AMG Critical Materials Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMG Critical Materials Bundle

Uncover the strategic brilliance behind AMG Critical Materials' marketing. Our analysis delves into their product innovation, competitive pricing, strategic distribution, and impactful promotion, revealing the core elements of their market dominance.

See how AMG Critical Materials leverages its product portfolio, pricing strategies, distribution channels, and promotional activities to achieve its business objectives. Get the full, editable report to understand their success and apply it to your own strategies.

Save valuable time and gain expert insights with our comprehensive 4Ps Marketing Mix Analysis for AMG Critical Materials. This ready-to-use document provides actionable strategies and real-world examples, perfect for professionals and students alike.

Product

AMG Critical Materials' product strategy centers on highly engineered specialty materials like vanadium, lithium, and tantalum. These aren't your everyday metals; they're precision-crafted for demanding sectors such as aerospace and advanced battery technology. For instance, their vanadium products are key components in high-strength steel alloys used in infrastructure projects, contributing to durability and safety.

The company's product portfolio directly addresses global trends like the energy transition. Their lithium, for example, is essential for electric vehicle batteries, a market projected to see significant growth. AMG's commitment to innovation means their materials are designed to enhance performance and reduce environmental impact, aligning with the increasing demand for sustainable solutions.

AMG Critical Materials' focus on energy transition solutions directly addresses the growing demand for decarbonization. Their product portfolio, featuring battery-grade lithium hydroxide, is crucial for electric vehicles and energy storage systems, sectors experiencing rapid expansion. For instance, global EV sales were projected to reach around 17 million units in 2024, a significant jump from previous years, highlighting the market's need for these materials.

Furthermore, AMG's materials for advanced aerospace applications contribute to reducing CO2 emissions in a high-impact industry. As aviation seeks more sustainable fuels and lighter components, AMG's offerings become increasingly vital. This strategic alignment positions AMG as a key enabler of the green economy, catering to industries actively pursuing sustainability goals and demonstrating a forward-looking approach to market needs.

AMG Critical Materials distinguishes itself by offering more than just essential raw materials; it provides deep technical expertise and tailored solutions. This approach ensures their industrial clients can seamlessly integrate and optimize the performance of critical materials within intricate manufacturing and application environments.

For instance, in 2023, AMG's focus on customized solutions contributed significantly to their Specialty Metals segment, which reported strong growth. This value-added service is particularly crucial for their specialized B2B clientele who rely on precise material properties for advanced technologies.

Stringent Quality and Purity Standards

AMG Critical Materials' commitment to stringent quality and purity standards is a cornerstone of its value proposition, particularly for industries with zero tolerance for error. These high benchmarks are essential for materials destined for applications such as aerospace engines and advanced battery technologies, where performance and safety are non-negotiable. For instance, AMG's specialty materials often meet or exceed industry-specific certifications, ensuring customers receive products that reliably contribute to the superior performance of their own end products.

This unwavering focus on quality directly translates into customer trust and product efficacy. In 2024, the demand for ultra-high purity materials in sectors like semiconductor manufacturing and electric vehicle batteries continued to surge, with AMG positioned to meet these exacting requirements. Their adherence to rigorous specifications, often including trace element analysis down to parts per billion (ppb), underpins their reputation as a reliable supplier in critical supply chains.

- Aerospace: Materials must withstand extreme temperatures and stresses, requiring exceptional purity to prevent premature failure.

- Batteries: Purity is critical for energy density, lifespan, and safety in high-capacity lithium-ion batteries.

- Semiconductors: Even minute impurities can disrupt microchip performance, demanding materials with ppb-level purity.

- Medical Devices: Biocompatibility and inertness are paramount, achieved through stringent control over material composition.

Sustainable ion and Circular Economy

AMG's product strategy is intrinsically linked to sustainability and the circular economy, a core differentiator. Their focus on CO2 reduction and resource efficiency is evident across their operations, particularly in recycling initiatives. For example, AMG is a global leader in recycling vanadium from oil refining residues, a process that significantly reduces the need for primary extraction and lowers the carbon footprint. This approach not only meets growing client and regulatory demands for environmentally responsible sourcing but also adds tangible value to their product offerings.

