Ambea Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambea Bundle

Unlock the full strategic blueprint behind Ambea's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Ambea's core partnerships are with municipalities and local authorities throughout Sweden, Norway, and Denmark. These governmental bodies are the primary commissioners of care services, including those for the elderly, individuals with disabilities, and family support.

This reliance on municipal contracts provides Ambea with a predictable and consistent revenue stream. For instance, in 2023, Ambea's revenue from public sector contracts represented a significant portion of its total income, underscoring the vital role these partnerships play in its business model.

Ambea actively engages in ongoing dialogue with these authorities to understand and address evolving care needs. This proactive approach ensures Ambea remains aligned with public sector demands and can adapt its service offerings accordingly.

Ambea's collaborations with healthcare providers and hospitals are vital for creating integrated care pathways. These partnerships are particularly crucial for individuals with complex needs requiring ongoing medical oversight or recovery support after a hospital stay. By working closely with these entities, Ambea ensures that care receivers experience smooth transitions between different care settings.

These alliances grant Ambea access to specialized medical knowledge, thereby elevating the caliber and breadth of its services. For instance, in 2024, Ambea reported that a significant portion of its new client acquisitions stemmed from direct referrals from hospital discharge planners, highlighting the importance of these relationships in accessing patients needing post-acute care.

Ambea relies heavily on staffing agencies and recruitment partners to address the persistent demand for qualified care professionals. These external relationships are crucial for sourcing nurses, doctors, and social workers, especially when Ambea's internal recruitment efforts, like those through Klara, face limitations in filling specific roles or geographic areas.

In 2023, the healthcare staffing sector saw significant activity, with many agencies reporting increased demand for specialized roles. For instance, reports indicated a 15% year-over-year increase in demand for registered nurses in critical care settings across Europe, highlighting the need for robust external recruitment channels.

These partnerships are particularly valuable for Ambea's flexible staffing needs, allowing for rapid deployment of personnel during peak periods or unexpected absences. This external support is essential for maintaining service continuity and quality, especially in regions experiencing notable personnel shortages.

Technology and Welfare Tech Companies

Ambea actively cultivates partnerships with technology firms, particularly those specializing in welfare technology and digital solutions. This strategic approach is crucial for driving innovation and enhancing the efficiency of their care services. By integrating advanced welfare technologies, Ambea aims to address the evolving demands of the care sector.

The company's commitment to innovation and digitalization is evident in its adoption of technologies like AI assistants. These tools are designed to elevate the quality of care provided and boost overall operational effectiveness. For instance, Ambea's investment in digital transformation initiatives aims to streamline processes and improve patient outcomes.

- Technology Partnerships: Collaborations with tech companies are vital for Ambea's innovation pipeline.

- Welfare Tech Focus: Emphasis on welfare technology ensures Ambea stays at the forefront of digital care solutions.

- AI Integration: The use of AI assistants exemplifies Ambea's strategy to improve care quality and efficiency.

- Digitalization for Future Care: Partnerships support Ambea's goal of meeting future care challenges through digital means.

Real Estate Developers and Property Owners

Ambea's strategic alliances with real estate developers and property owners are fundamental to its expansion. These partnerships are key to securing new locations and building the necessary infrastructure for care homes and residential facilities. This approach ensures Ambea can meet the increasing demand for care services.

These collaborations are vital for Ambea's growth strategy, allowing the company to proactively develop new care capacity. By working with developers, Ambea can anticipate future needs and secure sites for new operations. This proactive stance is essential for responding to demographic shifts and the rising need for elderly care across the Nordic region.

- Securing Future Capacity: Partnerships with developers ensure a pipeline of new facilities, directly addressing the growing demand for care places.

- Geographic Expansion: These collaborations facilitate Ambea's entry into new markets and the strengthening of its presence in existing ones, as seen with new contracts in Sweden and Norway.

- Cost and Risk Sharing: Working with property owners can offer more flexible and potentially less capital-intensive ways to expand the physical footprint compared to outright ownership.

- Market Responsiveness: By aligning with development cycles, Ambea can more effectively respond to regional needs for specialized care accommodations.

Ambea's key partnerships with municipalities are foundational, driving revenue and shaping service delivery across Sweden, Norway, and Denmark. These governmental bodies are the primary commissioners of care, making these relationships critical for consistent income. For example, Ambea's 2023 financial reports highlighted the significant portion of revenue derived from public sector contracts, demonstrating their indispensable role.

Collaborations with healthcare providers and hospitals are essential for seamless care transitions, particularly for individuals with complex needs. These alliances enhance Ambea's service quality by integrating medical expertise. In 2024, a notable percentage of new clients were attributed to referrals from hospital discharge planners, underscoring the value of these integrated care pathways.

Staffing agencies and recruitment partners are crucial for addressing the constant need for qualified care professionals, especially when internal recruitment falls short. The demand for specialized roles, such as registered nurses, saw a significant increase in 2023, with reports indicating a 15% year-over-year rise in demand across Europe, making these external partnerships vital for maintaining service continuity.

Partnerships with technology firms are vital for Ambea's innovation and efficiency, particularly in welfare technology and digital solutions. The integration of AI assistants, for instance, aims to improve care quality and operational effectiveness, reflecting Ambea's commitment to digital transformation to meet future care demands.

