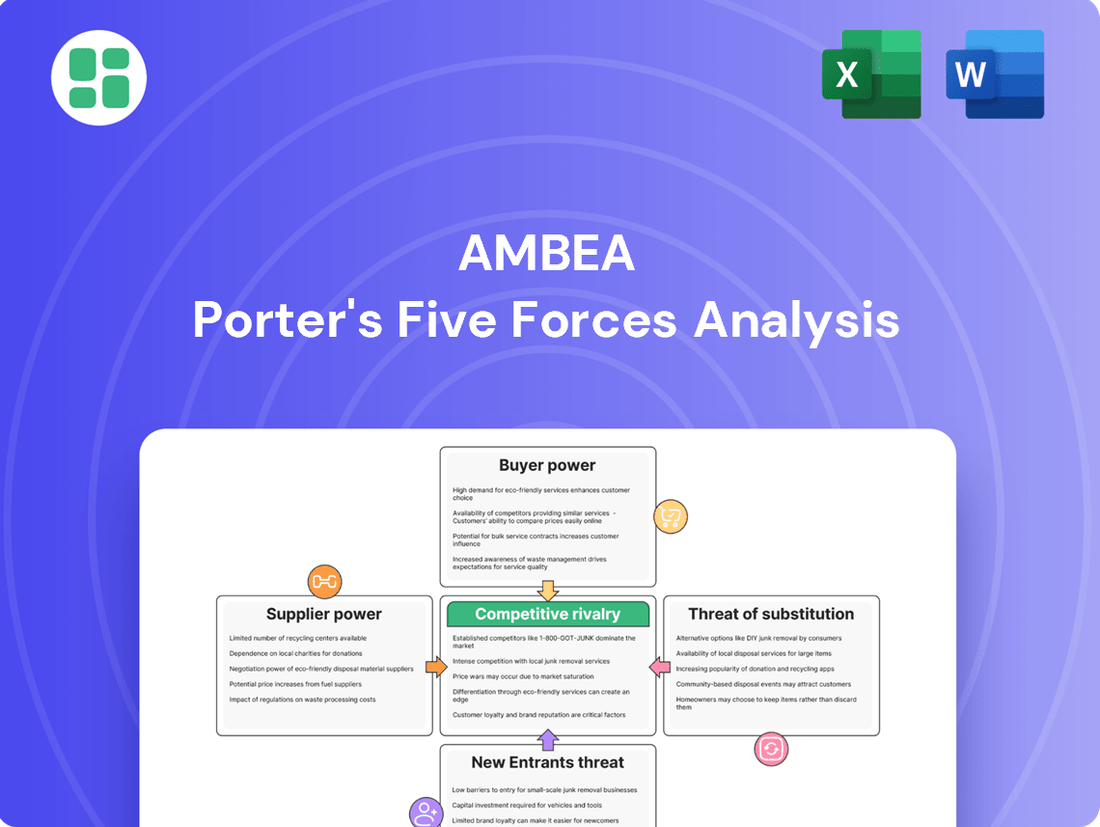

Ambea Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambea Bundle

Ambea's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the intense rivalry among existing players. Understanding these dynamics is crucial for any business operating within or looking to enter this sector.

The complete report reveals the real forces shaping Ambea’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ambea, a prominent player in the Nordic care sector, fundamentally depends on its qualified personnel, encompassing nurses, carers, and specialized therapists. The persistent deficit of healthcare professionals across the Nordic region, a trend consistently observed in recent market analyses, significantly amplifies the leverage held by these essential human resources.

This scarcity translates directly into heightened wage expectations and intensified recruitment hurdles for Ambea. For instance, reports from 2023 indicated a growing gap between the demand for nurses and their available supply in Sweden, a key market for Ambea, potentially driving up labor costs and complicating expansion efforts.