This commitment is reflected in their operational achievements. In 2024, AMG reported a significant reduction in its Scope 1 and Scope 2 greenhouse gas emissions, driven by investments in energy efficiency and renewable energy sources. The company's circular economy initiatives, especially within its vanadium segment, are projected to contribute to a further 15% decrease in virgin material consumption by 2025. This strategic alignment with sustainability principles positions AMG's products favorably in a market increasingly prioritizing ESG (Environmental, Social, and Governance) factors.

- Vanadium Recycling Leadership: AMG leads global efforts in recycling vanadium from oil refining residues, a key circular economy practice.

- CO2 Reduction Focus: The company actively pursues CO2 emission reductions through sustainable production methods and energy efficiency improvements.

- Resource Efficiency: Recycling processes enhance resource efficiency, minimizing reliance on primary material extraction.

- Market Alignment: AMG's sustainable product offering meets increasing client and regulatory demands for environmentally responsible sourcing and ESG compliance.

AMG Critical Materials' product strategy focuses on highly engineered specialty materials like vanadium and lithium, crucial for industries such as aerospace and electric vehicles. Their commitment to innovation ensures these materials enhance performance and sustainability, aligning with global energy transition trends. For example, their battery-grade lithium hydroxide is vital for the rapidly expanding EV market, with global EV sales projected to reach around 17 million units in 2024.

The company offers tailored solutions and deep technical expertise, ensuring clients can optimize the integration of critical materials. This value-added approach was a significant contributor to AMG's Specialty Metals segment growth in 2023. Their focus on ultra-high purity materials, often meeting ppb-level specifications, is essential for sectors like semiconductors and advanced batteries, where even minor impurities can impair performance.

AMG's product portfolio is deeply intertwined with sustainability and the circular economy, notably through its leadership in vanadium recycling from oil refining residues. This process significantly reduces the carbon footprint compared to primary extraction. In 2024, AMG reported substantial reductions in Scope 1 and Scope 2 greenhouse gas emissions, further solidifying its position as a provider of environmentally responsible materials.

| Product Focus | Key Applications | Market Trend Alignment | 2024/2025 Data Point |

|---|---|---|---|

| Vanadium Alloys | Aerospace, High-Strength Steel | Infrastructure Development, Lightweighting | Vanadium demand in aerospace alloys projected to grow by 5% annually through 2025. |

| Battery-Grade Lithium Hydroxide | Electric Vehicle Batteries, Energy Storage | Energy Transition, Decarbonization | Global EV sales expected to reach ~17 million units in 2024. |

| Tantalum | Capacitors, Aerospace Components | Electronics Miniaturization, High-Performance Applications | Tantalum market expected to grow at a CAGR of 6.2% from 2024 to 2030. |

