Amkor Technology PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amkor Technology Bundle

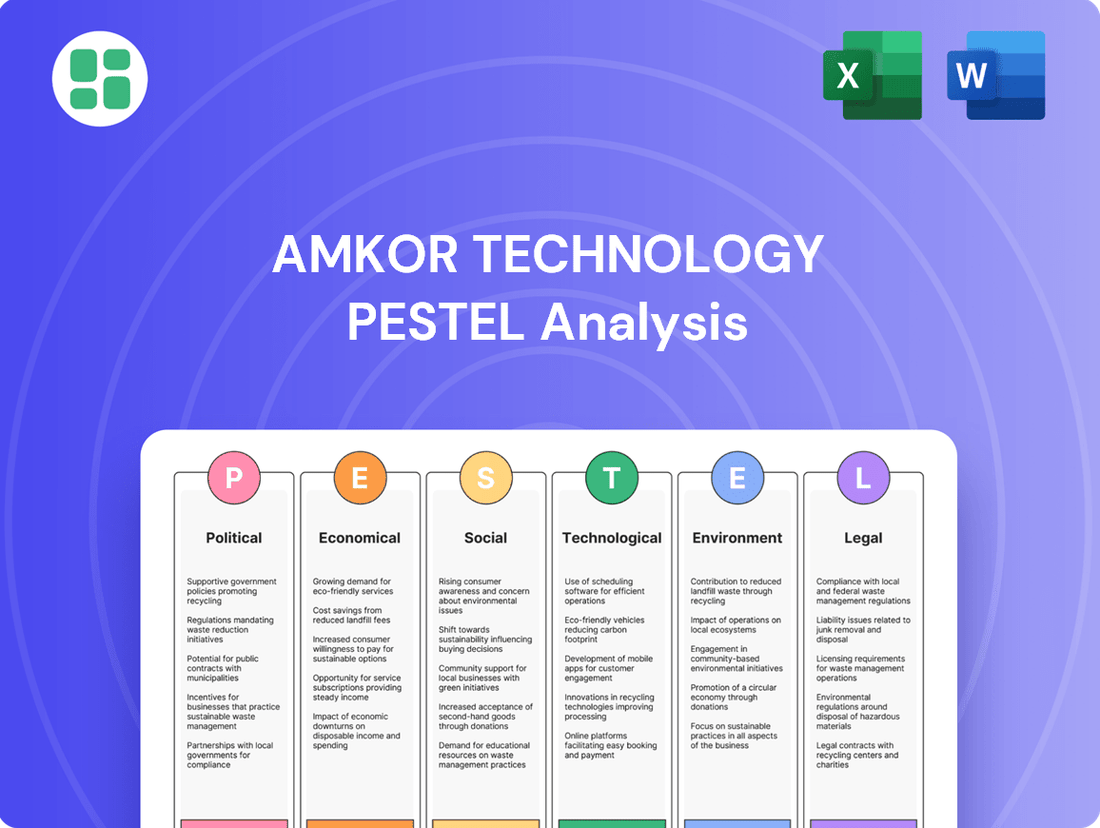

Unlock the critical external factors shaping Amkor Technology's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play, and how they present both opportunities and threats. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full report now for an in-depth understanding.

Political factors

The ongoing US-China trade friction and wider geopolitical instability are significantly reshaping the semiconductor industry, pushing nations toward 'tech sovereignty' and bolstering domestic manufacturing. This trend manifests in export controls on advanced computing goods and semiconductor manufacturing equipment, directly influencing Amkor's global operations and its customer relationships.

Amkor Technology, operating a distributed manufacturing network across Asia, Europe, and the USA, must adeptly manage these intricate trade limitations and the potential imposition of tariffs. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) has continued to implement export controls on certain advanced technologies, impacting the flow of critical components and manufacturing tools. In 2023, global semiconductor trade faced headwinds due to these restrictions, with estimates suggesting a potential impact on market access for companies with extensive international supply chains.

Governments globally are actively promoting domestic semiconductor production through significant subsidies and incentives. The United States CHIPS and Science Act, for instance, is a prime example, aiming to strengthen the nation's chip manufacturing capabilities and lessen dependence on overseas suppliers. Amkor Technology has already benefited from this initiative, securing CHIPS Act funding to bolster its U.S. manufacturing sites.

These government programs directly impact Amkor's strategic planning. They can influence decisions regarding capital investments, the expansion of production facilities, and the formation of new strategic alliances. This financial support encourages a shift towards more localized manufacturing operations, potentially reshaping Amkor's global production footprint.

Semiconductors are now recognized as vital national security assets, prompting governments worldwide to bolster supply chain resilience. This strategic shift directly affects outsourced semiconductor assembly and test (OSAT) providers like Amkor Technology.

