Ambea PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambea Bundle

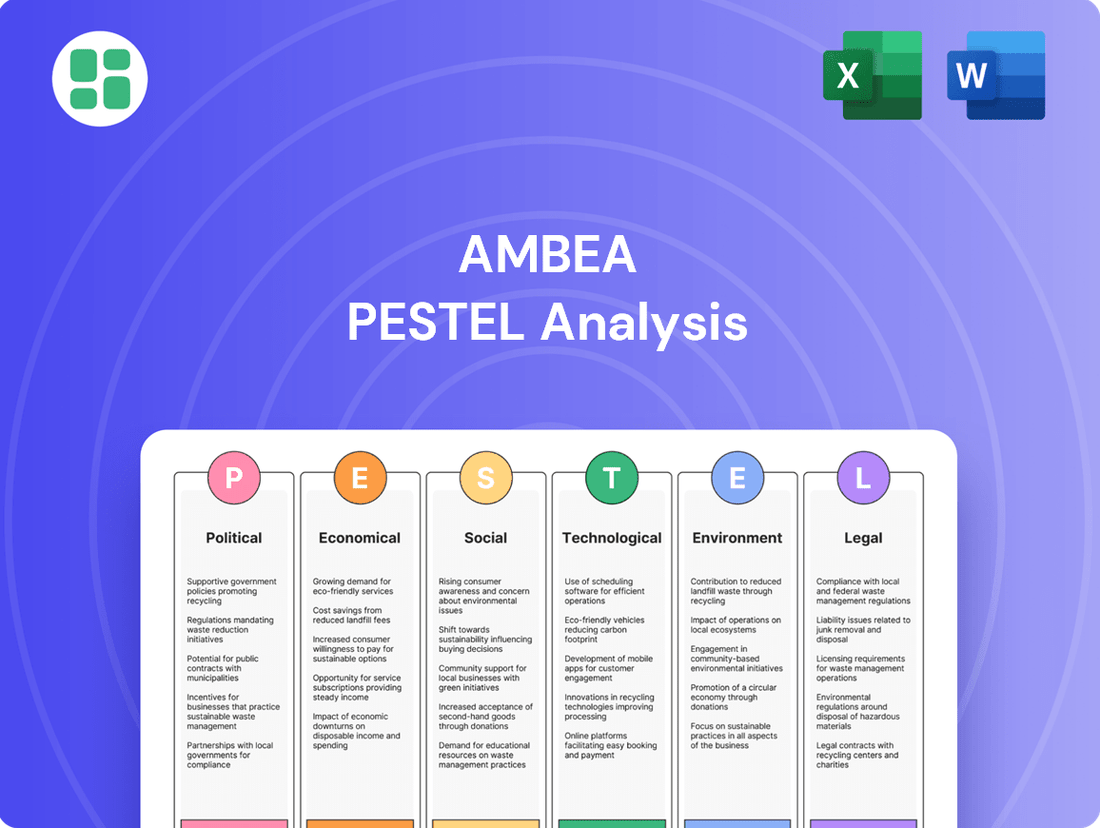

Navigate the complex external forces shaping Ambea's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now for an in-depth understanding.

Political factors

Government healthcare policies and funding levels are crucial for Ambea, directly shaping its operational landscape and revenue. Changes in public budgets for elderly, disability, and family care significantly influence demand and pricing for Ambea's services. For instance, Finland's Ministry of Social Affairs and Health budget saw a proposed decrease for 2025, while Denmark and Sweden projected increased healthcare spending, impacting the competitive environment for private care providers.

Ambea operates within a complex web of regulations across its key markets of Sweden, Norway, and Denmark. These include stringent quality standards, mandatory licensing for care providers, and ongoing supervision, all of which directly impact Ambea's compliance obligations and operational expenditures.

The introduction of new legislation, such as Finland's Disability Services Act effective in 2025, exemplifies how evolving regulatory frameworks can necessitate significant adjustments in service delivery models. Such changes often require increased investment in staff training and updated operational protocols to ensure adherence to new quality assurance measures, potentially leading to higher operating costs for Ambea.

The political stability within the Nordic region, where Ambea primarily operates, provides a solid foundation for its business. In 2023, Sweden, Denmark, and Norway consistently ranked high in global peace and stability indices, fostering a predictable operating environment.

Governments in these nations generally maintain a positive stance towards public-private partnerships in healthcare and elderly care. This approach is evident in the continued allocation of public funds to private providers, with approximately 15-20% of the social care sector in Sweden being privately run as of late 2024, demonstrating a sustained reliance on private entities.

