AMN Healthcare Services SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMN Healthcare Services Bundle

AMN Healthcare Services is a leader in healthcare staffing, boasting strong brand recognition and a vast network of healthcare professionals. However, they face intense competition and potential regulatory changes that could impact their operations. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want the full story behind AMN Healthcare's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AMN Healthcare boasts a comprehensive service portfolio encompassing travel nurse staffing, locum tenens, allied health, permanent placement, and advanced workforce management technology. This broad spectrum of offerings creates a resilient business model, capable of addressing diverse client requirements.

This strategic diversification significantly reduces dependence on any single service line, thereby mitigating market-specific risks. For instance, in the first quarter of 2024, AMN reported total revenue of $973 million, with its staffing services forming the largest segment, demonstrating the strength of its diversified approach.

AMN Healthcare Services boasts a leading market position and significant scale within the healthcare staffing and total talent solutions sector. This strong standing is underpinned by its extensive network and substantial market share across the United States.

The company's reach is particularly notable, as it partners with a vast number of healthcare systems, including a high proportion of the nation's top-tier facilities. This broad client base reinforces its competitive advantage and operational footprint in the industry.

AMN Healthcare's advanced technology, including its WorkWise platform and AMN Passport app, significantly boosts operational efficiency in recruitment and workforce management. These digital tools are designed to streamline processes, offering a competitive advantage in the fast-paced healthcare staffing market.

The company's investment in technology enhances the experience for both healthcare professionals and client facilities by providing data-driven insights and simplifying interactions. This focus on digital innovation is crucial for maintaining a strong market position and driving growth in the evolving healthcare landscape.

Strong Cash Flow and Financial Discipline

AMN Healthcare Services has shown remarkable financial discipline, evidenced by its strong cash flow from operations. This has allowed the company to make significant strides in debt reduction, a key indicator of financial health. For instance, as of the first quarter of 2024, AMN reported a substantial decrease in its long-term debt, bolstering its balance sheet.

This consistent cash generation provides a stable foundation, enabling AMN to continue investing in its business and pursue strategic opportunities. The company's commitment to managing its finances prudently ensures it can navigate market fluctuations effectively. This financial strength is a critical asset in the competitive healthcare staffing landscape.

- Robust operating cash flow generation.

- Significant debt reduction achieved.

- Financial stability supporting strategic investments.

- Prudent financial management in a dynamic market.

Addressing Critical Healthcare Staffing Shortages

AMN Healthcare's core strength lies in its direct response to the critical and escalating shortage of healthcare professionals. This persistent demand across numerous specializations, from nursing to allied health, positions the company as a crucial facilitator for healthcare providers. In 2024, the U.S. Bureau of Labor Statistics projected a significant need for registered nurses, with employment expected to grow 6% from 2022 to 2032, adding over 193,000 new jobs.

By bridging the gap between qualified healthcare talent and organizations facing staffing crises, AMN Healthcare ensures the uninterrupted delivery of patient care. This essential function makes them an indispensable partner within the broader healthcare system, vital for maintaining operational stability and quality of service.

- Addresses Persistent Healthcare Staffing Shortages: Directly tackles the ongoing and worsening deficit of healthcare professionals.

- Facilitates Continuity of Patient Care: Connects healthcare facilities with necessary talent to maintain essential services.

- Vital Role in Healthcare Ecosystem: Positions AMN Healthcare as an indispensable partner for providers.

- Growing Demand for Nurses: The projected 6% growth in registered nursing roles by 2032 underscores the market's need for AMN's services.

AMN Healthcare's diversified service model, encompassing travel nursing, locum tenens, and allied health staffing, provides significant resilience. This breadth reduces reliance on any single segment, as demonstrated by its Q1 2024 revenue of $973 million, where staffing services remained the largest contributor, showcasing the strength of its varied offerings.

The company holds a dominant market position, amplified by its extensive network and substantial U.S. market share. AMN's partnerships with a vast majority of top healthcare systems solidify its competitive edge and broad operational reach within the industry.

Advanced technology, including the WorkWise platform and AMN Passport app, enhances operational efficiency in recruitment and workforce management. These digital tools streamline processes, offering a distinct advantage in the dynamic healthcare staffing sector.

