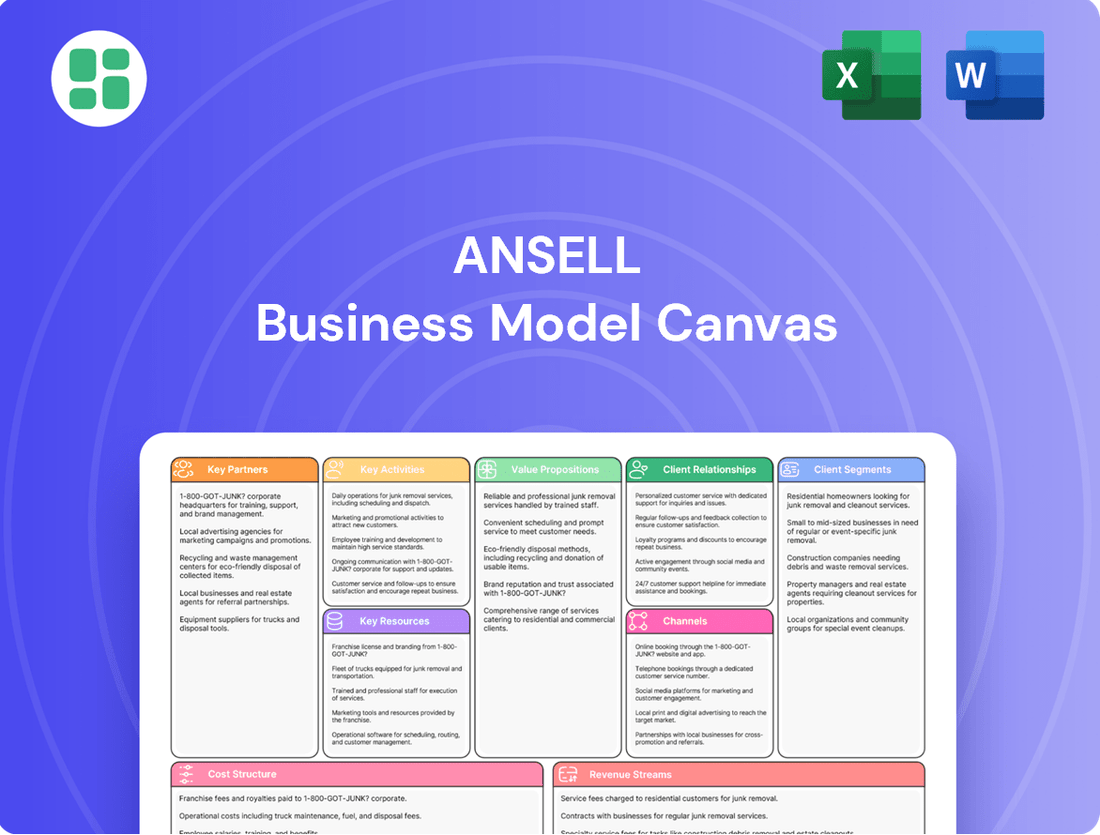

Ansell Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ansell Bundle

Unlock the strategic DNA of Ansell with our comprehensive Business Model Canvas. This detailed analysis breaks down how Ansell creates, delivers, and captures value, offering a clear roadmap to their success. Discover their customer segments, revenue streams, and key partnerships to fuel your own business strategy.

Partnerships

Ansell actively pursues strategic acquisitions to enhance its product range and market presence. A prime example is the acquisition of Kimberly-Clark Corporation's PPE business (KBU) in July 2024, a move that significantly bolstered Ansell's standing in critical scientific sectors.

This strategic move broadened Ansell's product portfolio, particularly strengthening its offerings for laboratories, cleanrooms, and industrial manufacturing settings. The integration of KBU's operations is expected to drive growth and expand Ansell's global footprint.

Ansell’s key partnerships with raw material suppliers are foundational, ensuring a steady flow of critical inputs like natural rubber latex and nitrile butadiene rubber. In 2024, Ansell continued to emphasize diversification within its supplier network to mitigate risks and secure competitive pricing for these essential components, vital for its extensive range of healthcare and industrial gloves.

Ansell leverages a vast global network of distributors, resellers, and specialized channel partners to ensure its safety solutions reach a wide array of customers in industrial, healthcare, and consumer sectors. These collaborations are crucial for expanding market reach and ensuring efficient product delivery worldwide.

In 2024, Ansell's commitment to its distribution network remained strong, with a significant portion of its revenue generated through these indirect sales channels, underscoring their importance for market penetration and logistical operations.

These partnerships are fundamental not only for sales but also for providing essential localized support, technical expertise, and tailored solutions to meet the specific needs of diverse customer segments in various regions.

Technology and Innovation Collaborations

Ansell actively pursues technology and innovation collaborations with leading research institutions and specialized technology providers. These partnerships are crucial for developing next-generation protective solutions, focusing on novel materials, advanced designs, and the integration of smart technologies. For instance, collaborations in 2024 are driving advancements in biodegradable packaging materials and enhancing product performance through smart sensor integration for real-time monitoring.

These strategic alliances allow Ansell to tap into external expertise and cutting-edge research, accelerating the pace of innovation. By working with industry experts, Ansell ensures its product development aligns with emerging market needs and regulatory landscapes. This focus on innovation is reflected in Ansell's R&D spending, which aims to maintain its competitive edge in the global safety market.

- Research Institution Partnerships: Collaborating with universities and specialized labs to explore new material science and ergonomic design principles.

- Technology Provider Alliances: Partnering with electronics and software firms to integrate smart features into protective gear, such as biosensors or connectivity modules.

- Industry Expert Engagement: Consulting with safety professionals and end-users to co-create solutions that address specific workplace hazards and improve user experience.

