis highlights which product units warrant investment, divestment, or a hold strategy to optimize Ansys's overall business performance.

Ansys BCG Matrix offers a clear, one-page overview, instantly clarifying business unit positioning to alleviate strategic uncertainty.

Cash Cows

Ansys's core simulation software, like Ansys Mechanical and Ansys Fluent, are firmly established in the market. These products hold significant market share in mature engineering fields, meaning they are already widely used and trusted.

Industries such as aerospace, automotive, and general manufacturing rely heavily on these foundational tools. This broad adoption translates into consistent, high profit margins and substantial cash flow for Ansys, often with less need for aggressive marketing spend.

In 2023, Ansys reported total revenue of $2.2 billion, with its simulation software suites forming the backbone of this figure. The company's focus on these mature, high-demand products solidifies their position as cash cows, providing the financial stability to invest in newer, high-growth areas.

Ansys's maintenance and support services are a prime example of a cash cow. This segment generates a substantial portion of their income through recurring contracts tied to their existing software licenses. These services are characterized by high profit margins and operate within a relatively stable, low-growth market, ensuring a predictable and reliable cash flow for the company.

This consistent revenue stream is crucial. It provides Ansys with the financial flexibility to invest heavily in research and development for their more innovative product lines and to pursue strategic acquisitions. The strong customer retention, often referred to as 'stickiness,' in this service area is a significant financial advantage, underpinning the company's overall stability.

Ansys's established enterprise customer relationships are a prime example of a cash cow. These long-standing ties with major companies across various sectors, who depend on Ansys for vital product development simulations, create substantial customer loyalty. This loyalty translates directly into high retention rates and predictable, recurring revenue, as the expense and complexity of switching engineering software providers are significant deterrents.

The stability provided by these deep relationships in a mature market segment ensures a consistent and reliable cash flow for Ansys. For instance, Ansys reported that approximately 80% of its revenue in 2023 came from recurring sources, underscoring the strength of these long-term customer commitments.

Industry-Specific Solutions for Traditional Sectors

Ansys offers highly specialized simulation software for established industries such as automotive and aerospace & defense. These sectors have long relied on simulation technology, making them mature markets.

Despite potentially slower growth compared to newer technology fields, Ansys's strong market position and unique product suites in these traditional areas guarantee steady revenue and significant cash flow.

- Dominant Market Share: Ansys holds a substantial share in the automotive and aerospace simulation markets, which are critical for product development and validation.

- Consistent Demand: The ongoing need for rigorous testing and design optimization in these sectors ensures a reliable customer base.

- Robust Cash Generation: The maturity and widespread adoption of simulation in these industries translate into predictable and substantial cash flows for Ansys.

- Specialized Offerings: Ansys's tailored solutions address the complex, specific needs of engineers in these demanding sectors, reinforcing their value proposition.

On-Premises Software Deployments

On-premises software deployments represent a significant Cash Cow for Ansys. Despite the growing trend towards cloud solutions, a substantial portion of Ansys's established customer base continues to rely on on-premises installations. This is often driven by the need to manage highly sensitive data or to leverage the immense computational power required for complex simulations, areas where on-premises infrastructure remains critical.

This mature segment consistently delivers robust revenue and stable cash flow for Ansys. Customers in this category typically operate with long-term software licenses and have made considerable investments in their existing on-premises infrastructure, creating a sticky ecosystem that perpetuates demand for Ansys's offerings. For instance, Ansys reported that approximately 70% of its revenue in 2023 was derived from existing customers, a testament to the loyalty and ongoing investment in their established deployments.

- Mature Revenue Stream: On-premises deployments provide a predictable and substantial income source.

- Customer Stickiness: Long-term licenses and infrastructure investments foster customer retention.

- High Computational Needs: Critical for industries requiring intensive simulation capabilities.

- Continued Relevance: Despite cloud growth, on-premises remains vital for sensitive data and performance.

Ansys's core simulation software, like Ansys Mechanical and Ansys Fluent, are firmly established in the market, holding significant market share in mature engineering fields. These products are widely used and trusted, generating consistent, high profit margins and substantial cash flow. In 2023, Ansys reported total revenue of $2.2 billion, with these simulation suites forming the backbone of this figure, solidifying their position as cash cows.