AMN Healthcare exhibits strong financial discipline, marked by robust operating cash flow and a significant reduction in long-term debt as of Q1 2024. This financial stability supports ongoing business investments and strategic growth initiatives.

| Strength | Description | Supporting Data |

|---|---|---|

| Diversified Service Portfolio | Broad range of staffing and workforce solutions. | Q1 2024 Revenue: $973 million; Staffing services remain largest segment. |

| Market Leadership & Scale | Extensive network and significant market share. | Partnerships with a high proportion of top U.S. healthcare systems. |

| Technological Innovation | Streamlined operations via WorkWise and AMN Passport. | Enhances efficiency in recruitment and workforce management. |

| Financial Strength | Strong cash flow and reduced debt. | Substantial decrease in long-term debt reported in Q1 2024. |

What is included in the product

Delivers a strategic overview of AMN Healthcare Services’s internal and external business factors, highlighting its market strengths, operational gaps, and risks.

Offers a clear view of AMN Healthcare's strategic landscape, helping to pinpoint areas for improvement and leverage competitive advantages.

Weaknesses

AMN Healthcare Services has experienced notable revenue declines. For instance, in the first quarter of 2024, the company reported a 23% decrease in revenue compared to the same period in 2023, falling to $771 million. This downturn was observed across its primary segments, with Nurse and Allied Solutions revenue dropping 27% and Technology and Workforce Solutions seeing a 19% decrease.

These revenue contractions have directly impacted profitability. Gross profit for Q1 2024 was $163 million, a significant decrease from $242 million in Q1 2023. Similarly, adjusted EBITDA declined substantially to $34 million, down from $99 million year-over-year, highlighting the pressure on the company's operational efficiency and earnings capacity in the current market.

AMN Healthcare Services faces significant headwinds from fluctuating healthcare policies and broader economic instability. For instance, the ongoing debates around healthcare reform and reimbursement rates can create uncertainty for hospitals, leading to a slowdown in their decision-making processes. This directly impacts the demand for staffing solutions, as clients become more cautious with their expenditures.

Market uncertainties, particularly in the broader economy, have historically caused clients to delay or reduce their hiring of temporary and permanent healthcare professionals. In 2023, for example, many healthcare systems reported budget constraints and a more cautious approach to capital expenditures, which trickled down to staffing needs. This cautiousness directly affects AMN's revenue streams and can dampen its financial performance.

AMN Healthcare's reliance on contingent staffing means its revenue can fluctuate significantly with client demand, especially in travel nursing. When healthcare facilities reduce their use of temporary staff or when bill rates fall, AMN's top line takes a hit. This sensitivity is amplified by the broader healthcare staffing market's projected contraction, creating headwinds for growth.

Impact of Goodwill and Intangible Asset Impairment Charges

AMN Healthcare has faced significant headwinds from non-cash goodwill and intangible asset impairment charges. These charges, particularly notable in recent quarters, have directly contributed to substantial GAAP net losses. For instance, the company reported a significant goodwill impairment charge in the fourth quarter of 2023, impacting its reported profitability.

While these are non-cash expenses, they signal a reassessment of the value of acquired assets. This revaluation can negatively affect key financial metrics and influence how investors perceive the company's underlying performance and the success of past acquisitions. The impact on reported earnings per share can be quite pronounced, even if it doesn't affect cash flow directly.

- Significant GAAP Net Losses: Impairment charges have directly led to reported net losses, masking operational cash flow generation.

- Investor Perception: Large impairment charges can raise concerns about management's past acquisition decisions and future growth prospects.

- Impact on Financial Ratios: These charges distort key profitability ratios, making year-over-year comparisons more complex.

Intense Competitive Landscape and Pricing Pressure

AMN Healthcare operates in a crowded marketplace with many companies competing for the same talent and clients. This intense competition, especially evident in areas like language services, can force AMN to lower its prices to stay competitive. For instance, in the first quarter of 2024, the healthcare staffing market saw continued pricing adjustments across various specialties as providers sought cost efficiencies.

The pressure to offer competitive rates can directly impact AMN's profit margins. When pricing power is limited, the company may find it harder to maintain or grow its profitability, even with strong demand for its services. This dynamic is a persistent challenge, requiring constant operational efficiency improvements to offset margin compression.

