Anaergia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anaergia Bundle

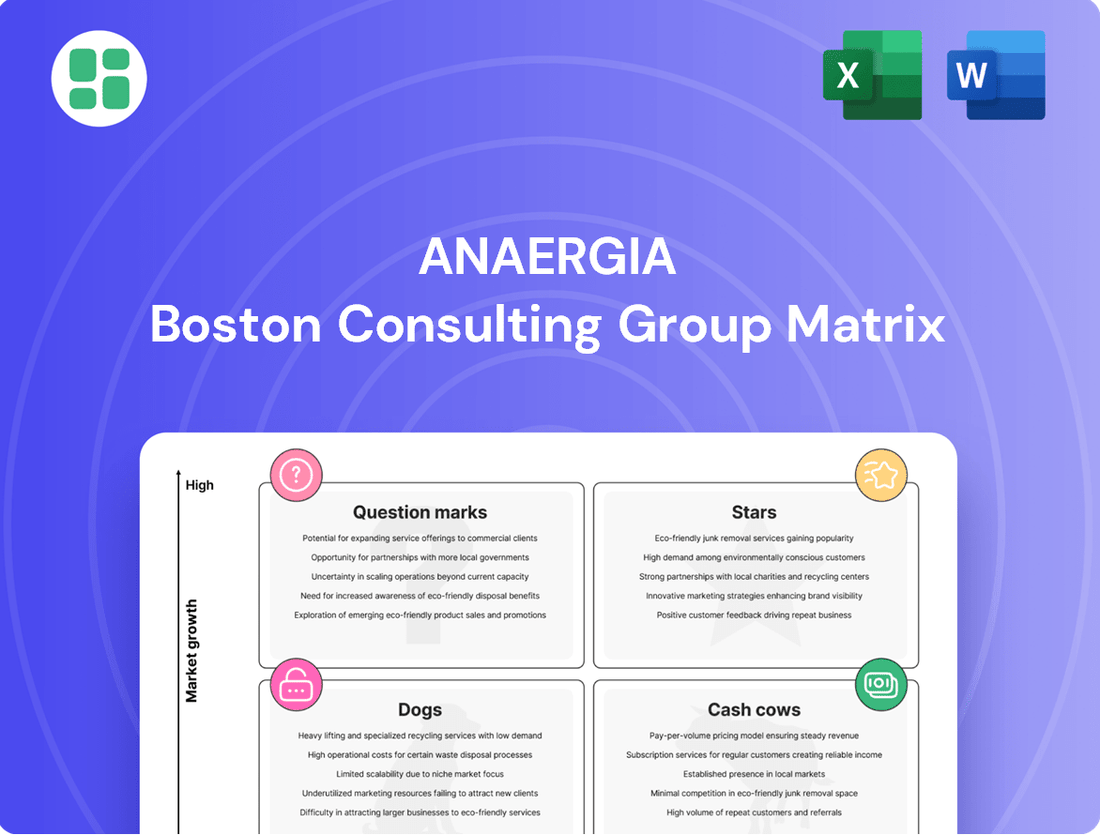

Curious about Anaergia's strategic product portfolio? Our BCG Matrix preview highlights key areas, but to truly unlock their market potential, you need the full picture. Understand which innovations are poised for growth (Stars), which are generating steady returns (Cash Cows), and which require careful consideration (Question Marks and Dogs).

Don't miss out on critical insights that can shape your investment decisions and product development strategy. Purchase the complete Anaergia BCG Matrix today for a detailed quadrant analysis, actionable recommendations, and a clear roadmap to maximizing profitability and market share.

Stars

Anaergia's large-scale renewable natural gas (RNG) projects are firmly positioned as Stars in the BCG matrix. These facilities, designed for substantial pipeline injection and vehicle fuel supply, are capitalizing on the booming RNG market. For instance, their Rialto project in California, operational since 2019, has been a significant contributor, demonstrating the company's capability in large-scale RNG production.

Anaergia's proprietary anaerobic digestion technologies, like Omnivore and OREX, are patented and have a strong history of success. These systems are crucial for their position in the market.

These advanced technologies excel at transforming various organic wastes into valuable products, giving Anaergia a significant edge. For instance, in 2023, Anaergia reported a strong pipeline of projects leveraging these core technologies, indicating continued demand and market penetration.

Anaergia's North American capital sales and project pipeline clearly positions it as a 'Star' within the BCG matrix. The company has demonstrated robust performance, with an increasing backlog of capital sales projects in this region. This growth is fueled by significant expansion in the renewable natural gas (RNG) and waste-to-energy sectors, bolstered by supportive regulatory frameworks.

