AMG Critical Materials PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMG Critical Materials Bundle

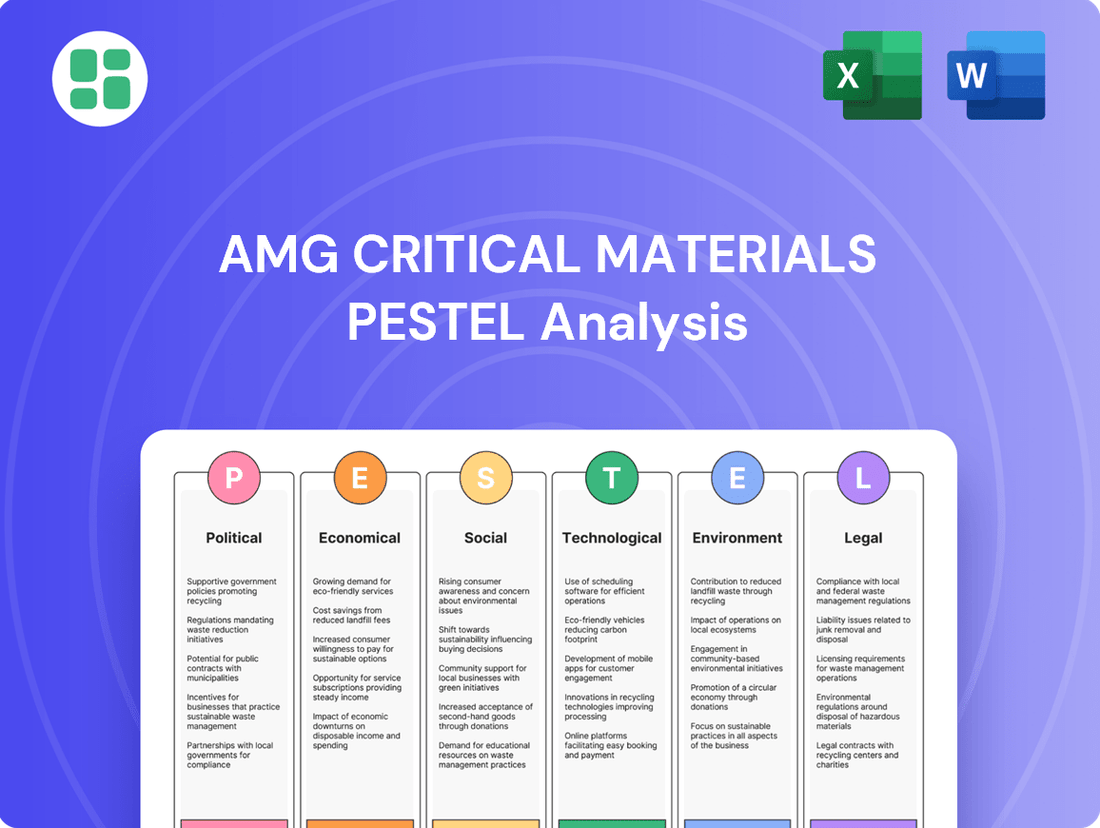

Uncover the critical external forces shaping AMG Critical Materials's future. Our PESTLE analysis dives deep into political, economic, social, technological, legal, and environmental factors, providing you with the strategic foresight needed to thrive. Don't get left behind; download the full, actionable report now and gain a competitive advantage.

Political factors

Global geopolitical tensions are increasingly disrupting critical mineral supply chains, sparking trade disputes and protectionist policies. For instance, China's export controls on materials like rare earths, tungsten, and gallium in 2023 significantly impacted global availability and pricing, demonstrating the direct link between political actions and material costs.

These trade wars and restrictions necessitate that companies like AMG actively diversify their sourcing and production locations. This strategic shift aims to build resilience against potential supply disruptions and price volatility stemming from international political friction, a trend that intensified throughout 2024.

Governments globally are actively pushing for an energy transition, which in turn is significantly increasing the demand for critical materials. For instance, the European Union's Critical Raw Materials Act, enacted in 2023, is designed to bolster supply chain resilience within the EU, directly impacting the market for these essential components.

The United States' Inflation Reduction Act, a landmark piece of legislation from 2022, offers substantial incentives for the domestic production and sourcing of materials crucial for electric vehicle batteries, particularly those from allied nations. This legislation alone is projected to drive billions in new investment into the battery supply chain through 2030.

These governmental actions create substantial market openings and present clear strategic directives for companies like AMG, positioning them to capitalize on the growing need for critical materials in the renewable energy and electric vehicle sectors.

