Alten Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alten Bundle

Understanding the forces shaping Alten's industry is crucial for strategic success. This analysis highlights the intense competition, the bargaining power of buyers, and the threat of new entrants impacting Alten's market position.

The complete report reveals the real forces shaping Alten’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Alten's most critical suppliers are its highly skilled engineers and technology consultants. The intense competition for specialized talent, particularly in rapidly evolving fields such as artificial intelligence, cybersecurity, and cloud computing, directly amplifies the bargaining power of these individuals and the recruitment agencies that represent them. This scarcity can translate into increased salary demands and more stringent working condition expectations, impacting Alten's operational costs and talent acquisition strategies.

For highly specialized projects, Alten faces significant supplier bargaining power if switching costs are high. This is particularly true when projects demand niche certifications or deep domain expertise, as finding and integrating new specialized teams or technologies can be time-consuming and expensive. For instance, if a project requires consultants with specific cybersecurity clearances or expertise in a proprietary AI platform, the existing supplier holds considerable leverage.

The concentration of niche technology providers can significantly impact Alten's bargaining power. If Alten's core offerings depend on specialized software, platforms, or hardware from a limited number of suppliers, these providers can dictate terms and pricing. For instance, a critical AI development platform used by Alten might only have two or three dominant vendors globally, granting them substantial leverage.

Alten mitigates these supplier pressures by adapting its organizational structure to support customer regionalization and accelerating offshoring initiatives. This strategy aims to diversify its supplier base and reduce reliance on any single concentrated provider, thereby strengthening its negotiating position.

Threat of Forward Integration by Consultants

The threat of forward integration by consultants poses a significant challenge to companies like Alten. Highly experienced and well-connected consultants, or even small, specialized firms, can bypass intermediaries and directly engage with clients. This capability gives these individual consultants greater leverage, allowing them to negotiate more favorable terms and pricing.

This dynamic is particularly pronounced in niche markets where specialized knowledge is at a premium. For instance, in the rapidly evolving field of AI implementation, individual consultants with proven track records can command higher fees by offering direct services, thereby reducing the perceived value of larger consulting firms that might act as intermediaries.

- Forward Integration Threat: Experienced consultants can directly serve clients, bypassing consulting firms.

- Leverage for Consultants: Strong client relationships and unique expertise empower consultants to demand better terms.

- Market Impact: This threat is amplified in specialized or rapidly developing sectors.

- Client Perspective: Clients may opt for direct engagement to potentially reduce costs and increase efficiency.

Importance of Alten as a Client

For smaller, niche consulting firms or individual contractors, Alten's status as a global leader in engineering and IT consulting makes it a highly desirable client. This can significantly diminish their individual bargaining power. For instance, losing a contract with Alten, which had revenues of approximately €4.0 billion in 2023, could represent a substantial portion of a small firm's annual income, making them less likely to push for unfavorable terms.

However, the power dynamic can shift dramatically for highly sought-after experts or specialized niche providers. If a consultant possesses unique skills or expertise that are in high demand across the industry, they may find that Alten, despite its size, is eager to secure their services. In such cases, these individuals or firms can leverage their scarcity to negotiate better rates and terms, effectively reversing the typical power imbalance.

The bargaining power of suppliers to Alten, including these specialized consultants, is therefore a nuanced issue. It depends heavily on the supplier's unique value proposition and market demand relative to Alten's need for that specific service. In 2024, the demand for specialized AI and cybersecurity expertise, for example, has remained exceptionally high, giving those suppliers considerable leverage.

- Niche Expertise: Specialized consultants with in-demand skills (e.g., AI, quantum computing) can command higher rates.

- Client Dependence: Smaller firms heavily reliant on Alten's business have less bargaining power.

- Market Conditions: Overall demand for consulting services and specific skill sets influences supplier leverage.

- Alten's Scale: As a major player with significant revenue (€4.0 billion in 2023), Alten can often absorb higher costs, but still values key talent.

The bargaining power of Alten's suppliers, particularly its highly skilled engineers and consultants, is substantial due to the intense competition for specialized talent in areas like AI and cybersecurity. This scarcity allows these professionals and their representatives to negotiate higher salaries and better working conditions, impacting Alten's costs. In 2024, the demand for these niche skills has kept supplier leverage high.

