Ansell SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ansell Bundle

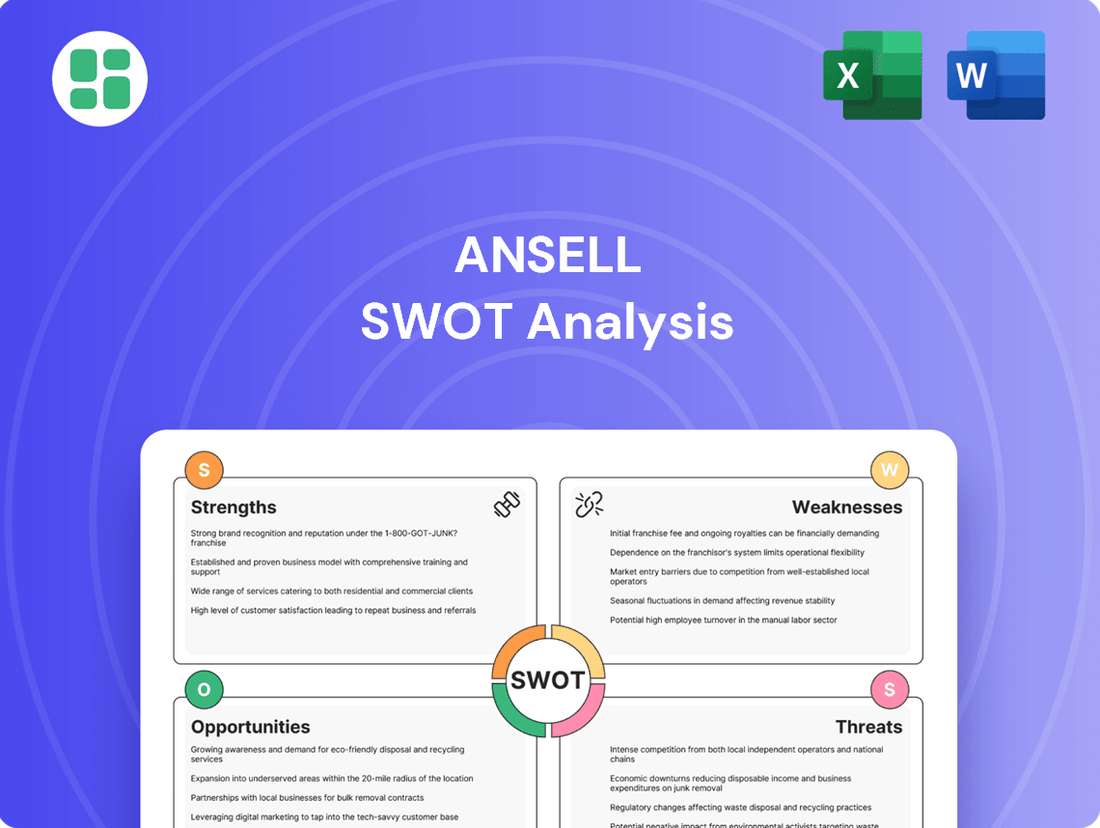

Ansell's market leadership in protective solutions is undeniable, but what truly drives their success and where do future opportunities lie? Our comprehensive SWOT analysis dives deep into their strengths, the competitive landscape, potential threats, and emerging avenues for growth.

Want to understand the full strategic picture behind Ansell's robust performance and navigate the complexities of the personal protective equipment market? Purchase the complete SWOT analysis to gain access to an in-depth, professionally crafted report designed to illuminate actionable strategies for your business.

Strengths

Ansell's global leadership in specialized protection solutions is underpinned by over 130 years of industry experience, fostering a powerful brand reputation. This legacy translates into trust across diverse sectors, solidifying its market standing. The company consistently ranks as a top player in critical global segments, a testament to its enduring quality and market penetration.

Ansell boasts a remarkably diverse product range, encompassing protective gloves, specialized clothing, and essential condoms. This breadth allows them to serve a wide spectrum of industries, from demanding industrial environments to critical healthcare settings and everyday consumer needs, significantly reducing their dependence on any single market segment.

