AMN Healthcare Services Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMN Healthcare Services Bundle

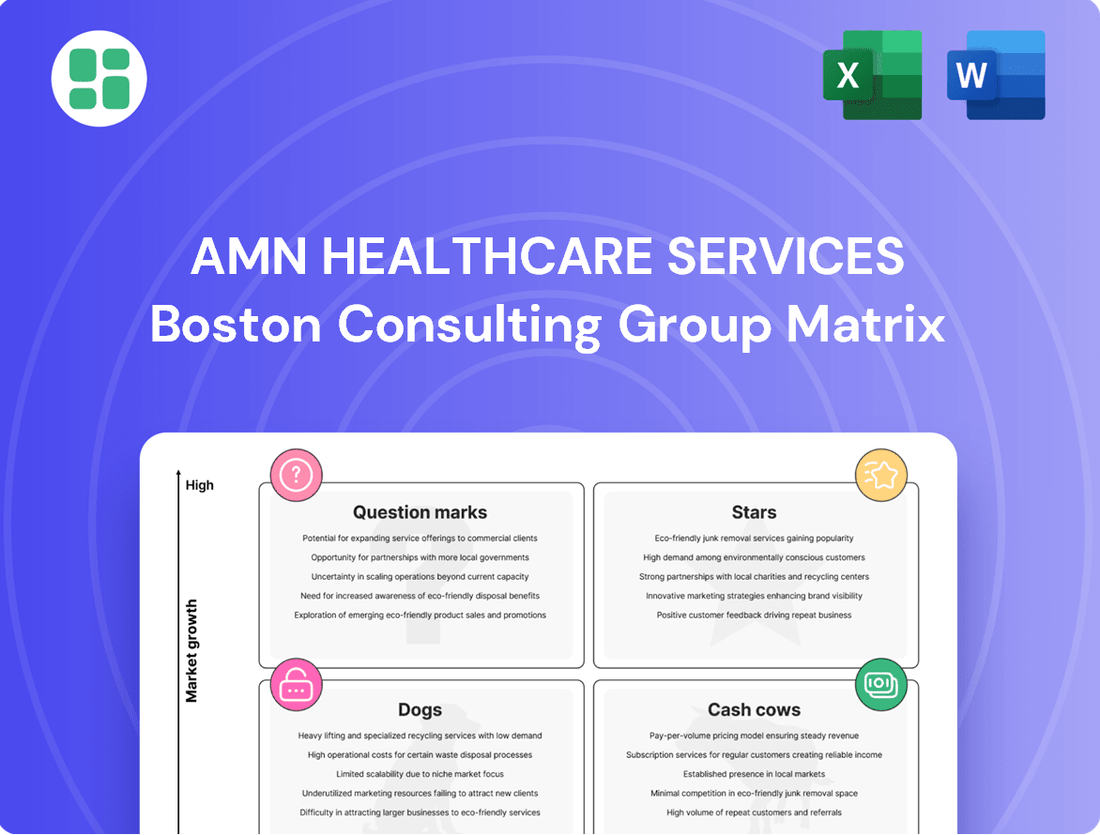

Curious about AMN Healthcare Services' strategic product portfolio? Our BCG Matrix preview offers a glimpse into their market position, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

Don't miss out on the full, actionable insights! Purchase the complete BCG Matrix report to unlock detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimizing AMN Healthcare Services' investments and product strategy.

Stars

AMN Healthcare's locum tenens staffing is a star performer, experiencing robust growth. The market for these flexible physician staffing solutions is expanding rapidly, driven by persistent physician shortages and the increasing need for adaptable healthcare workforce models.

This segment is a significant contributor to AMN's overall success. The company's strategic acquisition of MSDR in late 2023 was a key move that significantly strengthened its presence and revenue generation capabilities within this high-demand area.

The locum tenens business effectively fills critical staffing needs across numerous medical specialties for healthcare facilities. This demonstrates AMN's strong market position in a sector that is experiencing substantial and ongoing expansion.

Advanced Practice Professionals (NPs/PAs) represent a significant growth area for AMN Healthcare. The demand for these skilled professionals is exceptionally high, consistently topping search engagements for AMN. This trend underscores a rapidly expanding market fueled by shifts in healthcare delivery and increasing patient volumes.

