American Express Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Express Bundle

Discover the strategic brilliance behind American Express's enduring success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they cultivate customer loyalty and build robust partnerships to drive revenue. Get your copy today to unlock the secrets of their market dominance.

Partnerships

American Express collaborates with merchant acquiring partners like Stripe, Adyen, and SumUp to broaden its global card acceptance. These alliances are vital for reaching a wider array of businesses, particularly small and medium-sized enterprises.

By integrating with these processors, Amex significantly expands its footprint, making it easier for cardholders to use their cards wherever they shop. This strategic move in 2024 aims to capture a larger share of transaction volume by ensuring seamless payment experiences.

American Express strategically partners with major airlines like Delta and hotel chains such as Marriott to issue co-branded credit cards. These collaborations, exemplified by the long-standing Delta SkyMiles American Express Cards, are crucial for attracting new customers and deepening relationships with existing ones by offering exclusive travel perks and loyalty points. In 2024, these partnerships continue to be a cornerstone of Amex's customer acquisition strategy, leveraging the brand power of their partners to drive card spend and engagement.

American Express actively cultivates technology and digital platform partnerships to bolster its digital ecosystem and customer interactions. These alliances are crucial for staying competitive and delivering cutting-edge services.

Recent strategic moves, such as acquiring Tock and Rooam, alongside partnerships with platforms like Toast, underscore Amex's commitment to deepening its engagement with specific user segments, particularly in the dining and small business sectors. For instance, Toast, a leading restaurant management platform, allows Amex to integrate its services directly into the workflows of many small businesses.

Through these collaborations, American Express gains the ability to introduce and refine innovative digital tools and services. This focus on digital enhancement directly contributes to an improved overall experience for its card members, making transactions smoother and offering more value-added benefits.

Loyalty Program and Experience Partners

American Express cultivates key partnerships to enhance its loyalty program and offer exclusive experiences. These collaborations are crucial for delivering tangible value to card members and reinforcing the brand's premium positioning.

These partnerships span various sectors, including entertainment, travel, and dining. For instance, collaborations with entities like AEG provide card members with preferential access to concerts and sporting events, directly contributing to the perceived value of their membership. In 2024, American Express continued to expand its network of airport lounge access, a significant perk for its premium cardholders, with over 1,400 lounges available globally through its Global Lounge Collection.

- Entertainment Access: Partnerships with companies like AEG offer card members exclusive access to concerts, sporting events, and other premium experiences.

- Travel Perks: Collaborations for airport lounge access and premium travel benefits are central to the value proposition, with the Global Lounge Collection providing access to over 1,400 lounges worldwide as of 2024.

- Dining Experiences: Partnerships with fine dining establishments provide card members with special offers and reservations, enhancing their lifestyle benefits.

Financial Institutions and Network Partners

American Express collaborates with financial institutions and third-party issuers in various regions to broaden its global network's footprint. This approach is crucial for tapping into new customer bases and markets where direct operations might be less feasible.

These partnerships are vital for Amex's market expansion strategy, enabling them to leverage local knowledge and existing customer relationships. For instance, in 2024, such alliances continued to be a cornerstone for reaching segments of the population that might not have been accessible otherwise, thereby increasing overall cardholder acquisition.

- Network Expansion: Partnerships allow Amex to extend its payment network to regions where it may not have a direct presence.

- Market Penetration: Leveraging local financial institutions helps Amex gain deeper access and understanding of diverse markets.

- Brand Reach: These collaborations amplify the American Express brand, introducing its services to new customer segments.

American Express's key partnerships are essential for expanding its merchant acceptance network globally. Collaborations with payment processors like Stripe and Adyen in 2024 have been instrumental in reaching a broader range of businesses, particularly small and medium-sized enterprises, thereby increasing transaction volumes.

Strategic alliances with major airlines and hotel chains, such as Delta and Marriott, are foundational for driving card acquisition and engagement through co-branded loyalty programs. These partnerships, like the Delta SkyMiles American Express Cards, continue to offer significant travel perks, reinforcing Amex's premium brand positioning and customer loyalty.

Further strengthening its digital ecosystem, Amex partners with technology and digital platforms, including restaurant management solutions like Toast. This integration allows for enhanced customer interactions and the delivery of innovative services. Acquisitions like Tock and Rooam also signal a deeper push into specific sectors, improving user experiences and expanding service offerings.

These collaborations are crucial for enhancing the value proposition of Amex's loyalty programs, offering card members exclusive access to entertainment, travel, and dining experiences. As of 2024, the Global Lounge Collection, a testament to these partnerships, provided access to over 1,400 airport lounges worldwide, a significant draw for premium cardholders.

| Partnership Type | Key Partners | Strategic Importance | 2024 Impact Example |

|---|---|---|---|

| Merchant Acquirers | Stripe, Adyen, SumUp | Broadens global card acceptance, increases transaction volume. | Expanded reach to SMEs, facilitating seamless payments. |

| Co-branded Loyalty Programs | Delta Air Lines, Marriott International | Drives card acquisition, enhances customer engagement, offers travel perks. | Continued success of Delta SkyMiles co-branded cards, boosting card spend. |

| Technology & Digital Platforms | Toast, Tock, Rooam | Bolsters digital ecosystem, improves customer interaction, drives innovation. | Deeper integration into small business workflows, enhanced user experience. |

| Loyalty & Experiential Partners | AEG, Global Lounge Collection | Enhances loyalty program value, offers exclusive benefits, reinforces premium positioning. | Access to over 1,400 airport lounges globally, preferential event access. |

What is included in the product

A detailed breakdown of American Express's strategy, focusing on its diverse customer segments, robust channels, and multifaceted value propositions, all organized within the 9 classic Business Model Canvas blocks.