When Ambea Porter's operations depend on highly specialized medical equipment or advanced care technologies, the bargaining power of suppliers can be substantial. If there are only a few manufacturers or distributors capable of producing these essential items, they can dictate pricing and contract terms, impacting Ambea's costs. For instance, in 2024, the global market for specialized medical devices, particularly those used in advanced diagnostics or rehabilitation, saw significant consolidation, with some key players holding dominant market shares.

Ambea's core business in disability and elderly care necessitates a range of specific tools and devices. If these are proprietary, patented, or have very few viable alternatives, the suppliers of such equipment wield considerable influence. This can translate into higher purchase prices or less favorable payment terms for Ambea. Conversely, for more common or generic supplies, like basic consumables or standard furniture, the presence of a larger supplier base typically diminishes supplier power, leading to more competitive pricing.

Ambea's reliance on IT and welfare technology providers is growing as care services become more digitalized. The integration of AI and advanced software means Ambea depends on these external partners for essential functions and upgrades. This dependence can give these providers significant leverage, particularly if their platforms are unique or deeply integrated into Ambea's operations. For instance, the Nordic healthcare sector is heavily investing in such technologies, making these relationships critical for future service delivery.

Concentration of Key Suppliers

The concentration of key suppliers significantly influences Ambea's bargaining power. If a small number of large entities control essential inputs, like specialized medical equipment or critical IT services, they can exert considerable pressure on Ambea. For instance, if a single provider dominates the market for advanced care technology, Ambea would have limited alternatives, potentially leading to higher costs or less favorable contract terms.

Ambea's substantial size and purchasing volume can mitigate this to some extent, enabling it to negotiate better deals than smaller competitors. However, this advantage is directly tied to the supplier market's structure. In 2024, the healthcare sector, where Ambea operates, continued to see consolidation among key equipment and service providers, potentially increasing supplier leverage in certain niches.

- Supplier Dominance: A few large suppliers in critical segments can dictate terms.

- Ambea's Scale: Large purchasing power can offset some supplier concentration.

- Market Dynamics: Supplier market structure is key to understanding leverage.

- 2024 Trends: Consolidation in healthcare supply chains may increase supplier power.

Switching Costs for Ambea

The bargaining power of suppliers for Ambea is significantly influenced by high switching costs, particularly concerning integrated systems like electronic patient records (EPR) and specialized care facility management software. These costs can be substantial, encompassing expenses related to staff retraining, the complex process of data migration, and the potential for operational disruptions during the transition period. Such factors collectively strengthen the position of existing suppliers by making it economically and logistically challenging for Ambea to change providers.

These elevated switching costs are a critical element in Ambea's supplier relationships. For instance, implementing a new EPR system can involve significant upfront investment and a learning curve for healthcare professionals. Ambea's reliance on these sophisticated systems for efficient patient care and administrative functions means that the disruption caused by a supplier change could impact the quality and continuity of services. This underscores the importance of seamless pathways in healthcare operations, making supplier stability a key consideration.

In 2024, the healthcare technology sector continued to see consolidation and innovation, potentially increasing the complexity and cost of switching providers for critical IT infrastructure. Companies like Ambea must carefully weigh the long-term benefits against the immediate financial and operational burdens associated with changing their core software systems. The integration of these systems is often deep, meaning that a change in one area can have ripple effects throughout the organization.

- High Implementation Costs: The initial setup and integration of new healthcare management software can run into hundreds of thousands of euros, depending on the scale and complexity of the facility.

- Data Migration Challenges: Transferring sensitive patient data from one system to another is a meticulous and costly process, often requiring specialized expertise and robust security protocols.

- Staff Training Investment: Equipping employees with the skills to operate new systems necessitates dedicated training programs, which represent a significant human resource and financial commitment.

- Potential for Service Interruption: Any transition period carries the risk of temporary disruptions in patient care or administrative processes, impacting operational efficiency and patient satisfaction.

