AMN Healthcare Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMN Healthcare Services Bundle

Navigate the complex external environment impacting AMN Healthcare Services with our comprehensive PESTLE analysis. Understand the political shifts, economic fluctuations, and technological advancements that are reshaping the healthcare staffing industry. Gain a strategic advantage by uncovering social trends and regulatory changes. Download the full PESTLE analysis now for actionable intelligence to inform your decisions.

Political factors

Changes in federal and state healthcare policies, including funding for programs like Medicare and Medicaid, directly influence the demand for healthcare staffing. For example, a proposed 2% cut to Medicare physician payment rates in 2024, though subject to legislative changes, could impact hospital budgets and their reliance on temporary staffing solutions offered by companies like AMN Healthcare.

Shifts in reimbursement models, such as the move towards value-based care, also affect how healthcare providers operate and the types of staff they need. If reimbursement is tied more closely to patient outcomes, providers might increase demand for specialized nursing or allied health professionals to manage complex cases, a trend AMN Healthcare is positioned to address.

Furthermore, government initiatives to expand healthcare access, like potential expansions to Medicaid eligibility or funding for public health programs, can create new staffing needs. For instance, increased federal funding for community health centers, as seen in some proposed budgets, could translate into greater demand for primary care physicians and nurses, benefiting staffing agencies.

Ongoing healthcare reform and evolving regulations directly impact staffing demands for companies like AMN Healthcare. For instance, shifts in patient-to-provider ratios or licensing requirements can significantly alter the need for skilled healthcare professionals. Stricter nurse-patient ratios, a trend seen in various states, would likely boost demand for AMN's staffing solutions by requiring more nurses per patient.

Conversely, any regulatory easing of staffing mandates could potentially dampen demand. As of early 2024, discussions around workforce shortages and potential regulatory adjustments remain a key focus for policymakers. For example, California's proposed legislation on nurse-to-patient ratios has been a significant point of discussion, highlighting the direct link between policy and staffing needs.

Immigration policies significantly influence the availability of foreign-trained healthcare professionals, a critical talent pool for AMN Healthcare, particularly in regions facing staffing deficits. For instance, in 2024, the U.S. continued to grapple with healthcare worker shortages, with projections indicating a deficit of up to 124,000 physicians by 2034, making foreign talent essential.

Stricter immigration regulations could curtail the influx of these vital workers, intensifying existing shortages and potentially boosting demand for AMN's domestic temporary staffing solutions. Conversely, more accommodating policies would ease supply constraints, benefiting the company's ability to source talent.

Political Stability and Healthcare Spending

Political stability is a cornerstone for consistent government healthcare spending. In the US, for instance, the 2024 election cycle could introduce shifts in healthcare policy and funding priorities, potentially impacting demand for staffing services. A stable political climate, conversely, fosters predictable investment in public health initiatives.

Economic downturns or significant political realignments can lead to austerity measures, including reduced budgets for healthcare programs. This directly affects the demand for healthcare services and, by extension, the need for outsourced staffing solutions like those provided by AMN Healthcare. For example, a hypothetical 5% cut in federal healthcare funding could translate to a reduction in contract opportunities.

- Healthcare Budget Stability: Political stability generally correlates with consistent healthcare spending, providing a predictable market for staffing agencies.

- Policy Shifts: Changes in government administrations or legislative priorities can significantly alter healthcare funding levels and regulatory environments.

- Economic Impact: Budgetary constraints driven by political or economic factors can directly reduce demand for healthcare staffing services.

Telehealth and Digital Health Policy

Government policies and regulations around telehealth and digital health directly influence care delivery models and, consequently, staffing needs for companies like AMN Healthcare. For instance, the Centers for Medicare & Medicaid Services (CMS) has been instrumental in shaping reimbursement for telehealth services, with expansions during the COVID-19 pandemic proving critical. The continuation of these flexibilities post-pandemic is vital for sustained growth in the digital health sector.

Policies that encourage telehealth expansion can lead to a dual effect: a reduced need for certain types of on-site healthcare professionals in some regions, while simultaneously boosting demand for clinicians skilled in digital health platforms and remote patient monitoring. This shift necessitates a workforce equipped with new competencies.

- Telehealth Utilization: In early 2024, telehealth continued to be a significant part of healthcare delivery, with studies indicating that a substantial percentage of patients who used telehealth during the pandemic have continued to do so. For example, a McKinsey report from late 2023 highlighted that telehealth utilization remained at levels significantly higher than pre-pandemic norms.

- Regulatory Landscape: The Consolidated Appropriations Act of 2023 extended many pandemic-era telehealth flexibilities through December 31, 2024, providing a crucial window for continued adoption and integration.

- Workforce Impact: The increasing adoption of telehealth is reshaping demand for healthcare professionals, favoring those with digital literacy and adaptability to remote care models.