- Sustainability Focus: Joint initiatives with packaging specialists to develop eco-friendly and recyclable packaging solutions, aligning with global environmental goals.

Industry Associations and Regulatory Bodies

Ansell actively partners with industry associations to stay ahead of evolving workplace safety standards and best practices. For instance, their involvement in groups like the International Safety Apparel Coalition (ISAC) allows them to contribute to the development of new safety guidelines, ensuring their products meet and exceed emerging requirements. This collaboration is crucial for navigating the complex global regulatory environment, particularly as Ansell operates in over 100 countries.

Engagement with regulatory bodies is paramount for Ansell to ensure product compliance and market access. They actively monitor and adapt to regulations such as the European Union's Personal Protective Equipment (PPE) Regulation (EU) 2016/425, which sets stringent standards for safety equipment. In 2024, Ansell continued its focus on ensuring all its products sold within the EU met these updated requirements, demonstrating their commitment to legal and safety compliance.

- Industry Association Engagement: Ansell collaborates with key industry bodies to shape safety standards and gain insights into market trends.

- Regulatory Compliance: Partnerships ensure adherence to diverse international safety regulations, facilitating market entry and continued operations.

- Workplace Safety Promotion: Participation in initiatives with these organizations helps advance the broader agenda of workplace health and safety globally.

- Navigating Global Markets: These alliances are vital for understanding and complying with varying safety requirements across different regions.

Ansell's strategic acquisitions, like the July 2024 purchase of Kimberly-Clark Corporation's PPE business (KBU), significantly bolster its presence in scientific sectors and expand its product offerings for laboratories and cleanrooms.

Key partnerships with raw material suppliers, such as those for natural rubber latex and nitrile butadiene rubber, are critical for ensuring a consistent supply chain, with Ansell diversifying its supplier base in 2024 to secure competitive pricing and mitigate risks.

The company relies heavily on its extensive global network of distributors and resellers, which in 2024 continued to be a primary revenue driver, facilitating market penetration and efficient product delivery across industrial, healthcare, and consumer markets.

Ansell also actively engages in technology and innovation collaborations with research institutions and specialized providers, aiming to develop next-generation protective solutions, including advancements in biodegradable materials and smart sensor integration, as seen in their 2024 initiatives.

What is included in the product

A detailed framework outlining Ansell's approach to customer relationships, revenue streams, and key resources to deliver innovative safety solutions.

Provides a clear, visual framework to dissect complex business strategies, enabling rapid identification of inefficiencies and opportunities for improvement.

Activities

Ansell's commitment to Research and Development is a cornerstone of its strategy, driving the creation of cutting-edge protective solutions. In 2024, the company continued to focus on developing advanced materials and technologies to meet evolving safety demands and customer requirements.

Key R&D efforts in 2024 have yielded significant innovations, such as the introduction of sustainable packaging solutions like SMART Pack, designed to reduce environmental impact. Furthermore, Ansell has advanced its offerings in chemical-resistant gloves, enhancing protection for workers in hazardous environments.

Ansell's key activities center on the design, development, and manufacturing of protective goods like gloves, apparel, and condoms. This vast operation spans 14 global manufacturing sites, ensuring a broad reach and diverse product portfolio.

The company prioritizes efficient production processes and stringent quality control across all its facilities. This commitment to excellence is crucial for maintaining the high standards expected of protective wear.

Furthermore, Ansell is actively integrating sustainable manufacturing practices. For instance, new plants are being designed with features like zero liquid discharge, reflecting a dedication to environmental responsibility in their production.

Ansell's key activities heavily involve managing its intricate global supply chain. This encompasses everything from sourcing raw materials worldwide to ensuring finished goods reach customers in over 100 countries. In 2024, Ansell continued to focus on optimizing these complex logistics and inventory systems.

A significant aspect of this is building resilience. Given the inherent vulnerabilities in global trade, Ansell actively works to mitigate risks and ensure continuity of supply, a crucial element for maintaining market presence and customer satisfaction in a dynamic economic environment.

Sales, Marketing, and Brand Building

Ansell drives growth through robust sales and marketing, showcasing brands such as HyFlex, Microflex, and AlphaTec to capture market share. Their strategy involves direct sales teams, targeted digital campaigns, and active participation in industry trade shows to cultivate brand awareness and customer loyalty.

In 2024, Ansell continued to invest in these areas, with marketing expenses supporting the launch of new product lines and expansion into emerging economies. Digital marketing efforts saw a significant uptick, focusing on e-commerce channels and social media engagement to reach a broader customer base.

- Brand Promotion: Ansell actively promotes its key brands, including HyFlex and Microflex, through various marketing channels.

- Market Penetration: Strategies focus on entering and expanding presence in new geographical markets.

- Sales Channels: Utilizes a mix of direct sales, digital marketing, and industry event participation.

- Customer Engagement: Aims to build strong brand recognition and foster lasting customer loyalty.

Post-Sales Support and Customer Service

Ansell's commitment to post-sales support and customer service is a cornerstone of its business model, fostering loyalty and ensuring product effectiveness. This includes offering robust technical assistance and comprehensive customer education programs designed to maximize the value customers derive from Ansell’s protective solutions.

Key activities in this area are vital for customer satisfaction and long-term retention. For instance, AnsellGUARDIAN Safety Assessment provides tailored evaluations, while AnsellCARES Healthcare Education offers critical knowledge transfer. These initiatives not only ensure proper product usage but also empower customers to optimize their safety protocols and achieve better outcomes.

- Technical Assistance: Providing expert guidance on product selection, application, and troubleshooting to address specific customer needs and challenges.

