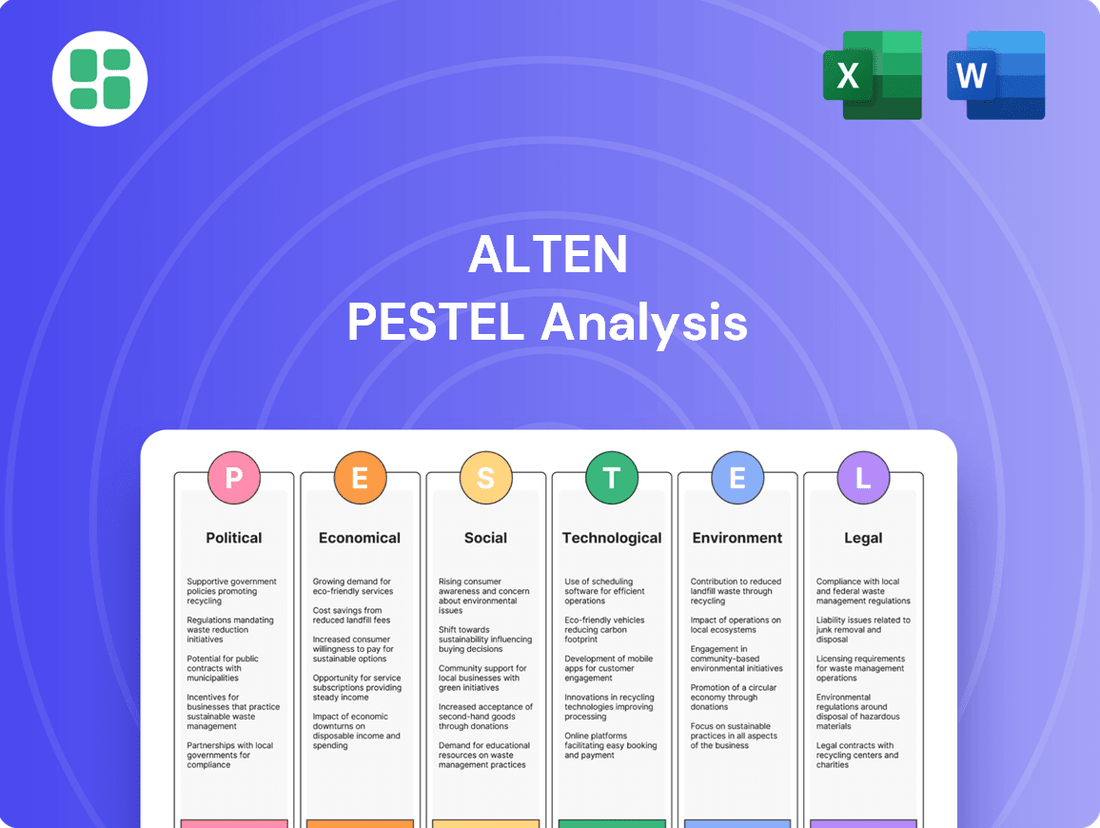

Alten PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alten Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Alten's trajectory. Our expert-crafted PESTLE analysis provides the vital intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now and gain a strategic advantage.

Political factors

Government R&D spending is a significant driver for companies like Alten. For instance, in 2023, the US government allocated approximately $194 billion to R&D, with substantial portions directed towards defense and energy sectors, areas where Alten actively operates. These investments directly translate into demand for advanced engineering and technology consulting.

The European Union's Horizon Europe program, with a budget of €95.5 billion for 2021-2027, also fuels innovation and creates opportunities for firms offering specialized services. Shifts in national budgets, such as the UK's commitment to increasing R&D investment to £22 billion by 2024-25, directly impact Alten's potential project pipeline and revenue growth.

Global geopolitical stability is a key concern for Alten. For instance, the ongoing trade tensions between major economic blocs, such as those involving the United States and China, continue to influence global supply chains and investment flows. These shifts can directly impact Alten's ability to secure resources or serve clients in affected regions, potentially leading to increased operational costs or project delays.

Evolving trade policies, including the implementation of new tariffs or the renegotiation of international agreements, create a dynamic operating environment. For example, changes in import duties on technology components could affect Alten's hardware procurement. This necessitates a proactive approach to understanding and adapting to these policy shifts to mitigate risks and maintain competitive pricing for multinational clients.

Alten's operations are heavily influenced by industry-specific regulations, particularly within aerospace, automotive, and defense sectors. These include rigorous safety standards, demanding certification requirements, and robust data security protocols that directly shape the nature and feasibility of projects. For instance, in 2024, the European Union's General Data Protection Regulation (GDPR) continued to impose strict data handling requirements across all sectors Alten serves, impacting how client data is managed in engineering and IT projects.