High switching costs for specialized projects further empower suppliers, especially when specific certifications or deep domain expertise are required. For instance, consultants with unique cybersecurity clearances or proficiency in proprietary AI platforms hold significant leverage. The limited number of providers for critical software or platforms also grants them considerable power to dictate terms and pricing.

While Alten's global standing can diminish the power of smaller, niche firms, the dynamic shifts for highly sought-after experts. These individuals can leverage their scarcity to negotiate favorable terms, effectively reversing the power imbalance. Alten's €4.0 billion revenue in 2023 highlights its scale, but securing top talent remains a key consideration.

| Supplier Type | Key Factors Influencing Power | Impact on Alten | 2024 Trend |

|---|---|---|---|

| Specialized Engineers/Consultants | Scarcity of skills (AI, Cybersecurity), High demand | Increased labor costs, Talent acquisition challenges | High leverage for suppliers |

| Niche Technology Providers | Limited number of vendors, High dependence | Pricing power, Potential supply chain disruptions | Continued supplier advantage |

| Small Niche Consulting Firms | Dependence on Alten's business | Lower bargaining power | Relatively stable |

What is included in the product

Explores the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all specifically for Alten's market position.

Quickly identify and prioritize competitive threats with a visual representation of all five forces, enabling faster and more informed strategic adjustments.

Customers Bargaining Power

Customer concentration poses a significant challenge for Alten, particularly within its core sectors such as aerospace, automotive, defense, and telecommunications. When a substantial portion of Alten's revenue is derived from a limited number of large clients, these key customers gain considerable leverage. This leverage can translate into intense pressure on pricing, forcing Alten to accept lower margins, and on contract terms, potentially dictating unfavorable conditions.

Alten's financial performance in 2024 underscored these client-side pressures. The company experienced a slowdown in key areas, notably in the automotive and life sciences industries. This deceleration suggests that major clients within these sectors were actively exerting pressure, likely through demands for cost reductions or renegotiated service agreements, directly impacting Alten's revenue streams and profitability.

For many standardized IT and engineering services, the bargaining power of customers is amplified by low switching costs. If a service provider offers little unique value, clients can readily shift to a competitor offering a more attractive price or better contract terms. This ease of movement significantly empowers customers.

Consider the IT services sector. In 2024, many general IT support and basic software development contracts involve readily available talent and widely adopted technologies. This means a client needing cloud migration or cybersecurity basics might find numerous vendors capable of delivering, making it simple to switch if dissatisfaction arises or a better deal appears. For instance, if a company is unhappy with its current managed IT provider, finding another within a few weeks is often feasible, especially for smaller-scale operations.

Alten's clients are generally large, sophisticated corporations. These companies possess deep financial literacy and employ rigorous procurement processes, giving them significant leverage in negotiations.

The clients' access to extensive market information significantly reduces information asymmetry. This knowledge empowers them to demand competitive pricing and high-quality service delivery from Alten.

For instance, in the IT consulting sector, major clients often benchmark service provider costs against industry averages, which were reported to be around 5-10% lower for comparable services in some European markets during 2024, putting pressure on margins for firms like Alten.

Threat of Backward Integration by Clients

Large corporate clients, particularly those in established sectors, possess the capability to develop or enhance their in-house R&D and IT functions, thereby reducing their reliance on external service providers like Alten. This potential for 'do-it-yourself' integration serves as a substantial bargaining tool for these customers.

This internal development strategy becomes particularly potent when clients perceive the costs of outsourcing to be excessive or when they desire greater direct oversight of their projects. For instance, many large enterprises in the automotive sector, a key market for IT consulting, have been investing heavily in digital transformation and in-house software development capabilities, aiming to gain a competitive edge and control over their technological roadmaps.

The threat of backward integration by clients significantly pressures service providers to maintain competitive pricing and demonstrate clear value. In 2024, the global IT outsourcing market experienced continued demand, but clients were increasingly scrutinizing vendor costs and demanding greater ROI, a trend likely to persist as companies prioritize efficiency.