- Customer Education: Delivering training and resources, such as the AnsellGUARDIAN Safety Assessment and AnsellCARES Healthcare Education, to enhance understanding and proper utilization of protective equipment.

- Product Support: Offering ongoing support for product performance, maintenance, and compliance, ensuring customers maintain high safety standards.

- Relationship Management: Building strong customer relationships through responsive communication and proactive problem-solving, leading to increased satisfaction and repeat business.

Ansell's key activities are multifaceted, encompassing the design, development, and manufacturing of protective solutions. This core function is supported by a robust global supply chain management system, ensuring efficient sourcing and distribution. Furthermore, the company actively engages in brand promotion and market penetration strategies, alongside providing crucial post-sales support and customer education.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Design & Development | Creating innovative protective gear. | Continued focus on advanced materials and sustainable packaging (e.g., SMART Pack). |

| Manufacturing | Producing gloves, apparel, and condoms. | Operating 14 global sites with emphasis on efficient processes, quality control, and sustainable practices like zero liquid discharge. |

| Supply Chain Management | Sourcing raw materials and distributing finished goods globally. | Optimizing logistics and inventory, building resilience against global trade vulnerabilities. |

| Sales & Marketing | Promoting brands like HyFlex and Microflex. | Investing in digital marketing, e-commerce, and expansion into emerging economies; marketing expenses supported new product launches. |

| Customer Support | Providing technical assistance and education. | Delivering AnsellGUARDIAN Safety Assessment and AnsellCARES Healthcare Education for proper product utilization and safety protocols. |

Full Version Awaits

Business Model Canvas

The Ansell Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring no discrepancies or surprises. Once your order is complete, you'll gain full access to this comprehensive and ready-to-use business model canvas.

Resources

Ansell's intellectual property, including a robust portfolio of patents and trademarks, underpins its market position. Brands like HyFlex, Microflex, Gammex, and AlphaTec are cornerstones of this, fostering strong recognition and trust across industrial and healthcare markets.

These established brands offer a significant competitive edge, enabling premium pricing and customer loyalty. In 2023, Ansell continued to invest in protecting its innovations, a crucial element for maintaining its leadership in protective solutions.

Ansell's global manufacturing facilities are its backbone, a network of 14 strategically placed sites across Malaysia, Sri Lanka, Thailand, Brazil, China, Lithuania, Portugal, Vietnam, and India. These aren't just buildings; they are the engines driving large-scale production and ensuring regional supply chains can meet demand efficiently.

This extensive manufacturing footprint allows Ansell to produce a vast array of products, from medical gloves to protective clothing, catering to diverse global markets. In 2024, the company continued to leverage these facilities to optimize production costs and maintain competitive pricing, a critical factor in the fast-moving consumer goods and healthcare sectors.

Ansell's skilled workforce is a cornerstone of its business model, comprising over 15,000 employees strategically positioned across more than 55 countries. This global team includes dedicated R&D scientists, innovative engineers, manufacturing specialists, customer-focused sales professionals, and crucial supply chain experts.

The collective specialized knowledge and hands-on skills of these individuals are absolutely essential for Ansell's day-to-day operations and its continuous drive for innovation in protective solutions.

Distribution and Logistics Network

Ansell's distribution and logistics network is a critical component of its business model, ensuring its protective solutions reach customers efficiently across the globe. This expansive network, comprising strategically located warehouses and a sophisticated transportation infrastructure, underpins the company's ability to deliver products on time and with reliability. For instance, in 2023, Ansell reported significant investments in optimizing its supply chain, aiming to reduce lead times and enhance customer service levels, a move that directly impacts its operational effectiveness.

The efficiency of this network is paramount, enabling Ansell to maintain a consistent supply of essential safety products. This operational strength is particularly vital in sectors demanding immediate and dependable access to protective gear. The company's commitment to a strong logistics backbone allows it to navigate complex international trade routes and varying regulatory landscapes, ensuring product availability even in challenging market conditions.

Key aspects of Ansell's distribution and logistics network include:

- Global Warehouse Footprint: Ansell operates a network of warehouses strategically positioned in key regions to serve diverse markets effectively.

- Integrated Transportation Systems: Utilizing a mix of sea, air, and land transport, the company ensures efficient movement of goods from manufacturing sites to customer locations.

- Supply Chain Technology: Investments in advanced logistics software and tracking systems enhance visibility and control over inventory and shipments.

- Resilience and Agility: The network is designed to be adaptable, capable of responding to fluctuations in demand and potential disruptions, as demonstrated by its performance during recent global supply chain challenges.

Proprietary Technologies and Data

Ansell’s proprietary manufacturing technologies are a cornerstone of its business model, allowing for the creation of specialized protective gear. This expertise is complemented by deep knowledge in advanced material science, which is crucial for developing innovative and high-performance products that meet stringent industry demands.

Data-driven insights, particularly from programs like AnsellGUARDIAN, provide a significant competitive edge. These assessments offer valuable information on workplace safety and product effectiveness, enabling Ansell to refine its offerings and provide tailored solutions that directly address customer needs and challenges.

- Proprietary Manufacturing: Enables efficient and specialized production of protective equipment.

- Material Science Expertise: Drives innovation in product performance and durability.

- Data-Driven Insights (AnsellGUARDIAN): Informs product development and customer-specific solutions.

- Competitive Advantage: These resources allow Ansell to differentiate its products and services in the market.

Ansell's key resources are its strong brand portfolio, extensive global manufacturing capabilities, a skilled workforce, and an efficient distribution network. Proprietary manufacturing technologies and data-driven insights further enhance its competitive edge.