Government funding for healthcare programs like Medicare and Medicaid directly influences demand for staffing services, with policy shifts impacting provider budgets. For instance, proposed Medicare payment rate adjustments for 2024 could alter hospitals' reliance on temporary staffing. Furthermore, immigration policies play a crucial role in the availability of foreign-trained healthcare professionals, a vital talent pool for AMN Healthcare, especially given projected physician shortages in the US, estimated to reach up to 124,000 by 2034.

Political stability underpins consistent healthcare spending, but election cycles and potential policy realignments can introduce uncertainty into healthcare budgets and staffing demand. For example, the 2024 US election cycle could lead to shifts in healthcare priorities and funding, directly affecting contract opportunities for staffing agencies. The regulatory environment for telehealth, with extensions of pandemic-era flexibilities through December 31, 2024, also shapes workforce needs, favoring digital health-skilled clinicians.

| Policy Area | Impact on AMN Healthcare | Relevant Data/Trend (2024/2025) |

|---|---|---|

| Medicare/Medicaid Funding | Influences hospital budgets and demand for temporary staffing. | Proposed 2% cut to Medicare physician payment rates in 2024 could impact demand. |

| Immigration Policy | Affects supply of foreign-trained healthcare professionals. | Projected US physician shortage of up to 124,000 by 2034 makes foreign talent critical. |

| Telehealth Regulation | Shapes demand for digitally skilled clinicians. | Pandemic-era telehealth flexibilities extended through Dec 31, 2024, supporting continued adoption. |

| Political Stability/Elections | Impacts healthcare spending predictability and policy direction. | 2024 US election cycle could lead to shifts in healthcare funding and priorities. |

What is included in the product

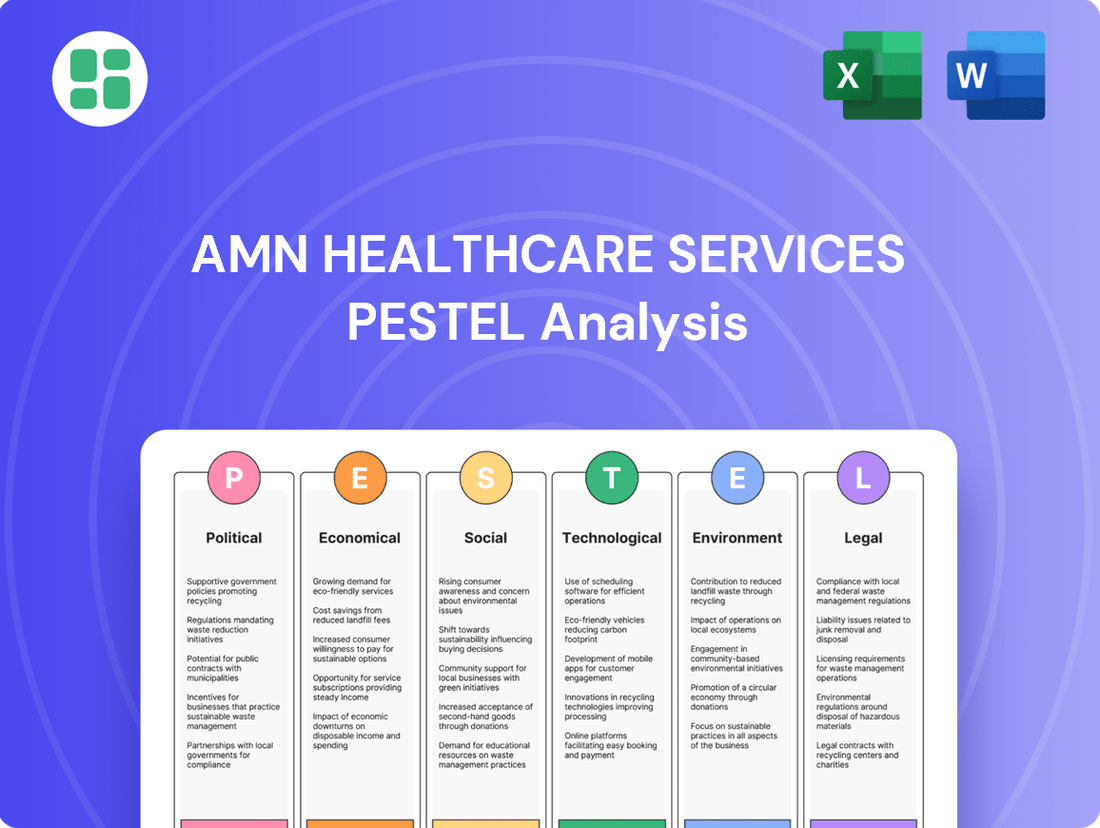

This PESTLE analysis for AMN Healthcare Services examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company’s operations and strategic planning.