Maintenance and support services, along with established enterprise customer relationships, further bolster Ansys's cash cow status. These segments generate substantial income through recurring contracts and customer loyalty, providing predictable and reliable cash flow. Approximately 80% of Ansys's revenue in 2023 came from recurring sources, highlighting the strength of these long-term commitments.

Ansys's specialized software for mature industries like automotive and aerospace also acts as a cash cow, guaranteeing steady revenue despite potentially slower growth. On-premises software deployments, though a mature segment, continue to deliver robust revenue as a significant portion of their customer base relies on these installations, with about 70% of 2023 revenue derived from existing customers.

| Product/Service Segment | Market Maturity | Revenue Stream | Cash Flow Generation | Key Driver |

|---|---|---|---|---|

| Core Simulation Software (Mechanical, Fluent) | Mature | High, consistent | Substantial | Dominant market share, broad adoption |

| Maintenance & Support Services | Mature | Recurring, predictable | High profit margins | Customer stickiness, recurring contracts |

| Established Enterprise Relationships | Mature | Recurring, high retention | Reliable and stable | Customer loyalty, switching costs |

| Specialized Industry Software (Auto, Aerospace) | Mature | Steady, reliable | Significant | Sector reliance, tailored solutions |

| On-Premises Software Deployments | Mature | Predictable, substantial | Robust and stable | Existing infrastructure, data sensitivity |

What You See Is What You Get

Ansys BCG Matrix

The Ansys BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content; you'll get the complete, analysis-ready report as is. This ensures you can confidently integrate this strategic tool into your business planning or client presentations without any further editing or adjustments. The professional design and comprehensive market analysis within this preview are exactly what you'll be able to leverage for actionable insights.

Dogs

Certain older or highly specialized simulation tools within Ansys's portfolio might be classified as 'dogs' if they target niche markets with limited growth potential and have not gained substantial market adoption. These products often yield minimal revenue while demanding significant support resources, making them prime candidates for divestiture or reduced investment.

For instance, if a legacy simulation product, say a specialized CFD solver for a now-obsolete industrial process, only accounted for 0.2% of Ansys's total revenue in 2024 and saw declining user numbers, it would fit this category. Such products typically have high maintenance costs relative to their contribution, draining valuable resources that could be better allocated to high-growth areas like AI-driven simulation or advanced materials analysis.

Ansys products with limited integration capabilities can be categorized as Dogs in the BCG matrix. These are typically older or niche tools that don't easily connect with other Ansys offerings or essential third-party software. For example, a legacy simulation tool that requires manual data transfer for further analysis would fall into this category.

In today's fast-paced engineering environment, a lack of interoperability is a significant drawback. Companies increasingly rely on integrated workflows to streamline design and analysis processes. Products that cannot seamlessly share data or collaborate with other software risk becoming obsolete, leading to decreased market share and profitability for Ansys.

Consider a scenario where a specialized Ansys simulation module, while powerful on its own, cannot directly import CAD data from widely used platforms like SOLIDWORKS or CATIA without complex workarounds. This friction in the workflow can deter potential customers, especially those already invested in other ecosystems. Such products tie up development resources without generating substantial returns, fitting the profile of a Dog.

If Ansys has acquired companies whose technologies or market positions haven't been effectively woven into its main product lines, or if these acquisitions haven't gained traction in their intended markets, they might be categorized as Dogs. These underperforming units could drain capital on revival efforts with little prospect of becoming market leaders, potentially leading to their sale.

Solutions in Stagnant or Declining Industry Segments

Within the Ansys portfolio, simulation solutions specifically targeting industry segments that are not experiencing growth, or are even shrinking, could be classified as 'dogs.' These are areas where Ansys might not possess a leading market share, making it difficult to gain traction or achieve profitability. For example, if Ansys offered a specialized simulation tool for a niche manufacturing process that has seen a significant decline in demand due to obsolescence, this would likely fall into the 'dog' category.

These 'dog' segments represent limited market potential. Companies operating in these areas may be hesitant to invest in new technologies, or their existing infrastructure might not be compatible with advanced simulation capabilities. This results in a struggle for Ansys to drive sales and expand its customer base in these specific product lines.