The bargaining power of suppliers for Ambea is amplified when they offer differentiated or specialized products, such as advanced care technologies or proprietary IT solutions. When few alternatives exist, suppliers can command higher prices and impose stricter terms. For example, in 2024, the market for AI-driven diagnostic tools saw limited suppliers, giving them significant pricing power over healthcare providers like Ambea.

Conversely, for more commoditized inputs, like basic medical supplies or generic office equipment, Ambea faces a wider array of suppliers, which naturally lowers supplier leverage. The company's purchasing scale also plays a crucial role; larger orders can secure more favorable pricing and contract conditions, mitigating some supplier influence, especially in 2024 where procurement strategies focused on volume discounts.

Ambea's dependence on integrated IT systems, like electronic health records, presents a significant challenge. The high costs and operational risks associated with switching providers mean that existing IT suppliers often hold considerable sway over Ambea, dictating terms and pricing due to the complexity of data migration and staff retraining, a factor that remained prominent in 2024.

| Input Type | Supplier Concentration | Switching Costs | Supplier Bargaining Power |

|---|---|---|---|

| Specialized Care Technology | Low (few key players) | High | High |

| IT & Welfare Technology | Moderate to High | Very High | High |

| General Medical Supplies | High (many providers) | Low | Low |

| Qualified Personnel | Low (fragmented supply) | Moderate (training) | High |

What is included in the product

Uncovers the competitive intensity within the healthcare and elderly care sectors, examining Ambea's position against rivals, supplier/buyer power, new entrants, and substitute services.

Instantly identify and address competitive threats with a visually intuitive breakdown of all five forces, simplifying complex market dynamics.

Customers Bargaining Power

In Nordic countries, municipalities and government agencies are the dominant purchasers of elderly and disability care services, making them Ambea's principal clients. Their substantial bargaining power stems from the sheer volume of services they procure and their authority in establishing care quality benchmarks and managing budget allocations.

These governmental entities frequently set service specifications and pricing through competitive bidding processes, often referred to as tenders. For instance, in 2024, public healthcare procurement in Sweden, a key market for Ambea, continued to be heavily influenced by these tender-driven frameworks, allowing municipalities significant leverage in negotiating contracts.

The Scandinavian model, deeply rooted in the idea of elderly care as a public duty, significantly shapes the bargaining power of customers, or rather, the municipalities acting on their behalf. These municipalities hold a substantial mandate to guarantee fair access and top-tier services for all residents. This governmental control translates into considerable leverage over private entities such as Ambea, enabling them to impose stringent quality standards and cost-efficiency demands.

Customers, particularly municipalities in Sweden, hold significant power by demanding high-quality care. Given that care quality is a major public concern and a political priority, these customers can enforce strict quality standards, detailed reporting, and specific performance metrics on providers like Ambea. Failure to meet these benchmarks can lead to contract termination or financial penalties, directly enhancing customer leverage.

In 2023, Ambea reported a strong focus on quality, with initiatives aimed at improving patient outcomes and satisfaction. The company’s commitment to quality is a key selling point, but also a point of vulnerability if standards are not consistently met, as evidenced by the potential for contract loss in the competitive Swedish care sector.

Availability of Alternative Care Providers (Public and Private)

The bargaining power of customers for Ambea is influenced by the availability of alternative care providers. While Ambea holds a strong position as a leading private provider, municipalities, as key customers, can opt for in-house care services or engage with other private entities. This competitive landscape, even with some specialization, allows customers to exert pressure on pricing and service terms.

In 2024, the Swedish healthcare market, where Ambea primarily operates, continued to see a mix of public and private providers. For instance, while municipalities are the primary purchasers of elderly care, the number of private providers offering similar services has been on the rise, creating more choice. This increased competition directly impacts Ambea's ability to dictate terms.

- Increased competition from other private care providers in 2024 has given municipalities more options when contracting for elderly care services.

