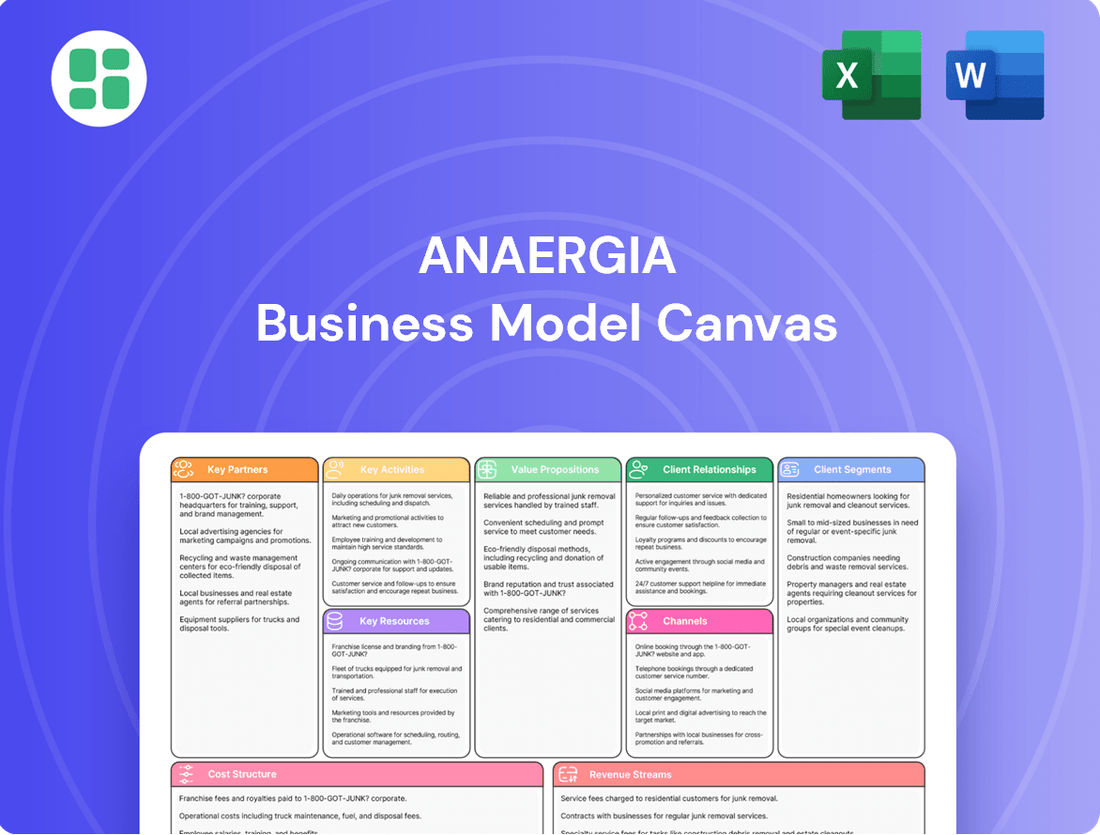

Anaergia Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anaergia Bundle

Unlock the full strategic blueprint behind Anaergia's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Anaergia collaborates with leading technology and equipment suppliers, such as Wärtsilä and GE, to integrate specialized components into their waste-to-value systems. These partnerships are crucial for sourcing advanced anaerobic digestion technology and high-efficiency biogas upgrading equipment, ensuring optimal performance and reliability in their renewable energy projects.

Anaergia's key partnerships with waste generators, including municipalities and industrial facilities, are foundational. These alliances ensure a steady stream of organic waste and wastewater, vital for their anaerobic digestion operations. For instance, in 2024, Anaergia continued to expand its agreements with various cities, securing feedstock for its facilities across North America and Europe.

These strategic alliances with agricultural operations, alongside municipal and industrial partners, are critical for feedstock quality and consistency. Reliable feedstock supply is the backbone of Anaergia's ability to continuously produce renewable natural gas and other valuable byproducts. Their 2024 operational data highlighted that over 70% of their feedstock volumes were secured through long-term agreements with these core partners.

Anaergia’s success hinges on strong relationships with off-takers, including major energy utilities and gas distributors who purchase its renewable natural gas (RNG). For example, in 2024, Anaergia continued to expand its RNG offtake agreements, securing new contracts that are projected to significantly increase its RNG sales volume by the end of the year.

Collaborations with agricultural companies are also crucial, as they provide both feedstock and an outlet for digestate, a nutrient-rich byproduct used as fertilizer. These partnerships in 2024 have been strengthened by increasing demand for sustainable farming practices, creating a dual benefit for Anaergia’s operations and its partners.

Furthermore, industrial end-users represent a growing market for Anaergia’s treated water and RNG. In 2024, the company has seen increased interest from manufacturing sectors looking to reduce their carbon footprint and secure reliable, renewable energy sources, leading to new offtake agreements that bolster revenue streams.

Engineering, Procurement, and Construction (EPC) Firms

Anaergia relies heavily on partnerships with experienced Engineering, Procurement, and Construction (EPC) firms. These collaborations are crucial for the successful design, construction, and commissioning of their advanced waste-to-value facilities, ensuring projects are delivered efficiently and on schedule.

These partnerships are vital for leveraging specialized expertise in complex project execution. For instance, Anaergia’s projects often involve intricate biogas processing and renewable natural gas (RNG) upgrading, requiring EPC firms with proven track records in these specialized areas. This ensures adherence to stringent quality standards, budgets, and project timelines, minimizing risks and maximizing operational readiness.

Key aspects of these partnerships include:

- Access to specialized technical expertise: EPC partners bring deep knowledge in areas like anaerobic digestion technology, gas purification, and plant automation.

- Risk mitigation: Experienced EPC firms help manage construction risks, supply chain complexities, and regulatory compliance.

- Project financing facilitation: Strong EPC relationships can sometimes aid in securing project financing by demonstrating execution capability.

- Timely project completion: Their expertise is critical for meeting ambitious construction and commissioning schedules, enabling faster revenue generation.

Financial Institutions & Investors

Anaergia's ability to execute its capital-intensive projects hinges on strong alliances with financial institutions and investors. These entities, including major banks and private equity firms, are vital for securing the substantial debt and equity financing needed for both new ventures and ongoing expansion. For instance, in 2024, Anaergia continued to leverage its relationships to fund its renewable natural gas (RNG) and waste-to-energy projects, which often require hundreds of millions of dollars in upfront capital.

