Amway Corporation Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amway Corporation Bundle

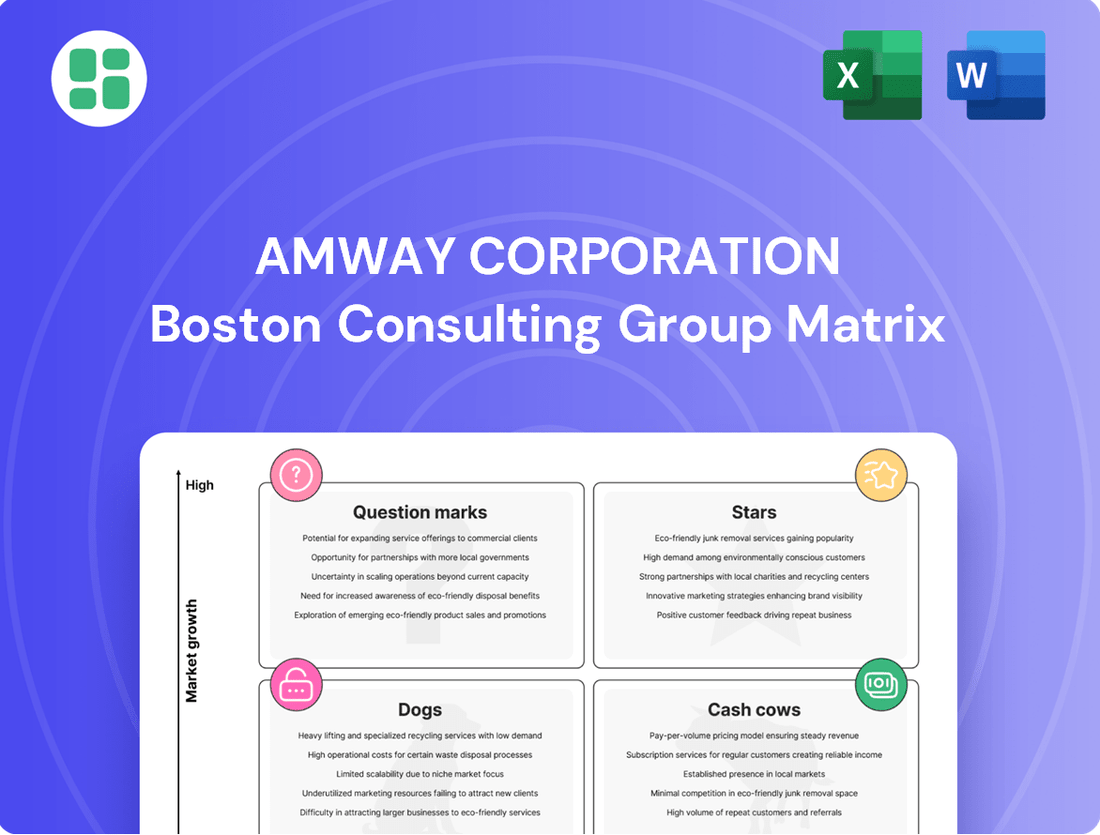

Curious about Amway's product portfolio performance? Our BCG Matrix analysis offers a glimpse into which of their offerings are market leaders and which might be underperforming. Understand the strategic implications of their current product mix.

Ready to unlock the full strategic picture? Purchase the complete Amway BCG Matrix to gain detailed insights into their Stars, Cash Cows, Dogs, and Question Marks, along with actionable recommendations for optimizing their product portfolio and driving future growth.

Stars

Nutrilite's Gut Health Solutions are a key component of Amway's nutrition category, which experienced 2% growth in 2024, now representing 64% of Amway's global sales. This strong market share in a growing category positions these solutions favorably.

The introduction of comprehensive Gut Health offerings, blending products with lifestyle advice, taps into significant consumer demand for science-backed wellness solutions. This strategic move places Nutrilite in a high-growth market segment.

By leveraging Amway's established expertise in plant science and microbiome research, Nutrilite's Gut Health Solutions are poised to lead in the expanding wellness sector. Ongoing investment in new probiotic products reinforces this strong market position.