Resource nationalism is intensifying, with countries increasingly prioritizing local control over critical minerals essential for the energy transition. This trend, fueled by geopolitical shifts, translates into tighter foreign investment rules and export controls in nations rich in these resources. For instance, the Democratic Republic of Congo, a major cobalt producer, has been reviewing its mining code to ensure greater state benefit from its mineral wealth.

These policies compel companies like AMG to invest in local processing and forge long-term supply contracts to guarantee access. Navigating this landscape requires AMG to adapt to varying national economic agendas and regulatory frameworks governing the extraction and refinement of vital raw materials, impacting its global supply chain strategy.

International Trade Agreements and Alliances

International trade agreements are increasingly focused on critical minerals, directly impacting companies like AMG. For instance, the ongoing negotiations between the European Union and the United States for a Critical Minerals Agreement (CMA) highlight a global push to secure supply chains. This type of agreement can significantly influence AMG's decisions on where to build new facilities or secure raw material sourcing, shaping its operational footprint.

These alliances often include provisions for harmonizing technical standards and facilitating joint project financing. Such collaborations can reduce regulatory hurdles and improve the economic viability of new mining and processing ventures. By aligning with these international efforts, AMG can potentially access more favorable financing and operate within more predictable regulatory environments.

- The EU and US are actively negotiating a Critical Minerals Agreement to ensure stable supplies.

- Such agreements can guide AMG's strategic decisions on facility location and raw material off-take.

- Harmonization of standards and collaborative project financing are key components of these alliances.

Political Stability in Operating Regions

AMG Critical Materials' global footprint, spanning operations in North America, South America, Europe, and Asia, exposes it to varying degrees of political stability. For instance, in 2024, geopolitical tensions in Eastern Europe continued to influence energy costs and supply chain reliability, impacting AMG's European operations. The company's reliance on regions with potentially volatile political landscapes necessitates constant vigilance and contingency planning.

Policy shifts, such as changes in environmental regulations or trade tariffs, can significantly alter the cost structure and market access for AMG's critical materials. For example, a potential increase in export restrictions on certain rare earth elements from a key supplier nation in 2025 could directly affect AMG's sourcing strategies and pricing. Proactive engagement with policymakers and diversification of supply chains are vital to mitigate these risks.

The company must actively monitor and manage political risk to ensure continuity of operations and the security of its investments. In 2024, AMG reported that its operational resilience was tested by localized labor disputes influenced by political sentiment in one of its Latin American facilities, requiring swift management intervention. This underscores the importance of robust risk assessment frameworks and adaptive business strategies to navigate the complexities of operating in diverse political environments.

- Global Operations Exposure: AMG's presence in over 10 countries means it's subject to the political climate of each region, from stable democracies to emerging economies with higher political risk profiles.

- Policy Impact on Supply Chains: Changes in trade agreements or national industrial policies, such as those being debated in the US regarding critical mineral sourcing for 2025, can directly affect AMG's ability to procure raw materials and distribute finished products.

- Investment Security and Stability: Political instability can deter new investment and impact the valuation of existing assets. For example, a sudden nationalization of resources in a key operating country, while unlikely, would pose a significant threat to AMG's long-term investment security.

Governments worldwide are increasingly leveraging policy to secure critical mineral supply chains, a trend that directly shapes the operational landscape for companies like AMG. The push for energy transition, exemplified by the EU's Critical Raw Materials Act (2023) and the US Inflation Reduction Act (2022), aims to incentivize domestic production and sourcing, particularly for battery materials. These legislative efforts are projected to drive billions in new investment, creating significant market opportunities and strategic directives for AMG to capitalize on the growing demand for these essential components.

Resource nationalism is on the rise, with countries like the Democratic Republic of Congo (a major cobalt producer) reviewing mining codes to ensure greater state benefit. This compels companies like AMG to invest in local processing and forge long-term supply contracts, necessitating adaptation to diverse national economic agendas and regulatory frameworks governing extraction and refinement.

International trade agreements are increasingly focused on critical minerals, with ongoing EU-US negotiations for a Critical Minerals Agreement highlighting a global push for supply chain stability. Such agreements can influence AMG's decisions on facility location and raw material sourcing, potentially reducing regulatory hurdles and improving project financing viability through harmonized standards and joint ventures.

AMG's global operations expose it to varying political stability, with 2024 geopolitical tensions in Eastern Europe impacting European operations and supply chain reliability. Policy shifts, such as potential export restrictions on rare earth elements in 2025, necessitate proactive engagement with policymakers and supply chain diversification to mitigate risks to sourcing strategies and pricing.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing AMG Critical Materials across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key threats and opportunities shaped by current market and regulatory dynamics.

A clear, actionable summary of AMG's Critical Materials PESTLE analysis, designed to quickly identify external threats and opportunities, thereby alleviating the pain of strategic uncertainty.