- High Competition: Numerous staffing firms, both large and small, vie for contracts.

- Pricing Pressure: Intense rivalry often leads to reduced pricing power, particularly in commoditized service lines.

- Margin Compression: The need to offer competitive rates can squeeze profit margins, impacting overall profitability.

- Service Line Vulnerability: Certain services, like language solutions, are more susceptible to aggressive pricing from competitors.

AMN Healthcare's financial performance has been impacted by significant revenue declines, with Q1 2024 revenue falling 23% year-over-year to $771 million. This downturn affected key segments, including Nurse and Allied Solutions, which saw a 27% decrease. Profitability also suffered, with gross profit dropping to $163 million in Q1 2024 from $242 million in Q1 2023, and adjusted EBITDA declining to $34 million from $99 million.

The company faces challenges from fluctuating healthcare policies and economic instability, leading to client caution and reduced demand for staffing solutions. Market uncertainties in 2023 saw healthcare systems implement budget constraints, impacting AMN's revenue streams. Furthermore, reliance on contingent staffing makes AMN vulnerable to shifts in client demand and falling bill rates, particularly in the travel nursing sector.

AMN has also experienced significant non-cash goodwill and intangible asset impairment charges, contributing to substantial GAAP net losses. These charges, such as the one in Q4 2023, can negatively affect key financial metrics and investor perception of past acquisitions. Intense market competition, especially in areas like language services, also exerts pricing pressure, potentially squeezing profit margins.

Preview Before You Purchase

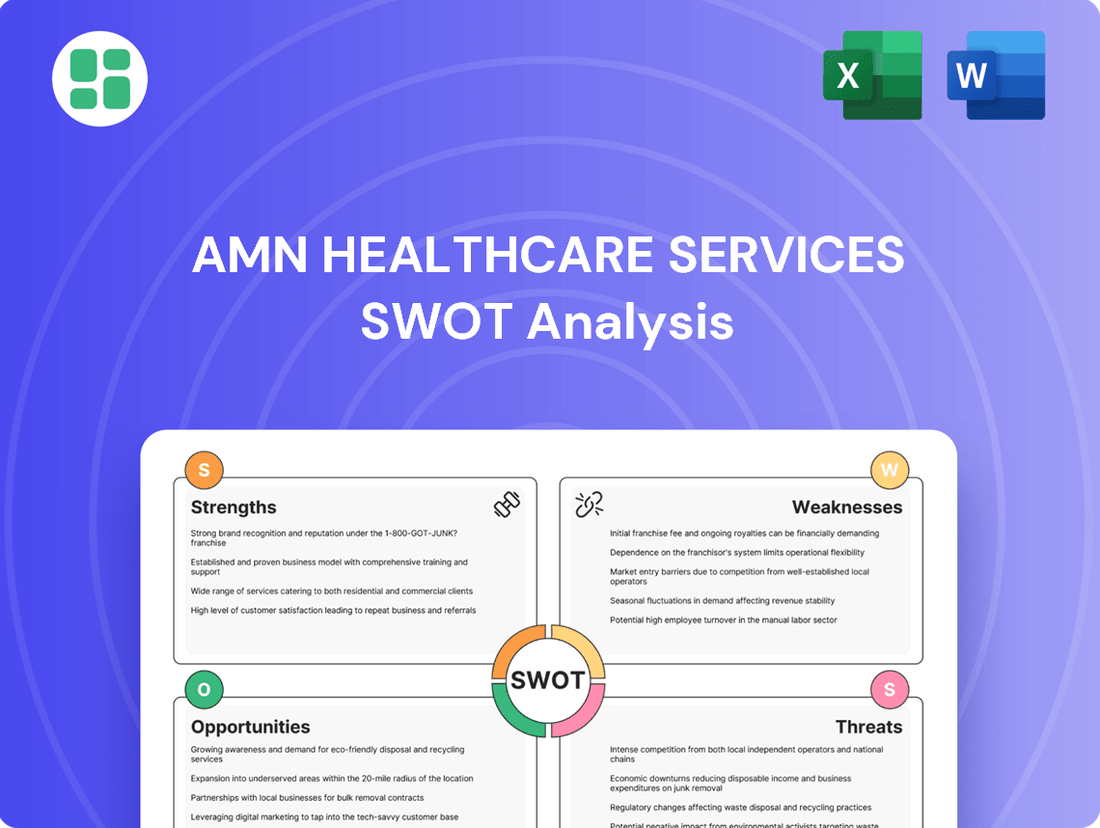

AMN Healthcare Services SWOT Analysis

You're viewing a live preview of the actual SWOT analysis file for AMN Healthcare Services. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after checkout. This ensures you receive the full, detailed report you expect.