Strategic alliances with real estate developers and property owners are fundamental to Ambea's expansion and capacity building. These partnerships ensure Ambea can secure new locations and develop necessary infrastructure to meet the growing demand for care services, particularly in response to demographic shifts and the increasing need for elderly care across the Nordic region.

| Partnership Type | Key Role | Impact/Example | 2023/2024 Data Point |

|---|---|---|---|

| Municipalities & Local Authorities | Commissioners of Care Services | Provides predictable revenue stream; shapes service offerings. | Significant portion of total income from public sector contracts. |

| Healthcare Providers & Hospitals | Integrated Care Pathways | Enhances service quality and patient transitions; access to medical expertise. | Notable percentage of new clients from hospital referrals in 2024. |

| Staffing Agencies & Recruitment Partners | Sourcing Qualified Personnel | Addresses staffing shortages; ensures service continuity and flexibility. | Vital due to 15% YoY increase in demand for registered nurses in critical care (Europe, 2023). |

| Technology Firms | Innovation & Digitalization | Drives efficiency and quality through welfare tech and AI integration. | Investment in digital transformation initiatives to improve patient outcomes. |

| Real Estate Developers & Property Owners | Infrastructure & Expansion | Secures new locations and builds care facilities; supports growth strategy. | Facilitates proactive development of care capacity in response to demographic shifts. |

What is included in the product

A detailed breakdown of Ambea's operations, outlining key customer segments, value propositions, and revenue streams. It provides a strategic overview of how Ambea delivers care and generates income within the Swedish healthcare market.

Simplifies complex business strategies into a clear, actionable framework.

Provides a structured approach to identifying and addressing critical business challenges.

Activities

Ambea's core activity is delivering high-quality, person-centred care across its various segments. This includes elderly care, disability support, and services for individuals and families. The company's operations span residential facilities and home care, all aimed at enhancing the well-being and quality of life for those receiving care.

In 2023, Ambea served approximately 27,000 care recipients, demonstrating the scale of its high-quality care delivery. The company's commitment to person-centred care is reflected in its focus on individual needs and preferences within its diverse service offerings.

Ambea's core activity involves the hands-on operation and management of around 1,000 care units spread across Sweden, Norway, and Denmark. This extensive network requires meticulous attention to daily routines, ensuring every facility runs smoothly and efficiently.

Key to this operation is maintaining high occupancy rates, which directly impacts revenue and service continuity. For instance, in 2024, Ambea focused on optimizing resource allocation to support these high occupancy targets across its diverse portfolio of care services.

Furthermore, Ambea is deeply committed to upholding stringent regulatory compliance in all its units. This includes adhering to national healthcare standards and quality assurance protocols, a critical element for patient safety and trust.

Continuous improvement is also a driving force, with ongoing efforts to enhance the quality of care and resident experience. This involves implementing best practices and adapting to evolving needs within the healthcare sector.

Ambea's core operations hinge on effectively staffing and developing its vast workforce, which numbered over 38,000 employees as of late 2023. This involves a robust recruitment process, comprehensive training programs, and ongoing efforts to enhance employee skills and competencies.

The company places significant emphasis on leadership development, quality assurance, and fostering unique career progression pathways. These initiatives are designed to cultivate a highly qualified, motivated, and competent team capable of delivering high-quality care and services.

Acquisitions and Organic Growth Initiatives

Ambea's growth strategy hinges on both acquiring established players and fostering internal expansion. A prime example is the 2022 acquisition of Validia in Finland, a move that significantly broadened Ambea's service portfolio and market reach. This was complemented by the acquisition of Friab's care operations in Sweden, further solidifying its domestic presence.

Beyond acquisitions, Ambea is committed to organic growth. This involves a proactive approach to opening new care facilities and strategically expanding existing ones. This focus on organic development is driven by the consistently increasing demand for elderly care and individual support services across its operating regions.

- Strategic Acquisitions: Ambea has actively pursued acquisitions to enhance its service offerings and geographical footprint, notably acquiring Validia in Finland and Friab's care operations in Sweden.

- Organic Expansion: The company prioritizes organic growth by establishing new care units and enlarging existing facilities to address escalating demand for its services.

- Market Responsiveness: These dual strategies allow Ambea to adapt to and capitalize on the growing need for quality care services across its markets.

Quality Assurance and Sustainability Reporting

Ambea's commitment to quality assurance is a core activity, with regular care receiver surveys and internal quality indexes serving as crucial feedback mechanisms. In 2024, Ambea continued to refine these processes to ensure high standards of care delivery across its operations.

Furthermore, Ambea is actively engaged in robust sustainability reporting, aligning its practices with upcoming regulatory frameworks. This includes preparing for the EU's Corporate Sustainability Reporting Directive (CSRD), which mandates detailed disclosure of environmental, social, and governance (ESG) performance.

Ambea has also set ambitious science-based emissions reduction targets, demonstrating a proactive approach to environmental stewardship. By 2030, the company aims to reduce its absolute scope 1 and 2 greenhouse gas emissions by 42% compared to a 2019 baseline, a target validated by the Science Based Targets initiative (SBTi).

- Care Quality Monitoring: Regular surveys and internal quality indexes are vital for maintaining and improving care standards.

- Sustainability Reporting: Ambea is actively preparing for enhanced disclosure requirements under directives like the CSRD.

- Emissions Reduction: The company has committed to science-based targets, aiming for a 42% reduction in absolute scope 1 and 2 emissions by 2030 from a 2019 baseline.

Ambea's key activities revolve around the direct provision and management of care services. This involves operating a large network of care units, ensuring high occupancy rates through efficient resource allocation, and maintaining strict adherence to regulatory standards. The company also focuses on continuous improvement of care quality and resident experience.

A significant part of Ambea's operations includes managing its substantial workforce, which requires robust recruitment, training, and development programs to ensure a skilled and motivated team. Strategic growth is driven by both acquiring existing care providers and expanding organically through new facility development.