Economic factors

Global economic growth is a key driver for industrial demand, directly impacting sectors that rely on specialty metals and minerals. The International Monetary Fund (IMF) anticipates a steady global GDP growth of 3.2% for both 2024 and 2025, providing a generally supportive environment for AMG's diverse industrial customer base.

While the global outlook is positive, regional economic performance will create varied demand. For instance, the Euro area is projected to see a modest economic acceleration, which could translate into increased demand for materials used in European manufacturing and infrastructure projects.

The prices of critical minerals essential for industries like electric vehicles and renewable energy, such as lithium and vanadium, exhibit significant volatility. This fluctuation is driven by a complex interplay of supply-demand dynamics, geopolitical tensions, and speculative trading. For instance, lithium carbonate prices saw a substantial decline in early 2024, falling from highs around $80,000 per ton in late 2022 to approximately $10,000 per ton by mid-2024, impacting mining company revenues.

This price instability poses a considerable challenge for mining companies, including AMG Critical Materials. Recent price drops have cooled investor sentiment and made it more difficult for some firms to secure the necessary capital for exploration and development projects. This directly affects AMG's ability to fund its growth initiatives and maintain profitability.

Consequently, AMG's financial performance and strategic investment decisions are heavily influenced by these raw material price swings. To navigate this environment, the company must implement and maintain robust risk management strategies, including hedging and diversification, to mitigate the impact of price volatility on its operations and earnings.

Persistent inflationary pressures, especially for energy and labor, are a key concern for AMG's global operations. For instance, the average hourly earnings in the manufacturing sector in the US saw an increase of 4.5% year-over-year as of April 2024, a trend mirrored in other regions where AMG operates.

While global inflation is expected to moderate, its lingering effects continue to influence operating expenses. Managing these rising costs is crucial for AMG to protect its profit margins and remain competitive in the capital-intensive critical materials industry.

Investment in Energy Transition Infrastructure

Massive global investment in the energy transition is a significant tailwind for AMG. This includes substantial capital flowing into renewable energy sources, the burgeoning electric vehicle (EV) market, and the development of advanced energy storage systems. These sectors are the primary drivers of demand for AMG's specialized materials.

The projected growth in demand for critical minerals is particularly impactful. Analysts anticipate that demand for key materials like lithium, vanadium, and tantalum could increase between 1.5 and 7 times by 2030. This surge is directly aligned with AMG's growth strategy, as these minerals are essential components in the technologies powering the energy transition.

This sustained investment in green infrastructure translates into a robust and expanding market for AMG's high-performance materials. The company is well-positioned to capitalize on this trend, supplying essential inputs for a cleaner energy future.

- Global renewable energy capacity additions reached approximately 510 GW in 2023, a record high.

- The global EV market is projected to reach over 10 million units sold in 2024.

- Demand for lithium is expected to grow by over 40% annually through 2030.

- Vanadium demand is forecast to increase by 50% by 2030, driven by grid-scale energy storage.

Currency Fluctuations and Exchange Rates

As a global enterprise with a presence spanning Europe, North America, Asia, and Africa, AMG's financial results are inherently susceptible to the ebb and flow of currency exchange rates. Significant movements in key currencies like the Euro, US Dollar, and Chinese Yuan can directly affect how AMG's international revenues are reported in its base currency, the cost of imported raw materials, and ultimately, its profitability. For instance, a stronger US Dollar against the Euro could reduce the reported revenue from AMG's European operations when translated into USD.

The volatility of exchange rates presents a tangible risk to AMG's financial performance. For example, in the first quarter of 2024, AMG reported that currency headwinds negatively impacted its adjusted EBITDA by approximately $5 million. This highlights the critical need for robust currency hedging strategies and astute financial management to cushion the impact of these fluctuations.

- Impact on Revenue: A strengthening USD can decrease the reported value of sales made in Euros or other weaker currencies.

- Cost of Imports: Fluctuations affect the cost of sourcing raw materials and components from different countries.

- Hedging Importance: AMG actively employs financial instruments to mitigate currency risk, aiming to stabilize earnings.

- 2024 Performance: Currency movements presented a notable challenge in early 2024, impacting profitability metrics.

