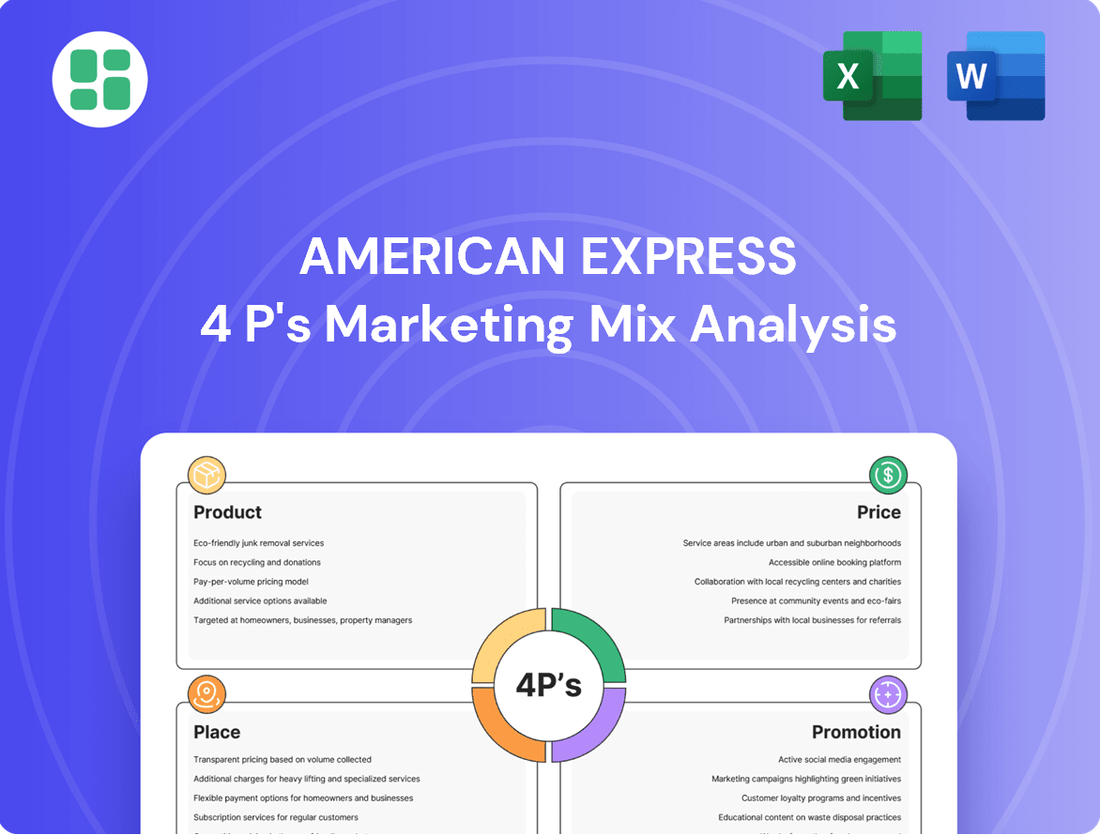

American Express Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Express Bundle

Discover how American Express masterfully crafts its offerings, sets competitive prices, strategically distributes its services, and executes impactful promotions. This analysis goes beyond the surface, revealing the intricate interplay of their 4Ps.

Unlock the secrets behind American Express's enduring market presence by delving into their complete 4Ps Marketing Mix Analysis. Gain a strategic advantage with insights into their product innovation, pricing models, distribution networks, and promotional campaigns.

Ready to elevate your marketing understanding? Get instant access to a comprehensive, editable 4Ps Marketing Mix Analysis for American Express, designed to provide actionable insights for business professionals and students alike.

Product

American Express Business provides a comprehensive suite of payment solutions, featuring a diverse range of credit and charge cards specifically designed for businesses of all sizes. These offerings cater to varied needs with distinct rewards, such as travel points and cash back, alongside premium services.

The company is committed to innovation, with plans to refresh around 40 products globally in 2025. This strategic product update aims to align with projected market growth and the dynamic expectations of its business clientele, ensuring Amex remains competitive.

American Express's Product strategy extends beyond basic payment cards to sophisticated expense management and cash flow optimization tools. These offerings, such as virtual cards and the Amex @ Work platform, empower businesses to streamline financial operations.

Businesses leverage these tools to meticulously track settlements, submissions, and transaction data, significantly enhancing financial oversight. This granular level of detail is crucial for effective financial planning and risk management.

