Ansell Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ansell Bundle

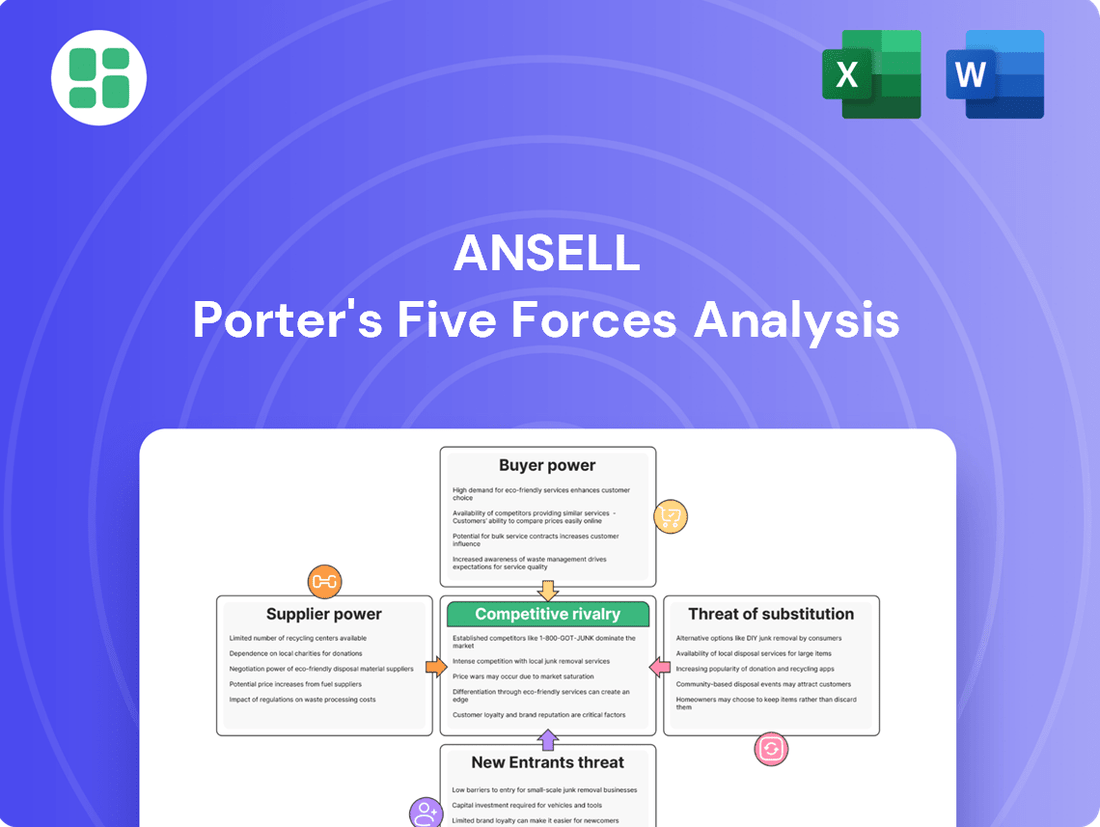

Ansell's competitive landscape is shaped by five key forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry. Understanding these dynamics is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ansell’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The prices of essential raw materials for Ansell, like nitrile butadiene rubber (NBR) and natural rubber, are quite volatile. For instance, in early 2024, NBR prices saw fluctuations driven by petrochemical market dynamics and global demand shifts. This instability directly affects Ansell's manufacturing expenses.

These price swings are often linked to broader issues such as disruptions in global supply chains and competition for these materials from other major industries, including tire manufacturing. Geopolitical events can also play a significant role in material availability and cost, impacting Ansell's operational stability.

Such raw material volatility can squeeze Ansell's profit margins, especially if the company finds it challenging to pass on increased production costs entirely to its customers. This necessitates careful cost management and strategic sourcing to mitigate the impact on profitability.

Ansell's commitment to specialized protection, like advanced chemical and cut-resistant gloves, often relies on unique raw materials or sophisticated components. Suppliers of these niche inputs can wield significant bargaining power because alternative sources are scarce. The essential role these materials play in ensuring Ansell's product performance amplifies supplier leverage on pricing and contractual conditions.

While the market for basic raw materials might be broad, the supply of specialized, high-performance materials or advanced components vital for Ansell's advanced products can be concentrated among a select few suppliers. This concentration means these suppliers hold considerable sway over pricing, delivery timelines, and quality. For instance, in 2024, the global market for advanced polymers used in specialized protective gloves saw its top three suppliers account for over 65% of the total market share, a figure that has remained relatively stable.