The company's intellectual property, including patents and well-recognized brands like HyFlex and Microflex, is vital. In 2023, Ansell continued to invest in innovation protection. Its 14 global manufacturing sites, spread across multiple countries, ensure large-scale production and efficient supply chains, with optimization efforts ongoing in 2024.

With over 15,000 employees in more than 55 countries, Ansell benefits from a diverse, skilled workforce essential for operations and innovation. The company's robust distribution and logistics network, including strategically located warehouses and advanced technology, ensures timely product delivery worldwide. Investments in supply chain optimization were noted in 2023.

Ansell's proprietary manufacturing technologies and material science expertise are critical for producing high-performance protective gear. Programs like AnsellGUARDIAN provide valuable data for product refinement and tailored customer solutions, strengthening its market position.

| Key Resource | Description | 2023/2024 Significance |

|---|---|---|

| Intellectual Property & Brands | Patents, trademarks, and recognized brands (e.g., HyFlex, Microflex) | Underpins market position, premium pricing, and customer loyalty; continued investment in innovation protection. |

| Global Manufacturing Footprint | 14 strategically located manufacturing sites | Enables large-scale production, regional supply chain efficiency, and cost optimization for competitive pricing. |

| Skilled Workforce | Over 15,000 employees across 55+ countries | Essential for daily operations, R&D, manufacturing, sales, and supply chain management; drives innovation. |

| Distribution & Logistics Network | Global warehouses and transportation infrastructure | Ensures efficient, reliable product delivery; optimized in 2023 for reduced lead times and enhanced customer service. |

| Proprietary Technologies & Data Insights | Advanced manufacturing processes, material science, AnsellGUARDIAN | Facilitates specialized product creation, drives innovation, and provides data for tailored customer solutions. |

Value Propositions

Ansell's core value is delivering superior safety and risk mitigation through specialized protective gear. Their solutions are engineered to shield individuals from a wide array of hazards, from infectious agents to dangerous chemicals and physical harm, ensuring peace of mind in demanding work settings.

These offerings are critical for industries where worker safety is paramount. For instance, in healthcare, Ansell's examination gloves are vital in preventing cross-contamination, a constant concern. In 2024, the global market for medical gloves alone was projected to reach over $15 billion, underscoring the immense demand for reliable protection.

Ansell's commitment extends beyond mere protection; their innovative hand protection solutions are meticulously designed to boost worker efficiency. By focusing on enhanced comfort and superior dexterity, these products enable individuals to execute tasks with greater precision and speed, directly contributing to improved overall performance on the job.

Ergonomic designs and specialized features are central to Ansell's value proposition. These advancements are engineered to significantly reduce worker fatigue and improve grip capabilities, allowing for sustained productivity throughout the workday and minimizing errors.

Ansell crafts specialized protective solutions for a broad array of industries, ensuring each sector receives precisely what it needs. This includes critical areas like healthcare, encompassing hospitals, surgical centers, and life sciences, where hygiene and safety are paramount.

Beyond healthcare, Ansell's expertise extends to demanding industrial environments. Think of the automotive sector, chemical processing plants, food production facilities, and the rigorous demands of mining operations. These sectors require robust protection tailored to their unique risks.

This deep industry focus is crucial. For instance, in 2023, Ansell reported that its Healthcare segment generated approximately $1.2 billion in revenue, highlighting the significant demand for specialized solutions in that market alone. Similarly, their Industrial segment also saw robust performance, indicating the value placed on tailored safety measures across various industrial applications.

Quality, Reliability, and Compliance

Ansell's customers, especially in demanding sectors like healthcare and cleanrooms, place immense trust in the company's unwavering dedication to superior quality and dependable product performance. This commitment is not just a promise; it's a foundational element of their business, ensuring that users can rely on Ansell's offerings even in the most critical applications.

The rigorous adherence to international safety standards and regulatory compliance provides a vital layer of assurance. For industries where safety failures can have severe consequences, knowing that Ansell products meet or exceed these stringent requirements is paramount. This compliance is a key driver of customer loyalty and a significant differentiator in the market.

In 2024, Ansell continued to emphasize its quality and compliance frameworks, a strategy that resonates deeply with its target audience. For instance, their commitment to ISO certifications and specific industry regulations, such as those governing medical devices, underpins the reliability customers expect. This focus is critical as global regulatory landscapes evolve, demanding constant vigilance and adaptation from manufacturers.

- Unwavering Quality Assurance: Ansell's products consistently meet high-performance benchmarks, ensuring customer confidence.

- Regulatory Adherence: Compliance with global standards like ISO 13485 for medical devices is a core value proposition.

- Risk Mitigation for Customers: Reliable and compliant products reduce operational risks, particularly in sensitive environments.

- Market Trust and Reputation: A history of quality and compliance builds a strong reputation, attracting and retaining discerning clients.

Sustainability and Environmental Responsibility

Ansell champions sustainability by integrating eco-friendly materials and processes into its product lifecycle. This commitment translates into tangible benefits for customers seeking to minimize their environmental footprint, such as the use of recycled content in packaging and innovative manufacturing techniques that reduce waste. For instance, Ansell's 2023 sustainability report highlighted a 15% reduction in water usage across its manufacturing facilities compared to 2020 benchmarks.

The company actively promotes responsible manufacturing, which not only benefits the environment but also resonates with a growing consumer and business demand for ethical sourcing and production. This focus on environmental stewardship is a key value proposition, attracting partners and customers who prioritize corporate social responsibility.

Ansell's dedication to sustainability is demonstrated through initiatives like:

- Development of products using recycled and renewable materials.

- Implementation of energy-efficient manufacturing processes.

- Reduction of waste and promotion of circular economy principles.

- Transparent reporting on environmental performance metrics.

