American Express PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Express Bundle

American Express operates in a dynamic world shaped by evolving political landscapes, economic fluctuations, and technological advancements. Understanding these external forces is crucial for strategic planning and identifying future opportunities. Our comprehensive PESTLE analysis delves into these critical factors, providing you with the intelligence needed to navigate the competitive financial services market. Gain a significant edge by downloading the full report today.

Political factors

Government regulations significantly shape the financial services landscape, impacting payment networks and lending practices. For American Express, evolving consumer protection laws, such as those related to credit reporting and fair lending, directly influence its operational strategies and product development. Changes in regulatory frameworks, like the CARD Act of 2009, have historically constrained certain fee structures, while new directives on data privacy could present both compliance challenges and opportunities for enhanced customer trust.

American Express's global operations are significantly shaped by international trade policies and geopolitical tensions. For instance, the ongoing trade disputes between major economies can lead to shifts in currency exchange rates and increased costs for cross-border transactions, directly impacting Amex's revenue from international spending. In 2024, global trade growth is projected to be around 2.6%, a figure that can be volatile based on these political dynamics.

Political stability in American Express's key operating regions is paramount. For instance, in 2024, the company's significant presence in the United States, a generally stable political environment, supports consistent business operations. However, potential policy shifts following elections, or geopolitical tensions impacting international markets where Amex operates, like the UK or Australia, could introduce uncertainty, affecting investor confidence and consumer spending habits.

Political factor 4

Government fiscal and monetary policies significantly shape the economic landscape for American Express. For instance, shifts in interest rates by the Federal Reserve directly impact borrowing costs for consumers and businesses, influencing spending on credit and the demand for Amex’s services. Stimulus packages, like those seen during economic downturns, can boost consumer disposable income, leading to increased transaction volumes for the company.

Taxation changes also play a crucial role. Reductions in corporate tax rates, such as the Tax Cuts and Jobs Act of 2017, can improve profitability for businesses that are major Amex clients, potentially leading to increased business spending and use of corporate cards. Conversely, changes affecting consumer tax burdens can alter discretionary spending, a key driver for Amex’s revenue.

Budget allocations by the government can also indirectly affect American Express. Increased government spending on infrastructure or social programs might stimulate overall economic activity, benefiting Amex through higher transaction volumes.

- Interest Rate Impact: The Federal Reserve's benchmark interest rate, which influences the prime rate, directly affects the cost of credit for Amex cardholders and businesses. For example, a sustained period of low interest rates through 2021 and into early 2022 generally supported consumer spending.

- Fiscal Stimulus Effects: The impact of fiscal stimulus measures, such as the CARES Act and subsequent relief packages in 2020-2021, provided a significant boost to household incomes, indirectly supporting credit card spending.

- Consumer Spending Trends: Government policies that aim to increase consumer confidence and disposable income, such as unemployment benefits or tax credits, directly correlate with higher spending on credit products offered by American Express.

- Business Investment Climate: Corporate tax policies and government incentives for business investment can influence corporate spending and the adoption of business credit solutions, a key segment for Amex.

Political factor 5

Political factor 5

The regulatory environment for financial services and payment processing is a key political factor for American Express. Increased scrutiny on market concentration and antitrust enforcement by governments globally could significantly influence the company's operations. For instance, ongoing discussions and potential legislative actions regarding interchange fees and network exclusivity in major markets like the United States and the European Union directly impact Amex's revenue streams and partnership models.

Government oversight aims to ensure fair competition, which can affect American Express's ability to maintain its unique closed-loop network structure and expand through strategic alliances. Regulatory bodies are increasingly focused on preventing monopolistic practices and promoting innovation, potentially leading to new rules that could alter existing market dynamics.

Key areas of regulatory focus include:

- Antitrust investigations: Scrutiny of market share and potential anti-competitive behavior in payment networks.

- Interchange fee regulation: Government caps or reviews of fees charged to merchants, impacting profitability.

- Open banking initiatives: Mandates for data sharing that could foster new competitors and alter partnership structures.

- Digital currency and fintech regulation: Evolving rules for emerging payment technologies that could reshape the competitive landscape.

Government policies on consumer protection and financial services are critical for American Express. Regulations like the CARD Act of 2009 continue to influence fee structures, while evolving data privacy laws, such as GDPR and CCPA, necessitate ongoing compliance efforts and can shape customer engagement strategies.

