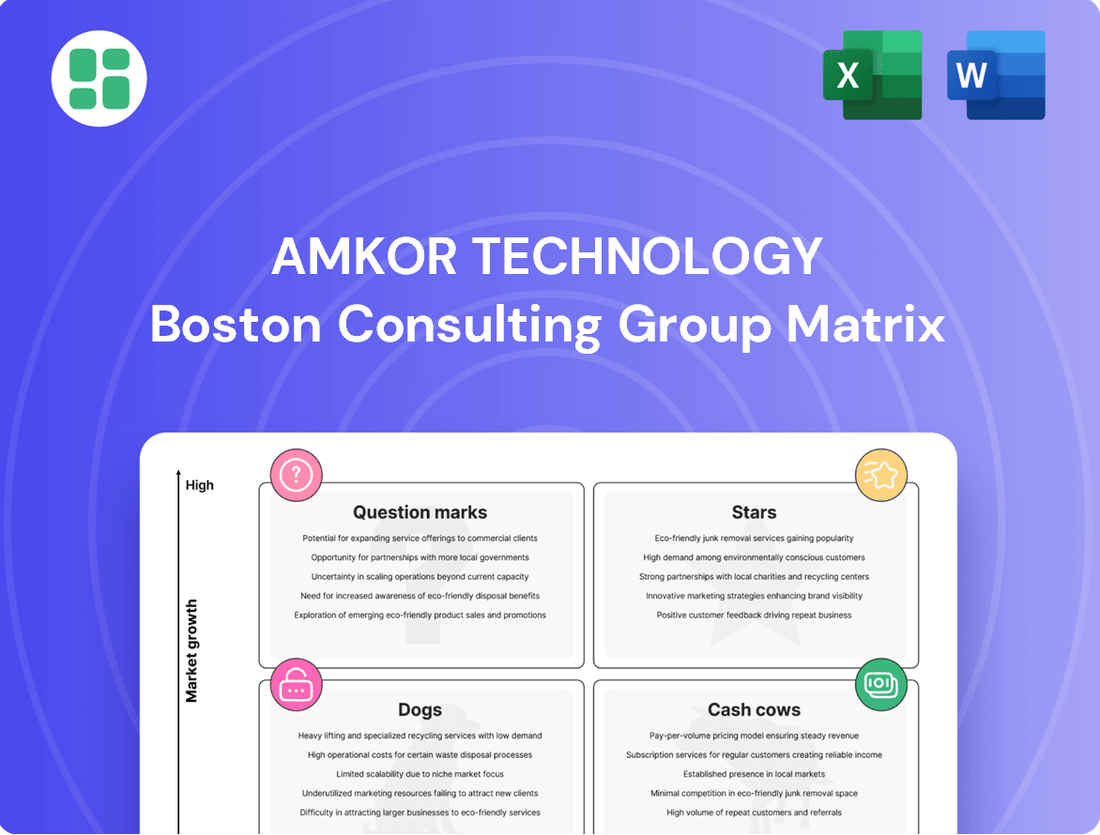

Amkor Technology Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amkor Technology Bundle

Amkor Technology's position within the BCG Matrix reveals a dynamic portfolio, with key products potentially acting as Stars driving future growth and others as Cash Cows generating stable revenue. Understanding these placements is crucial for strategic decision-making.

This preview offers a glimpse into Amkor's market standing, but the full BCG Matrix report unlocks a comprehensive breakdown of each product's quadrant, complete with data-backed recommendations. Purchase the full version to gain actionable insights and a clear roadmap for optimizing your investments and product strategy.

Stars

Amkor Technology is making substantial investments in advanced packaging technologies essential for AI and HPC. These include sophisticated 2.5D and 3D integration methods, which are vital for the performance of next-generation processors in these rapidly growing markets. Amkor's strategic focus here aims to solidify its position as a critical supplier for these demanding applications.

The company's Q2 2025 financial performance highlighted the strength of its computing segment, with growth directly attributed to the increasing adoption of its High-Density Fan-Out (HDFO) packaging solutions. This success underscores the market demand for advanced packaging that can support the complex architectures required by AI and HPC chips, demonstrating Amkor's effective execution in this area.