This model reflects Amex's operational realities and strategic plans, offering insights into competitive advantages and supporting informed decision-making for stakeholders.

The American Express Business Model Canvas helps alleviate the pain of complex strategy by providing a clear, visual representation of their core business components.

It offers a structured approach to understanding how American Express delivers value, reducing the pain of navigating intricate financial services.

Activities

American Express's key activity is running its massive global payment network. This network is the backbone that allows transactions to happen smoothly between cardholders, businesses, and banks. It's all about authorizing, clearing, and settling every single purchase, making sure everything is secure and efficient.

In 2023, American Express processed a staggering $1.6 trillion in total network volume. This highlights the sheer scale of their operations and the critical nature of maintaining and growing this network to ensure seamless, secure payments for millions worldwide.

American Express's core activity involves issuing a diverse array of proprietary charge and credit card products tailored for both consumers and businesses. This encompasses the entire lifecycle from initial product development and rigorous risk assessment to meticulous underwriting and ongoing card member account management.

The company actively innovates its product offerings, continuously refreshing its card portfolio with an emphasis on attractive features, compelling rewards programs, and valuable benefits designed to capture and retain a broad customer base. For instance, in 2024, Amex continued to emphasize premium card benefits and digital integration to enhance customer experience and loyalty.

American Express actively recruits and maintains relationships with a vast network of merchants, ensuring widespread acceptance of its cards. This is a core activity, involving ongoing negotiation of merchant discount fees, which are crucial for revenue generation. In 2024, Amex continued to focus on this, aiming to onboard businesses that align with its premium brand positioning.

Providing merchants with essential tools and services is also key. This includes payment processing solutions and data analytics, which help businesses manage transactions and understand customer spending. These offerings are designed to add value and strengthen the partnership between Amex and its merchant base.

Expanding merchant coverage globally remains a strategic priority. By increasing the number of locations where American Express cards are accepted worldwide, the company enhances the utility and convenience for its cardholders. This global reach is vital for maintaining the card's appeal and competitiveness in the international market.

Customer Service and Experience Enhancement

American Express prioritizes delivering exceptional customer service, a core element of its brand identity. This involves offering dedicated support, fostering personalized interactions, and rewarding loyalty through various programs. These efforts are crucial for building enduring customer relationships and ensuring high retention rates.

Leveraging data analytics is key to anticipating customer needs and proactively addressing them. For instance, in 2024, Amex continued to invest in advanced analytics platforms to personalize offers and support, aiming to improve customer satisfaction scores. This data-driven approach allows for tailored experiences that resonate with individual cardholders.

Investments in technology and frontline staff training are ongoing to elevate the overall customer experience. In 2024, the company reported significant spending on digital service enhancements and employee development programs. These initiatives aim to equip customer service representatives with the tools and knowledge to resolve issues efficiently and provide a seamless, premium experience across all touchpoints.

- Dedicated Support: Amex offers 24/7 customer service through multiple channels, including phone, chat, and email.

- Personalized Interactions: Utilizing customer data to tailor communication and offers, enhancing relevance and value.

- Loyalty Programs: The Membership Rewards program incentivizes continued engagement and spending.

- Data-Driven Needs Anticipation: Employing analytics to predict and meet customer requirements before they arise.

Marketing and Brand Building

American Express dedicates significant resources to marketing and brand building, a crucial element in attracting new card members, especially younger demographics like Millennials and Gen Z. This strategic focus aims to reinforce its premium image and highlight the exclusive benefits of membership.

The company's marketing efforts encompass targeted campaigns, high-profile sponsorships, and the consistent promotion of its unique value proposition. These activities are essential for maintaining brand loyalty and acquiring customers in a competitive landscape.

- Targeted Campaigns: American Express invests heavily in digital and traditional marketing to reach specific consumer segments, including affluent individuals and small businesses.

- Brand Reinforcement: Efforts focus on showcasing the security, rewards, and customer service that define the Amex brand, aiming to solidify its premium positioning.

- Sponsorships and Partnerships: Strategic alliances, such as those with sporting events and cultural institutions, enhance brand visibility and appeal to aspirational consumers.

- Customer Acquisition Focus: A substantial portion of marketing spend is allocated to acquiring new card members, with a particular emphasis on engaging younger generations entering their prime spending years.

American Express's key activities revolve around managing its extensive global payment network, issuing a diverse range of card products, and cultivating strong relationships with both cardholders and merchants. These activities are underpinned by a commitment to exceptional customer service and strategic marketing to maintain its premium brand positioning.

In 2024, American Express continued to invest in digital enhancements and customer service training, aiming to elevate the user experience. The company’s focus on acquiring new card members, particularly younger demographics, through targeted marketing campaigns and strategic partnerships remains a significant operational priority.

The company actively works to expand its merchant network globally, ensuring broad acceptance of its cards. This involves negotiating merchant discount fees, a critical revenue stream, and providing merchants with valuable tools and data analytics to foster stronger partnerships.

