Amway Corporation SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amway Corporation Bundle

Amway's established brand recognition and extensive distributor network are significant strengths, but the company also faces challenges like evolving consumer preferences and regulatory scrutiny. Understanding these dynamics is crucial for anyone looking to navigate the direct selling landscape.

Want the full story behind Amway's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Amway's strength lies in its impressive global footprint, operating in over 100 countries and territories. This vast reach is powered by a network of more than one million independent business owners (IBOs). This extensive presence diversifies its market base, mitigating risks associated with any single region and fostering strong worldwide brand recognition and deep market penetration.

Amway boasts a diverse product lineup, spanning nutrition, beauty, personal care, and home care. Key brands like Nutrilite, a leader in vitamins and dietary supplements, and Artistry, its premium skincare and cosmetics line, are central to this strength. This broad offering caters to a wide array of consumer needs.

The company's deliberate emphasis on health and wellness, especially within its nutrition segment, is a significant advantage. This focus directly addresses the growing global consumer trend towards healthier lifestyles and preventative care. For instance, Nutrilite reported substantial sales growth in recent years, reflecting this market alignment.

Amway's dedication to research and development is a significant strength. The company employs over 800 scientists and engineers and holds more than 750 patents worldwide. This robust R&D focus is particularly evident in their advancements in plant-based nutrition and gut microbiome science, areas poised for substantial growth.

Further bolstering this commitment, Amway is channeling considerable investment into its manufacturing and R&D facilities. These strategic capital expenditures are designed to accelerate innovation and enhance the efficiency of their product development pipeline, ensuring a steady stream of new and improved offerings.

Resilient Direct Selling Business Model

Amway's direct selling business model has proven remarkably robust, consistently positioning it as the world's leading direct selling company for an impressive thirteen years running. This enduring success, even amidst market shifts, highlights the model's inherent strengths in fostering entrepreneurship and enabling direct, personalized customer relationships.

The direct selling approach, while sometimes debated, offers a powerful platform for individuals seeking entrepreneurial ventures. It facilitates a unique, one-on-one customer experience that traditional retail often struggles to replicate. For instance, in 2023, Amway reported net sales of $8.4 billion, underscoring the continued viability and scale of its direct selling operations.

- Global Leadership: Amway has been the top direct selling company worldwide for 13 consecutive years, demonstrating sustained market dominance.

- Entrepreneurial Empowerment: The model provides individuals with opportunities to build their own businesses and achieve financial independence.

- Personalized Customer Engagement: Direct selling allows for tailored product recommendations and relationship building, fostering customer loyalty.

- Resilience: Despite economic fluctuations and evolving consumer behaviors, Amway's direct selling structure has consistently delivered strong financial results, with $8.4 billion in net sales reported for 2023.

Strategic Investments and Sustainability Initiatives

Amway is demonstrating a strong commitment to future growth through significant infrastructure investments. Between 2022 and 2026, the company is allocating over $127 million towards critical upgrades, enhancing its headquarters, manufacturing capabilities, quality control systems, and research and development processes.

These strategic investments are complemented by a robust focus on sustainability, which is becoming increasingly vital for long-term business success. Amway is actively working to reduce its environmental footprint, with key initiatives targeting a decrease in plastic usage and improvements in energy efficiency across its operations.

- Infrastructure Investment: Over $127 million earmarked for upgrades between 2022-2026.

- Operational Enhancements: Focus on headquarters, manufacturing, quality control, and R&D.

- Sustainability Goals: Prioritizing plastic reduction and enhanced energy efficiency.

Amway's extensive global network, spanning over 100 countries, is a cornerstone of its strength, supported by over one million independent business owners. This widespread presence diversifies its revenue streams and solidifies its brand recognition worldwide.

The company's diverse product portfolio, including leading brands like Nutrilite and Artistry, caters to a broad spectrum of consumer needs in nutrition, beauty, and home care. This multi-category approach enhances market penetration and resilience.