In 2024, Anaergia continued to solidify its market leadership in North America. The company secured several substantial new contracts, further expanding its project pipeline. This success underscores Anaergia's strong market share in a segment experiencing rapid, sustained growth, indicative of a 'Star' business unit.

Integrated Waste-to-Value Solutions

Anaergia's integrated waste-to-value solutions, encompassing waste processing, wastewater treatment, organics recovery, and the production of renewable natural gas (RNG), fertilizer, and water, position them as a 'Star' in the BCG matrix. This comprehensive, end-to-end approach is a significant market differentiator.

By offering multifaceted expertise, Anaergia can secure a larger share of complex projects within the expanding circular economy. This integrated model allows them to capture value across the entire waste stream, from collection to resource recovery.

- Market Growth: The global waste management market is projected to reach $700 billion by 2030, with a significant portion driven by waste-to-energy and resource recovery technologies.

- RNG Production: Anaergia's RNG projects are crucial for decarbonization efforts, with the North American RNG market alone expected to grow substantially in the coming years, driven by policy support and corporate sustainability goals.

- Diversified Revenue: The ability to produce multiple valuable byproducts (RNG, fertilizer, treated water) creates diversified revenue streams and enhances project economics.

- Project Pipeline: Anaergia reported a robust project pipeline in 2024, underscoring the strong demand for their integrated solutions.

Strategic Partnerships for Biomethane Facilities

Anaergia's strategic partnerships for biomethane facilities highlight its 'Star' status, particularly with new and expanding collaborations in Italy and across Europe. These alliances are crucial for deploying Anaergia's advanced technology in markets experiencing robust growth and favorable regulatory support. For instance, in 2024, Anaergia announced a significant expansion of its partnership with a leading European waste management company, aiming to develop multiple biomethane production sites across the continent.

These collaborations are instrumental in capitalizing on the increasing demand for renewable natural gas, driven by ambitious climate targets and energy security concerns in regions like Italy, which aims to significantly boost its biomethane production. Such partnerships provide Anaergia with access to feedstock, project development expertise, and secured offtake agreements, thereby solidifying its market position.

- Expanding European Footprint: Anaergia's 2024 pipeline includes several new joint ventures focused on biomethane projects in countries with strong renewable energy mandates, such as Germany and France.

- Technological Deployment: These partnerships facilitate the widespread adoption of Anaergia's proprietary technologies, including its Oakhill and Kitchener facilities, which have proven efficient in converting organic waste into high-quality biomethane.

- Revenue Stream Security: By securing long-term agreements for biomethane offtake, these strategic alliances provide predictable and growing revenue streams, reinforcing the 'Star' classification.

- Market Leadership: The ability to forge and expand these critical partnerships demonstrates Anaergia's leadership in the burgeoning biomethane sector, positioning it for sustained growth and market share capture.

Anaergia's large-scale renewable natural gas (RNG) projects, particularly in North America, are clearly positioned as Stars. These projects benefit from a rapidly expanding market driven by decarbonization goals and supportive policies. The company's success in securing new contracts in 2024 highlights its strong market share in this high-growth sector.

Anaergia's integrated waste-to-value solutions, which span waste processing to the production of RNG and fertilizer, are a key differentiator. This comprehensive approach allows them to capture value across the entire waste stream, enhancing project economics and securing a larger share of complex projects in the growing circular economy.

Strategic partnerships for biomethane facilities, especially in Europe, further cement Anaergia's Star status. These collaborations, like the significant expansion announced in 2024 with a European waste management leader, are crucial for deploying advanced technologies in markets with strong renewable energy mandates.

| Metric | 2023 (Approx.) | 2024 (Projected/Announced) |

|---|---|---|

| North American Capital Sales Backlog | Significant increase | Continued expansion with new contracts |

| RNG Market Growth (North America) | Strong growth trajectory | Sustained rapid growth, policy-driven |

| European Biomethane Partnerships | Active collaborations | New joint ventures and expansions announced |

| Waste Management Market Value (Global) | Projected to reach $700 billion by 2030 | Continued robust growth in waste-to-energy |

What is included in the product

Anaergia's BCG Matrix offers a strategic overview of its business units, categorizing them by market share and growth potential.

It guides decisions on resource allocation, identifying areas for investment, divestment, or maintenance.

The Anaergia BCG Matrix provides a clear, visual snapshot of your business units, alleviating the pain of strategic uncertainty.