Artistry Skin Nutrition is a star in Amway's portfolio, demonstrating robust growth and market leadership. In 2024, the brand introduced innovative products like sleeping masks, UV50 mineral sunscreen, and advanced serums, all backed by scientific research and traceable ingredients. This focus on science-driven skincare aligns with a key trend in the beauty industry.

The brand's strong performance is underscored by its status as one of Amway's top-selling brands, alongside Nutrilite and XS. This indicates a significant market share and consumer trust. Amway's strategic emphasis on 'healthy aging' for 2025 further highlights the potential for Artistry Skin Nutrition, as it directly addresses a burgeoning consumer demand for sophisticated anti-aging solutions that blend scientific efficacy with natural ingredients.

XS Energy and Sports Nutrition stands out as a star within Amway's portfolio, boasting top-selling status and a significant market share in its niche. This brand is actively pursuing growth, as evidenced by its expansion of fitness programs into new markets in 2024, offering more comprehensive solutions to meet evolving consumer fitness aspirations.

The broader health and wellness sector, particularly functional foods and beverages, is experiencing robust expansion. Projections indicate continued strong growth for this industry, placing XS in a highly favorable, high-growth market environment.

Digital Tools for IBOs (Amway+ & Wellbeing+ Apps)

Amway is strategically investing in its digital infrastructure, with a significant focus on mobile applications designed to support its Independent Business Owners (IBOs). This digital transformation aims to streamline operations and enhance user engagement.

The Amway+ app serves as a central hub for IBOs to manage their sales, track team performance, and access business resources. Concurrently, the Wellbeing+ app is being developed to support health and wellness programs, such as the Nutrilite Begin 30 initiative, reflecting a commitment to evolving health trends.

These digital tools are crucial for Amway's growth strategy, empowering IBOs and fostering a more connected and efficient direct selling model. By leveraging technology, Amway seeks to improve distributor retention and expand its market reach in a competitive environment.

- Amway+ App: Designed for sales management and team oversight, enhancing operational efficiency for IBOs.

- Wellbeing+ App: Supports health and wellness programs, aligning with growing consumer interest in personal well-being.

- Digital Investment: Amway's commitment to digital transformation underscores its belief in technology as a driver for distributor empowerment and market expansion.

- Growth Potential: The continuous evolution of these apps suggests a strong potential for future growth by adapting to new technologies and user needs.

New 'Solutions' & Holistic Wellness Programs

Amway launched new health management programs in 2024, integrating advanced products with lifestyle advice like Morning Nutrition and Gut Health. This strategy taps into a significant consumer demand for holistic wellness, a market segment experiencing rapid expansion.

These 'Solutions' are essentially curated product bundles designed to support specific daily habits, reflecting a strong market response to personalized health. Amway's move capitalizes on its established expertise in nutrition and plant science to address these growing consumer needs.

- Market Growth: The global wellness market was valued at over $5.6 trillion in 2023 and is projected to continue its upward trajectory, with personalized nutrition and gut health being key drivers.

- Product Integration: Amway's approach combines new product innovations with existing high-quality supplements, creating synergistic offerings.

- Consumer Trends: These programs align with the increasing consumer interest in preventative health and proactive lifestyle management.

- Strategic Leverage: By focusing on these trending areas, Amway aims to solidify its position in the health and wellness sector and drive significant new revenue streams.

Stars in Amway's portfolio, like Nutrilite, Artistry Skin Nutrition, and XS Energy, represent high-growth, high-market-share brands. These brands are crucial drivers of Amway's overall success, benefiting from significant consumer demand and strategic company investment. Their continued innovation and market penetration solidify their position as industry leaders.

Nutrilite’s Gut Health Solutions are a prime example, contributing to Amway’s nutrition category which saw 2% growth in 2024, making up 64% of global sales. Artistry Skin Nutrition, with its science-backed skincare and new product launches in 2024, demonstrates strong market leadership. XS Energy and Sports Nutrition is also a top performer, expanding fitness programs globally in 2024, capitalizing on the booming health and wellness sector.

| Brand | Category | 2024 Performance Highlights | Market Position | Growth Potential |

| Nutrilite | Nutrition / Gut Health | 2% growth in nutrition category (64% of global sales); new Gut Health solutions | High Market Share | Strong, driven by wellness trends |

| Artistry Skin Nutrition | Beauty / Skincare | Launched sleeping masks, UV50 sunscreen, advanced serums; science-driven | Top-selling brand | High, aligned with healthy aging trend |

| XS Energy | Sports Nutrition / Beverages | Expanded fitness programs into new markets; high-growth sector | Significant market share | Very High, benefiting from wellness sector expansion |

What is included in the product

Amway's BCG Matrix likely positions its established nutrition and beauty brands as Cash Cows, while newer ventures and emerging markets represent Question Marks needing strategic investment.