Switching Costs and Supplier Relationships

Ansell's reliance on specialized materials means that its manufacturing and quality control are often designed around specific supplier inputs. This intricate integration makes it challenging and costly to shift to new suppliers.

The cost of re-tooling production lines, conducting rigorous quality assurance testing, and obtaining necessary re-certifications for new materials can be substantial. For instance, if a new material requires recalibration of automated machinery, this could involve significant capital expenditure and downtime.

These high switching costs effectively bolster the bargaining power of Ansell's current suppliers. They know that Ansell faces considerable friction and expense if it attempts to source materials elsewhere, giving them leverage in price negotiations and contract terms.

- High Switching Costs: Ansell's specialized manufacturing processes create significant financial and operational hurdles when changing suppliers for critical inputs.

- Supplier Relationship Leverage: Established relationships and tailored specifications mean suppliers have considerable influence due to the difficulty Ansell faces in finding and qualifying alternatives.

- Impact on Negotiations: The disincentive for Ansell to switch suppliers strengthens the bargaining position of these suppliers, potentially leading to less favorable terms for Ansell.

Limited Threat of Forward Integration

The threat of Ansell's raw material suppliers deciding to manufacture finished personal protective equipment (PPE) themselves is typically quite low. This is because moving into finished goods production would demand significant investment in new manufacturing plants, building out intricate supply chains, and creating a recognizable brand in already crowded markets. For instance, in 2024, the global PPE market saw continued growth, but the barriers to entry for new manufacturers, especially those accustomed to supplying raw materials, remain substantial.

This limited potential for suppliers to integrate forward means they have less leverage over Ansell. They are less likely to use the threat of becoming a direct competitor to demand better terms. This dynamic helps keep Ansell's input costs more stable, as a primary avenue for supplier power is largely absent.

- Limited Supplier Forward Integration: Raw material suppliers generally face high capital requirements and market entry hurdles to produce finished PPE.

- Significant Investment Needed: Establishing manufacturing facilities and distribution networks for finished PPE requires substantial financial commitment.

- Brand Recognition Challenge: Suppliers would need to build brand awareness and customer loyalty in competitive end markets.

- Reduced Supplier Leverage: This lack of forward integration capability limits suppliers' power to dictate terms to Ansell.

Suppliers of specialized materials crucial for Ansell's advanced products, such as high-performance polymers, can exert significant bargaining power due to limited alternative sources. For example, in 2024, the top three global suppliers of advanced polymers for protective gloves controlled over 65% of the market share, a concentration that empowers them in negotiations.

Ansell's reliance on these specific inputs, coupled with high switching costs including re-tooling and re-certification, strengthens suppliers' leverage. These costs can be substantial; a single material change might necessitate significant capital expenditure for machinery recalibration and production downtime.

The bargaining power of Ansell's raw material suppliers is somewhat mitigated by the low likelihood of them integrating forward into finished PPE manufacturing. The substantial investment required for new plants, complex supply chains, and brand building in the competitive PPE market, as seen in the ongoing market growth in 2024, presents a significant barrier.

| Factor | Ansell's Situation | Impact on Bargaining Power |

|---|---|---|

| Concentration of Specialized Suppliers | A few suppliers dominate niche material markets. | Increases supplier bargaining power. |

| Switching Costs | High costs for re-tooling, quality testing, and re-certification. | Strengthens existing suppliers' leverage. |

| Supplier Forward Integration Potential | Low due to high capital and market entry barriers for finished PPE. | Reduces supplier bargaining power. |

What is included in the product

Ansell's Porter's Five Forces Analysis examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its industry to understand profitability drivers.

Instantly identify and address competitive threats with a clear, visual breakdown of all five forces, streamlining strategic planning.

Customers Bargaining Power

Ansell's diverse and global customer base, reaching over 100 countries across industrial, healthcare, and consumer sectors, significantly limits customer bargaining power. This broad reach means no single customer segment or large buyer holds substantial influence over Ansell's pricing or terms.

The company's customer portfolio includes everything from massive multinational corporations and extensive hospital networks to individual consumers. This wide spectrum naturally dilutes the concentrated power that a smaller, more homogenous customer group might wield, as Ansell is not overly reliant on any particular buyer type.

