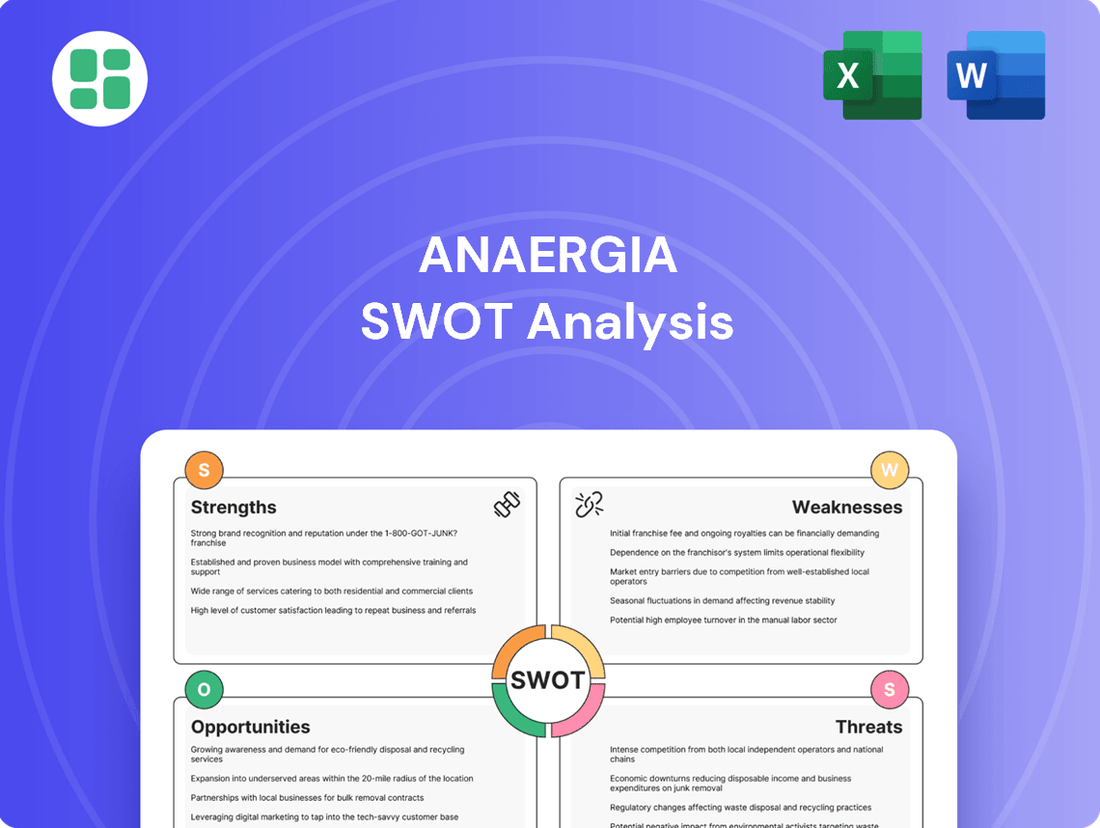

Anaergia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anaergia Bundle

Anaergia's strengths lie in its innovative technology and established market presence in the renewable energy sector. However, potential weaknesses include reliance on specific feedstock and regulatory uncertainties. Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Anaergia's strength lies in its extensive proprietary technology portfolio, boasting over 250 patents. This robust intellectual property underpins its integrated approach to waste-to-value solutions.

These technologies cover the entire waste processing spectrum, from solid waste and wastewater treatment to organics recovery and biomethane production. This end-to-end capability allows Anaergia to efficiently convert various organic waste streams into valuable resources.

The company's ability to transform diverse organic waste into renewable natural gas, fertilizer, and clean water directly supports greenhouse gas emission reductions and promotes a circular economy. For instance, their projects in 2024 are projected to offset thousands of tons of CO2 equivalent annually.

Anaergia boasts a robust and growing global project pipeline, underscored by a record revenue backlog of $200 million as of the first quarter of 2025. This represents a significant 94.1% surge compared to the backlog at the close of 2024, indicating strong demand for its services.