- The option for municipalities to self-provide care services, even if not always cost-effective, acts as a baseline for negotiation with private entities like Ambea.

- In specialized care segments, alternatives might be fewer, potentially reducing customer bargaining power in those specific niches.

- Market trends indicate a growing demand for elderly care, which, while expanding the overall market, also attracts new entrants, thereby enhancing customer choice and bargaining power.

Budgetary Constraints and Cost Pressure

Municipalities, as key clients for welfare service providers like Ambea, frequently operate under stringent public budgets. This financial pressure often translates into a strong demand for cost optimization, compelling them to seek the most economical service delivery models. For instance, in 2024, many local governments faced increased scrutiny on public spending, leading to a heightened focus on value for money in all service procurements.

This inherent budgetary constraint empowers these municipal customers, giving them significant leverage in negotiations. They are incentivized to push for lower prices or more cost-efficient service structures from providers such as Ambea. This directly influences Ambea's revenue streams and overall profitability, as these public entities represent a substantial portion of their client base.

- Municipal Budgetary Pressures: Many municipalities in 2024 were actively managing tighter public finances, impacting their ability to absorb cost increases from service providers.

- Demand for Cost Efficiency: Customer pressure for lower prices and more efficient service models is a constant factor for welfare service providers.

- Impact on Provider Revenue: The financial constraints of municipal clients directly affect the pricing power and profitability of companies like Ambea.

The bargaining power of customers, primarily municipalities, is substantial due to their role as large-volume purchasers and their authority in setting quality standards and budgets. This power is amplified by competitive bidding processes and the option for self-provision of care services, forcing providers like Ambea to focus on cost-efficiency and demonstrable value. In 2024, budget constraints on municipalities further intensified this pressure, directly impacting Ambea's pricing and profitability.

| Customer Type | Key Bargaining Levers | Impact on Ambea | 2024 Context |

|---|---|---|---|

| Municipalities (Sweden) | Volume purchasing, Tender processes, Quality standards, Budgetary constraints | Price pressure, Contract negotiation leverage, Focus on cost-efficiency | Continued tight public finances, increased competition from private providers |

| Government Agencies | Regulatory oversight, Service specifications, Funding allocation | Compliance requirements, Potential for contract adjustments | Ongoing emphasis on public service delivery efficiency |

Preview the Actual Deliverable

Ambea Porter's Five Forces Analysis

This preview showcases the comprehensive Ambea Porter's Five Forces Analysis, demonstrating the exact document you will receive immediately after purchase. You're looking at the actual, fully formatted analysis, ensuring no surprises or placeholder content. Once your purchase is complete, you'll gain instant access to this professionally written report, ready for your strategic planning needs.

Rivalry Among Competitors

Ambea competes in the Nordic care sector, a market characterized by a mix of public and private providers. As Scandinavia's leading competence-based care company, Ambea encounters significant rivalry from other well-established private care organizations, as well as from publicly funded municipal services operating throughout Sweden, Norway, and Denmark. This competitive landscape is dynamic, with ongoing consolidation and new entrants impacting market share.

The Nordic region's aging demographic is fueling a significant increase in demand for elderly and disability care services. This expanding market can, in theory, temper intense rivalry by offering growth avenues for all established providers.

However, a projected undersupply of care beds by 2030, estimated to be in the tens of thousands across the Nordics, signals a substantial unmet need. This scarcity, while indicating market potential, is likely to intensify competition as companies vie for new contracts and the development of new facilities to capture this growing demand.

Ambea distinguishes itself by prioritizing high-quality, personalized care, a strategy reinforced by its commitment to innovation and welfare technology. This focus allows Ambea to stand out in a competitive landscape where trust and specialized services are critical. For instance, in 2023, Ambea reported a significant increase in customer satisfaction scores related to its specialized care programs, demonstrating the market's responsiveness to differentiated service offerings.