Amway's BCG Matrix analysis provides a clear, actionable roadmap, relieving the pain of strategic uncertainty by highlighting growth opportunities and resource allocation needs.

Cash Cows

Nutrilite Core Vitamins and Dietary Supplements stand as Amway's undisputed Cash Cow. As the world's leading vitamin and dietary supplement brand, Nutrilite commands a significant market share. This dominance translated into a substantial contribution, accounting for 64% of Amway's total global sales in 2024, highlighting its consistent and robust cash generation.

Despite the nutrition category experiencing a modest 2% growth in 2024, Nutrilite's core vitamin and supplement lines operate within a mature and stable market. Amway leverages this established leadership position, which requires minimal aggressive investment to maintain its strong performance. These foundational products are crucial for funding Amway's other strategic ventures and initiatives.

The Amway Home L.O.C. Multi-Purpose Cleaner, a long-standing favorite since Amway's inception, exemplifies a classic Cash Cow within the company's product portfolio. Its enduring high market share and consistent demand are testaments to its established position in the mature home care market. This product's biodegradable formula and Safer Choice certification resonate with environmentally conscious consumers, ensuring steady sales with minimal marketing expenditure.

As a core component of Amway's brand equity, alongside products like SA8 detergent, L.O.C. consistently generates reliable cash flow for the corporation. In 2024, Amway reported robust sales in its home care segment, driven by established products like L.O.C. which continue to benefit from brand loyalty and a growing segment of consumers prioritizing sustainable cleaning solutions.

The eSpring Water Purifier continues to be a strong performer for Amway, demonstrating consistent revenue generation. In 2024, its global expansion into new markets, including several in Asia and Europe, underscores its established demand. This product’s advanced filtration technology, which effectively removes over 140 potential contaminants, contributes to its market leadership and high customer retention rates.

Artistry Core Skincare Lines

Artistry Core Skincare Lines represent a significant Cash Cow for Amway Corporation. Amway's beauty segment, which includes Artistry, consistently contributes a substantial portion of the company's overall revenue. For instance, in 2023, Amway reported global sales of $8.4 billion, with beauty and personal care being a cornerstone of this performance.

The Artistry brand, with its long-standing presence and deep customer loyalty, holds a stable and dominant market share in the competitive beauty industry. This stability is fueled by a consistent demand for its established product lines, which are recognized for their quality and efficacy. The brand's commitment to scientific innovation and traceable ingredients further solidifies its position, ensuring repeat purchases from a dedicated consumer base.

These core skincare offerings generate predictable and robust cash flows, characteristic of a mature product in a stable market. While not necessarily in a high-growth category, Artistry's consistent performance allows Amway to reinvest profits into other business areas or distribute them. This reliable income stream is vital for Amway's financial health.

Key characteristics of Artistry as a Cash Cow:

- Dominant Market Share: Artistry maintains a strong position within Amway's beauty portfolio, reflecting significant market penetration.

- Stable Demand: The brand benefits from consistent consumer interest due to its established reputation and product efficacy.

- Reliable Cash Flow Generation: Core skincare lines provide a steady stream of revenue, supporting Amway's overall financial stability.

- Mature Product Lifecycle: Artistry operates in a well-established market segment, offering predictable returns without the high investment needs of emerging products.

Basic Personal Care (e.g., Glister, g&h)

Amway's Basic Personal Care segment, featuring brands like Glister for oral hygiene and g&h for body and baby care, represents a solid Cash Cow within its BCG Matrix.

These are established product lines in mature, stable markets, benefiting from Amway's extensive distribution network and strong customer loyalty. The everyday necessity of these items ensures consistent demand and reliable cash generation, requiring limited reinvestment for growth or marketing.

- Brand Strength: Glister and g&h are foundational brands with decades of market presence.

- Market Position: They operate in mature, stable personal care segments with high Amway market penetration.