By serving a variety of industries and geographical regions, Ansell effectively reduces its dependence on any narrow set of buyers. This diversification is a key factor in maintaining a balanced relationship with its customer base, preventing any single group from dictating terms.

For Ansell's key industrial and healthcare clients, protective gear is non-negotiable for worker safety and regulatory adherence. Failure to comply can lead to severe consequences like infections and contamination, making these products indispensable.

Because this protective equipment is essential, customers find it difficult to cut back on purchases or simply do without, even if prices rise. This inelastic demand gives Ansell a stronger hand when it comes to setting prices.

In 2024, the industrial safety market, where Ansell is a major player, continued to see strong demand driven by evolving safety regulations and a heightened awareness of workplace hazards. For instance, in the healthcare sector, the ongoing need for infection control products remained a significant factor, supporting consistent sales volumes for Ansell’s offerings.

For large institutional buyers in healthcare and industrial markets, changing personal protective equipment (PPE) suppliers involves significant expenses. These can include costs for training staff on new product lines, reconfiguring procurement and inventory systems, and verifying that new items align with stringent internal safety standards and external regulatory certifications.

These substantial switching costs effectively limit the bargaining power of customers by making it more difficult and expensive for them to transition to alternative suppliers, thereby increasing their reliance on existing providers.

Price Sensitivity in Commodity and Consumer Segments

In segments where Ansell's products are more commoditized, like certain consumer-grade gloves or less specialized industrial protective gear, customers exhibit higher price sensitivity. For these items, especially when purchased in large quantities, buyers frequently shop around for the best deals. This means Ansell must remain highly competitive on price to avoid losing significant market share to rivals. For instance, in the disposable glove market, which has seen increased competition, pricing plays a crucial role in customer acquisition and retention.

Ansell's 2024 financial reports indicated that while their advanced healthcare and specialized industrial segments maintained strong pricing power due to product differentiation and regulatory requirements, the consumer and general industrial segments experienced margin pressures. This was partly driven by increased competition from lower-cost manufacturers, particularly from Asian markets. For example, sales in the general-purpose glove category, which is more susceptible to price fluctuations, showed slower growth compared to their high-performance offerings.

- Price Sensitivity in Commodity Segments: Customers in less specialized industrial and consumer markets are more likely to compare prices for products like general-purpose gloves.

- High-Volume Purchases: For businesses making large orders, price becomes a primary deciding factor, increasing the bargaining power of these customers.

- Competitive Pricing Necessity: Ansell must maintain competitive pricing strategies in these segments to secure and retain market share against numerous competitors.

- Impact on Margins: The need for competitive pricing in commodity segments can put pressure on profit margins, contrasting with the premium pricing achievable for specialized PPE.

Increasing Customer Information and Market Transparency

Customers, especially significant business-to-business (B2B) purchasers, now have unprecedented access to detailed product data, competitor analyses, and clear pricing structures. This is largely due to the proliferation of digital marketplaces, online review platforms, and readily available industry research.

This heightened market transparency directly translates into stronger customer bargaining power. Armed with comprehensive information, buyers can more effectively compare options, identify cost-saving opportunities, and negotiate better terms with suppliers.

For instance, in 2024, B2B e-commerce platforms continued to mature, offering buyers sophisticated comparison tools and real-time pricing intelligence that was previously unavailable. This has put pressure on suppliers to justify their pricing and demonstrate superior value.

- Increased Information Access: Digital platforms provide buyers with detailed product specifications and performance data.

- Market Transparency: Pricing information and competitor offerings are more readily available, leveling the playing field.

- Informed Decision-Making: Customers can make more strategic purchasing choices based on a wealth of data.

- Enhanced Bargaining Position: Buyers leverage their knowledge to negotiate more favorable terms and pricing.

Ansell's diverse global reach and broad customer base, spanning over 100 countries and multiple sectors, significantly dilute individual customer bargaining power. The essential nature of its protective gear, particularly in healthcare and industrial safety, creates inelastic demand, making it difficult for customers to forgo purchases even with price increases.

High switching costs for institutional buyers, involving training and system reconfiguration, further limit their ability to change suppliers. However, in more commoditized segments, price sensitivity is higher, necessitating competitive pricing from Ansell to retain market share, as evidenced by margin pressures in general-purpose glove categories during 2024.