It offers a simplified framework to identify and prioritize growth opportunities, reducing the burden of complex market analysis.

Cash Cows

Established O&M Service Contracts represent Anaergia's cash cows. These are long-term agreements for operating and maintaining existing infrastructure, like the Sterling Natural Resource Center, which generates consistent, recurring revenue with minimal further investment.

These contracts are vital as they contribute stable cash flow, reflecting the mature operational phase of Anaergia's projects. For instance, in 2023, Anaergia reported significant revenue from its O&M segment, underscoring the reliability of these cash-generating assets.

Certain mature Build, Own, Operate (BOO) projects, where the initial high investment phase is complete and they are now consistently generating revenue with minimal growth capital requirements, function as cash cows. These facilities contribute to the company's gross profit and help fund other strategic initiatives.

Anaergia's proven wastewater treatment infrastructure, particularly its established facilities, likely represent Cash Cows in the BCG Matrix. These operations have achieved a stable operational phase, consistently transforming wastewater into valuable resources such as clean water and biogas. For instance, as of early 2024, Anaergia's portfolio includes numerous such facilities generating predictable revenue streams from essential waste management services.

Stable Fertilizer Production from Digestate

The production and sale of fertilizer from digestate, particularly from mature anaerobic digestion facilities, can indeed be classified as a Cash Cow within the BCG Matrix. This byproduct provides a consistent revenue stream, capitalizing on existing infrastructure and core technology. It requires minimal additional investment for market development, as the demand for fertilizer is generally stable.

This segment leverages the established operational efficiency of the anaerobic digestion process. For instance, in 2024, Anaergia reported that its portfolio of facilities consistently produced high-quality digestate, which is a valuable nutrient-rich fertilizer. The sale of this digestate contributes significantly to the overall profitability of these operations.

- Stable Revenue: Digestate sales offer a predictable income, supporting ongoing operational costs.

- Low Investment: Minimal capital expenditure is needed to maintain and sell this byproduct.

- Existing Infrastructure: Utilizes the output from already operational anaerobic digestion plants.

- Market Demand: Fertilizer is a consistent agricultural input with steady demand.

Completed Italian Capital Sales Projects

The completion of significant capital sales projects in Italy, like the development of anaerobic digestion facilities, represents a successful monetization of Anaergia's technology and expertise. While these completions might lead to a temporary dip in new capital sales revenue from that region, the underlying operational assets now function as established cash cows. These facilities, having realized their initial sales potential, are now positioned to generate consistent, ongoing revenue streams, likely through operations and maintenance (O&M) contracts, bolstering Anaergia's financial stability.

These Italian projects, now operational, are prime examples of Anaergia's cash cow strategy in action. For instance, if Anaergia completed a major biogas plant in Italy in 2023, that project would have transitioned from a high-investment growth phase to a mature, revenue-generating asset by 2024. Such assets are crucial for funding further research, development, and expansion into new markets, embodying the core principle of a cash cow by providing reliable financial returns.

- Italian Capital Sales Projects as Cash Cows: Successful completion of large-scale projects in Italy, now operational, generate consistent O&M revenue.

- Revenue Realization: These completed projects have met their initial sales targets and contribute to the company's financial base.

- Financial Contribution: The ongoing operational phase of these Italian ventures provides a stable cash flow, supporting broader corporate financial health.

- Strategic Importance: These mature assets are vital for funding new growth initiatives and market development.

Anaergia's established O&M service contracts are definitive cash cows, providing stable, recurring revenue with minimal reinvestment. These long-term agreements, like those for the Sterling Natural Resource Center, highlight the financial predictability derived from mature operational assets.

Certain completed Build, Own, Operate (BOO) projects also function as cash cows, having passed their initial investment phase and now consistently generating revenue. These facilities contribute significantly to gross profit, enabling the funding of new strategic ventures.

The company's mature wastewater treatment infrastructure, which consistently transforms waste into valuable resources, represents a stable income source. As of early 2024, Anaergia's portfolio includes numerous such facilities, generating predictable revenue from essential services.

The sale of fertilizer derived from digestate, particularly from mature anaerobic digestion facilities, is a clear cash cow. This byproduct leverages existing infrastructure and core technology to generate consistent revenue with low additional investment, capitalizing on stable market demand for fertilizer.

Full Transparency, Always

Anaergia BCG Matrix

The Anaergia BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive upon purchase, offering immediate strategic insights without any watermarks or demo content. This comprehensive analysis, meticulously prepared, will be directly delivered to you, ensuring you gain access to the exact same professionally formatted and actionable BCG Matrix report. You can confidently rely on this preview as the final version, ready for immediate integration into your business planning and decision-making processes. This is not a mockup; it's the genuine, analysis-ready Anaergia BCG Matrix, designed for clarity and professional application.