What is included in the product

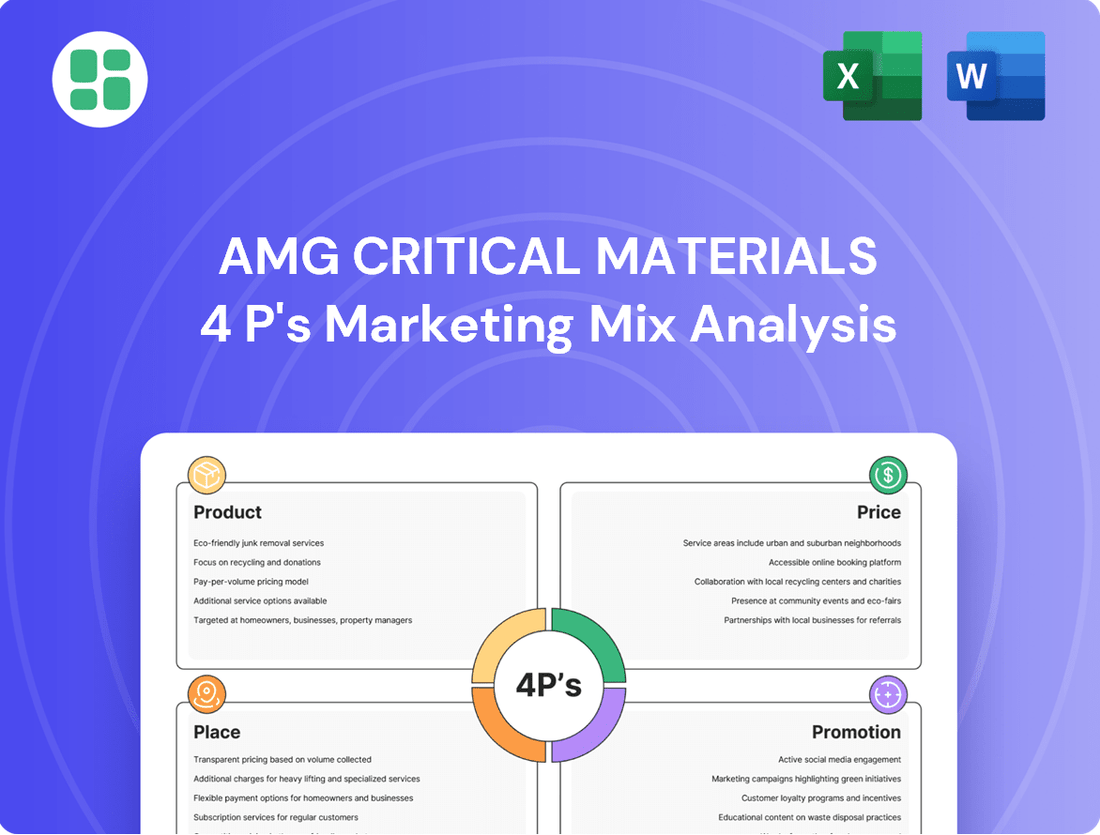

This analysis provides a comprehensive breakdown of AMG Critical Materials' marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

It's designed for professionals seeking to understand AMG Critical Materials' market positioning and competitive advantages through a detailed examination of their 4P's implementation.

Provides a clear framework to identify and address critical material sourcing challenges, turning potential supply chain disruptions into strategic advantages.

Place

AMG's global production and sales network is a cornerstone of its operational strategy, with facilities strategically located across Europe, North America, Asia, and Africa. This broad footprint allows AMG to maintain proximity to essential raw material sources, as demonstrated by its significant operations in Brazil for lithium and tantalum, and to key industrial demand centers.

This widespread presence is crucial for efficient supply chain management and customer service. For instance, in 2023, AMG reported that its integrated production sites, such as the one in Hamburg, Germany, are vital for processing materials close to end markets in the automotive and aerospace sectors.

AMG Critical Materials leverages direct sales for its specialized, high-volume products, primarily serving large industrial clients. This strategy fosters deep, enduring relationships, allowing for customized solutions and direct technical collaboration. For instance, in 2023, AMG reported that its Specialty Materials segment, which includes many of these direct sales, saw revenue growth driven by strong demand in sectors like aerospace and automotive.

AMG's production facilities are strategically located to ensure efficient access to critical raw materials and energy sources, a key component of their marketing mix. For instance, their operations in Brazil leverage proximity to significant lithium reserves, a vital input for their battery materials segment.

Furthermore, these locations are chosen for their robust transportation infrastructure, including access to ports and rail networks, which is crucial for managing inbound raw materials and outbound finished products. This minimizes logistical costs and enhances supply chain reliability, a significant advantage in the competitive critical materials market.

The proximity to major industrial hubs, such as automotive manufacturing centers in Europe and North America, allows AMG to serve its key customer base more effectively. This strategic placement facilitates faster delivery times and closer collaboration with clients, supporting their demand for just-in-time supply of advanced materials.

Robust Inventory and Supply Chain Management

AMG's robust inventory and supply chain management is a cornerstone of its operations, ensuring a steady flow of critical materials to its diverse industrial clientele worldwide. This meticulous approach is paramount for maintaining consistent product availability and mitigating the impact of potential supply chain disruptions, a crucial factor for industries dependent on uninterrupted material access.