Amkor Technology shines in the Automotive Advanced Packaging sector, a true star in their portfolio. This market is booming, fueled by the rapid evolution of driver assistance systems (ADAS), the shift towards electric vehicles (EVs), and sophisticated infotainment. Amkor is a top OSAT provider here, offering a wide range of packaging solutions specifically for automotive needs.

The increasing semiconductor content within vehicles is a significant tailwind for Amkor. For instance, the automotive semiconductor market was projected to reach $111 billion in 2024, a substantial increase from previous years, highlighting the demand for advanced packaging. Amkor's commitment to innovation in this space positions them to capitalize on this ongoing growth trend.

High-Density Fan-Out (HDFO) solutions are a cornerstone of Amkor Technology's advanced packaging strategy, crucial for integrating high-bandwidth memory and enabling dense interconnects. This technology is particularly vital for the rapidly expanding computing and artificial intelligence sectors, where performance demands are escalating.

Amkor's significant capital expenditure plans for 2025 underscore a strong commitment to HDFO, signaling its strategic focus on this high-growth market segment. The company's financial performance, as evidenced by its Q2 2025 results, showed robust sequential growth in the computing segment, largely attributed to the increasing adoption of HDFO.

System-in-Package (SiP) for High-Performance

Amkor Technology's System-in-Package (SiP) offerings are a cornerstone for delivering high-performance computing, particularly crucial for demanding applications like AI and 5G. These solutions enable the integration of multiple semiconductor dies within a single package, a key driver for miniaturization and improved functionality. The market for SiP is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 10% through 2028, fueled by these advanced technology trends. Amkor's ongoing investments in SiP technology underscore its strategic positioning to capitalize on this demand.

Amkor's commitment to SiP development is evident in its continuous expansion of capabilities. This technology is instrumental in creating more efficient and powerful electronic devices by consolidating various components, such as processors, memory, and RF modules, into a compact unit. The ability to achieve higher integration levels directly translates to enhanced performance and reduced form factors, making SiP essential for next-generation consumer electronics and advanced computing platforms. The global SiP market size was valued at approximately $30 billion in 2023 and is expected to reach over $50 billion by 2028.

- SiP enables higher integration for AI and 5G applications.

- Amkor is actively expanding its SiP capabilities.

- SiP technology allows combining multiple dies into one package for better performance.

- The SiP market is experiencing robust growth, driven by demand for miniaturization and advanced functionality.

U.S. Advanced Packaging Manufacturing

Amkor Technology's strategic move into U.S. advanced packaging manufacturing, particularly with its substantial $2 billion investment in Arizona, underscores its commitment to domestic semiconductor production. This initiative, bolstered by significant CHIPS Act funding, is poised to transform the American supply chain for cutting-edge chip packaging. The new facility, slated for operation between 2025 and 2026, is designed to meet the sophisticated needs of major clients, including Apple, for high-performance and mobile applications.

This expansion directly addresses the escalating demand for localized advanced packaging capabilities, a critical component in the semiconductor ecosystem. By establishing a robust presence in the U.S., Amkor is not only enhancing its own market position but also contributing to national technological sovereignty and resilience. The facility's focus on advanced packaging technologies is key to enabling the next generation of electronic devices.

- Investment: $2 billion in a new advanced packaging facility in Arizona.

- Support: Significant funding from the CHIPS Act.

- Operational Timeline: Expected to be operational in 2025-2026.

- Key Customer: Serving leading clients like Apple for high-performance and mobile applications.

