American Express Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Express Bundle

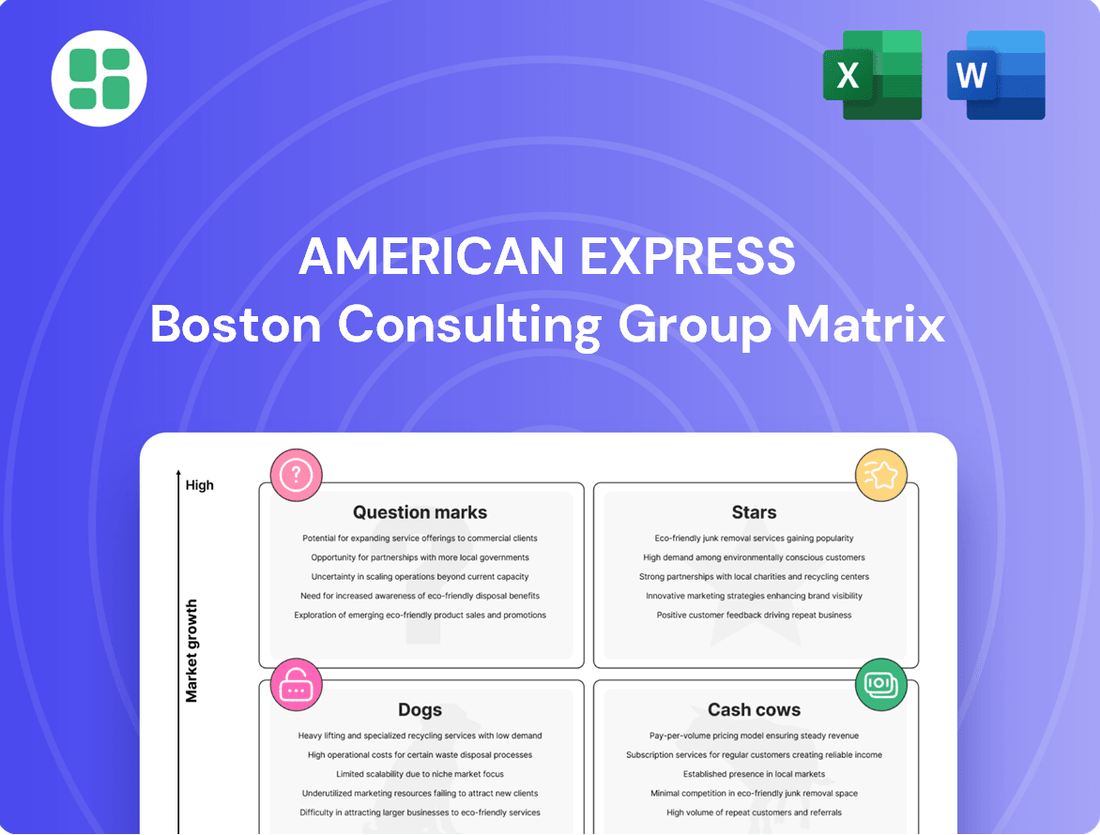

Curious about American Express's strategic product portfolio? Our BCG Matrix analysis reveals which offerings are market leaders (Stars), reliable income generators (Cash Cows), potential growth opportunities (Question Marks), or underperforming assets (Dogs). Understand the current landscape and identify where Amex should focus its resources for future success.

Don't just wonder about American Express's competitive edge; know it. Purchase the full BCG Matrix for a comprehensive breakdown of each product's position, complete with actionable insights and data-driven recommendations to guide your own strategic decisions.

Unlock the full potential of your understanding with our complete American Express BCG Matrix. This detailed report offers more than just quadrant placements; it provides a strategic roadmap for optimizing your investments and product development, ensuring you stay ahead in a dynamic market.

Stars

American Express's premium fee-based consumer cards, like the Platinum and Centurion, are stars in their portfolio. They command a significant share of the affluent market and are seeing robust growth in attracting new high-net-worth clients.