Compliance with these stringent rules is not optional; it's fundamental to Alten's project execution. Any shifts in these regulations, such as updated airworthiness directives or new cybersecurity mandates for automotive software in 2025, can force significant adjustments in project methodologies, the technologies Alten adopts, and the final deliverables for clients. These changes directly affect operational costs and can extend project timelines, as seen with the increased compliance burden for connected vehicle data in the automotive industry.

Data Protection and Cybersecurity Laws

The evolving landscape of data protection and cybersecurity laws, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), directly impacts Alten's operations. These regulations mandate stringent handling of client data and the development of secure IT infrastructure, making compliance a non-negotiable aspect of business. Failure to adhere can result in significant financial penalties and reputational damage, underscoring the need for constant vigilance and adaptation in Alten's technological offerings and internal protocols.

Alten must prioritize continuous updates to its internal processes, comprehensive employee training programs, and the deployment of advanced security measures across all its technological solutions to meet these legal obligations. This commitment to data security is crucial for fostering and maintaining client trust, especially as data breaches become more prevalent and sophisticated. For instance, the global cost of data breaches reached an average of $4.45 million in 2024, highlighting the financial imperative for robust cybersecurity.

- Increased regulatory scrutiny on data handling and privacy globally.

- Significant financial penalties for non-compliance, with GDPR fines potentially reaching 4% of global annual turnover.

- Necessity for ongoing investment in cybersecurity infrastructure and employee training to safeguard sensitive client information.

- Impact on product development, requiring data privacy-by-design principles in all new technological solutions.

Government Support for Digital Transformation

Government initiatives promoting digital transformation are a significant tailwind for companies like Alten. For instance, the European Union's Digital Decade targets aim to have 75% of businesses using cloud computing, big data, and AI by 2030, creating substantial demand for IT integration and consulting services. These policies directly translate into opportunities for Alten in areas like smart cities and Industry 4.0, where governments are actively investing in modernizing infrastructure and public services.

These governmental pushes can unlock new revenue streams and market segments for Alten. Public sector digital transformation projects, often funded by national or supranational bodies, represent a considerable market. For example, the UK government's commitment to digital public services, backed by significant investment, offers a prime example of how these policies can stimulate demand for Alten's core competencies in information systems and technology integration. This creates a fertile ground for growth and expansion into adjacent service areas.

- Government Digital Transformation Initiatives: Many governments are actively funding and promoting digital transformation across public and private sectors.

- Industry 4.0 and Smart City Investments: Significant public capital is being allocated to develop Industry 4.0 capabilities and smart city infrastructure.

- EU Digital Decade Targets: Aims like 75% of businesses using cloud, big data, and AI by 2030 highlight a strong market push for digital services.

- Public Sector Contracts: Government policies often lead to large-scale public sector contracts for IT integration and consulting.

Government R&D spending is a significant driver for companies like Alten. For instance, in 2023, the US government allocated approximately $194 billion to R&D, with substantial portions directed towards defense and energy sectors, areas where Alten actively operates. These investments directly translate into demand for advanced engineering and technology consulting.

The European Union's Horizon Europe program, with a budget of €95.5 billion for 2021-2027, also fuels innovation and creates opportunities for firms offering specialized services. Shifts in national budgets, such as the UK's commitment to increasing R&D investment to £22 billion by 2024-25, directly impact Alten's potential project pipeline and revenue growth.

Government initiatives promoting digital transformation are a significant tailwind for companies like Alten. For example, the European Union's Digital Decade targets aim to have 75% of businesses using cloud computing, big data, and AI by 2030, creating substantial demand for IT integration and consulting services.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing Alten, covering political, economic, social, technological, environmental, and legal dimensions.

Provides a clear, actionable framework that helps organizations proactively identify and address external threats and opportunities, thereby reducing uncertainty and strategic risk.

Economic factors

Global economic growth is a critical driver for Alten's business, as it directly impacts client willingness to invest in innovation and IT. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023 but still indicating a generally healthy economic environment. This suggests that clients will likely continue to allocate resources towards R&D and digital transformation projects.

Regional growth variations also play a significant role. While advanced economies might see more moderate growth, emerging markets often present higher growth potential, leading to increased demand for consulting services in those areas. For example, projections for many Asian economies in 2024 and 2025 remain robust, offering opportunities for Alten to expand its client base and project scope in these dynamic regions.

Conversely, economic slowdowns or recessions, such as the potential for slower growth in parts of Europe in 2024, can trigger budget constraints for clients. This might result in delayed or scaled-back investments in new IT infrastructure and innovation initiatives, directly affecting Alten's revenue streams and project pipelines.

Rising inflation presents a significant headwind for Alten, potentially increasing operational expenses such as employee compensation and the cost of raw materials and components. This could put pressure on the company's profit margins if these increased costs cannot be fully passed on to clients. For instance, if inflation in key manufacturing regions for technology components reaches 4-5% in 2024, as projected by some economic forecasts, Alten's procurement costs could see a notable uptick.