The prevailing Nordic welfare model, which often channels public funding directly to individuals who then choose their care providers, inherently supports private sector participation. This funding mechanism, which has been a cornerstone of social services for decades, ensures that market access for companies like Ambea remains robust, barring significant policy reversals.

Social Welfare Reforms

Ongoing social welfare reforms across Ambea's operating regions, particularly concerning social security, benefits, and support for vulnerable populations, directly influence the demand for and funding of care services. These changes can reshape the financial landscape for care providers and alter the needs of their client base. For example, Finland's recent reforms, which aim to streamline social security and encourage employment, could impact the number and financial capacity of individuals requiring care services.

These evolving policy environments present both potential hurdles and avenues for growth for Ambea. Adapting service models to align with new legislative frameworks and demographic shifts is crucial.

- Finland's social security reforms aim to simplify processes and boost employment, potentially affecting the demand for public care services.

- Changes to benefit structures in Sweden and Norway could alter the disposable income of individuals who purchase private care services.

- Increased focus on home-based care as a cost-saving measure in several European countries may drive demand for Ambea's home care solutions.

- Demographic shifts driven by welfare policies, such as incentives for larger families or support for the elderly, will shape the long-term client profile for care providers.

International and Regional Cooperation

Broader Nordic cooperation programs, like the Nordic Co-operation Programme for Health and Social Affairs 2025–2030, are instrumental in shaping Ambea's operational landscape. These initiatives aim to harmonize standards and policies across Ambea's key markets, promoting equal access to healthcare and mental health services. For instance, the program's focus on sustainable practices directly influences Ambea's strategic planning and the adoption of cross-border best practices in its service delivery.

These cooperative efforts foster an environment where shared challenges in social care and healthcare are addressed collectively. Ambea benefits from this by aligning its strategies with evolving regional benchmarks, potentially leading to more efficient resource allocation and improved service quality. The emphasis on mental health, a growing concern across Europe, is particularly relevant as Ambea seeks to expand its offerings in this critical area.

The Nordic countries consistently rank high in social welfare and healthcare innovation. For example, in 2023, Sweden, Denmark, and Norway were recognized for their advanced digital health solutions and patient-centric care models. Ambea's engagement with these cooperative programs allows it to integrate such leading practices, enhancing its competitive edge and commitment to high-quality care. This collaborative approach also supports Ambea in navigating diverse regulatory environments more effectively.

Key aspects of this cooperation include:

- Harmonization of standards: Promoting consistent quality and safety across Nordic healthcare and social care sectors.

- Focus on equal access: Ensuring that all citizens, regardless of location or background, have access to essential services.

- Mental health initiatives: Developing and implementing strategies to improve mental well-being and support systems.

- Sustainable development: Integrating environmentally and socially responsible practices into service provision.

Government healthcare policies and funding are paramount for Ambea, directly influencing demand and revenue streams. Shifts in public spending for elderly, disability, and family care significantly impact Ambea's service pricing and market access. For instance, while Denmark and Sweden projected increased healthcare spending for 2025, Finland's budget saw a proposed decrease, creating varied market conditions.

Ambea navigates a landscape of stringent regulations across Sweden, Norway, and Denmark, encompassing quality standards and licensing. New legislation, such as Finland's 2025 Disability Services Act, necessitates adaptations in service delivery, potentially increasing operational costs through staff training and protocol updates.

The Nordic region's political stability, underscored by high global peace indices in 2023 for Sweden, Denmark, and Norway, provides a predictable operating environment for Ambea. Governments in these nations generally support public-private partnerships in care services, with private providers accounting for an estimated 15-20% of Sweden's social care sector in late 2024.

The prevailing Nordic welfare model, where individuals often choose their care providers using public funds, ensures robust market access for companies like Ambea. Ongoing social welfare reforms, such as Finland's efforts to streamline social security and encourage employment, could reshape the demand and financial capacity for care services.

| Factor | Impact on Ambea | 2024/2025 Data Point |

| Government Healthcare Policy | Shapes demand, pricing, and operational scope. | Finland's social affairs budget proposed decrease for 2025; Denmark & Sweden projected increases. |

| Regulatory Frameworks | Dictates compliance, operational costs, and service delivery models. | Finland's Disability Services Act effective 2025 requires service model adjustments. |

| Political Stability | Creates a predictable operating environment. | Sweden, Denmark, Norway ranked high in global peace indices in 2023. |

| Public-Private Partnerships | Facilitates market access and revenue generation. | ~15-20% of Sweden's social care sector was privately run as of late 2024. |

| Welfare Model | Ensures market access through individual choice of providers. | Nordic welfare model channels public funds directly to individuals for care choices. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Ambea across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting opportunities and threats derived from real-world market and regulatory dynamics.