Opportunities

The persistent shortage of healthcare workers, particularly nurses and physicians, presents a significant opportunity for AMN Healthcare. Projections indicate this demand will continue for years due to an aging population and increased healthcare utilization.

In 2023, the U.S. faced a critical deficit, with estimates suggesting a need for hundreds of thousands of additional nurses by 2030. This ongoing imbalance directly translates to a sustained need for the staffing solutions AMN Healthcare provides, creating a robust market for their services.

While certain staffing sectors might experience challenges, others are poised for significant expansion. For instance, the locum tenens market is anticipated to grow robustly, and per diem roles are expected to see moderate increases as more healthcare professionals seek flexible work arrangements. This trend highlights a key opportunity for AMN Healthcare to leverage these growing segments.

AMN Healthcare can strategically focus on these high-demand areas, such as locum tenens staffing, which is projected to see continued strong demand throughout 2024 and into 2025, driven by ongoing physician shortages. By capitalizing on these specific growth opportunities, the company can effectively counterbalance any slowdowns in other, less dynamic segments of the healthcare staffing market and solidify its market leadership.

AMN Healthcare can capitalize on the growing integration of AI and advanced data analytics within the healthcare staffing sector. This presents a prime opportunity to refine recruitment processes, optimize workforce planning, and deliver more intelligent, data-backed solutions to clients.

By embracing these technological advancements, AMN Healthcare can boost operational efficiency and sharpen its talent acquisition strategies. For instance, AI-powered tools can analyze vast datasets to identify ideal candidates more quickly and predict staffing needs with greater accuracy, potentially reducing time-to-fill metrics and improving client satisfaction.

Expansion of Value-Based Care and Remote Care Models

The healthcare industry's significant pivot towards value-based care, prioritizing patient outcomes over service volume, directly fuels demand for skilled professionals capable of managing complex care pathways. Concurrently, the rapid expansion of remote and telehealth services, accelerated by technological advancements and patient preference, necessitates adaptable staffing solutions that can support virtual patient engagement and monitoring.

AMN Healthcare is strategically positioned to capitalize on these trends. Its established network and expertise in healthcare staffing allow for the recruitment and deployment of clinicians experienced in chronic disease management, care coordination, and telehealth platforms. This allows the company to offer flexible staffing models that align with the operational needs of providers implementing these new care paradigms.

The market for telehealth services, a key component of remote care, is projected for substantial growth. For instance, the global telehealth market was valued at approximately $90.7 billion in 2021 and is anticipated to reach $516.9 billion by 2030, growing at a CAGR of 20.7% from 2022 to 2030. This expansion presents a significant opportunity for AMN Healthcare to provide specialized staffing for virtual care teams, including remote nurses, telehealth coordinators, and virtual patient support staff.

- Increased Demand for Specialized Clinical Skills: Value-based care models require clinicians with expertise in areas like population health management and patient education, creating opportunities for AMN to supply these niche skill sets.

- Growth in Telehealth Staffing: The burgeoning telehealth sector offers a direct avenue for AMN to provide remote clinical staff, expanding its service offerings beyond traditional in-person placements.

- Adaptability to Evolving Care Delivery: AMN's ability to source and deploy flexible staffing solutions supports healthcare systems as they transition to more integrated and patient-centric care models.

- Market Expansion through New Service Segments: By aligning its staffing solutions with value-based and remote care, AMN can tap into new market segments and capture a larger share of the evolving healthcare workforce needs.

Strategic Partnerships and Acquisitions

AMN Healthcare can strategically pursue partnerships and acquisitions to broaden its service offerings, upgrade its technological capabilities, and penetrate new geographical markets. The company's recent divestiture of Smart Square, coupled with a new commercial partnership, highlights a commitment to collaborative approaches for delivering integrated solutions. This strategy is crucial in a dynamic healthcare landscape where comprehensive service delivery is increasingly valued.