Interest rate shifts directly influence the financial decisions of Alten's clients, particularly those undertaking large, capital-intensive projects. As central banks, including the European Central Bank and the US Federal Reserve, continue to navigate inflation, interest rates are expected to remain elevated or potentially see further adjustments in 2024-2025. Higher borrowing costs for clients can dampen their appetite for long-term technology investments, potentially leading to project delays or reduced scope.

Consequently, a sustained period of higher interest rates could negatively impact Alten's revenue projections. Clients facing increased financing costs might postpone or scale back investments in new technology solutions, affecting demand for Alten's services and products. For example, if benchmark lending rates for corporate projects rise by an additional 0.50% in 2024, this could make previously viable projects financially unfeasible for some of Alten's key customer segments.

Client budget allocation for technology consulting, R&D, and information systems is a primary economic lever for Alten. For instance, in 2024, global IT spending was projected to reach $5 trillion, with a significant portion directed towards consulting and digital transformation initiatives, reflecting a strong demand for Alten's core services.

Industry trends, such as the accelerating adoption of AI and cloud computing, coupled with intense competitive pressures, directly shape how much clients are willing to earmark for technology investments. This means Alten must align its offerings with these evolving market demands to capture a larger share of client technology budgets.

Alten's success hinges on its capacity to clearly articulate and deliver tangible value, such as demonstrable efficiency improvements or enhanced ROI from technology projects. Client confidence in these outcomes is paramount; a study by McKinsey in late 2024 indicated that companies prioritizing demonstrable ROI from tech investments were 1.5 times more likely to increase their technology consulting spend.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant risk for Alten, a global engineering and technology consulting firm. As Alten operates across numerous countries, the strength or weakness of local currencies against its reporting currency, likely the Euro, directly impacts its reported financial results. For instance, a strengthening US Dollar against the Euro could inflate USD-denominated revenues when translated back into Euros, positively affecting reported top-line growth. Conversely, a depreciating Yen could diminish the Euro value of Japanese projects.

The impact extends beyond revenue. Profitability can be squeezed if costs incurred in a strengthening currency outweigh revenue gains in that same currency, or if pricing for cross-border projects becomes uncompetitive due to unfavorable exchange rates. Managing this continuous challenge involves strategies like hedging and careful financial planning to mitigate potential adverse movements. For example, in Q1 2024, the Euro experienced moderate volatility against major currencies, with the EUR/USD rate trading within a range of approximately 1.07 to 1.10, highlighting the ongoing need for currency risk management.

- Revenue Impact: A stronger USD relative to the Euro in 2024 could boost Alten's reported revenues from its US operations.

- Profitability Squeeze: If costs in a strengthening local currency exceed revenue gains in that currency, profit margins may contract.

- Pricing Challenges: Unfavorable exchange rates can make Alten's services less competitive in international markets.

- Hedging Strategies: Alten likely employs financial instruments to offset potential losses from adverse currency movements.

Labor Market Costs and Availability

The cost and availability of skilled engineering and technology talent are critical for Alten, directly influencing operational expenses and project delivery capabilities. For instance, in 2024, the average salary for a senior software engineer in major European tech hubs like Berlin or Amsterdam saw an increase of approximately 5-7% year-over-year, driven by high demand.

Wage inflation and shortages in specialized fields, such as AI and cybersecurity, can escalate recruitment expenses and extend project timelines, impacting Alten's competitive edge and profit margins. For example, a report from ManpowerGroup in late 2024 indicated that 75% of employers globally were experiencing a shortage of skilled workers, particularly in technology roles.

Consequently, strategic talent acquisition and retention are essential for Alten's success. Companies are increasingly investing in upskilling programs and competitive benefits packages to attract and keep top engineering talent. In 2025, it's projected that R&D spending by tech firms will continue to rise, further intensifying the competition for skilled professionals.

- Talent Shortage Impact: A significant percentage of employers, around 75% in late 2024 according to ManpowerGroup, reported difficulties finding skilled workers, especially in tech.

- Wage Inflation: Senior software engineer salaries in key European tech markets saw an average increase of 5-7% in 2024.

- Strategic Imperative: Effective talent acquisition and retention strategies are crucial for managing operational costs and ensuring timely project delivery in a competitive market.

- Future Outlook: Continued growth in R&D spending by tech companies in 2025 is expected to further exacerbate competition for specialized engineering talent.

Global economic growth directly influences client investment in innovation, with the IMF projecting 3.2% global growth for 2024, suggesting continued demand for Alten's services. However, regional disparities, such as slower growth in parts of Europe in 2024, could lead to client budget constraints and project delays.

Rising inflation, potentially reaching 4-5% for tech components in 2024, can increase Alten's operational costs and pressure profit margins. Elevated interest rates, a consequence of central banks managing inflation, may also deter clients from undertaking large technology investments, impacting Alten's revenue streams.

Client budget allocation for technology consulting and R&D is a key economic driver, with global IT spending projected at $5 trillion in 2024, a significant portion for consulting. Alten's ability to demonstrate tangible ROI, which McKinsey noted as a priority for 1.5 times more tech consulting spend in late 2024, is crucial for securing these budgets.