- Client Control: Clients seeking more direct control over their intellectual property and project outcomes may opt for internal development.

- Cost Optimization: When external service costs are perceived as too high, clients may explore the economic benefits of building internal capabilities.

- Industry Trends: Mature industries often see a rise in backward integration as companies mature their internal expertise and seek greater vertical integration.

- Strategic Alignment: Clients may integrate IT functions to ensure closer alignment with their core business strategies and competitive positioning.

Price Sensitivity Driven by Economic Conditions

During economic downturns, customers tend to scrutinize prices more closely. This heightened price sensitivity can lead them to delay or cancel planned investments as they focus on cost containment. For Alten, this translated into clients adopting a cautious wait-and-see approach, directly impacting revenue streams.

Alten's 2025 outlook specifically highlighted this customer behavior, noting a general lack of visibility stemming from clients' hesitance to commit to new projects. This strategic pause by customers significantly pressured Alten's ability to forecast and secure future business.

- Economic Uncertainty: Clients increasingly prioritize cost optimization during uncertain economic periods.

- Investment Freezes: Many companies may freeze or postpone capital expenditure and investment projects.

- Alten's 2025 Outlook: The company's projections for 2025 reflected this client hesitancy and a lack of clear revenue visibility.

- Revenue Impact: The 'wait-and-see' strategy adopted by clients directly affected Alten's revenue generation.

The bargaining power of customers for Alten is substantial, driven by client concentration, low switching costs for standardized services, and clients' sophisticated procurement processes. Large clients, possessing deep market knowledge, can demand competitive pricing and exert pressure through potential backward integration, especially during economic slowdowns. This was evident in 2024, with clients in sectors like automotive and life sciences showing increased price sensitivity and a cautious approach to new projects, impacting Alten's revenue visibility.

| Factor | Impact on Alten | 2024 Data/Observation |

|---|---|---|

| Client Concentration | Increased leverage for large clients | Slowdown in key sectors like automotive and life sciences |

| Low Switching Costs (Standardized Services) | Clients can easily move to competitors | General IT support and basic software development are highly competitive |

| Client Sophistication & Information Access | Clients demand competitive pricing and high quality | IT consulting clients benchmarked costs 5-10% lower in some European markets in 2024 |

| Potential for Backward Integration | Clients can develop in-house capabilities | Automotive sector clients increased investment in in-house digital transformation |

| Economic Sensitivity | Clients scrutinize prices and delay investments | General hesitancy to commit to new projects impacting 2025 outlook |

