Ansell Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ansell Bundle

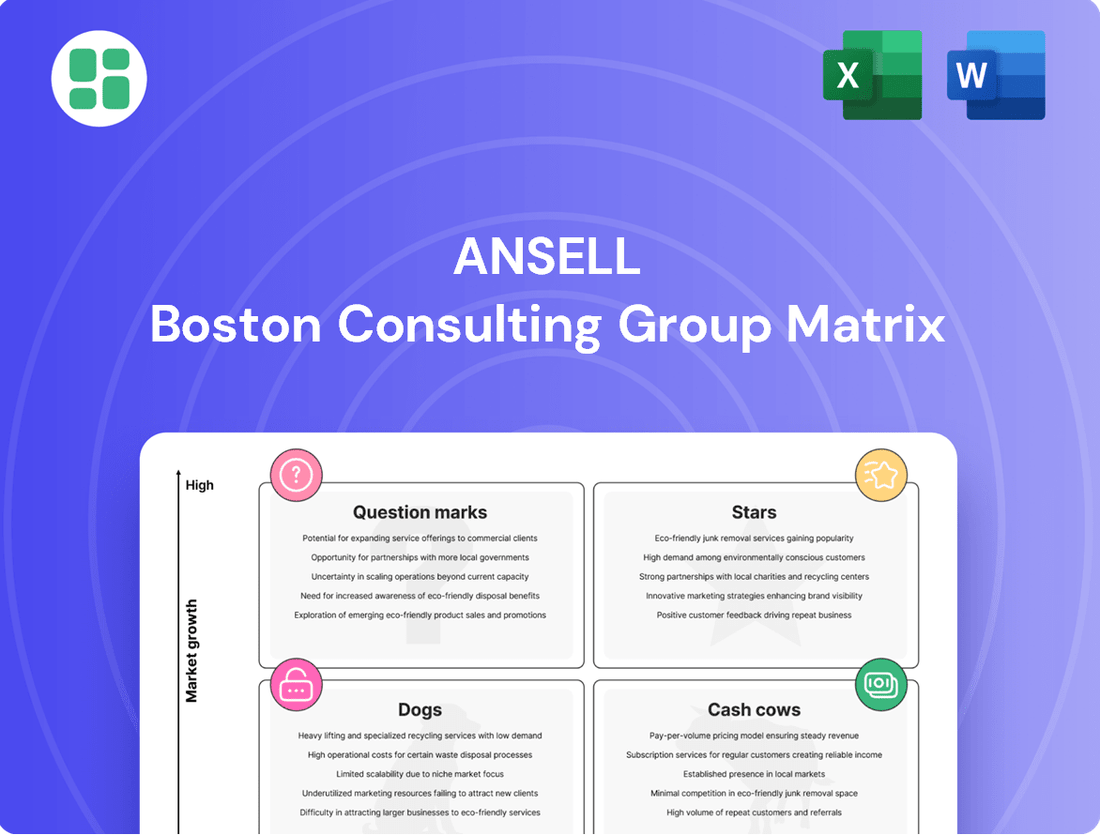

Uncover the strategic positioning of this company's product portfolio with the BCG Matrix. See which products are thriving Stars, which are reliable Cash Cows, which are underperforming Dogs, and which hold potential as Question Marks. Purchase the full BCG Matrix to gain a comprehensive understanding and actionable insights for optimized resource allocation and future growth.

Stars

Ansell's acquisition of the Kimtech and KleenGuard brands from Kimberly-Clark in July 2024 significantly strengthens its presence in North America and Europe, particularly within the scientific and industrial personal protective equipment (PPE) sectors. These established brands are key to Ansell's strategy for expanding market leadership in high-growth areas like cleanroom applications.

The integration of Kimtech and KleenGuard has already demonstrated a positive impact, contributing meaningfully to Ansell's Earnings Before Interest and Taxes (EBIT) growth and exceeding initial performance projections. This strategic move positions Ansell to capitalize on robust demand in scientific research and other critical industrial segments.

Ansell's HyFlex series, especially newer offerings like the HyFlex Ultra-Lightweight Cut Protection, are strong contenders in the expanding industrial safety glove market. This growth is fueled by stricter safety rules and a desire for better protective gear.

