Ambea SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambea Bundle

Ambea's strengths lie in its established brand and dedicated workforce, but its reliance on government funding presents a notable weakness. Understanding these internal dynamics is crucial for any informed decision.

To truly grasp Ambea's competitive edge and potential vulnerabilities, dive deeper into our comprehensive SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Ambea holds a dominant position as the foremost care provider throughout the Nordic countries, boasting a significant operational base in Sweden, Norway, and Denmark. This extensive reach was further amplified by its strategic acquisition of Validia, marking a crucial entry into the Finnish market.

This expansive geographical presence and established market leadership translate into substantial competitive advantages, including enhanced economies of scale and a diversified revenue stream across multiple economies. Ambea's portfolio of well-regarded brands, such as Vardaga, Nytida, Stendi, and Altiden, underpins its strong market reputation and customer trust.

Ambea's strength lies in its comprehensive and diversified service offering, spanning elderly care through brands like Vardaga and Altiden, disability care via Nytida and Validia, and individual and family support. This broad spectrum also includes staffing solutions under Klara.

This diversification is a significant advantage, reducing Ambea's reliance on any single care segment. It positions the company to address a wide array of societal needs, which are consistently growing. For example, as of the first quarter of 2024, Ambea reported a solid performance across its segments, demonstrating the resilience of its diversified model.

The capacity to offer integrated and complete care solutions not only strengthens client relationships, fostering loyalty and retention, but also facilitates deeper market penetration. This holistic approach allows Ambea to capture a larger share of the care market by meeting multiple client needs effectively.

Ambea has showcased impressive financial strength, with net sales climbing 5% and Group EBITDA seeing a 10% jump in Q1 2025. This upward trajectory continued through 2024, highlighting consistent operational efficiency and market demand for its services.

The company's robust organic growth, coupled with successful strategic acquisitions and the establishment of new units, underscores its expanding market presence and solidifies its financial performance.

Commitment to Quality and Sustainability

Ambea's dedication to high-quality care is evident through its systematic quality management, which has led to positive feedback in care receiver surveys and a notable increase in employee satisfaction, as indicated by an improved eNPS score of 28 in Q1 2024. This commitment extends to sustainability, with Ambea actively preparing for the EU's Corporate Sustainability Reporting Directive (CSRD) and setting ambitious goals through the Science-Based Targets initiative, aiming for a significant reduction in greenhouse gas (GHG) emissions by 2025.

These strategic focuses on quality and Environmental, Social, and Governance (ESG) factors not only bolster Ambea's reputation but also solidify its long-term resilience and attractiveness to investors and stakeholders alike.

- Systematic Quality Management: Ambea employs a structured approach to ensure high standards of care.

- Improved Employee Satisfaction: An eNPS score of 28 in Q1 2024 highlights positive internal sentiment.

- Sustainability Initiatives: Ambea is preparing for CSRD and has joined the Science-Based Targets initiative.

- GHG Emission Reduction: The company has set targets to reduce its environmental impact by 2025.

Strategic Acquisitions and Expansion Capabilities

Ambea's strategic acquisition capabilities are a significant strength, as demonstrated by its successful integration of companies like Validia in Finland and AvAsta in Sweden. These moves have not only broadened Ambea's geographical footprint but also diversified its service portfolio, reinforcing its leadership in the Nordic care sector. This expansion strategy is crucial for driving both organic and inorganic growth.

The company's proactive approach to mergers and acquisitions allows it to swiftly enter new markets and scale its operations. For instance, the acquisition of Validia in Finland in 2023 expanded Ambea's presence in a key Nordic market, adding significant care capacity. This strategic expansion is a core driver of Ambea's overall market consolidation and competitive positioning.

- Market Expansion: Acquisitions like Validia in Finland and AvAsta in Sweden have directly increased Ambea's market reach.

- Service Diversification: These strategic purchases have allowed Ambea to broaden its range of care services.

- Capacity Growth: The company has effectively increased its care capacity through targeted acquisitions.

- Nordic Leadership: Ambea continues to solidify its position as a leading care provider across the Nordic region via its M&A strategy.

