AMN Healthcare Services Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMN Healthcare Services Bundle

AMN Healthcare Services operates in a dynamic market influenced by several key forces, including the bargaining power of buyers and the threat of new entrants. Understanding these pressures is crucial for strategic planning and identifying competitive advantages.

The complete report reveals the real forces shaping AMN Healthcare Services’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The persistent national shortage of healthcare professionals, especially nurses and those in specialized fields, significantly bolsters the bargaining power of individual clinicians and professional groups. This sustained demand means qualified healthcare workers can negotiate for better pay and benefits, as healthcare facilities often face urgent needs to fill essential positions. For instance, the American Nurses Association (ANA) has projected a deficit of over 78,000 full-time registered nurses by 2025, underscoring this critical imbalance.

The growing preference for flexible work models among healthcare professionals significantly enhances supplier bargaining power. This shift, evident in the rising demand for locum tenens and travel nursing roles, allows clinicians to be more selective about their assignments, often prioritizing higher compensation and better work-life balance. For instance, the demand for travel nurses saw a substantial increase in 2024, with some agencies reporting a 20% year-over-year rise in placements.

This empowerment means staffing agencies, like AMN Healthcare Services, must actively compete for talent by offering competitive pay rates, benefits, and assignment flexibility. Failure to do so can lead to difficulties in meeting client staffing needs, as skilled professionals can easily move to providers offering more attractive terms. This dynamic directly impacts the cost and availability of healthcare labor, a key input for healthcare facilities.

Healthcare professionals with highly specialized skills, such as ICU nurses or certain locum tenens physicians, inherently hold greater bargaining power. This is because their unique expertise is often in high demand and short supply, allowing them to command premium rates and choose assignments that best suit their needs. For example, locum tenens physicians, particularly specialists, have seen their billing rates remain strong, with some experiencing increases in 2024 due to their critical, revenue-generating roles within healthcare facilities.

Licensing and Credentialing Requirements

The intricate web of state-specific licensing and credentialing for healthcare professionals significantly bolsters the bargaining power of suppliers. These rigorous processes act as a substantial barrier for new entrants, effectively limiting the available pool of qualified healthcare talent. For instance, in 2024, the average time to obtain a new nursing license varied significantly by state, with some requiring several months, thus concentrating power among those already possessing credentials.

While technological advancements are making verification processes more efficient, the core requirement for certified professionals remains a critical constraint on supply. This inherent limitation on readily available talent directly translates to increased leverage for existing, credentialed healthcare workers. The Nurse Licensure Compact, which aims to improve interstate mobility for nurses, saw continued expansion in 2024, with new states joining. However, its impact on significantly altering the fundamental supply dynamics remains gradual.

- Barrier to Entry: Stringent, state-specific licensing creates hurdles for new healthcare professionals.

- Limited Talent Pool: The need for certified individuals restricts the readily available workforce.

- Technology's Role: While streamlining verification, it doesn't eliminate the need for certification.

- Nurse Licensure Compact: Expansion offers potential for increased workforce mobility, but impact is gradual.

Ease of Switching Agencies

Healthcare professionals, particularly those in travel or contract roles, generally experience low costs when moving between staffing agencies. This fluidity allows them to readily sign up with various companies to secure the best opportunities and pay. In 2024, the demand for specialized healthcare talent remained high, further amplifying this ease of switching.

The ability for nurses and allied health professionals to easily move between staffing providers means that agencies like AMN Healthcare must remain competitive. They are driven to offer attractive terms and a wide array of assignments to keep their professionals engaged. For instance, AMN Healthcare's focus on clinician experience and diverse contract options in 2024 aimed to mitigate the impact of this low switching cost.

- Low Switching Costs for Healthcare Professionals: In 2024, the market continued to see healthcare professionals easily transition between staffing agencies, seeking better pay and assignments.

- Competitive Pressure on Agencies: This ease of movement forces staffing firms, including AMN Healthcare, to offer competitive compensation and a broad range of job opportunities to retain talent.

- AMN Healthcare's Strategy: AMN Healthcare's emphasis on a strong clinician network and diverse contract offerings in 2024 reflects an effort to counter the bargaining power derived from low switching costs.

The bargaining power of suppliers, primarily healthcare professionals, is significantly amplified by the persistent national shortage of qualified staff. This imbalance allows clinicians to demand higher compensation and better working conditions, as healthcare facilities are often desperate to fill critical roles. For example, the projected deficit of over 78,000 registered nurses by 2025, as highlighted by the American Nurses Association, underscores the leverage held by these essential workers.