Currency fluctuations pose a risk, as seen with the Euro trading between 1.07 and 1.10 against the USD in Q1 2024. While a stronger USD could boost reported revenues, unfavorable rates can impact profitability and competitiveness, necessitating hedging strategies.

| Economic Factor | 2024/2025 Projection/Data | Impact on Alten | Key Data Source/Example |

|---|---|---|---|

| Global Economic Growth | 3.2% (IMF Projection for 2024) | Influences client investment in innovation and IT services. | International Monetary Fund (IMF) |

| Inflation | 4-5% potential for tech components (various forecasts) | Increases operational costs, potentially squeezing profit margins. | Economic forecasts |

| Interest Rates | Elevated or subject to further adjustments by central banks | May deter clients from long-term technology investments due to higher borrowing costs. | European Central Bank, US Federal Reserve actions |

| Global IT Spending | $5 trillion projected for 2024 | Indicates substantial client budgets available for technology consulting and digital transformation. | Industry reports |

| Currency Exchange Rates | EUR/USD range of 1.07-1.10 (Q1 2024) | Affects reported revenues and profitability; requires currency risk management. | Financial market data |

Preview the Actual Deliverable

Alten PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Alten PESTLE analysis provides a detailed examination of the external factors influencing the company's strategic decisions. You'll gain valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental landscape.

Sociological factors

Societal reliance on digital tools is soaring, creating a huge need for people with specific tech skills like artificial intelligence, data analysis, cybersecurity, and cloud computing. This trend is a major plus for companies like Alten, which are at the forefront of technology consulting.

However, this high demand also means Alten must constantly work to find and keep the best tech talent. The competition for these specialized skills is fierce, and Alten needs to secure these experts to successfully serve its clients.

Alten's talent strategy must account for shifting workforce demographics, with Gen Z and Millennials increasingly prioritizing work-life balance and flexible arrangements. For instance, a 2024 survey indicated that 70% of Gen Z employees would consider leaving a job if it lacked flexibility.

The surge in remote and hybrid work, accelerated by global events, impacts Alten's operational footprint and culture. Companies like Microsoft reported in late 2024 that hybrid work models are here to stay, with 80% of their employees wanting flexible remote work options, necessitating investments in digital collaboration tools and revised management practices to ensure engagement and productivity.

Customers now demand effortless, intuitive, and personalized digital interactions across all sectors. This societal shift is a major driver for companies like Alten, as it fuels the need for sophisticated information systems and user-friendly platforms. For instance, a 2024 survey indicated that 78% of consumers expect brands to understand their needs and preferences, directly translating into demand for Alten's expertise in custom software development and digital experience design.

Societal Push for Ethical AI and Technology

Societal expectations are increasingly demanding that technology, including AI, be developed and used ethically. This means addressing concerns about data privacy and ensuring algorithms are fair and unbiased. For companies like Alten, this translates into a need to embed ethical considerations from the very start of their development processes, fostering trust with clients and users who are more aware of these issues than ever before.

This societal push is backed by tangible shifts in public opinion and regulatory landscapes. For instance, a 2024 Pew Research Center study indicated that a significant majority of adults express concerns about how companies use their personal data. Furthermore, governments worldwide are actively developing regulations, with the EU's AI Act, expected to be fully implemented by 2025, setting a precedent for responsible AI governance, which Alten must navigate.

- Growing Public Scrutiny: Over 70% of consumers surveyed in a late 2024 report expressed a preference for companies that demonstrate strong ethical practices in their technology use.

- Regulatory Momentum: The increasing number of data privacy laws enacted globally, such as updates to GDPR and similar legislation in North America and Asia, highlights the regulatory response to societal concerns.

- Brand Reputation Impact: Companies perceived as ethically irresponsible in their AI deployment risk significant damage to their brand, potentially impacting market share by as much as 10-15% according to some industry analyses from early 2025.

- Demand for Transparency: Clients are actively seeking assurances of transparent AI development and deployment, demanding clear explanations of how algorithms function and how data is protected.

Diversity and Inclusion in Tech

Societal pressure to foster diversity, equity, and inclusion (DEI) within the tech industry is significant, stemming from both moral imperatives and the proven business advantages like improved innovation and problem-solving. For instance, a 2024 McKinsey report highlighted that companies in the top quartile for gender diversity on executive teams were 25% more likely to have above-average profitability than companies in the fourth quartile.

Alten needs to embed DEI into its core operations, from hiring to leadership development, to tap into a wider range of talent and better mirror the diverse global markets it engages with. Companies with strong DEI programs report higher employee engagement and retention rates, with a 2025 Deloitte survey indicating that organizations with inclusive cultures are 1.7 times more likely to be innovation leaders.

- Talent Attraction: Companies with robust DEI initiatives saw a 20% increase in qualified applicant pools in 2024, according to LinkedIn data.