These partnerships are not merely transactional; they are strategic enablers of Anaergia's growth trajectory. By successfully engaging with these financial players, the company can unlock the necessary capital to develop its pipeline of infrastructure projects, thereby accelerating its mission to convert organic waste into valuable energy resources. This access to capital is a cornerstone of Anaergia's business model, allowing it to scale its operations efficiently.

- Project Financing: Banks and financial institutions provide the essential debt financing for Anaergia's large-scale infrastructure developments.

- Equity Investments: Private equity firms and other investors contribute equity capital, sharing in the project's risk and reward.

- Capital-Intensive Nature: Anaergia's business model requires significant upfront investment, making these financial partnerships indispensable for growth.

- 2024 Funding Activities: In 2024, Anaergia actively sought and secured funding rounds to support its expanding portfolio of RNG and waste-to-energy facilities.

Anaergia's key partnerships extend to research institutions and universities, fostering innovation in waste-to-value technologies. These collaborations are crucial for staying at the forefront of advancements in anaerobic digestion and biogas purification. For example, ongoing research in 2024 focused on optimizing microbial consortia for enhanced biogas yields from diverse waste streams.

These academic alliances also play a role in talent development, ensuring a pipeline of skilled engineers and scientists. By engaging with these partners, Anaergia benefits from cutting-edge research that can be translated into more efficient and profitable operations, as evidenced by pilot projects initiated in 2024.

Anaergia also forms strategic alliances with companies that provide complementary services, such as logistics and waste management consulting. These partnerships streamline operations and enhance the overall value proposition offered to clients. In 2024, the company deepened its relationships with specialized waste logistics providers to ensure efficient feedstock collection.

The company's commitment to sustainability also drives partnerships with environmental organizations and regulatory bodies. These collaborations ensure compliance and promote best practices in the renewable energy sector. Engagement with these groups in 2024 helped refine operational standards and community outreach programs.

What is included in the product

A detailed breakdown of Anaergia's operations, focusing on its renewable energy solutions and waste-to-value strategies.

This canvas outlines Anaergia's key partnerships, revenue streams, and cost structure in the circular economy.

Anaergia's Business Model Canvas acts as a pain point reliever by providing a clear, structured framework that simplifies complex business strategies, making them easily understandable and actionable for diverse teams.

Activities

Anaergia's commitment to Research and Development (R&D) is central to its business model. The company continuously invests in developing and improving its unique waste treatment and resource recovery technologies. This focus on innovation allows Anaergia to enhance process efficiency, broaden the types of waste it can handle, and increase the recovery of valuable resources.

In 2024, Anaergia reported significant progress in its R&D efforts, particularly in areas like advanced anaerobic digestion and biogas upgrading. These advancements aim to make their processes more cost-effective and environmentally beneficial, directly impacting their competitive edge in the renewable energy sector.

Project Development & Engineering is Anaergia's core activity, focusing on transforming waste into valuable resources and renewable energy. This crucial phase involves scouting promising locations, performing thorough feasibility studies to assess technical and economic viability, and navigating the complex process of securing necessary permits. In 2024, Anaergia continued to advance its pipeline of projects, with a significant emphasis on advanced engineering for facilities designed to capture biogas from organic waste streams, contributing to a cleaner energy future.

Anaergia's key activities revolve around the meticulous construction and commissioning of its advanced waste-to-energy facilities. This involves overseeing the entire build process, from site preparation to the final integration of complex anaerobic digestion, wastewater treatment, and resource recovery systems.

The company manages the precise installation of specialized equipment and ensures seamless system integration, a critical step for optimal plant performance. Rigorous testing protocols are implemented to guarantee that all facilities meet stringent operational readiness standards and performance guarantees before handover.

In 2024, Anaergia continued to advance its project pipeline, with several key construction phases underway. For instance, their Rialto, California facility, a significant project, reported substantial progress in its construction and equipment installation phases throughout the year, aiming for full operational capacity by late 2024 or early 2025.

Operations & Maintenance (O&M)

Anaergia's Operations & Maintenance (O&M) is crucial for ensuring their anaerobic digestion facilities run smoothly and profitably. This involves actively managing and maintaining the plants to keep them operating at peak efficiency, maximizing the conversion of organic waste into biogas and fertilizer. Think of it as the ongoing care that keeps the engine running strong.

This service is designed to guarantee the long-term performance and reliability of the facilities they build. By focusing on proactive measures like performance monitoring and preventative upkeep, Anaergia aims to extend the operational life of their assets and, consequently, boost revenue generation. This meticulous attention to detail is key to sustainable success in the renewable energy sector.

- Performance Monitoring: Continuous oversight of digester temperatures, feedstock input, and biogas production rates.

- Preventive Maintenance: Scheduled checks and servicing of equipment, such as pumps, mixers, and gas purification systems, to avert breakdowns.

- Troubleshooting & Repair: Rapid response to any operational anomalies or equipment failures to minimize downtime.

- Regulatory Compliance: Ensuring all environmental and safety standards are met throughout the operational lifecycle.

Sales & Marketing of Renewable Products

Anaergia actively markets and sells the valuable resources produced from its waste processing facilities. This includes renewable natural gas (RNG), organic fertilizers, and treated water, all key outputs that drive revenue. The company focuses on securing off-take agreements and building robust distribution networks to ensure these products reach the market efficiently and profitably.

In 2024, Anaergia continued to expand its RNG sales, leveraging the growing demand for cleaner fuels. For instance, their Rialto Bioenergy Facility in California, a significant RNG producer, contributes to meeting state mandates for renewable fuel. The company's strategy involves securing long-term contracts, providing predictable revenue streams and demonstrating the commercial viability of their waste-to-energy solutions.

- Monetizing Outputs: Anaergia's sales and marketing efforts are centered on converting waste streams into high-value commodities like RNG and fertilizers.

- Off-take Agreements: Securing long-term contracts with buyers for their renewable products provides stable revenue and market access.

- Distribution Channels: Establishing efficient pathways to deliver RNG, fertilizers, and treated water to end-users is critical for market penetration.

- Market Demand: The increasing global focus on sustainability and circular economy principles fuels demand for Anaergia's renewable products.

Anaergia's key activities encompass the entire lifecycle of waste-to-energy projects. This starts with innovation through R&D, moving into project development and engineering, followed by the construction and commissioning of facilities. The company then ensures optimal performance through operations and maintenance, and finally, monetizes the recovered resources through sales and marketing.