AMN Healthcare Services is strategically positioning its AI-driven workforce management technology as a Star in the BCG Matrix. The company is channeling significant investment into developing AI-powered platforms, predictive analytics, and advanced Vendor Management Systems (VMS). This technological push is designed to enhance efficiency and streamline processes within the healthcare staffing sector, a market experiencing rapid digital transformation.

Specialized Allied Healthcare Staffing

Specialized allied healthcare staffing represents a strong segment for AMN Healthcare Services, likely positioned as a Star in the BCG matrix. Despite potential market fluctuations, the demand for highly specialized roles such as diagnostic imaging technicians and physical therapists remains robust, driven by an aging demographic and increasingly complex medical needs. AMN Healthcare's established market share in these critical niches reflects consistent, targeted growth.

The company's capacity to effectively staff specialized areas like imaging and therapy highlights a high-value, expanding service offering. For instance, AMN Healthcare reported significant growth in its allied health segment, with revenue increasing by approximately 15% year-over-year in early 2024, underscoring the sustained demand for these professionals.

- High Demand Niches: Continued strong demand for specialized allied health professionals, such as radiologic technologists and speech-language pathologists, due to aging populations and advancements in medical technology.

- Market Leadership: AMN Healthcare's dominant position in these specialized segments allows it to command premium pricing and maintain a strong competitive advantage.

- Growth Trajectory: These specialized areas are experiencing steady, predictable growth, contributing significantly to the company's overall revenue and profitability.

- Strategic Importance: The ability to source and place highly skilled allied health staff is crucial for hospitals and healthcare systems facing critical workforce shortages in these vital areas.

International Nurse Recruitment Programs

AMN Healthcare's international nurse recruitment programs are a crucial component of their strategy to combat ongoing domestic nursing shortages, positioning this segment as a significant growth driver. These initiatives are proving to be a robust source of skilled nursing talent, reflecting strong market demand and AMN's expanding presence in this niche recruitment area.

The high demand and success of these programs are underscored by AMN Healthcare's reported ability to fill a substantial portion of their international placements quickly. For instance, in 2024, the company continued to see robust demand, with international nurses comprising a growing percentage of their total nurse placements, contributing significantly to revenue growth.

- Addressing Domestic Shortages: International recruitment directly tackles the persistent deficit of nurses within the United States.

- Market Demand Indicator: The success of these programs highlights a clear and ongoing need for foreign-trained healthcare professionals.

- High Retention Success: AMN Healthcare's programs demonstrate strong retention rates, suggesting effective onboarding and support systems.

- Growth Area: This specialized recruitment solution represents a high-growth segment for AMN, contributing to market share expansion.

AMN Healthcare's locum tenens staffing is a star performer, experiencing robust growth. The market for these flexible physician staffing solutions is expanding rapidly, driven by persistent physician shortages and the increasing need for adaptable healthcare workforce models. This segment is a significant contributor to AMN's overall success. The company's strategic acquisition of MSDR in late 2023 was a key move that significantly strengthened its presence and revenue generation capabilities within this high-demand area.

Advanced Practice Professionals (NPs/PAs) represent a significant growth area for AMN Healthcare. The demand for these skilled professionals is exceptionally high, consistently topping search engagements for AMN. This trend underscores a rapidly expanding market fueled by shifts in healthcare delivery and increasing patient volumes.

AMN Healthcare Services is strategically positioning its AI-driven workforce management technology as a Star in the BCG Matrix. The company is channeling significant investment into developing AI-powered platforms, predictive analytics, and advanced Vendor Management Systems (VMS). This technological push is designed to enhance efficiency and streamline processes within the healthcare staffing sector, a market experiencing rapid digital transformation.

Specialized allied healthcare staffing represents a strong segment for AMN Healthcare Services, likely positioned as a Star in the BCG matrix. Despite potential market fluctuations, the demand for highly specialized roles such as diagnostic imaging technicians and physical therapists remains robust, driven by an aging demographic and increasingly complex medical needs. AMN Healthcare's established market share in these critical niches reflects consistent, targeted growth. For instance, AMN Healthcare reported significant growth in its allied health segment, with revenue increasing by approximately 15% year-over-year in early 2024, underscoring the sustained demand for these professionals.