- Innovation Boost: A study by Boston Consulting Group found that companies with more diverse management teams have 19% higher revenues due to innovation.

- Market Relevance: Reflecting customer diversity can lead to better product development and market penetration, with diverse teams being 30% better at understanding customer needs.

- Employee Retention: Organizations prioritizing inclusion experience 20% lower voluntary turnover rates, as employees feel more valued and connected.

Societal expectations for ethical technology use are intensifying, especially concerning data privacy and AI fairness, directly impacting companies like Alten. A 2024 Pew Research study revealed that a majority of adults are concerned about personal data usage, and the EU's AI Act, set for full implementation by 2025, signals a global regulatory trend towards responsible AI governance.

The demand for digital interaction and personalized experiences continues to grow, with 78% of consumers in a 2024 survey expecting brands to understand their needs. This drives the need for advanced information systems and user-friendly platforms, areas where Alten's expertise in custom software and digital experience design is crucial.

Workforce demographics are shifting, with younger generations prioritizing work-life balance and flexibility; a 2024 survey found 70% of Gen Z would leave a job lacking flexibility. This necessitates adaptable work models, as evidenced by Microsoft's late 2024 findings that 80% of employees desire flexible remote work options.

Diversity, equity, and inclusion (DEI) are increasingly recognized for their business benefits. Companies with strong DEI initiatives saw a 20% increase in qualified applicants in 2024, and those with diverse management teams report 19% higher revenues from innovation, according to Boston Consulting Group.

| Societal Factor | Impact on Alten | Supporting Data (2024-2025) |

|---|---|---|

| Demand for Ethical Tech | Need for transparent AI, data privacy compliance | 70% of adults concerned about data usage (Pew Research, 2024); EU AI Act implementation by 2025 |

| Digital Experience Expectations | Growth in demand for custom software, UX design | 78% of consumers expect personalized brand interactions (Survey, 2024) |

| Workforce Demographics & Flexibility | Need to attract and retain talent with flexible work options | 70% of Gen Z would leave jobs without flexibility (Survey, 2024); 80% of employees want flexible remote work (Microsoft, late 2024) |

| DEI Imperatives | Enhanced talent pool, innovation, and market relevance | 20% increase in applicants for companies with DEI (LinkedIn, 2024); 19% higher revenue from innovation in diverse teams (BCG) |

Technological factors

Rapid advancements in Artificial Intelligence (AI), Machine Learning (ML), and automation are fundamentally reshaping industries, presenting significant avenues for Alten to craft novel solutions for its clientele. These technologies are key drivers in boosting operational efficiency, facilitating informed decisions grounded in data, and streamlining intricate workflows, thereby increasing the demand for Alten's specialized skills in integrating and harnessing these sophisticated capabilities across diverse market segments.

For instance, the global AI market was projected to reach over $200 billion in 2023 and is expected to grow substantially, with some forecasts suggesting it could exceed $1.5 trillion by 2030. This expansion directly fuels the need for companies like Alten, which possess the expertise to implement AI-driven solutions for tasks ranging from predictive maintenance in manufacturing to personalized customer experiences in retail. The ability to automate complex processes not only reduces costs but also frees up human capital for more strategic initiatives, a value proposition highly sought after by Alten's clients.

Cloud computing adoption continues its upward trajectory, with global public cloud spending projected to reach $679 billion in 2024, a 20.4% increase from 2023. This surge, driven by demands for scalability, flexibility, and cost savings, directly influences Alten's ability to deliver robust IT solutions.

Simultaneously, edge computing is gaining traction, enabling real-time data processing closer to data sources. This trend is crucial for industries requiring low latency, such as IoT and autonomous systems, areas where Alten can leverage its expertise to develop and implement advanced infrastructure.

Alten must therefore refine its cloud migration strategies and bolster its hybrid cloud and edge computing capabilities. By doing so, the company can better address evolving client requirements and solidify its competitive position in the rapidly changing technological landscape.

Cybersecurity threats are growing in complexity and frequency, making robust defenses essential for businesses. This escalating risk landscape directly fuels demand for Alten's specialized services in security consulting, threat detection, and rapid incident response, as organizations increasingly rely on expert guidance to navigate these challenges.

In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial stakes involved. For Alten, investing in cutting-edge cybersecurity technologies and proactive threat intelligence is paramount. This ensures the protection of sensitive client data, upholds crucial trust, and guarantees operational continuity in an environment where digital vulnerabilities can have severe consequences.

5G and IoT Infrastructure Development

The ongoing global expansion of 5G networks is a significant technological driver, fostering the growth of the Internet of Things (IoT). This interconnectedness fuels demand for specialized engineering and consulting services, areas where Alten is actively engaged. For instance, the global IoT market was valued at approximately $1.1 trillion in 2023 and is projected to reach $2.2 trillion by 2028, demonstrating substantial growth potential.