The increasing demand for flexible work arrangements, such as travel nursing and locum tenens positions, further empowers healthcare professionals. This trend enables them to be more selective about assignments, prioritizing lucrative pay and improved work-life balance. In 2024, agencies reported a notable surge in travel nurse placements, with some experiencing a 20% year-over-year increase, demonstrating this shift in power.

Highly specialized healthcare professionals, like ICU nurses or specific physician specialists, possess even greater bargaining power due to their limited availability and critical, revenue-generating roles. Their unique skills command premium rates, with locum tenens physicians seeing sustained strong billing rates and increases in 2024. This scarcity directly translates to increased leverage for these in-demand suppliers.

| Factor | Impact on Supplier Bargaining Power | Supporting Data (2024/2025 Projections) |

|---|---|---|

| National Healthcare Staffing Shortage | High | Projected deficit of over 78,000 RNs by 2025 (ANA) |

| Demand for Flexible Work (Travel/Locum Tenens) | High | 20% year-over-year increase in travel nurse placements reported by some agencies in 2024 |

| Specialized Skills & Critical Roles | Very High | Sustained strong billing rates and increases for locum tenens specialists in 2024 |

| State Licensing & Credentialing Barriers | Moderate to High | Average nursing license acquisition time varied significantly by state in 2024; Nurse Licensure Compact expansion ongoing |

| Low Switching Costs for Professionals | High | Continued high demand for specialized talent in 2024 facilitated easy movement between agencies |

What is included in the product

This analysis details the competitive forces impacting AMN Healthcare Services, assessing the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the healthcare staffing industry.

Instantly assess competitive intensity across the healthcare staffing landscape, pinpointing where AMN Healthcare Services can strategically differentiate and alleviate pressure.

Customers Bargaining Power

Large healthcare systems are consolidating their purchasing power and frequently engage multiple staffing vendors. This strategy allows them to compare pricing and services effectively, significantly increasing their leverage. In 2024, a substantial 87.3% of major healthcare systems reported using more than one staffing vendor.

AMN Healthcare's market share of roughly 12.5% in the $36.2 billion healthcare staffing market highlights a fragmented customer base. This fragmentation means healthcare systems have numerous options and can readily switch vendors or negotiate better terms, thereby reducing AMN's pricing power.

Healthcare organizations are feeling the squeeze from inflation and reimbursement challenges, making cost reduction a top priority. This directly impacts their focus on lowering operational expenses, especially staffing costs, which are a significant component of their budgets.

Because of these financial pressures, hospitals and health systems are leveraging their increased bargaining power to negotiate lower billing rates with staffing agencies. They are actively seeking more cost-effective staffing solutions to manage their budgets more effectively.

In fact, industry data indicates that healthcare organizations are pushing for an average annual reduction in staffing costs of around 5.7%, highlighting the intense pressure on providers like AMN Healthcare Services.

Healthcare facilities are increasingly building their own internal staffing programs, like float pools and in-house agencies. This move is a direct effort to lessen their dependence on external staffing companies, which can be costly. For instance, a 2024 survey indicated that over 60% of hospitals were either expanding existing internal programs or launching new ones to manage staffing needs more efficiently.

By cultivating a stable of internal staff, healthcare providers can ensure greater continuity of care with personnel who are already familiar with their specific protocols and patient populations. This internal capacity directly impacts the demand for temporary staffing services from external firms. In 2023, the average cost savings reported by hospitals that significantly invested in internal staffing programs ranged from 15% to 25% compared to relying solely on external agencies.

The growth of these internal staffing solutions effectively shifts bargaining power towards the healthcare facilities. When facilities can meet a larger portion of their staffing needs internally, their leverage increases when negotiating rates or contracts with external staffing agencies. This trend is particularly noticeable in specialized nursing fields, where the competition for temporary talent is fierce.

Adoption of Workforce Management Technology (VMS)

The growing adoption of Vendor Management Systems (VMS) and other workforce management technologies by healthcare clients significantly boosts their bargaining power. These platforms give clients more direct control and transparency over staffing, enabling them to optimize their workforce and potentially lessen reliance on staffing agencies. For example, in 2024, a significant portion of large healthcare systems have implemented VMS solutions, streamlining their contingent workforce management.