In 2024, Anaergia's focus remained on advancing its project pipeline and optimizing existing operations. The company reported progress in securing new off-take agreements for its renewable natural gas (RNG) and continued to enhance its technological capabilities. For example, their Rialto Bioenergy Facility in California, a key RNG producer, saw significant operational milestones throughout the year.

| Key Activity | 2024 Focus/Data | Impact |

|---|---|---|

| Research & Development | Advancements in anaerobic digestion and biogas upgrading | Improved efficiency and cost-effectiveness |

| Project Development & Engineering | Advancing pipeline, securing permits | Expanding renewable energy capacity |

| Construction & Commissioning | Progress on Rialto facility; equipment installation | Bringing new waste-to-energy plants online |

| Operations & Maintenance | Performance monitoring, preventive maintenance | Ensuring long-term asset performance and revenue |

| Sales & Marketing | Expanding RNG sales, securing off-take agreements | Generating revenue from recovered resources |

Preview Before You Purchase

Business Model Canvas

The Anaergia Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this comprehensive and ready-to-use business model canvas, allowing you to start strategizing right away.

Resources

Anaergia’s proprietary technology, including its patented systems for organic waste digestion and biogas upgrading, forms a core element of its business model. This intellectual property allows for highly efficient conversion of waste into valuable resources like renewable natural gas and fertilizer.

This technological edge translates into a significant competitive advantage, enabling Anaergia to achieve superior conversion efficiencies and create diverse output streams from waste materials. For instance, their advanced anaerobic digestion processes are designed to maximize biogas production, a key factor in their profitability.

In 2024, Anaergia continued to leverage its intellectual property to secure new projects and optimize existing operations. The company’s ability to innovate in resource recovery, such as extracting high-value nutrients from digestate, further solidifies its market position and revenue potential.

Anaergia's core strength lies in its highly skilled engineers, project managers, and technical specialists. These individuals possess deep knowledge in waste management, anaerobic digestion, and renewable energy, which is crucial for the successful design, construction, and operation of their complex facilities.

This specialized expertise directly translates into efficient project execution and optimized plant performance, ensuring Anaergia can deliver on its renewable energy solutions. For instance, in 2024, the company continued to leverage this talent pool to advance its projects globally, contributing to its ongoing growth in the biogas and renewable natural gas sectors.

Anaergia’s global network of operational waste-to-value and renewable energy facilities are substantial physical assets. These existing plants showcase proven operational capabilities, consistently generating recurring revenue streams. For instance, as of late 2023, Anaergia operated over 100 facilities globally, demonstrating a robust and scalable infrastructure.

These operational sites serve as tangible proof of concept, effectively functioning as blueprints for the company's future project development and expansion strategies. The successful track record established by these facilities underpins investor confidence and facilitates the replication of Anaergia's business model in new markets.

Financial Capital & Access to Funding

Anaergia's business model hinges on securing substantial financial capital, encompassing equity, debt, and specialized project financing. This is critical for their capital-intensive infrastructure projects, such as renewable natural gas facilities. For instance, in 2023, Anaergia secured a significant $300 million credit facility, demonstrating their ability to access substantial debt financing, which is vital for project development and construction.

Strong financial backing allows Anaergia to invest in new ventures and scale existing operations effectively. Their access to funding directly impacts their capacity to undertake multiple projects simultaneously and to pursue strategic acquisitions. This financial robustness is a cornerstone for their growth strategy in the burgeoning clean energy sector.

- Equity Financing: Anaergia relies on equity investments to fund its operations and growth initiatives.

- Debt Financing: Access to credit facilities and loans is crucial for project construction and capital expenditures.

- Project Financing: Securing non-recourse or limited-recourse project financing is key for developing large-scale infrastructure.

- Investor Confidence: A strong track record and transparent financial reporting build investor confidence, facilitating capital access.

Strategic Relationships & Supply Chain Partnerships

Anaergia’s strategic relationships are foundational to its business model, acting as crucial intangible assets. These include long-standing connections with waste generators, ensuring a steady flow of organic material for processing, and off-takers who purchase the biogas and fertilizer produced. For instance, in 2024, Anaergia continued to secure feedstock agreements with municipalities and industrial clients across North America and Europe, underpinning its operational capacity.

The company also relies heavily on its partnerships with technology suppliers and construction firms. These collaborations are vital for the efficient design, development, and deployment of its anaerobic digestion facilities. In 2024, Anaergia highlighted successful project completions where these partnerships were instrumental in meeting tight deadlines and budget requirements, demonstrating the tangible benefits of these strategic alliances.

- Waste Generators: Ensuring consistent and diverse feedstock supply, a critical input for anaerobic digestion processes.

- Off-takers: Securing markets for biogas (often upgraded to renewable natural gas) and digestate, crucial for revenue generation.

- Technology Suppliers: Access to specialized equipment and intellectual property for optimal plant performance.

- Construction Partners: Expertise in building and commissioning facilities, ensuring timely and cost-effective project execution.

Anaergia's proprietary technology, including its patented systems for organic waste digestion and biogas upgrading, forms a core element of its business model. This intellectual property allows for highly efficient conversion of waste into valuable resources like renewable natural gas and fertilizer.

This technological edge translates into a significant competitive advantage, enabling Anaergia to achieve superior conversion efficiencies and create diverse output streams from waste materials. For instance, their advanced anaerobic digestion processes are designed to maximize biogas production, a key factor in their profitability.

In 2024, Anaergia continued to leverage its intellectual property to secure new projects and optimize existing operations. The company’s ability to innovate in resource recovery, such as extracting high-value nutrients from digestate, further solidifies its market position and revenue potential.

Anaergia's core strength lies in its highly skilled engineers, project managers, and technical specialists. These individuals possess deep knowledge in waste management, anaerobic digestion, and renewable energy, which is crucial for the successful design, construction, and operation of their complex facilities.

This specialized expertise directly translates into efficient project execution and optimized plant performance, ensuring Anaergia can deliver on its renewable energy solutions. For instance, in 2024, the company continued to leverage this talent pool to advance its projects globally, contributing to its ongoing growth in the biogas and renewable natural gas sectors.

Anaergia’s global network of operational waste-to-value and renewable energy facilities are substantial physical assets. These existing plants showcase proven operational capabilities, consistently generating recurring revenue streams. For instance, as of late 2023, Anaergia operated over 100 facilities globally, demonstrating a robust and scalable infrastructure.