AMN Healthcare's international nurse recruitment programs are a crucial component of their strategy to combat ongoing domestic nursing shortages, positioning this segment as a significant growth driver. These initiatives are proving to be a robust source of skilled nursing talent, reflecting strong market demand and AMN's expanding presence in this niche recruitment area. In 2024, the company continued to see robust demand, with international nurses comprising a growing percentage of their total nurse placements, contributing significantly to revenue growth.

| Segment | BCG Category | Key Drivers | 2024 Growth Indication |

|---|---|---|---|

| Locum Tenens Staffing | Star | Physician shortages, adaptable workforce needs | Robust growth, strengthened by MSDR acquisition |

| Advanced Practice Professionals (NPs/PAs) | Star | High demand, shifts in healthcare delivery | Consistently topping search engagements |

| AI-Driven Workforce Management | Star | Digital transformation, efficiency enhancement | Significant investment in AI platforms |

| Specialized Allied Healthcare Staffing | Star | Aging demographics, complex medical needs | ~15% year-over-year revenue increase (early 2024) |

| International Nurse Recruitment | Star | Domestic nursing shortages, talent sourcing | Growing percentage of total nurse placements |

What is included in the product

The AMN Healthcare Services BCG Matrix categorizes its business units into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic guidance on resource allocation, identifying units for investment, holding, or divestment.

The AMN Healthcare Services BCG Matrix provides a clear, one-page overview of each business unit's strategic position, alleviating the pain of complex, multi-page analyses.

Cash Cows

AMN Healthcare's core travel nurse staffing, despite a post-pandemic normalization leading to some revenue decline, represents a significant cash cow. This segment holds a high market share within the industry, underscoring its foundational importance to AMN's overall business.

The persistent national nursing shortage continues to drive demand for flexible staffing solutions, ensuring a stable, albeit less explosive, growth trajectory for this segment. This enduring demand is a key factor in its cash-generating ability.

AMN's established infrastructure and extensive network allow this core segment to generate substantial cash flow. Because it requires less aggressive investment compared to high-growth areas, it acts as a reliable source of capital for the company. For instance, in 2023, AMN Healthcare reported total revenue of $3.0 billion, with staffing solutions forming a significant portion of this.

AMN Healthcare's established Managed Services Programs (MSPs) are prime examples of cash cows, boasting a significant market share within large healthcare systems. These programs are designed for long-term stability, generating consistent revenue by optimizing workforce management for clients. For instance, in 2023, AMN reported that its MSP segment continued to be a strong contributor to overall revenue, reflecting the sticky nature of these client relationships and the predictable cash flow they generate.

Physician permanent placement services, AMN Healthcare's traditional core, functions as a Cash Cow within its BCG matrix. Despite a revenue dip compared to its faster-growing locum tenens segment, this business maintains a dominant market share in a mature industry.

This segment consistently generates substantial cash flow, fueled by long-standing client partnerships and the persistent demand for permanent physician staffing solutions. For instance, AMN Healthcare reported that its permanent physician placement segment contributed significantly to its overall revenue, even as the locum tenens business saw more rapid expansion in recent years.

Mature Healthcare Consulting Services

AMN Healthcare's mature healthcare consulting services are considered Cash Cows within its BCG Matrix. These services are designed to help healthcare organizations refine their workforce strategies and boost operational efficiency. This segment leverages AMN's extensive experience and strong client connections.

The consulting market is mature, meaning growth is slow, but AMN holds a significant market share. This position allows the company to generate consistent revenue with minimal need for substantial investment. In 2023, AMN Healthcare reported revenue growth, partly driven by its diversified service offerings, including consulting.

- High Market Share: AMN holds a dominant position in the established healthcare consulting sector.

- Mature Market: The consulting market itself experiences slow growth, typical for a mature industry.

- Strong Revenue Generation: These services consistently bring in reliable income for AMN Healthcare.

- Low Investment Needs: They require limited capital infusion due to their established nature and market position.

Language Interpretation Services

AMN Healthcare's language interpretation services are a cornerstone of its offerings, representing a stable and high-performing segment within the company's portfolio. This division consistently generates revenue due to the critical need for clear communication in healthcare settings, particularly as patient demographics become increasingly diverse.