This extensive product diversification acts as a buffer against economic downturns or shifts in demand within a particular sector. For instance, while industrial glove sales might fluctuate, a strong performance in healthcare protective wear can help stabilize overall revenue, as seen in their consistent performance across various segments.

The strategic acquisition of Kimberly-Clark's PPE business in 2020 was a significant move, bolstering Ansell's portfolio with well-regarded brands like Kimtech™ and KleenGuard™. This expansion not only broadened their product offerings but also strengthened their market presence in key protective equipment categories.

Ansell’s commitment to innovation is a significant strength, evident in its consistent introduction of advanced products. The company's robust research and development pipeline ensures it stays ahead of evolving market demands and regulatory requirements, reinforcing its competitive edge.

Notable recent successes include the AlphaTec® 53-002 chemical-resistant glove, recognized with the 2024 Product of the Year Award, and the development of the HyFlex® Ultra-Lightweight Cut Protection Series. These product launches highlight Ansell's ability to create high-performance solutions that address specific industry challenges.

Furthermore, Ansell is actively integrating sustainability into its innovation strategy. By focusing on product designs that utilize recycled content and minimize environmental impact, the company not only meets growing consumer and regulatory demand for eco-friendly options but also positions itself for long-term resilience and market leadership.

Extensive Global Manufacturing and Distribution Network

Ansell boasts an impressive global manufacturing and distribution network, a significant strength that underpins its market position. This expansive reach, covering over 55 countries and supported by more than 15,000 employees, allows for efficient supply chain management and close proximity to a diverse global customer base.

The company's strategic moves, such as the acquisition of KBU, further bolster this global presence. These integrations not only expand Ansell's operational scale but also unlock substantial benefits through combined supply chain efficiencies, enhancing its competitive advantage in the international market.

- Global Footprint: Operations in over 55 countries.

- Workforce: Employs more than 15,000 people worldwide.

- Supply Chain Efficiency: Extensive network enables streamlined logistics.

- Strategic Acquisitions: KBU acquisition enhances scale and efficiency.

Commitment to Sustainability and ESG

Ansell's dedication to sustainability is a significant strength, deeply woven into its business strategy. The company actively prioritizes environmental, social, and governance (ESG) factors across its operations.

This commitment is underscored by ambitious goals, including science-based net-zero targets for its entire value chain by 2040. As of its latest reporting, Ansell achieved a notable 14% reduction in Scope 1 & 2 greenhouse gas emissions and sources 31% of its manufacturing electricity from renewable sources.

- Sustainability Integration: ESG principles are central to Ansell's core business strategy.

- Net-Zero Ambition: Committed to science-based net-zero targets across the value chain by 2040.

- Emissions Reduction: Achieved a 14% reduction in Scope 1 & 2 GHG emissions.

- Renewable Energy Use: Utilizes 31% renewable electricity in its manufacturing operations.

This robust ESG performance not only bolsters Ansell's corporate reputation but also resonates strongly with a growing segment of environmentally and socially conscious consumers and investors, providing a competitive edge.

Ansell's extensive product portfolio, covering industrial and healthcare protective solutions, significantly diversifies its revenue streams. This breadth, encompassing everything from chemical-resistant gloves to surgical gloves and condoms, reduces reliance on any single market. For example, the company's strong presence in healthcare, particularly evident during periods of heightened demand for personal protective equipment, demonstrates its resilience.

The company's commitment to innovation is a key differentiator, consistently leading to the development of advanced products. Recent examples like the AlphaTec® 53-002 chemical-resistant glove winning a 2024 Product of the Year Award highlight this capability. This focus on R&D ensures Ansell remains competitive by addressing evolving industry needs and regulatory landscapes.

Ansell's robust global manufacturing and distribution network is a significant asset, enabling efficient operations across more than 55 countries. This expansive infrastructure, coupled with a workforce exceeding 15,000, facilitates close customer relationships and streamlined logistics, enhancing its competitive market position.

What is included in the product

Provides a comprehensive assessment of Ansell's internal capabilities and external market dynamics, detailing its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable framework for identifying and addressing Ansell's strategic challenges and opportunities.