What is included in the product

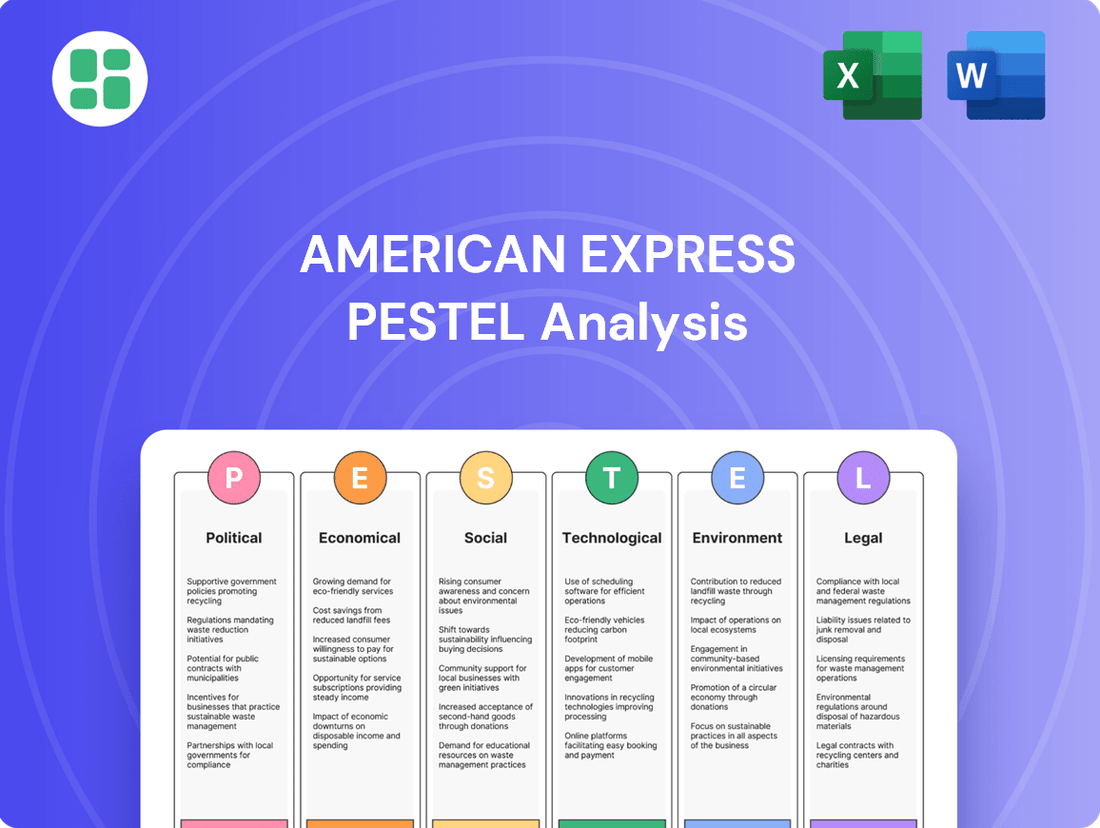

This PESTLE analysis examines the external macro-environmental factors influencing American Express, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying the complex external factors impacting American Express.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining political, economic, social, technological, legal, and environmental influences.

Economic factors

Interest rate fluctuations significantly impact American Express's profitability. Higher rates increase the cost of funding for Amex and can deter consumer spending on credit, directly affecting revenue from interest on outstanding balances. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023, with the federal funds rate reaching a range of 5.25%-5.50% by July 2023, put pressure on borrowing costs and consumer discretionary spending.

The health of the global and domestic economies significantly impacts American Express. For instance, the U.S. GDP growth was projected to be around 2.4% in 2024, according to the Congressional Budget Office, while inflation showed signs of moderating. Strong economic growth generally fuels consumer and business spending, directly benefiting Amex through increased transaction volumes and, consequently, higher merchant discount fees.

Conversely, a slowdown or recession increases the risk of reduced spending and higher default rates, potentially impacting Amex's revenue and profitability. For example, if inflation remains persistently high, it could erode consumer purchasing power, leading to lower card usage and a greater reliance on essential spending, which might not always involve premium card services.

Consumer spending is a crucial economic driver for American Express. In the first quarter of 2024, U.S. consumer spending increased at a 3.2% annual rate, indicating robust activity. This directly translates to more transactions processed by Amex, boosting their revenue from merchant fees and cardholder spending.