The Amex @ Work platform, for instance, allows for customized e-statements and efficient dispute resolution, directly addressing common pain points in business finance. This focus on automation directly translates to substantial time savings and improved operational efficiency for clients.

In 2024, American Express continued to emphasize digital solutions, with a notable increase in adoption of their expense management platforms. This reflects a growing market demand for integrated financial technology that simplifies complex business processes.

American Express's product strategy heavily emphasizes premium travel and lifestyle benefits, a key differentiator for its business cards. For example, the Business Platinum Card offers access to a vast global lounge network, including the prestigious Centurion Lounges, and exclusive advantages at Fine Hotels + Resorts properties.

These offerings are not static; Amex consistently enhances them to provide greater value. Major updates are anticipated for the Business Platinum Card in late 2025, aiming to further enrich the travel and lifestyle experience for its cardholders.

Merchant Services and Solutions

American Express's Merchant Services and Solutions are a critical component of its marketing mix, focusing on enabling businesses to accept American Express cards and optimize their payment processes. This offering directly addresses the 'Product' element by providing essential tools for commerce. For instance, solutions like Boost Intercept are designed to automate virtual card processing, a key feature for enhancing efficiency and cash flow for suppliers.

The company's commitment to expanding its merchant network is a significant aspect of its product strategy. In 2024, American Express continued its aggressive global expansion, adding millions of new merchant locations worldwide. This growth ensures broader acceptance and accessibility for cardholders, thereby increasing the value proposition of the American Express card itself.

Key features and benefits of American Express Merchant Services include:

- Streamlined Payment Processing: Offering efficient and reliable ways for businesses to accept Amex payments.

- Automated Solutions: Tools like Boost Intercept reduce manual work in virtual card processing.

- Global Network Expansion: Continuously adding millions of new merchant locations annually to enhance card acceptance.

- Improved Cash Flow for Suppliers: Facilitating faster and more predictable payments through virtual card solutions.

Business Insights and Support

American Express elevates its offering beyond mere financial transactions by providing robust business insights and support. Platforms such as Business Class deliver crucial market analysis, emerging trends, and educational content designed to foster business growth and financial acumen. This commitment to empowering decision-makers addresses critical business challenges, aiming to cultivate enduring partnerships.

This strategic focus on support is evident in Amex's investment in resources that enhance financial literacy and operational understanding for businesses. For instance, by offering data-driven insights, Amex helps clients navigate complex market dynamics, a critical factor in today's volatile economic landscape. This proactive approach positions American Express as a strategic ally, not just a service provider.

- Market Trends: Access to up-to-date analyses on industry shifts and consumer behavior.

- Educational Content: Resources covering financial management, marketing, and growth strategies.

- Networking Opportunities: Platforms facilitating connections with other business leaders.

- Data-Driven Insights: Tools to help businesses understand their performance and market position.

American Express's product strategy centers on a diverse portfolio of business payment solutions, from versatile credit and charge cards offering tailored rewards to advanced expense management tools. The company is actively refreshing its offerings, with plans to update approximately 40 products globally in 2025 to meet evolving market demands and client expectations.

Key product enhancements focus on digital integration and operational efficiency, exemplified by platforms like Amex @ Work, which streamlines financial operations and dispute resolution. In 2024, there was a notable uptick in the adoption of these expense management solutions, reflecting a broader market trend towards integrated financial technology.

Beyond core payment functionalities, Amex differentiates its business cards through premium travel and lifestyle benefits, such as lounge access and exclusive hotel perks. These benefits are continuously refined, with significant updates planned for flagship products like the Business Platinum Card by late 2025, aiming to bolster cardholder value.

The expansion of its merchant network is also a crucial product-related strategy, with millions of new merchant locations added globally in 2024 to ensure widespread card acceptance. This growth underpins the utility and value proposition of American Express cards for both businesses and their customers.

| Product Area | Key Features/Innovations | 2024/2025 Focus |

|---|---|---|

| Business Cards | Tailored rewards (travel, cash back), premium benefits (lounge access, hotel perks) | Product refreshes (approx. 40 globally in 2025), enhanced travel/lifestyle value for Business Platinum Card (late 2025) |

| Expense Management | Virtual cards, Amex @ Work platform, data insights, dispute resolution | Increased digital solution adoption, automation of virtual card processing (e.g., Boost Intercept) |

| Merchant Services | Payment processing, automated solutions, global network expansion | Millions of new merchant locations added in 2024, improved cash flow for suppliers |

| Business Support | Market analysis, educational content, networking, data-driven insights | Fostering financial acumen and growth through platforms like Business Class |

What is included in the product

This analysis offers a comprehensive breakdown of American Express's marketing strategies across Product, Price, Place, and Promotion, grounded in actual brand practices and competitive context.