This technological shift allows clients to negotiate more effectively with staffing providers by having better data on market rates and service performance. AMN Healthcare, recognizing this trend, offers its own VMS solutions like WorkWise and ShiftWise Flex, designed to meet these evolving client demands for greater efficiency and cost control.

- Increased Client Control: VMS platforms empower healthcare organizations to manage staffing directly, improving oversight and operational efficiency.

- Enhanced Transparency: Clients gain clearer visibility into staffing costs, vendor performance, and compliance metrics.

- Negotiating Leverage: Better data access through VMS allows clients to negotiate more favorable terms with staffing agencies.

- Market Trend: By mid-2024, the penetration of VMS in major healthcare markets continued to rise, indicating a strong client preference for these integrated solutions.

Fluctuating Patient Volumes and Demand Stabilization

The bargaining power of customers, particularly healthcare providers, has increased due to shifting market dynamics. While the overall demand for healthcare remains robust, the urgency for short-term contract labor, especially travel nurses, has lessened compared to the pandemic's peak. This stabilization in demand gives hospitals and health systems more leverage when negotiating with staffing agencies.

This shift is evident in the financial performance of the sector. For instance, travel nurse revenue experienced a significant decline, dropping by 37% in 2024. This reduction in immediate need allows providers to be more selective and price-sensitive in their staffing solutions.

- Decreased Urgency: Post-pandemic market adjustments have led to a stabilization and dip in demand for shorter-term contract labor.

- Increased Provider Leverage: Reduced urgency provides healthcare providers more time and flexibility in hiring, strengthening their negotiation position.

- Revenue Impact: Travel nurse revenue saw a notable 37% decrease in 2024, reflecting the changing demand landscape.

Healthcare customers possess significant bargaining power, amplified by consolidation and a greater willingness to use multiple staffing vendors. In 2024, a notable 87.3% of major healthcare systems reported engaging with more than one staffing vendor, enabling them to compare pricing and secure better terms. This, coupled with a focus on cost reduction due to inflation and reimbursement pressures, pushes down rates for staffing services.

Hospitals are increasingly building internal staffing programs, with over 60% expanding or launching new ones in 2024 to reduce reliance on external agencies. This strategy offers cost savings of 15% to 25% and improves care continuity. Furthermore, the adoption of Vendor Management Systems (VMS) by clients provides greater transparency and control, enhancing their negotiating leverage with staffing providers.

| Factor | Impact on Bargaining Power | Supporting Data (2024) |

|---|---|---|

| Customer Consolidation & Vendor Use | Increases buyer power | 87.3% of systems use multiple vendors |

| Focus on Cost Reduction | Drives down rates | Push for 5.7% annual staffing cost reduction |

| Internal Staffing Programs | Reduces reliance on external agencies | 60%+ hospitals expanding internal programs |

| VMS Adoption | Enhances client control and data | Increased VMS penetration in major markets |