Global economic growth, projected at 3.2% for both 2024 and 2025 by the IMF, provides a generally supportive backdrop for AMG's industrial customers, though regional variations in performance will influence demand. The critical materials sector faces significant price volatility, exemplified by lithium carbonate's drop from around $80,000 per ton in late 2022 to approximately $10,000 per ton by mid-2024, impacting mining revenues and investment. Persistent inflation, particularly in energy and labor costs, with US manufacturing hourly earnings up 4.5% year-over-year as of April 2024, continues to pressure operating expenses for global companies like AMG.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on AMG | Key Data Point |

|---|---|---|---|---|

| Global GDP Growth | 3.2% (IMF) | 3.2% (IMF) | Supportive demand for industrial products | IMF forecast |

| Lithium Carbonate Price | ~$10,000/ton (mid-2024) | Volatile | Revenue and profitability fluctuations | Price drop from late 2022 highs |

| US Manufacturing Wage Growth | +4.5% YoY (April 2024) | Continued pressure | Increased operating costs | Bureau of Labor Statistics |

Full Version Awaits

AMG Critical Materials PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured, detailing the AMG Critical Materials PESTLE Analysis. This comprehensive document covers all aspects of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You will receive this exact, ready-to-use analysis immediately after purchase, providing valuable insights for your strategic planning.

Sociological factors

Consumers are increasingly prioritizing sustainability, with studies in 2024 showing that over 60% of global consumers are willing to pay more for products from brands committed to positive social and environmental impact. This shift directly fuels demand for materials that underpin cleaner technologies, such as those used in electric vehicles and renewable energy infrastructure, areas where AMG Critical Materials is strategically positioned.

Environmental, Social, and Governance (ESG) factors are increasingly critical for mining and materials firms, with a significant emphasis from investors. By 2025, it's anticipated that over 70% of mining investors will place a higher priority on ESG performance, directly impacting companies like AMG. This means demonstrating clear climate action strategies and solid social responsibility is no longer optional.

This heightened investor focus translates into tangible pressure for AMG to showcase robust ESG credentials. Companies that fail to align with these evolving expectations face substantial risks, including difficulties in securing capital and potential damage to their public image. For instance, a lack of transparency in emissions reporting or inadequate community engagement can deter investment and lead to operational challenges.

AMG's ability to operate hinges on maintaining strong ties with the communities where its mines and processing plants are located. This social license to operate is not just about permits; it's about genuine acceptance. For instance, in 2024, the mining sector globally faced increased scrutiny over environmental, social, and governance (ESG) issues, leading to project delays and heightened community opposition in several regions.

Community opposition, often fueled by concerns over environmental impact, land rights, or benefit sharing, can halt production or block new developments. In 2024, several high-profile mining projects experienced significant delays due to local protests, costing companies millions in lost revenue and increased capital expenditure. AMG's proactive approach in 2024 involved increased dialogue with local stakeholders and investments in community development programs, aiming to mitigate these risks.

By prioritizing transparent communication, ensuring fair distribution of economic benefits, and actively addressing community concerns, AMG aims to build trust and prevent disruptive disputes. This strategy proved effective in 2024 when AMG successfully navigated a potential conflict at one of its European sites through early engagement and a commitment to local employment, securing continued operational approval.

Talent Attraction and Retention

AMG's reliance on specialized expertise in material science, engineering, and advanced manufacturing means talent attraction is paramount. The global demand for professionals skilled in areas like battery materials and clean energy technologies is surging, creating a competitive landscape. For instance, a 2024 report indicated a projected shortage of over 1 million skilled manufacturing workers in the US alone by 2030, a trend likely to impact specialized fields like AMG's.

Retention is equally critical, as AMG competes for talent with sectors embracing sustainable technologies and digital transformation. Companies are increasingly prioritizing robust employee development programs, competitive compensation, and a positive work environment. AMG's ability to foster a strong corporate culture and offer clear career progression will be key differentiators in securing its human capital through 2025 and beyond.

- Specialized Skill Demand: AMG requires expertise in material science, engineering, and advanced manufacturing, particularly in sustainable technologies.

- Intensifying Competition: The market for these specialized skills is highly competitive, with a global shortage of qualified professionals projected.

- Talent Development Investment: AMG must invest in training, attractive compensation, and a positive corporate culture to attract and retain top talent.

- Digital Transformation Impact: Expertise in digital transformation is becoming increasingly crucial, further intensifying the talent war.

Public Perception of Mining and Manufacturing

Public sentiment towards mining and heavy manufacturing is increasingly influenced by environmental and social governance (ESG) concerns. AMG, as a supplier of critical materials essential for green technologies, must actively showcase responsible sourcing, fair labor standards, and reduced environmental footprints across its operations to maintain a positive image. For instance, by 2024, over 70% of investors indicated that ESG factors are a significant consideration in their investment decisions, highlighting the commercial imperative of public perception.

This scrutiny extends throughout the entire value chain, from extraction to processing. Companies like AMG are under pressure to provide transparency regarding their supply chains and community engagement. A strong public perception can directly translate into improved brand reputation, easier access to capital, and smoother navigation of regulatory landscapes, especially as consumers and governments prioritize sustainability.