- Cash Flow Generation: Consistent sales of essential items provide a steady and predictable revenue stream.

- Investment Needs: Minimal new investment is required due to established market share and brand recognition.

Amway's Nutrilite brand, a leader in vitamins and dietary supplements, is a prime example of a Cash Cow. Its significant global market share, contributing 64% to Amway's total sales in 2024, underscores its consistent revenue generation. Operating in a mature market with modest growth, Nutrilite requires minimal aggressive investment, allowing it to reliably fund other company ventures.

The Amway Home L.O.C. Multi-Purpose Cleaner, a long-standing product, also functions as a Cash Cow. Its established position in the mature home care market ensures consistent demand and sales, supported by brand loyalty and growing consumer preference for sustainable cleaning solutions. This product generates reliable cash flow with limited marketing expenditure.

The eSpring Water Purifier continues to be a strong performer, demonstrating consistent revenue generation. Its expansion into new markets in 2024 and advanced filtration technology contribute to market leadership and high customer retention, solidifying its role as a dependable cash generator.

Artistry Core Skincare Lines are a significant Cash Cow within Amway's beauty segment, which was a cornerstone of its $8.4 billion global sales in 2023. The brand's deep customer loyalty and dominant market share in the stable beauty industry ensure predictable cash flows with minimal reinvestment needs.

Amway's Basic Personal Care segment, including Glister and g&h, also acts as a Cash Cow. These established brands in mature, stable markets benefit from Amway's extensive distribution and customer loyalty, providing steady revenue streams with low investment requirements.

| Product Category | Key Brands | Market Position | 2024 Sales Contribution (Est.) | Investment Need |

| Vitamins & Dietary Supplements | Nutrilite | Market Leader | 64% of Total Sales | Low |

| Home Care | Amway Home L.O.C. | Established, High Loyalty | Significant | Low |

| Health & Wellness (Water) | eSpring | Market Leader | Strong | Low |

| Beauty | Artistry | Dominant Share | Cornerstone of Beauty Segment | Low |

| Personal Care | Glister, g&h | Established Brands | Consistent | Low |

Delivered as Shown

Amway Corporation BCG Matrix

The preview you see of the Amway Corporation BCG Matrix is the complete, unwatermarked document you will receive immediately after purchase. This meticulously crafted report, designed for strategic clarity, offers a professional analysis of Amway's product portfolio, ready for immediate integration into your business planning. You'll gain access to the fully formatted, analysis-ready file, enabling you to make informed decisions without any further revisions or delays.

Dogs

Amway's durable goods, such as water and air purifiers, might include older models or those with less advanced technology. These could be struggling against specialized competitors who are quicker to innovate.

These less popular durable goods likely reside in a low-growth market segment for Amway. If they haven't seen recent upgrades or significant unique features, their market share may be declining, especially when compared to newer, more advanced alternatives.

Without substantial investment in research and development or marketing to boost their appeal, these products might only generate enough revenue to cover their costs or even become a drain on resources. For instance, if a particular air purifier model hasn't been updated in five years, its sales could be stagnant while newer, more energy-efficient, or smart-enabled models capture consumer interest.

Amway's extensive global reach means some products cater to very specific tastes or local demands, potentially limiting their broad appeal. These niche items, often found in smaller, less dynamic markets, would likely exhibit low market share and very little growth potential. For instance, a particular regional food supplement or a specialized personal care item might only sell in one or two countries, facing limited expansion opportunities.

Such products, while serving a dedicated customer segment, may struggle to generate substantial profits or contribute meaningfully to Amway's overall strategic growth objectives. Their revenue might barely cover operational expenses, positioning them as potential candidates for divestment or discontinuation if they don't align with future market trends or company priorities. In 2024, Amway continued to refine its portfolio, with a focus on high-growth categories, suggesting that underperforming niche products would be scrutinized.

Products in highly saturated markets, like certain personal care items or basic nutritional supplements, can find themselves facing stiff competition. For Amway, this means rivals from both direct selling channels and mainstream retail outlets are vying for consumer attention. In 2024, the global beauty and personal care market alone was valued at over $500 billion, highlighting the sheer scale of this competition.

When these Amway products also lack distinctive features or unique benefits, they can easily get lost in the noise. This low differentiation means they struggle to stand out, potentially leading to a low market share in a slow-growth environment. Such products might become cash traps, consuming resources without generating significant returns, a common challenge in mature consumer goods sectors.