Preview the Actual Deliverable

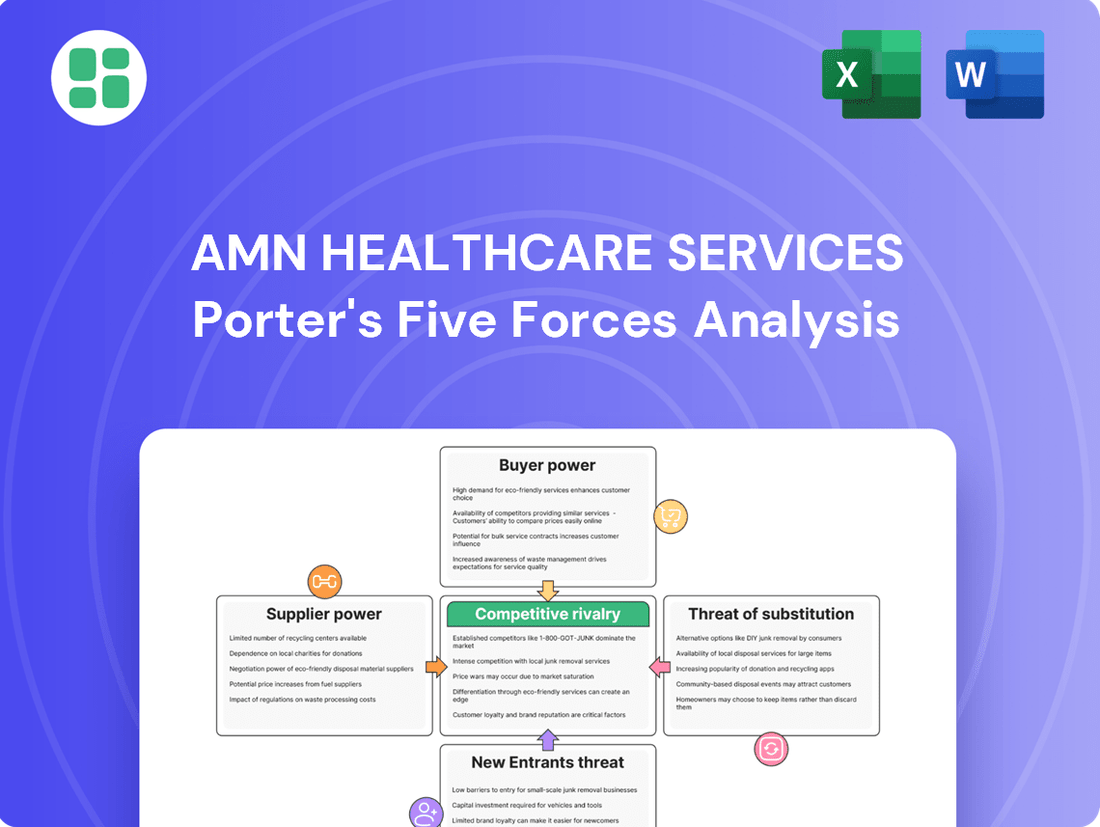

AMN Healthcare Services Porter's Five Forces Analysis

This preview showcases the comprehensive AMN Healthcare Services Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the company. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, providing actionable insights without any surprises.

Rivalry Among Competitors

The healthcare staffing market is incredibly fragmented, meaning there are many companies, big and small, all trying to win business. This intense competition means AMN Healthcare constantly faces rivals on multiple fronts, from pricing strategies to the quality of healthcare professionals they can supply.

In 2024, the global healthcare staffing market was valued at an impressive USD 69.3 billion. While this shows a substantial opportunity, it also highlights the crowded nature of the industry, with numerous national, regional, and local players actively competing for a piece of this large pie.

The healthcare staffing industry is seeing a wave of consolidation, driven by mergers and acquisitions. Larger companies are buying smaller ones to broaden their services, client lists, and reach. This trend is making the competition tougher among the remaining big players, as they aim for greater economies of scale and market leadership.

Significant M&A activity has been observed, such as Aya Healthcare's move to acquire Cross Country Healthcare in December 2024. Following this, TrueBlue acquired Healthcare Staffing Professionals in January 2025, demonstrating the ongoing consolidation efforts within the sector.

Competitive rivalry within the healthcare staffing industry is intense, with companies like AMN Healthcare differentiating themselves through a broad spectrum of services. This includes travel nursing, locum tenens, allied health, and permanent placement, all bolstered by technology solutions like Vendor Management Systems (VMS) and predictive analytics.

The capacity to deliver integrated, tech-enabled total talent solutions serves as a significant competitive advantage, crucial for attracting and retaining healthcare clients. AMN's proprietary platforms, such as WorkWise and AMN Passport, exemplify this strategy, aiming to streamline operations and enhance the client experience.

Pricing Pressure and Declining Billing Rates

Following the surge in demand during the pandemic, the healthcare staffing market has experienced a notable decrease in billing rates for temporary positions, especially in travel nursing. Hospitals, keen on managing their budgets, are pushing for lower costs, directly impacting staffing agencies.

This intensified pricing pressure compels firms like AMN Healthcare to compete more fiercely on cost, leading to reduced profit margins. The financial landscape for travel nurses in 2025 reflects this shift, with compensation levels significantly lower than the peaks seen during the public health crisis.

- Declining Travel Nurse Pay: Average weekly pay for travel nurses in 2025 has fallen by an estimated 20-30% compared to 2022 highs.

- Hospital Cost Containment: Healthcare facilities are actively seeking to decrease reliance on expensive temporary staff, driving down the rates offered.

- Margin Squeeze: Staffing companies face shrinking margins as they must offer competitive rates to secure contracts, impacting overall profitability.

Talent Acquisition and Retention Challenges

Competitive rivalry within the healthcare staffing industry, including for AMN Healthcare Services, is significantly intensified by the ongoing struggle to attract and retain skilled healthcare professionals. This challenge is exacerbated by widespread shortages and rising rates of burnout among clinicians.