- Growing Investor Demand: By Q1 2025, sustainable investment funds reached over $3.5 trillion globally, reflecting a strong public and institutional preference for ESG-compliant companies.

- Consumer Awareness: Surveys in late 2024 revealed that over 60% of consumers are willing to pay a premium for products from companies with demonstrable ethical and environmental practices.

- Regulatory Scrutiny: Upcoming regulations in 2025 are expected to mandate greater disclosure on carbon emissions and supply chain due diligence for critical materials producers.

Sociological factors significantly shape AMG Critical Materials' operational landscape, driven by evolving consumer and investor expectations. The increasing demand for sustainable products, with over 60% of global consumers in 2024 willing to pay more for ethically sourced goods, directly benefits companies aligned with clean technologies.

Investor focus on Environmental, Social, and Governance (ESG) performance is paramount, with projections indicating over 70% of mining investors prioritizing ESG by 2025. This necessitates robust climate action strategies and demonstrable social responsibility to secure capital and maintain a positive public image.

Maintaining a social license to operate is crucial, requiring genuine community acceptance and proactive engagement to mitigate opposition, which in 2024 led to project delays in the global mining sector. AMG’s success hinges on transparent communication and fair benefit sharing, as seen in its 2024 conflict resolution at a European site.

The competition for specialized talent in material science and clean energy technologies is intense, with a projected shortage of over 1 million skilled manufacturing workers in the US alone by 2030. AMG must invest in talent development and a positive work environment to attract and retain essential expertise through 2025.

| Factor | 2024/2025 Data Point | Impact on AMG |

|---|---|---|

| Consumer Sustainability Preference | 60%+ consumers willing to pay more for ethical products (2024) | Drives demand for AMG's materials in green tech. |

| Investor ESG Prioritization | 70%+ mining investors prioritizing ESG by 2025 | Requires strong ESG credentials for capital access. |

| Talent Shortage Projection | 1M+ US manufacturing skill gap by 2030 | Intensifies competition for specialized AMG personnel. |

| Public Sentiment on Mining | 70%+ investors consider ESG in decisions (2024) | Necessitates transparent and responsible operations. |

Technological factors

Rapid advancements in battery technologies, such as solid-state and sodium-ion, are significantly influencing the demand for critical materials like lithium and vanadium, key components in AMG's portfolio. These innovations promise enhanced energy density, faster charging, improved safety, and lower costs, directly shaping future material requirements.

For instance, the projected global battery market is expected to reach over $400 billion by 2025, with lithium-ion batteries dominating, but the emergence of alternatives like sodium-ion, which avoids lithium altogether, presents both opportunities and challenges for material suppliers like AMG. AMG's strategic adaptation to these evolving battery chemistries, potentially by diversifying its material offerings or focusing on high-purity grades for next-generation batteries, will be crucial for its sustained growth and market position.

The mining sector is rapidly integrating AI and automation, promising significant gains in efficiency and safety. For instance, autonomous haul trucks are becoming more common, with companies like Caterpillar reporting substantial progress in their development and deployment, aiming to reduce operational costs and improve fleet management. This technological shift is crucial for optimizing every stage of the mining process, from initial exploration to final processing.

AI's application extends to predictive maintenance, where algorithms analyze equipment data to anticipate failures, thereby minimizing downtime. In 2024, the global AI in mining market is projected to reach several billion dollars, underscoring its growing importance. AMG Critical Materials can capitalize on these advancements to refine its extraction and processing operations, leading to enhanced productivity and potentially lower operational expenditures.

AMG's focus on material science and metallurgy is crucial for staying competitive. In 2024, the global advanced materials market was valued at over $100 billion and is projected to grow significantly, driven by demand for lighter, stronger, and more sustainable materials in sectors like aerospace and electric vehicles. AMG's investment in R&D, like its ongoing work with advanced alloys for aerospace applications, directly taps into this growth, ensuring its specialty metals offer superior performance and meet stringent industry requirements.

Recycling and Circular Economy Technologies

Technological advancements in recycling critical materials are pivotal for strengthening supply chains and minimizing environmental footprints. Innovations in pyrometallurgy and hydrometallurgy are significantly boosting the recovery rates of valuable metals, including lithium, which is essential for battery production.

AMG's strategic emphasis on recycling vanadium from oil refining byproducts directly supports circular economy objectives. This initiative not only diversifies their material sources but also presents a clear pathway for growth in resource recovery.

Here's how these technologies are shaping the landscape:

- Enhanced Recovery Rates: New hydrometallurgical techniques are achieving over 95% lithium recovery from spent batteries, a substantial improvement from previous methods.