Disposable income levels significantly influence the ability of consumers to utilize credit products like those offered by American Express. As of early 2024, real disposable income showed a steady upward trend, supporting increased spending on discretionary items and services, which benefits Amex's transaction volume and membership growth.

Consumer confidence acts as a barometer for future spending. The Conference Board Consumer Confidence Index remained strong in early 2024, reflecting optimism about economic conditions. Higher confidence generally leads to more spending, directly impacting American Express's core business of facilitating payments and managing credit.

Economic factor 4

Currency exchange rate volatility significantly impacts American Express's global business. Fluctuations can alter the value of transactions processed in different currencies, affecting both the company and its cardholders. For instance, a stronger US dollar can make American Express's services more expensive for customers in other countries, potentially dampening international spending.

The translation of foreign earnings into US dollars is also a key concern. When foreign currencies weaken against the dollar, the reported value of profits earned abroad decreases. This was evident in late 2023 and early 2024, where a strengthening dollar presented headwinds for many multinational corporations, including financial services firms like American Express, impacting their reported international revenue streams.

- Impact on Transaction Value: Exchange rate shifts directly alter the cost of goods and services for cardholders making international purchases.

- Revenue Translation: Earnings generated in foreign currencies are worth less when converted back to US dollars if those currencies weaken.

- International Card Spending: A strong dollar can discourage spending by US cardholders abroad, while a weak dollar can boost it.

- Financial Reporting: Currency fluctuations necessitate careful accounting to accurately reflect the value of international operations in financial statements.

Economic factor 5

The American job market in 2024 and early 2025 is characterized by continued resilience, though with some moderating trends. Unemployment rates have remained historically low, hovering around 3.9% as of April 2024, according to the Bureau of Labor Statistics. This tight labor market generally supports consumer financial stability.

Wage growth, while still positive, has shown signs of normalizing from its post-pandemic surge. Average hourly earnings increased by 3.9% over the 12 months ending April 2024. This steady wage growth allows consumers to manage their finances, including credit card obligations, but the pace of increase is crucial for discretionary spending and debt repayment capacity.

The interplay of these factors directly impacts American Express. A strong job market and consistent wage increases bolster consumer confidence and their ability to utilize credit. However, any significant slowdown in wage growth or a rise in unemployment could increase American Express's risk exposure through higher delinquency rates and reduced spending on its cards.

- Unemployment Rate: Steadily below 4% in early 2024, indicating a robust labor market.

- Wage Growth: Averaging around 3.9% year-over-year as of April 2024, supporting consumer spending power.

- Consumer Financial Stability: Generally high due to low unemployment, enabling credit utilization.

- Risk Exposure: Sensitive to any downturn in employment or significant wage stagnation, which could increase credit defaults.

Economic growth is a primary driver for American Express, directly correlating with increased transaction volumes and revenue. The U.S. economy, projected by the Congressional Budget Office to grow around 2.4% in 2024, supports this trend. Conversely, economic downturns or recessions pose risks through reduced spending and higher default rates, impacting Amex's profitability.

Interest rate policies, such as the Federal Reserve's federal funds rate range of 5.25%-5.50% as of July 2023, influence Amex's funding costs and consumer borrowing behavior. Higher rates can dampen discretionary spending and increase the cost of credit for cardholders, affecting Amex's revenue streams.

Consumer spending, a key economic indicator, showed a 3.2% annual increase in Q1 2024, directly benefiting Amex through higher transaction fees. Coupled with steady growth in real disposable income and strong consumer confidence in early 2024, these factors create a favorable environment for Amex's core business operations.

| Economic Factor | 2024/2025 Data Point | Impact on American Express |

|---|---|---|

| GDP Growth (U.S.) | Projected ~2.4% (CBO) | Supports increased transaction volumes and revenue. |

| Federal Funds Rate | 5.25%-5.50% (as of July 2023) | Increases funding costs and can reduce consumer spending on credit. |

| Consumer Spending Growth | 3.2% annual rate (Q1 2024) | Drives higher merchant discount fees and transaction revenue. |

| Real Disposable Income | Steady upward trend (early 2024) | Enables increased discretionary spending and card usage. |

| Unemployment Rate | ~3.9% (April 2024) | Low unemployment supports consumer financial stability and credit utilization. |

Full Version Awaits

American Express PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of American Express delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the strategic landscape and make informed decisions with this complete report.