Firms actively compete by crafting compelling offers that include competitive compensation packages, comprehensive benefits, robust professional development programs, and increasingly, flexible work arrangements. The ability to effectively recruit and nurture strong relationships with recruiters is a critical differentiator.

- Talent Scarcity: In 2023, the U.S. faced a projected shortage of up to 124,000 physicians by 2034, and nursing shortages remain a persistent issue, driving up demand for staffing services.

- Retention Strategies: Companies are investing heavily in retention bonuses, continuing education, and improved work-life balance initiatives to combat turnover.

- Recruitment Effectiveness: AMN Healthcare reported that its recruitment solutions segment saw revenue growth, underscoring the importance of efficient talent acquisition in a competitive market.

- Burnout Impact: Studies indicate that over 40% of nurses report feeling burned out, making retention efforts paramount for staffing agencies.

The healthcare staffing market is highly competitive, with numerous players vying for market share, leading to aggressive pricing and a constant need for differentiation through service offerings and technology. This intense rivalry is further fueled by industry consolidation, as larger entities acquire smaller ones to expand their capabilities and market reach.

| Metric | 2024 Data/Trend | Impact on AMN Healthcare |

|---|---|---|

| Global Healthcare Staffing Market Value | USD 69.3 billion | Indicates a large, attractive market but also high competition. |

| M&A Activity | Aya Healthcare acquiring Cross Country Healthcare (Dec 2024) | Increases scale and competitive pressure from larger, consolidated entities. |

| Billing Rates (Travel Nursing) | Decreased by an estimated 20-30% from 2022 highs in 2025 | Pressures profit margins, necessitating cost-efficiency and value-added services. |

| Talent Scarcity (Physicians) | Projected shortage of up to 124,000 by 2034 (US) | Creates demand for staffing services but intensifies competition for talent. |

| Nurse Burnout | Over 40% of nurses report burnout | Makes talent retention a critical competitive factor, requiring investment in employee well-being and development. |

SSubstitutes Threaten

Healthcare organizations increasingly opt to bolster their internal recruitment and build dedicated float pools. This strategy directly competes with staffing agencies by fostering a more consistent, permanent workforce and potentially lowering overall labor expenses. For instance, many health systems are scaling back or eliminating their internal travel nurse programs, prioritizing the development of their own employee base.

The increasing adoption of telehealth and virtual care models presents a significant threat of substitutes for traditional in-person healthcare staffing. These virtual platforms can fulfill certain patient needs remotely, reducing the reliance on on-site healthcare professionals, particularly in specialties amenable to virtual consultations and monitoring.

The expansion of telehealth is not just a trend but a fundamental shift. For instance, by the end of 2024, it's projected that telehealth utilization will remain significantly higher than pre-pandemic levels, with an estimated 35% of all healthcare services potentially being delivered virtually. This directly impacts the demand for physical staffing in areas like primary care, mental health, and certain chronic disease management, offering a viable alternative to traditional employment models.

Advancements in automation and AI are increasingly capable of handling administrative and even some clinical tasks within healthcare. This efficiency can lead to a reduced demand for certain human healthcare roles, impacting staffing needs. For instance, AI-powered predictive scheduling and talent matching platforms are emerging, potentially lessening the reliance on traditional staffing agencies.

The healthcare staffing sector, including companies like AMN Healthcare Services, faces a growing threat from AI's ability to streamline recruitment and workforce management. By 2024, the global AI in healthcare market was valued at over $20 billion, demonstrating the rapid integration of these technologies. This suggests that AI solutions could directly compete with the core services offered by staffing intermediaries by optimizing talent acquisition and deployment more efficiently.

Alternative Care Settings and Models

The growing prevalence of alternative care settings, such as ambulatory surgery centers (ASCs) and convenient care clinics, presents a significant threat of substitutes for traditional hospital-based healthcare services. For instance, ASCs are increasingly performing a larger volume of outpatient surgeries that were historically done in hospitals, directly impacting hospital staffing demands. In 2023, the ASC industry saw continued growth, with many procedures shifting to these more cost-effective settings.

These alternative models often require a different mix or a reduced number of healthcare professionals compared to acute care hospitals, effectively substituting the traditional demand for a broad range of hospital staff. This shift directly influences the revenue streams and staffing strategies of hospitals, as patient volumes and acuity levels change.

