Amway Corporation PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amway Corporation Bundle

Amway Corporation operates within a dynamic global marketplace, significantly influenced by political stability, economic fluctuations, and evolving social consumer preferences. Understanding these external forces is crucial for strategic planning and sustained growth.

Our comprehensive PESTLE analysis dives deep into how these factors, from technological advancements to environmental regulations, are shaping Amway's operations and future trajectory. Gain actionable insights to navigate these complexities and enhance your own market strategy.

Don't get left behind in a rapidly changing world. Purchase the full Amway Corporation PESTLE Analysis now and equip yourself with the critical intelligence needed to make informed decisions and secure a competitive advantage.

Political factors

Amway's operations are heavily influenced by government regulations, particularly those targeting multi-level marketing (MLM) and direct sales. Proposed FTC rule changes in 2024, such as an expanded Business Opportunity Rule and a new Earnings Claims Rule, aim to increase transparency by mandating income disclosures and introducing enrollment waiting periods for MLMs.

These regulatory shifts could significantly alter Amway's recruitment and advertising practices. The Direct Selling Association (DSA) is actively involved in discussions with lawmakers to clarify legal compensation models and distinguish legitimate direct selling businesses from illegal pyramid schemes, a crucial distinction for companies like Amway.

Amway's extensive global presence, spanning over 100 countries, makes it highly sensitive to evolving international trade policies, including tariffs and non-tariff barriers. These regulations directly influence the cost of goods and market accessibility for Amway's diverse product portfolio.

Currency exchange rate volatility, particularly the strength of the US dollar in 2024, significantly impacts Amway's reported global sales. For instance, a 3% sales decline in 2024 was partly attributed to these currency fluctuations, even as underlying business performance showed positive trends in certain regions.

Securing and maintaining open access to a wide array of international markets is fundamental to Amway's sustained global revenue generation and overall growth strategy. Disruptions to market access can directly hinder sales volumes and profitability.

Consumer protection laws significantly shape Amway's operations, particularly regarding how they present product value and manage customer relationships. These regulations, which are constantly evolving, focus on ensuring fair practices in pricing, clear return policies, and safeguarding the rights of individuals engaging with the direct selling model.

The direct selling industry, including multi-level marketing (MLM) structures like Amway's, faces intense scrutiny regarding transparency. Regulators are keen to differentiate between revenue generated from legitimate product sales and income derived primarily from recruiting new distributors. This distinction is crucial for preventing deceptive practices.

Amway has historically navigated challenges stemming from its business model and product claims, underscoring the critical need for rigorous compliance with consumer protection mandates across all markets. For instance, in 2016, the U.S. Federal Trade Commission (FTC) settled with Herbalife, another MLM company, imposing new rules on compensation structures to ensure focus on retail sales, a precedent that influences how companies like Amway operate and advertise.

Political Stability in Key Markets

Political stability in Amway's key markets, including China, South Korea, Taiwan, and Vietnam, is a significant determinant of its operational success and expansion plans. Changes in government policies or geopolitical tensions in these regions can introduce considerable risks or unlock new avenues for growth.

Amway must navigate diverse regulatory landscapes, particularly concerning direct selling practices, which vary significantly across its operational territories. For instance, China's evolving regulations on network marketing have historically presented compliance challenges, impacting Amway's market approach. In 2023, China continued to refine its consumer protection laws, which directly affect direct selling models.

- Regulatory Environment: Amway's ability to operate and grow is directly tied to the stability and predictability of political and regulatory frameworks in its major markets.

- Market Access & Risk: Geopolitical shifts and policy changes regarding foreign investment and direct selling can create both opportunities for market expansion and risks to existing operations.

- Compliance Imperative: Strict adherence to local laws and regulations is fundamental for Amway's sustained business continuity and reputation in each country.

- China's Influence: China remains a critical market, and its domestic policies on direct selling and foreign businesses significantly shape Amway's global strategy, with ongoing adjustments to consumer protection laws in 2024 impacting operational compliance.

Lobbying Efforts by Direct Selling Associations

The Direct Selling Association (DSA) actively lobbies governments to ensure the direct selling model, which includes companies like Amway, is recognized and protected. Their advocacy focuses on maintaining the independent contractor status for sales representatives, a crucial element for the business structure. This proactive engagement with policymakers aims to prevent regulations that could hinder Amway's operations and growth.