Sociological factors

Sociological factor 1: Evolving consumer preferences are driving a significant shift towards digital payment methods. Consumers increasingly favor mobile wallets and contactless transactions for their convenience and speed. For instance, in 2024, global mobile payment transaction volume was projected to exceed $4 trillion, highlighting this trend.

American Express is actively adapting by enhancing its digital platforms and investing in mobile payment technologies. This includes expanding partnerships with mobile wallet providers and developing innovative contactless card solutions. Their focus on seamless digital experiences aims to capture a larger share of this growing market segment.

Demographic shifts significantly shape American Express's customer base. The aging population, while potentially holding more accumulated wealth, may have different spending patterns and a preference for established financial services. Conversely, the burgeoning Gen Z cohort, known for its digital nativity and focus on experiences, requires tailored digital solutions and rewards programs. For instance, by the end of 2024, it's projected that Gen Z will represent a substantial portion of the workforce, influencing demand for flexible payment options and financial literacy tools.

Consumers are increasingly seeking to improve their financial literacy and manage credit responsibly, a trend that presents a significant opportunity for American Express. For instance, a 2023 survey by the National Endowment for Financial Education found that 65% of Americans wished they had learned more about personal finance in school. By offering robust educational resources and promoting transparent, responsible lending, American Express can build stronger customer loyalty and attract a growing segment of financially-conscious individuals.

Sociological factor 4

Societal attitudes toward credit and debt are evolving, impacting how consumers engage with financial products. There's a growing emphasis on financial responsibility and mindful spending, which can influence the appeal of premium credit cards. For instance, a 2024 survey indicated that 65% of millennials prioritize saving over conspicuous consumption, a shift that could affect demand for high-tier Amex offerings.

Changing views on lifestyle choices also play a crucial role. While some consumers still seek the prestige and benefits associated with premium cards, others may opt for more minimalist or value-driven financial approaches. This dynamic influences the adoption of services like travel rewards and exclusive experiences, key components of American Express's value proposition.

- Shifting Consumer Priorities: A growing segment of the population is prioritizing financial wellness and debt reduction over overt displays of wealth.

- Impact on Premium Products: This trend may temper the demand for high-annual-fee credit cards, encouraging a focus on tangible value and rewards.

- Digital Financial Literacy: Increased access to financial education online empowers consumers to make more informed decisions about credit usage and lifestyle spending.

- Generational Differences: Younger generations, particularly Gen Z, often exhibit a more cautious approach to debt compared to previous generations, influencing their adoption of credit products.

Sociological factor 5

Societal expectations are increasingly pushing companies like American Express towards robust corporate social responsibility (CSR) and ethical operations. Consumers and stakeholders are actively seeking businesses that demonstrate a commitment to more than just profit. This shift directly impacts brand perception and can foster deeper customer loyalty.

American Express’s efforts in diversity, equity, and inclusion (DEI), alongside community engagement programs, are key to meeting these evolving demands. For instance, in 2023, American Express reported that 52% of its U.S. workforce identified as women, and 51% identified as people of color, reflecting a tangible commitment to DEI. Such initiatives resonate with a public that values responsible corporate citizenship, influencing purchasing decisions and reinforcing brand value.

- Growing Demand for Ethical Practices: Consumers are more likely to support companies with strong ethical track records.

- DEI as a Brand Differentiator: American Express’s investments in diversity and inclusion are not just internal policies but external brand builders.

- Community Engagement Impact: Active participation in community initiatives enhances American Express's social license to operate and builds goodwill.

- Customer Loyalty Driven by Values: Aligning business practices with societal values fosters stronger, more enduring customer relationships.

Societal attitudes are increasingly favoring digital financial tools and responsible credit management. A significant portion of consumers, particularly younger demographics like Gen Z, are demonstrating a preference for digital-first banking and a more cautious approach to debt. This trend is underscored by the projected growth in mobile payment transactions, which were expected to surpass $4 trillion globally in 2024.

American Express is responding by enhancing its digital offerings and investing in mobile technologies to cater to evolving consumer preferences. The company's focus on financial literacy resources also aligns with a societal desire for greater fiscal responsibility. By 2024, it was anticipated that Gen Z would constitute a substantial segment of the workforce, further emphasizing the need for tailored financial solutions.