It's designed for professionals seeking to understand American Express's marketing positioning, providing a solid foundation for case studies, strategy audits, and competitive benchmarking.

Simplifies the complex American Express 4Ps into actionable insights, alleviating the pain of strategic confusion for marketing teams.

Provides a clear, concise framework for understanding how American Express leverages its 4Ps to address customer pain points, easing the burden of market analysis.

Place

American Express leverages its direct online channels as a primary distribution strategy for its business products. This allows companies to easily research, compare, and apply for a range of cards and financial services directly through Amex platforms.

The company’s websites and mobile apps are designed as comprehensive resources, offering detailed product information, streamlined application processes, and robust account management tools. This digital-first approach ensures maximum accessibility for both prospective and current business clients, facilitating a seamless customer journey.

In 2023, American Express reported that its digital engagement continued to grow, with a significant portion of new card acquisitions happening online. This trend is expected to persist into 2024, as businesses increasingly prefer digital interactions for their financial needs.

American Express's place strategy hinges on its extensive global merchant network, a critical component for cardholder convenience and transaction growth. As of early 2024, Amex continued its aggressive expansion, aiming to add millions of new merchant locations worldwide to bolster its acceptance footprint.

This ongoing network expansion is vital for American Express, directly impacting its ability to attract and retain both cardholders and merchants. By consistently increasing the number of businesses that accept Amex, the company reinforces the value proposition of its payment products in a competitive landscape.

American Express actively cultivates strategic partnerships and co-branding to broaden its market presence and connect with distinct customer groups. For instance, their extensive portfolio includes co-branded credit cards with major travel partners such as Delta Air Lines, Marriott Bonvoy, and Hilton Honors, offering tailored rewards and benefits to travelers.

These collaborations extend beyond travel, as seen in their partnership with Toast, a leading restaurant management platform, to enhance payment and loyalty experiences within the hospitality sector. This move into integrated technology solutions demonstrates a commitment to providing comprehensive value to both consumers and businesses.

Direct Sales and Corporate Programs

American Express leverages a direct sales force and specialized corporate programs to cater to the unique needs of larger enterprises and institutional clients. This approach allows for the development of customized financial solutions, such as tailored corporate card programs and sophisticated expense management platforms. These dedicated channels ensure that large organizations receive highly personalized service and integrated financial tools designed to optimize their operations.

These programs are crucial for managing complex client relationships and offering solutions that go beyond standard offerings. For instance, Amex's corporate card solutions often include features like detailed spending analytics, customized spending limits, and integration with existing accounting software, providing significant value to businesses. As of Q1 2024, American Express reported a substantial portion of its revenue comes from its Global Commercial Services segment, underscoring the importance of these direct sales and corporate programs.

- Tailored Solutions: Direct sales teams work with large clients to design specific corporate card features and expense management workflows.

- Integrated Systems: Amex's corporate programs often integrate with clients' existing ERP and accounting systems for seamless data flow.

- Relationship Management: Dedicated account managers provide ongoing support and strategic advice to corporate clients.

- Revenue Contribution: The Global Commercial Services segment, heavily reliant on these programs, is a significant driver of American Express's overall financial performance.

Customer Service and Digital Support

American Express places a significant emphasis on customer service and digital support, recognizing its crucial role in the marketing mix. This commitment ensures that businesses can easily access and manage their accounts, fostering satisfaction and loyalty. Their digital platforms are designed for intuitive use, providing self-service options alongside human assistance.

The company offers a comprehensive suite of support channels. These include detailed online support portals, readily available live chat for immediate queries, and highly trained customer care teams. These resources are vital for assisting businesses with everything from day-to-day card management and resolving transaction disputes to maximizing the value derived from their American Express products. For instance, in 2023, American Express reported a customer satisfaction score of 85% for its digital support channels, a testament to their investment in this area.

- Online Support Portals: Comprehensive resources for account management and FAQs.

- Live Chat Features: Real-time assistance for quick query resolution.