These strategic moves can bolster AMN's competitive edge by allowing it to integrate complementary services or technologies, thereby offering more robust solutions to healthcare providers. For instance, acquiring a specialized healthcare staffing firm or a technology provider focused on patient flow management could significantly enhance AMN's value proposition. The company's financial flexibility, evidenced by its strong cash flow generation, positions it well for such strategic investments in 2024 and 2025.

- Expansion of Service Lines: Acquiring niche staffing or healthcare technology firms can quickly add new service capabilities.

- Technology Enhancement: Partnerships or acquisitions can accelerate the integration of advanced technologies, such as AI-driven scheduling or telehealth platforms.

- Geographic Market Entry: Targeted acquisitions can provide immediate access to new regions or expand existing market share.

- Smart Square Divestiture: The sale of Smart Square in late 2023 for $10 million, alongside a commercial partnership, generated capital and fostered a collaborative ecosystem, demonstrating a clear strategic direction.

The ongoing, significant shortage of healthcare professionals, especially nurses and physicians, is a major opportunity for AMN Healthcare. This demand is projected to persist for years, driven by an aging population and increased healthcare utilization.

The U.S. faced a substantial deficit in healthcare workers in 2023, with estimates suggesting a need for hundreds of thousands more nurses by 2030. This persistent imbalance directly fuels the demand for AMN Healthcare's staffing solutions, creating a strong market for their services.

AMN Healthcare is well-positioned to benefit from the growing telehealth sector, a key component of remote care. The global telehealth market, valued at approximately $90.7 billion in 2021, is projected to reach $516.9 billion by 2030, growing at a compound annual growth rate of 20.7% from 2022 to 2030. This expansion offers a clear opportunity for AMN to supply specialized staffing for virtual care teams.

| Opportunity Area | Key Driver | Projected Impact for AMN |

|---|---|---|

| Healthcare Worker Shortage | Aging population, increased utilization | Sustained demand for staffing services |

| Telehealth Growth | Technological advancements, patient preference | Demand for remote clinical staff |

| Value-Based Care Transition | Focus on patient outcomes | Need for specialized clinical skills |

Threats

A significant economic downturn or persistent inflation poses a substantial threat to AMN Healthcare Services. Reduced healthcare spending by facilities, a likely consequence of these economic pressures, could lead them to cut costs by decreasing their reliance on temporary staffing. This directly impacts AMN's revenue streams.

For instance, if healthcare systems face tighter budgets, they might opt for more permanent hires or reduce their overall staffing needs, thereby diminishing the demand for AMN's core services. This could put pressure on AMN's market share and profitability in the coming years, especially if economic headwinds persist through 2025.

The healthcare sector continues to grapple with persistent wage inflation and elevated pay rates for contingent workers. While some stabilization has occurred, these costs remain notably higher than pre-pandemic benchmarks, impacting the profitability of staffing firms like AMN Healthcare.

The healthcare staffing sector is a crowded space, featuring many national and local companies vying for business. This intense rivalry often forces companies like AMN Healthcare to engage in price wars, which can erode profit margins and make it difficult to expand market presence.

In 2023, the U.S. healthcare staffing market was valued at approximately $40 billion, with AMN Healthcare holding a significant, though not dominant, share. The sheer number of smaller, specialized agencies entering the market, particularly in niche areas like travel nursing and allied health, further fragments the landscape, intensifying competitive pressures.

Healthcare Professional Burnout and Retention Challenges

Widespread burnout and stress among healthcare workers present a significant threat. Reports from the U.S. Bureau of Labor Statistics in late 2024 indicated persistent high turnover rates across nursing and allied health professions, exceeding 20% annually in some specialties. This ongoing exodus from patient care roles directly impacts the available talent pool, making it harder for AMN Healthcare to meet the staffing needs of its clients.

The persistent challenge of retaining healthcare professionals could lead to a chronic shortage of qualified staff. This scarcity directly affects AMN Healthcare's capacity to fulfill contract demands, potentially limiting revenue growth and client satisfaction. For instance, a 2025 survey by the American Medical Association found that over 60% of physicians reported experiencing burnout, a sentiment echoed by a significant portion of nurses.