It provides a comprehensive overview of external forces shaping the healthcare staffing industry and identifies potential opportunities and threats for AMN Healthcare Services.

A concise, actionable summary of AMN Healthcare Services' PESTLE analysis, highlighting key external factors impacting the healthcare staffing industry to inform strategic decision-making.

Economic factors

National healthcare spending is a significant driver for companies like AMN Healthcare Services. In 2024, we observed robust growth in these expenditures, and this trend is expected to continue into 2025, though at a more moderate pace. Hospitals are projected to maintain their position as the largest segment of healthcare spending, which directly translates to sustained demand for staffing and workforce solutions.

Rising labor costs and inflationary pressures are key economic factors impacting AMN Healthcare Services. The persistent demand for healthcare professionals, particularly those with specialized skills, directly contributes to increased wage rates. This escalation in pay can squeeze profit margins if AMN Healthcare cannot fully pass these costs onto its clients through adjusted pricing.

AMN Healthcare's Q1 2025 financial performance illustrates these pressures. The company reported a revenue decline, with a contributing factor being a reduced reliance on contingent workers. Furthermore, declining bill rates in certain market segments indicate a softening of pricing power, likely influenced by a normalization of demand and ongoing economic adjustments, making it challenging to offset higher labor expenses.

Economic cycles significantly shape healthcare staffing decisions. When budgets tighten, facilities often pivot to flexible staffing, like travel nurses and locum tenens physicians, to manage fluctuating patient demand and control expenses. This trend is expected to continue, with the locum tenens market alone projected for robust growth in 2025.

Insurance Reimbursement Models

Changes in how insurance companies, especially government programs like Medicare and Medicaid, pay for healthcare services directly impact the money healthcare facilities earn. These shifts can alter how financially stable hospitals and clinics are, which in turn affects their capacity and eagerness to hire staffing agencies like AMN Healthcare. For instance, a slowdown in overall hospital spending growth, with projections indicating a modest increase for 2025, could lead to tighter budgets for these institutions.

The evolving reimbursement landscape presents several key considerations:

- Shifting Payer Mix: A greater reliance on government payers or private insurers with restrictive reimbursement policies can squeeze provider margins.

- Value-Based Care Models: As the industry moves towards paying for outcomes rather than just services, providers face pressure to manage costs and improve efficiency, influencing their staffing needs.

- Reimbursement Rate Adjustments: Annual updates to Medicare and Medicaid reimbursement rates, which often see modest increases, can fail to keep pace with rising operational costs, impacting profitability.

- Policy Changes: Legislative or regulatory changes affecting coverage or payment methodologies can create significant uncertainty and financial strain for healthcare providers.

Healthcare Facility Financial Pressures

Hospitals and healthcare systems are grappling with significant financial headwinds. Rising operating expenses, coupled with persistent margin pressures, are forcing these institutions to prioritize cost-saving measures. For instance, the average hospital operating margin in the U.S. for 2023 was projected to be around 3.2%, a slight improvement but still indicating a tight financial environment.

This challenging financial landscape directly fuels the demand for efficient workforce management solutions. Healthcare facilities are actively seeking ways to optimize staffing levels and control labor costs, which often represent a substantial portion of their budget. This creates a clear opportunity for companies like AMN Healthcare to provide services that address these critical needs.

The need for cost optimization is paramount, driving facilities to explore external partnerships. This environment is characterized by:

- Elevated labor costs: Hospitals continue to contend with increased wages and benefits for clinical staff.

- Supply chain disruptions: Ongoing issues in supply chains contribute to higher costs for essential medical supplies and equipment.

- Reimbursement challenges: Stagnant or declining reimbursement rates from government and private payers exacerbate margin pressures.

Economic factors significantly influence AMN Healthcare's operational environment. While national healthcare spending continues to grow, albeit at a slower pace into 2025, rising labor costs and inflation are key concerns. The company's Q1 2025 performance reflects these pressures, with reduced reliance on contingent workers and declining bill rates impacting revenue.

Healthcare facilities are responding to these economic headwinds by prioritizing cost-saving measures. This includes optimizing staffing levels and controlling labor expenses, which often represent a substantial portion of their budgets. The average hospital operating margin in the U.S. for 2023 was around 3.2%, underscoring the tight financial environment driving demand for efficient workforce solutions.

| Economic Factor | Impact on AMN Healthcare | Supporting Data/Trend |

|---|---|---|

| Healthcare Spending Growth | Sustained demand for staffing solutions | Projected moderate growth into 2025 |

| Labor Costs & Inflation | Pressure on profit margins, wage escalation | Persistent demand for specialized healthcare professionals |

| Reimbursement Rates | Impacts provider revenue and hiring capacity | Modest annual increases in Medicare/Medicaid rates, often lagging operational costs |

| Hospital Operating Margins | Drives demand for cost-optimization services | U.S. hospital operating margin projected around 3.2% for 2023 |

Same Document Delivered

AMN Healthcare Services PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of AMN Healthcare Services delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understanding these external forces is crucial for strategic planning and identifying potential opportunities and threats within the healthcare staffing industry.