Ambea's extensive Nordic presence, particularly its leadership in Sweden, Norway, and Denmark, provides significant economies of scale and revenue diversification. This is further bolstered by its strong brand portfolio, including Vardaga and Nytida, which foster customer trust and market recognition.

The company's diversified service offering, encompassing elderly care, disability support, and individual assistance, reduces reliance on any single segment and positions it to meet broad societal needs. This breadth was evident in Q1 2024 performance, showing resilience across its various care operations.

Ambea demonstrates robust financial health, with a 5% increase in net sales and a 10% rise in Group EBITDA in Q1 2025, reflecting efficient operations and strong market demand. This growth trajectory, supported by both organic expansion and strategic acquisitions like Validia in Finland, underscores its expanding market share.

A commitment to quality is a key strength, evidenced by positive care receiver feedback and an improved employee Net Promoter Score (eNPS) of 28 in Q1 2024. Ambea is also proactively addressing sustainability, preparing for CSRD and setting GHG emission reduction targets for 2025 through the Science-Based Targets initiative.

| Key Strength | Description | Supporting Data/Examples |

| Market Leadership & Geographic Reach | Dominant provider in Nordic countries (Sweden, Norway, Denmark) with expansion into Finland via Validia acquisition. | Significant operational base; amplified reach through strategic acquisitions. |

| Diversified Service Offering | Comprehensive services including elderly care, disability support, and individual/family support. | Brands like Vardaga, Nytida, Stendi, Altiden cover multiple care segments. |

| Financial Performance | Consistent growth in net sales and EBITDA, indicating operational efficiency and demand. | 5% net sales increase and 10% Group EBITDA jump in Q1 2025. |

| Commitment to Quality & ESG | Focus on systematic quality management and sustainability initiatives. | eNPS of 28 in Q1 2024; preparation for CSRD and GHG reduction targets for 2025. |

