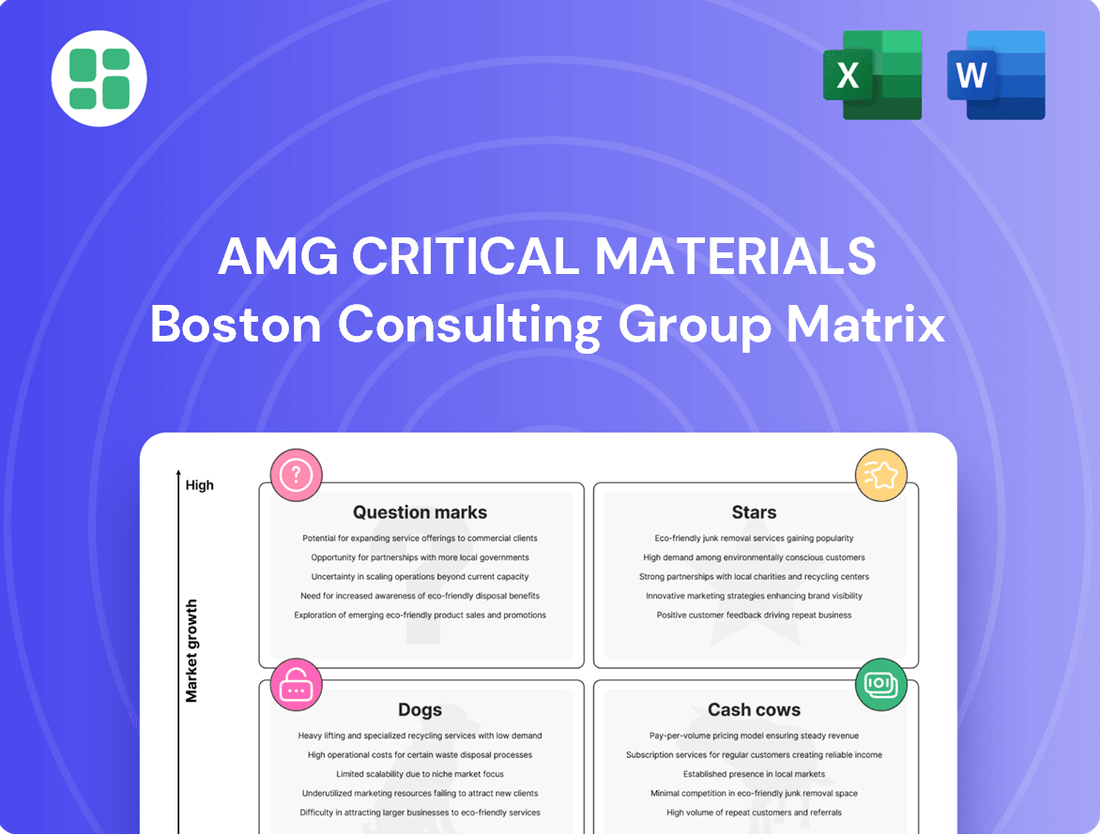

AMG Critical Materials Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMG Critical Materials Bundle

Uncover the strategic positioning of AMG Critical Materials' product portfolio with this insightful BCG Matrix preview. See where your investments are generating cash and which opportunities require careful consideration.

This glimpse into the AMG Critical Materials BCG Matrix is just the beginning. Purchase the full report to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights for optimizing your strategy.

Stars

AMG Critical Materials has initiated battery-grade lithium hydroxide production at its Bitterfeld, Germany facility. Commercial qualification batches are anticipated shortly, positioning AMG as a significant player in the burgeoning electric vehicle battery sector. This market is expected to experience substantial demand increases leading up to 2030.

The Bitterfeld plant’s initial 20,000-ton module is now operational. AMG plans to scale annual production to 100,000 metric tons by 2030, reflecting a strategic focus on this high-growth market where the company aims for leadership.

AMG's Technologies segment, a leader in advanced metallurgy for aerospace, saw a significant 34% revenue increase in Q1 2025, reaching a substantial $416 million order backlog. This growth is fueled by robust demand for specialized equipment, such as turbine blade coating furnaces, essential for the aerospace engine sector.

The aerospace industry's reliance on high-performance materials creates a lucrative niche where AMG has established a dominant market position. These advanced materials are critical for engine efficiency and durability, directly contributing to AMG's strong performance in this sector.

The market for Vanadium Redox Flow Batteries (VRFBs) is experiencing significant growth, driven by the global push for renewable energy. This surge in clean energy deployment directly translates to increased demand for high-purity vanadium, a critical component for industrial energy storage solutions. For instance, the global energy storage market was valued at approximately $150 billion in 2023 and is projected to reach over $300 billion by 2028, with VRFBs carving out a substantial niche.