Sociological factors

The world's population is getting older, especially in places like North America. This means more people are dealing with long-term illnesses, which naturally boosts the need for healthcare services. This demographic trend is a significant tailwind for companies like AMN Healthcare, as it creates a constant demand for more healthcare professionals, particularly those with specialized skills.

This aging trend directly translates into a growing need for a larger and more specialized healthcare workforce. AMN Healthcare, as a leading provider of healthcare staffing solutions, is well-positioned to capitalize on this sustained demand. The global healthcare staffing market is anticipated to experience substantial growth, with projections indicating a significant upward trajectory by 2034, largely driven by these demographic shifts.

Despite some recovery, the U.S. healthcare system continues to grapple with significant shortages of registered nurses (RNs) and other vital professionals. This persistent deficit is especially acute in rural and non-metropolitan regions, creating substantial operational challenges for healthcare facilities.

To bridge these critical gaps and ensure uninterrupted patient care, healthcare organizations are increasingly turning to staffing agencies like AMN Healthcare. This reliance highlights the ongoing demand for flexible staffing solutions in the face of workforce instability.

Looking ahead, projections for RN shortages remain concerning, with expectations of continued deficits through 2025 and into the foreseeable future. This enduring trend underscores the long-term strategic importance of addressing healthcare workforce development and retention.

High rates of burnout, stress, and dissatisfaction are significantly impacting the healthcare workforce, leading to increased exits and retention difficulties. For instance, a 2023 survey by the American Medical Association found that 60% of physicians reported experiencing burnout. This societal challenge directly fuels the demand for temporary staffing solutions, as seen in AMN Healthcare's consistent revenue growth in their nursing and allied health segments.

The persistent problem of healthcare professional burnout necessitates a strategic focus on staff well-being. By prioritizing initiatives that improve talent attraction and retention, healthcare organizations aim to mitigate these societal pressures and ensure continuity of care, which in turn benefits staffing providers like AMN Healthcare.

Changing Preferences for Flexible Work

Healthcare professionals increasingly favor flexible work, including travel nursing and per-diem roles. This trend directly benefits AMN Healthcare Services, as their core business thrives on providing these adaptable staffing solutions.

The rise of the 'gig economy' within healthcare means a broader availability of contingent workers. This expansion of the flexible workforce directly fuels the demand for AMN's services, allowing them to meet the dynamic staffing needs of healthcare facilities.

- Increased Demand for Flexibility: A 2024 survey indicated that over 60% of healthcare workers would consider freelance or contract roles for greater work-life balance.

- Growth in Contingent Workforce: The number of temporary and contract healthcare professionals is projected to grow by 15% annually through 2025, according to industry reports.

- AMN's Market Position: AMN Healthcare consistently ranks as a top provider of travel nursing and allied health staffing, capitalizing on this preference shift.

Public Health Crises and Fluctuating Demand

The specter of future public health crises, such as the COVID-19 pandemic, presents a significant sociological factor for AMN Healthcare. These events can trigger immediate and unpredictable spikes in demand for healthcare professionals, testing the agility of staffing solutions. AMN Healthcare’s capacity to rapidly deploy qualified personnel becomes paramount in addressing emergent societal health needs, underscoring the value of flexible workforce management.

The COVID-19 pandemic demonstrated this vividly. For instance, in the first quarter of 2021, AMN Healthcare reported a substantial increase in revenue, driven in part by the heightened demand for travel nurses and other healthcare workers to combat the virus. This surge highlighted the critical role of healthcare staffing agencies in providing essential personnel during national emergencies.

- Increased Demand: Public health crises, like the COVID-19 pandemic, led to an unprecedented demand for healthcare professionals, particularly travel nurses.

- Agility is Key: AMN Healthcare's success hinges on its ability to quickly mobilize and deploy staff to meet these fluctuating, often urgent, needs.

- Societal Impact: The company's role extends beyond business; it's crucial in supporting public health infrastructure during times of crisis.

- Future Preparedness: The potential for future pandemics necessitates continuous investment in robust recruitment and deployment networks.

Societal shifts toward greater work-life balance are profoundly influencing the healthcare sector, driving increased demand for flexible work arrangements like travel nursing and per-diem roles. This trend directly benefits AMN Healthcare Services, as their business model is built on providing these adaptable staffing solutions.