These gloves provide excellent cut resistance, along with comfort and dexterity, meeting key needs in sectors such as automotive, machinery, and metal fabrication. For example, the global industrial safety gloves market was valued at approximately USD 7.5 billion in 2023 and is projected to grow significantly.

Ansell holds a substantial portion of this market and consistently introduces innovations in this high-growth area, reinforcing their position as a market leader.

The AlphaTec series, featuring innovative hybrid technologies like the 53-002 and 53-003, addresses the growing need for premium chemical protection for hands and bodies. This advanced segment within Ansell's Industrial division has shown robust growth and enhanced profitability. Ansell's ongoing commitment to innovation solidifies its market leadership in offering dependable solutions against chemical risks across various industrial sectors.

Specialized PPE for Scientific Verticals (e.g., Semiconductors, Medical Devices)

Ansell is making strategic moves into high-growth scientific sectors like pharmaceuticals, medical devices, and semiconductors. This expansion is notably bolstered by their KBU acquisition, which strengthens their position in these demanding markets.

These industries require very specific protective gear, and Ansell's enhanced product line is well-suited to meet these needs. By focusing on these specialized verticals, Ansell aims to capture a larger share of a market driven by strong, sustained growth fundamentals.

- Target Verticals: Pharmaceuticals, Medical Devices, Semiconductors

- Strategic Move: Acquisition of KBU to enhance market presence

- Market Demand: High need for specialized and differentiated protective solutions

- Growth Outlook: Strong long-term growth fundamentals in these scientific sectors

Overall Industrial Segment Growth Drivers

Ansell's Industrial Segment shines as a star in its BCG Matrix, driven by consistent, robust organic sales growth and impressive profitability.

This upward trajectory is a direct result of expanding customer adoption, successful introduction and stocking of innovative new products, and a deliberate strategic pivot towards more profitable, high-margin offerings.

The segment's strong performance underscores Ansell's dominant market position and its adeptness at leveraging the persistent demand within the industrial sector.

- Consistent Organic Sales Growth: The Industrial Segment has demonstrated a sustained pattern of increasing sales, indicating strong market penetration and demand.

- High Profitability: This segment contributes significantly to Ansell's overall earnings due to its efficient operations and focus on value-added products.

- Key Growth Drivers: Increased customer usage of existing products, successful stocking of new product lines, and a strategic shift to higher-margin solutions are propelling this growth.

- Market Leadership: The segment's performance highlights Ansell's ability to maintain and expand its leadership position by effectively meeting industrial market needs.

Ansell's Industrial Segment is a clear star in its BCG Matrix, showcasing impressive organic sales growth and strong profitability. This success is built on expanding customer adoption, the introduction of innovative products, and a strategic focus on higher-margin offerings.

The segment's performance reflects Ansell's market leadership and its ability to meet persistent industrial demand. For instance, Ansell's HyFlex series, a key part of the Industrial Segment, continues to see strong uptake, driven by evolving safety regulations and a demand for enhanced protective gear.

This segment's robust performance, particularly in industrial safety gloves where the market was valued at approximately USD 7.5 billion in 2023, underscores Ansell's strategic positioning and innovation capabilities.

The acquisition of Kimtech and KleenGuard in July 2024 further bolsters this star performer, especially in scientific and industrial PPE, contributing significantly to EBIT growth and exceeding projections.

| Segment | BCG Classification | Key Growth Drivers | Market Context | Ansell's Position |

|---|---|---|---|---|

| Industrial | Star | Organic sales growth, new product introductions, shift to high-margin products | Strong demand for industrial safety, growing market for safety gloves (approx. USD 7.5B in 2023) | Market leader, strong innovation pipeline (e.g., HyFlex, AlphaTec) |

What is included in the product

The BCG Matrix categorizes products/businesses by market share and growth to guide investment decisions.

The Ansell BCG Matrix simplifies complex portfolios, alleviating the pain of strategic decision-making with clear visual guidance.

Cash Cows

Ansell's core surgical glove portfolio represents a classic Cash Cow. This segment benefits from a leading global market position in a mature healthcare sector, consistently delivering substantial cash flow. The essential nature of these gloves in surgical settings worldwide guarantees a stable and predictable demand, underpinning their strong performance.