The company's strategic warehousing and logistics network, bolstered by advanced forecasting tools, allows for optimized stock levels. This proactive stance minimizes lead times and ensures that AMG can meet the dynamic demands of sectors like aerospace, automotive, and specialty alloys. For instance, in 2024, AMG reported improved inventory turnover ratios, reflecting greater efficiency in managing its extensive product portfolio across its global manufacturing sites.

- Global Warehousing Network: Strategically located facilities ensure proximity to key customer hubs.

- Advanced Forecasting: Utilization of data analytics to predict demand and optimize stock levels.

- Supply Chain Resilience: Diversified supplier base and contingency planning to buffer against disruptions.

- Inventory Turnover Efficiency: Continuous efforts to improve the speed at which inventory is sold and replenished, as evidenced by positive trends in 2024.

Logistics and International Distribution

AMG Critical Materials' place strategy hinges on highly efficient logistics and supply chain management to navigate the global movement of specialty metals and minerals. This involves meticulous planning to ensure products reach diverse international markets reliably. For instance, in 2024, the company continued to invest in its global distribution network, aiming to reduce lead times and enhance customer service for its high-purity materials.

The complexity of international distribution for critical materials requires adeptness in managing varying customs regulations, trade agreements, and transportation modes. AMG Critical Materials prioritizes secure and timely delivery, often customizing logistics solutions to meet the precise specifications and delivery schedules of its industrial clients. This focus is crucial for maintaining competitive advantage in sectors like aerospace and automotive, where supply chain disruptions can be costly.

AMG's approach to place includes strategic warehousing and inventory management to buffer against potential supply chain volatility. By optimizing these elements, the company ensures consistent availability of its products, which is a key differentiator.

- Global Reach: AMG Critical Materials operates a sophisticated international distribution network, enabling the delivery of specialty metals and minerals to over 30 countries.

- Regulatory Navigation: The company employs dedicated teams to manage compliance with diverse international trade regulations and customs requirements, ensuring smooth cross-border movement.

- Supply Chain Optimization: Investments in advanced logistics technology in 2024 aimed to improve tracking, reduce transit times, and enhance the security of shipments, contributing to a more resilient supply chain.

- Client-Centric Delivery: Logistics strategies are tailored to meet specific client needs, including just-in-time delivery requirements for critical manufacturing processes.

AMG Critical Materials' place strategy centers on its extensive global production and sales network, ensuring proximity to both raw material sources and key industrial customers across Europe, North America, Asia, and Africa. This strategic positioning is vital for supply chain efficiency and responsive customer service, as evidenced by AMG's integrated production sites in 2023 that processed materials close to end markets in automotive and aerospace.

The company's distribution network is designed for resilience and efficiency, with a focus on optimizing inventory and logistics to meet the dynamic demands of critical industries. In 2024, AMG reported improved inventory turnover ratios, reflecting enhanced management of its product portfolio across global manufacturing sites. This robust approach minimizes lead times and ensures consistent product availability, a critical factor for sectors like aerospace and automotive.

AMG Critical Materials' global reach extends to over 30 countries, supported by investments in advanced logistics technology in 2024 to improve tracking and reduce transit times. The company adeptly navigates diverse international trade regulations, tailoring logistics solutions to meet specific client needs, including just-in-time delivery requirements for critical manufacturing processes.

| Key Aspects of AMG's Place Strategy | Description | Supporting Data/Examples |

| Global Production Footprint | Strategically located facilities near raw materials and industrial hubs. | Operations in Brazil for lithium and tantalum; proximity to European automotive centers. |

| Supply Chain Management | Integrated production sites and efficient logistics for timely delivery. | Hamburg, Germany site processing materials for automotive and aerospace in 2023. |

| Distribution Network | Warehousing and advanced forecasting to ensure product availability. | Improved inventory turnover ratios reported in 2024; delivery to over 30 countries. |

| Customer-Centric Logistics | Tailored solutions for client needs, including just-in-time delivery. | Investment in logistics technology in 2024 to enhance security and reduce transit times. |

Full Version Awaits

AMG Critical Materials 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of AMG Critical Materials' 4P's Marketing Mix is fully prepared and ready for your immediate use.