The rise of the gig economy within healthcare has expanded the pool of contingent workers, further fueling the demand for AMN's services to meet the dynamic staffing needs of healthcare facilities. A 2024 survey revealed that over 60% of healthcare workers are open to contract roles for better work-life balance, and industry reports project a 15% annual growth in the contingent healthcare workforce through 2025.

Healthcare professional burnout remains a critical issue, with a 2023 AMA survey indicating 60% of physicians experience it. This societal challenge directly increases the need for temporary staffing, supporting AMN Healthcare's consistent revenue growth in its nursing and allied health segments.

The potential for future public health crises, similar to COVID-19, highlights the critical need for AMN Healthcare's agility in rapidly deploying personnel. During Q1 2021, AMN Healthcare saw significant revenue increases driven by demand for travel nurses during the pandemic, underscoring the company's vital role in public health emergencies.

| Sociological Factor | Impact on AMN Healthcare | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Aging Population & Increased Healthcare Demand | Sustained demand for healthcare professionals, especially specialized roles. | Global healthcare staffing market projected to grow significantly by 2034 due to demographic shifts. |

| Healthcare Professional Burnout & Dissatisfaction | Increased demand for temporary and flexible staffing solutions. | 60% of physicians reported burnout in a 2023 AMA survey; AMN's nursing segment revenue growth reflects this. |

| Preference for Flexible Work Arrangements | Direct benefit to AMN's core business of travel and per-diem staffing. | Over 60% of healthcare workers would consider contract roles (2024 survey); 15% annual growth in contingent workforce projected through 2025. |

| Potential for Public Health Crises | Need for rapid deployment of staff, increasing demand for AMN's services. | Q1 2021 revenue surge for AMN Healthcare due to COVID-19 demand for travel nurses. |

Technological factors

The healthcare industry's reliance on sophisticated workforce management technology continues to grow, with platforms like those from AMN Healthcare playing a pivotal role. These advancements are key to optimizing staffing, ensuring compliance, and enhancing the efficiency of healthcare providers. For instance, the demand for integrated solutions that manage everything from scheduling to credentialing saw significant uptake in 2024, as facilities grappled with fluctuating patient loads and persistent staffing shortages.

AMN Healthcare's own technology offerings are designed to address these very challenges, enabling seamless talent deployment and improving operational effectiveness. The company reported in its 2024 fiscal year that its technology-enabled solutions contributed to a more agile and responsive healthcare workforce. These systems streamline processes, reducing administrative burdens and allowing healthcare professionals to focus more on patient care, a critical factor in maintaining quality service delivery.

Artificial intelligence (AI) and predictive analytics are revolutionizing healthcare staffing. AMN Healthcare, a leader in this space, leverages these technologies to forecast demand for specific healthcare roles, optimize clinician deployment, and identify potential shortages before they impact patient care. This data-driven approach allows for more proactive and efficient resource allocation.

The integration of AI streamlines recruitment by automating resume screening, candidate matching, and initial communication, significantly reducing time-to-hire. For instance, AI-powered platforms can analyze vast datasets to identify the best-fit candidates for critical positions, improving placement quality and reducing turnover. This efficiency translates directly into cost savings and improved operational performance for healthcare facilities.

Predictive analytics helps AMN Healthcare anticipate future staffing needs based on trends like patient demographics, seasonal illness patterns, and regulatory changes. By forecasting these demands, the company can build a more robust pipeline of qualified healthcare professionals, ensuring that facilities have the necessary staff to meet patient volumes, particularly during peak periods. This foresight is crucial in the face of ongoing healthcare workforce challenges.

The telehealth sector is experiencing robust expansion, with projections indicating a continued upward trajectory. For instance, the global telehealth market was valued at approximately $118.2 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 14.5% from 2024 to 2030. This surge directly affects how healthcare services, including staffing, are delivered and demanded.

This technological shift is reshaping the healthcare workforce. While certain traditional roles might see a migration towards virtual environments, there's a concurrent emergence of new specializations, such as remote care coordinators and telehealth support specialists. AMN Healthcare, a major player in healthcare staffing, will need to adapt its models to source and deploy talent capable of operating in these evolving digital care settings.

Furthermore, the increasing adoption of remote patient monitoring (RPM) devices and platforms broadens access to healthcare expertise, particularly for individuals in underserved or remote areas. This technological enablement can lead to more efficient patient management and potentially reduce the need for in-person visits, influencing the demand for specific types of healthcare professionals and the geographical distribution of staffing needs.

Digital Health Records and Interoperability

The increasing adoption of digital health records, with an estimated 96% of hospitals having adopted some form of EHR by 2023 according to the Office of the National Coordinator for Health Information Technology, is fundamentally reshaping healthcare operations. This digital transformation, coupled with a strong push for interoperability, allows for unprecedented data accessibility. For companies like AMN Healthcare Services, this translates into significantly more efficient credentialing and compliance processes, as verified data can be accessed and shared more readily.