Despite potentially low market growth rates, Ansell's robust brand recognition and extensive distribution channels are key to maintaining profitability and market leadership in this segment. For instance, in fiscal year 2024, Ansell reported that its Healthcare segment, which includes surgical gloves, continued to be a significant contributor to overall revenue, demonstrating the enduring strength of these core products.

Ansell's established examination gloves, including well-known brands like MICROFLEX and TouchNTuff, are prime examples of Cash Cows within the Boston Consulting Group (BCG) matrix. These products cater to a vast customer base in both healthcare and diverse industrial sectors.

The high volume and widespread adoption of these gloves have led to significant market penetration. In 2024, Ansell reported strong performance in its healthcare segment, driven by demand for examination gloves, contributing significantly to overall revenue stability.

These offerings represent a reliable revenue stream, benefiting from consistent demand in mature markets. While growth may be modest, their established position ensures a steady, predictable income for Ansell, allowing for investment in other areas of the business.

Ansell's established industrial hand protection lines, like HyFlex and TouchNTuff, are prime examples of cash cows. These foundational products boast high market penetration across diverse sectors due to their general-purpose safety applications, ensuring stable and predictable demand.

These mature offerings are significant cash flow generators for Ansell, requiring minimal incremental investment for marketing or distribution expansion. In 2024, Ansell continued to rely on these established product families for consistent revenue streams, underpinning their status as reliable cash cows.

Mature Protective Clothing Solutions for Established Industries

Ansell's mature protective clothing solutions cater to established industries with consistent demand, positioning them as cash cows. These offerings, like basic chemical protection and general manufacturing gear, have a strong market presence due to their focus on worker safety in mature sectors.

These product lines generate dependable revenue streams, contributing significantly to Ansell's robust cash flow. Their established nature means they require minimal new investment to maintain their market share and profitability.

- Consistent Demand: Mature industries rely on these protective clothing solutions for ongoing worker safety needs.

- Reliable Revenue: These products provide a stable income source for Ansell.

- Low Investment Needs: Unlike growth-oriented products, these cash cows require minimal capital infusion.

- Market Entrenchment: Ansell's long-standing presence ensures these solutions are well-recognized and trusted.

Ansell's Overall Healthcare Segment (Post-Destocking Recovery)

Ansell's Healthcare segment, a cornerstone of its business, is showing resilience after a period of customer destocking. This segment, historically a significant revenue driver, is now on a recovery path, underscoring its inherent stability and commanding market position in crucial healthcare personal protective equipment (PPE).

The segment's recovery is a positive sign for Ansell's overall financial health. For the fiscal year ending June 30, 2023, Ansell reported that its Healthcare segment generated approximately $926.7 million in revenue. While growth may be more moderate compared to other segments, its consistent earnings and strong cash flow generation solidify its role as a reliable cash cow for the company.

- Historical Dominance: The Healthcare segment has long been a major contributor to Ansell's revenue, demonstrating its established market presence.

- Post-Destocking Recovery: Following a period of inventory adjustments by customers, the segment is experiencing a rebound, indicating a return to stable demand.

- Essential PPE Provider: Ansell's leadership in healthcare PPE ensures continued relevance and demand, even in challenging economic environments.

- Consistent Cash Generation: Despite potentially lower growth rates, the segment provides a steady and predictable source of earnings and cash for the company.

Ansell's established surgical glove portfolio exemplifies a classic Cash Cow. This segment benefits from a leading global market position in a mature healthcare sector, consistently delivering substantial cash flow. The essential nature of these gloves in surgical settings worldwide guarantees stable demand, underpinning their strong performance.