The Ambea PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, simplifying complex external factors.

Economic factors

Government spending on healthcare and social services is a critical factor for Ambea, directly shaping its market opportunities and financial health within the Nordic region. The extent of public funding for these sectors dictates the demand for Ambea's care solutions.

Looking ahead, increased healthcare expenditure is anticipated in Denmark and Sweden. For instance, Sweden's healthcare spending was projected to rise, with specific increases eyed for Q2 2024, largely due to demographic shifts like an aging population. This trend suggests an expanding publicly funded market for Ambea's services in these key geographies.

Conversely, potential fiscal adjustments in Finland present a different outlook. Proposed budget reductions in areas such as social security for 2025 could affect the funding streams available for specific care segments, potentially impacting Ambea's revenue in those areas.

Inflation and wage growth are key economic factors for Ambea, especially in the Nordic region where labor costs are a significant operational expense. In 2024, inflation in Sweden, Ambea's primary market, has shown signs of easing, with forecasts suggesting a continued downward trend into 2025. However, wage growth remains a critical consideration.

While overall inflation is expected to moderate, the pace of wage increases in the Nordics, particularly for healthcare and care workers, could still impact Ambea's bottom line. For instance, average wage growth in Sweden was around 3.5% in 2024, and projections for 2025 suggest a similar or slightly lower but still positive real wage increase. If Ambea cannot fully pass these rising labor costs onto its clients through higher service fees or achieve substantial efficiency improvements, its profitability could face pressure.

Economic growth directly impacts how much people can spend on private care services, whether it's for themselves or their loved ones. When economies are doing well and people have more money left after essentials, they're more likely to invest in services like those Ambea offers. This is especially true in countries where public provisions might not cover all needs.

Looking ahead to 2025, there's a positive outlook for Nordic economies. Inflation is expected to decrease, and real incomes are projected to rise. For instance, Sweden, a key market for Ambea, saw its inflation rate fall to 3.2% in April 2024, down from a peak of over 10% in 2023. This trend suggests a potential increase in disposable income, which could translate into greater demand for Ambea's private care solutions.

Labor Market Dynamics and Workforce Availability

The availability and cost of a skilled care workforce are paramount economic considerations for Ambea. Nordic labor markets, while demonstrating robust recovery and high employment rates, are concurrently facing demographic shifts. An aging population inherently increases demand for healthcare services, potentially leading to a scarcity of available workers for support roles.

This growing demand, coupled with a potentially shrinking pool of available caregivers, could exert upward pressure on labor costs. For instance, in Sweden, the median wage for a registered nurse was approximately SEK 36,000 per month in 2024, a figure that may rise with increased competition for talent. Ambea's ability to attract and retain qualified staff will be directly influenced by these market dynamics.

To ensure sustainable staffing and mitigate rising labor expenses, Ambea must focus on strategies that enhance the attractiveness of the healthcare sector as a career choice. This includes competitive compensation, professional development opportunities, and a positive work environment. Such initiatives are crucial for securing the necessary workforce to meet the evolving needs of the elderly population.

- Labor Cost Pressure: An aging population in Nordic countries increases demand for care services, potentially driving up wages for healthcare workers.

- Skilled Workforce Shortage: High employment rates in the Nordic region, combined with growing healthcare needs, could lead to a scarcity of skilled care professionals.

- Attracting Talent: Ambea must invest in making the healthcare sector a more appealing workplace to secure a stable and qualified workforce.

- Wage Benchmarks: In 2024, the median monthly wage for registered nurses in Sweden was around SEK 36,000, indicating a baseline for potential cost increases.

Investment Climate and Capital Availability

The investment climate in the Nordic region, influenced by interest rates and investor appetite for social infrastructure, directly impacts Ambea's capacity for expansion and acquisitions. For instance, the European Central Bank's key interest rates, while fluctuating, remain a critical factor in the cost of capital for companies like Ambea. Investor interest in the social infrastructure sector has shown resilience, with significant capital flows noted in 2023 and early 2024, particularly towards care services.

The substantial and growing structural deficit in aged care across the Nordic countries, projected to require considerable annual investment to meet demand, renders the market highly attractive to international investors. This dynamic creates a favorable environment for Ambea to pursue its growth strategies, potentially through attracting new capital or favorable financing terms for its development projects.

- Nordic Aged Care Demand: Projections indicate a significant increase in individuals aged 65 and over in the Nordics, creating a persistent demand for aged care services.

- Investor Interest: Global investment in healthcare and social infrastructure, including aged care, saw robust activity in 2023, with continued positive sentiment projected for 2024-2025.