These operational sites serve as tangible proof of concept, effectively functioning as blueprints for the company's future project development and expansion strategies. The successful track record established by these facilities underpins investor confidence and facilitates the replication of Anaergia's business model in new markets.

Anaergia's business model hinges on securing substantial financial capital, encompassing equity, debt, and specialized project financing. This is critical for their capital-intensive infrastructure projects, such as renewable natural gas facilities. For instance, in 2023, Anaergia secured a significant $300 million credit facility, demonstrating their ability to access substantial debt financing, which is vital for project development and construction.

Strong financial backing allows Anaergia to invest in new ventures and scale existing operations effectively. Their access to funding directly impacts their capacity to undertake multiple projects simultaneously and to pursue strategic acquisitions. This financial robustness is a cornerstone for their growth strategy in the burgeoning clean energy sector.

- Equity Financing: Anaergia relies on equity investments to fund its operations and growth initiatives.

- Debt Financing: Access to credit facilities and loans is crucial for project construction and capital expenditures.

- Project Financing: Securing non-recourse or limited-recourse project financing is key for developing large-scale infrastructure.

- Investor Confidence: A strong track record and transparent financial reporting build investor confidence, facilitating capital access.

Anaergia’s strategic relationships are foundational to its business model, acting as crucial intangible assets. These include long-standing connections with waste generators, ensuring a steady flow of organic material for processing, and off-takers who purchase the biogas and fertilizer produced. For instance, in 2024, Anaergia continued to secure feedstock agreements with municipalities and industrial clients across North America and Europe, underpinning its operational capacity.

The company also relies heavily on its partnerships with technology suppliers and construction firms. These collaborations are vital for the efficient design, development, and deployment of its anaerobic digestion facilities. In 2024, Anaergia highlighted successful project completions where these partnerships were instrumental in meeting tight deadlines and budget requirements, demonstrating the tangible benefits of these strategic alliances.

- Waste Generators: Ensuring consistent and diverse feedstock supply, a critical input for anaerobic digestion processes.

- Off-takers: Securing markets for biogas (often upgraded to renewable natural gas) and digestate, crucial for revenue generation.

- Technology Suppliers: Access to specialized equipment and intellectual property for optimal plant performance.

- Construction Partners: Expertise in building and commissioning facilities, ensuring timely and cost-effective project execution.

Anaergia's key resources are its proprietary technologies, skilled workforce, operational facilities, financial capital, and strategic partnerships. These elements collectively enable the company to effectively convert organic waste into renewable energy and valuable byproducts, driving its growth and market position.

The company's intellectual property, particularly its patented digestion and upgrading systems, provides a significant competitive edge, allowing for higher conversion efficiencies and diverse revenue streams. This technological foundation is complemented by a team of specialized engineers and project managers crucial for facility development and operation.

Furthermore, Anaergia's established network of over 100 operational facilities globally, as of late 2023, serves as tangible proof of concept and a scalable infrastructure. Combined with robust financial backing, including a $300 million credit facility secured in 2023, and strong relationships with waste generators and off-takers, these resources underpin Anaergia's capacity to execute large-scale projects and maintain consistent revenue generation.

| Key Resource Category | Specific Examples | 2024 Relevance/Impact |

|---|---|---|

| Proprietary Technology | Patented anaerobic digestion systems, biogas upgrading technology | Continued to secure new projects and optimize operations; enhanced resource recovery capabilities. |

| Human Capital | Skilled engineers, project managers, technical specialists | Advanced global projects, contributed to growth in biogas and RNG sectors; ensured efficient project execution. |

| Physical Assets | Global network of operational waste-to-value and renewable energy facilities | Demonstrated proven operational capabilities and recurring revenue streams; served as blueprints for expansion. |

| Financial Capital | Equity, debt financing, project financing (e.g., $300M credit facility in 2023) | Enabled investment in new ventures, scaling operations, and pursuing strategic acquisitions. |

| Strategic Relationships | Waste generators, off-takers, technology suppliers, construction partners | Secured feedstock agreements; ensured timely and cost-effective project completions through collaborations. |

Value Propositions

Anaergia provides a complete system to keep organic waste out of landfills, dramatically cutting greenhouse gases and environmental harm. This ensures clients can manage their waste responsibly and meet regulations.

In 2024, Anaergia's projects are projected to divert over 1.5 million tons of organic waste annually, preventing the release of an estimated 500,000 metric tons of CO2 equivalent, a significant contribution to climate mitigation efforts.

Anaergia's core value proposition centers on transforming organic waste into high-quality renewable natural gas (RNG). This process provides a clean, sustainable energy solution, directly assisting clients and communities in their efforts to decarbonize and bolster energy independence.

This offering taps into the escalating global demand for environmentally friendly energy alternatives. For instance, in 2023, the U.S. Environmental Protection Agency reported that RNG production in the United States reached approximately 1 billion therms, a significant increase that highlights the market's growth trajectory and Anaergia's strategic positioning.

Anaergia excels at transforming waste into more than just energy. They create valuable byproducts like nutrient-rich fertilizer and purified, reusable water. This comprehensive resource recovery approach is key to their value proposition, promoting a circular economy and delivering tangible economic advantages to their partners.

For instance, in 2024, Anaergia's projects are projected to divert millions of tons of organic waste from landfills. The resulting digestate, a byproduct of their anaerobic digestion process, is increasingly being utilized as a high-quality fertilizer. This not only reduces reliance on synthetic fertilizers but also enhances soil health, contributing to sustainable agriculture.

Reduction of Greenhouse Gas Emissions

Anaergia's core value proposition centers on significantly lowering greenhouse gas emissions. By transforming organic waste into renewable energy, the company directly combats methane, a potent greenhouse gas, that would otherwise be released from landfills. This process also displaces the need for fossil fuels, further reducing carbon footprints.

This commitment to emission reduction offers tangible benefits to clients, bolstering their sustainability credentials. For instance, Anaergia's projects contribute to a cleaner environment and align with increasingly stringent environmental regulations. In 2024, the company's operations are projected to divert millions of tons of organic waste from landfills, preventing the equivalent of hundreds of thousands of metric tons of CO2 from entering the atmosphere.

- Methane Emission Reduction: Anaergia's anaerobic digestion processes capture methane from organic waste, preventing its release into the atmosphere.

- Fossil Fuel Displacement: The renewable energy generated, typically biogas or biomethane, replaces energy derived from fossil fuels, cutting associated emissions.

- Enhanced Sustainability Profiles: Clients partnering with Anaergia improve their environmental, social, and governance (ESG) scores and meet corporate sustainability goals.