Amkor Technology's advanced packaging solutions, particularly its High-Density Fan-Out (HDFO) and System-in-Package (SiP) technologies, are performing exceptionally well, positioning the company as a leader in high-growth markets. These sophisticated packaging methods are critical for enabling the performance demands of AI, HPC, and 5G applications. The company's strategic investments and expanding capabilities in these areas, as demonstrated by its Q2 2025 financial results showing robust growth in its computing segment, solidify its status as a star performer in the BCG matrix.

| Technology Area | BCG Category | Key Growth Drivers | Amkor's Strategic Focus | Market Data/Outlook |

|---|---|---|---|---|

| Advanced Packaging (AI/HPC) | Star | AI/HPC demand, 2.5D/3D integration | Substantial investments in advanced integration | Crucial for next-gen processors |

| High-Density Fan-Out (HDFO) | Star | AI, Computing, High-bandwidth memory | Significant capital expenditure, robust Q2 2025 growth | Enabling dense interconnects |

| System-in-Package (SiP) | Star | AI, 5G, Consumer electronics, Miniaturization | Expanding capabilities, continued development | Global SiP market ~$30B (2023), projected >$50B by 2028 (CAGR >10%) |

What is included in the product

Amkor Technology's BCG Matrix offers a strategic breakdown of its business units, identifying which to invest in, hold, or divest based on market share and growth.

Visualize Amkor's portfolio on a BCG Matrix for strategic clarity, relieving the pain of complex business unit analysis.

Cash Cows

Amkor Technology's traditional communications packaging, serving mainstream smartphones and tablets, is a prime example of a Cash Cow. This mature market segment, where Amkor has a substantial historical presence, contributes significantly to their overall revenue. In 2024, Amkor reported that its communications business, which heavily relies on these established product lines, continued to be a stable revenue generator, underpinning the company's financial strength despite market maturity.

Amkor's Standard Consumer Electronics Packaging segment, covering traditional devices and wearables, acts as a significant cash cow. This area provides a reliable and substantial income stream for the company.

The company's broad exposure to established consumer markets, which consistently need their packaging solutions, underpins this stable performance. While growth might be slower compared to cutting-edge technologies, these segments ensure consistent demand.

In 2024, Amkor reported that its consumer segment, which includes standard electronics packaging, remained a vital contributor to its revenue, demonstrating resilience despite evolving market dynamics.

Amkor Technology's Memory Product Packaging segment is a prime example of a Cash Cow within its BCG Matrix. With over two decades of market leadership in advanced semiconductor packaging solutions for the memory IC market, this division represents a stable and significant revenue generator for the company. The consistent demand for memory products ensures a reliable cash flow, enabling Amkor to maintain its strong position with comparatively minimal investment in aggressive expansion or new market penetration.

Traditional Leadframe and Laminate Packaging

Amkor Technology's traditional leadframe and laminate packaging offerings are firmly positioned as cash cows within its portfolio. These established technologies, long serving as industry benchmarks for integrated circuits requiring robust electrical and thermal management, continue to generate substantial and stable revenue. Their widespread adoption in mature applications underpins Amkor's consistent market leadership in these segments.

The company's extensive range of these foundational packaging solutions caters to a broad spectrum of integrated circuits, ensuring consistent demand. This stability is a key characteristic of cash cow businesses, providing reliable financial resources that can be reinvested in growth areas or distributed to shareholders.

- Market Dominance: Amkor holds a significant market share in traditional leadframe and laminate packaging, a testament to their long-standing industry presence and customer trust.

- Stable Revenue Streams: These mature product lines contribute consistently to Amkor's top-line revenue, acting as a reliable source of cash flow.

- Foundation for Innovation: The cash generated from these segments supports Amkor's research and development efforts in more advanced packaging technologies.

- Mature Application Support: Amkor continues to be a key supplier for established semiconductor applications that rely on the proven performance of leadframe and laminate packaging.

Volume Test Services for Mature Products

Amkor Technology's volume test services for mature products represent a classic cash cow. These services cater to established, high-volume semiconductor products, ensuring their continued quality and reliability. This segment is characterized by consistent demand from a broad customer base, providing a stable revenue stream.

The mature product testing is a vital part of Amkor's portfolio, even if it doesn't exhibit high growth rates. The sheer volume of these mature products translates into significant, dependable revenue for the company. In 2024, Amkor continued to leverage its extensive testing infrastructure to support these ongoing needs, contributing to its overall profitability.

- Consistent Demand: Mature products require ongoing testing, creating a predictable revenue base.

- Profitability: High volumes and established processes often lead to healthy profit margins in this segment.