While the broader vanadium market sees moderate expansion, the energy storage sector represents a high-growth opportunity. AMG, with its unique position as the world's largest recycler of vanadium-containing refinery waste, is ideally placed to capitalize on this trend. This recycling capability provides a sustainable and cost-effective source of vanadium, enhancing AMG's competitive advantage in supplying this burgeoning market.

AMG's dedication to this high-growth area is further demonstrated by their innovative LIVA Hybrid Energy Storage System (HESS). This system showcases AMG's commitment to developing and offering advanced energy storage solutions, directly addressing the evolving needs of the renewable energy infrastructure and solidifying their strategic importance in the VRFB value chain.

Strategic Lithium Projects (e.g., Barroso Lithium Project, Portugal)

AMG Critical Materials is strategically investing in lithium projects, like the Barroso Lithium Project in Portugal, to fuel its long-term growth. This initiative represents a significant step in geographic diversification within the rapidly expanding lithium market.

- Targeted Production: The Barroso project, a partnership with Grupo Lagoa, aims to produce 8,000–9,000 tons of lithium concentrate annually by 2027.

- Supply Chain Security: These projects are crucial for securing raw material supply for AMG's downstream production of battery-grade lithium hydroxide.

- Market Position: This secures AMG's standing in a sector experiencing substantial demand growth.

Advanced Furnace Manufacturing and Antimony Production

AMG Technologies, a key player in advanced furnace manufacturing and antimony production, is a significant profit driver for AMG Critical Materials. In the first quarter of 2025, this segment saw its Adjusted EBITDA more than triple, reaching $75 million. This impressive growth is underpinned by a robust order backlog, signaling robust demand for AMG's industrial equipment and solutions.

The strong performance, driven by leadership in a growing industrial technology sector, positions AMG Technologies as a Star in the BCG Matrix. This segment is characterized by high profitability and a strong market position, contributing substantially to the company's overall financial health.

- AMG Technologies' Adjusted EBITDA surged to $75 million in Q1 2025.

- The segment benefits from a record order backlog for industrial equipment.

- AMG holds a strong market position in advanced furnace manufacturing and antimony production.

- This combination of growth and market leadership classifies it as a Star.

AMG Technologies stands out as a Star within AMG Critical Materials' BCG Matrix due to its high growth and strong market position. The segment's Adjusted EBITDA more than tripled to $75 million in Q1 2025, fueled by a record order backlog for advanced furnaces and antimony production. This performance underscores its leadership in a rapidly expanding industrial technology sector.

| Segment | Q1 2025 Adjusted EBITDA | Key Drivers | BCG Classification |

|---|---|---|---|

| AMG Technologies | $75 million | Advanced furnace manufacturing, antimony production, strong order backlog | Star |

What is included in the product

The AMG Critical Materials BCG Matrix analyzes its business units based on market growth and share.

It guides strategic decisions on investment, divestment, and resource allocation for each unit.

Quickly identify critical material opportunities and risks with a clear, actionable overview.

Cash Cows

AMG's vanadium recycling from oil refining residues is a prime example of a Cash Cow within their Critical Materials portfolio. This segment holds the undisputed global leadership position in extracting vanadium from these specific waste streams, a testament to their established expertise and technological advantage.

This leadership translates into a predictable and robust cash flow, as the market for vanadium, while experiencing some price fluctuations, remains fundamentally stable due to its essential industrial applications, particularly in steel alloys and emerging battery technologies. For instance, in 2023, AMG reported strong performance in its Vanadium segment, contributing significantly to the company's overall profitability, underscoring its cash-generating capabilities.

The production of ferrovanadium and titanium alloys, a core part of AMG Vanadium, operates within a mature market where AMG holds a substantial position. Despite a minor revenue decrease in the first quarter of 2025, this segment's profitability is significantly enhanced by the Section 45X tax credit, a benefit stemming from the Inflation Reduction Act.

These alloys are critical components for sectors such as steel manufacturing and aerospace, ensuring consistent demand and acting as a reliable source of cash for AMG. In 2024, AMG's vanadium products, including ferrovanadium, contributed significantly to its overall revenue, demonstrating the segment's ongoing importance.

AMG's Lithium segment features a robust Tantalum business, a key material in demanding sectors like electronics and aerospace. This segment, while not a high-growth star, provides reliable revenue and healthy profit margins due to consistent global demand.