In fiscal year 2024, Ansell's Healthcare segment, which includes surgical gloves, continued to be a significant contributor to overall revenue, demonstrating the enduring strength of these core products and their reliable cash-generating capacity.

| Product Category | BCG Matrix Status | Key Characteristics | FY2024 Performance Insight |

| Surgical Gloves | Cash Cow | Mature market, high market share, stable demand, low investment needs | Continued significant revenue contribution |

| Examination Gloves (e.g., MICROFLEX, TouchNTuff) | Cash Cow | Widespread adoption, high market penetration, consistent demand | Strong performance driven by healthcare and industrial sectors |

| Industrial Hand Protection (e.g., HyFlex) | Cash Cow | High market penetration across diverse sectors, stable demand | Reliable revenue streams, underpinning cash flow |

Preview = Final Product

Ansell BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after completing your purchase. This means no watermarks, no placeholder text, and no hidden surprises—just the complete strategic analysis ready for your business planning. You can confidently use this preview as a true representation of the high-quality, actionable insights you'll gain. Once purchased, this comprehensive BCG Matrix will be directly accessible for immediate download, allowing you to seamlessly integrate its strategic framework into your decision-making processes.

Dogs

Ansell's decision to exit its retail household gloves business in fiscal year 2024 clearly places this segment in the 'Dog' category of the BCG Matrix. This move was driven by declining sales, a reflection of a low-growth market and the company's diminished market share within it. The divestment, confirmed by Ansell's strategic realignment, allows for the redirection of capital and focus towards more profitable ventures.

Certain basic, undifferentiated protective products where Ansell faces intense competition from low-cost manufacturers likely fall into the Dogs category. These products typically have low profit margins and offer limited growth potential. For instance, Ansell's 2024 financial reports indicate that while overall revenue grew, the contribution from these basic product lines remained stagnant, reflecting their commoditized nature and the price pressures in the market.

Ansell's older product lines, particularly those with limited innovation, are facing declining demand. These products, once staples, now struggle to compete in a market that constantly seeks newer, more advanced solutions. For instance, certain legacy medical glove types might see their market share shrink as advanced nitrile or specialty polymer alternatives gain traction.

These stagnant offerings typically contribute little to overall revenue while still requiring resources for maintenance and distribution. Ansell's strategic reviews in 2024 likely identified such underperforming categories, potentially including some of their older industrial safety apparel that hasn't been updated with new materials or safety features.

The financial impact of these outdated lines is a drain on profitability, generating minimal returns on investment. Ansell's approach, as demonstrated in their portfolio management, would involve assessing these products for potential discontinuation or significant resource reallocation to more promising growth areas.

Legacy Products from Unsuccessful Smaller Acquisitions

Legacy products originating from smaller, less successful acquisitions often become dogs in the BCG Matrix. These are typically older product lines that Ansell acquired but failed to effectively integrate or scale within its broader portfolio. They operate in stagnant or declining niche markets where Ansell couldn't establish a strong competitive position, leading to low market share and minimal revenue generation.

These products represent a drain on resources without significant return. For instance, a product acquired in 2018 for a specific niche market might have seen its market shrink by 15% by 2024 due to technological shifts or changing consumer preferences, leaving Ansell with a product that has low growth potential and low relative market share.

- Low Market Share: These products typically hold a small fraction of their respective markets, often below 10%.

- Low Growth: The markets these products serve are often mature or declining, with annual growth rates of less than 3%.

- Resource Drain: Continued investment in marketing, R&D, or operational support for these products yields minimal returns, diverting capital from more promising ventures.

- Integration Challenges: Past acquisitions may have faced difficulties in merging with Ansell's existing systems, supply chains, or brand identity, hindering their performance.

Products in Regions with Unsustainable Market Share

Ansell might have certain product lines in specific geographic markets where their market share is consistently low. This situation often arises due to intense local competition or market conditions that are simply not favorable for Ansell's offerings. For example, if Ansell's industrial gloves have a market share below 5% in a particular South American country, and there's no clear strategy for significant growth, it could be categorized as a 'Dog'.

Continuing to invest resources in these underperforming products within these challenging regions can be a drain on the company's finances. The returns generated are typically minimal, failing to justify the ongoing expenditure. This is the core characteristic of a 'Dog' in the BCG Matrix – low market share and low growth potential.

Consider a scenario where Ansell's healthcare gloves have struggled to gain traction in a specific Eastern European market, holding less than 3% market share. If market analysis for 2024 indicates no projected significant increase in demand or a strong competitive response, this product-region combination would likely fit the 'Dog' profile. Such products consume capital without delivering substantial profits, impacting overall portfolio efficiency.

- Low Market Share: Products in regions with less than 10% market share.

- Unfavorable Market Dynamics: Regions characterized by dominant local competitors or slow economic growth impacting product demand.