Dogs

Certain smaller-scale or older projects within Anaergia's portfolio might fall into the Dogs category. These ventures, perhaps those with localized market saturation or utilizing less efficient, older technology, may struggle to gain significant traction. For instance, if a project's return on investment (ROI) is consistently below the company's average, or if it requires substantial ongoing capital infusion without commensurate returns, it could be classified as a Dog.

These underperforming projects might be breaking even or even consuming more resources than they generate, presenting limited opportunities for substantial future growth. Anaergia's strategic pivot towards a capital-light operational model, as evidenced by their focus on partnerships and technology licensing, indicates a deliberate move away from such capital-intensive, low-return ventures.

Anaergia's strategic divestitures, such as the Envo Biogas facility in Denmark and the deconsolidation of Rialto Bioenergy Facility (RBF), highlight past 'Dog' assets. These were likely units with low market share and growth, or those consuming significant cash without aligning with the company's evolving strategy.

Anaergia's pilot projects, while innovative, have sometimes struggled to achieve commercial viability. For instance, early ventures in specific waste-to-energy niches, despite initial capital injections, failed to secure widespread market adoption or generate the projected returns. This often stemmed from unforeseen operational challenges or a lack of robust demand in the targeted segments.

Geographical Markets with Limited Traction

Geographical markets where Anaergia has experienced limited traction, falling into the 'Dogs' quadrant of the BCG Matrix, might include certain regions in Eastern Europe or specific developing nations. In these areas, Anaergia may have faced challenges securing new contracts or significantly expanding its market share, despite initial investments or pilot projects.

These regions often present a more competitive landscape, with established local players or different technological preferences. Additionally, unfavorable regulatory environments, such as inconsistent waste management policies or less supportive renewable energy incentives, can hinder the profitability and growth of Anaergia's offerings. For instance, as of early 2024, Anaergia's expansion into some Eastern European markets has been slower than anticipated, with fewer large-scale project announcements compared to its North American or European Union operations.

The challenges in these geographical markets can be attributed to several factors:

- Intense Competition: Local competitors with lower operational costs or established relationships may dominate the market.

- Unfavorable Regulatory Frameworks: Lack of clear, supportive policies for anaerobic digestion or biogas utilization can deter investment.

- Economic Instability: Fluctuations in currency or economic downturns can impact project financing and demand for Anaergia's services.

- Lower Awareness/Adoption Rates: Developing markets might have less familiarity with advanced waste-to-energy technologies, requiring more extensive education and market development efforts.

Obsolete or Less Efficient Legacy Technologies

Older, less efficient versions of Anaergia's technologies, perhaps those predating significant advancements in anaerobic digestion or gas upgrading, could be classified as Obsolete or Less Efficient Legacy Technologies within a BCG matrix framework. These might include older digester designs or less sophisticated biogas purification systems that struggle to compete with current market demands for higher energy yields and purer biomethane.

While Anaergia's strategic focus is on its advanced and innovative solutions, any legacy systems that present significant challenges in terms of upgrading to meet modern efficiency standards or are becoming increasingly difficult to market could be placed here. For instance, older mechanical components or control systems that are no longer supported by manufacturers would also fit this category. As of 2024, the global waste-to-energy market is experiencing rapid technological evolution, with a strong emphasis on maximizing resource recovery and minimizing environmental impact.

- Technological Obsolescence: Older digester designs with lower conversion efficiencies compared to current state-of-the-art systems.

- Market Competitiveness: Legacy gas upgrading units that produce lower purity biomethane, making them less attractive in a market demanding high-quality renewable natural gas.

- Upgrade Challenges: Systems requiring substantial and costly retrofits to meet new environmental regulations or performance benchmarks.

- Support & Maintenance: Technologies with diminishing availability of spare parts and specialized technical support, increasing operational risks.

Projects or technologies within Anaergia's portfolio that exhibit low market share and low growth potential are categorized as Dogs. These are typically underperforming assets that may consume resources without generating significant returns, potentially requiring divestment or restructuring.

For example, older, less efficient biogas upgrading units that produce lower-purity biomethane might struggle to compete in a market increasingly demanding high-quality renewable natural gas. As of early 2024, Anaergia's expansion into certain Eastern European markets has also been slower than anticipated, indicating potential Dog assets in those regions due to intense competition and less supportive regulatory frameworks.