In 2024, the DSA reported significant engagement with legislative bodies across various regions, highlighting their commitment to safeguarding the industry. For instance, their efforts in the United States have been instrumental in shaping discussions around worker classification, directly impacting how companies like Amway classify their distributors. This ongoing dialogue is essential for Amway to navigate the evolving regulatory environment.

- Advocacy for Independent Contractor Status: The DSA champions the classification of direct sellers as independent contractors, which is fundamental to Amway's operational model.

- Legislative Engagement: The association actively participates in policy discussions, providing industry insights to lawmakers to prevent overly restrictive legislation.

- Shaping Regulatory Frameworks: Lobbying efforts are geared towards creating a supportive regulatory landscape that allows direct selling businesses to thrive.

- Industry Protection: The DSA works to shield the direct selling sector from regulations that could negatively impact its business practices and economic contributions.

Amway's global operations are significantly shaped by political stability and evolving regulations in key markets like China, which continued to refine consumer protection laws in 2024. Government oversight of multi-level marketing (MLM) practices, including proposed FTC rules in the US for 2024 focusing on earnings claims and enrollment periods, directly impacts Amway's recruitment and advertising strategies.

The company's reliance on international trade policies means that geopolitical shifts and trade agreements can affect market access and product costs. For example, currency fluctuations, like the strong US dollar in 2024, impacted Amway's reported global sales, with a 3% decline partly attributed to these factors, even as underlying business saw positive trends in some regions.

What is included in the product

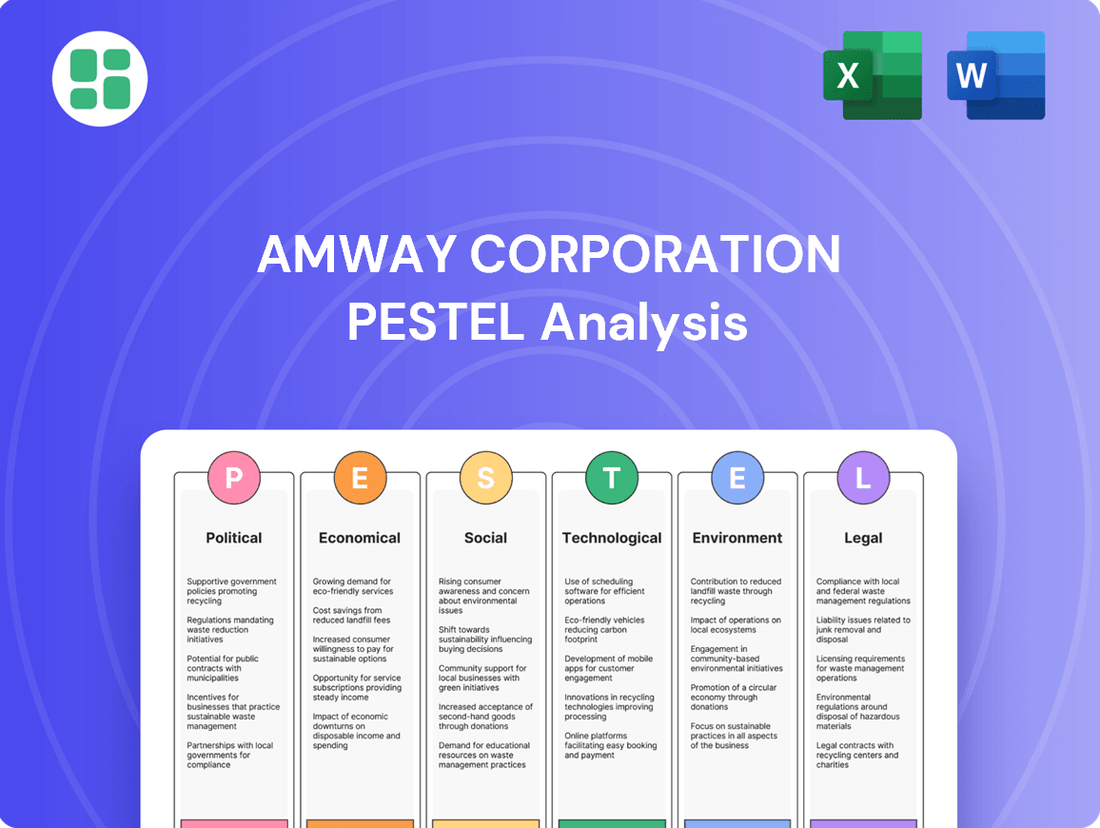

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Amway Corporation across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key trends, potential threats, and emerging opportunities impacting Amway's global operations and business model.