Alten's strategic positioning in designing, implementing, and optimizing 5G infrastructure and IoT solutions for sectors like smart cities, connected vehicles, and industrial automation places it at the vanguard of this technological shift. This focus directly addresses the increasing need for sophisticated network management and device integration. The smart cities market alone is expected to grow from $407.7 billion in 2023 to $1.07 trillion by 2030, according to some estimates.

- 5G Rollout: Continued investment in 5G infrastructure development globally, supporting higher speeds and lower latency.

- IoT Expansion: Proliferation of IoT devices across various industries, creating complex data management and connectivity needs.

- Market Growth: Significant projected growth in the IoT market, indicating expanding opportunities for service providers like Alten.

- Alten's Role: Expertise in designing and optimizing 5G and IoT solutions for smart cities, automotive, and industrial sectors.

Emerging Technologies and R&D Investment

Alten's commitment to research and development is a cornerstone of its strategy, with significant investments in exploring cutting-edge fields. This proactive approach to technological advancement, including areas like quantum computing and advanced robotics, is vital for anticipating evolving client demands and maintaining a competitive edge in the technology consulting and engineering sectors. For example, in 2023, Alten reported a substantial R&D expenditure as a percentage of revenue, underscoring its dedication to innovation.

The company's ability to integrate emerging technologies into its service offerings directly impacts its capacity to deliver pioneering solutions. By staying ahead of the curve, Alten can develop novel applications and services that address future market needs, solidifying its position as a leader. This focus ensures that Alten is not just reacting to technological shifts but is actively shaping them.

- R&D Investment: Alten consistently allocates a significant portion of its revenue to research and development, aiming to foster innovation and explore new technological frontiers.

- Emerging Technologies Focus: Key areas of exploration include quantum computing, blockchain, artificial intelligence, and advanced robotics, reflecting a strategy to capitalize on future technological trends.

- Competitive Advantage: Proactive engagement with these nascent technologies allows Alten to develop unique solutions, anticipate client needs, and maintain its leadership in the technology consulting and engineering market.

- Market Responsiveness: By understanding and integrating emerging tech, Alten enhances its ability to offer forward-thinking services, ensuring relevance and value for its clients in a rapidly changing landscape.

The relentless advancement of AI and automation presents significant opportunities for Alten to develop innovative solutions, enhancing operational efficiency and data-driven decision-making for clients. The global AI market's projected growth, potentially exceeding $1.5 trillion by 2030, underscores the demand for Alten's expertise in integrating these sophisticated capabilities.

Cloud computing's continued expansion, with global public cloud spending expected to reach $679 billion in 2024, directly supports Alten's ability to deliver scalable and flexible IT solutions. Edge computing's rise, crucial for low-latency applications like IoT and autonomous systems, further highlights areas where Alten can leverage its infrastructure expertise.

The increasing complexity of cybersecurity threats necessitates robust defenses, driving demand for Alten's specialized services in threat detection and incident response. With the global cost of cybercrime projected to reach $10.5 trillion annually by 2025, Alten's investment in cutting-edge cybersecurity is vital for client data protection and operational continuity.

The global rollout of 5G networks and the subsequent expansion of the Internet of Things (IoT) are creating substantial demand for specialized engineering and consulting services. The IoT market, valued at approximately $1.1 trillion in 2023 and projected to reach $2.2 trillion by 2028, offers significant growth potential for Alten's engagement in sectors like smart cities and connected vehicles.

Legal factors

Data privacy regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) significantly shape how Alten manages sensitive information. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the financial risk of non-compliance.

Alten's commitment to adhering to these evolving laws is critical for safeguarding client data and maintaining trust. This necessitates ongoing investment in robust data security measures and regular training for employees on best practices, especially as new regulations emerge or existing ones are updated.

Protecting intellectual property (IP) is paramount for Alten, safeguarding its proprietary technologies and client innovations. This involves a deep understanding of patent laws, trademarks, copyrights, and trade secrets across numerous global markets. For instance, in 2024, the World Intellectual Property Organization (WIPO) reported a 3.5% increase in international patent filings, highlighting the growing importance of IP protection in a competitive landscape.

Alten, as a global engineering and technology consulting firm, navigates a complex web of labor laws and employment regulations across its numerous operating countries. These regulations dictate everything from minimum wage and working hours to employee benefits, anti-discrimination policies, and severance packages. For instance, in Europe, the Working Time Directive sets a maximum average of 48 hours per week, a standard Alten must adhere to across its continental operations.

Compliance is paramount to avoid costly legal battles and maintain Alten's standing as a responsible employer. The company must continuously monitor evolving legislation, such as the recent updates to employment contracts and remote work regulations in France, which came into effect in 2024. Failure to adapt can lead to significant fines and reputational damage, impacting talent acquisition and retention efforts.

Industry-Specific Compliance Standards

Alten navigates a complex legal landscape, particularly within the aerospace, defense, and finance sectors. These industries are governed by rigorous, sector-specific compliance standards and certifications. For instance, aerospace projects often mandate adherence to AS9100, while various operations require compliance with ISO standards.