Ansell's value proposition centers on providing superior safety and risk mitigation through specialized protective gear. Their products are engineered to shield individuals from diverse hazards, ensuring peace of mind in challenging work environments. This commitment is particularly vital in sectors where worker safety is non-negotiable.

The company’s innovative hand protection solutions are designed to enhance worker efficiency by prioritizing comfort and dexterity. This focus allows individuals to perform tasks with greater precision and speed, directly contributing to improved job performance. For example, in 2024, the global market for medical gloves, a key Ansell product category, was projected to exceed $15 billion, reflecting substantial demand for reliable protective equipment.

Ansell's dedication to ergonomic designs and specialized features significantly reduces worker fatigue and improves grip, leading to sustained productivity and fewer errors. Their deep industry focus ensures tailored solutions for sectors like healthcare and demanding industrial environments such as automotive and chemical processing. In 2023, Ansell's Healthcare segment alone generated approximately $1.2 billion in revenue, underscoring the market's reliance on their specialized safety offerings.

Customers, especially in critical fields like healthcare, place immense trust in Ansell's unwavering commitment to quality and dependable performance. This trust is reinforced by rigorous adherence to international safety standards and regulatory compliance, providing crucial assurance. Ansell's continued emphasis on quality and compliance frameworks in 2024, including ISO certifications, solidifies their reputation for reliability in an evolving regulatory landscape.

| Value Proposition | Key Features | Customer Benefit | 2023/2024 Data Point |

|---|---|---|---|

| Superior Safety & Risk Mitigation | Specialized protective gear, hazard shielding | Peace of mind, reduced workplace accidents | Global medical glove market projected over $15B in 2024 |

| Enhanced Worker Efficiency | Comfortable, dexterous designs | Increased precision, speed, and productivity | Ansell Healthcare segment revenue ~$1.2B in 2023 |

| Quality & Regulatory Compliance | High-performance standards, ISO certifications | Trust, reduced operational risk, market differentiation | Continued emphasis on quality and compliance in 2024 |

Customer Relationships

Ansell's Key Account Management (KAM) is central to nurturing deep, enduring partnerships with its most significant clients. These include major players in industrial sectors, extensive healthcare networks, and large-scale distribution partners. This strategic approach ensures tailored support and a proactive understanding of their evolving requirements.

The KAM teams focus on delivering highly personalized service, engaging in joint strategic planning, and developing a granular understanding of each key account's unique operational complexities and business objectives. This dedicated focus is crucial for retaining and growing business with these vital partners.

For instance, Ansell's 2024 performance highlights the success of its KAM strategy, with key accounts demonstrating a consistent growth trajectory, often exceeding general market growth rates. These relationships are built on trust, reliability, and a shared vision for mutual success, contributing significantly to Ansell's overall market stability and revenue generation.

Ansell offers expert technical support and consultation, including services like the AnsellGUARDIAN Safety Assessment. This helps clients pinpoint the best protective gear and refine their safety procedures.

This consultative approach is key to building customer trust and showcasing Ansell's deep industry knowledge. In 2024, Ansell reported a significant increase in customer engagement with these support services, indicating a strong demand for personalized safety solutions.

Ansell provides direct customer service through dedicated helplines and online support portals. This allows customers to get immediate assistance with product inquiries, technical questions, and issue resolution, ensuring a smooth experience. In 2023, Ansell reported a customer satisfaction score of 88% across its key markets, reflecting the effectiveness of these direct support channels.

Educational Programs and Training

Ansell actively engages in customer relationships through robust educational programs and training initiatives designed to enhance product knowledge and promote safety. A prime example is the AnsellCARES Healthcare Education program, which offers vital resources to healthcare professionals. This commitment extends to industrial workers as well, ensuring they understand proper personal protective equipment (PPE) usage and adhere to best safety practices.

These programs are crucial for empowering users, thereby fostering stronger, more informed relationships with Ansell's customer base. By providing this essential knowledge, Ansell not only reinforces the value of its products but also contributes to improved safety outcomes across various industries.

Key aspects of Ansell's educational outreach include:

- AnsellCARES Healthcare Education: Providing specialized training and resources for healthcare professionals on the correct selection and use of medical gloves and protective apparel.

- Industrial Safety Training: Offering programs focused on the safe handling and application of industrial gloves and protective clothing to prevent workplace injuries.

- Digital Learning Platforms: Utilizing online modules and webinars to make educational content accessible to a wider audience, reaching thousands of users globally.

- Partnerships for Education: Collaborating with industry associations and regulatory bodies to develop and disseminate best practice guidelines.

Digital Engagement and Online Resources

Ansell actively cultivates customer relationships through robust digital engagement. Its website serves as a central hub, offering comprehensive product details, safety guidelines, and interactive tools like online product finders. This digital presence allows customers to easily access information and engage with the brand on their own terms, fostering a sense of empowerment and convenience.

Social media platforms are also key to Ansell's customer interaction strategy. By maintaining an active presence, the company can share updates, respond to inquiries, and build a community around its safety solutions. This approach not only broadens its reach but also provides a more personal and accessible channel for customer support and brand loyalty development.

- Website as a Digital Hub: Ansell's website provides extensive product catalogs, safety datasheets, and application guides, enabling customers to make informed purchasing decisions.

- Online Product Finders: Tools that help users select the appropriate Ansell product based on specific industry needs and protection requirements streamline the customer journey.

- Social Media Interaction: Platforms like LinkedIn are used to share industry insights, product innovations, and engage with professional audiences, reinforcing brand expertise.

- Self-Service Capabilities: Digital resources empower customers to find answers and solutions independently, reducing reliance on direct support channels and improving efficiency.