- High Burnout Rates: Continued high levels of burnout and job dissatisfaction among healthcare professionals, leading to increased attrition.

- Talent Shortage: A persistent exodus from direct patient care roles exacerbates the existing shortage of qualified healthcare workers.

- Impact on Staffing: This talent scarcity directly hinders AMN Healthcare's ability to fill client staffing demands efficiently and effectively.

Adverse Regulatory Changes and Policy Shifts

AMN Healthcare Services operates within a heavily regulated industry, making adverse regulatory changes a significant threat. For instance, potential shifts in healthcare staffing mandates, such as nurse-to-patient ratios or specific licensing requirements, could directly impact the demand for their travel nurse and allied health professional services. The Centers for Medicare & Medicaid Services (CMS) reimbursement policies, which are subject to annual adjustments, also pose a risk if they become less favorable to contract labor or temporary staffing solutions. In 2024, continued scrutiny on healthcare labor costs by policymakers could lead to new compliance burdens or limitations on the utilization of temporary staff by healthcare facilities.

Policy shifts could also affect the overall attractiveness of temporary staffing. For example, changes in tax laws or worker classification rules could increase the cost or complexity of engaging contract workers, potentially reducing the appeal of AMN's core offerings to hospitals and health systems. Such changes could also influence the willingness of healthcare professionals to work as independent contractors or temporary employees.

- Potential for stricter nurse-to-patient ratio laws impacting demand for travel nurses.

- Changes in Medicare/Medicaid reimbursement models affecting the profitability of staffing services.

- Increased compliance costs due to new licensing or credentialing regulations.

- Policy shifts that disincentivize the use of temporary healthcare staffing.

The healthcare industry's ongoing reliance on temporary staffing, while a strength for AMN, also exposes it to the threat of evolving labor models. If healthcare systems increasingly shift towards permanent hires to control costs or ensure continuity, demand for AMN's contingent workforce could decrease. This trend, potentially accelerated by economic pressures in 2024-2025, could impact AMN's market share and revenue growth.

The competitive landscape remains a significant threat, with numerous national and local staffing agencies vying for market share. This intense rivalry, particularly in high-demand areas like travel nursing, can lead to price competition, squeezing profit margins for companies like AMN Healthcare. The U.S. healthcare staffing market, valued at around $40 billion in 2023, is fragmented, with smaller, specialized firms often competing aggressively on price.

Persistent burnout among healthcare professionals is a critical threat, directly impacting the supply of qualified staff. High turnover rates, exceeding 20% annually in some nursing specialties as reported by the U.S. Bureau of Labor Statistics in late 2024, limit AMN's ability to meet client demand. This talent scarcity, exacerbated by over 60% of physicians reporting burnout in a 2025 AMA survey, can hinder revenue growth and client satisfaction.

Adverse regulatory changes pose a substantial risk. Potential shifts in staffing mandates, such as stricter nurse-to-patient ratios or changes in CMS reimbursement policies, could directly affect demand for AMN's services. Furthermore, policy changes impacting worker classification or tax laws could increase the cost or complexity of utilizing temporary staff, potentially reducing the attractiveness of AMN's core offerings.

| Threat Category | Specific Risk | Potential Impact | Data Point/Context |

|---|---|---|---|

| Economic Downturn/Inflation | Reduced healthcare spending leading to decreased reliance on temporary staff. | Lower revenue, pressure on market share. | U.S. healthcare staffing market valued at ~$40 billion in 2023. |

| Intense Competition | Price wars among numerous national and local staffing agencies. | Eroded profit margins, difficulty expanding market presence. | Fragmented market with many smaller, specialized agencies. |

| Healthcare Worker Burnout | High attrition rates and talent shortages in nursing and allied health. | Inability to meet client staffing demands, limited revenue growth. | Turnover rates exceeding 20% annually in some nursing specialties (late 2024 BLS data). |

| Regulatory Changes | New staffing mandates, altered reimbursement policies, or worker classification rules. | Increased compliance costs, reduced demand for contingent labor, decreased profitability. | Continued policy scrutiny on healthcare labor costs in 2024. |

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of robust data, including AMN Healthcare's official financial filings, comprehensive industry market research, and expert commentary from leading healthcare analysts.