Weaknesses

Ansell's reliance on key raw materials like natural rubber and nitrile makes it susceptible to price swings. For instance, the price of natural rubber can be significantly influenced by weather patterns and global demand, directly affecting Ansell's production costs. This dependency means that even with pricing adjustments, prolonged volatility in these commodity markets can put pressure on the company's profitability and its ability to maintain competitive pricing.

The personal protective equipment (PPE) market is incredibly crowded, featuring many global and local companies vying for market share. This intense competition, with major players like Honeywell, 3M, and DuPont, puts pressure on Ansell's pricing strategies and necessitates ongoing investment in research and development to stay ahead.

Ansell's extensive global manufacturing footprint and intricate supply chain expose it to significant vulnerabilities from worldwide disruptions. Geopolitical instability, trade disputes, and logistical hurdles can directly impede operations and product availability.

The lingering effects of events like the COVID-19 pandemic serve as a stark reminder of these risks. For instance, the pandemic initially caused Ansell to build up inventory, but this was followed by a period of customer destocking, which negatively impacted sales performance in subsequent periods.

High Regulatory Compliance Burden

Ansell faces a significant hurdle with the high regulatory compliance burden inherent in its operations within the industrial and healthcare sectors. These industries demand adherence to rigorous safety, quality, and environmental standards, which vary considerably across different global markets. For instance, Ansell's products must meet FDA regulations in the United States and CE marking requirements in Europe, among many others.

Meeting these complex and continuously evolving regulations necessitates substantial financial commitment towards compliance infrastructure, extensive testing, and obtaining necessary certifications. This directly impacts operational expenses, potentially increasing the cost of goods sold. Furthermore, any instance of non-compliance can expose the company to considerable legal risks and reputational damage, impacting its market standing and profitability.

- Regulatory Landscape: Ansell operates under strict regulations like FDA approval for medical gloves and REACH compliance for chemical substances in the EU.

- Compliance Costs: Investments in quality assurance, testing, and regulatory affairs teams are substantial, impacting profit margins.

- Evolving Standards: Keeping pace with new environmental and safety standards, such as those related to sustainable materials, requires ongoing adaptation and investment.

- Legal and Reputational Risk: Non-compliance can lead to product recalls, fines, and damage to brand trust, as seen with past industry-wide quality control issues.

Impact of Post-Pandemic Market Normalization

The post-pandemic market normalization has presented a significant challenge for Ansell. While the company saw a surge in demand for its protective equipment during the pandemic, this has since reversed. This shift has resulted in customers reducing their inventory levels, a process known as destocking, which directly impacts Ansell's sales.

This destocking effect has been particularly noticeable in the healthcare sector, a key market for Ansell. Consequently, the company experienced a negative impact on its net income and overall sales performance in fiscal year 2024. Ansell is now focused on navigating this period of adjustment and re-establishing a path towards organic growth.

- Post-Pandemic Destocking: Customer inventory reduction negatively affects sales volumes.

- Healthcare Sector Impact: The healthcare segment has seen a notable decline due to normalization.

- FY24 Financials: Ansell's net income and sales were adversely affected in fiscal year 2024.

- Focus on Organic Growth: The company is strategizing to return to sustainable sales increases.

Ansell's reliance on key raw materials like natural rubber and nitrile exposes it to price volatility, directly impacting production costs and competitive pricing. The company also faces intense competition from established players like Honeywell and 3M, necessitating continuous R&D investment to maintain market position.

Furthermore, Ansell's extensive global operations are vulnerable to disruptions from geopolitical instability and trade disputes, as demonstrated by post-pandemic customer destocking which negatively affected fiscal year 2024 sales and net income, particularly in the healthcare sector.

The company must also navigate a complex and evolving global regulatory landscape, requiring significant investment in compliance, testing, and certifications to meet standards such as FDA approval and CE marking, with non-compliance posing legal and reputational risks.

Full Version Awaits

Ansell SWOT Analysis

This is the same Ansell SWOT analysis document included in your download. The full content is unlocked after payment.