Amway's direct selling model has consistently positioned it as the leading company in its sector for 13 consecutive years, demonstrating remarkable business model resilience. This enduring success, with $8.4 billion in net sales in 2023, highlights its effectiveness in fostering entrepreneurship and direct customer relationships.

Significant investment in research and development, backed by over 800 scientists and 750 patents, fuels innovation, particularly in high-growth areas like plant-based nutrition. Furthermore, a commitment to sustainability and substantial infrastructure upgrades, with over $127 million allocated between 2022 and 2026, positions Amway for future growth and operational efficiency.

| Strength Category | Key Aspect | Supporting Data |

|---|---|---|

| Global Reach | Market Presence | Operates in over 100 countries and territories. |

| Product Portfolio | Brand Strength | Leading brands include Nutrilite (nutrition) and Artistry (beauty). |

| Business Model | Market Leadership | Top direct selling company for 13 consecutive years; $8.4 billion net sales in 2023. |

| Innovation & Investment | R&D and Infrastructure | 800+ scientists, 750+ patents; $127M+ infrastructure investment (2022-2026). |

What is included in the product

This SWOT analysis provides a comprehensive overview of Amway Corporation's internal strengths and weaknesses, alongside its external market opportunities and threats.

Offers a clear, actionable framework to address Amway's complex market challenges and competitive pressures.

Weaknesses

The multi-level marketing (MLM) structure employed by Amway often attracts public skepticism and regulatory attention, with accusations of operating like pyramid schemes. This persistent scrutiny, highlighted by past investigations and ongoing concerns in various markets, can indeed impact Amway's brand image and complicate efforts to attract new distributors and retain customer loyalty.

For instance, while specific recent regulatory actions against Amway are not publicly detailed as of mid-2025, the broader MLM industry has faced increased oversight. In 2024, several countries continued to review or strengthen regulations concerning direct selling and MLM practices, aiming to protect consumers from potentially fraudulent schemes. This environment necessitates Amway to continually demonstrate transparency and compliance to mitigate reputational damage and operational disruptions.

Amway's reliance on its Independent Business Owner (IBO) network and direct online sales means its products aren't found on traditional store shelves. This limits convenience for consumers accustomed to readily available retail options, a stark contrast to companies with widespread physical distribution. For instance, in 2024, while Amway reported significant global sales, its direct-to-consumer model contrasts with the extensive retail footprints of major consumer goods companies.

Furthermore, Amway's product pricing is often perceived as premium, which can deter price-sensitive shoppers. This high price point, while potentially reflecting quality or ingredient sourcing, can restrict market penetration to demographics with higher disposable income, thereby shrinking the potential customer pool compared to more affordably priced alternatives available in the mass market.

Amway's business model hinges on its vast network of independent distributors, a significant strength but also a core weakness. Their sales performance directly dictates company revenue, making Amway susceptible to fluctuations in distributor motivation and retention. For instance, managing the engagement of millions of distributors globally presents an ongoing operational challenge.

Financial Performance Challenges in Specific Markets

Amway's financial performance isn't uniform across all regions. For instance, while global sales reached $7.4 billion in 2024, a 3% dip was noted, partly due to a strong US dollar. More pointedly, Amway India experienced a net loss in fiscal year 2024, underscoring significant financial challenges in specific markets. This unevenness necessitates localized strategies to address unique regional economic conditions and competitive landscapes.

These regional financial difficulties present a clear weakness for Amway:

- Market-Specific Losses: Amway India's net loss in fiscal year 2024 highlights substantial financial headwinds in key territories.

- Global Sales Dip: A 3% decline in global sales to $7.4 billion in 2024, influenced by currency fluctuations, indicates broader market pressures.

- Uneven Performance: The disparity between global figures and specific market results points to a need for more effective, tailored market penetration strategies.