Furthermore, there's a growing emphasis on corporate social responsibility, with consumers increasingly supporting businesses that demonstrate ethical practices and a commitment to diversity, equity, and inclusion. American Express's reported workforce diversity in 2023, with 52% women and 51% people of color in the U.S., reflects an alignment with these societal expectations.

| Sociological Factor | Trend | American Express Response/Impact | Supporting Data (2023-2025 Projection) |

|---|---|---|---|

| Digital Payment Adoption | Rapid growth in mobile and contactless payments | Investment in digital platforms and partnerships | Global mobile payment transaction volume projected to exceed $4 trillion in 2024 |

| Financial Literacy & Responsibility | Increased consumer desire for financial education | Offering educational resources and promoting responsible lending | 65% of Americans wished they learned more about personal finance in school (2023 survey) |

| Generational Preferences | Gen Z's digital nativity and cautious debt approach | Tailored digital solutions and rewards programs | Gen Z projected to represent a substantial portion of the workforce by end of 2024 |

| Corporate Social Responsibility (CSR) | Demand for ethical operations and DEI | Focus on DEI initiatives and community engagement | 52% women, 51% people of color in U.S. workforce (2023) |

Technological factors

American Express is heavily investing in digital payment technologies, such as mobile wallets and contactless payments, to stay competitive. In 2024, the company continued to expand its offerings in this space, aiming to provide seamless and secure transaction experiences for its cardholders. This focus on innovation is crucial for maintaining customer loyalty and attracting new users in an increasingly digital financial landscape.

Cybersecurity and data protection are paramount in financial services, and American Express places a strong emphasis on these areas. The company invests heavily in advanced security technologies and protocols to protect sensitive customer information and prevent fraudulent activities. This commitment is crucial for maintaining customer trust and the integrity of its payment network.

For instance, in 2023, American Express reported significant investments in technology, including cybersecurity initiatives, as part of its ongoing efforts to enhance customer experience and operational resilience. These investments are designed to stay ahead of evolving threats and ensure the security of transactions across its global platform, safeguarding billions of dollars in customer data.

American Express is heavily leveraging Artificial Intelligence (AI) and Machine Learning (ML) to enhance its operations. These technologies are critical for sophisticated fraud detection, with AI models analyzing billions of transactions in real-time to identify suspicious patterns, significantly reducing financial losses.

In customer service, AI-powered chatbots and virtual assistants provide instant support, handling a growing volume of inquiries and freeing up human agents for more complex issues. This also contributes to personalized customer experiences by understanding individual needs and preferences.

Furthermore, AI and ML are integral to American Express's credit risk assessment, enabling more accurate evaluation of applicant creditworthiness and optimizing lending decisions. In 2024, the company continued to invest in these areas, aiming to improve the precision of credit scoring and reduce default rates.

Marketing strategies are also being refined through AI, allowing for hyper-personalized offers and campaigns. By analyzing vast datasets of customer behavior, American Express can deliver targeted promotions, increasing engagement and conversion rates, a key driver for revenue growth.

Technological factor 4

American Express is actively exploring how blockchain and distributed ledger technologies (DLT) can reshape the payments landscape. These technologies offer the potential for enhanced security and faster transaction settlements, which are critical for a company like Amex. For instance, in 2024, the global blockchain in finance market was valued at approximately $2.5 billion, with significant growth projected as more financial institutions adopt DLT for various applications.

Leveraging blockchain could enable Amex to streamline cross-border payments, reducing processing times and associated fees. Furthermore, DLT could facilitate the creation of new, secure financial products and services, potentially offering novel ways for customers to manage their finances or engage with loyalty programs. The company is likely investing in pilot programs and partnerships to understand and harness these evolving technological capabilities.

- Enhanced Security: Blockchain's cryptographic nature can bolster transaction security, reducing fraud.

- Faster Settlements: DLT can expedite the clearing and settlement of payments, improving liquidity.

- New Product Development: Opportunities exist for tokenized assets or innovative loyalty schemes built on blockchain.

- Industry Adoption: By mid-2025, a significant portion of major financial institutions are expected to have explored or implemented DLT in some capacity.

Technological factor 5

American Express leverages big data analytics extensively to gain a deep understanding of consumer behavior and emerging market trends. By analyzing vast datasets, the company identifies patterns and preferences, enabling it to tailor product offerings and marketing strategies more effectively. This data-driven approach is crucial for maintaining a competitive edge in the financial services industry.