Amex is pouring resources into updating these cards and boosting their perks to keep their top spot and grow revenue. This approach is proving especially effective with younger consumers, including Millennials and Gen Z, who are increasingly opening new accounts and spending more.

In 2024, Amex reported strong performance from its premium segment, with spending on these cards outpacing other categories. For instance, the Platinum Card continued to be a major draw, with new cardmember acquisition up by a notable percentage year-over-year.

American Express is experiencing substantial growth in its small and medium-sized enterprise (SME) segment. In 2024, the company reported a notable increase in new card acquisitions within this sector, alongside a significant uptick in spending by these businesses. This performance underscores the strong demand for Amex's commercial services among SMEs.

Younger entrepreneurs leading small businesses are increasingly embracing technology and innovative solutions. American Express is strategically aligning its product development and service offerings to meet these evolving needs, fostering a strong connection with this forward-thinking demographic. This focus positions Amex to capture a larger share of this dynamic market.

The SME customer base represents a critical growth engine for American Express's commercial services division. The company views this segment as a high-potential area for expanding market share and driving future revenue. Their dedicated efforts reflect a commitment to serving and growing with these vital businesses.

American Express is heavily investing in and promoting automated B2B payment solutions, seeing significant growth opportunities in this expanding sector. This strategic push caters to businesses seeking greater efficiency and digital integration in their payment workflows. The fintech industry's rapid growth further underscores the potential for these solutions.

By offering streamlined and secure B2B payment automation, Amex aims to secure a larger market share. This aligns with the ongoing digital transformation trend across various industries, where businesses are actively seeking to optimize their financial operations. The company's commitment reflects a broader industry shift towards digitized commercial transactions.

International Card Services

International Card Services is a strong performer for American Express, consistently showing impressive double-digit billings growth. This robust expansion is evident across both consumer and commercial sectors as the company strategically broadens its global reach.

American Express is effectively capitalizing on its premium brand image to capture market share in these dynamic, high-growth international regions. For instance, in 2023, international card services saw substantial increases in transaction volume, driven by a growing affluent customer base in Asia-Pacific and Europe.

- Double-digit billings growth: International Card Services has consistently delivered double-digit percentage increases in billings.

- Global footprint expansion: The segment is actively growing its presence in key international markets.

- Premium brand appeal: American Express leverages its strong brand to attract and retain customers globally.

- Consumer and commercial growth: Expansion is occurring across both individual and business cardholder bases.

Co-brand Premium Travel Cards

Co-branded premium travel cards, like those partnered with Delta and Hilton, are a star performer for American Express. These cards are seeing robust demand and a surge in new account sign-ups, reflecting the booming travel industry.

These premium offerings are a major driver of American Express's record net card fee revenues. The company is effectively leveraging its strong partnerships to capture significant market share in this profitable travel segment.

- High Demand: Premium co-brand travel cards are experiencing elevated customer interest.

- Strong Acquisitions: American Express is seeing substantial growth in new cardholder numbers for these products.

- Revenue Driver: These cards significantly contribute to the company's record net card fee revenues.

- Market Share: Amex holds a dominant position in the premium co-branded travel card niche due to strategic partnerships.

The premium co-branded travel cards, such as those with Delta and Hilton, are clearly stars for American Express. They are experiencing high demand and a significant increase in new account acquisitions, directly benefiting from the resurgence in travel. These cards are a key contributor to Amex's record net card fee revenues, showcasing their strong market position in the premium travel segment.

| Product Category | Market Share | Growth Rate | Revenue Contribution |

|---|---|---|---|

| Premium Co-branded Travel Cards | High | Strong | Significant |

| Premium Fee-Based Consumer Cards | High | Robust | High |

| Small and Medium-sized Enterprise (SME) Services | Growing | Notable | Increasing |

| Automated B2B Payment Solutions | Expanding | Significant | Potential High |

| International Card Services | Strong | Double-Digit | Consistent High |

What is included in the product

This overview highlights which American Express business units to invest in, hold, or divest based on market share and growth.