Low Brand Loyalty and High Switching Costs for Consumers

Amway faces a significant challenge with low brand loyalty, as the direct selling market is saturated with comparable products. The increasing accessibility of e-commerce platforms allows consumers to easily discover and switch to competing brands offering similar nutritional supplements, beauty products, and home care items. This ease of switching, coupled with the sheer volume of alternatives, puts pressure on Amway’s ability to retain its customer base and maintain market share.

The direct selling model, while offering entrepreneurial opportunities, also means Amway's success is heavily reliant on its network of independent business owners (IBOs). If IBOs are not adequately supported or incentivized, they may churn, directly impacting customer acquisition and retention efforts. For instance, while specific churn rates for Amway IBOs aren't publicly disclosed, the broader direct selling industry has historically seen significant turnover, highlighting the importance of robust distributor engagement strategies.

- Low Switching Costs: Consumers can easily shift to competing brands due to the availability of similar products online and in retail.

- Intensified Competition: The direct selling landscape, alongside traditional retail and e-commerce, presents numerous alternatives to Amway's offerings.

- Customer Retention Challenges: Without strong brand differentiation and loyalty programs, Amway may struggle to keep customers engaged in a dynamic market.

Amway's reliance on its independent distributors means its success is tied to their motivation and retention, a constant management challenge. The company's premium pricing can also limit its customer base to those with higher disposable incomes, shrinking its potential market share compared to more affordable competitors.

Furthermore, Amway faces significant hurdles in specific markets, as evidenced by Amway India's net loss in fiscal year 2024. This uneven financial performance across regions, coupled with a 3% dip in global sales to $7.4 billion in 2024, highlights the need for more effective, localized strategies to navigate diverse economic conditions and competitive pressures.

| Key Weaknesses | Description | Impact |

| Distributor Dependency | Success hinges on the motivation and retention of millions of independent distributors globally. | Vulnerability to fluctuations in sales performance and customer acquisition. |

| Premium Pricing Strategy | Products are often priced higher than mass-market alternatives. | Limits appeal to price-sensitive consumers, potentially reducing market penetration. |

| Market-Specific Financial Challenges | Regional performance varies, with instances like Amway India's net loss in FY2024. | Indicates difficulties in adapting to local economic conditions and competitive landscapes. |

| Global Sales Decline | Reported a 3% dip in global sales to $7.4 billion in 2024, influenced by currency. | Suggests broader market pressures affecting overall revenue growth. |