The company's success in securing new contracts is evident across diverse geographies and project types. Notable recent wins include several biomethane facilities in Italy, a substantial biogas plant in Jeju Island, South Korea, and an innovative organic waste-to-energy solution for PepsiCo in Colombia, demonstrating its broad international reach and capability.

Anaergia's strategic shift to a capital-light model, dubbed 'Anaergia 2.0', is proving a significant strength. By focusing on high-margin capital sales, technology provision, and operations and maintenance (O&M) agreements, often alongside equity partners, the company is optimizing its resource allocation.

This recalibration has been significantly reinforced by Marny Investment SA's substantial capital injection in July 2024, which has bolstered Anaergia's financial standing. This strategic move has directly contributed to an improvement in adjusted EBITDA and a reduction in net losses, showcasing the effectiveness of the new model.

Contribution to Environmental Sustainability and Circular Economy

Anaergia's core mission directly combats climate change by converting organic waste into valuable resources like Renewable Natural Gas (RNG), clean water, and fertilizer. This process is inherently carbon-negative, significantly reducing greenhouse gas emissions. This focus strongly aligns with increasing global ESG mandates and governmental programs pushing for waste diversion from landfills and lower emissions, positioning Anaergia as a vital contributor to the burgeoning green economy.

The company's commitment to sustainability is a significant strength, resonating with a growing demand for environmentally responsible solutions. This positions Anaergia favorably within a market increasingly driven by environmental consciousness and regulatory pressures.

- Environmental Impact: Anaergia's technology converts organic waste into carbon-negative RNG, directly addressing methane emissions.

- Circular Economy Contribution: The company's processes create valuable byproducts such as clean water and natural fertilizer, promoting resource recovery.

- Alignment with Global Trends: Anaergia's business model is perfectly suited to meet growing ESG requirements and government initiatives focused on waste reduction and emissions control.

Proven Track Record and Operational Expertise

Anaergia's proven track record and operational expertise are significant strengths. Established in 2007, the company has over 15 years of experience in developing and operating complex waste-to-value projects worldwide. This extensive history demonstrates a deep understanding of the sector and a capacity to deliver on large-scale infrastructure initiatives.

Their ability to leverage existing infrastructure and process diverse feedstocks, coupled with their experience in developing renewable natural gas (RNG), offers a distinct competitive edge. This operational proficiency builds trust with municipal and industrial partners, facilitating the development of substantial infrastructure projects.

- Established in 2007, Anaergia boasts over 15 years of global experience in waste-to-value projects.

- Operational Expertise in processing diverse feedstocks and developing RNG provides a competitive advantage.

- Proven Success in large-scale infrastructure development, fostering confidence with partners.

Anaergia's robust intellectual property, with over 250 patents, forms the bedrock of its integrated waste-to-value solutions. This extensive technological portfolio covers the entire waste processing chain, from initial treatment to the final production of valuable resources like biomethane.

The company's strategic shift to a capital-light model, "Anaergia 2.0," emphasizes high-margin capital sales, technology provision, and O&M agreements, often with equity partners. This recalibration, bolstered by Marny Investment SA's July 2024 capital injection, has improved adjusted EBITDA and reduced net losses.

Anaergia's proven track record, established in 2007, demonstrates over 15 years of global experience in complex waste-to-value projects. This operational expertise in handling diverse feedstocks and developing RNG provides a significant competitive edge, fostering trust with municipal and industrial partners.

| Metric | Q1 2025 | Change from Q4 2024 |

|---|---|---|

| Revenue Backlog | $200 million | +94.1% |

| Patents | 250+ | N/A |

| Years of Experience | 15+ | N/A |

What is included in the product

Delivers a strategic overview of Anaergia’s internal and external business factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Anaergia's strategic challenges and leverage opportunities.

Weaknesses

Anaergia's historical financial performance has been marked by significant underperformance and volatility. For fiscal year 2024, the company reported a substantial 24.2% decrease in full-year revenue compared to the previous year, continuing a trend of net losses that have impacted its financial stability.

This track record of financial challenges has directly affected investor sentiment. The company's stock price has seen a dramatic decline from its peak values, raising concerns about its ability to attract and retain capital, which is crucial for future growth and operational expansion.