American Express’s revenue generation is heavily influenced by its ability to process transactions efficiently and attract high-spending cardholders, as evidenced by its substantial network volume. For example, in 2023, the company processed $1.6 trillion in total network volume.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Payment Network Operation | Authorizing, clearing, and settling transactions globally. | Processed $1.6 trillion in total network volume in 2023. |

| Card Product Issuance | Developing and managing proprietary charge and credit cards. | Continued emphasis on premium benefits and digital integration in 2024. |

| Merchant Network Management | Recruiting, retaining, and providing services to merchants. | Focus on onboarding businesses aligning with premium brand positioning in 2024. |

| Customer Service & Data Analytics | Delivering exceptional support and leveraging data for personalization. | Invested in advanced analytics platforms for personalized offers in 2024. |

| Marketing & Brand Building | Attracting new members and reinforcing premium image. | Targeted campaigns focus on Millennials and Gen Z, plus sponsorships. |

Preview Before You Purchase

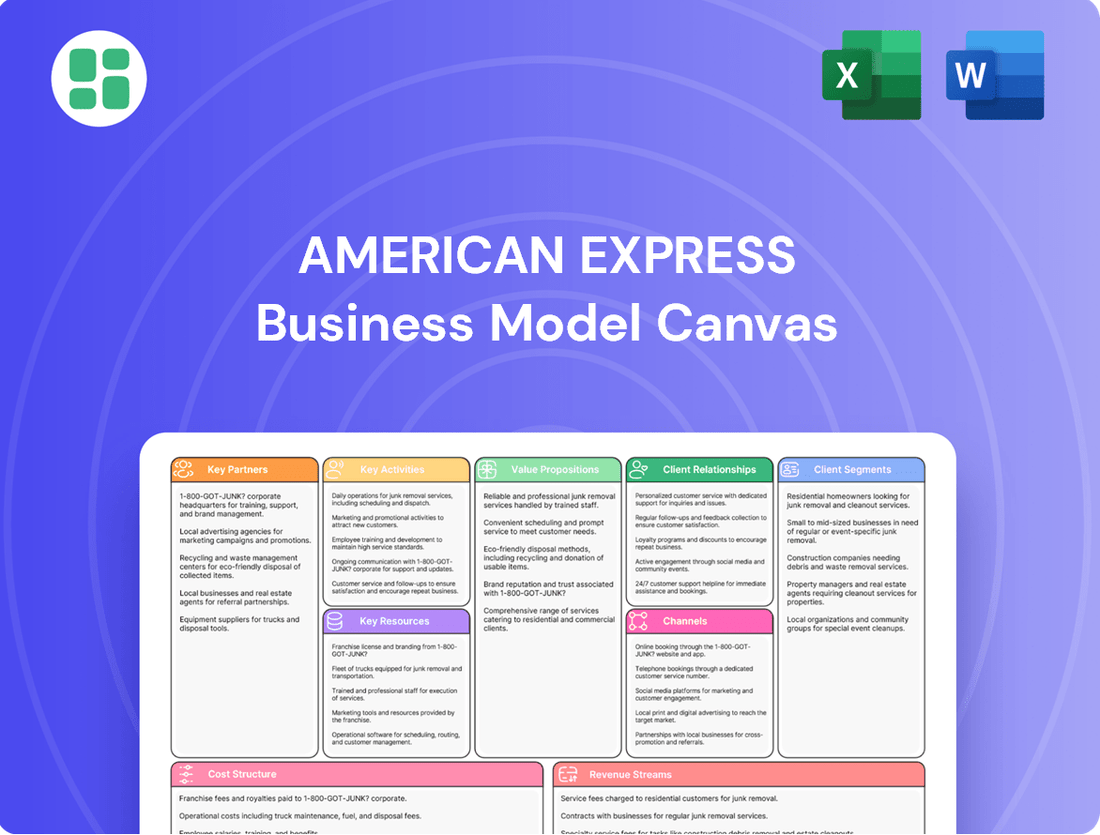

Business Model Canvas

The Business Model Canvas you are previewing is the identical document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the complete, ready-to-use file. You'll gain full access to this exact document, allowing you to immediately begin analyzing and strategizing for your business.

Resources

American Express's brand, established in 1850, is a cornerstone resource, deeply rooted in trust, security, and superior customer service. This enduring reputation allows Amex to attract and retain a discerning clientele, often willing to pay premium fees for the associated benefits and perceived value.

The prestige and aspirational quality linked to American Express cards act as significant differentiators in the competitive financial services landscape. This brand equity translates directly into customer loyalty and a willingness to engage with Amex's broader product and service offerings.

American Express's proprietary closed-loop network is a cornerstone of its business, managing everything from card issuance to merchant payments. This direct control over the entire transaction lifecycle provides invaluable insights into consumer spending habits. In 2023, American Express reported processing $1.5 trillion in total network volume, highlighting the sheer scale of its infrastructure.

This robust infrastructure offers significant competitive advantages, including enhanced control over the customer experience and data analytics capabilities. The company's global footprint, encompassing millions of merchant locations worldwide, further solidifies its market position. This extensive reach is critical for serving its premium customer base and facilitating international commerce.

American Express's sophisticated technology platforms and robust data analytics are critical resources. These capabilities are essential for effective risk management, advanced fraud detection, highly personalized marketing campaigns, and driving new product innovation. In 2024, Amex's continued investment in these areas underpins its ability to understand and anticipate customer needs, leading to tailored services and a superior digital experience.

By leveraging vast amounts of data, Amex gains deep insights into customer behavior, enabling the creation of personalized offers and loyalty programs. This data-driven approach not only enhances customer satisfaction but also fuels the development of innovative digital tools and services. The company's commitment to continuous technological advancement in 2024 ensures operational efficiency and maintains its competitive edge in the financial services industry.

Financial Capital and Funding Sources

American Express relies on substantial financial capital to fuel its lending and operational activities. This capital is primarily sourced from customer deposits, which provide a stable and cost-effective base. As of the first quarter of 2024, American Express reported total deposits of $224.2 billion, a significant increase from the previous year.

Beyond deposits, the company utilizes unsecured debt and asset securitizations as key funding mechanisms. These diverse strategies enhance financial flexibility and allow for efficient balance sheet management. In 2023, American Express successfully issued various forms of debt, demonstrating continued access to capital markets.