- Vanadium Recycling Potential: The global market for recycled vanadium is projected to grow, with estimates suggesting it could meet a significant portion of future demand, particularly from steel production byproducts.

- Circular Economy Integration: Companies adopting these technologies are better positioned to meet increasing regulatory demands for sustainable sourcing and waste reduction, aligning with a projected 30% increase in circular economy investments by 2025.

Digitalization and Data Analytics

The accelerating trend of digitalization, encompassing the Internet of Things (IoT), big data, and sophisticated analytics, presents significant avenues for optimizing AMG's worldwide operations. For instance, the mining sector, a key area for critical materials, is increasingly leveraging IoT sensors for real-time monitoring of equipment performance and environmental conditions. This data deluge, when analyzed effectively, can pinpoint inefficiencies and predict maintenance needs, thereby boosting uptime and reducing operational costs.

Real-time data analysis is proving transformative for decision-making across production, logistics, and resource management. In 2024, many industrial companies reported substantial gains in operational efficiency, with some seeing reductions in waste by as much as 15% through better inventory management and predictive analytics. For AMG, this translates to more agile responses to market demand and improved yield from its extraction and processing activities.

Embracing digital transformation is not merely about efficiency; it's a critical driver for enhanced competitiveness and operational visibility. Companies that effectively integrate advanced analytics into their supply chains, for example, are better positioned to navigate disruptions and secure competitive advantages. By 2025, it's projected that businesses with mature digital capabilities will outperform their less digitized peers by a significant margin in terms of profitability and market share.

- IoT Integration: Enabling real-time monitoring of production equipment and environmental factors to enhance operational efficiency and safety.

- Big Data Analytics: Processing vast datasets to identify trends, optimize resource allocation, and improve decision-making in logistics and supply chain management.

- Predictive Maintenance: Utilizing advanced analytics to forecast equipment failures, reducing downtime and maintenance costs in AMG's global facilities.

- Operational Visibility: Gaining deeper insights into every stage of the value chain, from raw material sourcing to final product delivery, fostering agility and responsiveness.

The relentless pace of technological innovation, especially in battery chemistry and mining automation, directly impacts AMG's core business. Advancements like solid-state batteries, while still developing, signal a potential shift in demand for traditional materials, necessitating agile adaptation. The mining sector's embrace of AI and automation, with companies reporting efficiency gains, offers AMG opportunities to optimize its extraction and processing operations, potentially reducing costs and enhancing safety.

AMG's commitment to material science and R&D is critical, particularly as the global advanced materials market, valued at over $100 billion in 2024, continues its upward trajectory. Innovations in recycling technologies, achieving over 95% lithium recovery in some cases, are vital for strengthening supply chains and supporting circular economy principles. The digitalization of operations through IoT and big data analytics is also a key technological factor, promising significant gains in operational efficiency and visibility for companies like AMG.

| Technological Factor | Impact on Critical Materials | AMG's Strategic Relevance |

| Battery Technology Advancements | Shifts demand for lithium, cobalt, nickel; rise of alternatives like sodium-ion. | Requires R&D in new material grades and potential diversification. |

| AI & Automation in Mining | Increases extraction efficiency, safety, and reduces operational costs. | Opportunity to optimize AMG's global mining and processing operations. |

| Material Science & Metallurgy | Drives demand for high-performance alloys and specialty metals. | Underpins AMG's focus on advanced materials for aerospace and EVs. |

| Recycling Technologies | Boosts recovery rates of critical materials, supports circular economy. | Enhances supply chain resilience and aligns with sustainability goals. |

| Digitalization (IoT, Big Data) | Improves operational efficiency, predictive maintenance, and supply chain visibility. | Enables agile responses to market demand and yield optimization. |

Legal factors

AMG Critical Materials faces increasingly stringent environmental regulations globally, impacting everything from emissions to water usage. For instance, the European Union's proposed Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023, could affect the cost of materials imported into the EU, potentially influencing AMG's supply chain and pricing strategies for its products like aluminum and ferroalloys.

Compliance with these evolving laws, including those related to carbon footprints and biodiversity, is paramount. Failure to adhere to these standards can lead to significant penalties, operational disruptions, and reputational damage. For example, in 2024, many nations are expected to tighten regulations on industrial waste disposal, requiring substantial investment in upgraded facilities for companies like AMG.

The EU's Critical Raw Materials Act (CRMA), enacted in 2023, sets ambitious targets, aiming for 10% of the EU's annual consumption of strategic raw materials to be extracted domestically, 40% processed domestically, and 15% recycled domestically by 2030. This legislation directly impacts companies like AMG by creating both opportunities and compliance demands.