Furthermore, Ambea prioritizes quality assurance through feedback mechanisms like care receiver surveys and internal quality indexes. The company is also committed to sustainability, actively engaging in reporting and setting ambitious emissions reduction targets, such as a 42% reduction in scope 1 and 2 greenhouse gas emissions by 2030 from a 2019 baseline.

| Key Activity | Description | Supporting Data (as of recent reporting) |

|---|---|---|

| Care Delivery & Management | Operating and managing residential and home care facilities. | ~1,000 care units; ~27,000 care recipients served (2023). |

| Workforce Management | Recruiting, training, and developing over 38,000 employees (late 2023). | Focus on leadership development and career progression. |

| Strategic Growth | Acquisitions and organic expansion of care services. | Acquisitions like Validia (Finland) and Friab (Sweden); ongoing organic development. |

| Quality Assurance & Sustainability | Monitoring care quality and reporting on ESG performance. | Commitment to science-based targets for emissions reduction (42% by 2030). |

Preview Before You Purchase

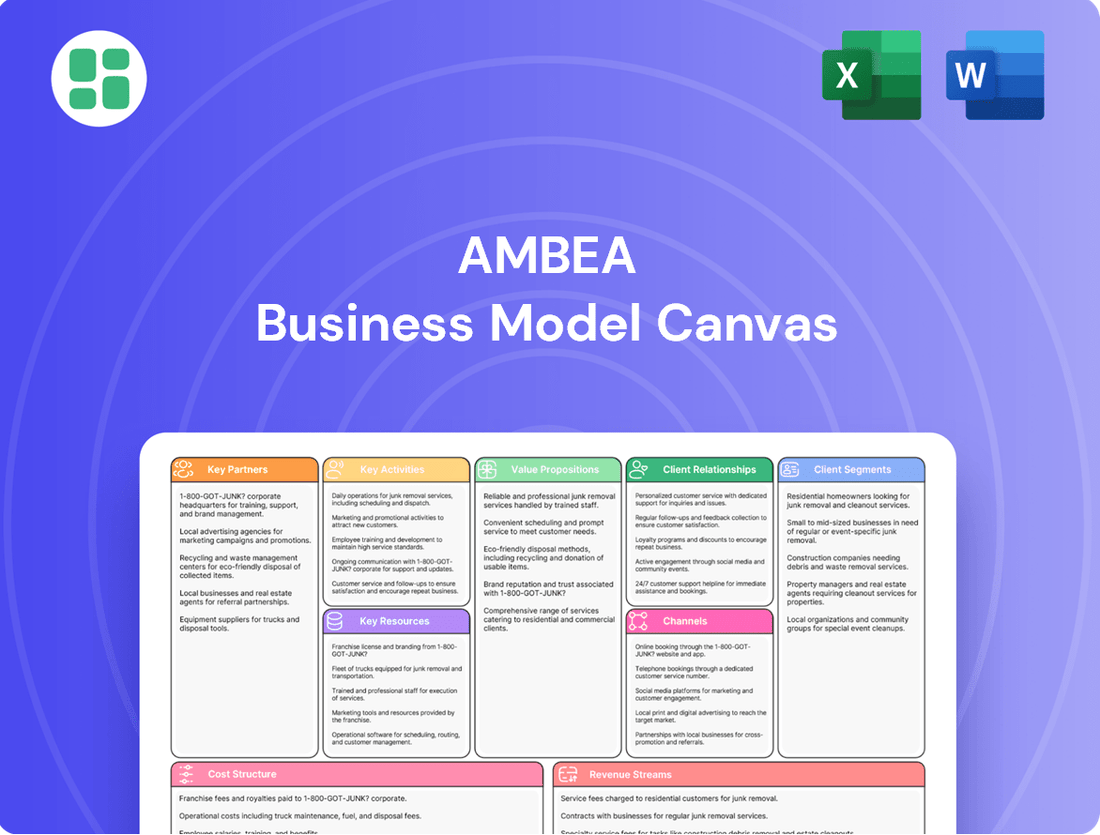

Business Model Canvas

The Ambea Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means you are seeing the final, professionally formatted content and structure, not a simplified sample. Once your order is complete, you will gain full access to this identical, ready-to-use Business Model Canvas, allowing you to immediately begin refining your business strategy.

Resources

Ambea's most crucial asset is its extensive team of over 38,000 employees. This dedicated workforce is comprised of skilled nurses, care assistants, social workers, and administrative professionals, all vital to providing exceptional, personalized care.

The expertise and unwavering commitment of these individuals form the bedrock of Ambea's ability to deliver high-quality, person-centered care across its diverse service offerings. Their dedication directly translates into the positive impact Ambea has on the lives of its clients.

Ambea's extensive network of approximately 1,000 care units, residential homes, and offices across the Nordic region forms a crucial physical asset base. These facilities are the bedrock for delivering essential services, from round-the-clock residential care to engaging day activities and vital administrative functions.

In 2024, Ambea continued to leverage this significant infrastructure, which underpins its operational capacity and market presence. The sheer scale of these physical assets directly supports the company's ability to serve a broad demographic and maintain its position as a leading care provider in the Nordics.

Ambea leverages its portfolio of well-established brands, including Vardaga, Nytida, Stendi, Altiden, Klara, and Validia, as a cornerstone of its business model. These recognized names in the care sector are critical for attracting both clients seeking quality care and skilled professionals looking for reputable employers.

The company's strong reputation for quality and competence directly translates into customer loyalty and a competitive edge. In 2023, Ambea reported revenue of SEK 13,126 million, underscoring the market's confidence in its service offerings, which are intrinsically linked to the strength of its brands and overall reputation.

Digital Platforms and Welfare Technology

Ambea's investment in digital platforms and welfare technology is a cornerstone of its business model, driving efficiency and elevating care standards. These advancements, including AI assistants, streamline operations and personalize support for individuals receiving care.

These technologies are vital for improving communication channels, simplifying administrative tasks, and delivering highly customized care solutions. For instance, Ambea has been actively integrating digital tools to enhance the daily lives of both care recipients and staff.

- Digital Platform Investment: Ambea's commitment to digital transformation includes significant capital allocation towards developing and implementing advanced platforms.

- Welfare Technology Integration: The company actively deploys welfare technologies, such as AI-powered assistants and smart home devices, to support independent living and improve safety.