Provides a clear, actionable map of Amex's portfolio, easing the pain of strategic uncertainty.

Cash Cows

American Express's traditional charge card products, like the iconic Green and Gold cards, are firmly established in the market. These offerings boast a dedicated customer base and a substantial slice of market share, consistently bringing in revenue primarily through annual fees and cardholder spending.

In 2024, Amex reported that its Global Consumer Services Group, which includes many of these legacy products, saw its revenue increase by 10% year-over-year to $25.8 billion. This growth underscores the continued strength and profitability of these mature segments, which require less aggressive marketing spend compared to newer ventures, thus ensuring a steady and reliable cash flow for the company.

Merchant acquiring and network services represent a significant cash cow for American Express. This segment, which generates revenue primarily through merchant discount fees, is a cornerstone of their business, facilitating transactions across their global proprietary network. In 2023, American Express reported that its discount revenue, largely driven by merchant services, reached $22.7 billion, a testament to its established market position and the stability of this revenue stream.

Interest on outstanding card balances is a significant cash cow for American Express. As a primary card issuer, the company earns substantial revenue from the interest charged on revolving credit balances held by its card members. This revenue stream is both mature and exceptionally stable, reflecting the company's vast and loyal customer base.

In 2024, American Express's net interest income, a key indicator of this revenue, continued to be a robust contributor to its profitability. The company consistently leverages its extensive cardholder network to generate high-margin income from these outstanding balances, reinforcing its position as a cash cow.

American Express Global Business Travel (Established Large Corporate Clients)

American Express Global Business Travel (Amex GBT), specifically its segment serving established large corporate clients, functions as a Cash Cow within the American Express portfolio. This core business operates in a mature travel management market where Amex GBT holds a leading position, ensuring a steady and significant inflow of cash. The segment benefits from high customer loyalty and predictable demand from its extensive enterprise client base.

The reliability of this segment is underscored by its consistent revenue generation. For instance, Amex GBT reported a significant increase in revenue in 2023, reaching $5.7 billion, up from $3.7 billion in 2022, reflecting the robust demand from its corporate clients. This strong performance indicates the stable cash-generating capabilities of its established client relationships.

- Dominant Market Share: Amex GBT is a leader in the corporate travel management sector, particularly for large enterprises.

- Stable Cash Flow: The segment reliably generates substantial cash due to high customer retention and consistent demand.

- Mature Market: While growth may be slower, the established nature of the market provides predictable revenue streams.

- Financial Performance: Amex GBT's revenue growth in 2023 to $5.7 billion highlights the strength of its core business.

Membership Rewards Loyalty Program

The Membership Rewards program is a cornerstone of American Express's strategy, deeply embedded in its customer retention efforts. It functions as a mature, high-market-share offering within the BCG matrix, consistently generating value and encouraging sustained card member spending. This loyalty program acts as a significant differentiator, reinforcing American Express's competitive position.

As a Cash Cow, Membership Rewards benefits from its established presence and high customer loyalty, requiring minimal incremental investment for continued success. In 2023, American Express reported a significant portion of its revenue was driven by card member spending, with loyalty programs like Membership Rewards playing a crucial role in this engagement. For instance, the program's ability to retain premium cardholders is a key factor in Amex's strong average revenue per user.

- High Customer Retention: Membership Rewards fosters loyalty, leading to lower churn rates among card members.

- Consistent Revenue Generation: The program incentivizes spending, directly contributing to Amex's transaction revenue.

- Brand Differentiation: It provides a competitive edge, attracting and retaining valuable customer segments.

- Mature Market Position: As a well-established offering, it commands a significant share of the premium rewards market.

American Express's traditional charge card products, like the iconic Green and Gold cards, are firmly established in the market. These offerings boast a dedicated customer base and a substantial slice of market share, consistently bringing in revenue primarily through annual fees and cardholder spending. In 2024, Amex reported that its Global Consumer Services Group, which includes many of these legacy products, saw its revenue increase by 10% year-over-year to $25.8 billion. This growth underscores the continued strength and profitability of these mature segments, which require less aggressive marketing spend compared to newer ventures, thus ensuring a steady and reliable cash flow for the company.