Governments are actively encouraging diversification of manufacturing and increased domestic chip production. For instance, the US CHIPS and Science Act, enacted in 2022, allocated $52.7 billion to boost domestic semiconductor manufacturing and research, aiming to reduce reliance on overseas production, particularly from East Asia.

This emphasis on secure and trusted supply chains, especially for critical sectors like defense and aerospace, creates both opportunities and challenges for Amkor. Companies are increasingly scrutinizing their supply chain partners to ensure compliance with national security standards and geopolitical stability.

Political Stability in Key Operating Regions

Amkor Technology's extensive manufacturing footprint, particularly in Asia, makes political stability in its key operating regions paramount. Unforeseen political unrest or abrupt shifts in regulatory frameworks in countries like South Korea, Taiwan, and Malaysia could significantly impede Amkor's operations, affecting everything from supply chains to workforce access. For instance, in 2024, geopolitical tensions in East Asia remained a focal point, necessitating robust contingency planning for companies with significant investments in the region.

Maintaining strong, collaborative relationships with host governments is a critical aspect of Amkor's strategy to ensure business continuity. Understanding and navigating local political landscapes allows Amkor to proactively address potential disruptions and foster a stable operating environment. This proactive approach is vital in regions where government policies on foreign investment, labor laws, and environmental regulations can change, impacting operational costs and efficiency.

The semiconductor industry, where Amkor is a major player, is particularly sensitive to political factors. Government incentives for domestic chip manufacturing, trade policies, and national security concerns related to technology supply chains can all influence market dynamics. For example, ongoing global discussions around semiconductor supply chain resilience, spurred by events in 2023 and continuing into 2024, highlight the direct impact of political decisions on the sector.

- Geopolitical Risk: Continued monitoring of geopolitical developments in East Asia is essential, as tensions could impact trade routes and manufacturing operations.

- Regulatory Compliance: Adherence to evolving labor, environmental, and trade regulations in operating countries is crucial for avoiding penalties and operational disruptions.

- Government Relations: Proactive engagement with government bodies in key manufacturing hubs like South Korea and Malaysia helps secure favorable operating conditions.

- Trade Policy Impact: Changes in international trade agreements or tariffs could affect the cost of raw materials and the competitiveness of Amkor's services.

Export Controls and Regulations

Strict export controls on advanced semiconductor technology, especially those targeting specific nations, directly impact Amkor's global customer reach. For instance, U.S. Bureau of Industry and Security (BIS) regulations require meticulous compliance for international sales and technology transfers. Amkor must remain agile, constantly adjusting its operations to align with shifting global trade laws.

These evolving regulations can influence Amkor's supply chain and market access. The semiconductor industry, a key sector for Amkor, is particularly sensitive to geopolitical tensions and trade policies. Compliance with these controls is paramount, affecting Amkor's ability to engage with certain markets and customers, potentially impacting revenue streams.

- Export Control Impact: Amkor's reliance on global markets means adherence to regulations like those from the U.S. BIS is critical for maintaining operational continuity and market access.

- Geopolitical Sensitivity: The semiconductor sector is inherently tied to international relations, making Amkor susceptible to policy shifts that can affect its business operations and strategic partnerships.

- Compliance Costs: Navigating and adhering to complex export control frameworks incurs significant compliance costs, requiring dedicated resources and continuous monitoring of regulatory changes.

Global governments are increasingly prioritizing domestic semiconductor manufacturing, driven by national security concerns and a desire for supply chain resilience. This trend, exemplified by initiatives like the US CHIPS and Science Act (which allocated $52.7 billion to boost domestic chip production and research), directly influences Amkor's investment and operational strategies. The ongoing US-China trade friction and broader geopolitical instability necessitate careful navigation of export controls and potential tariffs, impacting Amkor's global operations and customer relationships.

Amkor's extensive manufacturing footprint across Asia, Europe, and the USA means political stability in its key operating regions is paramount. For instance, geopolitical tensions in East Asia in 2024 highlighted the need for robust contingency planning. Proactive engagement with host governments in manufacturing hubs like South Korea and Malaysia is crucial for securing favorable operating conditions and ensuring business continuity amidst evolving labor, environmental, and trade regulations.

| Factor | Impact on Amkor | Example/Data Point |

| Government Subsidies | Encourages domestic manufacturing expansion, influencing capital investment decisions. | US CHIPS Act: $52.7 billion allocated to boost domestic semiconductor manufacturing and research. |

| Export Controls | Restricts market access and technology transfers, requiring meticulous compliance. | US BIS regulations impact international sales and technology transfers for advanced computing goods. |

| Geopolitical Instability | Threatens supply chain continuity and workforce access in key operating regions. | Geopolitical tensions in East Asia in 2024 necessitated contingency planning for companies with significant regional investments. |

| Trade Policy Changes | Can affect raw material costs and the competitiveness of Amkor's services. | Ongoing global discussions on semiconductor supply chain resilience in 2023-2024 highlight the direct impact of political decisions. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Amkor Technology, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights for strategic decision-making, helping stakeholders identify emerging threats and capitalize on opportunities within the semiconductor packaging industry.