AMG needs to ensure its European operations and sourcing strategies align with these CRMA benchmarks. Meeting these legal requirements can unlock access to EU strategic project support and preferential market access, crucial for maintaining competitiveness in the evolving regulatory landscape.

International trade laws, encompassing tariffs, export controls, and trade agreements, directly impact AMG's global operations. For instance, the United States' imposition of tariffs on goods from various countries, and China's strategic export restrictions on critical minerals like gallium and germanium, highlight the volatile nature of these regulations. Navigating this complex legal framework is crucial for AMG to ensure the seamless flow of its products and essential raw materials across borders, thereby safeguarding its supply chain and market access.

Labor Laws and Health & Safety Standards

AMG operates globally, meaning it navigates a complex web of labor laws that vary significantly by country. These regulations cover everything from minimum wage requirements and working hour limits to employee benefits and the right to unionize. For instance, in 2024, many European nations continued to strengthen worker protections, impacting operational costs and flexibility.

Maintaining rigorous health and safety standards is not just a legal obligation but a critical business imperative for AMG, which employs approximately 3,600 people worldwide. Mining and chemical processing are inherently hazardous, making compliance with occupational safety regulations vital to prevent accidents, protect its workforce, and avoid costly litigation and reputational harm. In 2024, the International Labour Organization (ILO) highlighted increased focus on mental health in the workplace, a trend that may influence future health and safety protocols.

- Diverse Labor Compliance: AMG must adhere to varying labor laws across its operating regions regarding wages, working hours, and collective bargaining rights.

- Employee Safety Focus: Strict enforcement of health and safety standards is crucial for protecting AMG's workforce of around 3,600 employees in high-risk environments.

- Risk Mitigation: Non-compliance with labor and safety laws can lead to significant legal liabilities, fines, and damage to AMG's corporate reputation.

- Evolving Standards: Emerging regulations, such as those addressing workplace mental health, may require ongoing adjustments to AMG's operational policies.

ESG Disclosure Requirements

The landscape of ESG disclosure is rapidly evolving, with new regulations like the EU Taxonomy and proposed US SEC climate rules significantly raising the bar for corporate transparency. These frameworks demand more detailed reporting on environmental and social impacts, directly affecting companies like AMG. For instance, the EU Taxonomy, fully applicable from January 1, 2023, requires companies to disclose the proportion of their turnover, capital expenditure, and operating expenditure aligned with its criteria for environmentally sustainable economic activities. This means AMG must provide verifiable data on its operations' alignment with sustainability goals to meet regulatory and investor expectations.

AMG faces increased scrutiny and a greater reporting burden as these ESG disclosure requirements become more stringent. Investors, in particular, are demanding comprehensive and credible data on environmental and social performance. For example, a 2024 survey by PwC indicated that 70% of investors consider ESG factors material to their investment decisions. Consequently, AMG is expected to demonstrate robust data collection and reporting mechanisms to satisfy these growing demands from both regulators and the investment community, impacting its access to capital and market valuation.

AMG's operations are heavily influenced by international trade policies, including tariffs and export controls, which can impact raw material sourcing and product distribution. For example, ongoing trade tensions between major economies in 2024 continue to create uncertainty in global supply chains, potentially affecting AMG's cost structures and market access.

The company must also navigate a complex web of labor laws across its global sites, covering aspects from wages to workplace safety. In 2024, many regions saw an increase in regulations aimed at enhancing worker protections and ensuring fair labor practices, necessitating ongoing compliance efforts and potential adjustments to operational costs for AMG's workforce of approximately 3,600 employees.

Furthermore, evolving ESG disclosure requirements, such as the EU Taxonomy, demand greater transparency in reporting environmental and social impacts. Investors increasingly prioritize ESG factors, with a 2024 PwC survey showing 70% of investors considering them material, compelling AMG to strengthen its data collection and reporting on sustainability performance to maintain investor confidence and market valuation.

Environmental factors

AMG's core business is intrinsically linked to the global push for energy transition and CO2 reduction, placing it at the forefront of environmental initiatives. The company's critical materials are essential components in technologies like electric vehicles (EVs) and renewable energy systems, directly benefiting from these worldwide environmental targets.

The accelerating global adoption of clean energy technologies is a significant tailwind for AMG. For instance, the International Energy Agency (IEA) reported in 2024 that global EV sales surpassed 14 million units in 2023, a substantial increase from previous years, directly boosting demand for materials like lithium and cobalt that AMG supplies.

This strategic alignment with sustainability trends presents AMG with considerable opportunities for long-term, sustainable growth. As governments and industries worldwide continue to invest heavily in decarbonization efforts, the demand for AMG's specialized materials is projected to remain robust through 2025 and beyond.