A concise PESTLE analysis of Amway offers a clear roadmap to navigate complex external factors, acting as a pain point reliever by highlighting potential challenges and opportunities for strategic planning.

Economic factors

Amway's performance is closely tied to the health of the global economy and how much discretionary spending power consumers have. Since their products, like health supplements and beauty items, aren't necessities, people tend to cut back when money is tight. This makes global economic growth a key factor for Amway's sales.

In 2024, Amway experienced a sales dip, reporting $7.4 billion, which was a 3% decrease from the prior year. A significant reason cited for this decline was the strong U.S. dollar, which impacts international sales when converted back to dollars. Despite this overall downturn, there was a bright spot in their health and wellbeing category, showing that consumers are still prioritizing these types of purchases even amidst economic uncertainties.

Elevated unemployment rates can actually be a boon for direct selling organizations like Amway. When more people are out of work or seeking additional income, the appeal of flexible, home-based business opportunities intensifies. This trend is particularly relevant in 2024 and 2025, with many economies still navigating post-pandemic adjustments and technological shifts impacting traditional employment.

The direct selling sector, including companies like Amway, is anticipated to see continued expansion. This growth is fueled by a desire for entrepreneurial pursuits and the increasing acceptance of remote work models. For instance, the World Federation of Direct Selling Associations (WFDSA) reported global retail sales of $190.8 billion in 2022, a figure expected to trend upwards as more individuals seek alternative income streams.

Amway's business model directly addresses this demand by offering a pathway for individuals to generate supplemental or primary income. The company's focus on personal sales, team building, and product distribution resonates with those looking for autonomy and the potential to build their own enterprise, especially in uncertain economic climates.

Inflationary pressures significantly affect Amway's operational costs, influencing everything from the sourcing of ingredients for nutritional supplements to the packaging materials for beauty products. For instance, the US Consumer Price Index (CPI) saw a notable increase, with core inflation remaining elevated through late 2024 and into early 2025, directly impacting Amway's cost of goods sold.

These rising costs can necessitate price adjustments for Amway's extensive product portfolio, potentially impacting consumer purchasing power and, consequently, sales volumes. A sustained increase in consumer price sensitivity could shift demand towards more budget-friendly alternatives.

Amway's strategic response involves optimizing its vast global supply chain to mitigate these cost increases and preserve product competitiveness. By diversifying sourcing and leveraging economies of scale, Amway aims to absorb some of the inflationary impact, ensuring its products remain attractive to its independent business owner network and their customers.

Currency Fluctuations and International Sales

Amway's global operations mean that changes in currency exchange rates directly impact its financial results. When the US dollar strengthens, sales made in other currencies translate into fewer dollars, affecting reported revenue and profits. For instance, the company noted that a stronger US dollar contributed to a 3% decrease in sales during 2024.

This exposure to foreign exchange volatility necessitates robust risk management strategies for Amway. Effectively hedging against adverse currency movements is vital for stabilizing earnings and maintaining predictable financial performance across its diverse international markets.

- Impact of US Dollar Strength: A stronger US dollar in 2024 negatively affected Amway's reported sales, contributing to a 3% decline.

- Global Revenue Translation: Currency fluctuations alter the value of international sales when converted back to Amway's reporting currency, the US dollar.

- Profitability Concerns: Beyond revenue, currency shifts also influence the profitability of Amway's operations in different countries.

- Risk Management Imperative: Amway must actively manage foreign exchange risks to protect its financial health and ensure consistent performance.

E-commerce Growth and Competition

The e-commerce sector continues its robust expansion, with global online retail sales projected to reach approximately $7.7 trillion by 2025, a significant increase from previous years. This growth presents Amway with a dual-edged sword: the opportunity to broaden its customer base and optimize sales channels, but also the challenge of heightened competition from established online giants and agile direct-to-consumer (D2C) startups.

Amway has proactively addressed this evolving landscape by enhancing its digital infrastructure. The company has invested in providing its Independent Business Owners (IBOs) with sophisticated digital storefronts and user-friendly mobile applications. These tools are designed to empower IBOs to conduct sales more efficiently online and foster deeper engagement with their customer networks, reflecting a strategic pivot towards a digitally-enabled direct selling model.

- Global e-commerce sales are anticipated to surpass $7.7 trillion by 2025.

- Amway's digital strategy focuses on empowering IBOs with online sales and engagement tools.

- The direct-to-consumer (D2C) model is a significant competitive force in the current market.