A clear, actionable PESTLE analysis for Amkor Technology streamlines strategic decision-making by highlighting key external factors, thus alleviating the pain of navigating complex market dynamics.

Economic factors

The global semiconductor market is on a strong upward trajectory, with projections indicating it will hit $697 billion by 2025. This significant expansion is largely fueled by the surging demand for chips powering artificial intelligence (AI) and high-performance computing (HPC) applications.

This overall market growth acts as a powerful tailwind for Amkor Technology, a key player in the outsourced semiconductor assembly and test (OSAT) sector. As demand for advanced packaging and testing services escalates across diverse industries, Amkor is well-positioned to capitalize on these trends.

Demonstrating its resilience and market position, Amkor reported net sales of $6.32 billion in 2024. While some sectors experienced downturns, the company saw robust growth in its computing end market, which helped to balance out declines in other areas.

Rising inflation and increasing operational costs, particularly for labor, energy, and essential raw materials, present a significant headwind for Amkor Technology's profitability. These pressures directly impact the cost of producing advanced packaging solutions.

Despite the semiconductor industry's general resilience, effectively managing these escalating costs is paramount for Amkor to sustain healthy profit margins. This is especially true considering the substantial investments required for research and development and the capital expenditures associated with cutting-edge packaging technologies.

For instance, the Producer Price Index for manufactured goods saw a notable increase in late 2023 and early 2024, reflecting broader inflationary trends that affect input costs across various industries, including semiconductors. Strategic supply chain optimization and continuous efficiency enhancements are therefore critical strategies for Amkor to navigate and mitigate these persistent cost pressures.

As a global company with operations and customers worldwide, Amkor Technology is significantly exposed to currency exchange rate fluctuations. These shifts can directly influence the company's reported revenues and costs across different operating regions.

In 2024, Amkor experienced a positive impact from foreign currency exchange movements, which contributed to an improvement in its gross margin. For instance, a stronger US dollar against other currencies can make Amkor's products more expensive for international buyers, potentially impacting sales volume.

Conversely, significant unfavorable shifts in exchange rates, such as a weakening US dollar, can reduce the value of foreign earnings when translated back into dollars, thereby impacting overall financial performance and profitability.

Demand from Key End Markets

Amkor Technology's performance is closely tied to the health of its diverse end markets, which span communications, consumer electronics, automotive, and industrial sectors. While certain areas experienced headwinds in 2024, the company saw significant strength in others.

The computing market, in particular, was a standout for Amkor in 2024. This surge was fueled by robust demand for ARM-based personal computers and the rapidly expanding market for Artificial Intelligence (AI) devices. This segment alone contributed to record revenue for Amkor, underscoring its critical role.

Looking ahead to 2025, Amkor is well-positioned to benefit from several key growth drivers. The continued expansion of AI technologies, the proliferation of the Internet of Things (IoT), the rollout of 5G and future 6G networks, and the increasing sophistication of automotive electronics are all expected to sustain and elevate the demand for advanced semiconductor packaging services.

- Computing Market Strength: Record revenue in 2024 driven by ARM-based PCs and AI devices.

- Sectoral Performance: Weakness in automotive and industrial sectors in 2024 contrasted with computing strength.

- 2025 Growth Catalysts: AI, IoT, 5G/6G, and automotive electronics are projected to boost demand for packaging.

- Market Diversification: Amkor's presence across communications, consumer, automotive, and industrial markets provides a broad base for growth.

Capital Expenditure and Investment Cycles

The semiconductor sector demands substantial capital for technological advancements and capacity growth. Amkor Technology's strategy emphasizes significant capital expenditure in advanced packaging technologies and expanding its global presence.

The company's ability to finance these crucial investments, bolstered by robust cash flow and strategic support such as the CHIPS Act, is paramount for sustained growth and maintaining a competitive edge in the market.

- Capital Intensity: The semiconductor industry is inherently capital-intensive, with companies like Amkor needing to consistently reinvest in R&D and manufacturing capabilities.

- Amkor's Investment Strategy: Amkor is actively investing in advanced packaging solutions and broadening its manufacturing footprint across key regions to meet growing demand.

- Funding and Growth: Access to capital, whether through operational cash flow or government initiatives like the CHIPS Act, is vital for Amkor to fund its expansion and technological upgrades, directly impacting its future market position.

Economic factors present a mixed landscape for Amkor Technology. While the global semiconductor market is projected to reach $697 billion by 2025, driven by AI and HPC, rising inflation and operational costs are a significant headwind.