- Financing Costs: While interest rates have stabilized, they remain a key consideration for Ambea's debt financing strategies for new facilities and potential acquisitions.

- Market Attractiveness: The clear demographic drivers and undersupply of services in Nordic aged care continue to draw both domestic and international private equity and institutional investors.

Economic growth in the Nordic region is projected to be moderate but steady through 2025, supporting consumer spending on private care services. For example, Sweden's GDP growth was estimated at 1.3% for 2024, with a forecast of 1.9% for 2025, indicating a healthy economic environment for Ambea.

Inflation is expected to continue its downward trend, with Sweden's inflation rate forecast to be around 2.5% in 2025. This moderation in inflation, coupled with anticipated wage growth of approximately 3.0% in 2025, should bolster disposable incomes, potentially increasing demand for Ambea's offerings.

The labor market remains tight, with high employment rates across the Nordics. However, the increasing demand for care services due to an aging population means Ambea must remain competitive in attracting and retaining skilled staff, as evidenced by the median registered nurse wage in Sweden being around SEK 36,000 monthly in 2024.

Investment in social infrastructure, including aged care, remains strong. Continued investor appetite, supported by favorable interest rate environments and the clear demographic need, positions Ambea well for growth and potential acquisitions in the coming years.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Ambea |

|---|---|---|---|

| GDP Growth (Sweden) | 1.3% | 1.9% | Supports demand for private care services |

| Inflation (Sweden) | ~3.2% (April 2024) | ~2.5% | Moderates cost pressures, supports real income growth |

| Wage Growth (Sweden) | ~3.5% | ~3.0% | Increases labor costs but also consumer purchasing power |

| Registered Nurse Median Wage (Sweden) | SEK 36,000/month | Likely to increase | Highlights competition for talent and potential cost increases |

Preview the Actual Deliverable

Ambea PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ambea PESTLE analysis dives deep into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations.

Sociological factors

The aging population in Nordic countries is a significant factor, directly boosting demand for Ambea's core services like residential and home care. This demographic shift is a global trend, with projections indicating that by 2030, one in six individuals worldwide will be 60 or older, solidifying a continuously expanding client base for Ambea.

This demographic reality means Ambea must consistently increase its care capacity. Ambea's CEO highlighted this necessity for ongoing expansion of care places in their 2024 annual report, underscoring the direct link between demographic trends and the company's strategic growth imperatives.

Family structures are evolving, with a trend towards smaller households and fewer adult children available to provide informal care. This societal shift means more individuals, particularly the elderly, are likely to require professional support services, directly benefiting companies like Ambea. For instance, in 2024, the average number of children per woman in many developed countries continues to be below replacement levels, a trend projected to persist into 2025.

Changing lifestyles also play a significant role, as busy schedules and increased geographic mobility often limit the capacity of families to offer hands-on care. Consequently, there's a growing demand for external care solutions, creating a larger market for Ambea’s elderly care and individual and family support services. This reliance on professional providers is a key driver for growth in the care sector.

Public perception and trust are paramount for Ambea, directly influencing its ability to attract clients and maintain a positive brand image. Concerns often arise when private entities manage essential welfare services, making transparency and consistent quality of care absolutely critical for building and retaining public confidence.

Ambea's commitment to high standards, as highlighted in its 2023 annual report, is a proactive step in addressing these societal concerns. By demonstrating a dedication to quality and ethical practices, Ambea aims to solidify trust and counter any negative sentiment associated with private sector involvement in care provision.

Demand for Quality and Personalized Care

Societal expectations are increasingly leaning towards healthcare and support services that are not just good, but truly personalized and focused on the individual. This means people want care that understands their unique needs and preferences, moving away from one-size-fits-all approaches.

Ambea's core mission directly addresses this shift by aiming to provide high-quality care and support that is specifically designed for individuals with varying requirements. This focus on tailoring services is crucial for staying competitive in the current market. For instance, a key indicator of success in this area is the positive feedback received through care receiver surveys, highlighting the effectiveness of individualized care plans.

- Growing Demand for Personalization: Surveys consistently show a preference for tailored care solutions, with a significant percentage of individuals expressing a desire for services that adapt to their specific life circumstances and health conditions.

- Quality as a Differentiator: In 2024, quality metrics and patient satisfaction scores are becoming primary decision-making factors for consumers choosing care providers. Ambea's commitment to high-quality, person-centered care directly aligns with this trend, aiming to boost its market standing.

- Impact on Service Design: This sociological factor necessitates a flexible service model, allowing for the development of bespoke care plans. Ambea's strategy emphasizes this adaptability, recognizing that individualized approaches lead to better outcomes and greater client loyalty.