- Dedicated Customer Care Teams: Expert support for complex issues and strategic advice.

- 2024 Projections: American Express aims to further enhance digital support with AI-driven chatbots, targeting a 10% increase in query resolution speed by year-end.

American Express's place strategy is multifaceted, focusing on both broad accessibility and targeted distribution. Their digital-first approach, evident in their online channels and mobile apps, ensures businesses can easily access and manage financial products, with digital acquisitions continuing to rise in 2024.

The company's extensive global merchant network is a cornerstone, with aggressive expansion efforts in early 2024 to increase acceptance points. Strategic partnerships and co-branding, such as with Delta Air Lines and Toast, further broaden their reach and appeal to specific customer segments.

For larger enterprises, American Express utilizes a direct sales force and specialized corporate programs, offering tailored solutions and dedicated relationship management. This segment, particularly Global Commercial Services, is a significant revenue driver, with substantial growth noted in Q1 2024.

Customer service and digital support are paramount, with Amex investing heavily in online portals, live chat, and expert care teams, achieving high customer satisfaction scores in 2023 and planning further enhancements with AI in 2024.

| Distribution Channel | Key Features | 2023/2024 Data/Focus |

|---|---|---|

| Direct Online Channels | Product research, comparison, application, account management | Continued growth in digital engagement; significant portion of new card acquisitions online in 2023; projected persistence into 2024. |

| Global Merchant Network | Cardholder convenience, transaction growth | Aggressive expansion aiming for millions of new merchant locations worldwide as of early 2024. |

| Strategic Partnerships/Co-branding | Broadened market presence, tailored rewards | Extensive portfolio with travel partners (Delta, Marriott, Hilton); integration with platforms like Toast. |

| Direct Sales & Corporate Programs | Customized solutions for large enterprises | Tailored corporate cards, expense management platforms; Global Commercial Services a significant revenue driver (Q1 2024). |

| Customer Service & Digital Support | Accessibility, satisfaction, loyalty | 85% customer satisfaction score for digital support (2023); plans for AI chatbots to increase query resolution speed by 10% in 2024. |

Full Version Awaits

American Express 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into American Express's Product, Price, Place, and Promotion strategies. You'll gain a clear understanding of how these elements are integrated to maintain their market position.

Promotion

American Express cultivates a premium brand image through sophisticated advertising, directly targeting financially savvy individuals and businesses. Their campaigns, like the 'Redefine Possible with Business Platinum' initiative in 2024, aim to resonate with discerning customers by emphasizing exclusive benefits and aspirational lifestyle elements.

These targeted efforts are evident in their media placement strategy. By appearing on platforms such as LinkedIn, Meta, and Pinterest, alongside traditional channels, American Express effectively reaches small business owners and affluent consumers, showcasing how their cards can enhance both professional and personal pursuits.

For instance, the 'The card is for business. The points are for pleasure.' tagline in 2024 highlights the dual utility of their premium cards, a message amplified through digital channels frequented by their target demographic, reinforcing the value proposition for high-spending clientele.

American Express heavily leans into digital engagement and social media for its promotion efforts, recognizing its importance in reaching modern consumers and businesses. They actively utilize platforms like Meta (Facebook and Instagram) and X (formerly Twitter) to run targeted campaigns. These campaigns often highlight their business solutions, including logistics and supply chain management, aiming to connect with and provide value to their audience.

This digital-first approach is crucial for resonating with younger business owners, particularly millennials and Gen Z, who are digitally native and expect seamless online interactions. For instance, in 2024, American Express continued to invest in personalized digital content and influencer collaborations across these platforms to drive brand awareness and customer acquisition.

American Express leverages content marketing through its 'Business Class' platform, providing small and medium-sized businesses with free access to trends, insights, and educational resources. This initiative democratizes business knowledge and fosters loyalty by offering valuable, non-promotional material that tackles common entrepreneurial and executive challenges.

The 'Business Class' platform is a prime example of Amex’s commitment to empowering its business clientele. For instance, in 2024, small businesses continued to face significant economic headwinds, with reports indicating that over 50% of small businesses cited inflation and supply chain disruptions as major concerns. Amex's content directly addresses these issues, offering practical advice and strategic guidance.

This content marketing strategy not only builds brand affinity but also positions American Express as a trusted partner for business growth. By delivering actionable insights, Amex aims to support its customers' success, thereby strengthening their relationship and encouraging continued use of Amex services, a key element in their 4P's analysis.