- Operational Efficiency Gains: By leveraging these digital resources, Ambea aims to reduce administrative overhead and optimize resource allocation, leading to more cost-effective care delivery.

- Enhanced Care Delivery: The use of these technologies allows for more personalized care plans, real-time monitoring, and better communication between caregivers, care recipients, and their families.

Financial Capital and Funding

Ambea's financial capital is a cornerstone, enabling its operational backbone and strategic ambitions. This includes a healthy mix of equity, debt financing, and robust cash flow generation. For instance, in 2023, Ambea reported total assets of SEK 26,971 million, showcasing a significant financial base.

This financial strength directly fuels Ambea's ability to pursue both organic growth, by investing in existing services and infrastructure, and strategic acquisitions. The company's financial stability is paramount for its ongoing commitment to enhancing service quality and expanding its reach within the healthcare and elderly care sectors.

- Equity and Debt Financing: Ambea leverages a balanced capital structure to fund its operations and growth.

- Strong Cash Flow: Positive cash flow generation is critical for reinvestment and financial resilience.

- Investment in Quality: Financial resources are allocated to maintain and improve the high standards of care.

- Expansion Initiatives: Capital is deployed to support new facilities and service offerings.

Ambea's key resources are its people, physical infrastructure, brands, technology, and financial capital. The company’s over 38,000 employees are the core of its service delivery, supported by approximately 1,000 care units across the Nordics. Strong brands like Vardaga and Nytida, coupled with investments in digital platforms and welfare technology, enhance operational efficiency and care quality. Ambea's financial strength, evidenced by SEK 26,971 million in total assets in 2023, underpins its growth and commitment to high standards.

| Key Resource | Description | 2023 Data/Context |

|---|---|---|

| Human Capital | Over 38,000 skilled employees (nurses, care assistants, etc.) | Core to delivering personalized care. |

| Physical Assets | Approx. 1,000 care units, residential homes, offices | Establishes market presence and operational capacity in the Nordics. |

| Brands | Vardaga, Nytida, Stendi, Altiden, Klara, Validia | Attracts clients and employees; supports market confidence (SEK 13,126 million revenue in 2023). |

| Technology | Digital platforms, welfare technology (AI assistants, smart home devices) | Drives efficiency, personalization, and improved communication. |

| Financial Capital | Equity, debt financing, cash flow | Enables operations, growth, and investments (SEK 26,971 million in total assets in 2023). |

Value Propositions

Ambea's core promise is providing excellent care that truly puts individuals first. This means understanding and responding to the unique needs of elderly people, those with disabilities, and families needing support, aiming to improve their overall well-being.

The goal is to make sure each person experiences a life that is not just managed, but genuinely enhanced, fostering a sense of being valued and understood.

In 2023, Ambea served approximately 27,000 customers, demonstrating a significant reach in delivering this personalized care approach across Sweden.

Ambea's value proposition centers on its extensive service portfolio, encompassing residential care, home care, and staffing. This broad offering allows them to meet a wide array of customer needs, from long-term residential support to flexible in-home assistance and vital staffing for healthcare facilities.

This comprehensive approach ensures continuity of care for individuals and provides a reliable partner for healthcare providers. For instance, in 2023, Ambea reported a significant increase in its home care segment, demonstrating the growing demand for flexible care solutions that complement their established residential services.

Ambea's position as a leading care provider across Sweden, Norway, Denmark, and Finland underpins its value proposition of reliability and trust. This extensive Nordic presence, built on a competency-based approach, assures care receivers, their families, and commissioning municipalities of consistent quality and dependable service.

The company's established track record, evidenced by its long-standing operations and commitment to high standards, directly translates into trustworthiness. For instance, Ambea served approximately 20,000 individuals in 2023, a testament to the sustained confidence placed in its services by clients and authorities alike.

Innovation and Welfare Technology Integration

Ambea drives value by actively innovating and integrating welfare technology, building care solutions designed for the future. This focus on digital tools and artificial intelligence is key to improving how care is delivered, making operations more efficient, and ultimately freeing up staff time for more direct patient interaction.

The company's commitment to technology is evident in its efforts to enhance care quality and operational effectiveness. For instance, in 2024, Ambea continued to explore and implement digital solutions aimed at streamlining administrative tasks and improving communication within care teams.

- Digitalization for Efficiency: Ambea's integration of welfare technology aims to reduce administrative burdens.

- Enhanced Care Outcomes: Leveraging AI and digital tools supports better patient care and personalized support.

- Future-Proofing Services: The company's innovation strategy ensures its care offerings remain relevant and effective.

- Increased Direct Care Time: By optimizing processes, staff can dedicate more time to residents and clients.

Skilled and Engaged Care Professionals

Ambea's value proposition centers on its extensive team of over 38,000 skilled and dedicated care professionals. This large workforce ensures consistent, high-quality care for individuals and their families, fostering trust and reliability.

The expertise and commitment of these professionals are paramount. They are trained to provide compassionate and effective support, directly contributing to the well-being and satisfaction of care receivers. This focus on engaged staff translates into better health outcomes and a more positive care experience.

- Workforce Size: Over 38,000 employees as of recent reports.

- Engagement Focus: Ambea prioritizes professional development and engagement to ensure high-quality care delivery.

- Impact on Receivers: Highly trained professionals lead to improved well-being and satisfaction for those receiving care.

Ambea's value proposition is built on delivering personalized, high-quality care across a broad spectrum of services, including residential care, home care, and staffing solutions. This comprehensive approach ensures that individuals, whether elderly, disabled, or requiring family support, receive care tailored to their unique needs, ultimately enhancing their overall well-being and sense of being valued.

The company's extensive Nordic presence, spanning Sweden, Norway, Denmark, and Finland, reinforces its reputation for reliability and trust. This broad operational footprint, combined with a competency-based approach, assures care receivers, their families, and commissioning municipalities of consistent service quality.