Anaergia's revenue and profitability are closely tied to the successful and timely completion of its large capital sales projects. Any delays in these projects, often influenced by customer timelines or decision-making processes, can directly impact financial performance. This sensitivity was observed in Q1 2025, where a slowdown in certain regional sales contributed to a slight dip in overall revenue.

Despite Anaergia's strategic pivot towards a capital-light approach, its 'Build, Own, Operate' (BOO) projects remain inherently capital-intensive. These projects, crucial for generating stable, long-term revenue streams, demand significant upfront financial commitments. This can strain resources, particularly when scaling operations.

The company has faced hurdles in optimizing certain BOO facilities, such as the Rialto Bioenergy Facility, to their full operational and financial potential. These ramp-up challenges can negatively affect financial performance, as seen in past operational inefficiencies and the need for further investment to achieve projected output.

Operational Risks and Feedstock Challenges

Anaergia's operations, which involve complex waste treatment and energy generation, are susceptible to operational risks. A significant concern is the consistent supply and quality of organic feedstock, which is crucial for efficient plant operation. For instance, in 2023, Anaergia reported that disruptions in feedstock availability at some of its facilities led to underutilization, impacting revenue streams.

These feedstock challenges can directly hinder the full utilization of facility capacity. When the input material isn't readily available or meets the required specifications, plants cannot operate at their optimal output levels. This leads to inefficiencies and can negatively affect the project economics, as seen in the increased operating costs reported in their Q4 2023 earnings call due to feedstock variability.

- Feedstock Variability: Inconsistent supply and quality of organic waste can lead to plant downtime and reduced energy output.

- Operational Complexity: Managing sophisticated waste-to-energy processes requires constant monitoring and maintenance to avoid breakdowns.

- Capacity Underutilization: Feedstock shortages in 2023 meant some of Anaergia's facilities operated below their designed capacity, impacting profitability.

- Economic Impact: Inefficiencies arising from operational and feedstock issues directly affect Anaergia's project economics and financial performance.

Competition in Key Verticals

While Anaergia emphasizes its integrated technology, the company operates in a highly competitive arena. It encounters significant rivalry from a multitude of companies across its core business areas, including those offering similar equipment, developing projects, and operating within the broader waste management and renewable energy industries.

For instance, in the anaerobic digestion sector, Anaergia competes with established players and emerging technologies. The global anaerobic digestion market was valued at approximately USD 15.5 billion in 2023 and is projected to grow, indicating a crowded space where differentiation is key. Competitors range from large industrial conglomerates to specialized technology providers, all vying for market share in biogas and renewable natural gas production.

- Intense Rivalry: Anaergia faces competition from numerous companies in equipment supply, project development, and operations within waste management and renewable energy.

- Market Saturation: Key verticals such as anaerobic digestion are experiencing growth, attracting a significant number of players, making market penetration and expansion challenging.

- Technological Advancements: Competitors are also investing in and developing new technologies, potentially eroding Anaergia's perceived technological advantage if not continuously innovated upon.

Anaergia's reliance on large capital sales projects creates a significant weakness due to their inherent delays and customer-dependent timelines. This sensitivity was evident in Q1 2025, where regional sales slowdowns impacted revenue. Furthermore, despite a move towards a capital-light model, their 'Build, Own, Operate' projects remain capital-intensive, straining resources during scaling efforts.

Operational challenges, particularly with feedstock consistency and quality, directly hinder optimal plant utilization. For example, in 2023, feedstock disruptions led to underutilization at several facilities, increasing operating costs. These issues impact project economics and financial performance, as demonstrated by past operational inefficiencies.

The company operates in a highly competitive landscape, with numerous players in equipment supply, project development, and operations. The anaerobic digestion market, valued at approximately USD 15.5 billion in 2023, is particularly crowded, making market penetration and expansion difficult.