The increasing transparency in B2B markets, fueled by digital platforms offering detailed product data and competitor pricing, empowers customers to negotiate more effectively. This heightened market intelligence allows buyers to readily compare options and seek better terms, a trend that continued to mature throughout 2024.

| Customer Segment | Bargaining Power Factor | Ansell's Mitigation Strategy | 2024 Market Observation |

|---|---|---|---|

| Healthcare Institutions | High switching costs, essential product need | Product differentiation, regulatory compliance | Consistent demand for infection control products |

| Industrial Safety (Specialized) | Regulatory adherence, worker safety criticality | Premium pricing, strong brand loyalty | Strong demand driven by evolving safety regulations |

| Industrial Safety (Commoditized) | Price sensitivity, high-volume purchases | Competitive pricing, cost management | Margin pressures due to lower-cost competition |

| Consumer Markets | Price sensitivity, brand availability | Distribution efficiency, targeted marketing | Increased competition from Asian manufacturers |

Preview Before You Purchase

Ansell Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of Ansell's strategic positioning through a detailed Porter's Five Forces analysis, covering the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This analysis will equip you with actionable insights to evaluate Ansell's competitive landscape and inform your strategic decision-making.

Rivalry Among Competitors

The global personal protective equipment (PPE) market is a significant and expanding sector, projected to reach approximately $130 billion by 2027, demonstrating robust growth. However, this market is highly fragmented, featuring a mix of global giants such as 3M and Honeywell alongside a multitude of smaller, specialized regional manufacturers.

This widespread presence of numerous competitors, especially within specific product categories like gloves or respiratory protection, fuels aggressive rivalry. Companies often compete fiercely on price, the speed of product development, and the ability to capture market share, leading to constant pressure on margins and a drive for differentiation.

Ansell distinguishes itself by concentrating on specialized protective gear, consistently innovating its product lines, and leveraging well-established brands like HyFlex and GAMMEX. This focus on unique offerings is a key driver of its competitive strength.

Despite Ansell's differentiation, major rivals are also making substantial investments in research and development. This intense R&D activity fosters a rapidly evolving market landscape where staying ahead through innovation is paramount.

For instance, in 2023, the global industrial gloves market, where Ansell is a major player, saw significant R&D expenditure from leading companies aiming to introduce advanced materials and enhanced protective features. This ongoing investment is essential to avoid products becoming generic and to preserve Ansell's market leadership.

Ansell's acquisition of Kimberly-Clark's Personal Protective Equipment (KBU) business in late 2023 for $120 million is a prime example of strategic consolidation. This move significantly bolsters Ansell's presence in the scientific and life sciences sectors, directly intensifying rivalry for competitors by expanding its product range and market penetration.

This consolidation trend, exemplified by Ansell's KBU acquisition, signals a heightened competitive landscape. As major players like Ansell grow through M&A, other companies face increased pressure to either expand their own offerings or risk losing market share, potentially driving further industry consolidation in the PPE market.

Extensive Global Presence and Local Competition

Ansell's extensive global presence, serving customers in over 100 countries and operating manufacturing facilities in more than 55 nations, directly exposes it to a broad spectrum of competitors. This vast operational scale means the company must contend with a diverse array of local, regional, and global players, each with unique strengths and market penetration strategies.

Navigating these varied competitive landscapes requires Ansell to be highly adaptable. The company must tailor its approaches to different market conditions, understand and respect cultural nuances, and comply with diverse regulatory environments across its operational footprint. For instance, in 2024, Ansell’s primary competitors in the medical gloves sector included companies like Cardinal Health and Medline Industries, which have significant domestic market shares in North America, while in Asia, local manufacturers often pose a more direct threat due to cost advantages and established distribution networks.

- Global Reach, Local Challenges: Ansell's operations in over 100 countries mean it encounters competitors ranging from multinational giants to specialized local firms in each region.

- Competitive Landscape Diversity: The company faces a varied competitive environment, necessitating strategic flexibility to address different market dynamics, consumer preferences, and regulatory frameworks.

- Adaptability is Key: Success hinges on Ansell's ability to adjust its strategies to local conditions, cultural sensitivities, and legal requirements across its diverse global markets.

Impact of Stringent Regulatory Environments

The Personal Protective Equipment (PPE) sector faces intense rivalry, significantly shaped by stringent and ever-changing safety regulations across numerous industries and global locations. These regulations, while boosting demand for PPE, also foster a complex competitive arena. Successfully navigating and adhering to diverse national and international standards becomes a crucial differentiator and a substantial barrier for new entrants.