Preview the Actual Deliverable

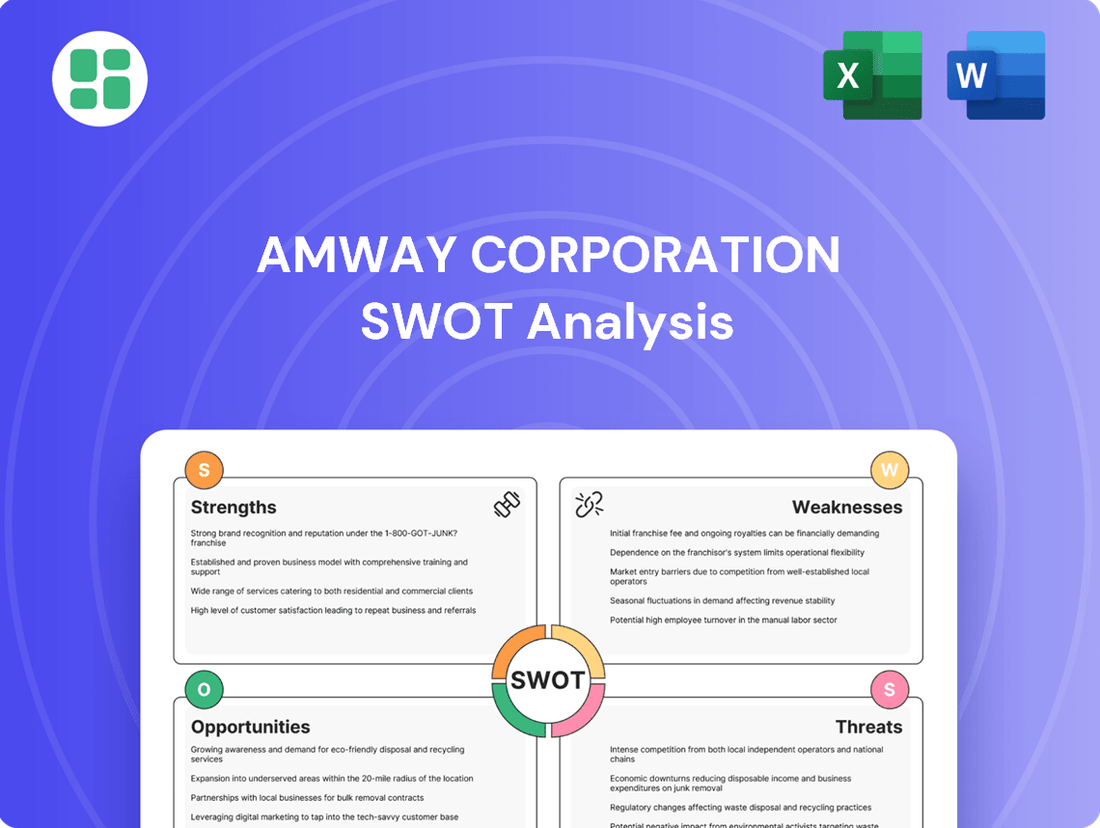

Amway Corporation SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're looking at the actual Amway Corporation SWOT analysis, detailing its Strengths, Weaknesses, Opportunities, and Threats. Purchase unlocks the complete, in-depth version for your strategic planning needs.

Opportunities

Emerging economies, especially in the Asia-Pacific region, offer substantial growth avenues for Amway. In 2024, the global health and beauty market in these regions is projected to see robust expansion, driven by increasing disposable incomes and a growing middle class keen on premium wellness and personal care items. Amway's direct selling model is well-suited to penetrate these markets, leveraging local networks to build brand awareness and customer loyalty.

Tailoring product portfolios and marketing campaigns to resonate with local tastes and cultural nuances is key to unlocking this potential. For instance, adapting product formulations or packaging to suit regional preferences, as seen with some successful launches in Southeast Asia, can significantly boost adoption rates. By strategically expanding its global footprint in these dynamic markets, Amway can tap into new customer bases and diversify its revenue streams, aiming for continued global sales growth in the coming years.

Amway is actively enhancing its digital presence, with significant investments in e-commerce platforms and AI-driven marketing tools. This strategy aims to capture a larger share of the growing online retail market, projected to reach $8.1 trillion globally by 2026, according to Statista. By leveraging AI for personalized customer engagement and streamlined recruitment processes, Amway can better connect with younger demographics increasingly favoring digital channels.

The company's focus on social commerce presents a substantial opportunity, aligning with the trend where social media platforms are increasingly integrated into the purchasing journey. This approach allows for direct sales and marketing within communities that Amway already cultivates, potentially boosting sales figures and brand loyalty. For instance, social commerce sales are expected to grow by 20% annually in the coming years.

Amway can capitalize on the booming health and wellness market by expanding its product offerings. This includes developing new items, especially those aligned with growing consumer preferences for plant-based and sustainable options. For instance, the global wellness market was projected to reach $7.0 trillion by 2025, indicating a substantial opportunity for Amway to capture market share by innovating within its nutrition and personal care segments.

Strategic Partnerships and Collaborations

Amway can significantly boost its market presence by forging strategic partnerships. Collaborating with local businesses, health experts, and beauty salons can lend credibility and introduce Amway's diverse product lines to new customer bases. For instance, a partnership with a prominent wellness influencer in 2024 could expose Amway's nutritional supplements to millions of followers.