| Weakness | Description | Impact | Example/Data |

| Project Delays | Revenue tied to capital sales projects with customer-dependent timelines. | Impacts financial performance and revenue predictability. | Q1 2025 saw revenue dip due to regional sales slowdowns. |

| Capital Intensity of BOO | 'Build, Own, Operate' projects require substantial upfront investment. | Strains resources, especially during scaling. | Ongoing need for significant financial commitments to expand operations. |

| Feedstock Issues | Inconsistent supply and quality of organic waste. | Leads to plant downtime, underutilization, and increased operating costs. | 2023: Feedstock disruptions caused underutilization; Q4 2023 earnings cited higher operating costs due to variability. |

| Intense Competition | Numerous rivals in equipment, project development, and operations. | Challenges market penetration and differentiation. | Global anaerobic digestion market valued at ~$15.5 billion in 2023, with many participants. |

Full Version Awaits

Anaergia SWOT Analysis

The file shown below is not a sample—it’s the real Anaergia SWOT analysis you'll download post-purchase, in full detail. This comprehensive document provides a thorough examination of Anaergia's internal strengths and weaknesses, as well as external opportunities and threats. You'll gain valuable insights to inform strategic decision-making.

Opportunities

The global appetite for Renewable Natural Gas (RNG) is surging, fueled by aggressive climate targets and supportive government policies. This trend creates a substantial runway for companies like Anaergia, whose technologies are central to producing this clean fuel.

Market projections indicate robust growth in the waste-to-value sector, with significant expansion anticipated through 2030. This presents a prime opportunity for Anaergia to leverage its proprietary processes, tapping into a rapidly expanding market eager for sustainable energy solutions.

Anaergia is strategically expanding into promising new territories, with significant project advancements noted in Japan and Colombia during 2024. This push into Latin America, particularly with the ongoing development in Colombia, signifies a key growth avenue.

Further European penetration is also a core focus, with Italy, Portugal, and Spain representing crucial markets for the company’s renewable natural gas (RNG) and waste-to-energy solutions. This broad geographical diversification is designed to tap into diverse regulatory environments and increasing demand for sustainable energy.

Government mandates are increasingly pushing for organic waste diversion from landfills, a trend directly benefiting Anaergia. For instance, California's SB1383 aims to cut organic waste in landfills by 75% by 2025, creating significant demand for anaerobic digestion facilities. This policy shift is a powerful tailwind for companies like Anaergia that offer solutions for this growing waste stream.

Stringent carbon reduction targets globally are also a major opportunity. The U.S. Inflation Reduction Act (IRA) offers substantial tax credits for renewable natural gas production, a key output from anaerobic digestion. These federal incentives, alongside state-level programs, directly lower the cost of Anaergia's projects, making them more competitive and attractive to investors.

The supportive policy landscape translates into tangible demand for waste-to-value infrastructure. As more municipalities and businesses are compelled to divert organic waste, they require advanced processing solutions. Anaergia's established expertise in anaerobic digestion and biogas production positions it to capture a significant share of this expanding market driven by favorable regulations.

Strategic Partnerships and Collaborations

Anaergia can significantly boost its growth by deepening existing strategic partnerships and forging new ones. For instance, its collaborations with QGM and Capwatt for biomethane plants in Italy and across Europe demonstrate a successful capital-light model. This approach allows Anaergia to accelerate its project pipeline and broaden its market presence by sharing development risks and capital requirements.

These alliances are crucial for expanding Anaergia's technological reach and operational footprint. By collaborating, the company can access new markets and integrate diverse technological solutions more efficiently than if it were to pursue these ventures independently. This strategy is particularly relevant as Anaergia aims to capitalize on the growing demand for renewable natural gas in 2024 and 2025.

- Leveraging Existing Agreements: Building on successful projects with partners like QGM and Capwatt, Anaergia can replicate this model in new European territories.

- Expanding Project Pipeline: Strategic partnerships enable a faster and more scalable development of new biomethane and renewable energy projects.

- Enhancing Technology Integration: Collaborations can facilitate the adoption and co-development of advanced waste-to-energy technologies.

- Capital-Light Expansion: This approach conserves Anaergia's capital, allowing for broader market penetration and diversification of revenue streams.

Leveraging ESG Investment Trends

Anaergia's core business, focused on environmental sustainability and greenhouse gas reduction, directly taps into the surging ESG investment market. This strong alignment is expected to attract significant capital flows as investors increasingly prioritize sustainable ventures. For instance, global ESG assets were projected to reach $50 trillion by 2025, according to some industry estimates, highlighting the immense opportunity for companies like Anaergia.