Mental Health and Wellbeing Trends

Societal trends show a growing emphasis on mental health and wellbeing, directly impacting the demand for care services. Increased stress levels, a prevalent issue, necessitate robust mental health support systems, influencing the market for individual and family care.

The Nordic Health Report 2024 underscores this, revealing elevated stress levels that notably impair work ability. This trend points to a heightened need for integrated care solutions that encompass both psychological and physical health needs.

- Rising Stress Impact: Studies indicate a significant portion of the population experiences work-related stress, leading to increased demand for mental health interventions.

- Demand for Holistic Care: Consumers are increasingly seeking services that address overall wellbeing, not just physical ailments.

- Workforce Wellbeing: Businesses are recognizing the link between employee mental health and productivity, driving investment in corporate wellness programs.

- Care Service Adaptation: Providers are adapting their offerings to include a broader range of mental health support, from counseling to stress management workshops.

The aging demographic in Nordic countries is a primary driver for Ambea, increasing demand for its core services like residential and home care. This trend is global, with projections indicating that by 2030, one in six people worldwide will be aged 60 or over, ensuring a continuously expanding client base.

Evolving family structures, marked by smaller households and fewer adult children available for informal care, mean more individuals will require professional support. This societal shift directly benefits companies like Ambea, as birth rates in many developed nations remain below replacement levels, a trend expected to continue into 2025.

Societal expectations are shifting towards personalized, individual-focused care. Ambea's mission to provide tailored support directly addresses this, with positive feedback from care receiver surveys highlighting the effectiveness of individualized care plans.

| Sociological Factor | Impact on Ambea | Supporting Data/Trend |

|---|---|---|

| Aging Population | Increased demand for residential and home care | By 2030, 1 in 6 globally will be 60+ |

| Changing Family Structures | Greater need for professional care services | Below-replacement fertility rates in developed nations |

| Demand for Personalization | Necessity for flexible, bespoke care plans | Surveys show preference for tailored care solutions |

Technological factors

The increasing digitalization of healthcare services in the Nordics is a major technological factor for Ambea. This trend, particularly strong in 2024-2025, means more adoption of digital tools for patient interaction, remote care, and better coordination. For instance, the Nordic HealthTech market is projected to grow significantly, with digital health solutions expected to reach over $25 billion by 2025, offering Ambea avenues to boost efficiency and expand services.

The adoption of AI and smart technologies is a significant technological factor influencing the care sector. These advancements are revolutionizing elderly and disability care by offering cognitive support, tailored assistance, and enhanced safety measures. For instance, AI-powered systems can analyze patient data to predict potential health issues, allowing for proactive interventions.

Ambea can capitalize on these trends by implementing AI-driven solutions to streamline operations. For example, AI can optimize staff scheduling, potentially reducing wait times for services, a challenge noted in some healthcare systems. Furthermore, AI scribes can automate documentation, freeing up valuable time for caregivers to focus on direct patient interaction, a move already being explored in Norwegian healthcare settings to boost efficiency.

The increasing digitalization of healthcare services, a trend amplified by events in 2024 and continuing into 2025, places immense pressure on organizations like Ambea to implement robust data security and privacy measures. Regulations such as the General Data Protection Regulation (GDPR) and emerging frameworks like the European Health Data Space (EHDS) mandate stringent compliance, requiring significant investment in secure IT infrastructure.

Ambea must prioritize compliance with these evolving data protection laws to safeguard sensitive client information and maintain user trust. Failure to do so could result in substantial fines, as seen with GDPR violations that have reached millions of euros for non-compliant companies in recent years, impacting brand reputation and operational continuity.

Innovation in Assistive Technologies

Innovation in assistive technologies is rapidly transforming the care sector. For instance, the global assistive technology market was valued at approximately USD 22.5 billion in 2023 and is projected to reach over USD 35 billion by 2030, indicating strong growth driven by an aging population and technological advancements.

These advancements are key to enhancing independence for care recipients. Ambea can leverage these trends by integrating smart home devices, remote monitoring systems, and advanced mobility aids into its service offerings, thereby improving care quality and operational efficiency.

- Smart Home Integration: Expect increased adoption of voice-activated assistants and automated environmental controls in care facilities.

- Remote Monitoring: Wearable sensors and telehealth platforms will become more prevalent for continuous health tracking.

- Robotics in Care: Developments in companion robots and robotic assistance for daily tasks are on the horizon.

- Enhanced Communication Tools: Sophisticated communication aids will further bridge gaps for individuals with speech or hearing impairments.