This enhanced data flow directly impacts AMN's ability to match healthcare professionals with suitable roles. With interoperable systems, staffing companies can more effectively leverage integrated data to assess candidate qualifications, track certifications, and ensure compliance with regulatory requirements, leading to faster and more accurate placements. For instance, the ability to access a unified patient record or a consolidated provider credentialing profile can reduce placement times by days.

- EHR Adoption: Over 96% of US hospitals utilized EHR systems as of 2023, a significant increase from previous years.

- Interoperability Initiatives: Government mandates and industry standards are driving greater data exchange capabilities between different healthcare IT systems.

- Efficiency Gains: Streamlined credentialing and compliance checks can reduce administrative burdens for staffing firms by an estimated 15-20%.

- Improved Matching: Access to comprehensive digital records allows for more precise matching of clinician skills and experience to specific job requirements.

Cybersecurity and Data Protection Technologies

The escalating reliance on digital health records and telehealth platforms places a significant emphasis on advanced cybersecurity and data protection technologies. AMN Healthcare's commitment to safeguarding sensitive patient and workforce data is crucial for maintaining regulatory compliance, such as HIPAA, and preventing costly data breaches. For instance, the global cybersecurity market is projected to reach $372 billion in 2024, highlighting the substantial investment required in this area. This necessitates continuous upgrades to encryption, threat detection, and access control systems to ensure operational continuity and build client trust.

Key technological factors impacting AMN Healthcare Services regarding cybersecurity and data protection include:

- Investment in AI-driven threat detection: To proactively identify and neutralize sophisticated cyber threats targeting healthcare data.

- Compliance with evolving data privacy regulations: Ensuring adherence to global standards like GDPR and CCPA, which carry significant penalties for non-compliance.

- Secure cloud infrastructure: Implementing robust security protocols for data storage and transmission in cloud environments, which are increasingly utilized for efficiency.

- Employee training on cybersecurity best practices: Mitigating human error, a common vector for cyberattacks, through regular and comprehensive training programs.

Technological advancements are fundamentally reshaping healthcare staffing, with AMN Healthcare leveraging AI and predictive analytics to forecast demand and optimize clinician deployment. The company's technology-enabled solutions streamline processes, reducing administrative burdens and improving operational effectiveness, as noted in their 2024 fiscal reports. The increasing adoption of digital health records, with over 96% of US hospitals using EHRs by 2023, facilitates more efficient credentialing and compliance checks, reducing placement times.

Legal factors

AMN Healthcare's operations are significantly shaped by the complex web of state and federal licensing and credentialing regulations for healthcare professionals. These rules, which are constantly being updated, directly influence how easily AMN can deploy its workforce across different geographical areas. For instance, the ongoing expansion of the Nurse Licensure Compact (NLC) is a key development. As of early 2024, the NLC has 39 member states, a notable increase that streamlines the process for nurses to practice in multiple jurisdictions, thereby broadening AMN's available talent pool and simplifying interstate staffing solutions.

The Health Insurance Portability and Accountability Act (HIPAA) continues to evolve, with recent amendments addressing reproductive health privacy and proposed changes to the security rule. AMN Healthcare must maintain stringent adherence to these regulations, which govern the handling of protected health information, to prevent significant fines and preserve its reputation with clients and patients.

Labor laws, encompassing wage and hour standards, worker classification, and general employment conditions, directly shape AMN Healthcare's operational framework. Navigating these regulations is critical, especially given the company's extensive use of a contingent workforce across diverse geographical locations.

For instance, the Fair Labor Standards Act (FLSA) sets minimum wage and overtime pay requirements, impacting AMN Healthcare's payroll and contractor agreements. As of January 1, 2025, the federal minimum wage remains $7.25 per hour, though many states and cities have established higher rates, necessitating careful compliance tracking.

Worker classification, distinguishing between employees and independent contractors, is another significant legal factor. Misclassification can lead to substantial penalties, including back wages and taxes, a risk AMN Healthcare must actively manage to ensure adherence to regulations like the ABC test in certain states.

Patient Safety and Malpractice Liability

Legal frameworks dictating patient safety and malpractice liability directly shape the standards of care and professional qualifications within the healthcare sector. AMN Healthcare must rigorously ensure that the clinicians it places meet these elevated benchmarks to effectively reduce legal exposure for its client facilities and the company itself.

The increasing scrutiny on patient safety in 2024 and 2025 means that any lapse in care can lead to substantial financial penalties and reputational damage. For instance, the U.S. Department of Health and Human Services reported that medical errors are a significant concern, contributing to patient harm and increased healthcare costs.