These cost pressures, particularly for labor and raw materials, directly impact Amkor's profitability, necessitating strategic supply chain optimization. Currency fluctuations also play a role, with favorable movements noted in 2024 contributing positively to gross margins, though unfavorable shifts can reduce foreign earnings.

Amkor's 2024 performance highlights the impact of economic trends, with strong growth in the computing sector, driven by AI devices and ARM-based PCs, offsetting weaknesses elsewhere. This sector contributed to record revenue, showcasing the company's ability to adapt to market dynamics.

What You See Is What You Get

Amkor Technology PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Amkor Technology PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain actionable insights into the external forces shaping Amkor's strategic landscape.

Sociological factors

The semiconductor industry is grappling with a significant skilled labor shortage, with projections indicating a need for over one million new skilled workers by 2030. This talent gap, especially in critical fields like advanced packaging and artificial intelligence, directly impacts Amkor Technology's ability to secure and keep the specialized engineers and technicians essential for its operations.

To combat this, companies are heavily investing in workforce development initiatives. These programs aim to upskill existing employees and attract new talent by emphasizing career growth opportunities and offering greater workplace flexibility, crucial factors for retaining a competitive workforce in 2024 and beyond.

The semiconductor industry, including companies like Amkor, is navigating a significant shift in workforce expectations. A growing demand for flexible work arrangements, such as remote or hybrid models, is becoming a key factor in employee satisfaction and retention. This trend directly impacts Amkor's ability to attract and keep skilled professionals in a highly competitive global market.

Data indicates a rising employee turnover rate within the semiconductor sector, with a notable 15% increase observed in 2024 according to industry reports. Key drivers for this turnover include a perceived lack of clear career development pathways and the limited availability of flexible work options, underscoring the need for companies like Amkor to proactively address these evolving employee needs to maintain a stable and engaged workforce.

Consumers increasingly want smaller, more powerful, and energy-efficient gadgets. This desire, spurred by advancements like AI, 5G, and the Internet of Things, directly boosts the need for Amkor's sophisticated packaging technologies. For instance, the global smartphone market, a key driver of advanced electronics, saw shipments reach approximately 1.17 billion units in 2023, with a significant portion demanding these cutting-edge components.

The constant upgrade cycle in consumer electronics, particularly with AI features becoming standard, is a strong tailwind for semiconductor demand. This ongoing evolution necessitates that Amkor consistently develops innovative packaging solutions to meet the performance and miniaturization requirements of the next generation of devices.

Social Responsibility and Ethical Sourcing

Amkor Technology, like many global manufacturers, faces increasing pressure from consumers and investors regarding social responsibility and ethical sourcing. This societal shift means companies must demonstrate a genuine commitment to fair labor practices, environmental stewardship, and transparent supply chains. For Amkor, this translates into rigorous adherence to its Code of Conduct and proactive efforts to ensure its suppliers also uphold high ethical standards. A strong track record in these areas is not just about compliance; it's crucial for maintaining stakeholder trust and a positive brand image in a competitive market.

The company's commitment to these principles is reflected in its ongoing efforts to integrate sustainability into its operations. For instance, in 2023, Amkor reported progress on its environmental, social, and governance (ESG) initiatives, highlighting investments in energy efficiency and waste reduction programs. These actions directly address growing societal expectations for businesses to operate responsibly and ethically. Such initiatives are vital for building long-term resilience and attracting investment from ESG-focused funds, which are increasingly influential in financial markets.

- Ethical Conduct: Amkor's Code of Conduct outlines its commitment to integrity, respect, and compliance with all applicable laws and regulations, forming the bedrock of its social responsibility framework.

- Supply Chain Transparency: The company actively works to ensure ethical sourcing by engaging with its suppliers to promote responsible labor and environmental practices throughout the value chain.

- Stakeholder Trust: Maintaining a robust reputation for social responsibility is paramount for fostering trust with customers, employees, investors, and the communities in which Amkor operates.

- ESG Reporting: Amkor's ESG reports, such as those released in 2023 and anticipated for 2024, provide stakeholders with data on its performance in areas like carbon emissions reduction and employee well-being, demonstrating accountability.

Impact of Automation and AI on Employment

The semiconductor industry, including OSAT providers like Amkor, is increasingly integrating AI and automation to boost manufacturing efficiency. This technological shift, however, necessitates a workforce adept at new skills, potentially impacting roles focused on manual processes. By 2025, it's projected that AI will contribute significantly to global GDP, underscoring the need for workforce adaptation.

Amkor must strategically manage this transition by investing in upskilling and reskilling programs. The industry's pivot towards R&D-intensive and AI-driven design models means that human capital development is crucial for maintaining a competitive edge. For instance, the demand for AI specialists in manufacturing is expected to rise sharply in the coming years.

- Workforce Skill Shift: Automation and AI adoption in semiconductor manufacturing will require a workforce with enhanced digital literacy and analytical capabilities, moving away from purely manual labor.