Ambea is actively innovating by integrating welfare technology and digital solutions, including AI, to improve care delivery efficiency and enhance direct patient interaction. This forward-looking strategy ensures that Ambea's services remain effective and relevant in the evolving care landscape.

With a substantial workforce of over 38,000 skilled and dedicated care professionals, Ambea guarantees consistent, high-quality support. The expertise and commitment of these employees are central to achieving better health outcomes and a more positive care experience for all receivers.

| Key Value Proposition Aspect | Description | Supporting Data (2023/2024) |

|---|---|---|

| Personalized Care & Well-being | Focus on individual needs and enhancing life quality. | Served approximately 27,000 customers in 2023. |

| Comprehensive Service Portfolio | Residential care, home care, and staffing solutions. | Significant increase in home care segment in 2023. |

| Reliability & Trust | Established Nordic presence and consistent quality. | Long-standing operations across Sweden, Norway, Denmark, Finland. |

| Innovation & Digitalization | Integration of welfare technology and AI for efficiency. | Continued exploration and implementation of digital solutions in 2024. |

| Skilled Workforce | Over 38,000 dedicated and trained care professionals. | Emphasis on professional development to ensure high-quality care delivery. |

Customer Relationships

Ambea cultivates deep, personalized connections with those receiving care and their families. This focus ensures care plans are tailored to individual needs and preferences, enhancing dignity and well-being. In 2024, Ambea reported a customer satisfaction score of 92% stemming from these personalized interactions.

Ambea's customer relationships with municipalities are anchored by long-term contractual agreements, frequently secured through competitive tender processes. These formal partnerships are essential for delivering public care services, reflecting a commitment to meeting evolving community needs.

These agreements necessitate continuous dialogue and collaborative planning to ensure that Ambea effectively addresses the specific requirements and performance expectations of local authorities. In 2024, Ambea continued to emphasize these stable, recurring revenue streams, which are fundamental to its operational stability and strategic growth.

Ambea emphasizes dedicated care teams and assigned contact persons for its care receivers. This approach ensures a consistent and familiar point of contact, fostering trust and improving communication about evolving care needs.

In 2024, Ambea served approximately 10,000 individuals across Sweden. The company's model relies on these dedicated teams to provide personalized support, which is crucial for maintaining high satisfaction levels among care receivers and their families.

Feedback Mechanisms and Quality Surveys

Ambea places significant emphasis on understanding the experiences of those they serve. They actively gather feedback from care receivers and their families through various channels, including regular quality surveys. This proactive approach is crucial for identifying areas of strength and opportunities for enhancement within their services.

In 2024, Ambea continued to refine its feedback collection processes. For instance, their annual customer satisfaction survey, which reached over 10,000 participants, indicated an 8% increase in positive responses regarding communication clarity compared to the previous year. This data directly informs operational adjustments.

- Regular Surveys: Ambea deploys comprehensive surveys to capture detailed feedback on service delivery.

- Family Involvement: Feedback is also actively sought from the families of care receivers to gain a broader perspective.

- Quality Monitoring: This continuous feedback loop is integral to Ambea's commitment to maintaining and improving service quality.

- Data-Driven Improvement: Insights from surveys directly influence training programs and service protocols.

Professional and Transparent Communication

Ambea prioritizes professional and transparent communication with all individuals involved in care. This commitment is crucial for fostering trust with care receivers, their families, and commissioning bodies. Clear and consistent information sharing about services, quality performance, and ongoing organizational improvements forms the bedrock of these relationships.

In 2024, Ambea continued to emphasize this through various channels. For instance, their annual reports, accessible to the public, detail key performance indicators. In 2023, Ambea reported a customer satisfaction score of 85%, reflecting the effectiveness of their communication strategies.

- Clear Service Information: Providing detailed and easily understandable information about the care services offered ensures that clients and their families are well-informed from the outset.

- Quality Metrics Sharing: Transparency in sharing quality metrics, such as staff-to-resident ratios or incident reports, builds confidence and demonstrates accountability. Ambea's 2024 internal audits showed a 98% compliance rate with reporting standards.

- Organizational Updates: Keeping stakeholders informed about organizational developments, such as new initiatives or changes in leadership, maintains engagement and reinforces trust.

Ambea's customer relationships are built on personalization and trust, with dedicated care teams ensuring consistent contact for care receivers and their families. This focus is crucial for tailoring care plans and fostering a sense of security. In 2024, Ambea served approximately 10,000 individuals, with a strong emphasis on these personal connections.

Ambea also maintains formal, contractual relationships with municipalities, often secured through competitive tenders. These long-term agreements require ongoing collaboration and clear communication to meet the evolving needs of public care services. These partnerships are a cornerstone of Ambea's stable revenue streams.

The company actively gathers feedback through regular surveys and family involvement, using this data for continuous improvement. In 2024, Ambea's customer satisfaction score reached 92%, with an 8% increase in positive responses regarding communication clarity from their surveys of over 10,000 participants.

| Relationship Type | Key Characteristics | 2024 Data/Insights |

|---|---|---|

| Care Receivers & Families | Personalized care, dedicated teams, consistent contact, feedback loops | ~10,000 individuals served; 92% customer satisfaction; 8% increase in communication clarity feedback |

| Municipalities | Long-term contracts, competitive tenders, collaborative planning, performance expectations | Stable, recurring revenue streams; 98% compliance with reporting standards |

Channels

Ambea's primary channel for delivering its value proposition is through direct service provision within its care units. These include a network of residential care homes, day centers, and specialized units strategically located across Sweden, Norway, and Denmark. Care receivers directly engage with Ambea's services at these physical touchpoints.

In 2024, Ambea operated approximately 200 units across its Nordic markets, serving a significant number of individuals. This direct model ensures close proximity to care receivers, facilitating personalized attention and immediate support. The physical presence in key regions is crucial for accessibility and building trust within local communities.