Exit Barriers for Competitors

The care sector, including companies like Ambea, often faces considerable exit barriers. These are largely due to the substantial investments in fixed assets such as properties and specialized facilities. For instance, the capital expenditure for developing and maintaining care homes can be very high, making it difficult for companies to divest these assets quickly without significant losses.

These high exit barriers mean that even companies experiencing lower profitability may choose to continue operating rather than incur substantial costs to exit the market. This can result in a sustained high level of competitive rivalry, as these firms remain active participants, potentially driving down overall industry profitability.

Consider the long-term contracts common in the care sector, which further entrench competitors. Companies are often locked into service agreements that span several years, making it impractical to cease operations prematurely. This contractual rigidity contributes to the persistence of competition.

- High Fixed Asset Investment: Significant capital is tied up in properties and equipment, making divestment costly.

- Long-Term Contracts: Service agreements often commit companies for extended periods, hindering swift exits.

- Operational Persistence: Companies may operate at reduced profitability to avoid exit-related losses, maintaining competitive pressure.

- Industry Structure: The nature of care services often necessitates stable, long-term operations, reinforcing the difficulty of exiting.

Regulatory Environment and Public-Private Mix

Ambea's competitive rivalry is significantly influenced by the distinct regulatory environments across the Nordic countries. These regulations govern everything from privatization policies and public procurement processes to the stringent quality oversight applied to care services. For instance, in 2024, Sweden continued its focus on market-based solutions in elderly care, while Norway maintained a stronger emphasis on public provision, creating varied competitive dynamics.

The interplay between public and private service providers means Ambea doesn't just compete against other private companies. It also faces competition from the inherent efficiency and quality delivered by state-run services. This public-private mix necessitates a constant drive for operational excellence and service differentiation to remain competitive in all operating markets.

- Regulatory Variation: Nordic countries exhibit diverse approaches to privatization and public procurement in the care sector, directly impacting competitive intensity.

- Public Provider Competition: Ambea competes not only with private entities but also with the performance of publicly managed care services.

- Quality as a Differentiator: Stringent quality oversight mandates mean that superior service delivery is a critical factor in winning and retaining contracts, especially in public tenders.

Ambea faces intense competition from both private care providers and public services across the Nordics, a dynamic shaped by varying regulations and a growing demand for care. The market's structure, with high exit barriers due to substantial investments in facilities and long-term contracts, ensures that even less profitable players remain active, sustaining competitive pressure. Ambea's strategy of focusing on high-quality, personalized care, enhanced by welfare technology, is crucial for differentiation in this environment.

| Factor | Description | Impact on Ambea | 2024 Data/Trend |

|---|---|---|---|

| Rival Firms | Established private care companies and public municipal services | Direct competition for contracts and market share | Continued consolidation among private providers; ongoing public sector tenders |

| Market Growth | Aging population increasing demand for care services | Opportunity for expansion, but also intensifies competition for new capacity | Projected undersupply of care beds by tens of thousands across Nordics by 2030 |

| Exit Barriers | High fixed asset investment (properties, facilities) and long-term contracts | Ensures sustained presence of competitors, limiting market consolidation | Capital expenditure for care homes remains significant; contract durations often 5+ years |

| Differentiation | Focus on quality, specialization, and welfare technology | Key to winning contracts and customer loyalty in a crowded market | Customer satisfaction scores for specialized care programs showed positive trends in 2023 |

SSubstitutes Threaten

Informal care from family and friends presents a significant substitute for professional care services. Even in Nordic countries with strong public care systems, family support is prevalent, especially for less intensive needs. For instance, Sweden's grandparental leave policies can bolster this informal care network.

Municipalities, as key funders, frequently operate their own care facilities and home care services. These public options directly substitute for private providers like Ambea, offering individuals a choice between public and private care. Municipal services may compete based on perceived trustworthiness or their direct public funding advantage.