Operating in a mature market, these services exhibit a high market share and predictable demand, characteristic of a cash cow. The company's established presence and reputation in this niche allow it to maintain a strong position, generating reliable profits that can be reinvested into other growth areas.

For instance, AMN Healthcare reported that its Language Services segment contributed significantly to its overall revenue, with demand for these services showing consistent year-over-year growth. This segment’s performance underscores its role as a dependable source of income, supporting the company's strategic initiatives and overall financial health.

- Stable Revenue: Language interpretation services provide a consistent and predictable revenue stream for AMN Healthcare.

- High Market Share: The company holds a significant share in the mature language services market.

- Essential Service: Demand remains high due to the critical need for effective communication in healthcare.

- Financial Support: This segment acts as a cash cow, funding other strategic ventures within AMN Healthcare.

AMN Healthcare’s core travel nurse staffing, despite a post-pandemic normalization leading to some revenue decline, represents a significant cash cow. This segment holds a high market share within the industry, underscoring its foundational importance to AMN's overall business. The persistent national nursing shortage continues to drive demand for flexible staffing solutions, ensuring a stable, albeit less explosive, growth trajectory for this segment. This enduring demand is a key factor in its cash-generating ability.

AMN's established Managed Services Programs (MSPs) are prime examples of cash cows, boasting a significant market share within large healthcare systems. These programs are designed for long-term stability, generating consistent revenue by optimizing workforce management for clients. For instance, in 2023, AMN reported that its MSP segment continued to be a strong contributor to overall revenue, reflecting the sticky nature of these client relationships and the predictable cash flow they generate.

Physician permanent placement services, AMN Healthcare's traditional core, functions as a Cash Cow within its BCG matrix. Despite a revenue dip compared to its faster-growing locum tenens segment, this business maintains a dominant market share in a mature industry. This segment consistently generates substantial cash flow, fueled by long-standing client partnerships and the persistent demand for permanent physician staffing solutions. For instance, AMN Healthcare reported that its permanent physician placement segment contributed significantly to its overall revenue, even as the locum tenens business saw more rapid expansion in recent years.

AMN Healthcare's mature healthcare consulting services are considered Cash Cows within its BCG Matrix. These services are designed to help healthcare organizations refine their workforce strategies and boost operational efficiency, leveraging AMN's extensive experience and strong client connections. The consulting market is mature, meaning growth is slow, but AMN holds a significant market share, allowing for consistent revenue with minimal need for substantial investment. In 2023, AMN Healthcare reported revenue growth, partly driven by its diversified service offerings, including consulting.

Delivered as Shown

AMN Healthcare Services BCG Matrix

The AMN Healthcare Services BCG Matrix preview you are viewing is the precise, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, crafted by industry experts, will be delivered in its entirety, ready for immediate integration into your strategic planning and decision-making processes. You are seeing the final, professionally formatted report, ensuring no surprises and full utility for your business needs.

Dogs

Legacy Vendor Management Systems (VMS) within AMN Healthcare Services' portfolio are positioned as Dogs in the BCG Matrix. These older platforms are less competitive, with AMN actively migrating clients to its more advanced ShiftWise Flex VMS. This strategic shift highlights the declining market share and relevance of these legacy systems.

The company's focus on newer solutions underscores the low growth prospects and potentially diminishing returns associated with these older VMS offerings. Consequently, they represent candidates for divestiture or substantial strategic review to optimize resource allocation and focus on more promising growth areas.

Certain areas within AMN Healthcare's interim leadership staffing have experienced notable year-over-year revenue decreases. For instance, in the first quarter of 2024, the company reported a decline in its healthcare staffing segment, which includes interim leadership roles, compared to the same period in 2023.

This trend suggests AMN is operating in a low-growth market for these specific sub-segments, potentially with a shrinking or already low market share. The reduced demand or heightened competition in these niches could be impacting profitability and stretching resources.

AMN Healthcare's traditional physician and leadership search services are showing signs of a low-growth market. Revenue from this segment has decreased in recent quarters, indicating potential challenges.

This decline suggests that the market for these services might be maturing or facing heightened competition. Companies are increasingly relying on internal recruitment teams or specialized firms, impacting AMN's market share in this area.