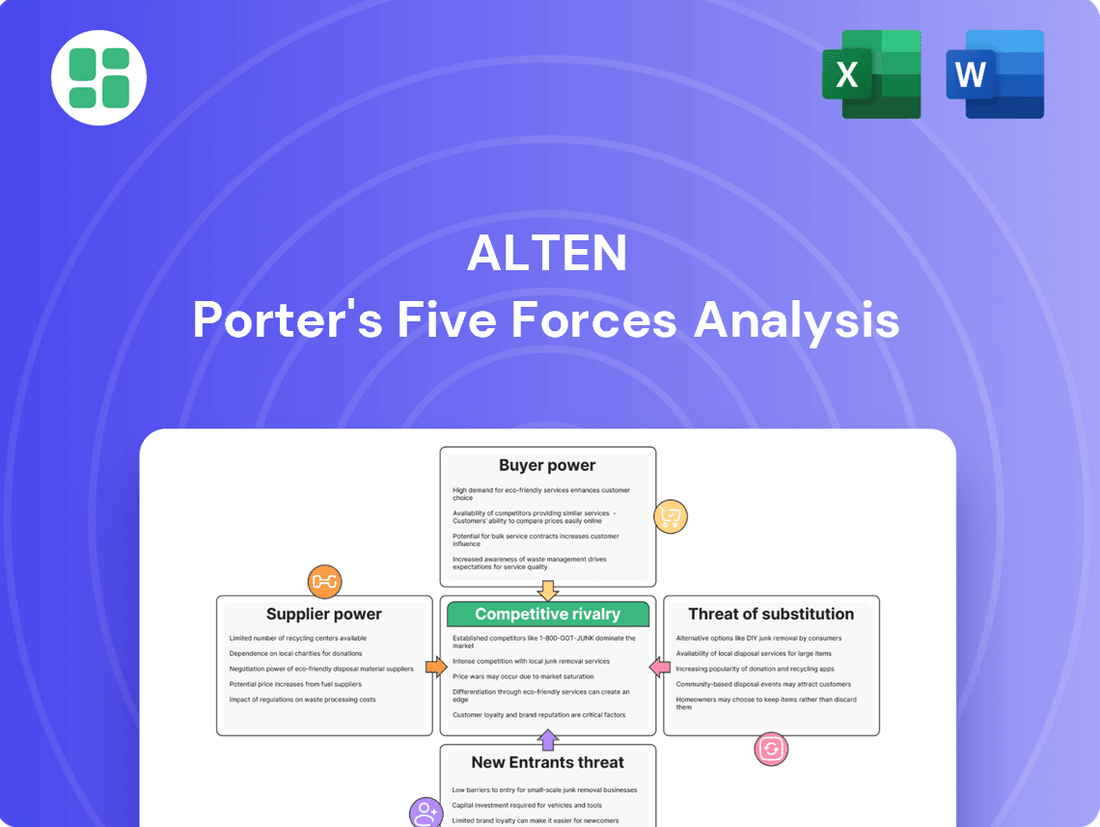

Preview the Actual Deliverable

Alten Porter's Five Forces Analysis

This preview showcases the entirety of the Porter's Five Forces analysis, offering a comprehensive examination of competitive forces within the industry. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, ensuring no surprises. This detailed breakdown will equip you with a clear understanding of the strategic landscape and potential challenges.

Rivalry Among Competitors

The technology consulting and engineering services market is characterized by a fragmented yet concentrated landscape. While numerous smaller, specialized firms operate, global leaders like Alten, Capgemini, Cognizant, and Atos dominate significant portions of the market, particularly for large-scale contracts. This duality fuels intense competition as these major players, alongside specialized niche providers, vie for market share and client engagement.

The technology consulting market is booming, with projections showing continued strong growth through 2025 and beyond. This expansion is largely driven by significant investments in digital transformation initiatives and research and development services, particularly in areas like artificial intelligence. For instance, global spending on IT services, a key component of tech consulting, was expected to reach over $1.3 trillion in 2024, an increase from the previous year.

Such robust market growth acts as a powerful magnet, attracting both established players looking to capitalize on new opportunities and entirely new companies eager to enter the lucrative tech consulting space. This influx of competitors, both existing firms scaling up and new entrants, naturally intensifies the competitive rivalry within the industry.

Competitive rivalry in the engineering and technology consulting sector is intense, with many firms offering similar core services. Differentiation, therefore, becomes crucial for success. This often manifests through specialization in rapidly evolving niche technologies such as artificial intelligence, the Internet of Things (IoT), and advanced cybersecurity solutions. For instance, in 2024, the global AI market was projected to reach hundreds of billions of dollars, highlighting the demand for specialized expertise.

Beyond technological specialization, firms also differentiate themselves through deep industry expertise. Companies excelling in sectors like aerospace, automotive, or healthcare can command premium pricing and attract clients seeking tailored solutions. Alten, for example, highlights its extensive experience and deep understanding within specific industries as a primary differentiator. This sector-specific knowledge allows them to address complex client challenges more effectively than generalist competitors.

Furthermore, unique delivery models play a significant role in competitive positioning. Offering flexible nearshore or offshore capabilities, for instance, can provide cost advantages and access to a wider talent pool. Alten leverages its global presence, which includes operations in over 20 countries, to offer a comprehensive suite of services and tap into diverse engineering talent. This international footprint is a key element in its strategy to stand out in a crowded marketplace.

Importance of Talent Acquisition and Retention

Competitive rivalry within the engineering and consulting sector is intensified by the critical importance of talent acquisition and retention. Human capital is the fundamental asset, making the competition for highly skilled engineers and consultants incredibly fierce. This intense rivalry necessitates significant investment in recruitment, training, and retention programs, which directly impacts operating costs and can affect overall profitability.