Ineffective or Underutilized Digital Marketing Tools (Older Versions)

While Amway is actively adopting new digital marketing technologies, some of its older or less intuitive platforms may not be fully leveraged by its Independent Business Owners (IBOs). These legacy digital assets, if not modernized or retired, could be a drag on growth, failing to attract new customers or generate leads effectively. Their continued maintenance diverts resources without contributing significantly to market share expansion.

These underutilized digital tools represent a potential ‘Dog’ in Amway’s BCG Matrix. For instance, if a CRM system introduced in 2018, which required extensive training and had a clunky interface, saw only a 15% adoption rate among IBOs by early 2024, it would fit this category. Such tools often have high maintenance costs relative to their low contribution to new customer acquisition or sales growth.

- Low Adoption Rate: Older digital platforms might exhibit low IBO engagement, potentially below 20% of the active IBO base by mid-2024.

- Limited Lead Generation: These tools may contribute minimally to new customer acquisition, perhaps generating less than 5% of new leads compared to newer digital initiatives.

- High Maintenance Costs: Annual upkeep for these legacy systems could exceed their revenue-generating capacity or lead generation impact.

- Stagnant Market Share Contribution: Their contribution to overall market share growth is negligible, likely remaining flat or declining.

Certain Home Fragrances or Niche Cookware

Within Amway's diverse portfolio, certain home fragrances and niche cookware items might find themselves categorized as 'dogs' in the BCG Matrix. These sectors often face intense competition and can be susceptible to shifting consumer trends, potentially leading to low market growth and a limited market share for specific Amway products.

If these product lines do not demonstrate substantial sales volume or establish strong brand loyalty, they risk being classified as dogs. This designation implies that they operate in markets with minimal growth potential and hold a small share of that market, making significant investment for a turnaround less advisable.

For instance, the global home fragrance market, while substantial, is highly fragmented. In 2024, while specific Amway sales figures for this segment aren't publicly detailed, the broader market growth is projected to be moderate. Similarly, niche cookware can be a challenging segment where differentiation is key; without it, products can struggle to gain traction against established brands.

- Market Saturation: The home fragrance and niche cookware markets are often crowded, requiring significant marketing spend to stand out.

- Low Growth Potential: Unless Amway introduces highly innovative or unique products in these categories, they may operate in slow-growing market segments.

- Limited Market Share: Without strong brand recognition or a compelling value proposition, Amway's offerings in these areas might hold a small percentage of the overall market.

- Investment Risk: Products classified as dogs typically yield low returns, making further investment a questionable strategy for Amway.

Dogs within Amway's portfolio represent products or services operating in low-growth markets with a small market share. These offerings often struggle to gain traction against competitors and may consume resources without generating significant returns. For example, older models of electronics or niche personal care items could fall into this category.

These products typically require minimal investment and may even be candidates for divestment if they do not show signs of improvement. In 2024, Amway's strategic focus on high-growth areas suggests a continued evaluation of its product lines to identify and address underperforming 'dogs'.

The challenge with dogs is their inability to contribute meaningfully to overall growth or profitability. Their low market share in stagnant markets means that even a slight increase in sales would not significantly impact Amway's financial performance.

Identifying and managing these products is crucial for optimizing Amway's resource allocation and portfolio strategy. By understanding which products are dogs, Amway can make informed decisions about whether to revitalize them, divest them, or simply minimize ongoing investment.

Question Marks

Amway's venture into personalized nutrition and microbiome testing, through a deepened partnership with a Korean microbiome firm, positions them in a high-growth sector. This move aims to develop novel probiotic products and expand microbiome testing into new territories.

While the personalized health and wellness market is booming, Amway's current market share in these specialized services is likely nascent, reflecting the newness of these initiatives. The global personalized nutrition market was valued at approximately $11.8 billion in 2023 and is projected to reach $27.1 billion by 2028, growing at a CAGR of 18.0% during the forecast period.

Significant capital investment is necessary to scale these offerings and capture a meaningful market share. This strategic focus on microbiome testing and personalized probiotics could evolve Amway's product portfolio, potentially transforming these new ventures into future Stars within their business portfolio, provided they can effectively navigate the competitive landscape and capitalize on market trends.