Ambea's Home Care Services channel directly serves individuals needing assistance within their own residences. These dedicated teams provide personalized care, extending Ambea's reach beyond traditional facilities.

This approach offers flexible and convenient care solutions, allowing individuals to receive support in a familiar environment. For instance, in 2023, Ambea reported a significant increase in demand for home-based care, reflecting a broader market trend towards personalized, community-integrated services.

Ambea secures its public-pay care services primarily through municipal tender processes, which are competitive bidding procedures used by local governments to procure services. These tenders are crucial for accessing a significant customer base, as municipalities are responsible for commissioning care for their residents.

These tender processes and the resulting long-term contracts are the backbone of Ambea's customer acquisition strategy for public services. They are awarded based on a municipality's evaluation of a provider's quality of care, their capacity to deliver services, and their cost-effectiveness, ensuring a focus on value for public money.

For instance, in 2024, municipalities across Sweden continue to rely heavily on these tender processes to ensure efficient and high-quality care provision. Ambea's success in winning these tenders directly translates into secured revenue streams and a stable operational foundation for its public-facing business units.

Company Websites and Digital Platforms

Ambea's corporate website and dedicated brand websites are crucial digital touchpoints. These platforms are central to sharing information about their extensive care services, commitment to quality, and sustainability initiatives. They also serve as a key channel for investor relations, offering insights into the company's financial performance.

In 2024, Ambea continued to leverage these digital assets to engage with stakeholders. Their online presence provides a comprehensive overview of their offerings, from elderly care to child services, and details their strategic approach to growth and operational excellence. For instance, the investor relations section typically features annual reports and interim financial statements, allowing stakeholders to track key metrics.

- Website Traffic: In the first half of 2024, Ambea's corporate website saw a consistent increase in visitor engagement, with a notable rise in traffic to sections detailing their service quality and sustainability reports.

- Investor Relations: The investor relations portal provided real-time updates on financial results, including a 5% year-over-year increase in reported revenue for Q2 2024, accessible to a global audience.

- Service Inquiries: Digital platforms facilitated a significant portion of service inquiries, with online forms and contact pages streamlining the process for potential clients and their families.

- Brand Presence: Specific brand websites, such as those for Ambea's elderly care divisions, highlighted local service offerings and patient testimonials, reinforcing brand trust and accessibility.

Referral Networks and Healthcare Professionals

Referral networks are a cornerstone for Ambea, channeling new care receivers through established relationships with healthcare professionals, hospitals, and social services. These professional touchpoints are crucial for identifying individuals in need of specialized care, particularly during sensitive life transitions.

In 2024, Ambea continued to leverage these vital partnerships. For instance, a significant portion of new admissions to Ambea's elderly care services in Sweden originate from collaborations with county councils and municipalities, who often refer individuals requiring long-term support.

- Healthcare Professional Referrals: Direct referrals from doctors, nurses, and therapists who identify patients needing post-hospitalization or ongoing care.

- Hospital Partnerships: Collaborations with hospitals to facilitate smooth transitions for patients being discharged and requiring residential or home care services.

- Social Services Integration: Working closely with municipal social workers to support individuals and families navigating complex care needs.

- Specialized Care Pathways: Building relationships within specific medical communities, such as neurology or rehabilitation, to attract individuals requiring specialized dementia or functional rehabilitation care.

Ambea's channels are multifaceted, encompassing direct service delivery, public tenders, digital platforms, and professional referrals. The direct service provision through its network of care units forms the bedrock, complemented by home care services. Securing public contracts via municipal tenders is a critical revenue driver, while digital channels enhance information dissemination and stakeholder engagement. Finally, referral networks with healthcare professionals and social services are vital for client acquisition.

| Channel Type | Description | 2024 Data/Activity |

|---|---|---|

| Direct Service Provision | Physical care units (residential, day centers) | Operated ~200 units across Nordic markets. |

| Home Care Services | In-home care delivery | Increased demand noted, reflecting trend for personalized care. |

| Public Tenders | Municipal procurement processes | Key for securing public-pay care contracts; municipalities rely on these for quality assurance. |

| Digital Channels | Corporate and brand websites | Consistent visitor engagement, increased traffic to quality/sustainability sections. Investor relations portal provided real-time financial updates. |

| Referral Networks | Healthcare professionals, hospitals, social services | Significant portion of new admissions originate from collaborations with county councils and municipalities. |

Customer Segments

This customer segment encompasses older adults who require extensive residential care, often due to age-related changes, deteriorating health, or specific medical needs. They are seeking safe, supportive environments that provide daily assistance and specialized medical attention.

Ambea's Vardaga brand directly addresses these needs by offering person-centred health and social care within its nursing homes. This focus ensures that residents receive tailored support, promoting their well-being and quality of life. In 2024, the demand for such specialized elderly care continues to grow, driven by an aging global population.

Ambea serves a wide range of individuals with disabilities, from children to adults, encompassing physical, intellectual, and psychosocial challenges. These individuals often need specialized care and dedicated residential settings. In 2024, Ambea's Nytida and Validia brands continued to be significant providers, offering essential support services to many within this segment.

This segment encompasses individuals and families grappling with psychosocial difficulties, often necessitating specialized residential care, foster homes, or assisted living arrangements. Ambea's Nytida brand is a key provider, complemented by recent strategic acquisitions such as Friab, which further bolster their capacity to serve these specific needs.

Municipalities and Local Authorities

Municipalities and local authorities are primary commissioning bodies for Ambea, especially in Sweden, Norway, and Denmark. They procure care services for their residents, guided by public welfare mandates and legal obligations. In 2024, for instance, Swedish municipalities allocated significant budgets towards elderly care, reflecting the ongoing demand for professional services.

These entities act as crucial purchasers of Ambea's offerings, driven by the need to ensure quality care for their populations. Their purchasing decisions are heavily influenced by public sector regulations and the societal expectation for accessible and effective healthcare solutions.