- Limited Market Growth: Ansys solutions tied to industries with declining demand, such as certain legacy automotive components or specific types of traditional manufacturing, would face inherent growth limitations.

- Low Market Share: In stagnant sectors where Ansys doesn't hold a dominant position, the investment required to capture market share often outweighs the potential returns.

- Reduced R&D Focus: Resources are typically shifted away from 'dog' products to focus on more promising 'star' or 'question mark' segments, further hindering their development and competitiveness.

- Potential for Divestment: If a particular simulation solution continues to underperform and drain resources without a clear path to improvement, Ansys might consider divesting or discontinuing it.

Non-Core Services or Offerings with Low Scalability

Ansys may offer highly specialized consulting or custom development services that cater to niche client needs. These offerings, while potentially profitable on an individual basis, typically lack the inherent scalability of their core software products. For instance, if a significant portion of Ansys's revenue in 2024 came from bespoke simulation projects for a handful of clients, these could be considered 'dogs' if they represent a small fraction of the company's overall business and demand considerable resource allocation without a clear path for widespread adoption.

These types of offerings often require significant upfront investment in specialized personnel and infrastructure for each client engagement. If these non-core services have a low market share within Ansys's broader portfolio and contribute minimally to the company's strategic growth objectives, they fit the 'dog' quadrant of the BCG matrix. For example, if custom integration services for legacy systems accounted for less than 1% of Ansys's total revenue in 2024, and required dedicated teams that could otherwise be focused on core product development, this would highlight their 'dog' status.

- Low Market Share: These services represent a small percentage of Ansys's total revenue streams.

- Low Growth Potential: The inherent nature of highly customized offerings limits widespread market expansion.

- Resource Intensive: They often require significant investment in specialized talent and time per client.

- Minimal Strategic Contribution: These services do not align with Ansys's primary focus on scalable software solutions.

Ansys products classified as 'dogs' are those with low market share and low growth potential, often legacy or niche tools. These products consume resources without generating significant returns, making them candidates for divestment or reduced investment. For instance, specialized simulation software for obsolete industries or modules with poor integration capabilities fit this description.

In 2024, Ansys continued to refine its portfolio, likely identifying certain older simulation solvers or specialized tools as dogs. These might be products serving shrinking markets, such as those for legacy automotive components or specific traditional manufacturing processes where demand is declining. Such offerings typically have high maintenance costs relative to their revenue contribution.

These 'dog' products often represent a small fraction of Ansys's overall revenue, perhaps less than 1% for individual underperforming modules. Their limited market growth potential and low market share mean that the investment required to revitalize them often outweighs the potential returns, leading Ansys to reallocate resources to more promising areas.

An example could be a specialized computational fluid dynamics (CFD) solver for a niche industrial application that has seen a significant decline in demand. If this product accounted for only 0.5% of Ansys's total revenue in 2024 and required substantial ongoing support, it would clearly fit the 'dog' category, representing a drain on resources that could be better utilized elsewhere.

Question Marks

New AI/ML-driven simulation solutions, such as Ansys SimAI and Ansys Engineering Copilot, are positioned as Stars in the BCG Matrix. Their high growth potential stems from the transformative impact of AI on engineering workflows, promising faster design cycles and more accurate predictions. For instance, Ansys reported a significant increase in customer engagement with its AI-powered tools in early 2024, indicating strong market interest.

Despite this promising outlook, these cutting-edge offerings currently hold a relatively low market share. This is largely because the market is still in the discovery and adoption phase, with potential buyers actively evaluating the benefits and integration of these new technologies. Ansys, like other leaders in this space, is investing heavily in marketing and further development throughout 2024 and into 2025 to educate the market and drive wider adoption, aiming to solidify their position as market leaders.

Ansys's collaboration with IonQ to embed quantum computing in engineering simulations positions them in a high-potential, yet emerging, market segment. This venture targets a future where quantum capabilities could revolutionize complex problem-solving in fields like materials science and fluid dynamics, areas where traditional computing faces limitations.