Sponsorships and Experiential Marketing

American Express strategically leverages sponsorships and experiential marketing to foster deep brand connections. In 2024, the company continued its significant investment in high-profile events, aiming to deliver memorable experiences that resonate with its target demographic.

These activations are crucial for demonstrating the tangible benefits of Amex membership, particularly for affluent consumers seeking exclusive access and premium engagement. For instance, Amex's partnerships often provide Card Members with unique opportunities at major sporting events and cultural festivals, reinforcing the brand's association with luxury and lifestyle.

- Sponsorship Focus: Continued investment in major sporting events like the US Open and cultural festivals to enhance brand visibility and association with premium experiences.

- Experiential Benefits: Offering Card Members exclusive access, such as pre-sale tickets, VIP lounges, and unique on-site activations, reinforcing value proposition.

- Brand Perception: Initiatives are designed to position American Express as a facilitator of exceptional lifestyle experiences, particularly appealing to affluent and high-spending customers.

- 2024 Impact: The company reported strong engagement metrics from these events, contributing to increased brand recall and positive sentiment among Card Members.

'Shop Small' and Community Initiatives

The 'Shop Small' campaign is a cornerstone of American Express's promotional strategy, actively encouraging cardholders to patronize local businesses. This initiative directly fuels community engagement and stimulates merchant sales, reinforcing Amex's dedication to small business growth.

This commitment translates into significant economic impact. For instance, during the 2023 holiday season, American Express reported a substantial increase in spending at small businesses participating in 'Shop Small' events, with participating merchants seeing an average uplift of 15% in sales compared to the previous year.

- Community Support: 'Shop Small' directly benefits local economies by driving consumer spending towards independent businesses.

- Merchant Growth: The campaign provides a tangible boost to small business revenue and visibility.

- Economic Impact: American Express's initiatives have demonstrably increased sales for participating small businesses, fostering local economic vitality.

American Express's promotional strategy is multifaceted, aiming to build a premium brand image and foster deep customer relationships. They leverage targeted digital advertising, content marketing, sponsorships, and community initiatives like 'Shop Small' to connect with their audience. These efforts are designed to highlight the exclusive benefits and aspirational lifestyle associated with their products, particularly for affluent consumers and small businesses.

Their digital-first approach, evident in 2024 campaigns on platforms like Meta and X, focuses on personalized content and influencer collaborations to reach younger demographics. Simultaneously, initiatives like 'Business Class' offer valuable resources to small and medium-sized businesses, positioning Amex as a trusted partner. The 'Shop Small' campaign, in particular, demonstrably boosts sales for local businesses, with participating merchants seeing an average uplift of 15% in sales during the 2023 holiday season.

| Promotional Tactic | Objective | 2024/2025 Focus | Key Metrics/Impact |

|---|---|---|---|

| Targeted Digital Advertising | Brand Awareness & Acquisition | Personalized content, influencer collaborations on Meta, X | Increased engagement, positive sentiment |

| Content Marketing (Business Class) | Brand Affinity & Thought Leadership | Addressing small business challenges (inflation, supply chain) | Fosters loyalty, positions as trusted advisor |

| Sponsorships & Experiential Marketing | Brand Association & Premium Experience | Major sporting events (US Open), cultural festivals | Strong engagement, increased brand recall |

| 'Shop Small' Campaign | Community Engagement & Merchant Support | Driving consumer spending to local businesses | 15% average sales uplift for participating merchants (2023 holiday season) |

Price

American Express generates substantial revenue through annual membership fees, a core component of its pricing strategy. For instance, the Platinum Card® from American Express carries an annual fee of $695 as of early 2024, reflecting the premium benefits offered, such as extensive travel credits and elite status perks.

American Express generates revenue primarily through merchant discount rates (MDR), often called 'swipe fees.' These fees are levied on businesses for each transaction processed using an American Express card.

Historically, Amex's MDRs have been higher than those of Visa and Mastercard. However, in a strategic move to broaden merchant acceptance, American Express announced a global reduction in these fees by 5-6 basis points, a significant adjustment expected to impact their revenue streams in 2024 and beyond.

Interest on outstanding balances is a core component of American Express's pricing strategy, reflecting the value of revolving credit. This revenue stream is crucial, as a significant portion of the company's income originates from the interest charged on cardholder balances, especially for those utilizing revolving credit features.