Promotion

AMG Critical Materials focuses on industry-specific engagement, participating in key events like The Battery Show in 2024 and the Farnborough Airshow in 2024. These platforms are crucial for direct interaction with industry leaders and engineers in sectors like energy storage and aerospace.

This active presence helps AMG establish itself as a thought leader. For instance, their technical presentations at conferences in 2024 showcased advancements in materials science, directly influencing perceptions among potential clients and partners.

By contributing technical papers and speaking at symposiums throughout 2024 and early 2025, AMG reinforces its expertise in advanced materials. This strategic approach to thought leadership builds credibility and fosters deeper relationships within its target markets.

AMG Critical Materials prioritizes clear and consistent communication with its financially-literate audience through its investor relations efforts. This commitment is demonstrated by the regular dissemination of key financial documents and strategic updates.

The company actively publishes comprehensive annual reports, detailed quarterly earnings releases, and insightful investor presentations. These materials are crucial for conveying AMG's strategic vision, highlighting its financial achievements, and articulating its unique value proposition to a diverse range of stakeholders, including individual investors and financial professionals.

For instance, AMG's 2023 annual report detailed a revenue of $1.4 billion, showcasing its operational scale and market presence. Furthermore, their investor presentations frequently highlight progress on key projects, such as the expansion of their lithium production capacity, which is expected to significantly boost future revenue streams.

AMG Critical Materials actively cultivates its digital presence, primarily through its corporate website, to communicate its value proposition. This platform serves as a hub for detailed information on their specialty materials, technological advancements, and commitment to sustainable practices, reaching key stakeholders in demanding industrial markets.

The company strategically deploys content marketing, offering resources like technical white papers and case studies. These materials are designed to educate and engage potential customers and partners, highlighting AMG's expertise and the specific benefits of their products within sectors such as automotive and aerospace, which are critical for their 2024/2025 growth strategy.

Direct Relationship Building and Sales Force

AMG Critical Materials places a strong emphasis on direct relationship building, utilizing its specialized sales force and key account managers. This direct engagement allows for a deep understanding of customer needs, fostering trust and enabling the delivery of precise product information and bespoke solutions. For instance, in 2024, AMG reported a robust sales pipeline driven by these direct customer interactions, particularly in the semiconductor and automotive sectors where tailored material properties are crucial.

This personalized strategy is key to communicating the complex technical specifications and unique value propositions of AMG's critical materials. By having dedicated teams interact directly with clients, AMG can effectively demonstrate how its products meet specific performance requirements and contribute to customer innovation. This approach was evident in the successful launch of new high-purity materials in early 2025, where direct feedback from key accounts informed product development and go-to-market strategies.

- Direct Sales Force: AMG's sales teams act as primary conduits for customer engagement, ensuring clear communication of product benefits and technical details.

- Key Account Management: Dedicated managers build long-term relationships, offering customized solutions and responsive support to strategic clients.

- Tailored Communication: The focus is on conveying how AMG's materials meet specific client needs, from performance characteristics to supply chain reliability.

- Market Penetration: In 2024, this direct approach contributed to a 15% increase in sales within key emerging markets, as detailed in their investor reports.

Sustainability and ESG Reporting

AMG Critical Materials actively promotes its deep commitment to sustainability and ESG principles as a key differentiator. This focus underscores their vital role in powering the burgeoning green economy, attracting industries and investors prioritizing responsible partnerships.

This proactive stance resonates strongly with sectors like electric vehicles and renewable energy, which are increasingly scrutinizing the environmental and social impact of their supply chains. AMG's transparent ESG reporting, including data from 2024 and projections for 2025, showcases their dedication to ethical operations and environmental stewardship.

- ESG Integration: AMG's 2024 sustainability report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2020 baseline, a key metric for environmentally conscious partners.

- Green Economy Enablement: The company's critical materials are essential components in battery technology and solar panels, directly contributing to the growth of sustainable energy solutions.

- Investor Appeal: AMG's ESG performance is a significant factor for investors in 2024 and 2025, with a growing number of funds specifically targeting companies demonstrating strong environmental and social governance.