This positioning offers Anaergia preferential access to capital, likely at more favorable terms, and bolsters investor confidence. The company's circular economy principles further enhance its appeal within this growing investment landscape.

- Growing ESG Fund Inflows: Global ESG assets are on a trajectory to exceed $50 trillion by 2025, creating a substantial pool of capital for sustainable businesses.

- Enhanced Investor Confidence: Anaergia's business model naturally aligns with investor mandates seeking environmental and social impact, fostering trust and long-term relationships.

- Preferential Capital Access: The strong ESG profile can lead to easier and potentially cheaper access to financing compared to non-ESG compliant peers.

- Market Leadership Potential: By effectively leveraging ESG trends, Anaergia can solidify its position as a leader in the sustainable energy and waste management sectors.

Anaergia is well-positioned to capitalize on the increasing global demand for renewable natural gas (RNG) and the growing emphasis on ESG investing. The company's strategic expansion into new markets like Japan and Colombia, coupled with its focus on European penetration in countries such as Italy, Portugal, and Spain, presents significant growth avenues. Favorable government policies, including California's SB1383 and the U.S. Inflation Reduction Act, directly support Anaergia's business model by incentivizing organic waste diversion and renewable energy production.

The company's capital-light expansion strategy, exemplified by its partnerships with QGM and Capwatt, allows for accelerated project development and broader market reach. This approach, combined with a strong alignment with the burgeoning ESG investment market, which is projected to exceed $50 trillion by 2025, provides Anaergia with preferential access to capital and enhances investor confidence. These factors collectively create a robust landscape of opportunities for Anaergia to expand its operations and solidify its market leadership in the sustainable energy sector.

| Opportunity | Description | Key Drivers | Projected Impact (2024-2025) |

|---|---|---|---|

| Surging RNG Demand | Increasing global demand for clean fuels driven by climate targets. | Government mandates, corporate sustainability goals. | Expansion of existing projects, new project acquisitions. |

| Strategic Market Expansion | Entry into new geographic regions like Japan and Colombia, alongside European growth. | Untapped markets, favorable regulatory environments. | Increased project pipeline, diversified revenue streams. |

| Supportive Policy Landscape | Government incentives for organic waste diversion and renewable energy. | Climate change mitigation policies, carbon reduction targets. | Lower project development costs, enhanced project economics. |

| ESG Investment Growth | Attracting capital from investors prioritizing sustainable ventures. | Growing ESG asset base ($50 trillion projected by 2025). | Easier and potentially cheaper access to financing. |

| Partnership-Driven Growth | Leveraging capital-light models through strategic alliances. | Shared development risks, accelerated project deployment. | Faster scaling of operations, broader technological integration. |

Threats

Anaergia's financial results are sensitive to the unpredictable swings in commodity prices. For instance, the market price for renewable natural gas (RNG) and fertilizers, key outputs for the company, can significantly impact its profitability.

A sharp decline in RNG prices, which have seen fluctuations, could directly reduce Anaergia's revenue streams, especially for its build, own, and operate (BOO) projects. Similarly, lower fertilizer prices can squeeze gross margins, making operations less lucrative.

Anaergia operates in a highly competitive landscape within the waste-to-value and renewable energy sectors. Despite its proprietary technologies, the threat of rivals developing or acquiring similar innovations poses a significant challenge. For instance, as of early 2024, the global biogas market, where Anaergia is active, is projected to reach over $35 billion by 2028, indicating substantial investment and competition.

Competitors may also employ aggressive pricing strategies, undercutting Anaergia's offerings and potentially impacting its market share and profitability. This pricing pressure could force Anaergia to adjust its own pricing, thereby reducing its margins. The rapid pace of technological advancement in the sector means that even established proprietary solutions can become outdated quickly, requiring continuous innovation and investment.

Anaergia's business model is intrinsically linked to government policies that encourage waste diversion and renewable energy. Changes in these regulations, such as altered feed-in tariffs or stricter permitting, could directly impact project economics and Anaergia's competitive edge.

For instance, a reduction in renewable energy credits or carbon pricing mechanisms, which have been crucial drivers for Anaergia’s projects, could decrease the financial attractiveness of its waste-to-value solutions. In 2024, many governments are reviewing their energy policies, and any tightening of environmental standards or reduction in financial support for anaerobic digestion could pose a significant threat.