The insights derived from big data analytics allow American Express to optimize operational efficiencies across its business. This includes fraud detection, risk management, and customer service, all of which contribute to a smoother and more secure customer experience. For instance, advanced analytics help in identifying and mitigating fraudulent transactions in real-time, protecting both the company and its cardholders.

- Consumer Insights: American Express utilizes data to understand spending habits, lifestyle choices, and financial needs of its diverse customer base.

- Market Trend Analysis: Big data helps in identifying shifts in consumer preferences and economic indicators to adapt product development and marketing.

- Operational Efficiency: Analytics are applied to streamline processes like credit risk assessment, fraud prevention, and customer support, reducing costs and improving service.

- Product Innovation: Data-driven insights inform the creation of new financial products and services that better meet evolving customer demands.

American Express is aggressively integrating advanced technologies like AI and machine learning to sharpen its competitive edge. These tools are vital for sophisticated fraud detection, analyzing billions of transactions in real-time to spot anomalies and minimize losses. By mid-2025, the company expects AI-driven insights to further refine its credit risk assessments, leading to more precise scoring and reduced default rates.

The company is also exploring blockchain and distributed ledger technologies (DLT) for potential enhancements in payment security and settlement speed. In 2024, the global blockchain in finance market reached approximately $2.5 billion, indicating strong industry interest in DLT applications for streamlining cross-border payments and developing innovative financial products.

Big data analytics remain a cornerstone for understanding consumer behavior and market shifts, enabling Amex to tailor offerings and marketing. These insights are crucial for optimizing operations, from fraud prevention to customer service, ensuring a more efficient and secure experience for cardholders.

| Technology Focus | Key Applications | 2024/2025 Impact/Outlook |

|---|---|---|

| AI & Machine Learning | Fraud Detection, Credit Risk Assessment, Personalized Marketing, Customer Service Chatbots | Enhanced accuracy in risk modeling, improved customer engagement, operational efficiency gains. |

| Blockchain & DLT | Payment Security, Faster Settlements, New Financial Products | Potential for streamlined cross-border transactions; exploration of tokenized loyalty programs. |

| Big Data Analytics | Consumer Behavior Analysis, Market Trend Identification, Operational Optimization | Deeper customer insights, more effective product development, improved fraud mitigation strategies. |

Legal factors

American Express must navigate a complex web of data privacy regulations, including the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), which significantly impact how it collects, stores, and uses customer information. Compliance demands robust data protection measures and transparent consent processes, with potential fines for violations reaching substantial amounts, such as up to 4% of global annual revenue under GDPR. The company's 2024 strategy likely involves ongoing investment in cybersecurity and data governance to meet these evolving global standards.

Consumer protection laws significantly shape American Express's operations, particularly in credit card and lending practices. Regulations like the Credit CARD Act of 2009 mandate transparency in fee structures, interest rate changes, and marketing disclosures, impacting how Amex presents its offerings and manages customer relationships. For instance, the Consumer Financial Protection Bureau (CFPB) actively enforces these rules, ensuring fair treatment and clear communication for cardholders.

These legal frameworks directly influence American Express's marketing strategies, fee disclosures, and dispute resolution mechanisms. Compliance requires meticulous attention to detail in advertising, terms and conditions, and customer service protocols to prevent deceptive practices and ensure fair handling of billing errors or customer complaints. Failure to adhere can result in substantial fines and reputational damage, underscoring the critical role of legal compliance in maintaining consumer trust and operational integrity.

American Express faces stringent legal obligations concerning Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules mandate robust procedures to prevent financial crime, ensuring the legitimacy of transactions and customer identities. Failure to comply can result in significant penalties, impacting reputation and financial stability.

In 2023, financial institutions globally, including American Express, continued to invest heavily in AML/KYC compliance technologies and personnel. Reports indicate that the cost of compliance for major financial firms can run into hundreds of millions of dollars annually, reflecting the complexity and ongoing evolution of these legal frameworks.

Legal factor 4

Antitrust laws significantly shape American Express's operations. Regulatory bodies like the Department of Justice and the Federal Trade Commission actively monitor the payments industry for anti-competitive practices. For instance, ongoing scrutiny of interchange fees and merchant acceptance rules can impact Amex's revenue streams and its ability to forge exclusive partnerships, a cornerstone of its business model.

The competitive landscape for payment networks is intensely scrutinized. Regulations aimed at fostering fair competition can lead to changes in how Amex structures its co-brand partnerships or its agreements with merchants. Such oversight is particularly relevant given the significant market share held by major payment networks, with Visa and Mastercard also facing similar regulatory attention.