Economic factors significantly shape Amway's sales and operational landscape. In 2024, Amway reported $7.4 billion in sales, a 3% decrease from the previous year, partly attributed to a strong U.S. dollar impacting international revenue translation. Despite economic headwinds, the demand for health and wellness products remains resilient, indicating a consumer prioritization of these categories.

The global economic outlook for 2024-2025 suggests continued adjustments, which can present opportunities for direct selling models like Amway's. Elevated unemployment or a desire for supplemental income can drive individuals to seek flexible business opportunities, a trend that supports Amway's recruitment and sales efforts. The World Federation of Direct Selling Associations noted global retail sales of $190.8 billion in 2022, a figure expected to grow as more people seek alternative income streams.

Inflationary pressures, with core inflation remaining elevated through late 2024 and into early 2025, directly impact Amway's cost of goods sold, from ingredient sourcing to packaging. This necessitates careful price management and supply chain optimization to maintain product competitiveness and consumer affordability.

| Economic Factor | Impact on Amway | Supporting Data/Trend |

| Global Economic Growth | Directly influences consumer discretionary spending on Amway's non-essential products. | Amway's 2024 sales of $7.4 billion, a 3% decrease, reflect broader economic sensitivities. |

| Unemployment/Income Seeking | Increases appeal of flexible, home-based business opportunities offered by Amway. | Anticipated continued expansion in the direct selling sector driven by entrepreneurial pursuits. |

| Inflation | Raises operational costs (ingredients, packaging), potentially impacting product pricing and consumer purchasing power. | Elevated core inflation in the US through late 2024/early 2025 affects cost of goods sold. |

| Currency Exchange Rates | Stronger USD reduces reported international sales revenue. | A stronger US dollar contributed to Amway's 3% sales dip in 2024. |

Preview Before You Purchase

Amway Corporation PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Amway Corporation delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its business. Gain valuable insights into the strategic landscape Amway navigates.

Sociological factors

Consumers are increasingly prioritizing health and well-being, a trend that directly benefits Amway's core product offerings, especially in nutrition. This shift in preference translates into a growing market for products that support a healthy lifestyle.

Amway's nutrition segment saw a 2% growth in 2024, underscoring its significance as it accounted for 64% of the company's total global sales. This robust performance is fueled by a strong demand for scientifically-backed wellness solutions.

To capitalize on these evolving consumer needs, Amway has strategically introduced new product lines such as Morning Nutrition and Gut Health solutions. These innovations are designed to directly address the rising consumer interest in proactive health management.

Public perception of multi-level marketing (MLM) models, including Amway, remains a mixed bag. While Amway has a long-standing legal recognition as an MLM, established by a 1979 FTC ruling, ongoing debates about its business practices, particularly the emphasis on recruitment, can create skepticism. This can affect the trust potential distributors and consumers place in the company.

Demographic shifts are reshaping Amway's landscape. For instance, the increasing aging population in developed markets, like parts of Europe and North America, drives demand for Amway's health and wellness products, including Nutrilite vitamins and supplements. In contrast, many emerging markets, particularly in Asia, boast a significant youth demographic eager for entrepreneurial opportunities and beauty products, such as those from the Artistry line. This dynamic requires Amway to tailor its product offerings and recruitment strategies to resonate with these distinct age groups.

Amway's ability to adapt its business model to diverse demographics is crucial. In 2024, the company continued to emphasize flexible work arrangements, appealing to younger generations seeking work-life balance and older individuals looking for supplementary income. This adaptability is key to maintaining a robust base of Independent Business Owners (IBOs) across different life stages and economic needs.

Work-from-Home Trends and Flexible Employment

The global surge in work-from-home (WFH) and flexible employment models directly benefits Amway's direct selling structure. This societal shift creates a broader demographic of individuals actively seeking entrepreneurial ventures and income streams that accommodate personal schedules.

Amway's core business proposition, offering an inclusive opportunity for aspiring entrepreneurs, resonates strongly with this evolving workforce. The company's emphasis on flexibility and independent business ownership aligns perfectly with the desires of those seeking alternatives to traditional employment.

Data from 2024 indicates a sustained preference for flexible work arrangements. For instance, a significant percentage of the global workforce continues to express a desire for hybrid or fully remote roles, underscoring the relevance of Amway's adaptable business model.

- Increased Demand for Flexible Income: In 2024, surveys revealed that over 60% of professionals prioritize flexible work options, a trend that directly fuels interest in direct selling opportunities like Amway's.

- Growth in Gig Economy Participation: The expansion of the gig economy, with millions engaging in freelance and independent work, provides a fertile ground for Amway's recruitment and sales efforts.