Firms must continuously innovate their talent strategies to secure and keep top performers. For instance, Alten's strategic objective to grow its engineering workforce to 70,000 by 2026 highlights the scale of investment required to maintain a competitive edge in this talent-scarce market. Such ambitious growth targets underscore the pressure to attract and retain specialized skills.

- Intense competition for skilled engineers and consultants.

- Human capital is the core asset, driving up recruitment and retention costs.

- Alten aims to reach 70,000 engineers by 2026, indicating significant talent investment.

- High operating costs and potential impact on profitability due to talent wars.

Geographic and Sectoral Market Conditions

Competitive intensity is not uniform; it shifts based on where a company operates and which industries it serves. Some markets are booming, attracting more competition for opportunities, while others are contracting, intensifying the fight for existing business. Alten's 2024 and early 2025 reports highlight this, showing a noticeable downturn in sectors like automotive and telecommunications within Europe, which naturally escalates rivalry in those specific segments.

This uneven landscape means Alten faces heightened competition in certain areas. For instance, the automotive sector in Europe, already experiencing a slowdown, likely saw increased price pressure and a more aggressive pursuit of contracts by competitors vying for a smaller pool of available work. Similarly, challenges in the European telecoms market would have amplified the competitive environment there.

- Geographic Variation: Competitive pressures differ across regions.

- Sectoral Dynamics: Industry-specific conditions dictate rivalry levels.

- European Automotive Decline: Faced increased competition due to market contraction.

- European Telecoms Challenges: Intensified rivalry in this sector as well.

The technology consulting and engineering services market is highly competitive, with numerous firms vying for market share. This rivalry is driven by the sector's rapid growth and the constant need for specialized expertise in areas like AI and IoT.

Differentiation is key, with companies focusing on niche technology specializations, deep industry knowledge, and flexible delivery models to stand out. The intense competition for top engineering and consulting talent also significantly impacts operational costs and profitability.

Competitive intensity varies by geography and industry sector; for example, downturns in specific markets like European automotive in 2024 have intensified competition for remaining business.

| Key Differentiators | Talent Investment Example | Market Pressure Example (2024) |

|---|---|---|

| Niche Technology Specialization (AI, IoT) | Alten aims for 70,000 engineers by 2026 | European Automotive Sector Downturn |

| Deep Industry Expertise | Significant recruitment and retention costs | European Telecoms Sector Challenges |

| Flexible Delivery Models (Nearshore/Offshore) | Competition for highly skilled professionals | Increased price pressure in contracting markets |

SSubstitutes Threaten

Clients, especially large corporations, can choose to build or enhance their own R&D and IT teams rather than engaging external providers like Alten. This internal capacity acts as a direct substitute, particularly for crucial, long-term projects where maintaining intellectual property and operational control is a priority.

For instance, a significant trend observed in 2024 is the increasing investment by major tech companies in their in-house AI development, potentially reducing reliance on external specialized firms for certain AI-driven projects. This in-house trend could impact demand for outsourced R&D services.

Clients increasingly turn to standardized software and SaaS solutions as viable alternatives to custom development or specialized consulting services. For instance, the global SaaS market was projected to reach over $200 billion in 2024, indicating a substantial shift towards readily available, often more cost-effective, solutions.

These off-the-shelf or cloud-based platforms are becoming increasingly sophisticated and adaptable, capable of fulfilling a growing range of business requirements that were once the exclusive domain of bespoke development. This trend presents a significant threat, as these scalable and feature-rich SaaS products can directly substitute for some of the tailored services Alten offers, potentially limiting their market share.

The proliferation of online freelance platforms like Upwork and Fiverr presents a significant threat of substitutes for traditional consulting services. These platforms enable companies to directly source talent for specific projects, often at a lower cost than engaging a full-service firm. For instance, Upwork reported over $3.7 billion in gross service volume in 2023, indicating substantial adoption of this model.

Automation and AI Tools

Advances in automation and AI, including machine learning, are increasingly capable of handling analytical, data processing, and routine IT management tasks. This technological progress can diminish the demand for human consultants in specific areas.