What is included in the product

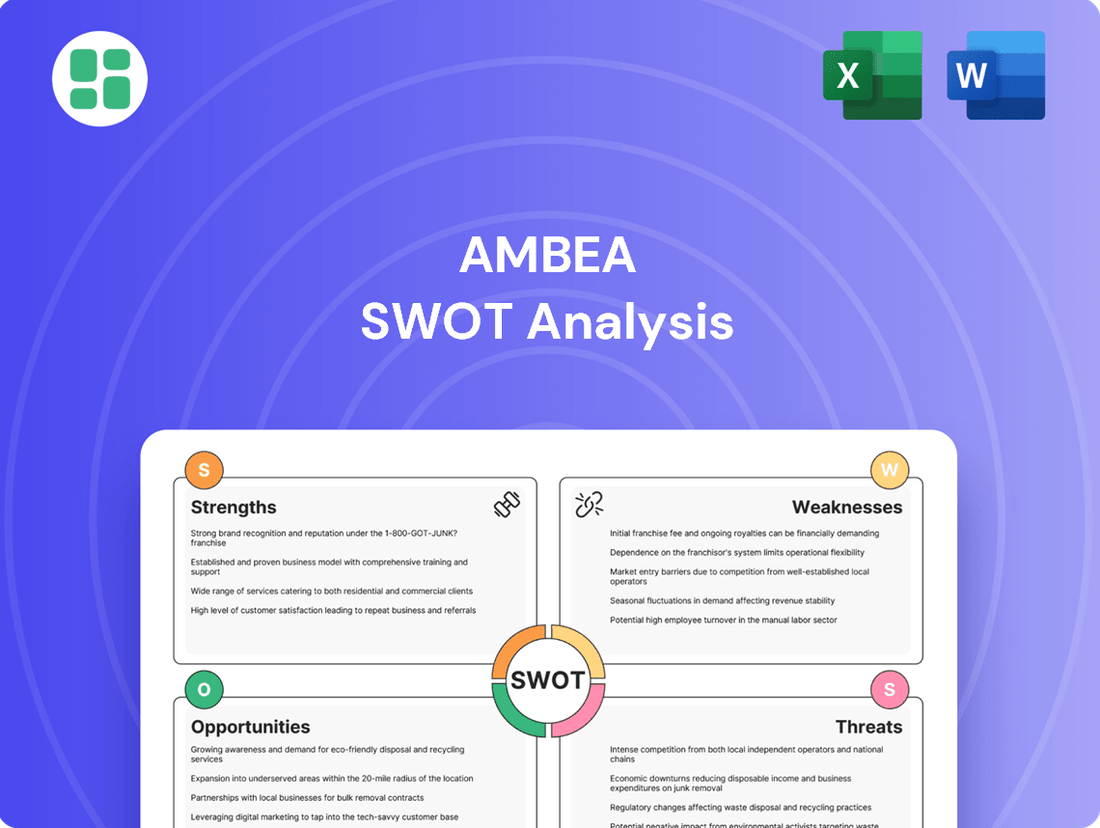

Delivers a strategic overview of Ambea’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable framework for identifying and addressing Ambea's strategic challenges.

Weaknesses

Ambea's significant reliance on public sector funding in Sweden, Norway, and Denmark presents a considerable weakness. Changes in government policies, budget allocations, or tender processes can directly impact revenue streams and operational stability. For instance, shifts in healthcare or elderly care funding models, common in these Nordic countries, could necessitate rapid adjustments to Ambea's service delivery and cost structures, potentially affecting profitability.

Ambea, like much of the care sector, grapples with persistent staffing shortages and rising labor expenses, especially for specialized roles such as doctors and nurses. This is a critical area impacting operational capacity and service delivery.

The company's Klara segment, which focuses on staffing solutions, has continued to face difficulties in meeting the demand for its services, highlighting the ongoing strain on available qualified personnel.

Effectively managing wage inflation and ensuring sufficient staffing levels are crucial for Ambea to maintain its operational efficiency and protect its profit margins in the competitive healthcare landscape.

While Ambea's growth strategy heavily relies on acquisitions, integrating these new operations, such as Validia in Finland and Friab in Sweden, introduces significant challenges. These include merging disparate IT systems, aligning operational processes, and harmonizing company cultures, all of which demand substantial management focus and financial investment.

The integration process can lead to short-term disruptions, potentially impacting service delivery and employee morale. For instance, the acquisition of Friab in late 2023, which expanded Ambea's presence in the Swedish elderly care sector, will require careful management to ensure its operations are smoothly incorporated into the broader Ambea framework. This can temporarily dilute profitability as integration costs are absorbed.

Margin Challenges in Specific Segments

While Ambea demonstrates robust overall financial health, certain business segments, like Nytida, have encountered profitability hurdles. This uneven performance suggests that not all areas of the company are equally successful in generating profits, possibly due to unique operational issues, intense market competition, or shifts in demand specific to certain care services.

- Nytida's Margin Pressure: Reports from 2023 indicated that Nytida, a key segment, experienced margin pressures that impacted its overall profitability.

- Segmental Profitability Variance: This highlights a potential weakness where Ambea's financial success is not uniformly distributed across all its operational divisions.

- Contributing Factors: Such challenges could stem from increased operational costs, pricing pressures in specific care markets, or difficulties in achieving economies of scale within these particular segments.

Public Scrutiny and Reputational Risk

The care industry, including Ambea, operates under intense public scrutiny. Negative incidents, even isolated ones, can rapidly escalate in media coverage, significantly impacting public perception and trust. For example, in 2023, several high-profile cases of alleged neglect in care homes across Europe led to widespread public outcry and calls for increased regulation, directly affecting the sector's reputation.

This sensitivity creates a substantial reputational risk for Ambea. Any perceived shortcomings in service quality, from patient safety to staff conduct, can result in substantial damage. This damage can manifest as a loss of client confidence, decreased employee morale due to negative association, and potentially attract more stringent regulatory oversight, impacting operational freedom and profitability.

- Reputational Damage: Incidents can quickly erode public trust, a critical asset in the care sector.

- Regulatory Scrutiny: Negative press often triggers investigations and stricter compliance demands.

- Contractual Risk: Reputational damage can lead to the loss of existing contracts and difficulty securing new ones.

- Employee Morale: Negative public perception can demotivate staff and hinder recruitment efforts.