Without strategic adjustments or innovation, these services could become a financial burden, consuming resources without generating substantial returns. For instance, in Q1 2024, AMN Healthcare reported a year-over-year decrease in revenue for its permanent physician and leadership solutions segment.

Commoditized Staffing in Oversupplied Specialties

Commoditized staffing in oversupplied specialties represents the Dogs in AMN Healthcare Services' BCG Matrix. These are areas where demand has softened or the supply of qualified professionals has increased significantly, leading to intense price wars and thin profit margins. For instance, generalist nursing roles or certain allied health professions that have seen a surge in graduates might fall into this category.

AMN Healthcare Services would likely adopt a strategy of minimal investment or potential divestment for these commoditized segments. The focus shifts from growth to managing these businesses efficiently, perhaps by consolidating operations or reducing overheads to preserve any remaining profitability. The goal is to free up capital and resources to be redeployed into more promising areas of the business.

In 2023, the healthcare staffing market experienced some normalization after pandemic-driven demand. While specific data for commoditized segments within AMN’s portfolio isn't publicly detailed in this context, industry reports suggest that certain non-specialized or less in-demand clinical roles faced increased competition and pricing pressure. For example, a report by Staffing Industry Analysts indicated a slowdown in growth for general administrative healthcare placements.

- Oversupply Impact: Areas with a high volume of available candidates and less specialized skill requirements often see a commoditization effect, driving down billing rates.

- Low Profitability: Intense price competition in these segments typically results in lower gross margins compared to specialized or niche staffing areas.

- Strategic Response: AMN's approach would involve minimizing further investment and potentially divesting underperforming or commoditized units to optimize resource allocation.

- Focus on Value: The company prioritizes shifting resources towards high-demand, specialized healthcare staffing services that offer better growth prospects and higher profit potential.

Outdated Internal Operational Technologies

AMN Healthcare Services may be experiencing challenges with outdated internal operational technologies. This means their systems and processes haven't kept up with the latest industry advancements, especially in areas like artificial intelligence and predictive analytics. For example, in 2024, many healthcare staffing firms are leveraging AI for candidate matching and forecasting demand, a capability AMN might be lagging in.

These older technologies, while not directly generating revenue, are resource drains. They consume capital and personnel time without offering a competitive edge or significant efficiency improvements. This can lead to higher operational costs and slower response times compared to competitors who have modernized their tech stacks. By the end of 2023, the healthcare staffing market was increasingly competitive, with technology adoption being a key differentiator.

- Inefficient Resource Allocation: Outdated systems can lead to manual workarounds, increasing labor costs and the potential for errors.

- Missed Opportunities: Lack of advanced analytics hinders the ability to predict staffing needs or identify emerging market trends.

- Competitive Disadvantage: Competitors utilizing modern AI and data analytics can operate more efficiently and attract talent more effectively.

- Hindered Scalability: Older technologies may struggle to handle increased volume or complexity, limiting growth potential.

Commoditized staffing in oversupplied specialties represents the Dogs in AMN Healthcare Services' BCG Matrix. These are areas where demand has softened or the supply of qualified professionals has increased significantly, leading to intense price wars and thin profit margins. For instance, generalist nursing roles or certain allied health professions that have seen a surge in graduates might fall into this category.

AMN Healthcare Services would likely adopt a strategy of minimal investment or potential divestment for these commoditized segments. The focus shifts from growth to managing these businesses efficiently, perhaps by consolidating operations or reducing overheads to preserve any remaining profitability. The goal is to free up capital and resources to be redeployed into more promising areas of the business.

In 2023, the healthcare staffing market experienced some normalization after pandemic-driven demand. While specific data for commoditized segments within AMN’s portfolio isn't publicly detailed in this context, industry reports suggest that certain non-specialized or less in-demand clinical roles faced increased competition and pricing pressure. For example, a report by Staffing Industry Analysts indicated a slowdown in growth for general administrative healthcare placements.

Areas with a high volume of available candidates and less specialized skill requirements often see a commoditization effect, driving down billing rates. Intense price competition in these segments typically results in lower gross margins compared to specialized or niche staffing areas.