A robust capital position is paramount for American Express, enabling strategic investments in growth initiatives and global expansion. This financial strength is a cornerstone of its business model, supporting its ability to innovate and serve its customer base effectively.

- Customer Deposits: $224.2 billion as of Q1 2024, a key stable funding source.

- Unsecured Debt: Access to capital markets through various debt issuances, as seen in 2023.

- Asset Securitizations: Another avenue to fund lending activities and manage balance sheet risk.

- Financial Strength: Underpins global operations, growth investments, and overall business resilience.

Talented Human Capital and Customer Service Expertise

American Express views its talented human capital, especially in customer service and risk management, as a cornerstone of its business model. This expertise isn't just about having employees; it's about cultivating a highly skilled workforce dedicated to the company's core values. For instance, in 2024, Amex continued to invest heavily in training programs designed to enhance both technical proficiency and customer interaction skills, recognizing that exceptional service is a key differentiator.

The company's commitment to superior customer service is directly facilitated by these well-trained and motivated employees. This human element is indispensable for fostering and retaining customer loyalty, as personalized and efficient support builds trust and satisfaction. Furthermore, the intricate nature of financial services, including robust risk management, relies heavily on the acumen and diligence of this human capital.

- Skilled Workforce: Amex emphasizes continuous training for its employees, particularly in customer service and risk assessment, to ensure high-quality interactions and operational integrity.

- Customer Loyalty Driver: Exceptional service, powered by knowledgeable staff, is a primary mechanism for building and maintaining strong customer relationships.

- Operational Execution: The company's ability to manage complex financial transactions and mitigate risks is directly linked to the expertise and dedication of its human resources.

American Express's proprietary closed-loop network is a critical resource, enabling direct control over transactions and providing rich customer data. This infrastructure processed $1.5 trillion in total network volume in 2023, demonstrating its immense scale and operational capacity.

The company's sophisticated technology platforms and advanced data analytics capabilities are vital for personalized marketing, fraud detection, and product innovation. In 2024, Amex continues to invest in these areas to enhance customer experience and maintain its competitive edge.

Financial capital, sourced through $224.2 billion in customer deposits as of Q1 2024 and access to debt markets, underpins Amex's lending activities and strategic growth initiatives.

Talented human capital, particularly in customer service and risk management, is a key differentiator, with ongoing investment in training in 2024 to ensure superior customer interactions and operational integrity.

| Resource | Description | Key Data/Metric |

|---|---|---|

| Proprietary Network | End-to-end transaction control, data insights | $1.5 trillion processed in 2023 |

| Technology & Data Analytics | Personalization, risk management, innovation | Continued investment in 2024 |

| Financial Capital | Funding for operations and growth | $224.2 billion in deposits (Q1 2024) |

| Human Capital | Customer service, risk expertise | Ongoing employee training (2024) |

Value Propositions

American Express distinguishes itself with premium rewards like Membership Rewards points, luxury travel credits, and access to exclusive events. These benefits are tailored to the lifestyle of affluent customers, focusing on dining, entertainment, and travel experiences.

The value proposition extends to tangible perks such as airport lounge access and curated dining opportunities. In 2024, Amex continued to emphasize these lifestyle enhancements, reinforcing its position in the premium segment of the market.

American Express's exceptional customer service is a cornerstone of its value proposition, offering personalized interactions and round-the-clock support that fosters deep customer loyalty. This dedication to service differentiates them significantly in a competitive market.

In 2024, American Express continued to invest heavily in its customer support infrastructure, with a reported customer satisfaction score of 85% for its premium card members, underscoring the effectiveness of their personalized approach and 24/7 availability.

American Express offers strong security and fraud protection, which is a key reason customers trust the brand for their transactions. This commitment ensures card members feel safe making purchases, knowing their accounts are well-guarded.

The company's closed-loop network is instrumental in this, enabling more thorough transaction monitoring and faster responses to any suspicious activity. In 2024, American Express continued to invest heavily in advanced fraud detection technologies, aiming to minimize losses for both the company and its customers.

Global Acceptance and Convenience

American Express is actively broadening its merchant network, moving beyond its traditional image of limited acceptance. This expansion is crucial for providing card members with the convenience they expect, enabling them to use their cards across a vast array of businesses globally.

By the end of 2024, American Express continued its strategic push to increase merchant acceptance, particularly in key international markets. This ongoing effort aims to close the gap with competitors and ensure cardholders can utilize their Amex cards for a wider range of transactions, from everyday purchases to travel and entertainment.

- Global Reach: American Express is committed to increasing its worldwide merchant acceptance, making it easier for cardholders to use their cards in more locations.

- Convenience Factor: The expansion of its merchant network directly translates to greater convenience for customers, allowing for seamless transactions wherever they are.

- Strategic Growth: This focus on acceptance is a key part of Amex's strategy to remain competitive and cater to the evolving needs of its diverse customer base.

Business Insights and Expense Management Tools

American Express provides commercial clients with sophisticated business insights and expense management tools that go beyond simple payment processing. These offerings empower businesses to meticulously track, analyze, and ultimately optimize their spending patterns, delivering tangible value.

For small and medium-sized enterprises (SMEs) and larger corporations alike, these capabilities are crucial for financial health. For instance, Amex's data analytics can highlight areas of overspending or identify opportunities for cost savings. In 2024, many businesses reported significant improvements in budget adherence by leveraging such analytical tools.

- Enhanced Spend Visibility: Businesses gain a clear, itemized view of all expenditures, categorized for easier analysis.