- Landfill Diversion: In 2023 alone, Anaergia facilities processed over 1.5 million tons of organic waste, diverting it from landfills.

Integrated Design, Build, Own, and Operate (DBOO) Model

Anaergia's integrated Design, Build, Own, and Operate (DBOO) model provides a comprehensive, turnkey solution for clients. This end-to-end approach encompasses everything from initial project conception and detailed engineering through to the actual construction, ongoing ownership, and long-term operational management of facilities.

This holistic strategy simplifies complex infrastructure development by offering clients a single, accountable point of contact. It significantly de-risks projects by consolidating responsibility and expertise across the entire project lifecycle. For instance, Anaergia's involvement in the Rialto Bioenergy Facility in California, a significant renewable natural gas project, exemplifies this integrated approach from development through to successful operation.

The DBOO model offers several key advantages:

- End-to-End Project Management: Anaergia handles all phases, from design to ongoing operations, ensuring seamless execution.

- Risk Mitigation: Clients benefit from a single point of accountability, reducing the complexities and potential risks associated with managing multiple contractors.

- Operational Expertise: Long-term operation by Anaergia ensures facilities are managed efficiently and effectively, maximizing performance and lifespan.

- Project Certainty: This integrated model provides greater certainty in project delivery and financial outcomes for stakeholders.

Anaergia’s value proposition is built on providing comprehensive solutions for organic waste management, transforming it into valuable resources while significantly reducing environmental impact. They offer a complete system that keeps waste out of landfills, directly addressing greenhouse gas emissions and helping clients meet their sustainability targets.

The company's core strength lies in converting organic waste into high-quality renewable natural gas (RNG), a clean energy alternative that supports decarbonization efforts and enhances energy independence. This aligns with the growing global demand for sustainable energy sources, as evidenced by the U.S. RNG market, which saw production reach approximately 1 billion therms in 2023.

Beyond energy, Anaergia recovers valuable byproducts such as nutrient-rich fertilizer and purified water, fostering a circular economy and providing economic benefits. Their integrated Design, Build, Own, and Operate (DBOO) model ensures seamless project execution and long-term operational efficiency, simplifying complex infrastructure development for clients.

Customer Relationships

Anaergia focuses on building long-term strategic partnerships, often securing multi-year contracts for critical services like waste intake, energy off-take, and ongoing operations and maintenance. This approach fosters stability and predictable revenue streams.

These enduring relationships are founded on mutual trust and a shared vision for developing sustainable infrastructure. For instance, Anaergia's partnership with the City of Edmonton for the biomethanation facility, a multi-year agreement, exemplifies this commitment to collaborative, long-term engagement.

Anaergia ensures each client has a dedicated project management team. This team provides hands-on guidance, technical assistance, and consistent communication from the project's inception through its operational launch, ensuring all client needs are addressed and any challenges are swiftly resolved.

Anaergia frequently structures its customer relationships through performance-based contracts. These agreements are designed to directly link Anaergia's compensation to the client's operational success and the output achieved by the anaerobic digestion facilities. This approach ensures that Anaergia is highly motivated to optimize plant performance, as their financial returns are tied to tangible results.

For instance, a key aspect of these contracts is the inclusion of performance guarantees. These guarantees incentivize Anaergia to ensure the plants run efficiently, meeting or exceeding agreed-upon metrics for biogas production or digestate quality. This alignment of interests demonstrates a strong commitment to delivering concrete value and measurable outcomes for their clients.

Consultative and Solution-Oriented Approach

Anaergia's customer relationships are built on a foundation of deep consultation. They don't just sell equipment; they partner with clients to dissect complex waste streams and energy goals, crafting custom solutions. This ensures the final infrastructure is perfectly aligned with each client's distinct operational landscape and objectives.

This solution-oriented strategy is crucial for Anaergia's success. For instance, in 2024, Anaergia secured a significant project in the UK to upgrade a biogas facility, a direct result of their ability to demonstrate a tailored approach that addressed specific operational inefficiencies and projected energy output targets for the client.

- Tailored Solutions: Anaergia designs systems based on individual waste composition and energy demands.

- Problem Solving: The company focuses on resolving specific client challenges in waste management and energy generation.

- Long-Term Partnerships: This consultative model fosters strong, ongoing relationships with clients.

- Optimized Performance: Bespoke infrastructure leads to higher efficiency and better returns for customers.

Post-Commissioning Operational Support

Anaergia extends its commitment beyond the initial commissioning phase by offering robust post-commissioning operational support. This includes ongoing maintenance, performance monitoring, and optimization services designed to ensure the long-term efficiency and profitability of the installed facilities.

This continuous engagement is crucial for maximizing the value derived from the assets throughout their operational life. For instance, in 2024, Anaergia's service agreements often include performance guarantees, incentivizing efficient operation and waste-to-energy conversion rates. Their support helps clients navigate regulatory changes and adapt to evolving market conditions, ensuring sustained revenue streams from biogas and renewable natural gas production.

- Ongoing Maintenance: Proactive and reactive maintenance programs to minimize downtime and ensure system reliability.

- Performance Optimization: Continuous monitoring and adjustments to maximize biogas yield and energy output.

- Technical Support: Access to specialized expertise for troubleshooting and operational guidance.

- Asset Lifecycle Management: Strategies to extend the lifespan and enhance the value of the operational facilities.

Anaergia cultivates deep, collaborative relationships, often securing multi-year contracts for waste processing and energy offtake, ensuring predictable revenue. Their approach emphasizes long-term partnerships built on trust and shared sustainability goals, exemplified by their multi-year agreement with the City of Edmonton for a biomethanation facility.

Dedicated project management teams provide clients with hands-on guidance and technical assistance throughout project lifecycles. Performance-based contracts, featuring guarantees on biogas production and digestate quality, directly link Anaergia's compensation to client success, incentivizing optimized plant performance.

In 2024, Anaergia's UK biogas facility upgrade project highlights their tailored, solution-oriented strategy, addressing specific client inefficiencies. Post-commissioning support, including maintenance and optimization, further solidifies these relationships, ensuring sustained asset value and revenue streams.

| Customer Relationship Aspect | Description | Example/Data Point |

|---|---|---|

| Partnership Duration | Multi-year contracts | City of Edmonton biomethanation facility agreement |

| Contract Structure | Performance-based | Guarantees on biogas yield and digestate quality |

| Client Engagement | Dedicated project teams | Ongoing support and technical assistance |

| Solution Approach | Tailored solutions | UK biogas facility upgrade project (2024) |

Channels

Anaergia's direct sales and business development team is crucial for securing large-scale projects. They focus on municipalities, industrial companies, and agricultural businesses, understanding their unique needs to craft customized waste-to-energy solutions. This direct approach allows for complex negotiations and the structuring of bespoke financial agreements.