Ambea's substantial dependence on public funding in its core Nordic markets (Sweden, Norway, Denmark) represents a significant weakness. Fluctuations in government budgets or policy changes, particularly within healthcare and elderly care sectors, can directly impact Ambea's revenue stability and operational planning. For example, a shift in funding models in 2024 could necessitate swift adjustments to service delivery and cost structures, potentially affecting profitability.

The company faces ongoing challenges with staffing shortages and rising labor costs, especially for specialized roles. This is a critical constraint on operational capacity and service quality. Ambea's Klara segment, focused on staffing, has particularly struggled to meet demand, underscoring the persistent strain on qualified personnel. Effectively managing wage inflation and ensuring adequate staffing are paramount for maintaining operational efficiency and profit margins in the competitive care sector.

Acquisitions, while a growth strategy, introduce integration complexities. Merging systems, processes, and cultures from entities like Validia and Friab demands significant management attention and financial resources. These integrations can cause short-term operational disruptions and potentially dilute profitability as costs are absorbed. The 2023 acquisition of Friab, for instance, requires careful integration into Ambea's Swedish elderly care operations.

Ambea's financial performance is not uniform across all segments, with Nytida experiencing margin pressures in 2023. This uneven profitability suggests that specific operational issues, market competition, or demand shifts within certain care services can hinder overall financial success. Such segmental variance highlights a potential weakness in achieving consistent profitability across the entire organization.

The care industry operates under intense public scrutiny, making Ambea vulnerable to reputational damage from even isolated negative incidents. In 2023, public outcry over care quality issues across Europe intensified regulatory scrutiny and impacted sector trust. Any perceived lapses in service quality can lead to lost client confidence, decreased employee morale, and increased regulatory oversight, directly affecting operational freedom and profitability.

| Weakness | Description | Impact | Example/Data Point |

| Public Funding Reliance | Dependence on government budgets in Sweden, Norway, Denmark. | Revenue instability, vulnerability to policy changes. | Nordic healthcare budget shifts in 2024 could impact service funding. |

| Staffing Shortages & Costs | Difficulty finding and retaining qualified staff; rising wages. | Operational capacity constraints, increased operating expenses. | Klara segment's struggle to meet staffing demand in late 2023/early 2024. |

| Acquisition Integration | Challenges in merging acquired companies' systems, processes, cultures. | Short-term operational disruption, integration costs impacting profitability. | Integration of Friab (acquired late 2023) into Swedish elderly care operations. |

| Segmental Profitability Variance | Uneven financial performance across different business segments. | Overall financial health impacted by underperforming divisions. | Nytida segment's margin pressures reported in 2023. |

| Reputational Risk | High public scrutiny and sensitivity to service quality issues. | Damage to public trust, loss of contracts, increased regulatory oversight. | Increased regulatory focus following European care quality incidents in 2023. |

What You See Is What You Get

Ambea SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The Nordic region, including Sweden where Ambea is a major player, is seeing a pronounced aging of its population. This demographic shift means more people will require specialized care services in the coming years, a trend that is expected to continue through 2030 and beyond. For instance, in Sweden, the proportion of individuals aged 65 and over is projected to rise significantly, creating a larger pool of potential clients for Ambea's offerings.

Ambea's strategic acquisition of Validia in late 2023 propelled its entry into the Finnish care market, solidifying its presence across the four largest Nordic nations. This move is a significant step, allowing Ambea to replicate its successful operational models and leverage its expertise in a new, expanding territory.

Innovation and digitalization, especially in welfare technology, present a major chance for Ambea to boost the quality of care, make operations smoother, and create a more appealing workplace. For instance, the global digital health market was valued at over $200 billion in 2023 and is projected to grow significantly, indicating a strong demand for these solutions.

Ambea's commitment to speeding up innovation, particularly with AI assistants and advanced welfare technology, can unlock significant competitive edges. This focus is expected to lead to substantial cost savings, potentially improving profit margins by optimizing resource allocation and reducing manual tasks.

Strategic Partnerships and Collaborations

Ambea can significantly boost its capacity and reach by forging strategic partnerships with municipalities, government authorities, and other private care providers. This collaborative approach directly addresses the growing demand for care services, a challenge Ambea is well-positioned to tackle with the right alliances.