While companies like Alten integrate AI into their offerings, the growing sophistication of these tools presents a potential substitute for traditional consulting hours. For instance, AI-powered analytics platforms can now perform complex data analysis that previously required significant consultant input, potentially impacting the billable hours for certain service lines.

- AI in Consulting: By 2024, the global AI market is projected to reach hundreds of billions of dollars, with a significant portion dedicated to business process automation and analytics, directly impacting the consulting landscape.

- Automation of Tasks: Routine tasks like data entry, report generation, and even initial client onboarding can be automated, reducing the need for junior consultants or support staff.

- Cost Efficiency: AI tools offer a cost-effective alternative for businesses needing specific analytical outputs, potentially diverting spending from external consulting services.

- Scalability: AI solutions can scale rapidly to handle large data volumes or fluctuating workloads, offering a flexibility that traditional consulting models may struggle to match.

Generic IT Services and Staff Augmentation

For fundamental IT needs like basic support or infrastructure management, clients often opt for less specialized, more budget-friendly IT service providers instead of comprehensive technology consulting firms. These alternatives provide a more rudimentary substitute, primarily focused on supplying personnel rather than offering strategic direction.

This threat is significant as many companies require straightforward IT functions that don't necessitate deep technological expertise. For instance, in 2024, the global IT staffing market was valued at approximately $300 billion, indicating a substantial segment of the market that can be addressed by less specialized providers.

- Lower Cost: Generic IT services and staff augmentation firms typically operate with lower overheads, allowing them to offer more competitive pricing for basic IT tasks.

- Accessibility: A vast number of providers exist, making it easy for businesses to find and engage with services for common IT requirements.

- Focus on Execution: These substitutes excel at fulfilling direct resource needs without the added complexity or cost of strategic consulting.

The threat of substitutes for companies like Alten stems from various alternatives that can fulfill similar client needs. These range from in-house capabilities to readily available software and freelance talent, each offering a distinct value proposition that can divert business.

Clients increasingly leverage off-the-shelf software and Software-as-a-Service (SaaS) solutions, which are becoming more sophisticated and adaptable. The global SaaS market was projected to exceed $200 billion in 2024, highlighting a significant shift towards these more accessible and often cost-effective alternatives to custom development or specialized consulting.

Furthermore, the rise of freelance platforms and the increasing automation capabilities of AI present potent substitutes. For instance, Upwork's gross service volume surpassed $3.7 billion in 2023, demonstrating the scale of talent sourcing available outside traditional firms. AI tools, capable of performing complex data analysis, also reduce the need for human consultants in specific analytical tasks, impacting billable hours for certain service lines.

| Substitute Category | Description | 2024 Market Data/Trend | Impact on Alten |

|---|---|---|---|

| In-house R&D/IT Teams | Clients building internal expertise. | Increased corporate investment in AI development. | Reduced demand for outsourced specialized projects. |

| SaaS & Standardized Software | Off-the-shelf solutions for business needs. | Global SaaS market projected >$200 billion. | Direct competition for custom development services. |

| Freelance Platforms | Direct sourcing of project-specific talent. | Upwork gross service volume >$3.7 billion (2023). | Lower-cost alternative for specific skill sets. |

| AI & Automation Tools | Automating analytical and IT management tasks. | AI market projected in hundreds of billions. | Diminished need for human consultants in routine tasks. |

Entrants Threaten

The threat of new entrants into the technology consulting space is heightened by the relatively low capital requirements for establishing a basic consulting practice. Unlike industries demanding significant investment in physical assets, technology consulting primarily relies on expertise and human capital. This accessibility allows individuals or small teams to launch specialized boutique firms, potentially fragmenting the market.

Alten’s established reputation and deep client relationships act as a significant barrier to new entrants. Building trust and a proven track record in securing complex technology and engineering projects takes years, if not decades. For instance, in 2024, the average sales cycle for large enterprise technology solutions often exceeds 12 months, underscoring the time investment required to cultivate these essential partnerships.