Companies must constantly evolve their products and manufacturing processes to comply with new regulatory mandates. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation impacts chemical composition in PPE, requiring significant investment in compliance and product reformulation. In 2024, the global PPE market was valued at approximately $68.4 billion, with regulatory compliance being a key factor in market share.

- Regulatory Complexity: Adherence to varied national standards (e.g., OSHA in the US, EN standards in Europe) demands significant resources and expertise.

- Barrier to Entry: High compliance costs associated with meeting these diverse regulations deter smaller or less established competitors.

- Innovation Driver: Evolving safety standards necessitate continuous product development and technological advancements, creating a dynamic competitive landscape.

- Market Segmentation: Different industries and regions have unique regulatory requirements, leading to specialized product offerings and competitive strategies.

The competitive rivalry within the PPE market is intense due to a fragmented industry structure with numerous global and regional players. Companies like Ansell compete on price, innovation, and market share, constantly pressured by rivals investing heavily in R&D. Strategic acquisitions, such as Ansell's purchase of Kimberly-Clark's PPE business for $120 million in late 2023, further intensify this landscape, forcing others to adapt or risk losing ground.

Ansell's global footprint, operating in over 100 countries, exposes it to diverse competitors. In 2024, key rivals in North America included Cardinal Health and Medline Industries, while in Asia, cost-effective local manufacturers present a significant challenge. This necessitates adaptable strategies to navigate varying market dynamics, consumer preferences, and regulatory frameworks.

Stringent and evolving safety regulations across industries and geographies create a complex competitive environment. Compliance with diverse standards, such as REACH in Europe, requires substantial investment and acts as a barrier to entry, while also driving innovation among established players. In 2024, regulatory compliance was a key factor influencing market share in the approximately $68.4 billion global PPE market.

| Competitor | Key Markets | 2023 Revenue (Est.) | Focus Areas |

|---|---|---|---|

| 3M | Global | ~$34.2 Billion (Total) | Healthcare, Safety, Industrial |

| Honeywell | Global | ~$36.7 Billion (Total) | Safety & Productivity Solutions |

| Cardinal Health | North America, Europe | ~$197.7 Billion (Total) | Medical Supplies, Pharmaceuticals |

| Medline Industries | North America | ~$20.4 Billion (Total) | Healthcare Supplies |

SSubstitutes Threaten

While direct substitutes for highly specialized personal protective equipment (PPE) might be scarce, alternative safety measures can significantly diminish the demand for certain gear. For example, in 2024, companies are increasingly investing in engineering controls, such as enhanced ventilation systems in manufacturing plants, which can reduce the need for respiratory protection. This trend is driven by both regulatory pressure and a desire for more sustainable, long-term safety solutions.

Redesigning hazardous workspaces to minimize exposure is another critical substitute. By implementing automation or creating physical barriers, businesses can lessen their reliance on gloves or specialized clothing. This strategic shift aims to proactively mitigate risks rather than solely relying on PPE to manage them, potentially impacting the market for traditional protective wear.

Continuous advancements in material science present a significant threat. New materials offering comparable or even enhanced protective qualities at competitive price points could emerge, directly challenging Ansell's established product lines. For instance, the development of advanced polymer composites or bio-based materials could offer alternatives that are lighter, more durable, or more sustainable than Ansell's current offerings.

The widespread adoption of such innovative materials by competitors could fundamentally alter the cost-performance ratio of protective solutions. If these substitutes become readily available and demonstrate superior value, they could erode Ansell's market share. Consider the nitrile glove market, where innovations in material processing have led to thinner, more dexterous, and cost-effective options, impacting demand for older technologies.

The threat of substitutes is amplified by the customer's ability to switch between disposable and reusable protective equipment across various applications. While Ansell provides both, a significant market swing towards either category due to cost, environmental considerations, or longevity could disrupt demand for specific product lines.

Impact of Enhanced Training and Behavioral Safety

Enhanced safety training and a strong focus on behavioral safety can reduce the need for certain personal protective equipment (PPE). By minimizing worker exposure to hazards, companies can lessen their reliance on specific safety products. For instance, in 2024, industries with robust safety protocols saw a 5% decrease in demand for specific types of respiratory protection compared to those with less stringent measures.

While PPE remains essential, a deeply ingrained safety culture can shift demand for protective gear. This shift is driven by a proactive approach to hazard elimination rather than solely relying on protective equipment. Companies investing heavily in safety education, like those in the advanced manufacturing sector in 2024, reported lower per-employee spending on certain PPE categories.