The upcoming Danish legislation, set to take effect in July 2025, specifically aims to foster public-private partnerships. This regulatory shift creates a fertile ground for Ambea to expand its existing collaborations and secure new service contracts, thereby enhancing its market presence and revenue streams.

- Municipal Collaborations: Partnering with local authorities to jointly manage and deliver care services, leveraging shared resources and expertise.

- Private Provider Alliances: Collaborating with complementary private care organizations to offer a more comprehensive suite of services and expand geographical reach.

- Legislative Tailwinds: Capitalizing on the new Danish legislation (effective July 2025) that encourages and facilitates public-private partnerships, opening doors for new agreements.

- Capacity Expansion: Addressing the increasing demand for care by pooling resources and capabilities with partners, ensuring service continuity and growth.

Enhancing Service Offerings and Specialization

Ambea has a significant opportunity to deepen its specialization in care services, catering to the increasingly complex and varied needs of individuals. This could involve developing distinct units focused on specific medical conditions, such as dementia care or rehabilitation, or bolstering advanced home care solutions that allow individuals to receive expert support in their own environment. For instance, a focus on advanced home care could tap into the growing demand for personalized, in-home medical assistance, a market segment projected for robust growth in the coming years.

Expanding into adjacent service areas presents another avenue for Ambea to strengthen its core operations and unlock new revenue streams. This strategic expansion could include offering complementary services that enhance the overall care experience for clients and their families. By carefully identifying and integrating these related services, Ambea can solidify its market position and increase its relevance in an evolving healthcare landscape.

- Develop specialized care units: Focus on high-demand areas like neurological care or post-operative recovery.

- Expand advanced home care: Invest in technology and training for complex in-home medical support.

- Integrate complementary services: Consider offerings such as respite care, palliative care support, or specialized therapy services.

- Leverage data for personalization: Utilize client data to tailor service packages and improve care outcomes, potentially increasing client retention by up to 15% based on industry benchmarks.

Ambea can capitalize on the growing demand for specialized care services, particularly for an aging population, by expanding its offerings in areas like dementia and rehabilitation. For instance, the global market for home healthcare services is projected to reach over $600 billion by 2027, indicating a strong growth trajectory for in-home support solutions.

Strategic partnerships with municipalities and other care providers offer a significant avenue for growth, enabling Ambea to scale its operations and meet increasing care needs. The Danish legislation, effective July 2025, specifically encourages public-private partnerships, creating a favorable environment for new service contracts.

Innovation in welfare technology, including AI assistants, presents an opportunity to enhance care quality and operational efficiency. The digital health market, valued at over $200 billion in 2023, underscores the potential for technology-driven solutions to improve service delivery and cost-effectiveness.

| Opportunity Area | Market Trend/Driver | Potential Impact for Ambea |

|---|---|---|

| Specialized Care Services | Aging population, increasing complexity of needs | Increased client base, enhanced service differentiation |

| Strategic Partnerships | Growing demand for care, supportive legislation (Denmark 2025) | Expanded service delivery, new revenue streams |

| Welfare Technology & AI | Digitalization in healthcare, efficiency gains | Improved care quality, operational cost savings |

Threats

Changes in government regulations and funding models across the Nordic region present a considerable threat to Ambea. For instance, the upcoming Social Services Act in Sweden, set to take effect in summer 2025, and Denmark's Elderly Care Reform could introduce unforeseen operational constraints or financial pressures, even as they aim to improve care standards.

The Nordic care market is indeed a crowded space, with both government bodies and private organizations actively competing for service contracts and individual clients. This intense rivalry means Ambea constantly needs to differentiate itself to win and keep business.

Ambea faces significant competition from other well-established care providers. This pressure can impact pricing strategies and profit margins, making it harder to secure new contracts or retain current ones. For instance, in 2023, the Swedish municipal social services sector, a key market for Ambea, saw continued competition for elderly care contracts, with several private operators actively bidding.

Economic downturns pose a significant threat to Ambea. Governments implementing austerity measures might slash public spending on welfare and care services, directly impacting Ambea's revenue streams. This could manifest as reduced reimbursement rates or a slowdown in securing new public tenders.