Ansell's customer relationships are built on a foundation of personalized service, expert consultation, and continuous education. Key Account Management (KAM) ensures tailored support for major clients, fostering growth that often outpaces general market trends, as evidenced by 2024 performance data. The AnsellGUARDIAN Safety Assessment exemplifies this consultative approach, with increased customer engagement in 2024 highlighting the demand for personalized safety solutions.

Channels

Ansell leverages its dedicated direct sales force to cultivate deep relationships with major industrial clients, healthcare systems, and life science organizations. This approach enables detailed product showcases and tailored solutions, fostering strong partnerships.

This direct channel is crucial for Ansell's strategy, allowing them to provide expert advice and support, particularly for complex product needs in sectors like healthcare and advanced manufacturing. For instance, in 2024, Ansell's focus on high-value sectors like healthcare contributed to their robust performance, with sales in the healthcare segment showing consistent growth.

Ansell's extensive network of industrial and healthcare distributors and resellers is a cornerstone of its go-to-market strategy, enabling access to a diverse global customer base. These vital partners manage crucial aspects like warehousing, logistics, and navigating local market nuances, ensuring Ansell's products reach end-users efficiently.

Ansell increasingly utilizes e-commerce platforms, such as its dedicated online shop, to offer direct purchasing for select product lines. This strategy is particularly effective for reaching smaller businesses and individual consumers, providing them with a convenient and accessible way to acquire Ansell products. In 2024, Ansell reported continued growth in its digital sales channels, reflecting a broader industry trend towards online procurement.

Healthcare Providers and GPOs

Ansell leverages a dual-channel strategy to serve the healthcare market, directly engaging with hospitals, surgical centers, and clinics. This direct approach allows for tailored solutions and strong relationships within healthcare institutions. In 2024, the healthcare sector continued to be a significant revenue driver for Ansell, with demand for infection control products remaining robust.

Group Purchasing Organizations (GPOs) represent another vital channel for Ansell, facilitating bulk purchasing for a wide network of healthcare providers. These partnerships streamline the procurement process for many facilities. For instance, GPOs often negotiate favorable pricing and ensure consistent supply, which is critical in the fast-paced healthcare environment.

- Direct Sales: Hospitals, surgical centers, and clinics purchase directly from Ansell, enabling personalized service and product customization.

- Group Purchasing Organizations (GPOs): Ansell partners with GPOs to reach a broader customer base through aggregated purchasing power, streamlining institutional procurement.

- Market Penetration: In 2024, Ansell's presence through these channels was instrumental in maintaining its market share in essential healthcare supplies.

Retail (for Consumer Products)

Ansell leverages extensive retail networks for its consumer products, reaching consumers through pharmacies, supermarkets, and mass merchandise stores. This broad accessibility is crucial for items like condoms and household gloves, ensuring they are readily available where people shop for everyday needs.

In 2024, the global retail market for consumer health products, which includes many of Ansell's offerings, continued its robust growth. For instance, the household glove segment alone saw significant demand, driven by increased awareness of hygiene and safety, with sales projections indicating a compound annual growth rate (CAGR) of over 4% through 2027.

- Broad Consumer Reach: Ansell's strategy targets high-traffic retail locations for maximum product visibility and purchase convenience.

- Market Penetration: By partnering with major supermarket chains and mass merchandisers, Ansell ensures its products are accessible to a wide demographic.

- Product Availability: Pharmacies serve as a key channel for health-related consumer goods, reinforcing Ansell's presence in this critical segment.

Ansell's channels are diverse, encompassing direct sales to major industrial and healthcare clients, a robust distributor network for broad market access, and growing e-commerce platforms for smaller businesses and consumers. These channels are essential for delivering specialized solutions and ensuring product availability across different market segments.

Customer Segments

Ansell's Industrial Workers and Businesses segment encompasses a broad range of sectors like automotive, chemical manufacturing, and construction. These industries rely heavily on protective gear to ensure worker safety. For instance, in 2024, the global industrial safety market, which includes protective clothing, was projected to reach over $50 billion, highlighting the critical demand for Ansell's offerings.

Businesses in mining and oil & gas, for example, face hazardous environments requiring specialized hand and chemical protective clothing. The increasing focus on occupational health and safety regulations worldwide, particularly in developed economies, drives consistent demand for high-quality protective solutions. In 2023, workplace injuries in manufacturing sectors across the US accounted for a significant portion of total reported incidents, underscoring the value of preventative safety equipment.

Ansell's customer segment of healthcare professionals and institutions is vast, encompassing hospitals, surgical centers, dental practices, veterinary clinics, and emergency services. These entities rely heavily on Ansell for critical infection control products like surgical and examination gloves, as well as other single-use protective wear. In 2023, the global surgical gloves market alone was valued at approximately $4.5 billion, a significant portion of which Ansell serves.

The demand within this segment is driven by stringent hygiene protocols and the constant need to prevent cross-contamination during procedures. For instance, the Centers for Disease Control and Prevention (CDC) consistently emphasizes the importance of appropriate personal protective equipment (PPE) in healthcare settings, directly fueling the market for Ansell's offerings. Ansell's commitment to quality and innovation in these protective solutions makes them a key supplier to these vital organizations.

Life sciences and pharmaceutical companies, including research labs and sterile manufacturing facilities, represent a critical customer segment. They require highly specialized clean and sterile gloves, garments, and other consumables to maintain stringent controlled environments for product development and production. For instance, the global sterile filtration market, heavily reliant on such consumables, was projected to reach approximately $15.5 billion in 2024, underscoring the significant demand for high-purity materials in this sector.

Consumers

Ansell's consumer segment targets individuals seeking protection and well-being in their daily lives. This encompasses a broad range of products, notably household gloves for cleaning and personal hygiene, as well as condoms for sexual health. This market is separate from Ansell's significant industrial and healthcare professional channels.