In the first quarter of 2025, American Express reported a notable increase in its net interest income. This growth was directly fueled by an expansion in its revolving loan balances, demonstrating the ongoing importance of this pricing element in the company's financial performance.

Tiered Card Offerings and Value-Based Pricing

American Express strategically utilizes tiered card offerings, a core element of its value-based pricing, to capture a broad customer base. This approach means customers can choose from a spectrum of cards, from entry-level options with minimal fees to ultra-premium cards commanding substantial annual charges, each tailored with distinct benefits and rewards.

This segmentation is evident in their product lineup, where the value proposition directly correlates with the annual fee. For instance, the American Express Platinum Card, known for its extensive travel perks and lifestyle benefits, carries a significantly higher annual fee than the American Express Green Card, which focuses on everyday spending rewards.

In 2024, American Express continued to refine these tiers. While specific fee structures are dynamic, the company's focus remains on aligning benefits with customer perceived value. For example, the premium cards often offer substantial credits and exclusive access, justifying their higher price points. In Q1 2024, Amex reported a 10% increase in cardholder spending, indicating the effectiveness of their tiered strategy in driving engagement and transaction volume across their product portfolio.

- Platinum Card: High annual fee, premium travel and lifestyle benefits.

- Gold Card: Mid-tier fee, strong rewards on dining and groceries.

- Green Card: Lower annual fee, focused on everyday spending and travel.

- Blue Cash Preferred: Cash back focused, competitive fee for everyday purchases.

Introductory Offers and Credit Terms

American Express leverages introductory offers and flexible credit terms as a key component of its marketing mix to attract new cardholders. These incentives are designed to encourage initial sign-ups and foster early engagement with the card's features and benefits. For instance, welcome bonuses, such as substantial Membership Rewards point offers, are a common tactic. In 2024, many premium Amex cards continued to feature welcome bonuses exceeding 100,000 points for new applicants meeting spending thresholds, significantly boosting acquisition.

Furthermore, American Express often provides 0% introductory Annual Percentage Rate (APR) on purchases or balance transfers for a specified period. This can be a powerful draw for consumers looking to manage large expenses or consolidate debt. For example, the Blue Cash Preferred Card often features a 0% introductory APR on purchases for the first 12 months. This strategy directly addresses a consumer need for cost savings and payment flexibility, making the card more appealing during the initial decision-making phase.

The effectiveness of these introductory offers is evident in customer acquisition rates. By lowering the initial barrier to entry and offering tangible value upfront, American Express can significantly increase its new cardholder base. This approach is crucial for stimulating spending and encouraging long-term loyalty, as customers who experience positive initial interactions are more likely to continue using the card.

- Welcome Bonuses: Many Amex cards offered welcome bonuses of over 100,000 Membership Rewards points in 2024 for new cardholders meeting spending requirements.

- 0% Intro APR: Introductory 0% APR periods on purchases or balance transfers are frequently offered, such as the 12-month 0% intro APR on purchases for the Blue Cash Preferred Card.

- Customer Acquisition: These incentives are vital for attracting new customers by providing immediate value and payment flexibility.

- Stimulating Spending: Introductory offers encourage initial card usage and spending, laying the groundwork for sustained engagement.

American Express employs a multi-faceted pricing strategy that includes annual fees, merchant discount rates, and interest on revolving balances. The company also utilizes tiered card offerings and introductory incentives to attract and retain customers.

| Pricing Component | Description | Example/Data (2024/2025) |

|---|---|---|

| Annual Fees | Charged for card membership, often tiered based on benefits. | Platinum Card: $695 (early 2024). |

| Merchant Discount Rates (MDR) | Fees charged to merchants for processing Amex transactions. | Global reduction of 5-6 basis points announced for 2024. |

| Interest on Balances | Revenue generated from revolving credit balances. | Net interest income increased in Q1 2025 due to expanding revolving balances. |

| Introductory Offers | Incentives like welcome bonuses and 0% APR to attract new users. | Welcome bonuses often exceed 100,000 points in 2024; 0% intro APR on purchases common. |

4P's Marketing Mix Analysis Data Sources

Our American Express 4P's Marketing Mix Analysis leverages a comprehensive array of data sources, including official company reports, investor relations materials, and publicly available financial disclosures. We also incorporate insights from industry analysis, competitive intelligence, and direct observations of their product offerings, pricing structures, distribution channels, and promotional activities.