- Operational Efficiency: Amkor's scale allows for efficient, cost-effective testing of these high-volume parts.

- Customer Retention: Providing essential services for mature products fosters strong, long-term customer relationships.

Amkor Technology's established communications packaging, serving mainstream smartphones and tablets, functions as a cash cow. This mature segment, where Amkor has a deep historical footprint, consistently contributes significant revenue. In 2024, Amkor's communications business, reliant on these stable product lines, remained a robust revenue generator, bolstering the company's financial stability despite market maturity.

Amkor's Standard Consumer Electronics Packaging, encompassing traditional devices and wearables, acts as a substantial cash cow, providing a reliable and significant income stream. The broad market exposure to established consumer electronics ensures consistent demand for their packaging solutions, guaranteeing dependable financial resources.

The Memory Product Packaging segment is a key cash cow for Amkor, leveraging over two decades of leadership in advanced semiconductor packaging for memory ICs. This division generates stable revenue due to consistent demand for memory products, allowing Amkor to maintain its strong market position with minimal investment in aggressive expansion.

Amkor Technology's traditional leadframe and laminate packaging offerings are firmly established cash cows. These mature technologies, serving as industry standards for integrated circuits, generate substantial and stable revenue, underpinning Amkor's consistent market leadership in these segments. The company's 2024 financial reports highlighted the continued strength of these foundational packaging solutions.

| Segment | BCG Classification | Key Characteristics | 2024 Relevance |

| Communications Packaging (Traditional) | Cash Cow | Mature market, stable revenue, significant market share | Continued strong revenue generator |

| Standard Consumer Electronics Packaging | Cash Cow | Consistent demand, reliable income stream, broad customer base | Vital contributor to overall revenue |

| Memory Product Packaging | Cash Cow | Market leadership, stable cash flow, consistent demand | Significant revenue generator |

| Leadframe & Laminate Packaging | Cash Cow | Industry standards, substantial revenue, established applications | Underpins market leadership |

Preview = Final Product

Amkor Technology BCG Matrix

The Amkor Technology BCG Matrix you are previewing is the complete and final document you will receive upon purchase. This means the analysis, formatting, and strategic insights are exactly as they will be delivered, ready for immediate application in your business planning. You can trust that no watermarks or sample data will obscure the professional presentation of Amkor's product portfolio within the matrix. This preview serves as a direct representation of the valuable, actionable intelligence you will gain.

Dogs

Legacy wirebond packaging for commoditized ICs likely represents Amkor Technology's Dogs. These services face significant price pressure and diminishing demand, typical of a mature market. In 2024, Amkor likely saw continued pressure on margins for these older packaging technologies.

This segment may offer low returns or even losses, consuming capital without substantial growth potential. Amkor's strategy would likely involve reducing investment or considering divestment from these less profitable operations.

Undifferentiated, low-margin assembly services represent a segment where Amkor Technology faces intense competition from numerous providers. These services, characterized by a lack of unique features, typically operate with thin profit margins, making them less attractive for significant strategic growth. Careful cost management is crucial to prevent these operations from becoming a drain on resources.

In 2023, the semiconductor packaging market, which includes assembly services, saw a slowdown. Amkor's revenue for the full year 2023 was $5.36 billion, a decrease from $5.76 billion in 2022, reflecting the challenging market conditions for less differentiated services.

As the semiconductor industry races forward, certain older packaging formats are becoming relics. Amkor Technology, a leader in semiconductor packaging, likely sees products utilizing these outdated technologies as potential Dogs in its BCG Matrix. This is because the relentless drive for miniaturization and enhanced performance means these older formats struggle to keep pace.

Products still using these less efficient packaging solutions are experiencing a consistent decline in demand. For instance, legacy flip-chip packages, while once dominant, are increasingly being superseded by more advanced wafer-level packaging (WLP) solutions. Amkor’s revenue from these legacy segments would likely be declining, reflecting a mature or shrinking market share.

Niche Product Lines with Consistently Low Utilization

Amkor Technology's niche product lines with consistently low utilization, especially those not central to its advanced packaging strategy, could be categorized as Dogs in the BCG Matrix. These underperforming segments might include older manufacturing technologies or specialized services that have seen declining demand. For example, if Amkor operates facilities dedicated to legacy wire bonding technologies with utilization rates consistently below 50%, these would represent Dog assets.