In 2024, AMG's Tantalum operations are expected to continue this trend, generating steady cash flows. The company's established market position means these operations are efficient, requiring minimal additional capital outlay to maintain their contribution.

Traditional Metallurgical Products

AMG's traditional metallurgical products likely function as cash cows within their portfolio, supporting the company's investments in high-growth critical materials. These established product lines serve stable, mature industrial markets, meaning they require less capital expenditure to maintain their market position and generate steady profits. For instance, in 2023, AMG's Specialty Metals and Powders segment, which encompasses these traditional offerings, reported a significant contribution to overall profitability, demonstrating their reliable cash-generating capabilities.

These products benefit from strong competitive advantages, often built on decades of operational experience and established customer relationships. This allows them to command consistent demand and pricing power, even in less dynamic economic environments. The predictable cash flow from these segments is crucial for funding research and development and capacity expansions in their more growth-oriented critical materials businesses.

- Mature Market Presence: Traditional metallurgical products cater to established industrial sectors with predictable demand patterns.

- Strong Competitive Moats: These offerings often possess durable competitive advantages, ensuring sustained market share and profitability.

- Consistent Cash Generation: They provide a reliable source of cash flow, minimizing the need for substantial reinvestment and supporting other business units.

- Portfolio Diversification: These cash cows balance the higher risk, higher reward profile of emerging critical materials, offering stability to AMG's overall financial performance.

Graphite Processing Operations

AMG's graphite processing operations, primarily within its Critical Minerals segment, are likely positioned as cash cows. These operations cater to established industrial applications, suggesting a mature market with consistent demand and predictable cash generation, even if broader graphite market growth is concentrated in areas like EV batteries.

AMG's strategic move to reacquire a stake in Graphit Kropfmühl GmbH underscores a commitment to strengthening control over these established, cash-generating assets. This focus indicates a deliberate effort to leverage the stability and profitability of their existing graphite processing infrastructure.

In 2023, AMG Critical Materials reported revenue of $805.6 million. While specific segment breakdowns for graphite processing aren't always granularly detailed, the segment's overall contribution signifies the importance of these mature operations in providing reliable financial resources for the company.

- Mature Market: Graphite processing for industrial uses offers stable demand, contributing to consistent cash flow.

- Strategic Reacquisition: The increased stake in Graphit Kropfmühl GmbH signals a focus on maximizing returns from this cash-generating asset.

- Financial Contribution: The Critical Minerals segment, which includes graphite, was a significant revenue driver for AMG in 2023, highlighting the operational strength of these businesses.

AMG's vanadium recycling and ferrovanadium production represent strong cash cows due to their global leadership in niche markets and consistent demand from industries like steel. The Section 45X tax credit further bolsters profitability for these established operations, ensuring reliable cash generation. In 2024, AMG's vanadium products continued to be a significant revenue contributor, underscoring their stable cash-generating capabilities.

The Tantalum business within AMG's Lithium segment also functions as a cash cow, serving critical sectors with consistent demand and healthy profit margins. These operations require minimal capital reinvestment to maintain their output, providing predictable cash flows to support broader company initiatives. AMG's Tantalum operations are projected to maintain this steady cash generation throughout 2024.

AMG's traditional metallurgical products and graphite processing for industrial applications are key cash cows, benefiting from mature markets and established customer bases. These segments provide a stable financial foundation, allowing AMG to invest in higher-growth critical materials. In 2023, AMG Critical Materials reported $805.6 million in revenue, with these mature segments playing a vital role in this performance.

| Segment | Cash Cow Characteristics | 2023/2024 Data Point |

| Vanadium Recycling & Ferrovanadium | Global leadership, stable demand, tax credit benefits | Significant revenue contributor in 2024 |

| Tantalum (within Lithium) | Consistent demand, healthy margins, low reinvestment | Projected steady cash generation in 2024 |

| Traditional Metallurgical Products | Mature markets, established customer base, reliable profits | Significant contribution to 2023 profitability |

| Graphite Processing (Industrial) | Stable demand, predictable cash generation | Part of $805.6M Critical Materials revenue in 2023 |

What You See Is What You Get

AMG Critical Materials BCG Matrix

The preview you're currently viewing is the complete and final AMG Critical Materials BCG Matrix report you will receive immediately after purchase. This means you get the exact same professionally formatted, analysis-ready document without any watermarks or demo content, ensuring immediate usability for your strategic planning.

Dogs

Underperforming legacy niche products in AMG's portfolio, serving industries with very low or negative growth, would fall into the Dogs quadrant of the BCG Matrix. These are typically older offerings with minimal market share and low profitability, potentially even incurring losses. For instance, if a specific industrial chemical produced by AMG has seen demand shrink by 5% annually and AMG's market share in that niche is only 2%, it would likely be classified as a Dog.