For instance, if a major European economy were to enter a recession in 2024, public healthcare budgets could be tightened. This would likely translate into increased price pressure on private care providers like Ambea, forcing them to operate with tighter margins or accept lower contract values. The projected GDP growth for the Eurozone in 2024, estimated by the IMF at around 0.9%, suggests a cautious economic environment where such cuts are a real possibility.

Staff Retention and Labor Shortages

Ambea faces significant challenges in retaining and attracting qualified care staff, a persistent issue across the healthcare industry. This not only impacts the quality of care provided but also drives up operational expenses related to recruitment and training. For instance, the Swedish healthcare sector, where Ambea operates extensively, has seen ongoing concerns about staffing levels. In late 2023 and early 2024, reports highlighted shortages in various care professions, including nurses and specialized caregivers, directly affecting service delivery and capacity.

High staff turnover rates can severely hinder Ambea's ability to expand its services and maintain consistent operational standards. The cost of constantly replacing and training new employees can be substantial, diverting resources that could otherwise be invested in service improvement or growth initiatives.

- Staffing Shortages: The healthcare sector, including Ambea's operating regions, continues to grapple with a deficit of qualified care personnel.

- Increased Operational Costs: High turnover necessitates continuous spending on recruitment, onboarding, and training, impacting profitability.

- Quality of Care Risk: Inadequate staffing levels or inexperienced personnel can compromise the standard of care delivered to clients.

- Growth Limitations: Labor constraints can directly limit Ambea's capacity to take on new clients or expand its geographical reach.

Reputational Damage from Quality Incidents

Reputational damage stemming from quality incidents poses a significant threat to Ambea. Negative publicity or adverse events concerning the quality of care delivered by Ambea or its subsidiaries could erode public trust. This erosion can result in client departures, increased regulatory oversight, and diminished prospects for new business, particularly in the highly sensitive care sector.

For instance, a major incident in 2024 involving patient neglect at one of Ambea's facilities could lead to widespread media coverage. Such an event might trigger immediate investigations by Swedish healthcare authorities, potentially resulting in fines or temporary operational suspensions. The financial impact could be substantial, with analysts projecting a potential 5-10% drop in revenue from affected regions due to client churn and a slowdown in new contract acquisitions.

- Loss of Public Trust: Incidents can quickly turn public perception negative, making it harder to attract new clients and retain existing ones.

- Client Attrition: Families seeking care services are highly sensitive to quality concerns, leading to a direct loss of business.

- Increased Regulatory Scrutiny: Quality failures often invite stricter oversight and compliance demands from governing bodies.

- Diminished Business Opportunities: A tarnished reputation can hinder expansion efforts and partnerships, limiting future growth.

Ambea faces significant threats from evolving regulatory landscapes and intense market competition within the Nordic region. Changes in government funding models and new legislation, such as Sweden's Social Services Act effective summer 2025, could introduce operational challenges and financial pressures. Intense competition from both public and private entities requires continuous differentiation to secure and maintain contracts, impacting pricing and profit margins.

| Threat Category | Specific Threat | Potential Impact | Example/Data Point |

|---|---|---|---|

| Regulatory Changes | New legislation and funding shifts | Operational constraints, financial pressure | Sweden's Social Services Act (Summer 2025), Denmark's Elderly Care Reform |

| Market Competition | Rivalry from public and private providers | Pricing pressure, reduced profit margins | Continued competition for elderly care contracts in Sweden (2023) |

| Economic Downturns | Government austerity measures, reduced public spending | Lower reimbursement rates, slower contract acquisition | Projected Eurozone GDP growth of ~0.9% for 2024 (IMF) |

| Staffing Issues | Shortages of qualified care personnel, high turnover | Compromised care quality, increased operational costs | Ongoing concerns about staffing levels in Swedish healthcare (late 2023/early 2024) |

| Reputational Risk | Quality incidents and negative publicity | Loss of public trust, client attrition, regulatory scrutiny | Potential 5-10% revenue drop from affected regions due to incidents (analyst projection) |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of Ambea's official financial reports, comprehensive market research, and insights from industry experts. These sources provide a robust understanding of the company's internal capabilities and external market positioning.