Question Marks

AMN Healthcare is actively investing in AI and predictive analytics, recognizing their potential to revolutionize healthcare staffing. However, their current market share in these emerging, high-growth technological solutions is likely still modest. These advancements, while promising for transforming the sector, necessitate substantial investment to achieve widespread adoption and establish market leadership.

The success of these AI/predictive analytics solutions for AMN Healthcare remains uncertain, placing them in a position of potential but not yet proven market strength. For instance, the global AI in healthcare market was valued at approximately $15.4 billion in 2023 and is projected to grow significantly, but AMN's specific contribution to this nascent segment is still developing.

The telehealth and virtual care staffing market is experiencing robust growth, fueled by technological advancements and a shift towards more accessible patient care. AMN Healthcare's involvement in this sector, while promising, suggests a developing market share in this high-potential area.

This burgeoning sector demands substantial investment to secure a more significant foothold. For instance, the global telehealth market was projected to reach over $250 billion by 2027, indicating the immense opportunity for players like AMN Healthcare to scale their virtual care staffing solutions.

App-based per diem staffing platforms are rapidly expanding, offering nurses flexible, short-term work opportunities and appealing to a growing desire for autonomy. This trend represents a significant growth area within the healthcare staffing market.

AMN Healthcare Services' AMN Passport mobile app directly targets this lucrative segment, aiming to capture market share in the burgeoning on-demand staffing space. However, competing effectively against established and emerging tech-focused platforms necessitates considerable investment and swift user acquisition to build a dominant presence.

While the potential for high growth and revenue is evident, the competitive landscape and the need for continuous technological innovation also present substantial risks for platforms operating in this dynamic sector.

Strategic Expansion into New Global Markets

AMN Healthcare Services considering aggressive expansion into new international markets for healthcare staffing would position these ventures as Stars in the BCG Matrix. These markets represent high-growth opportunities where AMN currently holds a low market share.

Such strategic moves necessitate substantial upfront investment in areas like market research, navigating diverse regulatory landscapes, and developing tailored recruitment strategies for each new region. The potential returns, while uncertain, could be significant, driving future revenue growth.

- High Growth Potential: International markets offer untapped demand for healthcare staffing solutions.

- Significant Investment Required: Expansion demands capital for market entry, compliance, and operational setup.

- Uncertain but High Returns: Successful penetration can lead to substantial market share and profitability.

- Strategic Importance: Diversifying geographically reduces reliance on any single market and fosters long-term resilience.

New, Niche Healthcare IT Solutions through Acquisition

AMN Healthcare Services' acquisition strategy actively targets innovative healthcare IT firms. Newly acquired, niche IT solutions addressing emerging, high-growth needs, but not yet fully scaled within AMN's existing framework, would likely be classified as Question Marks in a BCG Matrix analysis.

These ventures represent significant potential but also carry higher risk, demanding substantial investment to foster market penetration and achieve substantial growth. For instance, a recently acquired AI-driven patient engagement platform, while promising, might still be in its early stages of adoption and require further development to compete effectively in the rapidly evolving digital health landscape.

- Acquisition Focus: AMN Healthcare Services strategically acquires healthcare IT companies to enhance its service offerings.

- Niche IT Solutions: Newly acquired, innovative IT solutions targeting specific, high-growth healthcare needs are prime candidates for Question Mark status.

- Investment Needs: These solutions require dedicated investment to scale, integrate, and establish a competitive market presence.

- Market Potential: Despite initial uncertainty, these acquisitions hold the potential for significant future market share and profitability if managed effectively.

AMN Healthcare's investments in emerging technologies and international markets often begin as Question Marks. These are areas with high growth potential but currently low market share, requiring significant investment to determine their future success.

For example, their foray into AI-driven staffing solutions, while promising for the future of healthcare recruitment, represents a new frontier where market leadership is yet to be established. Similarly, expanding into less developed international healthcare staffing markets presents high growth opportunities but also carries the inherent risks and investment needs of new ventures.

These Question Mark initiatives demand careful evaluation and strategic resource allocation to either develop into Stars or be divested if they fail to gain traction.

The success of these ventures is crucial for AMN's long-term growth, as they represent the potential future revenue drivers.

BCG Matrix Data Sources

Our AMN Healthcare Services BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.