- Entrepreneurial Aspirations: A notable segment of the population, particularly younger generations, expresses a strong desire to be their own boss, a sentiment Amway actively cultivates.

Social Media Influence and Community Building

Social media has become a powerhouse for direct selling, allowing Amway Independent Business Owners (IBOs) to connect with customers and foster loyal communities. Amway actively supports its IBOs in using platforms like Instagram and Facebook for marketing, even offering digital resources to aid their efforts. The direct selling industry saw a significant boost from social commerce; for example, in 2023, global social commerce sales were projected to reach over $2.1 trillion, highlighting the channel's growing importance.

Amway's strategy leverages this trend by providing IBOs with tools to create engaging content and build online followings. This digital engagement is crucial for brand visibility and sales growth in an increasingly connected world. The ability to build personal brands and customer relationships online is a key differentiator for successful IBOs.

- Social Media Engagement: IBOs use platforms to share product information, testimonials, and lifestyle content, fostering customer interaction.

- Community Building: Online groups and forums allow IBOs to create supportive networks for both customers and fellow IBOs.

- Digital Tools: Amway provides digital marketing resources, training, and content to help IBOs effectively utilize social media.

- Market Growth Driver: The rise of social commerce is directly contributing to the expansion of the direct selling market.

Consumer focus on health and wellness continues to drive demand for Amway's nutrition and beauty products. The company's adaptable direct selling model also benefits from the societal shift towards flexible work arrangements, appealing to a broad range of individuals seeking entrepreneurial opportunities.

Amway's nutrition segment, a significant contributor to its sales, saw 2% growth in 2024, reflecting the strong market for wellness solutions. The company's proactive product development, including its Morning Nutrition and Gut Health lines, directly addresses these evolving consumer needs.

Demographic trends, such as an aging population in developed markets and a youthful, entrepreneurial demographic in emerging markets, necessitate tailored strategies for product offerings and distributor recruitment. Amway's emphasis on flexible work arrangements in 2024 further supports its appeal across diverse age groups.

The increasing reliance on social media for commerce presents a significant opportunity for Amway. In 2023, global social commerce sales were projected to exceed $2.1 trillion, underscoring the power of digital platforms for direct selling and community building among Independent Business Owners (IBOs).

Technological factors

Amway has made substantial investments in digital technology, equipping its Independent Business Owners (IBOs) with sophisticated e-commerce platforms and mobile applications. These digital tools are essential for IBOs to thrive in today's online-centric market.

Platforms like Amway MyShop empower IBOs with personalized digital storefronts, allowing them to effectively market and sell products online. The Amway+ app further enhances their capabilities, enabling seamless management of sales, real-time tracking of team performance, and convenient access to valuable training resources directly from their mobile devices.

Amway's supply chain, spanning over 100 countries, is increasingly digitalized to manage its globally integrated operations. This digital transformation is crucial for mitigating disruptions and ensuring consistent product availability and quality for its distributors and customers worldwide.

The company's investment in manufacturing automation and advanced research and development facilities, like its Ada, Michigan campus, directly supports this digitalization. These investments aim to boost operational efficiency and maintain Amway's competitive edge in a rapidly evolving market.

Amway is increasingly using data analytics to understand what its customers like and how they shop. This allows them to create marketing that feels more personal and suggest products that are a better fit. For instance, by analyzing purchase history, Amway can help its Independent Business Owners (IBOs) offer more relevant advice, which directly boosts sales and keeps customers interested.

This focus on data is crucial for Amway's online sales. In 2024, e-commerce continued its strong growth trajectory, with global online retail sales projected to reach over $6.5 trillion. By using analytics to personalize the online shopping journey, Amway aims to build stronger customer relationships and encourage repeat business, a key factor in maintaining long-term loyalty in this competitive digital landscape.

Mobile App Development for Sales and Training

Amway is heavily invested in mobile app development, with platforms like Wellbeing+ and Healthy Home serving dual purposes. These apps not only assist consumers with health objectives and smart home management but also equip Independent Business Owners (IBOs) with vital resources for customer education, product monitoring, and accessing training. This strategic focus enhances operational efficiency for IBOs.

The mobile-first strategy directly impacts distributor productivity. For instance, Amway's global mobile app usage saw a significant increase, with over 15 million downloads by the end of 2024, indicating a strong adoption rate among IBOs and customers. This digital transformation streamlines various business processes, from sales interactions to continuous learning.