- Employment Level Impact: Certain roles may see reduced demand due to automation, necessitating proactive workforce planning and transition support from companies like Amkor.

- Industry Transition: The move towards R&D-heavy and AI-driven design models highlights the growing importance of intellectual capital and specialized technical expertise within the OSAT sector.

- Upskilling Imperative: Amkor's ability to adapt will depend on its investment in training and development to equip its employees with the skills needed for the evolving technological landscape.

The semiconductor industry faces a critical skills gap, with projections showing a need for over a million new skilled workers by 2030, directly impacting Amkor's ability to recruit specialized talent. Companies are responding by investing heavily in workforce development and offering greater flexibility, crucial for retaining employees in 2024. This focus on employee well-being and career growth is vital as industry reports indicate a 15% increase in employee turnover in 2024, often linked to a lack of clear career paths and flexible work options.

Consumer demand for smaller, more powerful, and energy-efficient devices, driven by AI and 5G, directly fuels the need for Amkor's advanced packaging. The constant upgrade cycle in consumer electronics necessitates Amkor's continuous innovation in packaging solutions. For instance, global smartphone shipments reached approximately 1.17 billion units in 2023, highlighting the market's reliance on cutting-edge components.

Societal expectations are pushing Amkor and its peers towards greater social responsibility and ethical sourcing. This includes a strong commitment to fair labor practices, environmental stewardship, and supply chain transparency. Amkor's 2023 ESG reports demonstrate progress in energy efficiency and waste reduction, aligning with growing investor and consumer focus on sustainability.

The integration of AI and automation in semiconductor manufacturing, projected to significantly boost global GDP by 2025, necessitates a workforce skilled in new technologies. Amkor must invest in upskilling and reskilling programs to adapt to this shift, as the demand for AI specialists in manufacturing is expected to rise sharply.

Technological factors

Amkor Technology is at the forefront of advanced packaging, a critical enabler for the semiconductor industry's expansion, especially in high-performance computing and artificial intelligence. The company's focus on technologies like 2.5D and 3D packaging, chiplets, and hybrid bonding directly addresses the demand for enhanced performance, improved power efficiency, and smaller device footprints.

These advanced packaging techniques are crucial for integrating multiple semiconductor components into a single package, boosting processing power and functionality. For instance, the chiplet approach allows for more modular and cost-effective design of complex processors, a trend heavily driven by the needs of AI accelerators and advanced CPUs.

Amkor's ongoing investment in these cutting-edge packaging solutions, including significant R&D spending in 2024 and projected investments for 2025, ensures they can meet the dynamic requirements of their clients. This strategic focus positions Amkor to capitalize on the increasing demand for sophisticated semiconductor solutions across various high-growth markets.

The rapid advancement of Artificial Intelligence (AI) and High-Performance Computing (HPC) is a significant technological driver for the semiconductor industry, directly impacting companies like Amkor Technology. These technologies are fueling an unprecedented demand for specialized chips, including Graphics Processing Units (GPUs) and High-Bandwidth Memory (HBM), all of which rely heavily on sophisticated advanced packaging solutions that Amkor provides.

Amkor's own financial performance reflects this trend. In 2024, the company's computing end market, a key beneficiary of AI-driven device demand, achieved record revenue. This surge highlights how critical advanced packaging is for enabling the powerful processors required for AI and HPC applications.

Furthermore, the integration of AI is not just creating demand for chips but also transforming the very fabric of the semiconductor industry. AI is increasingly being used to optimize chip design, streamline manufacturing processes, and enhance supply chain management, leading to greater efficiency and innovation across the board.

The relentless drive towards smaller device footprints and increased functionality within integrated circuits (ICs) directly fuels the demand for advanced semiconductor packaging. This trend means ICs are packed with more transistors and features in ever-tighter spaces.

Amkor Technology's expertise in package design and advanced packaging solutions is therefore essential. These capabilities allow semiconductor manufacturers to meet the miniaturization and integration demands, ultimately enabling the creation of more powerful and compact electronic devices.

For instance, the global advanced packaging market, a key indicator of this trend, was projected to reach over $60 billion in 2024, with significant growth driven by AI, high-performance computing, and mobile devices. Amkor's ability to provide these sophisticated packaging services positions them to capitalize on this expanding market.

Research and Development (R&D) Investment

Amkor Technology's commitment to continuous Research and Development (R&D) is paramount for maintaining its leadership in advanced semiconductor packaging and test solutions. This investment is vital for tackling intricate design hurdles, such as optimizing thermal management, electrical performance, and mechanical integrity in increasingly complex chip architectures. The semiconductor industry's trajectory, heavily influenced by geopolitical considerations and the burgeoning demands of artificial intelligence (AI), necessitates a relentless focus on innovation to stay competitive.