You're viewing a live preview of the actual Ansell SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real Ansell SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Ansell is well-positioned to capitalize on the expansion opportunities in emerging markets, particularly in the Asia-Pacific region. Rapid industrialization and increasing urbanization are fueling a growing demand for protective gear, driven by enhanced manufacturing activity and the implementation of stricter occupational safety regulations. For instance, the Asia-Pacific healthcare gloves market alone was valued at approximately USD 3.5 billion in 2023, with projections indicating continued robust growth.

The demand for technologically advanced and smart protective equipment is growing, with integrated sensors and advanced materials becoming key features. Ansell can capitalize on this trend by expanding its research and development efforts, much like its investment in Inteliforz™ connected safety solutions. This focus on innovation allows for product differentiation and access to higher-value market segments.

The global healthcare sector is experiencing robust growth, driven by an aging worldwide population and heightened awareness of health and hygiene. This trend creates a substantial opportunity for Ansell, particularly in infection prevention where its expertise is paramount.

Ansell is well-positioned to capitalize on this expanding market. Its established leadership in surgical and examination gloves, coupled with the strategic acquisition of KBU's scientific personal protective equipment (PPE) business in early 2024, significantly strengthens its presence in the high-growth life sciences and cleanroom segments. These areas are critical for research and development, further boosting demand for Ansell's specialized products.

Leveraging Sustainability for Competitive Advantage

Ansell's robust sustainability efforts present a significant opportunity to gain a competitive edge. As consumers and regulators increasingly prioritize environmental responsibility, Ansell can highlight its eco-friendly product development and initiatives to attract a growing segment of conscious customers and investors.

The company's proactive approach to reducing greenhouse gas emissions, incorporating renewable electricity into its operations, and designing products with a lower environmental footprint can serve as a powerful differentiator in the market. This commitment resonates with stakeholders who are actively seeking to align their purchasing decisions and investments with their environmental values.

Ansell's sustainability performance, for instance, saw its Scope 1 and 2 greenhouse gas emissions decrease by 22.6% in fiscal year 2023 compared to its 2020 baseline. Furthermore, the company aims to source 50% of its electricity from renewable sources by 2025, a target it was on track to meet as of its latest reporting. This focus on tangible environmental improvements directly translates into a stronger brand image and market appeal.

- Attracting ESG-focused investors: Companies with strong Environmental, Social, and Governance (ESG) ratings, like Ansell's focus on sustainability, often see increased investor interest and potentially lower cost of capital.

- Enhanced brand loyalty: Consumers are increasingly willing to pay a premium for products from companies demonstrating genuine commitment to environmental protection.

- Regulatory advantage: Proactive environmental stewardship can position Ansell favorably against competitors who may face stricter regulations and compliance costs in the future.

- Innovation in materials: Continued investment in sustainable materials and manufacturing processes can lead to new product lines and market opportunities.

Strategic Acquisitions and Partnerships

The Personal Protective Equipment (PPE) market remains somewhat fragmented, creating fertile ground for strategic acquisitions. Ansell can leverage this by acquiring smaller, specialized companies to broaden its product portfolio and gain access to new technologies. For instance, in 2023, the global PPE market was valued at approximately USD 60 billion, with continued growth projected. This presents a significant opportunity for consolidation and expansion.

Ansell's proven ability to integrate acquisitions, as demonstrated by the successful completion of the Karl Büttner GmbH (KBU) acquisition, underscores its strategic capability. This integration not only expanded Ansell's geographic footprint in Europe but also enhanced its offering in industrial safety gloves. Such strategic moves are crucial for unlocking synergistic value and driving market share growth in a competitive landscape.

Partnerships offer another avenue for growth, allowing Ansell to collaborate with complementary businesses. These alliances can facilitate market entry into new regions or product segments without the full commitment of an acquisition. Exploring joint ventures or distribution agreements can accelerate market penetration and share best practices, particularly in emerging markets where localized knowledge is key.

- Market Consolidation: The fragmented PPE market offers opportunities for Ansell to acquire competitors and expand its product range.