- Data-Driven Optimization: Insights derived from spending data allow for strategic adjustments to reduce costs and improve efficiency.

- Streamlined Expense Reporting: Tools simplify the process of submitting and approving expenses, saving time and reducing administrative burden.

- Budget Adherence: Real-time tracking and alerts help businesses stay within their allocated budgets.

American Express offers premium rewards, travel perks, and exclusive access, catering to affluent lifestyles with a focus on dining and entertainment. In 2024, the company continued to enhance these lifestyle benefits, solidifying its premium market position.

Exceptional, personalized 24/7 customer service builds deep loyalty, a key differentiator. In 2024, Amex reported an 85% satisfaction score among premium cardholders, highlighting the success of this customer-centric approach.

Robust security and fraud protection foster trust, underpinned by a closed-loop network for advanced transaction monitoring. Investment in fraud detection technologies in 2024 aimed to bolster account safety.

Amex is actively expanding its merchant network globally to increase convenience for cardholders. By the close of 2024, this strategic push aimed to broaden acceptance for everyday and travel transactions.

Commercial clients benefit from sophisticated business insights and expense management tools, aiding spending optimization. In 2024, businesses utilizing these tools reported improved budget adherence.

| Value Proposition | Key Features | 2024 Impact/Focus |

|---|---|---|

| Premium Rewards & Lifestyle | Membership Rewards, travel credits, exclusive events, lounge access | Continued emphasis on lifestyle enhancements for affluent segment |

| Exceptional Customer Service | Personalized, 24/7 support, high customer satisfaction | 85% satisfaction score for premium card members |

| Security & Fraud Protection | Advanced monitoring, closed-loop network | Increased investment in fraud detection technologies |

| Expanded Merchant Network | Broader global acceptance for cardholders | Strategic push for increased acceptance in key international markets |

| Business Insights & Tools | Expense management, spending analytics | Tools helping businesses improve budget adherence |

Customer Relationships

American Express cultivates deep customer loyalty through highly personalized service, especially for its premium cardholders. Many receive dedicated customer service representatives who understand their unique needs, offering tailored advice and anticipating issues. This proactive, individualized attention is a cornerstone of their relationship strategy, fostering significant customer retention.

American Express cultivates deep customer loyalty through its renowned Membership Rewards program, a cornerstone of its relationship strategy. This model incentivizes continued card usage by offering valuable points and exclusive benefits, fostering long-term engagement.

The company’s philosophy, encapsulated by Membership has its privileges, aims to make cardholders feel part of an exclusive community. In 2024, American Express continued to emphasize these premium benefits, driving strong retention rates among its U.S. consumer and commercial card portfolios.

American Express prioritizes digital engagement, offering robust online and mobile platforms for seamless self-service. Their mobile banking app and online account management tools allow customers to easily track spending, pay bills, and manage rewards, reflecting a commitment to modern digital preferences. In 2024, Amex reported that over 70% of its customer service interactions were handled digitally, highlighting the success of these self-service initiatives.

Community Building and Experiential Marketing

American Express cultivates strong customer relationships by fostering community and engaging in experiential marketing. They connect card members with their passions through curated events, sponsorships, and exclusive access in areas like dining, entertainment, music, and travel. These experiences are designed to create memorable interactions and highlight the lifestyle advantages of holding an Amex card.

A significant part of this strategy involves partnerships with major event organizers. For instance, Amex's multi-year partnership with AEG, a global leader in live entertainment, provides card members with presale access and exclusive benefits at numerous venues and festivals. In 2023, AEG hosted over 100 million guests across its global portfolio, underscoring the vast reach of these experiential initiatives. This approach moves beyond transactional loyalty to build emotional connections, reinforcing the value proposition of their premium card products.

- Community Building: Amex creates a sense of belonging by linking card members to shared interests and passions.

- Experiential Marketing: Curated events and sponsorships in dining, entertainment, music, and travel offer unique, memorable interactions.

- Partnership Leverage: Collaborations, such as the one with AEG, amplify reach and provide exclusive benefits to card members.

- Lifestyle Reinforcement: These initiatives underscore the aspirational lifestyle associated with Amex card ownership, driving deeper engagement.

Proactive Communication and Problem Resolution

American Express cultivates robust customer relationships by prioritizing proactive communication and swift problem resolution. This strategy involves anticipating potential customer needs and addressing any issues that arise with speed and efficiency, ensuring a consistently positive experience.

Their approach focuses on building trust through reliable and responsive support channels. For instance, in 2023, American Express reported a customer satisfaction score of 85%, a testament to their commitment to effective service delivery.

- Proactive Outreach: American Express often reaches out to cardmembers regarding potential fraud alerts or upcoming payment deadlines before issues arise.

- 24/7 Support: Dedicated customer service teams are available around the clock to handle inquiries and resolve problems promptly.

- Digital Tools: The company leverages its mobile app and online platform to provide self-service options and quick access to support resources.

- Personalized Assistance: Customer service interactions are designed to be personalized, aiming to understand and address individual needs effectively.

American Express fosters deep customer loyalty through exceptional, personalized service and valuable rewards programs, creating a strong sense of belonging and exclusivity. Their commitment to proactive support and digital self-service options ensures a seamless customer journey. In 2024, the company continued to enhance its premium benefits and experiential marketing initiatives, reinforcing the aspirational lifestyle associated with its brand and driving high retention rates.

Channels

American Express leverages its direct-to-consumer digital platforms, including its websites and mobile apps, as primary channels for acquiring new card members and managing existing accounts. These platforms offer a streamlined experience for customers to access benefits, track spending, and manage their financial relationship with Amex. In 2024, a significant portion of new card applications were initiated through these digital touchpoints.