- Resource Drain: Continued investment in these areas yields low or negative returns, diverting capital from more promising ventures.

- Strategic Re-evaluation: Such 'Dogs' often require a decision on whether to divest, harvest, or attempt a turnaround strategy.

Ansell's 'Dogs' are product lines with low market share in slow-growing or declining markets. These segments, like certain legacy medical gloves or undifferentiated protective items facing intense price competition, consume resources without generating significant returns. For example, Ansell's exit from its retail household gloves business in FY2024 highlights a strategic move away from such underperforming areas, reflecting their low-growth, low-share characteristics.

These underperforming products often stem from older, less innovative offerings or acquisitions that failed to gain traction. In 2024, Ansell's portfolio review likely identified these segments, which may include basic industrial safety apparel lacking modern features, as candidates for discontinuation or significant resource reallocation. Their contribution to overall revenue remained stagnant, underscoring their commoditized nature and limited profit potential.

Products with a market share below 10% in specific geographic regions, where Ansell faces strong local competition or unfavorable market dynamics, also fall into the 'Dog' category. These segments, such as healthcare gloves in certain Eastern European markets with less than 3% share and no projected growth, represent a drain on finances, yielding minimal returns and impacting portfolio efficiency.

| Ansell Product Category Example | Market Share | Market Growth | Rationale for 'Dog' Classification |

| Retail Household Gloves (Exited FY2024) | Low (declining) | Low (declining) | Strategic exit due to poor performance and market conditions. |

| Basic Undifferentiated Protective Products | Low (e.g., <10%) | Low (e.g., <3%) | High competition, low margins, commoditized nature. |

| Legacy Medical Glove Types | Low (declining) | Low (declining) | Outdated technology, losing to advanced alternatives. |

| Certain Industrial Safety Apparel (Un-updated) | Low (e.g., <5% in specific regions) | Low (stagnant) | Lack of innovation, failing to compete with updated solutions. |

Question Marks

Kimtech and Kleen Guard, following their acquisition, are considered Stars in developed markets. However, their expansion into Latin America and Asia Pacific, slated for June 2025, positions them as Question Marks in these emerging territories. Ansell anticipates substantial growth from these regions, but current market share is minimal as order acceptance is just commencing.

Significant capital investment will be essential to establish a robust market presence and secure a meaningful share in Latin America and Asia Pacific. This strategic push reflects Ansell's confidence in the long-term potential of these markets, despite the initial low market penetration and the inherent risks associated with expanding into new territories.

The market for smart safety gloves, integrating sensors for real-time data on hand movements, grip force, and temperature, is a burgeoning high-growth sector. Ansell's exploration of wearable pods and glove sensors signals a strategic move into this innovative space. While this technology is still in its early stages, Ansell's current market share in this niche segment is likely minimal, necessitating significant investment to elevate it to a 'Star' category within the BCG matrix.

New, highly specialized chemical protection products, such as Ansell's AlphaTec 53-002 and 53-003, represent a significant investment in advanced formulations. These products utilize innovative hybrid technology designed to offer superior chemical resistance, targeting a market segment that demands increasingly sophisticated safety solutions. The global market for personal protective equipment (PPE), particularly in specialized chemical handling, is projected to grow, with some estimates showing a compound annual growth rate (CAGR) of over 6% in the coming years, driven by stricter regulations and increased awareness of workplace hazards.

While these advanced formulations hold considerable promise, their position within the BCG matrix is likely that of a question mark. Despite entering a growing market, their adoption and market share are still in nascent stages. For instance, early market feedback suggests strong technical performance, but widespread commercial penetration takes time and significant effort. Ansell must therefore allocate substantial resources towards targeted marketing campaigns and robust distribution channel development to effectively convert these innovations into dominant market players.

PI-KARE Non-Sensitizing, Skin-Friendly Gloves

PI-KARE Non-Sensitizing, Skin-Friendly Gloves, featuring Ansell's proprietary PI-KARE technology, represent a promising innovation in the protective gloves sector. This technology focuses on synthetic polyisoprene, specifically engineered to minimize allergic reactions and enhance user comfort, tapping into a growing demand for safer and more comfortable personal protective equipment (PPE).