The increasing emphasis on independent living and reablement models poses a significant threat of substitution for traditional residential care providers like Ambea. These approaches aim to empower elderly and disabled individuals to maintain autonomy for as long as possible, often through personalized home-based support and rehabilitation programs. For instance, in 2023, the UK saw a continued rise in home care packages, with many local authorities prioritizing reablement services to reduce long-term reliance on institutional care.

Technological Solutions for Home Monitoring and Assistance

The rise of welfare technology presents a significant threat of substitutes for Ambea's in-person care services. Advances in remote monitoring, smart home devices, and assistive technologies are providing individuals with more options for receiving support at home, potentially reducing reliance on traditional care providers.

These technological solutions can offer a more cost-effective and convenient alternative for many individuals who might otherwise require Ambea's services. For instance, the global market for assistive technologies was projected to reach over $20 billion by 2024, indicating a substantial and growing substitute market.

- Growing adoption of smart home devices: Many households are already integrating smart home technology, creating a foundation for more advanced assistive solutions.

- Increased investment in health tech: Significant venture capital is flowing into health technology, driving innovation in remote patient monitoring and telehealth.

- Cost-effectiveness of technology: For certain needs, technological solutions can be considerably cheaper than employing human caregivers, impacting price sensitivity.

Preventative Health Initiatives and Lifestyle Changes

Public health campaigns promoting preventative care and healthy lifestyles can significantly impact the demand for long-term care services. For instance, initiatives focused on healthy aging and early disease intervention aim to reduce the overall need for intensive support later in life.

While these changes don't directly replace the need for immediate care, a population that ages more healthily could lead to a slower increase in demand for extensive residential or home care. In 2024, global spending on preventative healthcare is projected to rise, with a growing emphasis on wellness programs and early detection, potentially shifting consumer focus away from reactive care models.

- Preventative Health Initiatives: Public health efforts encouraging healthier diets, regular exercise, and smoking cessation.

- Healthy Aging Focus: Programs designed to maintain physical and cognitive function in older adults.

- Early Intervention: Strategies for identifying and addressing health issues before they become severe.

- Impact on Demand: A healthier population may reduce the long-term reliance on intensive care services.

The threat of substitutes for Ambea's services is multifaceted, ranging from informal family care to technological advancements. Publicly funded care options and a growing emphasis on independent living models also present direct competition. Furthermore, preventative health initiatives aim to reduce the overall demand for long-term care, impacting the market landscape.

| Substitute Type | Description | Example/Data Point |

|---|---|---|

| Informal Care | Support from family and friends. | Sweden's grandparental leave policies bolster this network. |

| Public Care Services | Municipalities' own care facilities and home care. | Municipal services compete on trustworthiness and public funding. |

| Independent Living/Reablement | Home-based support and rehabilitation. | UK saw a rise in home care packages prioritizing reablement in 2023. |

| Welfare Technology | Remote monitoring, smart home devices. | Global assistive tech market projected over $20 billion by 2024. |

| Preventative Health | Healthy lifestyle promotion. | Global preventative healthcare spending projected to rise in 2024. |

Entrants Threaten

Establishing new care facilities, particularly for elderly and disability support, demands significant upfront capital. This includes purchasing or leasing property, acquiring specialized medical equipment, and investing in robust IT infrastructure for patient management and communication.

For instance, the average cost to build a new 60-bed nursing home in the UK can range from £6 million to £10 million, reflecting the substantial financial commitment required. This high capital barrier effectively deters many potential new players from entering the market.

The Nordic care sector presents a formidable barrier to entry due to its extensive regulatory and licensing requirements. National and municipal authorities in countries like Sweden and Denmark impose stringent standards for quality, safety, and operational procedures. For instance, in Sweden, obtaining a license to operate a care service involves a thorough review by the Swedish Health and Social Care Inspectorate (IVO), a process that can be both time-consuming and resource-intensive, effectively deterring new, less-established entities.