While capital needs might not be the primary hurdle, securing a steady supply of highly skilled and specialized engineers and consultants presents a substantial barrier for new entrants. Established players like Alten often have robust recruitment pipelines and strong employer branding, making it difficult for newcomers to attract and retain top-tier talent.

Regulatory and Industry-Specific Barriers

Alten's operation in specialized sectors like aerospace and defense presents substantial barriers to new entrants. These industries demand rigorous adherence to stringent regulatory frameworks, often requiring specific certifications and security clearances. For instance, in the aerospace sector, compliance with standards like AS9100 is critical, a certification that involves significant investment in quality management systems and processes.

New companies looking to enter these markets must navigate complex approval processes, which can be lengthy and costly. This regulatory landscape, coupled with the need for deep, sector-specific technical expertise, acts as a significant deterrent. In 2024, the global aerospace market, valued at over $900 billion, continues to see high barriers to entry due to these very requirements.

The threat of new entrants is therefore moderated by these entrenched industry-specific barriers:

- High Capital Investment: New entrants require substantial upfront capital for certifications, specialized equipment, and talent acquisition.

- Stringent Regulatory Compliance: Obtaining necessary security clearances and industry certifications (e.g., AS9100 for aerospace) is a lengthy and expensive process.

- Proprietary Technology and IP: Established players often possess proprietary technologies and intellectual property, making it difficult for newcomers to compete on innovation.

- Established Relationships: Long-standing relationships with key clients and government bodies in sectors like defense are hard for new firms to replicate.

Economies of Scale and Scope in Global Delivery

Global leaders in the IT services sector, such as Alten, leverage significant economies of scale. This advantage is particularly evident in areas like talent acquisition, where a vast global presence allows for more efficient and cost-effective recruitment. For instance, in 2024, major IT consulting firms continued to expand their offshore capabilities, with India alone employing over 5 million IT professionals, a testament to the scale achievable in these regions.

New entrants often struggle to replicate this scale. They typically lack the established global delivery networks, including sophisticated offshore centers, which are crucial for managing large, complex, multi-country projects. This absence of a global footprint directly impacts their ability to compete on price or offer the comprehensive service packages demanded by major clients.

Furthermore, Alten's experience in training and developing a large, diverse workforce across multiple geographies translates into specialized expertise and streamlined operational processes. This accumulated knowledge and infrastructure represent a substantial barrier for newcomers who must invest heavily to build similar capabilities from the ground up.

- Economies of Scale: Global leaders benefit from cost advantages in recruitment and training due to their extensive operations.

- Global Delivery Models: Established offshore centers and multi-country project management expertise are key differentiators.

- Barriers for New Entrants: Lack of global footprint and inability to manage complex, large-scale projects hinder new competition.

- Cost Competitiveness: Established players can often offer more competitive pricing due to their operational efficiencies.

The threat of new entrants into technology consulting is generally moderate, influenced by factors like capital needs and established client relationships. While initial setup costs can be low, building credibility and securing large projects takes time. For example, in 2024, the IT services market saw continued consolidation, with larger players leveraging scale.

Newcomers face hurdles in talent acquisition and navigating industry-specific regulations, particularly in sectors like aerospace and defense. Established firms like Alten benefit from economies of scale and global delivery networks, making it difficult for smaller entities to compete on price and service breadth.

Additionally, proprietary technology and deep-rooted client partnerships are significant barriers. These factors collectively limit the ease with which new companies can effectively challenge established market leaders.

| Barrier Type | Impact on New Entrants | Example for Alten (2024) |

|---|---|---|

| Capital Investment | Moderate to High (for specialized certifications/talent) | AS9100 certification costs for aerospace projects. |

| Brand Reputation & Client Relationships | Very High | Decades-long partnerships with major automotive and aerospace firms. |

| Talent Acquisition & Retention | High | Competition for specialized engineers in high-demand fields like AI and cybersecurity. |

| Regulatory Compliance | High (in specific sectors) | Navigating defense procurement regulations and security clearances. |

| Economies of Scale | High | Leveraging global delivery centers for cost-efficiency in large projects. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from company annual reports, industry-specific market research, and government economic indicators to provide a comprehensive view of competitive dynamics.