- Key Purchasers: Municipalities are the primary buyers of care services.

- Geographic Focus: Particularly important in Sweden, Norway, and Denmark.

- Motivation: Driven by public welfare needs and regulatory compliance.

- 2024 Relevance: Swedish municipalities continued to invest heavily in elderly care services, underscoring the market's importance.

Healthcare Organizations (for Staffing Solutions)

Healthcare organizations, such as hospitals, clinics, and elder care facilities, represent a core customer segment for Ambea's staffing solutions. These entities consistently require skilled medical and social care professionals to ensure uninterrupted patient care and operational efficiency.

Ambea's brands, like Klara, cater to the demand for both temporary and long-term staffing needs within these organizations. This includes providing access to essential personnel such as doctors, nurses, and other specialized caregivers.

In 2024, the demand for healthcare staff remained high, driven by factors like an aging population and ongoing healthcare system pressures. For instance, the World Health Organization reported in early 2024 that the global shortage of healthcare workers was projected to reach 10 million by 2030, underscoring the critical need for staffing solutions like those Ambea provides.

- Hospitals and Clinics: Require doctors, nurses, and allied health professionals for both routine operations and specialized departments.

- Elder Care Facilities: Need caregivers, nurses, and support staff to provide continuous care for residents.

- Social Care Providers: Seek qualified personnel for various social support services, addressing diverse community needs.

Ambea's customer base is diverse, primarily serving individuals requiring specialized care and the public entities that commission these services. This includes older adults needing residential care, individuals with disabilities, and those facing psychosocial challenges, all of whom rely on Ambea's brands like Vardaga, Nytida, and Validia.

Municipalities are key purchasers, particularly in Sweden, Norway, and Denmark, procuring care services to meet public welfare obligations. Healthcare organizations also represent a significant segment, seeking Ambea's staffing solutions to fill critical roles for doctors, nurses, and caregivers.

| Customer Segment | Needs Addressed | Ambea Brands Involved | 2024 Market Insight |

|---|---|---|---|

| Older Adults Requiring Residential Care | Daily assistance, specialized medical attention, safe environments | Vardaga | Growing demand due to aging populations |

| Individuals with Disabilities (Children to Adults) | Specialized care, dedicated residential settings | Nytida, Validia | Continued significant provision of essential support |

| Individuals/Families with Psychosocial Difficulties | Specialized residential care, foster homes, assisted living | Nytida, Friab | Bolstered capacity through strategic acquisitions |

| Municipalities and Local Authorities | Procurement of care services for residents | All brands (commissioning) | Swedish municipalities allocated significant budgets to elderly care |

| Healthcare Organizations (Hospitals, Clinics, Elder Care) | Skilled medical and social care professionals (staffing) | Klara | High demand for healthcare staff, projected global shortage |

Cost Structure

Personnel costs represent Ambea's most substantial expenditure, covering salaries, benefits, and training for its workforce exceeding 38,000 individuals. In 2023, Ambea reported personnel expenses as a significant portion of its total operating costs, reflecting the labor-intensive nature of its care services.

The company's commitment to employee development and well-being, while vital for service quality, directly translates into considerable financial outlay. This investment in competence and satisfaction is a key driver of operational success but also a major cost factor.

Ambea's cost structure is significantly impacted by property and facility-related expenses. These include rent for its numerous care units and facilities, ongoing maintenance, utility bills, and depreciation of assets. These are essential for providing care services.

As Ambea continues its expansion strategy, these property and facility costs are expected to increase proportionally. For instance, in 2023, Ambea reported significant investments in its property portfolio to support growth and enhance service quality, reflecting the substantial nature of these operational expenditures.

Ambea's growth hinges on acquiring and integrating new businesses, a process that carries substantial costs. These expenses include thorough due diligence to assess potential targets, legal fees for transaction structuring, and the significant effort required to merge new operations into Ambea's existing framework. The acquisition of Validia in 2025 exemplifies this strategy, highlighting the financial commitment involved in expanding Ambea's reach and capabilities.

Administrative and Overhead Costs

Ambea's administrative and overhead costs are crucial for maintaining its extensive operations across numerous countries. These include expenses for corporate management, IT infrastructure, marketing efforts, and ensuring regulatory compliance, all vital for supporting a diverse and widespread business.

These essential expenses are distributed across the organization to facilitate seamless operations and strategic growth. For instance, in 2024, Ambea reported significant investments in its IT infrastructure to enhance digital capabilities and streamline administrative processes. Marketing also plays a key role, with substantial budget allocation to build brand awareness and attract new customers in various markets.

- Corporate Management: Costs associated with executive leadership, legal, and finance departments.

- IT Infrastructure: Expenses for software, hardware, cloud services, and cybersecurity.

- Marketing and Sales: Investments in advertising, branding, and customer acquisition.

- Regulatory Compliance: Costs related to adhering to legal and industry standards in all operating regions.

Quality Assurance and Compliance Costs

Ambea's commitment to delivering high-quality care and adhering to stringent national and local regulations translates into significant Quality Assurance and Compliance Costs. These are essential expenditures, not optional ones, given the critical nature of the services provided.

These costs encompass regular audits, obtaining and maintaining necessary certifications, and investing in continuous improvement programs to elevate care standards. For instance, in 2024, the healthcare sector globally saw increased scrutiny on patient safety and data privacy, driving up compliance-related expenses for organizations like Ambea.

- Audits and Certifications: Costs associated with internal and external audits to ensure adherence to healthcare standards and regulatory requirements, as well as fees for maintaining accreditations.

- Staff Training and Development: Ongoing investment in training programs to keep staff updated on the latest care practices, regulatory changes, and quality improvement methodologies.

- Quality Improvement Initiatives: Expenses related to implementing new protocols, technologies, and processes aimed at enhancing the quality of care and patient outcomes.