Meeting these stringent legal and regulatory mandates is crucial, not just for securing project opportunities but also as a testament to Alten's dedication to quality, safety, and operational integrity. This commitment directly influences client trust and acquisition, as demonstrated by the company's continued success in securing contracts within these highly regulated fields.

Key legal factors impacting Alten include:

- Aerospace & Defense Regulations: Compliance with standards like AS9100D is essential for participation in defense contracts and aerospace projects, impacting revenue streams.

- Financial Services Compliance: Adherence to regulations such as GDPR, MiFID II, and various national financial oversight laws is critical for its financial sector clients.

- Data Protection and Privacy Laws: With increasing data-driven services, compliance with global data privacy regulations (e.g., GDPR, CCPA) is paramount for client data security and trust.

- Cybersecurity Legal Frameworks: Operating in sensitive sectors requires strict adherence to cybersecurity laws and standards to protect client intellectual property and operational integrity.

Contractual Agreements and Liability Laws

Alten's reliance on robust contractual agreements with clients, partners, and subcontractors is paramount. These agreements clearly define project scopes, deliverables, and payment terms, forming the bedrock of its operational framework. For instance, in 2024, Alten's project success rate, heavily influenced by contract clarity, remained a key performance indicator, with over 95% of projects adhering to initial contractual parameters.

Mitigating risks associated with contractual disputes and professional liability is crucial for safeguarding Alten's financial health and ensuring seamless project execution. The company actively manages potential litigation by adhering to stringent compliance protocols and investing in legal expertise. In 2023, Alten reported a minimal percentage of revenue impacted by contractual disputes, demonstrating effective risk management strategies.

- Contractual Robustness: Alten's operational success hinges on well-defined contracts that specify project scope, deliverables, and payment terms.

- Liability Mitigation: Proactive management of professional liability and potential litigation is essential for protecting financial interests.

- Dispute Resolution: Effective strategies for resolving contractual disagreements minimize disruptions and financial exposure.

- Compliance Focus: Adherence to legal frameworks and industry regulations underpins Alten's commitment to secure and reliable operations.

Alten's operations are heavily influenced by international and national legislation regarding data privacy and cybersecurity. For example, the EU's GDPR, with fines up to 4% of global annual revenue, and similar regulations like California's CCPA, necessitate robust data protection measures and compliance protocols. As of 2024, cybersecurity threats continue to escalate, making adherence to evolving legal frameworks crucial for protecting sensitive client information and maintaining operational integrity.

Intellectual property (IP) law is a critical legal factor, safeguarding Alten's innovations and client-specific solutions. The company must navigate patent, trademark, and copyright laws across its global operations. The World Intellectual Property Organization (WIPO) reported a 3.5% increase in international patent filings in 2024, underscoring the competitive importance of IP protection.

Labor laws and employment regulations vary significantly across the countries where Alten operates. Compliance with standards on working hours, minimum wage, and employee benefits, such as the EU's Working Time Directive (max 48 hours/week average), is mandatory. Recent updates to employment contracts and remote work regulations in France, effective 2024, illustrate the dynamic nature of these legal requirements.

Sector-specific regulations, particularly in aerospace and defense (e.g., AS9100D) and financial services (e.g., MiFID II), impose stringent compliance obligations. Adherence to these standards is vital for securing contracts and maintaining client trust, reflecting Alten's commitment to quality and safety in highly regulated industries.

| Legal Factor | Impact on Alten | Key Regulations/Standards | 2024/2025 Relevance |

| Data Privacy & Cybersecurity | Client data protection, trust, operational integrity | GDPR, CCPA, NIS2 Directive | Increased regulatory scrutiny on data handling and breach notification. |

| Intellectual Property | Protection of proprietary technology and client IP | Patent Law, Copyright Law, Trademark Law | Growing importance of IP protection in innovation-driven sectors. |

| Employment Law | Employee rights, working conditions, talent management | Working Time Directive, National Labor Codes | Adaptation to evolving remote work policies and employee rights legislation. |

| Industry-Specific Compliance | Market access, project eligibility, reputation | AS9100D (Aerospace), ISO standards, Financial Services Regulations | Continued need for rigorous certification and adherence to maintain competitive advantage. |

Environmental factors

Clients across key sectors like energy, automotive, and manufacturing are increasingly seeking engineering and IT solutions that minimize environmental harm. This growing demand pushes companies like Alten to embed sustainability into their core offerings, from green design to energy efficiency.

For instance, the global market for sustainable engineering services was estimated to reach over $200 billion in 2024, highlighting a significant shift in client priorities. Alten's ability to deliver solutions aligned with circular economy principles and reduced carbon footprints directly addresses this market imperative.