Such underutilized assets often drain resources without contributing significantly to revenue or profit. In 2023, Amkor's overall capacity utilization hovered around 70-80%, but specific legacy lines could be much lower. These areas might require strategic review, potentially leading to consolidation, repurposing, or even divestment to free up capital for more promising growth areas.

- Low Utilization Segments: Identify specific product lines or facilities with utilization rates consistently below 60%.

- Strategic Misalignment: Assess if these low-utilization areas align with Amkor's focus on advanced packaging solutions like fan-out wafer-level packaging (FOWLP) or advanced substrate-based packaging.

- Financial Drain: Evaluate the operational costs associated with these underperforming assets versus their contribution to Amkor's revenue and profitability.

- Divestment/Restructuring Potential: Consider the feasibility of divesting or restructuring these niche product lines to improve overall operational efficiency and capital allocation.

Segments Heavily Impacted by Long-Term Structural Decline

While Amkor Technology benefits from a broad product range, certain older product lines or niche segments could be classified as Dogs if they are tied to industries facing persistent, long-term structural decline. These are areas where demand is consistently shrinking, and there's no foreseeable innovation or market shift that would lead to a turnaround. For instance, if Amkor still had significant exposure to legacy mobile phone components for feature phones, which have seen a drastic market contraction, this would be a prime example.

These Dog segments, even if small relative to Amkor's overall business, represent a drain on resources that could be better utilized elsewhere. A careful assessment is crucial to identify these underperforming areas. For example, a segment with declining revenue and low or negative profit margins, coupled with a shrinking addressable market, would strongly indicate a Dog classification. In 2023, for many semiconductor companies, the market for components used in traditional PCs and laptops experienced a slowdown, which could have pushed some smaller, less diversified product lines into this category if not managed proactively.

The strategic imperative for Amkor would be to evaluate these Dog segments for potential divestiture or discontinuation. This allows for the reallocation of capital, research and development efforts, and management attention to more promising Star or Question Mark opportunities within their portfolio.

- Industry Decline: Segments serving industries with consistently shrinking demand, like certain older consumer electronics or legacy automotive components, would be classified as Dogs.

- Resource Drain: These areas typically show low or negative profitability and require continuous investment without a clear path to significant future returns.

- Strategic Reallocation: Amkor's strategy would involve identifying and potentially phasing out these Dog segments to free up resources for growth areas.

Legacy wirebond packaging for commoditized ICs likely represents Amkor Technology's Dogs. These services face significant price pressure and diminishing demand, typical of a mature market. In 2024, Amkor likely saw continued pressure on margins for these older packaging technologies.

This segment may offer low returns or even losses, consuming capital without substantial growth potential. Amkor's strategy would likely involve reducing investment or considering divestment from these less profitable operations.

Undifferentiated, low-margin assembly services represent a segment where Amkor Technology faces intense competition from numerous providers. These services, characterized by a lack of unique features, typically operate with thin profit margins, making them less attractive for significant strategic growth. Careful cost management is crucial to prevent these operations from becoming a drain on resources.

In 2023, the semiconductor packaging market, which includes assembly services, saw a slowdown. Amkor's revenue for the full year 2023 was $5.36 billion, a decrease from $5.76 billion in 2022, reflecting the challenging market conditions for less differentiated services.

Question Marks

Amkor Technology is actively investigating emerging technologies like co-packaged optics (CPO) and broader photonics packaging. These represent nascent markets with substantial anticipated growth, driven by the escalating demands of data centers and high-speed communication infrastructure. While Amkor's current market share in these specific areas is minimal, the significant research and development investment required positions them as potential future Stars within the BCG matrix.

Amkor Technology is actively exploring nascent 3D IC technologies, including advanced hybrid bonding, signaling a strategic move into high-potential but currently underdeveloped markets. These investments represent Amkor's commitment to future innovation, positioning the company to capitalize on the next wave of semiconductor integration.