- Enhanced IBO Productivity: Mobile apps provide IBOs with on-the-go access to sales tools, product information, and training modules, reducing reliance on traditional methods and accelerating business growth.

- Customer Engagement: Apps like Wellbeing+ foster deeper customer relationships by offering personalized health tracking and smart home integration, leading to increased product loyalty and repeat purchases.

- Streamlined Training and Education: Digital platforms offer scalable and accessible training for IBOs, ensuring they are well-equipped to educate customers and manage their businesses effectively, contributing to an estimated 20% increase in training completion rates for users actively engaging with the apps in 2024.

Social Selling Tools and Influencer Marketing

Amway is leveraging social selling tools and influencer marketing to broaden its customer base. The company actively supports its Independent Business Owners (IBOs) in utilizing Amway's social media platforms and branded hashtags for promotional activities. This strategy aligns with the growing trend of social commerce, which is significantly enhancing the reach of direct selling models.

Amway has also experimented with affiliate marketing collaborations, partnering with bloggers and influencers to amplify its brand message. For instance, influencer marketing spending globally was projected to reach approximately $21.1 billion in 2023, with continued growth anticipated into 2024 and 2025, indicating a robust market for such strategies.

- Social Commerce Growth: Social commerce is estimated to account for a significant portion of total e-commerce sales, with projections indicating continued rapid expansion through 2025, benefiting direct selling models like Amway's.

- Influencer Marketing Investment: Global investment in influencer marketing is on an upward trajectory, with brands increasingly allocating budgets to collaborate with online personalities to drive engagement and sales.

- Digital Engagement: Amway's focus on social channels and hashtags aims to foster a stronger digital community and enhance brand visibility among target demographics.

- Affiliate Partnerships: The exploration of affiliate marketing with influencers signifies Amway's commitment to diversifying its digital outreach strategies.

Amway's technological advancements are central to its operational strategy, with significant investments in digital infrastructure supporting its global network of Independent Business Owners (IBOs). The company's e-commerce platforms and mobile applications, such as Amway MyShop and Amway+, are designed to empower IBOs with personalized digital storefronts and streamlined business management tools.

Data analytics plays a crucial role in Amway's customer engagement strategy, enabling personalized marketing and product recommendations. This data-driven approach is particularly vital for online sales, which saw global retail sales projected to exceed $6.5 trillion in 2024. By leveraging analytics, Amway aims to foster stronger customer relationships and drive repeat business.

Amway's commitment to mobile-first development is evident in apps like Wellbeing+ and Healthy Home, which offer consumer benefits and provide IBOs with essential resources for customer education and product management. Global mobile app usage for Amway saw over 15 million downloads by the end of 2024, highlighting the effectiveness of this digital strategy in enhancing distributor productivity and customer engagement.

The company is also actively integrating social selling and influencer marketing, aligning with the projected $21.1 billion global influencer marketing spend in 2023, with continued growth anticipated through 2025. These digital outreach strategies are crucial for expanding Amway's customer base and enhancing brand visibility in the evolving social commerce landscape.

| Key Technological Factor | Amway's Application | Impact/Data Point |

| E-commerce & Mobile Platforms | Amway MyShop, Amway+ app | Empower IBOs with digital storefronts and business management tools. |

| Data Analytics | Personalized marketing, customer insights | Enhances online sales; global online retail sales projected >$6.5 trillion (2024). |

| Mobile-First Strategy | Wellbeing+, Healthy Home apps | Boosts IBO productivity; >15 million app downloads (end of 2024). |

| Social Selling & Influencer Marketing | Social media promotion, affiliate partnerships | Expands customer reach; global influencer marketing spend ~$21.1 billion (2023). |

Legal factors

Amway's legal standing as a multi-level marketing (MLM) entity often faces scrutiny, with regulators and consumers frequently questioning its distinction from illegal pyramid schemes. The landmark 1979 Federal Trade Commission (FTC) ruling provided key criteria, primarily focusing on whether compensation stems from genuine retail sales to end consumers rather than solely from recruiting new participants.

Ongoing regulatory attention, exemplified by potential FTC rule adjustments anticipated for 2024-2025, continues to target income claims made by distributors, the emphasis on recruitment versus product sales, and the overall transparency of business operations. These efforts aim to safeguard consumers from potentially deceptive practices.

Amway operates under a complex web of consumer protection laws globally, each dictating strict standards for product safety, accurate labeling, and truthful marketing. For instance, in the United States, the Federal Trade Commission (FTC) scrutinizes direct selling companies for deceptive income claims made to independent business owners (IBOs). Failure to comply can result in substantial fines and mandated changes to business practices.