- Ambulatory Surgery Centers (ASCs): Performing an increasing share of outpatient procedures, reducing demand for hospital-based surgical staff.

- Convenient Care Clinics (Urgent Care, Retail Clinics): Handling minor ailments and routine care, diverting patients and associated staffing needs from hospitals.

- Impact on Staffing: These shifts can lead to a reduced need for certain specialized hospital roles and potentially alter the overall skill mix required.

- Financial Implications: Hospitals may see reduced patient volumes and revenue, necessitating adjustments in their staffing models and operational strategies.

Focus on Staff Retention and Well-being Initiatives

The threat of substitutes for AMN Healthcare Services is influenced by healthcare facilities' increasing focus on retaining their permanent staff. By investing in employee well-being and retention initiatives, such as flexible scheduling and mental health resources, organizations aim to reduce turnover. This internal focus can lessen their reliance on external staffing agencies like AMN Healthcare.

In 2024, the healthcare industry continued to grapple with significant staffing shortages, making retention a critical strategic imperative. For instance, a survey indicated that over 60% of healthcare executives identified staff retention as a top priority. This push for internal stability directly impacts the demand for temporary staffing solutions.

- Healthcare facilities are prioritizing permanent staff retention to mitigate turnover.

- Initiatives like flexible scheduling and mental health support aim to improve employee well-being and reduce reliance on temporary staff.

- A 2024 survey revealed that over 60% of healthcare executives consider staff retention a primary concern.

- This internal focus on stability can decrease the demand for services provided by staffing agencies.

The rise of telehealth and alternative care settings like ambulatory surgery centers (ASCs) offers substitutes for traditional hospital staffing needs. By 2024, telehealth was projected to handle a significant portion of healthcare services, impacting demand for on-site professionals. ASCs are also increasingly performing procedures historically done in hospitals, altering staffing requirements.

Automation and AI present another substitute threat, with AI-powered platforms potentially streamlining recruitment and workforce management. The global AI in healthcare market exceeded $20 billion by 2024, highlighting the rapid integration of technologies that can reduce reliance on traditional staffing agencies.

| Substitute | Description | Impact on Staffing Demand | Market Trend (2024 Data) |

|---|---|---|---|

| Telehealth | Virtual delivery of healthcare services | Reduces need for on-site staff in certain specialties | Projected 35% of healthcare services delivered virtually |

| ASCs | Outpatient surgical facilities | Shifts demand from hospital-based surgical staff | Continued growth in ASC procedures |

| AI/Automation | Automated recruitment and management tools | Can lessen reliance on staffing intermediaries | Global AI in healthcare market > $20 billion |

Entrants Threaten

The healthcare staffing sector is burdened by substantial regulatory and compliance requirements, acting as a significant deterrent to new players. Companies must navigate intricate licensing, credentialing, and compliance standards that vary by state and medical specialty. For instance, in 2024, the average time to obtain necessary state licenses for healthcare professionals could extend several months, adding considerable upfront cost and operational delay for any new entrant attempting to establish a foothold. These complexities necessitate robust internal processes and considerable investment, effectively raising the barrier to entry.

Success in the healthcare staffing industry, including for companies like AMN Healthcare Services, is deeply rooted in cultivating strong, established networks. These networks are crucial for connecting healthcare facilities with the right talent and for attracting a consistent supply of qualified professionals. Building this trust and reach takes significant time and financial resources, creating a substantial barrier for newcomers aiming to quickly challenge established players.

AMN Healthcare's advantage lies in its extensive nationwide client base and its robust pool of job seekers, developed over years of operation. For instance, as of the first quarter of 2024, AMN Healthcare reported a diverse client base across various healthcare settings, underscoring the depth of their established relationships. This allows them to efficiently match staffing needs, a feat that new entrants would find incredibly challenging to replicate in the short term.

The threat of new entrants into the healthcare staffing market is somewhat mitigated by substantial capital requirements. New players need significant investment not just for basic recruitment infrastructure, but also for sophisticated technology platforms. This includes Vendor Management Systems (VMS), and increasingly, AI-driven tools for candidate sourcing and matching, which are crucial for competitive operation.

AMN Healthcare itself has demonstrated this commitment to technology, investing heavily in digital capabilities, including mobile applications for both clinicians and clients, and advanced data analytics. For instance, in 2023, AMN continued to enhance its technology offerings, aiming to streamline the staffing process and improve user experience, a costly but necessary endeavor for any serious competitor.