- Technological Advancement: Strategic acquisitions can provide access to innovative materials and manufacturing processes, enhancing competitive advantage.

- Geographic Expansion: Partnerships and acquisitions can accelerate Ansell's entry into new and high-growth international markets.

- Synergistic Value Creation: Successful integration of acquired entities, like KBU, demonstrates Ansell's capacity to unlock significant value through M&A.

Ansell is poised to benefit from the increasing demand for advanced healthcare solutions, particularly in infection prevention and life sciences. The company's strategic acquisition of KBU in early 2024 bolstered its presence in high-growth segments like life sciences and cleanrooms, crucial for R&D activities. This expansion, coupled with a global healthcare sector growth trend, presents a significant opportunity for Ansell to leverage its expertise in protective gear.

The company's strong commitment to sustainability offers a distinct competitive advantage. By focusing on eco-friendly product development and operational improvements, such as reducing greenhouse gas emissions by 22.6% in FY2023 against a 2020 baseline and aiming for 50% renewable electricity by 2025, Ansell can attract environmentally conscious consumers and investors. This proactive approach enhances brand loyalty and potentially provides a regulatory edge.

The fragmented nature of the Personal Protective Equipment (PPE) market, valued at approximately USD 60 billion in 2023, presents significant opportunities for Ansell through strategic acquisitions and partnerships. Its proven ability to integrate acquisitions, as seen with KBU, allows for portfolio expansion and technological advancement. Collaborations can also accelerate market entry into new regions, leveraging localized expertise.

| Opportunity Area | Market Context (2023-2025 Data) | Ansell's Strategic Advantage |

|---|---|---|

| Emerging Markets & Industrialization | Asia-Pacific healthcare gloves market: ~USD 3.5 billion (2023), with strong growth projections. Increased manufacturing and safety regulations drive demand. | Well-positioned due to growing demand for protective gear in rapidly industrializing regions. |

| Technological Advancement & Innovation | Growing demand for smart protective equipment with integrated sensors. | Investment in R&D for connected safety solutions (e.g., Inteliforz™) enables product differentiation and higher-value market access. |

| Healthcare Sector Growth | Global healthcare sector expansion driven by aging populations and hygiene awareness. | Leadership in infection prevention and surgical/examination gloves, strengthened by KBU acquisition in life sciences and cleanroom segments. |

| Sustainability & ESG Focus | Increasing consumer and regulatory emphasis on environmental responsibility. | Eco-friendly product development and operational initiatives (e.g., 22.6% GHG reduction in FY23) attract ESG-focused investors and enhance brand loyalty. |

| Market Consolidation & Partnerships | Global PPE market: ~USD 60 billion (2023), with ongoing consolidation. | Ability to acquire smaller firms to broaden product lines and access new tech; partnerships for market entry and best practice sharing. |

Threats

Global economic instability and downturns pose a significant threat by curbing industrial activity and consumer spending, directly impacting demand for Ansell's protective and healthcare products. For instance, Ansell experienced customer destocking in FY24, a direct consequence of economic uncertainty and its effect on purchasing patterns.

A slowdown in crucial industrial sectors or budget constraints within healthcare systems can translate into reduced sales volumes and profitability for Ansell. This was evident in the company's FY24 performance, where cautious customer behavior due to economic headwinds led to inventory adjustments.

The personal protective equipment (PPE) market is incredibly crowded, with Ansell facing constant pressure from established players and emerging companies, especially those based in lower-cost regions. This intense competition often translates into significant price wars, which can squeeze profit margins for everyone involved.

For Ansell, this means a relentless need to innovate and improve operational efficiency just to keep pace. For instance, in fiscal year 2024, Ansell reported a 3.2% decrease in sales to $1.38 billion, partly influenced by competitive market dynamics and a normalization of demand post-pandemic, highlighting the ongoing challenge of maintaining market share and profitability amidst such pressures.

Rising trade protectionism and the imposition of tariffs present a significant threat to Ansell's global operations. These policies can disrupt established supply chains, leading to increased lead times and higher costs for raw materials and finished goods. For instance, the ongoing trade tensions between major economies could directly impact Ansell's ability to source essential components or distribute its products efficiently, potentially squeezing profit margins.