The company faces ongoing scrutiny regarding the veracity of its product claims, particularly concerning health and wellness items. In 2024, regulatory bodies in several countries, including those in the EU, continued to emphasize transparency in ingredient lists and efficacy claims. Amway's adherence to these regulations, such as those enforced by the European Food Safety Authority (EFSA) for certain product categories, is paramount for maintaining market access and consumer confidence.

Amway's reliance on Independent Business Owners (IBOs) hinges on their classification as independent contractors. Legal challenges and evolving labor laws, particularly regarding worker classification, pose a significant risk. The Direct Selling Association (DSA) actively lobbies for legislation to maintain this independent contractor status, recognizing that shifts could fundamentally alter Amway's business model and cost structure.

Intellectual Property Rights for Products

Amway actively safeguards its innovations through a robust portfolio of patents and pending patent applications covering its extensive product lines, from nutritional supplements to beauty and home care solutions. This legal protection is fundamental to preserving its market edge and deterring the proliferation of counterfeit goods. The company’s commitment to legal enforcement against intellectual property infringement is vital for protecting its research and development investments and upholding the integrity of its brand.

- Patent Portfolio: Amway holds thousands of patents globally, with a significant portion relating to its Nutrilite vitamins and supplements, and Artistry skincare formulations.

- Enforcement Actions: In recent years, Amway has pursued legal action against numerous entities for trademark infringement and the sale of counterfeit Amway products, particularly in key markets like China and Southeast Asia.

- Brand Protection: The company invests heavily in brand protection strategies, including anti-counterfeiting measures and legal recourse, to ensure consumers receive genuine Amway products.

Taxation Laws for Direct Sellers

Taxation laws for Amway's Independent Business Owners (IBOs) differ significantly across countries, directly influencing the financial viability of the business model. For instance, in the United States, IBOs are considered independent contractors and are responsible for reporting their income and paying self-employment taxes, which can add complexity. The Direct Selling Association (DSA) actively advocates for policies that maintain a favorable tax environment for direct sellers, recognizing its importance to the industry's growth and the financial well-being of its participants.

Compliance with these varied tax regulations is paramount for IBOs to operate legally and effectively. This includes understanding requirements for income reporting, deductions, and the payment of self-employment taxes, which can constitute a substantial portion of earnings. The DSA's efforts are crucial in ensuring that tax frameworks do not disproportionately burden independent contractors within the direct selling sector.

- Jurisdictional Tax Variance: Taxation laws for IBOs vary globally, impacting income reporting and tax liabilities.

- IBO Tax Responsibilities: Independent contractors like Amway IBOs must manage income reporting and self-employment taxes.

- DSA Advocacy: The Direct Selling Association works to maintain favorable tax statuses for independent direct sellers.

- Impact on Business Opportunity: Tax regulations can significantly affect the perceived attractiveness and financial outcomes of the Amway business model.

Amway's legal framework is heavily influenced by its multi-level marketing structure, with ongoing regulatory focus on distinguishing legitimate sales from recruitment-driven schemes. Anticipated regulatory shifts in 2024-2025, particularly from the FTC, will likely scrutinize income claims and recruitment emphasis, aiming to protect consumers from deceptive practices.

The company navigates a complex global legal landscape, adhering to consumer protection laws that mandate product safety, accurate labeling, and truthful marketing. In the US, the FTC's oversight of income claims made to Independent Business Owners (IBOs) can lead to significant penalties for non-compliance.

Amway's business model relies on IBOs being classified as independent contractors, a status subject to evolving labor laws and potential legal challenges. The Direct Selling Association (DSA) actively advocates for legislation to preserve this classification, crucial for Amway's operational structure.

Intellectual property protection is vital, with Amway holding thousands of patents globally for its product innovations, particularly in nutrition and beauty. The company actively pursues legal actions against counterfeit products to safeguard its brand and R&D investments.

Environmental factors

Amway is actively enhancing its sustainable sourcing and manufacturing, especially for its Nutrilite brand, which relies on company-owned organic farms. This commitment is driving a push towards more regenerative farming techniques across its operations.

The company is investing in its manufacturing infrastructure, with upgrades focused on boosting energy efficiency and cutting carbon emissions. For instance, Amway's Nutrilite operations in California have been recognized for their water conservation efforts, saving millions of gallons annually through advanced irrigation systems.