Telehealth and Remote Care Solutions

Telehealth and remote care solutions are significantly reshaping how Ambea delivers services. These models allow Ambea to expand its reach, serving a greater number of patients and potentially alleviating workforce shortages by enabling staff to manage more patients remotely. For instance, the global telehealth market was valued at approximately $128 billion in 2023 and is projected to grow substantially, indicating a strong demand for these services.

The adoption of virtual consultations, remote patient monitoring, and digital communication tools enhances access to care, especially in geographically challenging areas. This improved efficiency is crucial for organizations like Ambea, which operates across various regions. By leveraging these technologies, Ambea can provide more timely and convenient care, leading to better patient outcomes and operational efficiencies. The increasing penetration of broadband internet and smartphone usage further supports the scalability of these remote care initiatives.

Key technological advancements enabling these solutions include:

- AI-powered diagnostic tools: Assisting in early detection and personalized treatment plans.

- Wearable health trackers: Enabling continuous remote monitoring of vital signs and patient activity.

- Secure video conferencing platforms: Facilitating high-quality virtual consultations between patients and healthcare providers.

- Remote patient monitoring (RPM) devices: Transmitting real-time health data to clinical teams for proactive intervention.

Technological advancements, particularly in AI and smart home integration, are revolutionizing care delivery. The global assistive technology market, valued at approximately USD 22.5 billion in 2023, is projected for strong growth, offering Ambea opportunities to enhance service quality and recipient independence. These innovations allow for more personalized care and greater operational efficiency.

The increasing digitalization of healthcare, a trend accelerating through 2024 and into 2025, necessitates robust data security measures. Compliance with regulations like GDPR and the emerging European Health Data Space (EHDS) requires significant investment in secure IT infrastructure. Failure to comply can lead to substantial financial penalties, impacting brand reputation.

Telehealth and remote care solutions are expanding Ambea's service reach, especially in underserved areas. The global telehealth market, valued at roughly $128 billion in 2023, demonstrates a strong demand for these efficient care models. These technologies improve access and allow staff to manage more patients effectively.

| Technology Area | 2023 Value/Projection | Impact on Ambea |

|---|---|---|

| Assistive Technology Market | USD 22.5 billion (2023) to over USD 35 billion by 2030 | Enhances recipient independence, improves care quality. |

| Telehealth Market | USD 128 billion (2023) | Expands service reach, improves operational efficiency. |

| Nordic HealthTech Market | Projected over $25 billion by 2025 | Drives adoption of digital tools for patient interaction and remote care. |

Legal factors

Ambea navigates a landscape shaped by national healthcare and social welfare legislation across Sweden, Norway, and Denmark. Shifts in these regulations, particularly concerning public funding, service delivery frameworks, and the role of private operators, have a direct bearing on Ambea's operational strategies and future planning.

The Nordic Co-operation Programme for Health and Social Affairs, targeting the period of 2025–2030, emphasizes equitable access to healthcare and the reinforcement of universal welfare systems. This initiative could influence service provision models and funding streams relevant to Ambea's business.

Ambea's operations are significantly shaped by labor and employment laws, which dictate everything from working hours and minimum wages to mandatory employee benefits and the recognition of union agreements. These regulations directly impact Ambea's workforce management strategies and can substantially influence operational costs. For instance, in Sweden, where Ambea has a significant presence, collective bargaining agreements are common, and adherence to these agreements is crucial for maintaining stable labor relations and managing wage expenses.

Navigating these legal frameworks requires diligent compliance, which is paramount for Ambea's success. Moreover, in a sector facing persistent staffing shortages, Ambea must not only comply with labor laws but also actively work to make the healthcare and elderly care sectors appealing workplaces. This includes offering competitive compensation and benefits packages, fostering a positive work environment, and investing in professional development to attract and retain qualified personnel, especially given the projected demand for healthcare professionals in the coming years.

Stricter data protection laws, such as the GDPR, mean Ambea must be extra careful with personal and health information. This is crucial for maintaining trust and avoiding hefty fines, which can be up to 4% of global annual revenue or €20 million, whichever is higher. Ambea needs strong systems to manage data securely and transparently.

Disability Rights Legislation and Accessibility Standards

Legislation safeguarding the rights of individuals with disabilities, alongside accessibility mandates for both physical spaces and service delivery, directly shapes Ambea's operations within the disability care sector. These legal frameworks necessitate that Ambea's offerings are not only compliant but also proactively designed to foster inclusion and equal access for all clients.

The upcoming Disability Services Act in Finland, effective January 1, 2025, is a prime example. This legislation is designed to champion equality, integration, and the autonomy of individuals with disabilities. Consequently, Ambea must strategically adjust its service models and physical infrastructure to align with these new legal obligations, ensuring continued operational viability and ethical service provision.