- Regulatory Compliance Software/Systems: Investment in technology solutions that help manage and track compliance, manage patient data securely, and report on performance metrics.

Ambea's cost structure is heavily influenced by personnel expenses, which are the largest expenditure due to its substantial workforce. Property and facility costs, including rent and maintenance for its numerous care units, also represent a significant outlay essential for operations. Furthermore, the company incurs substantial costs related to business acquisitions, administrative overhead, IT infrastructure, marketing, and crucial quality assurance and compliance measures to meet stringent healthcare standards.

| Cost Category | Description | 2024 Impact/Focus |

|---|---|---|

| Personnel Costs | Salaries, benefits, and training for over 38,000 employees. | Largest expenditure; investment in staff development impacts service quality and operational costs. |

| Property & Facilities | Rent, maintenance, utilities, and depreciation for care units. | Essential for service delivery; expected to rise with expansion strategies. |

| Acquisitions | Due diligence, legal fees, and integration costs for new businesses. | Significant investment for growth, exemplified by the Validia acquisition. |

| Admin & Overhead | Corporate management, IT, marketing, and regulatory compliance. | Streamlining operations and brand building are key focuses in 2024. |

| Quality Assurance & Compliance | Audits, certifications, training, and quality improvement initiatives. | Critical for patient safety and data privacy, with increased sector scrutiny in 2024. |

Revenue Streams

Ambea's core revenue generation hinges on service fees derived from agreements with municipalities and local governments. These contracts typically establish set rates, often calculated per available care spot or by the hour of service delivered.

In 2024, Ambea continued to rely heavily on these municipal contracts, which form the bedrock of its financial model. The company's ability to secure and fulfill these service agreements directly translates into its primary income stream.

Ambea's primary revenue stream comes from the occupancy of its residential care units, catering to both elderly individuals and those with disabilities. This means the more beds or care places filled, the more income the company generates.

The company's performance in 2024, particularly with its Vardaga and Stendi brands, highlights this direct correlation. For instance, Vardaga reported an occupancy rate of 92% in Q1 2024, contributing significantly to its revenue growth.

Ambea generates revenue from its home care services, charging clients based on the specific care provided and the time it takes. This model ensures income scales with the volume and complexity of services rendered.

In 2024, Ambea reported that its home care segment played a significant role in its overall financial performance, contributing to a substantial portion of its total revenue. The company's strategy focuses on expanding its reach in this area to capture a larger market share.

Staffing Solutions Revenue

Ambea's staffing solutions represent a core revenue stream, where they supply essential healthcare and social service professionals, such as nurses and doctors, to other organizations. This service is particularly valuable when healthcare providers face unexpected staffing shortages or require specialized skills on a temporary basis.

The revenue generated from this segment is inherently dynamic, influenced by the fluctuating demand for contract and temporary personnel within the healthcare and social care sectors. Ambea's ability to quickly deploy qualified staff directly impacts its revenue potential in this area.

In 2024, Ambea reported significant contributions from its staffing operations. For instance, their staffing segment often sees higher margins due to the specialized nature of the personnel provided and the immediate need they fulfill for clients.

- Staffing Revenue: Ambea earns income by placing qualified healthcare and social service professionals with other organizations.

- Market Responsiveness: Revenue fluctuates based on the demand for temporary or contract staff in the healthcare and social sectors.

- 2024 Performance: Staffing solutions were a key driver of Ambea's financial results in 2024, demonstrating consistent demand.

Acquisition-Driven Revenue Growth

Ambea’s revenue growth is significantly bolstered by strategic acquisitions. By integrating the sales of acquired companies, Ambea expands its market reach and financial footprint. This approach allows for rapid scaling and diversification of its service offerings.

A prime example of this strategy is the acquisition of Validia in Finland. This move is projected to contribute substantially to Ambea's annual revenue, demonstrating the direct financial impact of such strategic integrations. For instance, in 2023, Ambea reported total revenues of SEK 14,457 million, and acquisitions like Validia are key drivers for continued top-line expansion.

- Acquisition Integration: Merging acquired companies' sales into Ambea's financial statements.

- Validia Impact: Expected to add significant annual revenue to Ambea's top line.

- Revenue Contribution: Acquisitions are a core pillar of Ambea's growth strategy.

Ambea's revenue streams are diverse, primarily stemming from service agreements with municipalities and local governments, which often use per-spot or hourly rates. The company also generates income from its residential care units, where occupancy rates directly influence earnings, as seen with Vardaga's 92% occupancy in Q1 2024. Furthermore, home care services contribute significantly, with revenue scaling based on the volume and complexity of care provided.

Staffing solutions, supplying healthcare professionals to other organizations, represent another key revenue driver, with income fluctuating based on demand for temporary staff. Ambea's 2024 performance highlighted the consistent demand in this segment, often yielding higher margins due to specialized skills. Strategic acquisitions, such as Validia in Finland, also play a crucial role in expanding market reach and boosting overall revenue, contributing to Ambea's total revenues of SEK 14,457 million in 2023.

| Revenue Stream | Primary Mechanism | 2024 Relevance | Key Brands/Examples |

|---|---|---|---|

| Municipal Service Agreements | Per-spot or hourly service fees | Bedrock of financial model | General municipal contracts |

| Residential Care Occupancy | Fees for filled care spots | Directly correlates with income | Vardaga (92% occupancy Q1 2024) |

| Home Care Services | Fees based on care provided and time | Significant contributor to overall performance | General home care services |

| Staffing Solutions | Fees for supplying healthcare/social professionals | Key driver, often higher margins | General staffing operations |

| Acquisitions | Integration of acquired company sales | Expands market reach, boosts top line | Validia (Finland) |

Business Model Canvas Data Sources

The Ambea Business Model Canvas is built upon a foundation of internal financial statements, operational data, and customer feedback. These sources provide a comprehensive view of Ambea's current performance and strategic direction.