Anaergia actively participates in major industry conferences like the World Biogas Summit and the North American Waste-to-Energy Conference. These events are crucial for demonstrating their advanced anaerobic digestion and biogas upgrading technologies to a global audience. In 2024, industry attendance at key environmental tech shows saw a significant increase, with many companies reporting strong lead generation from these gatherings.

Anaergia leverages strategic alliances and joint ventures to access large-scale projects, often partnering with engineering and construction firms. These collaborations are crucial for bidding on complex infrastructure developments, allowing Anaergia to combine its waste-to-energy technology with partners' execution capabilities. For instance, in 2024, the company was involved in securing contracts for significant renewable natural gas facilities, a testament to the power of these partnerships in expanding market reach.

Public Relations & Thought Leadership

Anaergia actively cultivates its image as a leader in waste-to-value through strategic public relations and thought leadership. This involves leveraging media relations to highlight successful projects and innovations, thereby increasing brand visibility and trust among stakeholders.

Publishing white papers and in-depth reports on topics like anaerobic digestion and biogas upgrading establishes Anaergia as an authority, providing valuable insights to the industry. For instance, their work in 2024 on advanced biogas purification technologies demonstrated a commitment to pushing the boundaries of the sector.

Participation in key industry forums and conferences allows Anaergia to share its expertise directly with potential clients and partners. This engagement is crucial for attracting inbound inquiries from environmentally conscious organizations seeking sustainable solutions. In 2024, Anaergia executives presented at over a dozen major sustainability and energy conferences globally.

- Media Relations: Securing coverage in prominent business and environmental publications to showcase project successes and technological advancements.

- White Papers and Research: Publishing detailed analyses on waste-to-value technologies, contributing to industry knowledge and positioning Anaergia as an expert.

- Industry Forums: Actively participating in and presenting at conferences to engage with stakeholders and build brand recognition.

- Brand Credibility: Building trust and attracting inbound leads from organizations committed to environmental sustainability and circular economy principles.

Digital Presence (Website, LinkedIn)

Anaergia's corporate website is a primary hub for detailed information on their waste-to-energy solutions and project portfolio. This digital storefront is essential for showcasing their technological expertise and attracting potential clients and investors. As of early 2024, the company actively updates its site with case studies and financial highlights, reinforcing its market position.

LinkedIn serves as Anaergia's key professional networking and communication channel. It's instrumental in sharing company news, technological breakthroughs, and job opportunities, fostering engagement with industry peers, potential employees, and stakeholders. The platform is vital for building brand awareness and facilitating direct outreach for business development.

- Website as Information Hub: Anaergia's website provides comprehensive details on their diverse waste-to-energy technologies, including anaerobic digestion and landfill gas capture.

- LinkedIn for Engagement: The company leverages LinkedIn to announce project milestones, such as the recent commissioning of their facility in Rialto, California, which processes organic waste.

- Lead Generation and Recruitment: Both platforms are critical for attracting new business leads and recruiting skilled professionals in the renewable energy sector.

- Stakeholder Communication: Anaergia uses these channels to maintain transparency and communicate their commitment to sustainable waste management solutions to a global audience.

Anaergia’s channels are multifaceted, combining direct engagement with strategic digital and public relations efforts. Their direct sales team targets municipalities and industrial clients for large-scale projects, while participation in industry events like the World Biogas Summit in 2024 generated significant leads. Strategic partnerships with engineering firms are also key, as seen in their 2024 renewable natural gas facility contracts.

Thought leadership through white papers and media relations builds brand authority, with their 2024 research on biogas purification being a prime example. Their corporate website acts as a central information source, updated with project case studies in early 2024. LinkedIn is vital for professional networking and sharing company news, including project milestones like the Rialto, California facility commissioning.

Customer Segments

Municipalities and public waste utilities are key customers for Anaergia. These entities, responsible for managing everything from household trash to wastewater, are increasingly focused on diverting waste from landfills and generating renewable energy. They are driven by a need to meet stringent environmental regulations and achieve their sustainability goals.

In 2024, many municipalities are facing pressure to reduce their carbon footprint. For instance, the US Environmental Protection Agency (EPA) reported that in 2018, landfills were the third-largest source of human-related methane emissions in the United States. This statistic highlights the critical need for solutions that Anaergia offers, such as anaerobic digestion, which can capture methane from organic waste for energy production, thereby reducing greenhouse gas emissions.

Industrial & Commercial Waste Generators are key customers for Anaergia, encompassing large facilities like food and beverage manufacturers, pulp and paper mills, and pharmaceutical companies. These businesses generate substantial organic waste and wastewater streams. In 2024, the global waste management market is projected to reach over $1.6 trillion, with organic waste processing being a significant segment.

These generators are actively seeking waste management solutions that are not only efficient and cost-effective but also ensure strict environmental compliance. They face increasing regulatory pressure and a growing desire for sustainable practices, making Anaergia's technologies attractive for converting waste into valuable resources like biogas and fertilizer.

Agricultural Operations & Dairy Farms are a core customer segment, especially large-scale operations with substantial animal waste. These businesses are primarily interested in Anaergia's solutions for managing manure, which often creates odor issues. They see value in converting this waste into biogas for renewable energy production and creating valuable, nutrient-rich digestate as fertilizer.

Environmental compliance is a significant driver for this segment. For instance, in 2024, dairy farms in California continued to face stricter regulations regarding methane emissions from manure. Anaergia's anaerobic digestion technology offers a direct pathway to meet these mandates while simultaneously recovering resources. The economic benefits of reduced waste disposal costs and revenue from energy sales further incentivize adoption.

Energy Utilities & Renewable Energy Developers

Energy utilities and renewable energy developers are key customers seeking to integrate sustainable energy sources into their operations. These companies are often driven by regulatory mandates to increase their renewable energy portfolio and meet ambitious sustainability targets. For instance, in 2024, many utilities are actively looking to diversify their energy mix beyond traditional fossil fuels.