Governments worldwide are intensifying their focus on environmental regulations, pushing for greener technologies and stricter ESG reporting. For Alten, this means adapting its own operations to meet these evolving standards, such as reducing its carbon footprint. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD) mandates detailed ESG disclosures for many companies, including those operating within or serving the EU market.

This regulatory shift directly impacts Alten's service portfolio, creating opportunities to assist clients in navigating complex environmental laws and achieving their sustainability goals. As of late 2024, over 70% of global companies are now reporting on ESG metrics, a significant increase from previous years, highlighting the growing importance of this area for businesses like Alten.

Alten, as a technology and engineering leader, is actively engaged in reducing its operational carbon footprint. This includes focusing on energy consumption within its data centers and managing emissions from business travel, a key aspect for a global firm. For instance, in 2023, Alten reported a 5% reduction in its Scope 1 and 2 greenhouse gas emissions compared to 2022, demonstrating progress in its sustainability efforts.

Internally, Alten is implementing sustainable practices like optimizing IT infrastructure for greater energy efficiency and encouraging remote work arrangements. These initiatives not only contribute to the company's corporate social responsibility goals but also bolster its attractiveness to investors and clients who prioritize environmental stewardship. The company aims for a further 10% reduction in its carbon intensity by 2025.

Resource Efficiency in IT Operations

The environmental footprint of IT operations is a growing concern, with data centers and server energy consumption being major contributors. In 2024, global data center energy consumption was estimated to be around 1.5% of total electricity usage, a figure projected to rise. Furthermore, the escalating volume of electronic waste, or e-waste, presents a significant challenge, with millions of tons generated annually worldwide.

Alten needs to champion resource efficiency in its IT solutions. This involves steering clients towards sustainable hardware choices and optimizing software to reduce energy demands. For instance, implementing virtualization technologies can consolidate servers, leading to substantial energy savings. By 2025, the global IT services market is expected to see increased demand for green IT solutions, reflecting this environmental imperative.

- Data Center Energy Consumption: Estimated at 1.5% of global electricity use in 2024, with an upward trend.

- E-waste Generation: Millions of tons of electronic waste are produced globally each year, requiring responsible disposal strategies.

- Sustainable Hardware Procurement: Prioritizing energy-efficient and longer-lasting IT equipment.

- Software Optimization: Developing and deploying code that minimizes processing power and energy usage.

Supply Chain Sustainability Requirements

Clients and regulators are increasingly scrutinizing the environmental performance of entire supply chains, pushing companies like Alten to ensure their suppliers and partners adhere to sustainable practices. This means looking beyond Alten's direct operations to assess the environmental footprint of everyone involved in delivering a project. For instance, in 2024, a significant percentage of major corporations reported implementing supplier environmental assessments, with some aiming for 100% coverage by 2025.

This involves evaluating the environmental credentials of vendors, promoting ethical sourcing of materials, and advocating for reduced waste and emissions throughout the project lifecycle. Companies are actively seeking suppliers with certifications like ISO 14001 or those demonstrating clear carbon reduction targets. The push for ethical sourcing also extends to ensuring fair labor practices and avoiding materials linked to environmental degradation. For example, the demand for conflict-free minerals and sustainably sourced timber is growing across industries.

- Supplier Environmental Audits: Companies are conducting more rigorous audits of their suppliers' environmental management systems and performance data.

- Ethical Sourcing Mandates: Procurement policies are increasingly incorporating requirements for ethically sourced raw materials and components, with a focus on traceability.

- Waste and Emission Reduction Targets: Collaboration with suppliers to set and achieve shared goals for reducing waste generation and greenhouse gas emissions is becoming standard practice.

- Circular Economy Principles: There's a growing emphasis on incorporating circular economy principles, encouraging suppliers to design for durability, repairability, and recyclability.

The increasing client demand for sustainable engineering and IT solutions, driven by environmental concerns, is a significant factor. Companies like Alten are responding by integrating green design and energy efficiency into their services, reflecting a global market shift towards sustainability. The market for sustainable engineering services was projected to exceed $200 billion in 2024.

Governments worldwide are implementing stricter environmental regulations and ESG reporting mandates, such as the EU's CSRD. This compels companies like Alten to adapt their operations and services to comply, creating opportunities to help clients meet environmental goals. By late 2024, over 70% of global companies were reporting on ESG metrics.

Alten is actively working to reduce its own operational carbon footprint, focusing on areas like data center energy consumption and business travel emissions. In 2023, the company achieved a 5% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2022, with a target for a further 10% reduction in carbon intensity by 2025.

The environmental impact of IT operations, including data centers and e-waste, is a growing concern. Data centers consumed an estimated 1.5% of global electricity in 2024, a figure expected to rise. Alten is focused on promoting resource efficiency in IT solutions, including sustainable hardware choices and software optimization, anticipating increased demand for green IT solutions by 2025.

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using data from reputable sources including government publications, international organizations, and leading market research firms. We draw upon economic indicators, regulatory updates, technological advancements, and socio-cultural trends to provide a comprehensive overview.