Affiliate marketing presents another avenue for growth, allowing Amway to expand its reach efficiently. By leveraging the networks of affiliates, Amway can tap into previously unreached demographics and geographic regions, potentially driving substantial sales growth. The global affiliate marketing market was projected to reach over $20 billion in 2024, indicating the immense potential.

- Brand Credibility: Alliances with respected local entities and professionals can bolster Amway's reputation.

- New Market Access: Partnerships offer a direct channel to introduce products to untapped consumer segments.

- Affiliate Marketing Expansion: This strategy can broaden Amway's sales force and market penetration significantly.

Leveraging Data Analytics and AI for Business Optimization

Amway can significantly enhance its operations by integrating AI and data analytics. This allows for highly personalized product recommendations and targeted marketing campaigns, improving customer engagement. For instance, leveraging AI for predictive lead scoring can help identify high-potential customers, increasing sales efficiency.

The adoption of these technologies offers substantial benefits for business optimization. Amway could see improved conversion rates and a more streamlined supply chain, reducing costs and delivery times. By analyzing vast datasets, the company can gain deeper insights into consumer behavior, leading to more effective strategies.

- Tailored Recommendations: AI can analyze purchase history and browsing behavior to offer personalized product suggestions, potentially increasing average order value.

- Efficient Supply Chain: Predictive analytics can optimize inventory management and logistics, reducing waste and improving delivery speed, a critical factor in direct selling.

- Targeted Marketing: Data analytics enables Amway to segment its customer base more effectively, delivering relevant promotions and content that resonate with specific groups.

- Predictive Lead Scoring: AI can identify and prioritize potential distributors or customers based on their engagement and demographic data, boosting recruitment and sales efforts.

Amway can tap into the burgeoning health and wellness sector by expanding its product range, particularly with plant-based and sustainable options. The global wellness market was projected to hit $7.0 trillion by 2025, presenting a significant chance for Amway to innovate in its nutrition and personal care lines.

Strategic partnerships with local businesses and influencers offer a pathway to enhanced market presence and credibility. For example, a 2024 collaboration with a prominent wellness influencer could expose Amway's supplements to millions of new consumers.

Affiliate marketing provides an efficient route for Amway to broaden its reach, tapping into new demographics and regions. The affiliate marketing market was expected to exceed $20 billion in 2024, highlighting substantial growth potential.

Amway's digital transformation, including e-commerce and AI-driven marketing, positions it to capture a larger share of the online retail market, which Statista projected to reach $8.1 trillion globally by 2026.

Threats

Amway navigates a highly competitive landscape, contending with established direct-selling rivals, traditional Fast-Moving Consumer Goods (FMCG) players, and agile e-commerce startups. These competitors frequently offer comparable products, often at more aggressive price points, directly challenging Amway's market position and customer loyalty.

The FMCG sector, where Amway's health, beauty, and home care products compete, is particularly saturated. For instance, in 2024, the global FMCG market was valued at over $9.7 trillion, with intense price wars and promotional activities common among major players, putting pressure on Amway's margins and sales volume.

Furthermore, the rise of online-only retailers and direct-to-consumer (DTC) brands in 2024-2025 has amplified this threat by providing consumers with wider choices and often faster delivery, forcing Amway to continually innovate its product offerings and distribution strategies to maintain its competitive edge.

Amway faces growing scrutiny of its multi-level marketing (MLM) model, with regulators worldwide proposing stricter rules on transparency and income claims. For instance, in 2024, several countries continued discussions around enhanced disclosure requirements for MLMs, aiming to prevent misrepresentation of earning potential. This evolving regulatory environment creates uncertainty and potential compliance costs for Amway's operations.

Legal challenges, including ongoing allegations of operating as a pyramid scheme, represent a significant threat. Adverse legal rulings or settlements could result in substantial financial penalties and damage Amway's brand reputation. The company's defense against these claims is crucial for maintaining operational stability and investor confidence.