These "Dogs" can also include pilot projects that failed to achieve commercial viability, such as early ventures in specific waste-to-energy niches that didn't secure widespread market adoption. Anaergia's strategic divestitures, like the Envo Biogas facility in Denmark, often involve shedding such underperforming assets to focus on more promising growth areas.

Anaergia's strategic pivot towards a capital-light model further suggests a move away from capital-intensive, low-return ventures that would likely fall into the Dog quadrant. The company's focus on partnerships and technology licensing aims to mitigate the risks associated with developing and operating these types of assets.

Question Marks

Anaergia's emerging market entry ventures, particularly in Japan and South Korea, are currently positioned as question marks within the BCG matrix. These markets represent significant growth opportunities for waste-to-energy solutions, with Japan aiming to increase its renewable energy share to 36-38% by 2030. Anaergia is actively securing initial contracts and establishing a foothold, but their market share is still nascent, indicating potential for future growth if these ventures mature successfully.

Anaergia's investment in next-generation technology development, venturing beyond its current patented portfolio, represents a strategic move into early-stage, high-growth potential areas. These initiatives, while demanding substantial R&D capital with inherent uncertainty, aim to secure future market leadership. For instance, in 2024, Anaergia allocated a significant portion of its research budget towards exploring advanced bio-conversion processes and novel waste-to-energy solutions, anticipating substantial long-term returns.

Anaergia's exploration of new feedstock types, such as advanced agricultural residues or specific industrial byproducts, could be categorized as a Question Mark. These ventures require substantial investment in research and development to adapt existing anaerobic digestion technologies. For instance, developing specialized pre-treatment methods for recalcitrant materials could unlock new revenue streams, but the market demand and economic viability of processing these novel feedstocks remain uncertain.

Small-Scale, High-Potential Pilot Projects

Small-scale, high-potential pilot projects in Anaergia's portfolio represent ventures into novel applications or emerging market segments. These initiatives, while currently holding a low market share due to their experimental stage, are strategically positioned for significant future expansion. They are essential for driving innovation and identifying new revenue streams, even though they require investment and are not yet generating substantial returns.

For instance, a pilot project testing the viability of a new type of biogas upgrading technology in a specific niche market, like providing biomethane for heavy-duty transport in a particular region, would fit this category. Such projects are crucial for Anaergia's long-term vision, allowing them to explore and validate new technologies and market opportunities before committing to larger-scale deployments.

- Testing advanced anaerobic digestion techniques for waste streams with unique compositions.

- Exploring niche markets for digestate as a premium fertilizer in specific agricultural sectors.

- Developing modular biogas systems for decentralized energy generation in remote communities.

- Piloting the integration of AI for optimizing biogas production efficiency in varied feedstock scenarios.

Leveraging New Regulatory Incentives

New projects designed to leverage evolving regulatory incentives, particularly for Renewable Natural Gas (RNG) and carbon capture technologies, represent a key area for Anaergia. These initiatives are often in markets where the regulatory framework is still developing, allowing Anaergia to solidify its position as a market leader by scaling operations rapidly. For instance, in 2024, several North American jurisdictions introduced or enhanced tax credits and mandates for RNG production, creating a more favorable economic environment for projects that Anaergia is actively pursuing.

- RNG Production Growth: Anaergia's expansion into regions with new RNG incentives, such as California's Low Carbon Fuel Standard (LCFS) and Oregon's Renewable Energy Standard, allows it to capture significant market share.

- Carbon Capture Opportunities: Emerging regulations supporting carbon capture, utilization, and storage (CCUS) are creating new avenues for Anaergia's waste-to-energy solutions, potentially unlocking additional revenue streams.

- Strategic Partnerships: Collaborating with entities that benefit from these incentives, like utilities or industrial emitters, is crucial for accelerating project development and deployment in these nascent markets.

- Scalability Advantage: Anaergia's established expertise in developing and operating anaerobic digestion facilities provides a critical advantage in rapidly scaling up production to meet the growing demand driven by these regulatory tailwinds.

Anaergia's ventures into emerging markets like Japan and South Korea are currently classified as question marks. These regions present substantial growth prospects for waste-to-energy, with Japan targeting a 36-38% renewable energy share by 2030. While Anaergia is actively securing initial contracts, its market presence is still developing, indicating significant potential for future expansion if these endeavors mature successfully.

BCG Matrix Data Sources

Our Anaergia BCG Matrix draws from a robust blend of financial disclosures, market growth data, and sector-specific research to deliver actionable strategic insights.