Recent legal developments underscore this. In late 2023 and early 2024, ongoing investigations and potential litigation related to interchange fees and network access continued to be a key concern for the entire payments sector. These legal battles can directly influence Amex's pricing strategies and its market positioning.

Key legal considerations for American Express include:

- Antitrust investigations into interchange fees and their impact on merchant costs.

- Scrutiny of exclusive co-brand partnerships and their effect on market competition.

- Potential litigation challenging network rules and their fairness to all participants.

- Regulatory oversight of market dominance within the credit card processing industry.

Legal factor 5

American Express navigates a complex web of legal frameworks governing cross-border transactions and international financial regulations. Compliance with diverse legal requirements across the numerous jurisdictions where it operates is paramount for its global payment processing business.

Adhering to varying data privacy laws, anti-money laundering (AML) regulations, and consumer protection statutes presents significant operational challenges. For instance, the General Data Protection Regulation (GDPR) in Europe and similar legislation elsewhere demand stringent data handling practices.

- Global Regulatory Landscape: Amex must comply with a patchwork of international financial regulations, including those related to sanctions, payment system oversight, and anti-bribery laws.

- Cross-Border Transaction Compliance: Facilitating seamless international payments requires adherence to diverse currency exchange controls, tax regulations, and reporting requirements in each country.

- Data Privacy and Security Laws: Operating globally means complying with varying data protection mandates, such as the GDPR and CCPA, impacting how customer data is collected, stored, and processed.

- Consumer Protection Standards: Amex is subject to consumer protection laws that dictate fair lending practices, dispute resolution processes, and transparent fee disclosures across its markets.

American Express operates under stringent consumer protection laws, such as the Credit CARD Act of 2009, which mandates transparency in fees and interest rates. The Consumer Financial Protection Bureau (CFPB) actively enforces these regulations, ensuring fair practices for cardholders.

The company also faces significant legal obligations regarding Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, requiring robust systems to prevent financial crime. In 2023, financial institutions globally, including Amex, continued substantial investments in AML/KYC compliance, with costs for major firms often reaching hundreds of millions annually.

Antitrust laws are a critical consideration, with bodies like the Department of Justice scrutinizing interchange fees and merchant acceptance rules. These investigations, ongoing into early 2024, can directly impact Amex's revenue and partnership strategies within the competitive payments landscape.

American Express must also navigate a complex global regulatory environment, adhering to diverse data privacy laws like GDPR and CCPA, as well as international financial regulations concerning sanctions and cross-border transactions.

| Legal Area | Key Regulations/Bodies | Impact on Amex | 2023/2024 Focus |

|---|---|---|---|

| Consumer Protection | Credit CARD Act, CFPB | Fee transparency, fair lending | Enhanced disclosure practices |

| AML/KYC | FinCEN, international bodies | Financial crime prevention | Technology investment, compliance personnel |

| Antitrust | DOJ, FTC | Interchange fees, partnerships | Scrutiny of network rules, potential litigation |

| Data Privacy | GDPR, CCPA | Customer data handling | Robust data governance, cybersecurity |

Environmental factors

American Express faces growing pressure to embed sustainable practices and provide clear ESG reporting. The company actively integrates sustainability by focusing on reducing its carbon footprint and promoting responsible sourcing. For instance, in 2023, Amex achieved a 19% reduction in absolute Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, demonstrating a tangible commitment to environmental stewardship.

Climate change poses a significant risk to American Express's travel-centric business. Extreme weather events, like hurricanes or wildfires, can disrupt travel plans, leading to cancellations and reduced spending on services like flights and accommodations, which are often paid for using Amex cards. For instance, in 2023, weather-related disruptions cost the U.S. economy billions, impacting consumer confidence and discretionary spending on travel.

American Express is actively working to shrink its environmental impact. In 2023, the company achieved a 30% reduction in its Scope 1 and 2 greenhouse gas emissions compared to a 2019 baseline, demonstrating a commitment to energy efficiency across its global operations.

The company's strategy includes significant investments in renewable energy for its facilities and a focus on reducing waste generated from its business activities. For instance, Amex aims to divert 90% of its operational waste from landfills by 2025, with substantial progress already made in 2024 through enhanced recycling programs and reduced paper consumption.