The increasing demand for critical minerals, coupled with concerns about the near-term depletion of easily accessible, high-grade ores, underscores the urgent need for sustainable sourcing and enhanced resource efficiency. This shift is driving innovation in how materials are recovered and utilized.

AMG's established expertise in recycling vanadium from oil refining residues directly addresses this resource scarcity challenge. This capability not only mitigates reliance on primary extraction but also positions AMG as a frontrunner in adopting circular economy principles, turning waste streams into valuable resources.

Furthermore, diversifying supply chains to reduce geopolitical risk and responsibly exploring new mineral deposits are paramount. For instance, the global demand for lithium, a key component in electric vehicle batteries, highlights the importance of securing stable and ethical supply routes, with projected demand for lithium carbonate equivalent (LCE) expected to reach over 2 million metric tons by 2025, up from approximately 1 million metric tons in 2022.

The environmental impact of extractive waste and the push for greater circularity in material use are becoming increasingly significant concerns. As of 2024, global efforts to reduce landfill waste and promote resource efficiency are intensifying, driven by both regulatory pressure and consumer demand for sustainable practices.

Regulations are stepping up, mandating that operators create robust waste management plans and actively assess the potential for recovering critical raw materials from their waste streams. This trend is evident in new directives being implemented across major markets, aiming to close material loops and minimize virgin resource extraction.

AMG's demonstrated commitment to recycling, particularly in its 2024 operational reports highlighting increased recovery rates for certain by-products, positions it well. Further exploration of circular economy initiatives, such as product take-back programs or the development of secondary material markets, will be crucial for its long-term sustainability and competitive advantage.

Water Management and Scarcity

Water scarcity poses a significant challenge for AMG's mining and processing activities, particularly in regions facing water stress. For instance, by 2025, an estimated 2.4 billion people are projected to live in areas with high water stress, according to the UN. This environmental factor directly impacts operational continuity and requires robust management strategies.

AMG's commitment to sustainable water use is paramount for maintaining its social license to operate and securing necessary regulatory approvals. The company's ability to demonstrate responsible water management practices, including advanced water recycling systems, is crucial for mitigating environmental impact and ensuring long-term operational viability.

Efficient water management is not just an environmental imperative but also a strategic business advantage. By investing in technologies that minimize water consumption and maximize recycling, AMG can reduce operational costs and enhance its resilience against water-related risks. This proactive approach is vital for maintaining a competitive edge in the critical materials sector.

- Water Stress Impact: Regions where AMG operates may face increasing water scarcity, affecting resource availability for mining and processing.

- Regulatory Scrutiny: Stricter regulations on water usage and discharge are anticipated, requiring advanced compliance measures.

- Operational Efficiency: Implementing water recycling technologies can reduce reliance on freshwater sources and lower operational expenses.

- Corporate Responsibility: Demonstrating strong water stewardship is essential for maintaining brand reputation and investor confidence.

Climate Change Impacts and Adaptation

Climate change presents significant physical risks to AMG's operations. Extreme weather events, like floods and droughts, could disrupt mining and processing activities, impacting supply chains and asset integrity. For instance, the World Meteorological Organization reported that 2023 was the warmest year on record, with global average temperatures 1.45°C above pre-industrial levels, highlighting the increasing frequency of such events.

Consequently, there's a growing expectation for companies to demonstrate robust climate resilience. This involves developing comprehensive adaptation strategies, quantifying potential climate-related financial risks, and investing in infrastructure hardening. AMG must proactively assess how its global sites, from lithium extraction in South America to specialty alloys production in Europe, are exposed to these physical impacts and implement measures to ensure business continuity.

- Physical Risks: Extreme weather events can damage mining sites and processing facilities, leading to costly downtime and supply disruptions.

- Adaptation Strategies: Companies are increasingly required to create plans to withstand climate impacts, including fortifying infrastructure and diversifying supply chains.

- Financial Quantification: Regulators and investors are pushing for clear reporting on the financial implications of climate risks, requiring companies to quantify their exposure.

- Operational Continuity: AMG needs to ensure its global operations can continue despite changing climate conditions, necessitating proactive risk management and investment in resilient assets.

The increasing global focus on sustainability and circular economy principles directly benefits AMG, as its critical materials are vital for the energy transition. The accelerating adoption of electric vehicles, with global sales surpassing 14 million units in 2023 according to the IEA, fuels demand for AMG's products. This trend is projected to continue robustly through 2025, presenting significant growth opportunities.

PESTLE Analysis Data Sources

Our AMG Critical Materials PESTLE Analysis is built upon a robust foundation of data from leading global institutions, government agencies, and reputable industry research firms. We incorporate insights from economic forecasts, environmental policy updates, technological advancements, and legal frameworks to ensure comprehensive and accurate analysis.