These businesses are particularly interested in purchasing renewable natural gas (RNG) and other forms of bioenergy. This interest stems from a need to comply with environmental regulations and enhance their corporate social responsibility profiles. The global renewable energy market, valued at over $1 trillion in 2023 and projected to grow significantly through 2030, underscores the demand for such solutions.

- Regulatory Compliance: Utilities face increasing pressure to meet renewable energy portfolio standards (RPS) and carbon emission reduction targets, making RNG a viable compliance tool.

- Sustainability Goals: Many companies have set net-zero or carbon-neutral goals, and procuring bioenergy directly supports these commitments.

- Portfolio Diversification: Integrating RNG allows utilities to diversify their energy supply, reducing reliance on volatile fossil fuel markets and enhancing grid resilience.

- Market Demand: Growing consumer and investor demand for sustainable energy options pushes utilities to adopt cleaner alternatives like RNG.

Governmental & Regulatory Bodies

Governmental and regulatory bodies are essential stakeholders, though not direct purchasers of Anaergia's services. They shape the landscape by enacting policies, offering incentives, and setting standards that significantly influence the viability and expansion of anaerobic digestion projects. For instance, in 2024, many regions continued to implement or strengthen renewable energy mandates and carbon pricing mechanisms, directly benefiting companies like Anaergia.

These entities provide the critical frameworks that enable project financing and market development. Without supportive regulations and incentives, the economic case for many advanced waste-to-energy solutions would be considerably weaker. The Inflation Reduction Act in the United States, for example, offers substantial tax credits for clean energy projects, including those utilizing anaerobic digestion, thereby de-risking investments.

- Policy Influence: Governments set renewable energy targets and waste management regulations that create demand for Anaergia's solutions.

- Incentive Programs: Tax credits, grants, and feed-in tariffs provided by regulatory bodies make projects more financially attractive.

- Market Enablement: Clear regulatory pathways and permitting processes streamline project development and reduce uncertainty.

Anaergia serves a diverse customer base, including municipalities focused on waste diversion and renewable energy, and industrial clients seeking efficient waste management. Agricultural operations, particularly large dairy farms, are also key, looking to manage manure and produce biogas. Energy utilities and renewable energy developers are crucial for purchasing the generated bioenergy, driven by sustainability goals and regulatory requirements.

In 2024, the increasing global focus on circular economy principles and carbon reduction directly benefits Anaergia's customer segments. Municipalities are under pressure to reduce landfill reliance, with the US EPA noting landfills as a major methane source. Industrial entities are navigating stricter environmental compliance, making waste-to-resource solutions attractive.

Agricultural businesses are responding to mandates on manure management and methane emissions, finding value in Anaergia's technology for both compliance and resource recovery. Energy companies are actively expanding their renewable portfolios, with bioenergy from anaerobic digestion fitting into their diversification and sustainability strategies.

| Customer Segment | Primary Needs/Drivers | 2024 Relevance/Data Point |

|---|---|---|

| Municipalities & Public Waste Utilities | Landfill diversion, renewable energy generation, regulatory compliance | US landfills were the third-largest source of human-related methane emissions in 2018 (EPA), driving demand for methane capture solutions. |

| Industrial & Commercial Waste Generators | Cost-effective waste management, environmental compliance, resource recovery | Global waste management market projected over $1.6 trillion in 2024, with organic waste processing a significant segment. |

| Agricultural Operations & Dairy Farms | Manure management, odor control, biogas production, fertilizer creation | Dairy farms facing stricter methane emission regulations in 2024, making anaerobic digestion a compliance and resource solution. |

| Energy Utilities & Renewable Energy Developers | Renewable energy portfolio expansion, carbon reduction, grid resilience | Global renewable energy market exceeded $1 trillion in 2023, indicating strong demand for bioenergy integration. |

Cost Structure

Anaergia dedicates substantial resources to Research & Development, a critical element for its proprietary waste treatment and resource recovery technologies. These significant costs cover the continuous innovation, rigorous testing, and ongoing refinement of their advanced systems. For instance, in 2023, the company reported R&D expenses of approximately $10.5 million, reflecting investments in their core technologies.

Project Development & Engineering Costs encompass the essential expenses incurred in bringing new waste-to-value projects to fruition. These costs cover everything from initial feasibility studies and detailed engineering designs to crucial environmental impact assessments and legal work for contracts and regulatory approvals.

For Anaergia, these upfront investments are critical. In 2024, the company continued to focus on expanding its project pipeline, with development costs being a significant factor in its overall expenditure. While specific figures for this category are often bundled within broader operating expenses, the industry trend indicates substantial investment is required to de-risk projects before construction begins.

Anaergia's construction and capital expenditure costs are significant, reflecting the substantial investment needed for large-scale waste processing and energy generation facilities. These upfront expenditures cover essential equipment procurement, extensive civil works, and the complex installation processes required for their advanced infrastructure.

These capital costs represent the largest initial outlay for Anaergia's new projects. For instance, the company's Rialto Bioenergy Facility in California, a flagship project, involved hundreds of millions of dollars in capital investment, a common scenario for facilities of this magnitude.

Financing for these considerable capital expenditures is typically secured through a combination of debt and equity. This approach allows Anaergia to manage the large upfront financial burden while enabling the development of its impactful waste-to-energy solutions.

Operations & Maintenance (O&M) Expenses

Operations & Maintenance (O&M) expenses are the backbone of Anaergia's ongoing business, covering everything needed to keep their facilities running smoothly. These are the recurring costs that ensure their waste-to-energy and renewable natural gas plants operate efficiently and reliably. Think of it as the everyday costs of keeping the lights on and the machinery turning.

These costs include essential elements like the wages for skilled plant operators who monitor and manage the processes, as well as routine maintenance to prevent breakdowns. Anaergia also budgets for spare parts, necessary chemicals for the biological and processing stages, and the utilities required to power the plants. For specific contracts, feedstock acquisition costs are also factored in here, ensuring a steady supply of organic material for conversion.

In 2024, Anaergia reported that its O&M costs are a significant component of its overall cost structure. For instance, in their Q1 2024 earnings, they highlighted that while revenues grew, O&M expenses also saw an increase, partly due to higher utility costs and investments in preventative maintenance programs across their portfolio. This reflects the dynamic nature of managing complex biological and mechanical systems.

- Labor: Costs associated with plant operators, technicians, and administrative staff.

- Maintenance: Expenses for routine servicing, repairs, and replacement of parts.

- Supplies: Costs of chemicals, lubricants, and other consumables used in operations.

- Utilities: Expenditure on electricity, water, and other services needed to run the facilities.