Merchant acquiring and network services represent a significant cash cow for American Express. This segment, which generates revenue primarily through merchant discount fees, is a cornerstone of their business, facilitating transactions across their global proprietary network. In 2023, American Express reported that its discount revenue, largely driven by merchant services, reached $22.7 billion, a testament to its established market position and the stability of this revenue stream.

Interest on outstanding card balances is a significant cash cow for American Express. As a primary card issuer, the company earns substantial revenue from the interest charged on revolving credit balances held by its card members. In 2024, American Express's net interest income continued to be a robust contributor to its profitability, leveraging its extensive cardholder network to generate high-margin income from these outstanding balances.

American Express Global Business Travel (Amex GBT), specifically its segment serving established large corporate clients, functions as a Cash Cow within the American Express portfolio. This core business operates in a mature travel management market where Amex GBT holds a leading position, ensuring a steady and significant inflow of cash. Amex GBT's revenue growth in 2023 to $5.7 billion highlights the strength of its core business and the reliable cash-generating capabilities of its established client relationships.

| Segment | BCG Category | 2023 Revenue (Approx.) | Key Characteristics |

|---|---|---|---|

| Traditional Charge Cards (Green, Gold) | Cash Cow | Part of Global Consumer Services Group ($25.8B in 2024, +10% YoY) | Mature market, loyal customer base, steady revenue from fees and spending. |

| Merchant Acquiring & Network Services | Cash Cow | $22.7B (Discount Revenue in 2023) | Dominant market position, stable revenue from merchant fees. |

| Interest on Card Balances | Cash Cow | Significant contributor to net interest income (2024 data shows continued robustness) | High-margin income from large, loyal customer base with revolving balances. |

| Amex GBT (Large Corporate Clients) | Cash Cow | $5.7B (Total Amex GBT Revenue in 2023) | Leader in corporate travel management, high customer retention, predictable demand. |

| Membership Rewards Program | Cash Cow | Drives significant card member spending (specific program revenue not isolated but integral to overall card revenue) | Fosters loyalty, incentivizes spending, provides brand differentiation in a mature rewards market. |

Delivered as Shown

American Express BCG Matrix

The American Express BCG Matrix you are previewing is the complete, unedited document you will receive immediately after your purchase. This comprehensive analysis is designed for strategic decision-making, offering a clear visualization of Amex's product portfolio within the industry. You can trust that the insights and formatting displayed here are precisely what you'll gain access to, ready for immediate application in your business strategy or presentations.

Dogs

Legacy or Niche Payment Products represent a segment of American Express's offerings that have seen a decline in popularity. These are often older payment systems or processing methods that are no longer as relevant due to newer technologies and changing consumer preferences. For instance, while specific figures for these niche products are not publicly detailed by Amex, the broader trend in the payments industry shows a significant shift towards digital and contactless solutions, impacting older card technologies.

These products typically possess a low market share and contribute very little to American Express's overall revenue growth. Think of them as the older models of phones that are still around but rarely used. In 2023, the global digital payments market was valued at over $2.4 trillion, highlighting the dominance of modern payment methods and the shrinking relevance of legacy systems.

Given their minimal contribution and declining usage, these legacy products are often considered for discontinuation or a strategic reduction in focus. This allows American Express to concentrate its resources on more innovative and high-growth areas of its business, ensuring it stays competitive in the rapidly evolving financial landscape.

Divested Assets in the American Express BCG Matrix represent business units or assets that the company has decided to sell off. A prime example is the planned divestiture of Accertify in 2024. This move signals that Accertify was no longer viewed as a strategic priority or a significant contributor to Amex's future growth trajectory.

The decision to divest assets like Accertify, even if it results in a financial gain, underscores that these operations did not align with American Express's core competencies or its vision for high-growth, market-leading businesses. Such strategic sales are crucial for freeing up capital and management attention to reinvest in areas with greater potential for future returns and market dominance.