- Malpractice Claims: The frequency and severity of malpractice claims continue to be a critical risk factor for healthcare providers and staffing agencies.

- Regulatory Compliance: Adherence to evolving patient safety regulations, such as those from CMS (Centers for Medicare & Medicaid Services), is paramount.

- Credentialing and Verification: Robust processes for credentialing and verifying the qualifications of healthcare professionals are essential to prevent negligent placement.

- Insurance Costs: The cost of malpractice insurance for both the agency and its placed professionals is directly influenced by the perceived legal risk.

Contractual and Business Regulations

Regulations governing contracts between staffing agencies like AMN Healthcare and healthcare facilities are paramount. These rules dictate terms for pricing, service level agreements, and how disputes are handled, directly impacting AMN's business relationships. For instance, in 2024, the healthcare staffing industry continues to navigate evolving state-specific regulations concerning independent contractor status for nurses, which can affect AMN's workforce model and associated costs.

Legal compliance in these contractual areas is not just a formality; it's critical for maintaining stable and profitable operations. The competitive healthcare staffing market demands adherence to these legal frameworks to ensure predictable revenue streams and mitigate risks. Failure to comply can lead to significant penalties and damage to reputation, affecting AMN's ability to secure and retain clients.

- Pricing Transparency: Contractual clauses often mandate clear pricing structures for various staffing services, preventing hidden fees and ensuring fair compensation.

- Service Level Agreements (SLAs): These legally binding agreements define performance metrics, such as response times for staffing requests and credentialing processes, ensuring quality of service.

- Dispute Resolution: Contracts typically outline specific mechanisms for resolving disagreements, ranging from mediation to arbitration, providing a structured approach to conflict management.

- Independent Contractor vs. Employee Status: Evolving legal interpretations of worker classification, particularly for travel nurses, directly impact AMN's operational costs and compliance strategies.

The evolving landscape of healthcare regulations, including those related to patient privacy and data security under HIPAA, presents ongoing compliance challenges. Furthermore, the Nurse Licensure Compact (NLC), which as of early 2024 includes 39 member states, significantly impacts AMN's ability to deploy nurses across state lines, streamlining operations but requiring careful tracking of state participation.

Labor laws, particularly concerning minimum wage and worker classification, are critical. The federal minimum wage remains $7.25 as of January 1, 2025, but state variations necessitate meticulous compliance. Ensuring correct classification of independent contractors versus employees is vital to avoid penalties, a risk amplified by the company's extensive contingent workforce.

Malpractice claims and patient safety standards directly influence operational protocols and insurance costs. Adherence to evolving patient safety regulations from bodies like CMS is paramount, as lapses can lead to substantial financial penalties and reputational damage, as highlighted by U.S. Department of Health and Human Services concerns over medical errors.

Contractual agreements with healthcare facilities are governed by specific legal frameworks impacting pricing, service levels, and dispute resolution. The classification of workers, especially travel nurses, remains a key area of legal scrutiny in 2024, directly affecting AMN's operational costs and compliance strategies.

Environmental factors

The healthcare sector is a substantial contributor to greenhouse gas emissions, with estimates suggesting it accounts for around 4.4% of global net emissions. This significant environmental impact is spurring a growing demand for sustainability and decarbonization across the industry.

While AMN Healthcare primarily offers staffing and services, its client base, which includes hospitals and clinics, faces mounting pressure to implement eco-friendly operations. This trend can indirectly affect AMN by influencing how clients evaluate suppliers and choose partners who align with their environmental goals.

Healthcare facilities are increasingly prioritizing sustainability, with many investing in energy efficiency projects and waste reduction programs. For instance, a 2024 report indicated that over 60% of hospitals have set targets for reducing their carbon footprint.

These environmental commitments directly impact the demand for services and technologies that AMN Healthcare provides. Clients are more likely to seek staffing and solutions from partners who demonstrate a strong commitment to eco-friendly practices, influencing purchasing decisions and service provider selection.

The intensifying effects of climate change, marked by more frequent extreme weather events and a rise in climate-sensitive diseases, are directly impacting public health. This translates into unpredictable surges in demand for healthcare services, requiring swift responses from staffing providers.

In 2024, the World Health Organization reported that climate change is already a significant threat to human health, exacerbating existing conditions and creating new health challenges. For AMN Healthcare, this means their agility in deploying nurses and allied health professionals to disaster-stricken regions or areas experiencing disease outbreaks is a critical component of their service offering.

The increasing incidence of vector-borne diseases, heat-related illnesses, and respiratory problems linked to air quality deterioration necessitates a flexible and responsive healthcare workforce. AMN Healthcare's capacity to meet these fluctuating staffing needs in 2025 will be a key differentiator.