The increasing R&D intensity within the semiconductor sector, particularly as companies strive to meet the performance requirements for AI accelerators and advanced computing, directly impacts Amkor. For instance, the global semiconductor R&D spending is projected to reach significant figures, with estimates suggesting it could surpass $100 billion annually in the coming years, reflecting this industry-wide emphasis on innovation. Amkor's ability to secure and deploy capital effectively into R&D will be a key determinant of its success in developing next-generation packaging technologies.

- Amkor's R&D spending as a percentage of revenue is a critical metric to monitor for innovation capacity.

- The industry's push for smaller, more powerful, and energy-efficient chips, driven by AI and 5G, requires substantial R&D investment in materials science and advanced manufacturing processes.

- Geopolitical factors, such as supply chain diversification and onshoring initiatives, may influence R&D priorities and investment allocation for companies like Amkor.

Automation and Industry 4.0 Adoption

The increasing adoption of automation and Industry 4.0 principles is a significant technological driver for Amkor Technology. These advancements are revolutionizing manufacturing by boosting efficiency, cutting expenses, and elevating product quality. For instance, nearly 60% of semiconductor foundries are actively integrating AI and other digital tools to streamline their operations, a trend Amkor can capitalize on.

By embracing these transformative technologies, Amkor can unlock substantial improvements in its operational performance and bolster its competitive standing within the semiconductor packaging and testing industry. This strategic integration allows for more agile production, better resource allocation, and a heightened capacity to meet evolving market demands.

- Enhanced Efficiency: Automation reduces manual labor, speeding up production cycles.

- Cost Reduction: Optimized processes and reduced errors lead to lower operational costs.

- Improved Quality: AI-driven quality control systems minimize defects.

- Competitive Advantage: Early adopters of Industry 4.0 gain a significant edge in the market.

The relentless pursuit of smaller, more powerful, and energy-efficient chips, especially for AI and 5G, necessitates significant R&D investment in advanced materials and manufacturing. Amkor's commitment to R&D is crucial for developing next-generation packaging, with global semiconductor R&D spending projected to exceed $100 billion annually in the coming years.

Automation and Industry 4.0 principles are transforming manufacturing, boosting efficiency and quality. Nearly 60% of semiconductor foundries are integrating AI and digital tools, a trend Amkor can leverage for operational improvements and a stronger competitive position.

The company's focus on advanced packaging technologies like 2.5D, 3D packaging, chiplets, and hybrid bonding directly addresses the growing demand for enhanced performance and smaller device footprints, particularly for AI accelerators and advanced CPUs.

The global advanced packaging market was projected to surpass $60 billion in 2024, with AI and HPC being key growth drivers, positioning Amkor to capitalize on this expansion.

| Metric | 2023 (Actual) | 2024 (Projected/Actual) | 2025 (Projected) |

| Global Advanced Packaging Market Size (USD Billion) | ~55 | ~60+ | ~65+ |

| Global Semiconductor R&D Spending (USD Billion) | ~90-100 | ~100-110 | ~110-120 |

| Foundries Integrating AI/Digital Tools (%) | ~50 | ~60 | ~70 |

Legal factors

Protecting intellectual property, such as unique package designs and advanced test methodologies, is paramount for Amkor Technology in the fiercely competitive semiconductor landscape. Navigating the intricate web of global intellectual property laws is essential to shield its innovations and deter any infringement.

Amkor's strategy involves constant legal oversight and proactive patent filing to maintain its competitive edge. For instance, in 2024, the semiconductor industry saw significant investment in R&D, underscoring the importance of IP as a key differentiator. Failure to adequately protect its IP could lead to substantial financial and market share losses.

Amkor Technology's global operations mean it must navigate a complex web of international trade laws and export controls. These regulations are particularly stringent for advanced semiconductor technologies and can vary significantly depending on the destination country, with China often being a focal point for scrutiny.

Adherence to rules like those from the U.S. Bureau of Industry and Security (BIS), which govern items related to advanced computing and semiconductor manufacturing, is critical. For instance, in 2024, the U.S. continued to implement and adjust export control policies impacting the semiconductor sector, aiming to restrict certain technologies from reaching specific geopolitical adversaries.

Failure to comply with these evolving international trade regulations can lead to severe penalties, including hefty fines and the loss of essential market access, directly impacting Amkor's ability to conduct business and maintain its competitive edge in the global semiconductor packaging and testing industry.

Amkor Technology, operating globally, must navigate a complex web of labor laws and regulations across its various locations. These laws dictate everything from minimum wages and working hours to employee benefits and the right to unionize, directly affecting operational costs and human resource strategies. For instance, in 2024, many regions are seeing increased scrutiny on fair wage practices and workplace safety, potentially leading to higher compliance expenditures.