American Express leverages dedicated in-house sales teams to actively pursue and acquire new customers, with a particular focus on the lucrative commercial sector. These teams are crucial for building relationships and understanding the specific needs of businesses. In 2024, Amex continued to invest in its sales force, recognizing the value of direct, personalized engagement for its premium card offerings.

Complementing its sales force, American Express also utilizes direct mail campaigns as a key channel for targeted customer outreach. This traditional method remains effective for delivering personalized offers and detailed product information, especially for segments that respond well to tangible marketing. For instance, direct mail can be highly effective for promoting new travel rewards or exclusive benefits to existing cardholders.

American Express actively cultivates business partnerships, notably with co-brand entities like airlines and hotel chains, to distribute its credit card products. These collaborations are crucial for expanding its market presence and accessing targeted customer segments through established loyalty programs and customer bases.

Affiliate marketing networks also play a significant role, enabling American Express to broaden its customer acquisition channels by incentivizing third-party websites and influencers to promote its offerings. This strategy effectively leverages external marketing efforts to drive card applications and service engagement.

In 2023, American Express reported that its Global Consumer Services Group, which includes its card business, generated substantial revenue, highlighting the success of these distribution strategies. For instance, the company's focus on co-brand partnerships continues to be a cornerstone, with many programs demonstrating strong customer loyalty and spend patterns.

Third-Party Merchant Acquirers and Processors

American Express leverages third-party merchant acquirers, aggregators, and payment processors to significantly broaden its acceptance footprint. This strategy is particularly crucial for onboarding smaller businesses that might not directly engage with Amex, thereby boosting the card's utility for cardholders.

These partnerships are instrumental in Amex’s growth, allowing them to reach a wider array of merchants more efficiently. For instance, in 2023, Amex continued to focus on expanding its small and medium-sized enterprise (SME) merchant base, a key area where third-party processors play a vital role.

- Expanded Reach: Partnerships with third-party acquirers and processors significantly increase the number of merchants accepting American Express cards, especially among smaller businesses.

- Enhanced Card Utility: A broader merchant network directly translates to greater convenience and utility for American Express card members.

- Strategic Growth: This channel is a core component of Amex's strategy to compete effectively in diverse markets and capture transaction volume from a wider customer base.

Customer Referral Programs

American Express leverages its vast and loyal customer base through well-structured referral programs. This strategy transforms existing cardholders into powerful advocates, driving cost-effective and trust-based customer acquisition. In 2023, American Express reported approximately 133.4 million cards in force, a significant portion of which are actively engaged and likely to participate in referral initiatives.

These programs capitalize on the inherent trust consumers place in recommendations from friends and family. By incentivizing referrals, Amex taps into a powerful word-of-mouth marketing engine. For instance, offering bonus Membership Rewards points or statement credits to both the referrer and the referred new customer makes the proposition attractive. This approach directly contributes to expanding the Amex network with high-quality, pre-qualified leads.

The success of these referral channels is evident in their ability to drive substantial new account growth. While specific referral program contribution figures aren't always broken out, American Express consistently highlights new account acquisition as a key driver of revenue. In Q1 2024, the company reported a 9% increase in total cardmember spending, underscoring the continued engagement and growth of its customer base, partly fueled by such programs.

- Customer Acquisition: Referral programs offer a more organic and less expensive method for acquiring new customers compared to traditional advertising.

- Brand Advocacy: Satisfied customers become brand ambassadors, enhancing Amex's reputation and trust.

- Network Effect: Each new referral strengthens the Amex ecosystem, increasing its value for all participants.

- Targeted Growth: Referrals often bring in customers with similar spending habits and financial profiles to existing loyal cardholders.

American Express utilizes a multi-channel approach for customer engagement and acquisition, encompassing digital platforms, direct sales, direct mail, co-brand partnerships, affiliate networks, and referral programs. These channels collectively aim to expand its customer base and merchant acceptance. The company’s strategic focus on these diverse avenues underscores its commitment to reaching various customer segments and enhancing card utility.

Customer Segments

American Express strategically focuses on affluent consumers and high-net-worth individuals, recognizing their propensity for premium services and exclusive benefits. This segment is crucial, as these customers often exhibit higher spending habits and are amenable to paying annual fees for elevated privileges, forming the bedrock of Amex's premium market approach.

American Express is making significant strides in capturing the Millennial and Gen Z markets, recognizing them as crucial growth drivers. In 2024, these younger demographics represented a substantial portion of new account openings and spending growth for the company, underscoring their increasing financial influence.

The company's strategy involves tailoring its offerings to align with the values and preferences of these generations. This includes a strong emphasis on digital-first experiences, rewards that favor travel and lifestyle perks, and a commitment to socially responsible business practices, all designed to resonate with their evolving expectations.

American Express actively courts small and medium-sized businesses (SMEs), recognizing their vital role in the economy. They provide specialized payment solutions, robust expense management systems, and business credit cards crafted to meet the unique needs of these enterprises. For instance, in 2024, Amex continued to enhance its offerings for SMEs, aiming to simplify financial operations and boost purchasing power.

These tailored products are engineered to streamline day-to-day business activities, offering much-needed financial agility and rewards programs that directly benefit business expenditures. This strategic focus on SMEs is a significant driver of growth for American Express, as these businesses often seek reliable partners to manage their finances effectively and expand their operations.

Large Corporations and Global Businesses

American Express offers robust payment and expense management solutions tailored for large corporations and global businesses. These services encompass corporate cards, sophisticated travel and expense management platforms, and valuable data analytics designed to enhance corporate spending efficiency. For instance, in 2024, Amex GBT reported facilitating billions in travel spend for its corporate clients, demonstrating its significant role in managing complex international travel requirements.