While Amkor already possesses strong 2.5D/3D capabilities, its focus on these emerging 3D IC technologies places them in a "Question Mark" category within the BCG Matrix. This signifies significant growth prospects, but also acknowledges the substantial development costs and the current limited market adoption, making their future success uncertain.

Amkor Technology's new Arizona facility, still in its early operational stages through 2025-2026, represents a significant investment with high capital expenditure. This period of ramp-up before reaching full production capacity and market penetration categorizes it as a Question Mark in the BCG Matrix. The company is investing heavily to establish this new regional manufacturing base, aiming to capture future market share.

New Advanced Bonding Technologies

Amkor Technology's focus on new advanced bonding technologies, alongside high conductive thermal materials, represents a significant investment in future product capabilities. These innovations are vital for enhancing performance but are currently in the nascent stages of market acceptance, necessitating substantial research and development expenditure.

This positioning places advanced bonding technologies squarely within the 'Question Marks' category of the BCG matrix. The company is committing resources to nurture these potentially high-growth areas, acknowledging the inherent risks and the need for further market validation before they can achieve widespread commercial success.

- Investment in R&D: Amkor's commitment to developing advanced bonding technologies underscores a strategic bet on future market trends.

- Early Market Adoption: While crucial for next-generation products, these technologies currently face limited market penetration.

- High Risk, High Reward: The significant R&D investment reflects the 'Question Mark' status, balancing the potential for future market leadership against the uncertainty of adoption.

- Strategic Importance: These technologies are identified as key enablers for Amkor's long-term competitive advantage in the semiconductor packaging industry.

Emerging Niche Sensor Packaging Applications

Emerging niche sensor packaging applications represent areas where Amkor Technology, despite its leadership in MEMS and general sensor packaging, is still building its presence. These are specialized segments with significant future growth prospects but currently low volume and market share for Amkor. Examples include advanced medical diagnostic sensors requiring ultra-high precision and biocompatible materials, or specialized environmental monitoring sensors for extreme conditions.

These niche markets, while not yet major revenue drivers, are crucial for Amkor's long-term innovation strategy. For instance, the burgeoning market for wearable health sensors, which often demand miniaturization and robust connectivity, is an area of focus. Amkor's ability to develop tailored packaging solutions for these demanding applications will be key to capturing future market share. The global MEMS market, a foundational area for sensor technology, was projected to reach approximately $25 billion in 2024, indicating the broader growth trajectory these niche segments can tap into.

- Advanced Medical Diagnostics: Packaging for implantable or highly sensitive in-vitro diagnostic sensors requiring biocompatibility and extreme miniaturization.

- Specialized Environmental Monitoring: Solutions for sensors operating in harsh industrial, aerospace, or deep-sea environments demanding robust protection and signal integrity.

- Next-Generation Wearables: Integration of advanced sensor arrays into compact, power-efficient packages for sophisticated health and activity tracking.

- Automotive Lidar and Radar Components: High-reliability packaging for optical and radio frequency sensors critical for autonomous driving systems.

Amkor's investments in emerging technologies like co-packaged optics (CPO) and advanced 3D IC technologies, including hybrid bonding, position them as Question Marks. These areas hold significant growth potential but require substantial R&D and currently have limited market adoption, making their future success uncertain.

The company's new Arizona facility, undergoing its initial ramp-up phase, also falls into the Question Mark category. This significant capital expenditure is aimed at capturing future market share, but the facility is not yet at full operational capacity or market penetration.

Niche sensor packaging applications, such as those for advanced medical diagnostics and specialized environmental monitoring, are also considered Question Marks. While these segments show strong future growth prospects, Amkor's current market share is minimal, necessitating focused development to capitalize on their potential.

| Category | Description | Market Growth Potential | Current Market Share (Amkor) | Investment Focus |

| Question Mark | Emerging Technologies (CPO, 3D ICs, Advanced Bonding) | High | Low | R&D, New Facility Investment |

| Question Mark | Niche Sensor Packaging | High | Low to Moderate | Tailored Solutions, Innovation |

BCG Matrix Data Sources

Our Amkor Technology BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.