The dynamic nature of these legal frameworks, coupled with the persistent global talent shortage observed throughout 2024 and projected into 2025, presents significant challenges for Amkor. Attracting and retaining skilled labor in a competitive market requires adapting compensation and benefits packages, which can escalate recruitment and retention expenses. Furthermore, shifts in labor legislation, such as new mandates on remote work policies or employee data privacy, necessitate ongoing adjustments to internal processes and potential investments in compliance technology.

Environmental Regulations and Compliance

Amkor Technology operates within a complex web of environmental regulations governing its manufacturing, particularly concerning waste disposal and chemical use. For instance, the increasing scrutiny around per- and polyfluoroalkyl substances (PFAS) necessitates careful management and potential reformulation of materials used in their semiconductor packaging processes.

While legislative efforts like the U.S. Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act of 2022 aim to accelerate new semiconductor fabrication plant construction by potentially streamlining certain federal environmental reviews, Amkor remains bound by a broader spectrum of environmental laws. This includes compliance with existing clean air and water acts, hazardous waste management regulations, and increasing pressure from stakeholders, including investors and customers, to adopt more sustainable operational practices and reduce their environmental footprint. For example, many companies in the semiconductor supply chain are setting ambitious targets for reducing greenhouse gas emissions and water consumption, which Amkor will likely need to align with to maintain its competitive position and meet evolving ESG (Environmental, Social, and Governance) expectations.

- PFAS Compliance: Amkor must navigate evolving regulations concerning PFAS, impacting chemical sourcing and waste management.

- CHIPS Act Influence: While the CHIPS Act may offer some regulatory streamlining for new facilities, Amkor still faces comprehensive environmental oversight.

- Sustainability Pressure: Growing demand for sustainable practices from investors and customers requires Amkor to focus on reducing emissions and resource consumption.

- Broader Environmental Laws: Compliance extends to various statutes covering air quality, water discharge, and hazardous materials handling.

Data Privacy and Security Regulations

Amkor Technology operates in an environment where data privacy and security are paramount due to increasing digitalization and interconnected supply chains. Regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose strict requirements on how companies handle personal data.

Amkor must implement and maintain robust data protection measures to safeguard its operational data, sensitive customer information, and valuable intellectual property. Compliance with these evolving global standards is crucial for mitigating the significant risks associated with data breaches, which can lead to substantial financial penalties and reputational damage.

- GDPR Fines: Non-compliance can result in fines up to 4% of global annual revenue or €20 million, whichever is higher.

- CCPA Impact: Businesses face potential penalties of $2,500 per unintentional violation and $7,500 per intentional violation under the CCPA.

- Cybersecurity Investment: Global spending on cybersecurity is projected to reach $267.1 billion in 2024, highlighting the increasing importance of data security.

Amkor Technology must meticulously adhere to an evolving landscape of legal and regulatory frameworks that impact its global operations. This includes navigating stringent intellectual property laws to safeguard its innovative packaging designs and testing methodologies, a critical factor given the semiconductor industry's substantial R&D investments in 2024.

Compliance with international trade laws and export controls, particularly concerning advanced semiconductor technologies, is essential. The U.S. Bureau of Industry and Security's regulations, for instance, continue to shape market access, with policy adjustments in 2024 impacting the sector's global reach.

Furthermore, Amkor is subject to diverse labor laws across its international sites, with increasing emphasis in 2024 on fair wages and workplace safety, potentially raising operational costs. The company also faces growing environmental regulations, including scrutiny over substances like PFAS, and must align with sustainability demands to maintain its competitive standing.

Data privacy regulations, such as GDPR and CCPA, impose significant obligations on Amkor regarding the handling of personal and operational data, with non-compliance carrying substantial financial penalties. Global cybersecurity spending, projected to exceed $267 billion in 2024, underscores the critical need for robust data protection measures.

Environmental factors

Semiconductor manufacturing, including Amkor's operations, is notoriously energy-intensive, leading to a substantial carbon footprint. In 2023, the semiconductor industry's energy consumption continued to be a focal point for environmental sustainability efforts.

Amkor, recognizing this, is under increasing pressure from regulators, investors, and customers to curb its energy use and greenhouse gas emissions. This aligns with broader industry trends aiming for greener production methods.

The company demonstrates its commitment to environmental stewardship through participation in programs like the Carbon Disclosure Project (CDP). Amkor publicly discloses its climate-related data, reflecting a dedication to transparent and responsible environmental practices as it navigates the evolving regulatory landscape.

Semiconductor manufacturing, like Amkor's operations, demands significant amounts of water. In 2023, the semiconductor industry's global water consumption was estimated to be in the billions of gallons annually, with fabrication plants being major users. Many of these facilities are situated in areas already experiencing water stress, posing a direct operational risk.