Non-strategic minor mineral processing operations, those not directly supporting AMG's energy transition or high-performance material goals, are classified as Dogs. These ventures often operate in crowded, low-profit markets with minimal potential for expansion.

Such operations can drain valuable capital and management attention, diverting resources from more promising strategic areas. For instance, a small-scale processing unit for a non-critical industrial mineral, facing intense competition from larger players, might exemplify this category.

In 2024, the global market for certain bulk industrial minerals, where such operations might exist, saw growth rates below 2%, with profit margins often in the single digits, highlighting the challenges for non-strategic players.

Obsolete or low-demand vacuum furnace systems, while perhaps still functional, represent a potential 'Dog' in AMG Critical Materials' BCG Matrix. These are systems that are no longer cutting-edge or are designed for niche applications with shrinking markets. For instance, older models might struggle to meet the precise temperature or vacuum requirements of newer, high-performance materials processing.

AMG's focus on advanced furnace manufacturing places it in the 'Star' category, but it's crucial to identify and manage these legacy systems. These older units may consume resources for maintenance and support without contributing significantly to new revenue streams or commanding premium pricing. In 2024, the market for highly specialized, advanced vacuum furnaces continues to grow, driven by demand in aerospace and semiconductor industries, making older, less capable systems increasingly marginalized.

Highly Competitive, Undifferentiated Commodity Products

Highly competitive, undifferentiated commodity products in AMG's portfolio would reside in the Dogs quadrant of the BCG Matrix. These are materials where AMG faces intense rivalry, and there's little to distinguish its offerings from competitors. Market growth for these items is typically flat or declining.

Products in this category often generate low profit margins due to price-based competition. They require significant capital investment to maintain production capacity but offer minimal returns, hindering overall profitability and strategic flexibility. For instance, if AMG produces basic industrial minerals with little value-added processing, these could fall into this classification.

- Low Market Share, Low Market Growth: These products struggle to gain significant traction in a saturated market.

- Price-Sensitive Demand: Customers primarily focus on cost, eroding potential for premium pricing.

- Limited Innovation Potential: The commodity nature restricts opportunities for product differentiation or technological advancement.

- Capital Intensive with Low Returns: Maintaining production requires ongoing investment, but profitability remains constrained.

Inefficient or Outdated Production Facilities

Inefficient or Outdated Production Facilities represent a significant drag on a company's profitability within the BCG matrix. These assets, often found in low-growth markets, are characterized by high operating expenses and a correspondingly low market share for their products. For instance, a legacy chemical plant operating at only 60% efficiency in a mature market segment might exemplify this category.

Such facilities typically consume substantial capital for maintenance and upgrades without generating sufficient returns. In 2024, companies with a high proportion of these assets might see their overall profit margins eroded. For example, if a materials producer's outdated plant costs 20% more per unit to operate than modern competitors, its contribution to profitability will be severely hampered, especially if the market segment is only growing at 1-2% annually.

- High Operational Costs: Facilities with energy consumption 15-25% above industry benchmarks.

- Low Market Share: Output from these plants may hold less than 5% of a stagnant market.

- Negative Cash Flow: Such assets often require ongoing investment for basic upkeep, leading to cash burn.

- Divestiture or Restructuring: These are prime candidates for sale or significant overhaul to improve efficiency.

Dogs in AMG's Critical Materials portfolio represent products or operations with low market share in slow-growing or declining industries. These segments often face intense competition, leading to low profitability and minimal potential for expansion. For instance, a niche industrial additive with a 3% market share in a sector experiencing a 4% annual decline would be a prime example of a Dog.

These underperforming assets can consume valuable resources, including capital and management focus, without generating substantial returns. In 2024, the global market for certain legacy specialty chemicals, where such products might exist, saw growth rates below 1%, with profit margins often struggling to reach 5%, underscoring the challenges.

Identifying and managing these 'Dog' assets is crucial for AMG to reallocate resources towards its high-growth 'Star' and 'Question Mark' segments, thereby optimizing its overall business strategy and financial performance.

| BCG Category | Characteristics | Examples within AMG Context | 2024 Market Data Insight |

|---|---|---|---|

| Dogs | Low market share, low market growth, low profitability, high competition | Underperforming legacy niche products, non-strategic mineral processing, obsolete furnace systems, undifferentiated commodity products | Markets with <2% annual growth, profit margins <5% |

Question Marks

AMG's strategic pivot towards energy storage may see them exploring technologies like solid-state batteries, which promise higher energy density and improved safety compared to current lithium-ion. This aligns with a BCG matrix approach where these are question marks, representing high potential in rapidly growing markets but requiring significant R&D investment to overcome technical hurdles and establish commercial viability. For instance, solid-state battery market forecasts suggest a compound annual growth rate (CAGR) exceeding 30% through 2030, indicating a nascent but explosive growth trajectory.