Ansell has acknowledged the potential impact of tariffs, noting plans to mitigate these increases through pricing adjustments. However, this strategy carries the risk of making its products less competitive in price-sensitive markets. If competitors are less affected by tariffs or can absorb costs more readily, Ansell might see a decline in market share. The company's 2023 annual report highlighted the dynamic nature of global trade policies as a key risk factor, underscoring the need for continuous monitoring and strategic adaptation.

Rapid Technological Disruption by New Entrants

Ansell faces a significant threat from rapid technological disruption by new, agile market entrants. While Ansell commits to research and development, a sudden technological leap by a competitor offering more innovative or cost-effective protective solutions could quickly erode market share. This risk is amplified by the pace of innovation in materials science and manufacturing, potentially making current Ansell product lines less competitive or even obsolete if adaptation is not swift enough.

For instance, the medical glove market, a core area for Ansell, has seen continuous innovation. In 2024, companies are focusing on biodegradable materials and advanced barrier technologies. A breakthrough in these areas by a smaller, more nimble competitor could present a substantial challenge. Ansell's ability to integrate such advancements into its production lines and marketing strategies will be crucial for maintaining its leadership position.

- Material Science Advancements: Competitors may introduce novel materials offering enhanced protection, comfort, or sustainability, potentially disrupting Ansell's established product lines.

- Agile Innovation Cycles: Smaller, specialized firms can often innovate and bring new technologies to market faster than larger, established companies, creating a competitive disadvantage.

- Cost-Effective Production: New entrants might leverage disruptive manufacturing technologies to offer similar or superior products at significantly lower price points, pressuring Ansell's margins.

Supply Chain Volatility and Geopolitical Instability

Ansell faces significant threats from ongoing geopolitical tensions and regional conflicts, which can disrupt its global manufacturing and distribution networks. Events like the Red Sea shipping disruptions in early 2024, for instance, led to increased transit times and surcharges for many companies, a risk Ansell is not immune to. These disruptions can cause supply shortages and escalate logistics costs, directly impacting profitability and product availability.

Natural disasters also pose a considerable threat to Ansell's complex global supply chain. The increasing frequency and intensity of such events, as observed with severe weather patterns impacting key manufacturing regions, can lead to production delays and damage to inventory or facilities. Maintaining resilience and agility within this intricate network is a constant challenge, especially as global trade patterns remain susceptible to unforeseen shocks.

- Geopolitical Tensions: Ongoing conflicts and trade disputes create uncertainty, potentially affecting raw material sourcing and finished goods distribution for Ansell.

- Supply Chain Disruptions: Events such as port congestion or regional instability can lead to increased lead times and higher transportation expenses, impacting Ansell's operational efficiency.

- Natural Disasters: Adverse weather events in key production or logistics hubs can halt operations, causing significant financial losses and delays in product delivery.

- Rising Logistics Costs: The combined effects of geopolitical instability and supply chain bottlenecks are driving up freight rates, directly impacting Ansell's cost of goods sold.

Ansell faces substantial threats from intensifying competition, particularly from lower-cost manufacturers, which can lead to price erosion and reduced profit margins. For example, the company's sales in FY24 saw a decline, partly attributed to market normalization and competitive pressures.

Global economic instability and trade protectionism are significant risks, impacting demand and increasing operational costs. Ansell's FY24 performance reflected cautious customer spending due to economic headwinds, and the company has noted plans to adjust pricing to mitigate tariff impacts.

Rapid technological advancements by competitors could disrupt Ansell's market position, especially in areas like medical gloves where innovation in materials and production is ongoing. The company's ability to adapt quickly to these changes is crucial for maintaining its competitive edge.

Geopolitical tensions and natural disasters pose ongoing threats to Ansell's global supply chain, leading to potential disruptions, increased logistics costs, and delivery delays. The Red Sea shipping disruptions in early 2024 serve as a recent example of such vulnerabilities.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Ansell's official financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded and actionable strategic overview.