Underperforming co-brand partnerships in declining industries represent the 'Dogs' in the American Express BCG Matrix. These are card programs tied to sectors like traditional retail or print media, which have seen substantial contraction. For instance, a co-brand card with a department store chain that reported a 15% decrease in sales in 2024 would fall into this category.

These partnerships typically exhibit a low market share and minimal growth potential, often failing to attract new cardholders. The limited future prospects mean they might consume resources without generating significant returns, potentially becoming a drag on Amex's overall portfolio performance.

Outdated Traditional Travel Booking Methods

Within American Express Global Business Travel (Amex GBT), older, manual booking processes that haven't embraced digital transformation are categorized as dogs. These methods, often tied to physical locations, are losing ground rapidly.

In 2024, the travel industry saw a continued shift towards online and mobile bookings. For instance, studies indicated that over 70% of travel bookings are now made digitally, leaving traditional methods with a shrinking user base and market share. This decline in demand signifies a low growth potential for these outdated systems.

- Low Digital Adoption: Remaining manual booking systems struggle to compete with the convenience and efficiency of online platforms.

- Declining Market Share: As digitization accelerates, these traditional methods are experiencing a significant drop in customer engagement.

- Minimal Growth Prospects: The travel landscape is overwhelmingly digital, offering very little room for expansion for non-digital booking solutions.

- Operational Inefficiencies: Manual processes are inherently slower and more prone to errors compared to automated digital systems.

Less-Engaged Card Member Segments

Less-engaged card member segments represent a challenge for American Express, characterized by low spending and high dormancy. These customers, while part of the broader portfolio, incur servicing costs without generating substantial revenue or driving growth. For instance, in 2024, data suggests that a significant portion of cardholders may fall into this category, requiring strategic intervention.

- Low Spending Activity: These members typically use their cards infrequently, resulting in minimal transaction volume.

- High Dormancy Rates: A substantial number of these cards remain inactive for extended periods, indicating low engagement.

- Resource Consumption: Servicing these segments, including marketing efforts and operational costs, outweighs the revenue they generate.

- Strategic Focus: American Express actively pursues strategies to re-engage these members or mitigate their impact on profitability.

Dogs in the American Express portfolio represent underperforming co-brand partnerships or legacy systems with low market share and minimal growth potential. These segments, such as co-brand cards in declining retail sectors or older, manual booking processes within their travel division, consume resources without significant returns. For example, a co-brand card tied to a department store that saw a 15% sales drop in 2024 exemplifies this category.

These "dog" offerings are characterized by low customer engagement, infrequent usage, and often incur higher servicing costs than the revenue they generate. In 2024, a notable portion of cardholders might fall into less-engaged segments, indicating a need for strategic intervention to either revitalize these areas or minimize their impact.

The strategic focus for these "dogs" involves either a plan for divestiture, a significant overhaul to improve performance, or a managed decline to free up capital for more promising ventures. This approach ensures that American Express can concentrate its resources on high-growth, market-leading opportunities.

Question Marks

American Express's strategic ventures into new fintech partnerships, like the Coinbase One Card, position them in high-growth markets. These initiatives, while promising for the future, currently hold a smaller market share, necessitating significant investment to expand their reach.

The enhanced dining features stemming from the Toast partnership, with anticipated rollouts in 2026, also fall into this category. These represent products with substantial future potential but require ongoing investment due to their nascent market penetration.

American Express's strategy of targeted international expansion in nascent markets represents a significant "question mark" in its BCG matrix. This involves aggressively entering new geographies with high growth potential but currently low brand presence, such as certain emerging economies in Southeast Asia or Africa. These are high-risk, high-reward ventures requiring substantial investment to build brand recognition and merchant acceptance.