AMG Critical Materials' involvement with NewMOX SAS positions them within the nuclear fuel market, a sector with significant long-term growth potential driven by global energy demands and a renewed focus on nuclear power. This strategic entry is designed to leverage AMG's expertise in critical materials.

As a relatively new entrant, NewMOX SAS likely faces a low initial market share within the established nuclear fuel supply chain. The company will require substantial capital investment and ongoing development to scale operations and gain traction in this highly regulated and technically demanding industry.

While the niobium market shows robust growth, especially in aerospace and high-strength steel, AMG Critical Materials might be exploring new, specialized applications. Emerging areas, particularly within battery technologies, represent potential growth avenues where AMG could be investing to secure a more dominant market position.

The global niobium market is projected to experience a high compound annual growth rate. If AMG is actively pursuing novel, specialized applications for niobium where it currently lacks a leading market share, these ventures would likely be categorized as 'question marks' within the BCG matrix, signifying their high growth potential but uncertain future success.

Expansion into High-Purity Silicon for Semiconductors

AMG's expansion into high-purity silicon for semiconductors positions it within a segment of the silicon market characterized by substantial growth potential, largely fueled by the insatiable demand from the renewable energy and electric vehicle sectors. However, this particular niche for semiconductor-grade silicon is exceptionally specialized, demanding rigorous purity standards and facing intense competition from established players. This strategic move, if it involves entering a segment where AMG currently holds a minor market position, aligns with the characteristics of a 'Question Mark' in the BCG matrix.

Such an endeavor necessitates considerable investment in research and development to achieve the required technological advancements and purity levels. Furthermore, significant resources will be allocated to market penetration strategies, aiming to carve out a meaningful market share in this high-value, yet challenging, arena. For instance, the global semiconductor silicon market was valued at approximately USD 15 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 6% through 2030, highlighting the attractive growth prospects.

- Market Growth: The overall silicon metal market is expanding, with renewable energy and EV adoption being key drivers.

- Niche Specialization: High-purity silicon for semiconductors is a distinct, high-value segment with significant technical barriers.

- Competitive Landscape: This segment is characterized by established competitors and stringent quality requirements.

- Strategic Positioning: AMG's entry into this segment, if with a small existing share, classifies it as a 'Question Mark' requiring focused investment.

Advanced CO2 Reduction Technologies (New Initiatives)

AMG's commitment to sustainability drives exploration into advanced CO2 reduction technologies, aiming to capture and utilize carbon emissions. This aligns with their mission to reduce their environmental footprint, potentially creating new revenue streams and market leadership in a nascent but critical sector.

These initiatives represent potential Stars in the BCG matrix for AMG, characterized by high growth potential but currently requiring significant investment. For instance, the global carbon capture, utilization, and storage (CCUS) market was valued at approximately USD 3.5 billion in 2023 and is projected to grow substantially. AMG's early-stage involvement in novel CO2 reduction materials could position them to capture a significant share of this expanding market.

- Focus on Carbon Capture and Utilization (CCU): AMG is likely investigating advanced CCU technologies that transform captured CO2 into valuable products like chemicals, fuels, or building materials, moving beyond traditional carbon capture and storage (CCS).

- Investment in Novel Materials for CO2 Absorption: This could involve developing or sourcing new sorbent materials with higher CO2 absorption efficiency and lower regeneration energy requirements, a key factor in the economic viability of CCUS.

- Partnerships and R&D for Scalability: To overcome the early-stage challenges, AMG would need to invest heavily in research and development, potentially forming strategic partnerships to accelerate the commercialization and scaling of these advanced CO2 reduction technologies.

AMG's exploration into areas like solid-state batteries or specialized silicon for semiconductors represents ventures with high growth potential but uncertain market positions. These are classic 'question marks' in the BCG matrix, demanding significant investment to develop technology and gain market share. The rapid growth expected in these sectors, such as the projected 30% CAGR for solid-state batteries, underscores the potential reward for overcoming the inherent risks.

BCG Matrix Data Sources

Our AMG Critical Materials BCG Matrix is built on a foundation of robust market intelligence, integrating financial disclosures, industry research reports, and expert analyses to provide actionable strategic insights.