The current market share for quantum-enhanced engineering simulations is virtually non-existent, reflecting the early adoption phase of quantum technology. For instance, while quantum computing hardware is advancing, widespread commercial application in simulation software is still years away, with the market still in its infancy.

This strategic move places Ansys's quantum computing initiative squarely in the 'Question Mark' quadrant of the BCG matrix. It signifies a significant investment opportunity with the potential for substantial future returns, but also carries the inherent risks associated with pioneering a nascent technology. Continued R&D and strategic partnerships are crucial for its development.

Ansys is actively developing its materials intelligence capabilities, exemplified by Ansys Granta 2025 R2, to address the growing demand for simulating novel materials in fields like tapes, adhesives, and advanced composites. These sectors are experiencing significant expansion, with the global advanced composites market projected to reach $31.7 billion by 2027, indicating substantial opportunity.

While Ansys's overall market presence is strong, its share in these specific, high-growth material simulation niches may still be developing. This presents a strategic imperative for Ansys to invest in further innovation and market penetration to establish a dominant position in these emerging application areas.

Model-Based Systems Engineering (MBSE) Solutions

Ansys is actively strengthening its Model-Based Systems Engineering (MBSE) portfolio, exemplified by the introduction of the System Architecture Modeler Enterprise in its 2025 R2 release. This enhancement aims to streamline workflows, particularly in software prototyping, safety, and cybersecurity integration. The MBSE market is experiencing robust growth, projected to reach approximately $11.5 billion by 2027, demonstrating significant opportunity.

Despite this market expansion, Ansys faces competition from established MBSE providers. To capture a larger market share, Ansys must continue investing in its solutions and clearly articulate their value proposition in this dynamic field. The company's strategic focus on integrating advanced capabilities within its MBSE offerings is crucial for differentiation and market penetration.

- Market Growth: The global MBSE market is expanding rapidly, driven by the increasing complexity of systems and the need for efficient development processes.

- Ansys Enhancements: Ansys's 2025 R2 release, featuring the System Architecture Modeler Enterprise, highlights a commitment to integrating critical workflows like software prototyping and cybersecurity.

- Competitive Landscape: Ansys competes with established players in the MBSE space, necessitating strategic investments to gain market share and effectively communicate its unique value.

- Value Proposition: Demonstrating the comprehensive benefits of Ansys's MBSE solutions is key to capturing a larger portion of the growing market.

Simulation Solutions for New Verticals or Niche Disruptive Technologies

Ansys actively pursues new market frontiers, showcasing this with ventures like its partnership with Mars for advanced packaging simulations. This strategic move into a niche, high-growth area highlights Ansys's approach to building market share in emerging verticals, even starting from a comparatively low base.

These new vertical explorations, such as the development of solutions for hydrogen fuel technology, represent significant potential for disruptive growth. Ansys's investment in these areas is crucial for establishing a strong presence and gaining substantial market traction against established or nascent competitors.

- Niche Market Entry: Ansys targets specific, high-potential segments like advanced packaging and hydrogen fuel technology.

- Strategic Investment: Significant resources are allocated to build market share in these emerging verticals.

- Disruptive Potential: These new solutions aim to revolutionize existing processes and create new markets.

- Growth Trajectory: The focus is on achieving substantial traction and market leadership from a low initial share.

Ansys's exploration into quantum computing for engineering simulations places it in the Question Mark category. This is a high-growth, but currently very small, market. The company is investing in R&D, recognizing the long-term potential for quantum to solve currently intractable problems.

The quantum computing market for simulations is nascent, with virtually no current market share for specialized applications. Ansys is betting on future technological advancements and its ability to integrate these capabilities into its existing simulation platforms. This is a strategic gamble on a disruptive technology.

Ansys's investment in quantum computing is a clear example of a Question Mark. It requires significant capital and research, with the outcome uncertain but potentially transformative for the engineering simulation landscape. Success hinges on both quantum hardware development and Ansys's software integration prowess.

The quantum simulation market is expected to grow significantly, but its current size is negligible. Ansys's commitment reflects a forward-looking strategy to be at the forefront of this technological shift, aiming to capture a dominant share as the market matures.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial statements, industry growth rates, and competitor analysis, to provide a robust strategic overview.