Project Financing and Capital Availability Challenges

Even with Anaergia's shift to a capital-light approach, large infrastructure projects still demand significant capital. For instance, securing financing for projects like the recent Rialto Bioenergy Facility, which has a capacity of 10.5 MW, requires substantial upfront investment and ongoing access to capital. Economic uncertainties, rising interest rates, and tighter credit conditions, as seen with the Federal Reserve's continued rate hikes through early 2024, can increase the cost and difficulty of obtaining this crucial project financing, potentially slowing down Anaergia's expansion plans.

Challenges in capital availability can directly impact Anaergia's growth trajectory. A tightening of credit markets, a recurring concern in 2024 due to global economic pressures, could limit the number of projects the company can undertake or extend their development timelines. This is particularly relevant as Anaergia aims to scale its operations globally, requiring consistent access to diverse funding sources to support its pipeline of renewable natural gas and waste-to-energy projects.

- Increased Cost of Capital: Rising interest rates, such as the benchmark federal funds rate which remained elevated through mid-2024, directly increase the cost of debt financing for projects.

- Reduced Investor Appetite: Economic volatility can lead to a more cautious approach from investors, potentially reducing the availability of equity for new developments.

- Project Delays: Difficulty in securing timely and adequate financing can lead to significant delays in project commencement and completion, impacting revenue generation.

- Competitive Landscape: Competitors also vying for limited capital may gain an advantage if Anaergia faces more significant financing hurdles.

Public Acceptance and Permitting Hurdles

Anaergia’s projects, like many in the waste-to-energy sector, face the significant threat of public opposition, commonly known as NIMBYism, and intricate, lengthy permitting procedures. These challenges can severely impact project timelines and budgets. For instance, delays in securing necessary permits can push back revenue generation, while unexpected community concerns might necessitate costly project modifications.

The complexity of these hurdles is substantial. Permitting processes often involve multiple governmental agencies at federal, state, and local levels, each with its own set of requirements and review periods. This can lead to extended timelines, with some projects experiencing delays of several years from initial application to final approval. Such protracted processes directly translate into increased development costs, impacting overall project viability and Anaergia's financial projections.

The potential consequences of public acceptance and permitting issues are severe. They can manifest as:

- Significant Project Delays: Extended review periods and public consultations can add years to development schedules.

- Increased Capital Expenditures: Modifications to appease community concerns or navigate regulatory changes often inflate project costs.

- Risk of Project Cancellation: Inability to overcome public opposition or secure permits can lead to the complete abandonment of a project, resulting in sunk costs and lost opportunities.

Anaergia faces significant threats from fluctuating commodity prices, particularly for renewable natural gas (RNG) and fertilizers, which directly impact revenue and margins. For example, a downturn in RNG prices, which have shown volatility, could reduce earnings from its build, own, and operate projects.

The company also operates in a highly competitive market where rivals can emerge with similar technologies or utilize aggressive pricing. As of early 2024, the global biogas market is projected to exceed $35 billion by 2028, highlighting intense competition and the need for continuous innovation to avoid technological obsolescence.

Changes in government policies and incentives, such as renewable energy credits or carbon pricing, pose a substantial risk. Any reduction in these financial supports, which are critical drivers for Anaergia’s projects, could diminish the attractiveness of its waste-to-value solutions. Many governments are reviewing energy policies in 2024, potentially impacting financial support for anaerobic digestion.

Securing adequate and affordable capital remains a challenge, especially with rising interest rates, like the Federal Reserve's continued hikes through early 2024, increasing the cost of debt financing. Economic uncertainties can also reduce investor appetite, potentially delaying or canceling projects, impacting Anaergia's growth trajectory.

Public opposition (NIMBYism) and complex, lengthy permitting processes are further threats, capable of causing significant project delays and cost overruns. These hurdles often involve multiple agencies, extending timelines and potentially leading to project modifications or cancellations, impacting financial projections.

SWOT Analysis Data Sources

This Anaergia SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry commentary to provide a well-rounded and accurate strategic overview.