In 2024, the global market for household gloves alone was projected to reach several billion dollars, demonstrating the substantial demand within this consumer category. Similarly, the personal protective equipment market, which includes items like condoms, continues to see steady growth driven by increased awareness of health and safety.

- Household Protection: Products like dishwashing gloves and cleaning gloves cater to everyday domestic tasks, enhancing user safety and comfort.

- Personal Well-being: Condoms represent a key offering in this segment, addressing critical aspects of sexual health and family planning.

- Market Reach: This segment leverages retail channels and direct-to-consumer strategies to reach a wide audience.

Government and Public Safety Entities

Government and public safety entities represent a crucial customer segment for protective solutions. These organizations, including emergency services, military branches, and essential utility providers, demand highly reliable and high-performance gear to safeguard their personnel in hazardous environments. In 2024, the global market for personal protective equipment (PPE) continued its robust growth, with government and defense sectors being significant contributors, driven by ongoing geopolitical events and increased focus on first responder safety.

Ansell's offerings are tailored to meet the stringent requirements of this segment, providing advanced protection against chemical, biological, radiological, and nuclear (CBRN) threats, as well as physical hazards. The emphasis is on durability, comfort, and compliance with rigorous safety standards. For instance, Ansell's commitment to innovation in materials science ensures that their products offer superior barrier protection without compromising mobility or dexterity, which is vital for effective operation in critical situations.

- Demand Drivers: Increased defense spending and a heightened focus on first responder preparedness in 2024, influenced by global security concerns.

- Product Needs: High-performance protective gear, including chemical-resistant suits, cut-resistant gloves, and respiratory protection, meeting stringent military and safety certifications.

- Market Value: The global government and public safety PPE market is projected to reach substantial figures, with specific segments like CBRN protection experiencing significant year-over-year growth in 2024.

- Key Considerations: Reliability, compliance with evolving safety regulations, and the need for specialized solutions for diverse operational scenarios are paramount for these customers.

Ansell's customer segments are diverse, serving critical needs across industries and consumers. The business model effectively addresses specialized requirements in healthcare, industrial safety, life sciences, and government sectors, alongside direct consumer markets.

Cost Structure

Ansell's manufacturing and production expenses represent a substantial cost driver, encompassing the acquisition of essential raw materials like natural rubber latex and nitrile, alongside the labor directly involved in production and factory operational expenses. These costs are largely variable, fluctuating with production volume.

For the fiscal year 2024, Ansell reported Cost of Goods Sold (COGS) of $1.71 billion, highlighting the significant outlay associated with producing its diverse range of protective solutions.

Ansell's commitment to innovation is reflected in its significant Research and Development (R&D) expenses. In fiscal year 2023, Ansell reported R&D expenses of $116.6 million, a notable increase from $105.9 million in fiscal year 2022. This investment fuels the continuous development of new products, advanced materials, and cutting-edge technologies, crucial for maintaining a competitive edge in the protective solutions market.

Ansell's Selling, General, and Administrative (SG&A) expenses are a significant component of their cost structure, covering everything from marketing campaigns to the salaries of their corporate leadership. These costs are essential for building brand awareness, managing customer relationships, and ensuring the smooth day-to-day running of the global business. In fiscal year 2023, Ansell reported SG&A expenses of approximately $564.4 million, reflecting investments in sales teams, advertising, and administrative functions necessary to support their extensive product lines and global reach.

Distribution and Logistics Costs

Ansell's extensive global operations necessitate significant investment in distribution and logistics. These costs are critical for ensuring their products, from healthcare gloves to industrial safety gear, reach customers across numerous countries efficiently. In 2024, managing this complex network involves substantial outlays for warehousing, transportation, and freight.

These expenditures directly support Ansell's ability to serve diverse markets, from established economies to emerging regions. The company's commitment to timely delivery and supply chain resilience means these costs are a fundamental component of their operational strategy.

- Warehousing: Costs associated with maintaining strategically located distribution centers worldwide.

- Transportation: Expenses for moving finished goods from manufacturing sites to warehouses and then to customers via various modes of transport.

- Freight: Charges for shipping products, including ocean freight, air freight, and land transportation, often influenced by fuel prices and global trade dynamics.

- Logistics Management: Investments in technology and personnel to optimize inventory, route planning, and overall supply chain efficiency.

Acquisition and Integration Costs

Ansell's cost structure includes substantial acquisition and integration expenses. Strategic moves, like the acquisition of Kimberly-Clark's Personal Protective Equipment (PPE) business (KBU), necessitate significant upfront capital for the purchase itself, alongside substantial ongoing costs to merge operations. These integration efforts can involve considerable legal and advisory fees, restructuring charges to align business processes, and temporary escalations in operating expenses as systems and workforces are combined. For instance, the KBU acquisition, completed in 2020, represented a major integration undertaking that would have carried these associated costs.

These costs are critical to managing for successful integration and realizing the full value of strategic acquisitions.

- Acquisition Outlays: Direct purchase price for strategic assets like the Kimberly-Clark PPE business.

- Integration Expenses: Costs related to merging systems, operations, and personnel.

- Restructuring Charges: Expenses incurred from reorganizing acquired entities to fit Ansell's operational framework.

- Professional Fees: Significant outlays for legal, financial, and consulting services during M&A activities.

Ansell's cost structure is heavily influenced by its manufacturing and raw material expenses, as evidenced by its Cost of Goods Sold (COGS). For fiscal year 2024, COGS stood at $1.71 billion, underscoring the significant investment in materials like natural rubber latex and nitrile, as well as direct labor and factory overhead.