Furthermore, American Express is scrutinizing its supply chain for sustainability, promoting responsible sourcing and encouraging partners to adopt similar environmental practices. This holistic approach underscores their dedication to managing resource consumption and minimizing their overall carbon footprint.

Environmental factor 4

Consumers and investors increasingly favor financial companies with strong environmental, social, and governance (ESG) credentials. American Express is responding to this trend by exploring more sustainable offerings. For instance, in 2024, the company continued to expand its Amex Offers platform to include more eco-friendly merchants and experiences, aligning with customer preferences for responsible consumption.

To capture this growing market, American Express could further develop and promote green initiatives. This might include enhancing sustainable travel programs, offering card benefits tied to carbon offsetting, or partnering with organizations focused on environmental conservation. Such moves would not only resonate with environmentally conscious cardholders but also attract ESG-focused investors, a segment that saw significant growth in 2024, with global sustainable fund assets projected to reach new highs.

- Growing Demand: Consumer and investor demand for environmentally responsible financial products is a significant driver for companies like American Express.

- Green Initiatives: American Express is exploring initiatives such as sustainable travel programs and environmentally conscious card benefits.

- Market Alignment: These efforts aim to align the company's offerings with the values of a growing segment of its customer base and the investment community.

- 2024 Trends: The company's actions in 2024 reflected a broader market trend towards ESG integration in financial services.

Environmental factor 5

Environmental regulations are increasingly shaping corporate behavior, and American Express is no exception. The company must navigate a complex web of environmental protection laws and international agreements that dictate operational standards and reporting obligations.

Emerging legislation, particularly concerning climate risk disclosure and sustainable finance, directly impacts how American Express assesses and manages its environmental footprint. For instance, the Securities and Exchange Commission's (SEC) proposed climate disclosure rules, while undergoing review, signal a move towards greater transparency in environmental impact for publicly traded companies.

Key areas of focus for American Express include:

- Carbon Emissions: Monitoring and reducing Scope 1, 2, and 3 emissions across its global operations and supply chain.

- Sustainable Finance: Integrating environmental, social, and governance (ESG) factors into investment and lending decisions, aligning with growing investor demand for sustainable products.

- Resource Management: Implementing efficient practices for energy, water, and waste management within its facilities.

- Climate-Related Financial Risk: Assessing and disclosing the potential financial impacts of climate change on its business, as recommended by frameworks like the Task Force on Climate-related Financial Disclosures (TCFD).

American Express is responding to growing consumer and investor demand for environmentally responsible financial products. The company is exploring initiatives like sustainable travel programs and environmentally conscious card benefits, aligning its offerings with the values of a growing customer and investor base. These actions in 2024 reflect the broader market trend towards ESG integration in financial services.

Climate change poses a direct risk to American Express's travel-dependent business model. Extreme weather events can lead to travel disruptions, impacting consumer spending on services often facilitated by Amex cards. For instance, in 2023, weather-related disruptions cost the U.S. economy billions, affecting consumer confidence and discretionary travel spending.

American Express is actively working to reduce its environmental impact, achieving a 30% reduction in its Scope 1 and 2 greenhouse gas emissions by 2023 compared to a 2019 baseline. The company also aims to divert 90% of its operational waste from landfills by 2025, with significant progress made in 2024 through enhanced recycling and reduced paper consumption.

Navigating environmental regulations is crucial, with emerging legislation on climate risk disclosure and sustainable finance directly impacting operational standards and reporting. The SEC's proposed climate disclosure rules, for example, signal a move towards greater environmental impact transparency for public companies.

| Environmental Focus Area | Amex Action/Goal | 2023/2024 Data/Context |

|---|---|---|

| Greenhouse Gas Emissions | Reduce Scope 1 & 2 emissions | Achieved 30% reduction vs. 2019 baseline by end of 2023. |

| Waste Management | Divert waste from landfills | Aiming for 90% diversion by 2025; progress noted in 2024. |

| Consumer Preference | Offer eco-friendly options | Expanded Amex Offers to include more green merchants in 2024. |

| Climate Risk Impact | Assess and disclose climate-related financial risks | Influenced by evolving regulations like SEC proposed rules. |

PESTLE Analysis Data Sources

Our PESTLE analysis for American Express is built on a robust foundation of data from leading financial institutions, government economic reports, and reputable market research firms. We synthesize information on global economic trends, regulatory changes, and technological advancements to provide a comprehensive view.