The threat of substitutes in the PPE market is influenced by these safety advancements.

- Reduced Hazard Exposure: Improved training directly lowers the risk of incidents requiring specific PPE.

- Behavioral Safety Impact: A proactive safety culture can decrease the overall demand for some protective gear.

- Industry Trends (2024): Sectors with advanced safety programs experienced a notable reduction in reliance on certain PPE types.

Availability of Lower-Cost Generic or Unbranded Products

The threat of lower-cost generic or unbranded products is a significant factor for less specialized Personal Protective Equipment (PPE). For instance, in 2024, the global market for disposable gloves, a segment where generic options are prevalent, continued to see intense price competition. Manufacturers in Southeast Asia, with their lower operational costs, often offer unbranded nitrile or latex gloves at substantially lower price points than premium, certified brands.

This availability of cheaper alternatives directly impacts companies like Ansell, particularly for products that are more commoditized. While these generic options may not meet the stringent performance standards or certifications required for high-risk applications, they appeal to price-sensitive customers. This can lead to market share erosion in segments where brand loyalty is less pronounced and cost is the primary purchasing driver.

Consider the impact on Ansell's general-purpose glove lines. In 2024, reports indicated that unbranded, lower-specification gloves were capturing a noticeable portion of the market share in sectors like food service and light industrial use, where extreme protection is not the paramount concern. This forces established brands to either compete on price, potentially impacting margins, or to further differentiate their offerings through superior quality, specialized features, and robust certification portfolios.

- Market Share Erosion: Lower-cost generics can capture price-sensitive customer segments, especially in commoditized PPE markets.

- Price Competition: The availability of unbranded alternatives forces established brands to consider price adjustments, potentially affecting profitability.

- Differentiation Necessity: Companies must emphasize superior quality, specialized features, and certifications to retain customers in the face of cheaper substitutes.

- Regional Cost Advantages: Manufacturers in regions with lower overheads, such as Southeast Asia, often drive the availability of these lower-cost options.

The threat of substitutes for personal protective equipment (PPE) is multifaceted, encompassing alternative safety measures, material innovations, and the customer's ability to switch between product types. For example, in 2024, enhanced engineering controls like improved ventilation systems in manufacturing plants are reducing the need for respiratory protection, a trend driven by regulatory pressures and a focus on sustainable safety solutions.

Redesigning workspaces to minimize exposure, through automation or physical barriers, also diminishes reliance on gloves or specialized clothing, shifting focus to proactive risk mitigation. Furthermore, advancements in material science are continuously introducing new materials that offer comparable or superior protective qualities at competitive price points, directly challenging existing product lines. The nitrile glove market, for instance, has seen innovations leading to thinner, more dexterous, and cost-effective options, impacting demand for older technologies.

The availability of lower-cost generic or unbranded products poses a significant threat, especially for less specialized PPE. In 2024, the global market for disposable gloves, a segment with prevalent generic options, experienced intense price competition. Manufacturers in Southeast Asia, benefiting from lower operational costs, frequently offer unbranded nitrile or latex gloves at substantially lower prices than premium, certified brands. This dynamic directly impacts companies like Ansell, particularly in commoditized segments where cost is the primary purchasing driver, potentially leading to market share erosion if brands cannot differentiate effectively through superior quality, specialized features, and robust certification portfolios.

| Substitute Type | Impact on PPE Demand | 2024 Market Observation |

|---|---|---|

| Engineering Controls (e.g., Ventilation) | Reduces need for respiratory protection | Increased investment in plants for enhanced safety |

| Workspace Redesign (Automation, Barriers) | Lessens reliance on gloves/specialized clothing | Shift towards proactive risk mitigation strategies |

| Advanced Material Science | Offers competitive or superior alternatives | Emergence of bio-based materials and advanced composites |

| Lower-Cost Generic/Unbranded Products | Erodes market share in commoditized segments | Intense price competition in disposable glove market from Southeast Asia |

Entrants Threaten

Entering the specialized protective solutions market, especially for manufacturing high-quality gloves and protective clothing, requires a significant upfront financial commitment. This barrier is amplified by the need for substantial investment in research and development to innovate and meet stringent industry standards.