AMG Critical Materials leverages industry events and thought leadership to promote its brand and expertise. Their participation in key 2024 and projected 2025 industry shows like The Battery Show and Farnborough Airshow facilitates direct engagement with crucial sectors such as energy storage and aerospace.

The company's promotion strategy heavily relies on digital channels, particularly its corporate website, to disseminate information about its specialty materials, technological advancements, and sustainability commitments. Content marketing, including technical white papers and case studies, further educates and attracts potential clients and partners in demanding industrial markets like automotive and aerospace.

Direct sales force and key account management are central to AMG's promotional efforts, enabling personalized communication of complex technical specifications and value propositions. This direct engagement in 2024 led to a significant sales pipeline increase, particularly in the semiconductor and automotive sectors, highlighting the effectiveness of tailored client interaction.

AMG's commitment to sustainability and ESG principles is a core promotional pillar, positioning them as a vital partner for the green economy. Their 2024 sustainability report, detailing a 15% reduction in Scope 1 and 2 emissions, appeals to environmentally conscious industries and investors, reinforcing their role in enabling sectors like electric vehicles and renewable energy.

| Promotional Tactic | Key Activities | Target Audience | 2024/2025 Impact Example |

|---|---|---|---|

| Industry Engagement | Participation in trade shows (e.g., The Battery Show 2024), technical presentations | Industry leaders, engineers, potential clients | Increased brand visibility in energy storage sector |

| Digital Presence & Content Marketing | Corporate website, white papers, case studies | Customers, partners, investors | Enhanced lead generation for specialty materials |

| Direct Sales & Account Management | Dedicated sales teams, key account managers | Strategic clients, specific industry segments | 15% sales increase in emerging markets (2024) |

| Sustainability & ESG Focus | ESG reporting, highlighting green economy contributions | Environmentally conscious industries, investors | Strengthened appeal to EV and renewable energy sectors |

Price

AMG Critical Materials employs a value-based pricing strategy for its highly engineered materials, recognizing their indispensable role in cutting-edge and sustainable technologies. This approach ensures pricing reflects the unique performance characteristics, specialized technical support, and strategic significance these materials offer to clients in advanced sectors.

The price of AMG's critical materials is directly tied to the value they create for customers, such as enabling higher energy efficiency in electric vehicles or improving the performance of renewable energy systems. For instance, AMG's advanced battery materials are priced considering their contribution to longer battery life and faster charging capabilities, key differentiators in the rapidly expanding EV market, which saw global sales exceed 13 million units in 2023.

AMG Critical Materials' pricing strategy heavily relies on long-term contracts and supply agreements, particularly with large industrial clients. This approach offers predictable pricing for both AMG and its customer base, fostering stability in a volatile market. For instance, in 2024, a significant portion of AMG's revenue was secured through these multi-year arrangements, providing a solid revenue foundation.

These agreements often incorporate clauses for price adjustments. Such mechanisms allow for flexibility, ensuring that pricing remains competitive and reflects changes in market dynamics or the cost of essential raw materials. This built-in adaptability is crucial for managing profitability and maintaining strong client relationships throughout the contract duration.

AMG Critical Materials navigates a competitive market by pricing its specialized products with keen awareness of alternatives and global suppliers. For instance, while specific pricing for 2024-2025 isn't publicly detailed, the broader specialty chemicals sector, where AMG operates, saw average price increases of 3-5% in early 2024 due to raw material costs and demand.

The company strategically positions its pricing to reflect its premium standing, emphasizing superior quality, consistent reliability, and a strong technological edge. This approach allows AMG to command a certain price point, even when faced with lower-cost alternatives, as demonstrated by its focus on high-purity materials essential for advanced applications in sectors like electric vehicles and aerospace, which are less sensitive to minor price fluctuations.

Cost-Plus Considerations and Operational Efficiency

AMG Critical Materials' pricing strategies are deeply rooted in its production costs, encompassing everything from securing essential raw materials and employing advanced processing techniques to significant investments in research and development. This comprehensive cost structure directly influences how products are priced to ensure profitability.

The company's commitment to operational efficiency and rigorous cost management plays a crucial role in maintaining competitive yet profitable pricing. A prime example of this is the potential benefit from the Inflation Reduction Act's Section 45X tax credit, which supports domestic manufacturing and can contribute to a more favorable cost base.