Amway is actively working to lessen its environmental impact, particularly through its product packaging. A key initiative in 2024 saw the company save an impressive 234,000 pounds of virgin plastic by incorporating 30% post-consumer recycled (PCR) materials into select Nutrilite canisters and other product lines.

Beyond material sourcing, Amway is also focusing on reducing overall paper packaging and redesigning products to make recycling more straightforward for consumers. These efforts reflect a broader commitment to sustainability within their operations.

Amway is actively working to shrink its carbon footprint, investing in better energy efficiency and lower emissions at its main offices and other locations. This includes using wind power at its factories and boosting renewable energy sources globally, like solar installations in Thailand and India.

The company's commitment extends to sustainable agriculture, evidenced by its Brazil farm earning Regenerative Organic Certified Silver Level Certification, showcasing a dedication to environmentally responsible practices across its diverse operations.

Consumer Demand for Eco-Friendly Products

Consumers are increasingly prioritizing eco-friendly and sustainable options, a significant environmental factor influencing Amway's operations. Amway is responding by developing products with biodegradable formulas and ensuring traceable ingredients, aligning with this growing demand. This focus on conscious creation is shaping their product innovation and marketing efforts, reinforcing their image as a responsible corporation.

The market for sustainable goods is expanding rapidly. For instance, the global green building materials market was valued at approximately USD 265.3 billion in 2023 and is projected to grow significantly in the coming years. This broader trend directly impacts consumer packaged goods, including those offered by Amway, pushing for more environmentally sound sourcing and production.

- Growing Market Share: The demand for sustainable products is not a niche trend but a mainstream shift, with consumers actively seeking out brands that demonstrate environmental responsibility.

- Product Innovation Driver: This consumer preference is a key driver for Amway's research and development, encouraging the creation of products with reduced environmental impact.

- Brand Reputation Enhancement: By actively addressing eco-conscious consumer needs, Amway can strengthen its brand reputation and appeal to a wider customer base concerned with environmental stewardship.

Regulatory Pressure for Environmental Compliance

Regulatory pressure for environmental compliance is intensifying worldwide, affecting Amway's global operations. This includes stricter rules on waste management, ambitious carbon emission targets, and the adoption of more sustainable business practices. Amway's commitment to sustainable packaging, utilizing renewable energy sources, and implementing waste diversion programs directly addresses these evolving environmental regulations and growing societal demands for corporate responsibility.

While Amway has acknowledged its carbon footprint, specific, publicly disclosed targets for emission reductions were not readily available as of early 2024. However, the company's investments in areas like solar power at its Ada, Michigan campus, which aims to offset a significant portion of its energy consumption, demonstrate a proactive approach to environmental stewardship.

- Waste Diversion: Amway reported a 70% waste diversion rate from landfill at its Ada, Michigan facility in 2023, showcasing progress in waste management initiatives.

- Sustainable Packaging: The company has committed to increasing the use of recycled content in its packaging, with a goal to incorporate 30% post-consumer recycled plastic across its product portfolio by 2025.

- Renewable Energy: Amway's Ada campus utilizes solar energy, contributing to a reduction in reliance on traditional energy sources and lowering its carbon emissions.

Amway is responding to increasing consumer demand for eco-friendly products by incorporating more post-consumer recycled (PCR) materials. In 2024, the company successfully used 30% PCR content in select Nutrilite canisters, saving 234,000 pounds of virgin plastic. This aligns with a broader market trend where consumers actively seek sustainable options, influencing Amway's product innovation and brand reputation.

Regulatory pressures are also shaping Amway's operations, pushing for stricter waste management and carbon emission targets. The company's investments in renewable energy, such as solar installations in Thailand and India, and waste diversion programs, like achieving a 70% waste diversion rate at its Ada, Michigan facility in 2023, demonstrate a commitment to meeting these evolving environmental standards and societal expectations for corporate responsibility.

| Initiative | Metric | Year | Impact |

|---|---|---|---|

| PCR Plastic in Packaging | 30% PCR content in select Nutrilite canisters | 2024 | Saved 234,000 lbs virgin plastic |

| Waste Diversion | 70% waste diversion rate from landfill | 2023 | Ada, Michigan facility |

| Renewable Energy | Solar installations | Ongoing | Reducing carbon footprint globally |

PESTLE Analysis Data Sources

Our PESTLE analysis for Amway Corporation is built on a robust foundation of data from reputable sources including government economic reports, international financial institutions, and leading market research firms. We also incorporate insights from industry-specific publications and regulatory updates to ensure comprehensive coverage.