- Finland's Disability Services Act (effective Jan 1, 2025): Focuses on promoting equality, inclusion, and independent living.

- Accessibility Standards: Mandate that facilities and services are usable by people with diverse abilities.

- Impact on Ambea: Requires adaptation of services and infrastructure to meet evolving legal requirements.

- Potential Costs: Compliance may involve investments in facility upgrades or service redesign.

Competition Law and Market Entry Regulations

Competition laws in the Nordic region, particularly in Sweden where Ambea has a significant presence, directly impact its ability to acquire other care providers and expand its service offerings. For instance, the Swedish Competition Authority (Konkurrensverket) scrutinizes mergers and acquisitions to prevent market dominance and ensure fair competition. In 2023, Konkurrensverket reviewed several transactions within the healthcare and social services sectors, highlighting the active enforcement of these regulations.

Adherence to anti-monopoly laws is crucial for Ambea's long-term sustainability and growth. These regulations ensure a level playing field, preventing any single entity from unfairly controlling the market. This is particularly relevant as Ambea considers entering new geographical markets or consolidating its position within existing ones. Failure to comply could result in significant fines and operational restrictions.

- Market Entry Scrutiny: Nordic competition authorities actively assess mergers and acquisitions in the care sector, influencing Ambea's expansion plans.

- Anti-Monopoly Adherence: Maintaining fair competition is vital for Ambea's sustainable development and avoiding penalties.

- Regulatory Oversight: Konkurrensverket’s active review of sector transactions in 2023 underscores the importance of compliance.

- Geographical Expansion Impact: Competition laws can shape Ambea's strategy for entering new regions and consolidating its market share.

Ambea's operations are heavily influenced by evolving healthcare and social welfare legislation across Sweden, Norway, and Denmark, particularly concerning public funding and service delivery models. The Nordic Co-operation Programme for Health and Social Affairs (2025–2030) aims to bolster universal welfare systems, potentially impacting Ambea's service provision and funding streams.

Labor laws are critical, dictating wages, benefits, and union agreements, directly affecting Ambea's workforce management and costs. For instance, collective bargaining in Sweden is a key factor. Ambea must also comply with stringent data protection laws like GDPR, which mandates robust data security to avoid penalties of up to 4% of global annual revenue or €20 million.

New legislation, such as Finland's Disability Services Act effective January 1, 2025, emphasizes equality and autonomy for individuals with disabilities, requiring Ambea to adapt its services and infrastructure. Competition laws also play a significant role, with authorities like Sweden's Konkurrensverket actively scrutinizing mergers and acquisitions to ensure fair market practices, impacting Ambea's expansion strategies.

Environmental factors

The growing focus on sustainability and Environmental, Social, and Governance (ESG) reporting, exemplified by the EU's Corporate Sustainability Reporting Directive (CSRD), is significantly shaping how companies like Ambea operate and disclose their impact. This directive mandates more comprehensive and standardized reporting, pushing businesses toward greater transparency in their environmental and social practices.

Ambea has proactively addressed these evolving requirements. By joining the Science-Based Targets initiative (SBTi) in 2024, the company signals a strong commitment to aligning its emission reduction goals with climate science. This move underscores Ambea's strategy to embed sustainability deeply within its operations and long-term planning, preparing it for stricter reporting mandates and investor expectations.

The healthcare sector, including organizations like Ambea, is a significant contributor to waste generation and resource consumption. This necessitates a strong focus on efficient waste management strategies and reducing overall resource use to mitigate environmental impact. For instance, in 2023, the UK's National Health Service alone generated over 1.2 million tonnes of waste, highlighting the scale of the challenge.

Ambea's commitment to minimizing its environmental footprint is therefore crucial. This includes actively seeking ways to improve its waste sorting, recycling rates, and adopting more sustainable procurement practices for resources. Continuous improvement in measuring and reporting emissions, as part of their sustainability reporting, is key to tracking progress and demonstrating accountability in 2024 and beyond.

Climate change presents broader implications for public health, potentially increasing demand for specific healthcare services that could indirectly affect Ambea. Extreme weather events and rising temperatures can exacerbate existing health conditions and lead to new ones, placing greater strain on healthcare systems globally.

Ambea's proactive stance in setting science-based emissions reduction targets demonstrates a commitment to mitigating these climate change risks. This aligns with global efforts to combat climate change, which in turn aims to reduce the long-term burden on healthcare infrastructure and services.

Energy Consumption and Renewable Energy Adoption

Energy consumption is a critical environmental consideration for care facilities like those operated by Ambea. In 2023, the European Union's healthcare sector alone accounted for a substantial portion of energy use, with buildings being major contributors. Ambea's commitment to sustainability likely involves enhancing building efficiency and exploring renewable energy options to reduce its environmental impact.