- Feedstock Acquisition: Costs related to securing organic waste materials under specific contractual agreements.

Sales, General & Administrative (SG&A) Expenses

Anaergia's Sales, General & Administrative (SG&A) expenses encompass the costs of running its operations and reaching customers. These include salaries for its management team, sales force, and administrative staff, as well as marketing and advertising initiatives aimed at promoting its waste-to-energy solutions. For instance, in 2023, Anaergia reported SG&A expenses of approximately $87.5 million, reflecting investments in expanding its market presence and supporting its project pipeline.

These costs are crucial for building brand awareness and driving revenue growth. They also cover essential business functions such as:

- Executive and administrative salaries: Compensation for leadership and support staff.

- Marketing and sales campaigns: Costs associated with promoting products and services.

- Travel and entertainment: Expenses incurred for business development and client relations.

- Office overheads and professional services: Rent, utilities, legal, and accounting fees.

Anaergia's cost structure is heavily weighted towards its capital-intensive projects and ongoing operational needs. Significant investments are made in research and development to maintain technological leadership, alongside substantial upfront costs for project development and engineering. The construction and capital expenditures for their facilities represent the largest initial financial outlay, often running into hundreds of millions of dollars per project.

Ongoing operations and maintenance (O&M) form a critical recurring cost base, encompassing labor, maintenance, supplies, and utilities. Sales, General & Administrative (SG&A) expenses are also considerable, supporting business growth and market expansion. In 2024, O&M costs saw an increase due to higher utility prices and maintenance investments, as noted in their Q1 earnings report.

| Cost Category | Description | 2023 Data (Approx.) | 2024 Trend |

|---|---|---|---|

| R&D | Innovation and technology refinement | $10.5 million | Continued investment |

| Project Development & Engineering | Feasibility, design, legal for new projects | Significant focus | Ongoing pipeline expansion |

| Construction & Capital Expenditure | Facility and equipment procurement | Hundreds of millions per project (e.g., Rialto) | Major upfront investment |

| Operations & Maintenance (O&M) | Day-to-day facility operation | Increasing component | Higher utility costs, maintenance investment |

| Sales, General & Administrative (SG&A) | Business operations, sales, marketing | $87.5 million | Supporting market presence |

Revenue Streams

Anaergia's primary revenue stream comes from selling Renewable Natural Gas (RNG). This upgraded biogas is sold to energy utilities, gas distributors, and industrial customers. These sales are frequently secured through long-term contracts, with pricing often linked to prevailing energy market rates or the value of environmental credits.

Anaergia generates revenue from tipping fees, charging municipalities, industrial clients, and agricultural operations for accepting and processing their organic waste. These fees, crucial for project economics, are typically calculated based on the volume or weight of the waste delivered.

For instance, in 2024, Anaergia's facility in Guelph, Ontario, processed a significant volume of organic waste, with tipping fees forming a substantial portion of its operational income. The company's ability to attract diverse waste streams directly impacts the predictability and scale of this revenue.

Anaergia generates revenue by selling nutrient-rich digestate, a byproduct of its anaerobic digestion processes, as organic fertilizer. This digestate, available in both liquid and solid forms, offers a sustainable alternative to synthetic fertilizers, promoting soil health and reducing environmental impact.

This revenue stream directly supports a circular economy by transforming organic waste into valuable agricultural inputs. For instance, in 2024, Anaergia's facilities processed significant volumes of organic waste, yielding substantial quantities of digestate for sale, contributing to both environmental stewardship and economic returns.

Sale of Treated Water & Resource Recovery

Anaergia generates revenue by selling treated wastewater, a valuable resource for industrial or agricultural use. This stream diversifies income beyond just energy production. In 2024, the company continued to explore and implement these opportunities across its global projects.

Beyond water, Anaergia also focuses on resource recovery, extracting valuable by-products from the waste treatment process. This approach maximizes the value derived from complex feedstocks, turning waste into revenue-generating materials.

- Treated Water Sales: Revenue generated from the purification and sale of wastewater for reuse.

- Resource By-products: Income from recovering and selling other valuable materials like nutrients or biogas.

- Diversified Income: This dual approach creates multiple revenue streams, enhancing financial stability.

Operations & Maintenance (O&M) Service Fees

Anaergia generates recurring revenue through its Operations & Maintenance (O&M) services. These fees are derived from long-term contracts for managing facilities, whether owned by Anaergia or third parties.

This revenue stream is crucial as it ensures the ongoing optimal performance of anaerobic digestion facilities. The contracts provide a stable income post-construction, contributing significantly to Anaergia's financial predictability.

- Recurring Revenue: Long-term contracts for O&M services provide a consistent income.

- Facility Management: Ensures optimal performance of Anaergia's and third-party facilities.

- Post-Construction Income: Stabilizes revenue after initial project development.

- Operational Efficiency: Drives continued profitability through expert management.

Anaergia's revenue streams are diverse, encompassing the sale of Renewable Natural Gas (RNG), tipping fees for waste processing, and the sale of digestate as organic fertilizer. The company also generates income from treated wastewater sales and the recovery of other valuable by-products from its waste treatment processes. Furthermore, Anaergia secures recurring revenue through long-term Operations & Maintenance (O&M) service contracts for its facilities.

| Revenue Stream | Description | 2024 Data/Notes |

|---|---|---|

| Renewable Natural Gas (RNG) Sales | Selling upgraded biogas to utilities, distributors, and industrial customers. | Long-term contracts with pricing often tied to energy markets or environmental credits. |

| Tipping Fees | Charging for accepting and processing organic waste from municipalities, industries, and agriculture. | Fees based on waste volume or weight; Guelph, Ontario facility a key example. |

| Digestate Sales | Selling nutrient-rich digestate as organic fertilizer. | Supports circular economy; significant volumes processed in 2024. |

| Treated Wastewater Sales | Selling purified wastewater for industrial or agricultural reuse. | Diversifies income beyond energy; ongoing exploration of opportunities globally in 2024. |

| Resource By-products | Income from recovering and selling other valuable materials. | Maximizes value from feedstocks. |

| Operations & Maintenance (O&M) Services | Recurring revenue from long-term contracts for managing facilities. | Ensures optimal performance and provides financial predictability. |

Business Model Canvas Data Sources

Anaergia's Business Model Canvas is constructed using a blend of internal operational data, financial projections, and extensive market research. This approach ensures a robust and data-driven representation of the company's strategic framework.