Within the Ansell BCG Matrix, PI-KARE gloves would likely be classified as a Question Mark. While the technology addresses a high-growth niche in the market for reduced allergic reactions in gloves, its overall market share is still relatively small and developing. This means significant investment is required to increase its adoption and establish a stronger market presence.

The market for medical gloves, a key segment for PI-KARE, saw substantial growth, with the global medical gloves market valued at approximately $15.2 billion in 2023 and projected to reach $25.3 billion by 2030, growing at a CAGR of 7.5%. This growth presents an opportunity for PI-KARE to capture a larger share, particularly given the increasing awareness and regulation around latex allergies.

- Market Niche: Addresses the growing demand for hypoallergenic and skin-friendly protective gloves, reducing instances of Type IV latex allergy.

- Innovation: Utilizes advanced synthetic polyisoprene (PI-KARE technology) for enhanced comfort and safety.

- Market Growth: Operates within the expanding global medical and industrial glove markets, which are projected for continued strong growth.

- Investment Need: Requires strategic investment to increase production capacity, market penetration, and brand awareness to move towards a Star position.

New Product Lines Targeting Niche Emerging Life Sciences Segments

Ansell's strategic expansion into niche emerging life sciences segments, beyond its established cleanroom offerings, positions these ventures as potential Question Marks in the BCG matrix. These areas, while showing promise for high growth, currently hold minimal market share for Ansell, necessitating substantial investment and diligent evaluation to ascertain their future potential. For instance, by 2024, Ansell has been actively investing in areas like advanced wound care materials and specialized biopharmaceutical consumables, segments experiencing rapid technological advancements and increasing demand.

These new product lines are characterized by their nascent stage and the significant capital required to cultivate market presence and brand recognition. The success of these initiatives hinges on Ansell's ability to innovate and adapt to evolving scientific landscapes. In 2024, Ansell's commitment to R&D in these emerging fields is evident, with a notable portion of its innovation budget allocated to developing next-generation protective solutions for cell and gene therapy manufacturing, a segment projected for substantial growth.

- Targeting High-Growth Niches: Ansell is focusing on emerging life sciences areas with significant growth potential, such as advanced bioprocessing and personalized medicine consumables.

- Low Current Market Share: These new ventures, while promising, represent a small fraction of Ansell's overall market share in 2024, reflecting their early-stage development.

- Significant Investment Required: Substantial capital expenditure is needed for research, development, and market penetration to transform these Question Marks into future Stars.

- Strategic Importance: The successful development of these niche segments is crucial for Ansell's long-term diversification and sustained competitive advantage in the evolving life sciences industry.

Question Marks in the Ansell BCG Matrix represent products or business units with low market share in high-growth markets. These are typically new products or ventures that require significant investment to gain traction and potentially become future Stars. Ansell's strategic focus on emerging markets and innovative product lines places several of its offerings in this category.

Significant capital is needed to build market share and brand awareness for these Question Marks. The success of these investments will determine whether they transition into Stars or remain underdeveloped. For example, Ansell's expansion into Latin America and Asia Pacific for its Kimtech and Kleen Guard brands, along with new specialized chemical protection products, are currently positioned as Question Marks.

The company must carefully manage these investments, balancing the potential for high returns with the inherent risks of low market penetration. Ansell's commitment to R&D in areas like smart safety gloves and life sciences consumables further highlights its strategic approach to nurturing potential future market leaders.

| Product/Segment | Market Growth | Market Share | Investment Need | BCG Classification |

|---|---|---|---|---|

| Kimtech/Kleen Guard (Latin America & Asia Pacific) | High | Low | High | Question Mark |

| Smart Safety Gloves | High | Low | High | Question Mark |

| AlphaTec 53-002/53-003 (Specialty Chemical Protection) | High (Projected 6%+ CAGR for specialized PPE) | Low | High | Question Mark |

| PI-KARE Gloves (Medical & Industrial) | High (Medical gloves market $15.2B in 2023, 7.5% CAGR) | Low | High | Question Mark |

| Emerging Life Sciences Segments (e.g., Advanced Wound Care) | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial disclosures, market research reports, and competitive landscape analysis to provide a comprehensive view of product portfolio performance.