Waste Management and Environmental Regulations

Regulations surrounding medical waste management and broader environmental standards significantly influence healthcare facility operations. While AMN Healthcare, as a staffing company, isn't directly managing waste, its consulting services could guide clients on environmental compliance. Changes in waste disposal requirements, for instance, might lead healthcare providers to adjust their operational needs, indirectly impacting staffing demands or the types of services AMN offers.

The healthcare industry is under increasing scrutiny for its environmental footprint. For example, the U.S. Environmental Protection Agency (EPA) continues to refine regulations on hazardous waste management, which includes certain medical materials. A 2023 report indicated that healthcare facilities are investing more in sustainable practices, a trend likely to continue into 2024 and 2025, potentially creating opportunities for AMN's advisory services to support clients in adapting their workforce to these evolving environmental mandates.

- Increased focus on reducing single-use plastics in healthcare settings, impacting supply chain and staffing needs for reusable alternatives.

- Stricter guidelines for the disposal of biohazardous and pharmaceutical waste, requiring specialized training for staff.

- Growing demand for healthcare facilities to adopt energy-efficient technologies and sustainable building practices, influencing facility management and operational staffing.

- Potential for new regulations on carbon emissions from healthcare operations, prompting shifts in service delivery models.

Resource Scarcity and Supply Chain Resilience

Potential scarcities in critical medical supplies, such as semiconductors for medical devices or active pharmaceutical ingredients, can directly impact the demand for healthcare services and, by extension, the need for specialized staffing. For instance, disruptions in the supply of certain diagnostic equipment could lead to increased reliance on manual processes, requiring more personnel in the short term.

The healthcare sector's increasing emphasis on supply chain resilience is a significant environmental factor. Companies like AMN Healthcare are likely to see a growing need for flexible and adaptable staffing solutions to manage fluctuations caused by supply chain vulnerabilities. A report by McKinsey in late 2023 highlighted that 93% of supply chain leaders expected disruptions to continue for at least a year, underscoring the persistent challenge.

The push for sustainable sourcing and reduced environmental impact in healthcare operations also plays a role. This could influence the types of medical equipment used and the logistical networks supporting them, indirectly affecting staffing requirements. For example, a shift towards more localized manufacturing of certain medical supplies could alter regional demand for healthcare professionals.

Key considerations for AMN Healthcare include:

- Impact of semiconductor shortages on medical device availability and related staffing needs.

- Growing importance of resilient supply chains in healthcare for maintaining operational continuity.

- Potential shifts in demand for healthcare professionals due to sustainable sourcing initiatives.

- The ongoing trend of supply chain disruptions affecting the healthcare industry, as noted by industry analyses.

The healthcare industry's environmental footprint is a growing concern, with significant implications for AMN Healthcare. As clients, such as hospitals, face pressure to decarbonize and adopt sustainable practices, AMN may see shifts in demand for services that align with these eco-friendly goals. This trend is evidenced by reports indicating that a majority of hospitals are setting carbon reduction targets, influencing their supplier choices.

Climate change itself presents a dual challenge: it exacerbates public health issues, leading to unpredictable demand for healthcare services, and necessitates rapid deployment of medical staff to affected areas. For example, the WHO's 2024 report highlights climate change as a direct threat to human health, requiring AMN's agility in providing workforce solutions during health crises.

Furthermore, evolving regulations on medical waste and emissions directly impact healthcare operations. While AMN isn't directly managing these aspects, its consulting services might need to adapt to help clients navigate compliance, potentially altering staffing needs or service requirements. The EPA's ongoing refinement of hazardous waste management rules, for instance, underscores the need for healthcare providers to adjust their operations.

| Environmental Factor | Impact on Healthcare Sector | Implication for AMN Healthcare |

|---|---|---|

| Greenhouse Gas Emissions | Healthcare accounts for ~4.4% of global net emissions, driving demand for sustainability. | Clients may favor staffing partners with demonstrated eco-friendly practices. |

| Climate Change & Health Impacts | Increased frequency of extreme weather and climate-sensitive diseases drives demand for healthcare services. | Requires AMN to provide agile and responsive staffing solutions for disaster relief and outbreaks. |

| Waste Management & Emissions Regulations | Stricter regulations on medical waste and carbon emissions impact facility operations. | Potential for advisory services to guide clients on workforce needs related to environmental compliance. |

| Supply Chain Sustainability | Focus on resilient and eco-friendly supply chains affects medical equipment and logistics. | Demand for flexible staffing to manage disruptions and adapt to shifts in sourcing. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for AMN Healthcare Services is built on a robust foundation of data from official government agencies, including the Bureau of Labor Statistics and the Centers for Medicare & Medicaid Services, alongside reports from reputable industry associations and market research firms.