Economies of Scale and Cost Advantages of Incumbents

Established players in the healthcare staffing sector, such as AMN Healthcare Services, benefit significantly from economies of scale. This scale advantage translates into lower per-unit costs across their operations, including recruitment, onboarding, and technology infrastructure. For instance, in 2024, AMN's extensive network and operational efficiencies allow them to negotiate better terms with healthcare facilities and manage a larger volume of placements more cost-effectively than smaller, emerging competitors.

These cost advantages create a substantial barrier to entry. New entrants would struggle to match the pricing power and profitability of incumbents like AMN without achieving a comparable scale of operations. AMN's ability to absorb market volatility and fluctuations in billing rates, a common challenge for smaller firms, further solidifies its competitive position.

- Economies of Scale: AMN's large operational footprint reduces average costs in recruitment, administration, and technology.

- Cost Advantages: Incumbents can offer more competitive pricing due to their scale, hindering new entrants' profitability.

- Market Stability: Larger firms like AMN are better equipped to handle demand shifts and billing rate variations.

Emergence of Tech-Driven Platforms and Niche Players

The threat of new entrants for AMN Healthcare Services is moderately low, but evolving. While significant capital investment and established relationships typically deter new players in healthcare staffing, the emergence of tech-driven platforms is changing the landscape. These digital solutions can streamline processes like shift filling and credentialing, offering a lower-overhead model that appeals to niche markets. For instance, platforms focusing on specific specialties or geographic regions can bypass some of the traditional barriers to entry.

However, these new entrants face challenges in building the trust and comprehensive service offerings that established players like AMN provide. Scaling operations to meet the broad demands of large healthcare systems and navigating complex regulatory environments remain significant hurdles. Despite these challenges, the increasing adoption of digital tools in healthcare suggests that agile, tech-focused startups could continue to chip away at market share, particularly in specialized or less complex staffing needs.

In 2024, the digital health market continued its rapid expansion, with investment flowing into innovative staffing solutions. Companies leveraging AI for matching and blockchain for credential verification are gaining traction, although their market penetration remains relatively small compared to incumbent agencies. AMN Healthcare, with its established infrastructure and broad client base, is better positioned to adapt to these technological shifts than smaller, less resourced newcomers.

- Digital Health Platforms: Rise of tech-enabled solutions simplifying staffing processes.

- Niche Specialization: New entrants often target specific healthcare sectors or roles.

- Disruption Potential: Lower overhead and innovative technology can challenge traditional models.

- Barriers Remain: Trust, scale, and regulatory compliance are still significant challenges for newcomers.

The threat of new entrants in healthcare staffing is generally moderate, primarily due to high regulatory hurdles and the significant capital required for technology and network development. AMN Healthcare benefits from established client relationships and a large talent pool, which are difficult for newcomers to replicate quickly.

However, the rise of digital platforms and specialized staffing solutions presents a growing challenge. These tech-focused entrants can offer lower overhead and more agile services, potentially attracting niche markets. For instance, in 2024, several startups emerged focusing on specific allied health professions or travel nursing assignments, leveraging AI for faster matching and digital credentialing.

Despite these innovations, the need for extensive compliance, robust vetting processes, and building trust with healthcare providers and professionals remains a substantial barrier. AMN's scale and comprehensive service offerings provide a competitive edge that new entrants must overcome through significant investment and strategic differentiation.

| Factor | Impact on New Entrants | AMN Healthcare's Position |

| Regulatory Compliance & Licensing | High Barrier; Significant upfront cost and time | Established processes and expertise |

| Capital Requirements | High; Investment in technology (VMS, AI) and infrastructure | Economies of scale in technology investment |

| Network & Relationships | Difficult and time-consuming to build | Extensive, long-standing client and talent networks |

| Economies of Scale | New entrants lack cost advantages | Lower per-unit costs in operations and recruitment |

| Digital Innovation | Opportunity for tech-savvy entrants | Adapting and investing in digital solutions |

Porter's Five Forces Analysis Data Sources

Our AMN Healthcare Services Porter's Five Forces analysis is built upon a foundation of robust data, including AMN's annual reports, industry-specific market research from firms like IBISWorld, and regulatory filings from the SEC. This blend of primary and secondary sources allows for a comprehensive understanding of the competitive landscape.