The global push towards a greener economy is accelerating renewable energy adoption across all sectors, including healthcare. By investing in energy-efficient infrastructure and integrating renewable sources, Ambea can align with this trend and potentially lower operational costs. For instance, solar power installations on care home roofs are becoming increasingly common, offering a tangible way to reduce reliance on fossil fuels.

- Energy Efficiency Investments: Ambea may focus on upgrading insulation, HVAC systems, and lighting to reduce overall energy demand in its facilities.

- Renewable Energy Integration: Exploring options like solar panels or purchasing green energy tariffs can directly lower the company's carbon footprint.

- Healthcare Sector Trends: The healthcare industry is increasingly prioritizing sustainability, with many organizations setting ambitious targets for emissions reduction by 2030 and beyond.

Environmental Certifications and Standards

Ambea's commitment to environmental certifications and standards significantly bolsters its public image and showcases a dedication to sustainability. For instance, achieving ISO 14001 certification demonstrates a robust environmental management system, which can lead to operational efficiencies and reduced waste. This proactive stance on environmental responsibility is crucial in the healthcare sector, where public trust is paramount.

Engaging in industry-specific initiatives, such as the Nordic Conference on Sustainable Healthcare, positions Ambea at the forefront of developing more environmentally conscious healthcare solutions. These conferences often highlight best practices and emerging technologies for reducing carbon footprints within healthcare operations. In 2024, discussions at such events focused on circular economy principles in medical supplies and energy-efficient building designs for healthcare facilities, areas where Ambea can demonstrate leadership.

Adherence to these standards is not merely about compliance; it's about building a resilient and future-proof business model. By integrating sustainable practices, Ambea can mitigate risks associated with environmental regulations and resource scarcity. For example, a focus on waste reduction in its operations could lead to significant cost savings, as seen in the healthcare industry's broader efforts to cut down on single-use plastics and improve recycling rates. In 2025, the push for greater transparency in supply chains regarding environmental impact will likely intensify, making certifications even more valuable.

- ISO 14001 Certification: Provides a framework for effective environmental management, potentially leading to cost savings through resource efficiency.

- Nordic Conference on Sustainable Healthcare: Participation signals a commitment to adopting greener practices and staying abreast of industry innovations.

- Waste Reduction Initiatives: Aligning with industry trends in 2024-2025 to cut down on single-use plastics and enhance recycling can improve operational costs and environmental performance.

The increasing emphasis on environmental sustainability, driven by regulations like the EU's Corporate Sustainability Reporting Directive (CSRD), is a significant factor for Ambea. Companies are now expected to provide more detailed and standardized disclosures on their environmental impact, pushing for greater transparency in operations. Ambea's participation in the Science-Based Targets initiative (SBTi) in 2024 demonstrates a commitment to aligning its emission reduction goals with climate science, preparing for these evolving reporting standards and investor expectations.

The healthcare sector's environmental footprint, including waste generation and resource consumption, is substantial. For example, the UK's NHS generated over 1.2 million tonnes of waste in 2023, highlighting the need for efficient waste management. Ambea's focus on improving waste sorting, recycling, and sustainable procurement practices is therefore critical for mitigating its environmental impact and demonstrating accountability.

Climate change poses direct and indirect risks to healthcare, potentially increasing demand for services due to exacerbated health conditions. Ambea's proactive approach in setting science-based emissions reduction targets is a strategic move to mitigate these risks and contribute to a more resilient healthcare system. This aligns with global efforts to combat climate change and reduce its long-term strain on healthcare infrastructure.

Energy efficiency and the adoption of renewable energy sources are key environmental considerations for care facilities. The EU's healthcare sector's significant energy consumption in 2023 underscores the importance of Ambea enhancing building efficiency and exploring renewables. Initiatives like solar panel installations on care home roofs are becoming more common, offering a tangible way to reduce reliance on fossil fuels and potentially lower operational costs.

| Environmental Factor | Relevance to Ambea | 2023/2024 Data/Trend |

|---|---|---|

| Sustainability Reporting (ESG) | Increased transparency and standardized reporting mandates | EU's CSRD implementation |

| Emissions Reduction Targets | Alignment with climate science and investor expectations | Ambea joined SBTi in 2024 |

| Waste Management | Mitigating sector-wide waste generation | UK NHS generated 1.2M tonnes of waste in 2023 |

| Energy Consumption | Improving building efficiency and adopting renewables | Healthcare sector is a major energy consumer |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Ambea is meticulously constructed using a blend of public and proprietary data. This includes official government reports, industry-specific market research, and economic indicators from reputable global institutions.