Innovation is a key cost driver, with Research and Development (R&D) expenses in fiscal year 2023 reaching $116.6 million. This investment supports the development of new products and materials.

Selling, General, and Administrative (SG&A) expenses, totaling approximately $564.4 million in fiscal year 2023, cover marketing, sales, and corporate operations essential for global brand management and customer relations.

Logistics and distribution costs are also substantial, ensuring efficient product delivery worldwide. These include warehousing, transportation, and freight charges, which are critical for maintaining supply chain resilience.

| Cost Category | FY 2023 (Millions USD) | FY 2024 (Millions USD) |

|---|---|---|

| Cost of Goods Sold (COGS) | N/A | 1,710.0 |

| Research & Development (R&D) | 116.6 | N/A |

| Selling, General & Administrative (SG&A) | 564.4 | N/A |

Revenue Streams

Ansell generates significant revenue by selling a broad portfolio of industrial protective equipment. This includes specialized items like mechanical gloves designed for grip and durability, chemical protection gloves engineered for hazardous substance resistance, and comprehensive chemical protective clothing. These products are distributed across numerous industrial sectors worldwide.

The industrial segment demonstrated a positive growth trajectory in the fiscal year 2024. This growth underscores the increasing demand for advanced safety solutions in industries facing evolving workplace hazards and stricter regulatory environments.

Ansell's business model heavily relies on the sales of healthcare protective solutions, a critical revenue driver. This includes a wide array of products like surgical gloves, examination gloves, and other single-use gloves essential for healthcare settings. These are predominantly sold to hospitals, surgical centers, and life science organizations.

While the company experienced some destocking in fiscal year 2024, which impacted this segment, a recovery is anticipated. For instance, Ansell's healthcare segment saw a reported net sales decline of 12.1% in constant currency for the first half of fiscal year 2024 compared to the prior year, reflecting the destocking trend.

Ansell’s sales of life sciences and cleanroom products form a significant revenue stream, encompassing essential items like specialized gloves, protective garments, and various consumables. These products are indispensable for maintaining sterile and controlled environments within the demanding pharmaceutical and medical device manufacturing industries.

In 2024, the demand for these high-purity products remained robust, driven by continued global investment in healthcare and biopharmaceutical research. Ansell’s commitment to innovation in material science and contamination control directly supports its market position in these critical sectors.

Sales of Consumer Products

Ansell also generates revenue from selling consumer products directly to individuals. This includes items like household gloves and condoms, which are readily available in retail stores.

While this segment represents a smaller portion of Ansell's overall income compared to its industrial and healthcare offerings, it plays a crucial role in diversifying the company's revenue streams. This diversification helps to mitigate risks associated with reliance on a single market segment.

- Consumer Product Sales: Household gloves and condoms sold through retail channels.

- Revenue Diversification: Contributes to a broader income base for Ansell.

Value-Added Services and Solutions

Ansell generates revenue and deepens customer relationships through its value-added services. These offerings go beyond just selling protective equipment, focusing on enhancing product effectiveness and ensuring customer safety. For instance, the AnsellGUARDIAN safety assessment program helps businesses identify and mitigate workplace risks, directly linking Ansell's products to improved safety outcomes.

The AnsellCARES initiative provides crucial healthcare education, further solidifying Ansell's role as a partner in health and safety. These programs not only boost product utility but also foster significant customer loyalty by demonstrating a commitment to customer well-being. This approach creates recurring engagement and reinforces the value proposition of Ansell's solutions.

- AnsellGUARDIAN: Offers on-site safety assessments to optimize personal protective equipment (PPE) usage and reduce workplace incidents.

- AnsellCARES: Provides educational resources and training focused on infection prevention and control in healthcare settings.

- Customer Loyalty: These services build strong partnerships by addressing critical customer needs beyond product supply.

- Revenue Enhancement: While primarily loyalty-focused, these services can also open avenues for consulting fees or premium support packages.

Ansell's revenue streams are primarily driven by the sale of industrial and healthcare protective solutions, alongside a smaller contribution from consumer products. The industrial segment, encompassing mechanical and chemical protection gloves and clothing, saw positive growth in fiscal year 2024, reflecting increased demand for advanced safety equipment. The healthcare segment, which includes surgical and examination gloves, experienced a challenging first half of fiscal year 2024 due to destocking, with net sales declining 12.1% in constant currency, though a recovery is anticipated.

The company also generates income from specialized life sciences and cleanroom products, crucial for pharmaceutical and medical device manufacturing, where demand remained robust in 2024. Consumer products like household gloves and condoms offer revenue diversification. Value-added services such as AnsellGUARDIAN safety assessments and AnsellCARES educational initiatives further enhance customer relationships and can indirectly contribute to revenue through increased product utilization and loyalty.

| Revenue Segment | Fiscal Year 2024 Performance Insights | Key Drivers |

|---|---|---|

| Industrial Protective Solutions | Positive growth trajectory | Demand for advanced safety, evolving workplace hazards, stricter regulations |

| Healthcare Protective Solutions | H1 FY24 net sales declined 12.1% (constant currency) | Destocking trends, anticipated recovery, essential medical supplies |

| Life Sciences & Cleanroom Products | Robust demand | Global investment in healthcare and biopharma research, contamination control needs |

| Consumer Products | Smaller but diversifying contribution | Retail availability of household gloves and condoms |

| Value-Added Services | Customer loyalty and engagement | Safety assessments (AnsellGUARDIAN), healthcare education (AnsellCARES) |

Business Model Canvas Data Sources

The Ansell Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research reports, and strategic insights derived from industry analysis. These diverse data sources ensure that each component of the canvas is grounded in factual evidence and reflects current market realities.