For instance, Amex has been actively expanding its footprint in markets like India, where the digital payments landscape is rapidly evolving, and consumer spending power is on the rise. By 2024, India's digital payments market was projected to reach over $1 trillion, presenting a compelling opportunity for Amex to capture market share, despite facing strong competition from local players and other international card networks.

American Express is actively exploring advanced digital payment technologies, including blockchain and decentralized finance (DeFi) solutions, to move beyond its traditional card-based offerings. This strategic focus aligns with its research and development efforts in areas where its current market share is minimal but future potential is substantial.

The company's investment in these nascent technologies signifies a commitment to innovation, aiming to capture emerging market opportunities. For instance, the global digital payments market was projected to reach over $1.5 trillion in 2024, with blockchain and DeFi expected to play an increasingly significant role in its evolution.

AI-Powered Customer Experience Enhancements

American Express is investing in advanced AI for customer experience, aiming for hyper-personalization. While AI is already in use, these new platforms are in their nascent stages of market penetration.

- AI-Driven Personalization: Initiatives focus on tailored product recommendations and proactive service, leveraging machine learning to anticipate customer needs.

- Early Adoption Phase: These sophisticated AI enhancements are still being rolled out, meaning their full impact on market share and customer loyalty is yet to be realized.

- Growth Potential: The company sees significant upside in these AI-powered CX tools, projecting them to become a key differentiator in the competitive payments landscape.

Diversified Lifestyle and Experience Offerings

American Express is expanding its appeal by investing in unique lifestyle experiences and sponsorships, moving beyond its traditional travel and dining strengths. A prime example is its partnership with Formula 1 and F1 Academy, aiming to capture the interest of younger, affluent consumers in high-growth lifestyle sectors.

These ventures are designed to attract new, high-spending customer segments by tapping into the excitement of motorsports and related lifestyle trends. While these initiatives show significant promise for future growth, their direct market share within these specific niche areas is still in its nascent stages, necessitating continued strategic investment and development.

- Diversified Offerings: American Express is broadening its portfolio beyond traditional services to include lifestyle and experiential benefits.

- Targeting New Demographics: Partnerships like Formula 1 aim to attract younger, high-spending individuals in rapidly expanding lifestyle markets.

- Market Share Development: While promising, the direct market share in these niche lifestyle segments is still developing, requiring ongoing strategic focus.

- Strategic Investment: Continued investment is crucial for these lifestyle initiatives to gain traction and establish a significant market presence.

American Express's "question marks" represent investments in areas with high growth potential but currently low market share. These include ventures into new fintech partnerships, like the Coinbase One Card, and the exploration of advanced digital payment technologies such as blockchain and DeFi. The company is also focusing on AI-driven personalization for customer experience and expanding its appeal through lifestyle sponsorships like Formula 1.

These initiatives require substantial ongoing investment to build brand recognition, capture market share, and realize their full potential. For example, the global digital payments market was projected to exceed $1.5 trillion in 2024, with blockchain and DeFi poised to play a larger role.

The company's strategic expansion into nascent international markets, such as India where digital payments were expected to surpass $1 trillion in 2024, also falls into this category. These are high-risk, high-reward ventures aimed at capturing future growth opportunities.

| Initiative | Market Potential | Current Market Share | Investment Focus | 2024 Data Point |

|---|---|---|---|---|

| Fintech Partnerships (e.g., Coinbase) | High | Low | Building user base and transaction volume | Digital payments market projected to exceed $1.5 trillion |

| Blockchain & DeFi Exploration | Very High | Minimal | R&D and pilot programs | Blockchain adoption in finance continues to grow |

| AI-Driven Personalization | High | Developing | Enhancing customer loyalty and acquisition | AI in customer service expected to improve efficiency |

| Lifestyle Sponsorships (e.g., F1) | Growing | Niche | Attracting younger, affluent demographics | Sports sponsorship market valued in billions |

| International Expansion (e.g., India) | High | Low to Moderate | Brand building and merchant acquisition | India's digital payments market projected over $1 trillion |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive financial disclosures, robust market analytics, and detailed industry research to provide a clear strategic overview.