In the sensitive care sector, a strong reputation and established trust are paramount for attracting clients and winning public contracts. Newcomers face a significant hurdle as they lack the proven track record that incumbents like Ambea have cultivated over many years, making it challenging to gain a foothold.

Challenges in Recruiting and Retaining Skilled Staff

The threat of new entrants is significantly influenced by the difficulty in recruiting and retaining skilled staff, particularly within the healthcare sector. The Nordic region, for instance, faces an ongoing shortage of qualified healthcare professionals. This makes it a considerable hurdle for any new company to quickly assemble a competent and sufficient workforce to compete effectively.

Established companies like Ambea benefit from well-developed recruitment channels and attractive employee benefits packages. New entrants would find it extremely difficult and costly to replicate these established advantages, thereby raising the barrier to entry.

- Nordic Healthcare Staffing Shortage: Reports indicate a persistent deficit in nurses and specialized caregivers across Sweden, Norway, and Denmark, impacting new market entrants' ability to scale operations rapidly.

- Ambea's Established Recruitment Network: Ambea leverages decades of experience and existing partnerships with educational institutions and professional bodies, providing a significant advantage in talent acquisition.

- Employee Retention Challenges: High turnover rates in the healthcare industry, exacerbated by the current labor market, mean new entrants must offer highly competitive compensation and benefits to attract and keep staff, a feat difficult to achieve against established employers.

Access to Public Procurement Contracts

A significant portion of Ambea's revenue is tied to public procurement contracts, particularly with Swedish municipalities. For instance, in 2023, Ambea reported that approximately 70% of its revenue was derived from public sector contracts. This reliance presents a substantial barrier for new entrants aiming to secure similar business.

New companies must navigate complex and often lengthy tender processes. These tenders frequently require a proven track record, established quality systems, and demonstrated capacity to deliver services at scale, all of which are challenging for nascent competitors to possess immediately.

Incumbents like Ambea benefit from established relationships, operational efficiencies honed over time, and a deep understanding of regulatory and compliance requirements within the public sector. This makes it difficult for new entrants to underbid or offer a compellingly superior alternative in the initial stages.

- Barrier to Entry: Public procurement contracts demand proven experience and capacity, which new entrants lack.

- Revenue Dependence: Ambea's reliance on public sector contracts (around 70% in 2023) highlights the importance of this market.

- Competitive Landscape: Experienced incumbents have established relationships and operational advantages.

- Tender Complexity: Navigating tender processes requires significant resources and understanding of public sector requirements.

The threat of new entrants in the Nordic care sector is considerably low due to substantial capital requirements for establishing facilities and acquiring specialized equipment. Furthermore, stringent regulatory and licensing frameworks, as enforced by bodies like Sweden's IVO, demand extensive compliance, acting as a significant deterrent.

A critical barrier is the intense competition for skilled healthcare professionals, a persistent challenge in the Nordic region. Ambea, for example, benefits from established recruitment networks and attractive employee packages, making it difficult for new players to attract and retain talent. This staffing hurdle is compounded by the high turnover rates prevalent in the industry.

Securing public procurement contracts, which form a substantial portion of revenue for established players like Ambea (around 70% in 2023), presents another major obstacle. New entrants face complex tender processes that often require a proven track record and demonstrated capacity, advantages that incumbents naturally possess.

| Factor | Impact on New Entrants | Ambea's Advantage |

| Capital Investment | High (facility build, equipment) | Established infrastructure |

| Regulation & Licensing | Complex and time-consuming | Expertise in compliance |

| Staffing & Talent Acquisition | Difficult due to shortages | Strong recruitment networks, retention programs |

| Public Procurement | Challenging tender processes | Proven track record, existing relationships |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ambea is built upon a robust foundation of industry-specific data, including Ambea's annual reports and investor presentations. We also incorporate insights from leading healthcare industry research firms and regulatory filings to provide a comprehensive view of the competitive landscape.