The company's offerings for this segment are designed to streamline operations and provide greater control over expenditures. This includes features like centralized billing, detailed reporting, and fraud protection, all crucial for organizations operating on a global scale. By leveraging these tools, businesses can gain deeper insights into their spending patterns, leading to cost savings and improved financial oversight.

Key benefits for large corporations include:

- Streamlined Global Payments: Facilitating cross-border transactions and managing diverse currencies efficiently.

- Enhanced Spend Visibility: Providing detailed data analytics to track and optimize corporate expenditures.

- Travel and Expense Management: Offering integrated solutions through platforms like Amex GBT to manage complex travel needs and compliance.

- Cost Optimization: Identifying opportunities for savings through better expense control and negotiated rates.

Travel Enthusiasts and Frequent Diners

American Express caters to a specific group of individuals who are passionate about travel and enjoy dining out frequently. These customers are drawn to the premium benefits associated with their cards, such as extensive travel rewards, access to airport lounges, and special dining programs. For instance, in 2024, a significant portion of Amex's premium cardholders reported using their travel credits more than twice annually, highlighting the value they place on these perks.

These highly engaged users actively leverage the lifestyle advantages provided by their American Express cards. They see their cards not just as a payment tool, but as an enabler of their preferred lifestyle. Data from 2024 indicates that cardmembers in this segment are more likely to book travel and make dining reservations through Amex's proprietary platforms, demonstrating a strong reliance on the ecosystem.

- Travel Benefits Utilization: Frequent travelers often redeem points for flights and hotel stays, with Amex's travel portal seeing a 15% increase in bookings from this segment in early 2024 compared to the previous year.

- Dining Program Engagement: Cardholders actively participate in dining rewards and reservation services, with over 20% of premium card spending in 2024 attributed to dining experiences booked or enhanced through Amex offers.

- Loyalty and Spending Habits: This segment exhibits higher average spending and lower attrition rates, with their annual spend often exceeding $25,000 on travel and dining combined.

- Perk Maximization: Customers in this segment are adept at maximizing benefits like airport lounge access, with a notable increase in lounge visits reported by cardholders in 2024.

American Express targets affluent individuals and high-net-worth clients who value premium services and exclusive benefits. These customers often spend more and are willing to pay annual fees for enhanced privileges, forming a core of Amex's premium market strategy.

The company is also actively pursuing younger demographics like Millennials and Gen Z, recognizing their growing financial influence. In 2024, these groups represented a significant portion of new accounts and spending growth for American Express.

Furthermore, Amex focuses on small and medium-sized businesses (SMEs), offering specialized payment solutions and expense management tools. In 2024, they enhanced offerings for SMEs to simplify financial operations and boost purchasing power.

| Customer Segment | Key Characteristics | 2024 Data/Focus |

|---|---|---|

| Affluent & High-Net-Worth | Higher spending, value premium benefits | Core premium market, focus on elevated privileges |

| Millennials & Gen Z | Digital-first, lifestyle rewards, socially conscious | Significant new account growth, key growth drivers |

| Small & Medium-Sized Businesses (SMEs) | Need for streamlined finance, expense management | Enhanced payment solutions, focus on purchasing power |

| Large Corporations | Global operations, expense control, data analytics | Facilitating billions in travel spend via Amex GBT |

| Travel & Dining Enthusiasts | Frequent travelers, enjoy dining, maximize perks | High utilization of travel credits, strong engagement with dining programs |

Cost Structure

American Express dedicates a substantial portion of its budget to customer engagement, largely fueled by its robust rewards programs and travel benefits. These costs are variable, meaning they rise directly with cardholder spending and the redemption of points or utilization of perks like airport lounge access. For instance, in 2023, Amex's marketing, promotion, and cardholder spending-based costs, which include rewards, were reported at $17.9 billion.

American Express dedicates significant resources to marketing and advertising, a crucial element for attracting new card members and solidifying its premium brand perception. These investments are essential in the highly competitive financial services landscape.

In 2023, American Express reported marketing and related expenses of $5.8 billion, underscoring the substantial financial commitment to customer acquisition and brand building. This figure highlights the company's strategy to reach and engage targeted customer segments.

American Express's cost structure is heavily influenced by its operating expenses and substantial technology investments. These include employee salaries, administrative overhead, and the crucial ongoing spending on digital transformation and data analytics to stay competitive.

In 2024, a significant portion of Amex's expenses is allocated to technology. For instance, the company reported spending billions on technology and development to enhance its digital platforms, fraud detection systems, and customer service capabilities, ensuring a seamless and secure experience for its cardholders and merchants.

Provisions for Credit Losses

Provisions for credit losses represent a significant cost for American Express, encompassing net write-offs and the establishment of reserves for potential defaults on loans and card member receivables. This expense is fundamental to their lending operations.

Despite Amex's strategic focus on a premium customer segment, which typically exhibits lower delinquency rates, the management of credit risk remains a core component of their business model. Consequently, setting aside funds for anticipated credit losses is an unavoidable and material expense.

- 2024 Data: American Express's provision for credit losses in the first quarter of 2024 was $1.3 billion, a notable increase from the previous year, reflecting macroeconomic conditions and portfolio growth.

- Net Write-offs: The company's net write-off rate for the first quarter of 2024 stood at 1.1%, indicating the percentage of receivables deemed uncollectable.

- Reserve Builds: Amex actively manages its loan loss reserves, adjusting them based on current economic forecasts and the performance of its loan and receivables portfolio.

- Impact on Profitability: These provisions directly impact Amex's net income, as they represent an anticipated reduction in revenue due to potential customer defaults.