Amkor Technology must prioritize efficient water management and invest in advanced water recycling technologies. This proactive approach is crucial for mitigating the financial and operational impacts of water scarcity, especially in regions like Arizona or parts of Asia where many semiconductor facilities are located. Furthermore, stringent water-use regulations are increasingly being implemented globally, requiring companies like Amkor to demonstrate responsible water stewardship.

Amkor Technology's manufacturing processes, like those in the semiconductor packaging industry, inherently involve chemicals, including substances like PFAS. These chemicals are crucial for certain functionalities but also present environmental challenges. The company must navigate stringent regulations governing their handling and disposal.

Adherence to waste management, hazardous material handling, and pollution prevention rules is paramount for Amkor. For instance, the U.S. Environmental Protection Agency (EPA) continues to refine regulations around PFAS, with significant proposed rules expected in 2024 and 2025 concerning reporting and potential restrictions. Amkor’s compliance efforts are directly impacted by these evolving legal frameworks.

Growing concerns about the environmental persistence and potential health impacts of substances like PFAS are driving a demand for safer alternatives. This push for innovation means Amkor faces pressure to invest in research and development for cleaner manufacturing methods and materials, impacting operational costs and strategic planning through 2025.

Climate Change and Extreme Weather Events

Climate change is a growing concern, leading to more frequent and intense extreme weather events. These events pose a significant risk to global supply chains and manufacturing, impacting companies like Amkor Technology. For instance, in 2023, severe floods in Thailand, a key hub for electronics manufacturing, caused widespread disruptions.

Amkor's reliance on manufacturing facilities in regions susceptible to climate impacts, such as parts of Asia, necessitates robust mitigation strategies. The company's ability to maintain operations and deliver products hinges on its preparedness for these environmental shifts. This includes ensuring business continuity plans are in place for weather-related disruptions.

To counter these risks, Amkor is likely focusing on diversifying its manufacturing footprint and strengthening its supply chain resilience. This proactive approach aims to minimize the impact of any single event, ensuring a more stable operational environment. By spreading operations across different geographical areas, Amkor can buffer against localized climate-related challenges.

- Increased Frequency of Extreme Weather: Global average temperatures have risen, contributing to more severe storms, floods, and heatwaves, impacting manufacturing hubs.

- Supply Chain Vulnerability: Events like the 2023 Thai floods highlight how weather can halt production and logistics for semiconductor packaging and testing companies.

- Strategic Diversification: Amkor's investment in facilities across multiple continents is a key strategy to mitigate geographic concentration risks from climate change.

- Resilience Investment: Companies are increasingly investing in infrastructure upgrades and contingency planning to withstand climate-related operational disruptions.

Sustainability Initiatives and ESG Reporting

Investors, customers, and regulators are increasingly scrutinizing companies' environmental, social, and governance (ESG) performance. Amkor Technology's dedication to sustainability, as evidenced by its corporate responsibility reporting and CDP scores, highlights its proactive approach to managing environmental impacts and satisfying stakeholder demands.

This commitment to sustainability can foster innovation in developing more environmentally friendly manufacturing processes. For instance, Amkor reported its 2023 CDP Water Security score as B-, indicating a solid understanding and management of water-related risks and opportunities.

- Investor Demand: A significant portion of global assets under management are now directed towards ESG-integrated funds, driving companies to improve their environmental performance.

- Regulatory Pressure: Emerging regulations worldwide are mandating greater transparency and accountability in corporate environmental reporting.

- Operational Efficiency: Investments in sustainable practices often lead to reduced waste, lower energy consumption, and improved resource management, enhancing overall operational efficiency.

Amkor Technology operates within an industry heavily reliant on natural resources, facing scrutiny over its environmental footprint. The company's energy-intensive manufacturing processes, particularly in semiconductor packaging and testing, contribute to significant greenhouse gas emissions, a trend that intensified in 2023 as global sustainability efforts ramped up.

Water scarcity is another critical environmental factor, with semiconductor fabrication plants being major consumers. Amkor must prioritize efficient water management and recycling technologies to mitigate risks, especially given that many facilities are located in water-stressed regions. Stringent water-use regulations are also on the rise globally, impacting operational compliance.

The use of chemicals, including PFAS, in manufacturing presents ongoing environmental challenges and regulatory hurdles. Amkor's compliance with waste management and pollution prevention rules is paramount, particularly as agencies like the EPA refine regulations around substances like PFAS, with significant updates anticipated in 2024 and 2025.

Climate change poses a direct threat through extreme weather events, which can disrupt global supply chains and manufacturing operations. Amkor's strategic diversification of its manufacturing footprint across continents is a key measure to build resilience against these climate-related risks, ensuring business continuity.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Amkor Technology is informed by a comprehensive review of global economic indicators, technological advancements, and regulatory landscapes. We leverage data from reputable sources like industry-specific market research reports, government publications, and international financial institutions to ensure accuracy and relevance.