Amway's foray into advanced tech-driven beauty devices, such as at-home skincare tools for next-level results and healthy aging, positions them in a rapidly expanding sector. This segment is characterized by high innovation and consumer interest, driven by the desire for professional-grade treatments at home.

As a newer entrant, Amway's current market share in this specialized area is likely modest when measured against established competitors who have a longer track record and deeper penetration. The initial investment in brand building and consumer education for these sophisticated devices is significant, reflecting their potential to become future market leaders.

These devices represent a high-potential growth opportunity, but their success hinges on effective marketing and robust consumer education to drive adoption and build brand loyalty. Amway's strategy here aims to cultivate these offerings into Stars within their product portfolio.

Amway's Brazil farm achieved Regenerative Organic Certified Silver Level Certification in June 2024. This certification highlights a dedication to sustainable and regenerative agricultural methods, aligning with increasing consumer interest in eco-friendly and traceable goods.

New product lines featuring this certification could capitalize on the expanding market for environmentally responsible products. However, as this niche is still developing, Amway's current market share in truly regenerative products may be limited, requiring significant investment to grow these offerings.

Specific Targeted Wellness Solutions (e.g., Menopause Support)

In 2024, Amway strategically expanded its Nutrilite line with targeted wellness solutions like Complete Menopause Support, recognizing the significant demand in specific demographic health segments. This move positions these products within the question mark category of the BCG matrix, as they target growing markets with high potential but may currently hold a smaller market share. Amway's investment in these niche areas reflects a proactive approach to capturing emerging consumer needs.

- Targeted Market: Nutrilite Complete Menopause Support addresses a growing, often underserved, segment of the population seeking tailored health solutions.

- Market Growth Potential: Increased consumer awareness and demand for personalized wellness products indicate substantial growth opportunities in these specific niches.

- Market Share Challenge: While the market is expanding, Amway's initial market share in these precise wellness categories might be relatively low, necessitating dedicated marketing efforts for wider acceptance.

- Strategic Investment: The introduction of such specialized products signifies Amway's commitment to innovation and capturing value in evolving health and wellness markets.

AI and Data Analytics for Tailored Recommendations

Amway is strategically investing in AI and data analytics to personalize recommendations and enhance the direct selling experience for its Independent Business Owners (IBOs) and customers. This focus on advanced digital capabilities is crucial for optimizing marketing efforts and streamlining its supply chain.

The company's commitment to these technologies positions it in a high-growth segment of the direct selling industry. For example, in 2024, Amway continued to emphasize digital transformation, with a significant portion of its operational budget allocated to technology upgrades aimed at improving customer engagement and data-driven decision-making.

- AI-driven personalization: Amway aims to leverage AI to offer highly tailored product suggestions and business-building advice to IBOs and customers.

- Targeted marketing: Data analytics will enable more precise segmentation and outreach, increasing the effectiveness of marketing campaigns.

- Supply chain efficiency: AI and analytics are being implemented to optimize inventory management and logistics, ensuring timely product delivery.

- Developing potential: While these digital capabilities are vital for future growth, their full impact on market share is still unfolding, requiring substantial investment to mature into a strong market position.

Amway's Nutrilite line, with targeted wellness solutions like Complete Menopause Support, exemplifies products in the question mark category. These ventures target growing, specific health demographics, indicating high potential but potentially low initial market share. Amway's investment in these niche areas reflects a proactive strategy to capture emerging consumer needs and develop future market leaders.

The success of these targeted products hinges on effective marketing and consumer education to build acceptance and market share. Amway's strategic allocation of resources to these specialized wellness categories signals a commitment to innovation and capturing value in evolving health markets.

These question marks require significant investment to shift into the star category. For instance, the global menopause market was valued at approximately $15.4 billion in 2023 and is projected to grow significantly, presenting a clear opportunity for Amway's specialized offerings.

Amway's strategic focus on AI and data analytics for personalized recommendations and improved IBO/customer experiences places it in a high-growth segment. While these digital capabilities are crucial for future growth, their impact on market share is still developing, necessitating substantial investment.

BCG Matrix Data Sources

Our BCG Matrix leverages Amway's financial disclosures, market research reports, and product sales data to accurately assess market share and growth potential.