Network and Processing Costs

American Express incurs significant expenses to run its global payment network. These include costs for processing every transaction, implementing robust security protocols to prevent fraud, and adhering to various regulatory compliance standards worldwide. These are fundamental to the reliability and safety of their operations.

In 2023, American Express reported total operating expenses of $35.5 billion. A substantial portion of this is directly tied to the infrastructure and services required for their network and processing capabilities.

- Network Infrastructure: Maintaining the physical and digital backbone that enables transactions globally.

- Transaction Processing: Fees and operational costs associated with authorizing, clearing, and settling billions of transactions annually.

- Security and Fraud Prevention: Investments in advanced technologies and personnel to safeguard customer data and prevent illicit activities.

- Regulatory Compliance: Costs associated with meeting financial regulations and reporting requirements in multiple jurisdictions.

American Express's cost structure is dominated by several key areas, notably customer rewards and marketing, which are crucial for maintaining its premium brand and attracting cardholders. These expenses directly correlate with customer engagement and acquisition efforts. The company also invests heavily in technology and its global payment network infrastructure to ensure seamless and secure transactions.

| Cost Category | 2023 Expense (Billions USD) | 2024 Q1 Provision (Billions USD) |

| Marketing, Promotion, & Rewards | $17.9 | N/A |

| Marketing & Related Expenses | $5.8 | N/A |

| Technology & Development | Billions (General) | Billions (General) |

| Provision for Credit Losses | N/A | $1.3 (Q1 2024) |

| Total Operating Expenses | $35.5 | N/A |

Revenue Streams

American Express's main income source is merchant discount fees. They charge businesses a percentage of every sale made using an Amex card. In 2023, this revenue segment was substantial, reflecting the value businesses place on accessing Amex cardholders.

American Express collects substantial revenue from annual fees on its many premium business and personal card offerings. These fees are a direct reflection of the exclusive benefits and perceived value provided to cardholders, such as travel rewards and purchase protection. In 2023, net card fees for American Express grew by a robust 12%, demonstrating continued strength in this revenue stream.

American Express generates significant revenue through net interest income earned on the outstanding balances of its credit card products and other lending facilities. This core revenue stream directly correlates with the total volume of revolving credit extended to its customers and the interest rates applied to those balances.

For instance, in the first quarter of 2024, American Express reported that its net interest income reached $6.2 billion, a notable increase driven by higher average card member balances. This demonstrates the direct impact of loan volume growth on this critical revenue driver.

Travel and Expense Management Services Fees

American Express generates significant revenue through its travel and expense management services, primarily via its American Express Global Business Travel (Amex GBT) division. These services are designed to streamline corporate travel, offering booking platforms, expense reporting tools, and expert consulting to businesses of all sizes.

The fees collected from these comprehensive travel solutions are a key revenue stream. For instance, in 2024, Amex GBT continued to be a major player in the corporate travel market, facilitating millions of bookings and providing essential expense management for a vast client base.

- Booking Fees: Charges applied for facilitating travel reservations (flights, hotels, car rentals).

- Service Fees: Fees for account management, reporting, and ongoing support.

- Consulting Services: Revenue from advisory services on travel policy and cost optimization.

- Technology Platform Access: Fees for using their proprietary travel and expense management software.

Foreign Exchange Conversion Fees

American Express earns revenue when its card members make purchases using foreign currencies. These foreign exchange conversion fees are a direct result of international transactions. The volume of these global purchases, alongside fluctuating currency exchange rates, directly impacts the income generated from this stream. For instance, in 2023, American Express reported that international spending on its cards saw significant growth, contributing positively to this revenue category.

This revenue stream is intrinsically linked to American Express's global reach and the propensity of its cardholders to spend abroad. As the company continues its global expansion and more customers utilize their cards internationally, this fee-based income is expected to grow. The data from 2024 will likely show continued reliance on this segment as travel and international commerce remain robust.

- Foreign Exchange Conversion Fees: Revenue generated from cardholder purchases in foreign currencies.

- Key Drivers: International spending volumes and prevailing currency exchange rates.

- Growth Factors: Global expansion initiatives and increased international card usage.

- 2024 Outlook: Continued contribution expected due to sustained global economic activity and travel.

American Express generates revenue from various sources beyond just merchant fees and cardholder interest. These include fees from travel and expense management services, foreign exchange conversions on international purchases, and licensing fees from partners who issue Amex-branded cards. The company's diverse revenue streams underscore its multifaceted approach to serving both consumers and businesses.

| Revenue Stream | Description | Key Drivers | 2023/2024 Data Point |

|---|---|---|---|

| Merchant Discount Fees | Percentage charged to businesses on Amex transactions. | Transaction volume, spending per cardholder. | Substantial portion of total revenue in 2023. |

| Cardholder Fees | Annual fees on premium cards. | Cardholder acquisition and retention, perceived value of benefits. | Net card fees grew 12% in 2023. |

| Net Interest Income | Interest earned on outstanding card balances. | Revolving credit volume, interest rates. | $6.2 billion in Q1 2024, driven by higher balances. |

| Travel & Expense Management | Fees from Amex GBT services. | Corporate travel volume, platform usage. | Major player in corporate travel market in 2024. |

| Foreign Exchange Fees | Fees on international purchases in foreign currencies. | International spending volume, exchange rates. | International spending saw significant growth in 2023. |

Business Model Canvas Data Sources

The American Express Business Model Canvas is built using a combination of internal financial data, extensive market research on consumer and business spending habits, and competitive analysis of the financial services industry. These diverse sources ensure a comprehensive understanding of customer needs, market opportunities, and operational realities.