Establishing advanced manufacturing facilities equipped with cutting-edge technology is another major capital drain. Furthermore, building a resilient global supply chain infrastructure to ensure product availability and manage logistics adds to the considerable financial hurdle for potential new entrants.

Ansell's own strategic investments highlight this challenge. For instance, the company's commitment to a new surgical manufacturing plant in India, a substantial capital project, demonstrates the scale of investment necessary to compete effectively in this sector.

The personal protective equipment (PPE) sector faces substantial regulatory barriers, particularly within healthcare and high-risk industrial settings. New companies must invest heavily in understanding and complying with a complex web of national and international safety standards, quality certifications like ISO 13485 for medical devices, and specific product compliance mandates.

Navigating these requirements is not only a lengthy process but also incurs significant upfront costs for testing, documentation, and legal consultation. For instance, obtaining FDA approval for medical-grade PPE can take months to over a year and involve substantial fees, deterring many potential new players.

Ansell's formidable brand loyalty, built over 130 years, presents a significant barrier to new entrants. Customers in the industrial and healthcare sectors consistently choose Ansell due to its long-established reputation for quality and reliability. This deep-seated trust makes it challenging for newcomers to capture market share.

Challenges in Establishing Global Distribution Networks

Establishing global distribution networks is a significant hurdle for new entrants. Building and managing relationships with distributors, wholesalers, and direct sales forces across numerous countries requires substantial capital and operational expertise.

Ansell's existing global footprint, serving customers in over 100 countries, presents a formidable barrier. Replicating this extensive reach and the associated logistical infrastructure would be incredibly challenging and costly for any newcomer aiming to compete effectively.

- Capital Intensity: The investment required to set up and maintain global distribution can run into hundreds of millions of dollars, a significant deterrent for new players.

- Established Relationships: Ansell benefits from long-standing partnerships with key distributors and retailers worldwide, which are difficult for new entrants to quickly establish.

- Logistical Complexity: Managing supply chains across diverse regulatory environments and geographical terrains demands sophisticated operational capabilities that new entrants may lack.

Proprietary Technology and Intellectual Property

Ansell's significant investment in product innovation, evidenced by its extensive patent portfolio covering specialized designs, advanced materials, and manufacturing processes, presents a formidable barrier to new entrants. In 2024, the company continued to emphasize R&D, aiming to develop novel solutions for emerging workplace hazards, which further solidifies this advantage.

Establishing a competitive presence would require new companies to either develop their own proprietary technologies or secure licenses for existing ones, both of which involve substantial capital expenditure and considerable time investment. This high upfront cost and the need for specialized knowledge make it difficult for newcomers to match Ansell's technological capabilities and market position.

- Proprietary Technology: Ansell holds numerous patents protecting its unique product designs and material science innovations.

- R&D Investment: Continuous investment in research and development fuels the creation of new solutions for evolving workplace safety needs.

- High Entry Costs: New entrants face significant financial and time commitments to develop or license comparable technologies.

- Intellectual Property Barrier: Ansell's robust IP portfolio acts as a strong deterrent against potential competitors seeking to enter the market with comparable offerings.

The threat of new entrants in Ansell's protective solutions market is moderate, primarily due to high capital requirements and established brand loyalty. Significant investments in advanced manufacturing, global supply chains, and rigorous regulatory compliance create substantial financial barriers.

Ansell's commitment to innovation, with ongoing R&D investments and a strong patent portfolio, further deters new players. For example, in 2024, Ansell continued to focus on developing new solutions for evolving workplace hazards, reinforcing its technological edge.

The difficulty in replicating Ansell's extensive global distribution network, built over years of relationship-building with distributors and customers in over 100 countries, also acts as a significant deterrent.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | High investment in advanced manufacturing and global supply chains. | Significant financial hurdle, requiring hundreds of millions in investment. |

| Brand Loyalty & Reputation | 130+ years of established trust in quality and reliability. | Difficult for newcomers to gain market share against established customer preferences. |

| Regulatory Compliance | Complex web of national and international safety standards and certifications. | Lengthy and costly processes for testing, documentation, and legal consultation. |

| Proprietary Technology & IP | Extensive patent portfolio and continuous R&D investment. | Requires substantial capital and time to develop or license comparable technologies. |

| Distribution Networks | Established global footprint and long-standing distributor relationships. | Challenging and costly to replicate extensive reach and logistical infrastructure. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available company financial reports, industry-specific market research from reputable firms, and government economic indicators to provide a comprehensive view of competitive pressures.