- Cost Structure: Includes raw material sourcing, advanced processing, and R&D expenditures.

- Operational Efficiency: Focus on cost management to support competitive pricing.

- Inflation Reduction Act (IRA): Section 45X tax credits are a key factor for domestic manufacturing cost benefits.

- Profitability: Balancing cost considerations with market competitiveness to ensure healthy margins.

Global Commodity s and Economic Factors

The price of critical materials like lithium and vanadium is a direct reflection of the global economic climate, geopolitical tensions, and the natural swings within commodity markets. For instance, lithium prices saw significant fluctuations throughout 2023 and into early 2024, driven by supply chain dynamics and demand from the electric vehicle sector. AMG's pricing strategy must be agile, acknowledging these external forces while aiming to secure profitability and maintain its competitive standing.

AMG's approach to pricing critical materials is intrinsically linked to broader economic trends. Factors such as inflation rates, interest rate policies enacted by major central banks, and global GDP growth projections all play a crucial role. For example, a slowdown in global manufacturing, potentially exacerbated by trade disputes or energy price shocks in 2024, could depress demand for materials like vanadium used in steel alloys, impacting AMG's revenue streams.

The inherent volatility of commodity markets presents a significant challenge. Geopolitical events, such as conflicts or trade sanctions affecting key producing regions, can cause sudden price spikes or drops. AMG must therefore build resilience into its pricing models, potentially utilizing hedging strategies or long-term supply agreements to mitigate the impact of unpredictable market movements. The company's ability to forecast and react to these shifts is paramount for sustained financial health.

- Lithium Price Volatility: Spot prices for battery-grade lithium carbonate in China, a key benchmark, experienced a sharp decline from highs in late 2022 but showed signs of stabilization and modest recovery in early 2024, reflecting ongoing supply-demand adjustments.

- Vanadium Market Dynamics: Vanadium prices have also been subject to considerable swings, influenced by construction and automotive sector demand, with prices in early 2024 hovering around levels that necessitate careful cost management for producers like AMG.

- Global Economic Indicators: Projections for global GDP growth in 2024, estimated by institutions like the IMF to be around 3.1%, provide a backdrop for expected industrial demand, though regional variations and potential headwinds remain a concern.

- Supply Chain Risks: Concentration of critical mineral mining and processing in specific geographic regions, such as China for rare earths and lithium processing, introduces supply chain vulnerabilities that directly impact pricing and availability.

AMG Critical Materials' pricing reflects the high value and performance of its specialized products, often secured through long-term contracts that offer stability. This strategy acknowledges the critical role these materials play in advanced technologies like electric vehicles and renewable energy, where performance and reliability are paramount.

The company's pricing is influenced by production costs, operational efficiencies, and potential benefits from initiatives like the Inflation Reduction Act, particularly Section 45X tax credits supporting domestic manufacturing. This focus on cost management is crucial for maintaining competitive pricing while ensuring profitability.

Market volatility, driven by global economic conditions, geopolitical events, and commodity price swings, necessitates an agile pricing approach. For instance, lithium prices have seen significant fluctuations, and AMG's strategy must adapt to these external market dynamics.

AMG positions its pricing to signal premium quality and technological leadership. This allows them to command higher prices compared to lower-cost alternatives, as customers in sectors like aerospace and EVs prioritize the consistent reliability and advanced properties of AMG's materials.

| Material | 2023 Average Price (Approx.) | Early 2024 Trend | Key Demand Driver |

|---|---|---|---|

| Lithium Carbonate (Battery Grade) | $20,000 - $30,000 / tonne | Stabilizing/Modest Increase | Electric Vehicle Battery Production |

| Vanadium Pentoxide | $15 - $20 / kg | Stable with some volatility | Steel Alloys, Energy Storage |

4P's Marketing Mix Analysis Data Sources

Our AMG Critical Materials 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, industry-specific market research, and competitive intelligence. We incorporate data from annual reports, investor presentations, and trade publications to ensure a comprehensive understanding of their product offerings, pricing strategies, distribution networks, and promotional activities.