Global economic instability, particularly in 2024 and projected into 2025, poses a significant threat to Amway. Factors like persistent inflation and potential recessions in key markets can directly reduce consumer discretionary income, impacting sales of premium health, beauty, and home products. For instance, if consumer confidence indexes continue to decline, as seen in some European economies during late 2023, it signals a reduced willingness to spend on non-essential items, which could affect Amway's direct selling model.

Negative Public Perception and Brand Image Issues

Amway continues to grapple with persistent allegations of pyramid scheme characteristics, a lingering issue that impacts public perception and trust in its direct selling model. These concerns, often amplified by past legal controversies, can significantly deter potential independent business owners (IBOs) and customers from engaging with the brand. For instance, while Amway has settled numerous lawsuits over the years, the reputational damage can be long-lasting, affecting recruitment and sales efforts.

The company's brand image is directly challenged by this negative sentiment. In 2023, Amway faced continued scrutiny regarding its compensation structure and recruitment practices, with some consumer advocacy groups still raising red flags. This ongoing public relations challenge necessitates substantial investment in marketing and corporate social responsibility initiatives to rebuild and maintain consumer confidence.

- Reputational Risk: Allegations of pyramid scheme structures can erode consumer trust and deter potential IBOs.

- Legal Scrutiny: Past legal battles and ongoing regulatory oversight create a persistent threat to brand image.

- Market Perception: Negative public sentiment can directly impact sales volume and the ability to attract new distributors.

Difficulty in Attracting and Retaining Independent Business Owners

The multi-level marketing (MLM) structure inherently faces challenges in consistently attracting and retaining independent business owners (IBOs). The allure of the gig economy, with its promise of immediate rewards and flexibility, often overshadows the long-term commitment and effort required in an MLM. This makes it increasingly difficult for companies like Amway to capture and hold the attention of potential recruits who are drawn to quicker gratification.

Furthermore, the financial realities for many participants in MLM schemes can act as a significant deterrent. Reports from various sources, including FTC data and academic studies, consistently highlight that a substantial percentage of MLM participants earn very little, or even incur losses after accounting for expenses. For instance, a 2018 FTC study on MLM, which analyzed data from 2000-2016, found that over 99% of participants lost money. Such statistics can understandably make prospective IBOs hesitant to join, fearing similar financial outcomes.

- Increased competition from the gig economy: The rise of platforms offering flexible, short-term work presents a more immediate and often less risky alternative for individuals seeking supplemental income.

- "Instant gratification" culture: Modern consumers and potential entrepreneurs are often accustomed to quicker results, making the sustained effort required for MLM success less appealing.

- Negative perceptions of MLMs: Highlighting financial losses reported by a majority of participants in MLM models can significantly deter new recruits.

Amway faces significant regulatory headwinds as governments worldwide increase scrutiny of multi-level marketing (MLM) practices. These evolving regulations, focusing on transparency and income claims, could necessitate costly operational adjustments and create legal uncertainties. For example, in 2024, discussions continued in several jurisdictions regarding enhanced disclosure mandates for MLMs, aiming to prevent misleading earning potential representations.

The company's brand image is also under pressure from persistent allegations of operating as a pyramid scheme, a perception that can deter both potential distributors and customers. Negative public sentiment, often fueled by past legal issues and consumer advocacy group concerns, requires ongoing investment in public relations and corporate responsibility to maintain trust. For instance, while Amway has settled numerous lawsuits, the reputational impact can linger, affecting recruitment and sales.

Economic instability, particularly in 2024 and projected into 2025, poses a threat by reducing consumer discretionary spending on Amway's premium products. Inflationary pressures and potential recessions in key markets can dampen consumer confidence, impacting sales of health, beauty, and home care items. A decline in consumer confidence indexes, as observed in some European markets in late 2023, signals a reduced willingness to purchase non-essential goods.

SWOT Analysis Data Sources

This Amway Corporation SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial reports, comprehensive market research, and industry expert analyses to provide a well-rounded perspective.