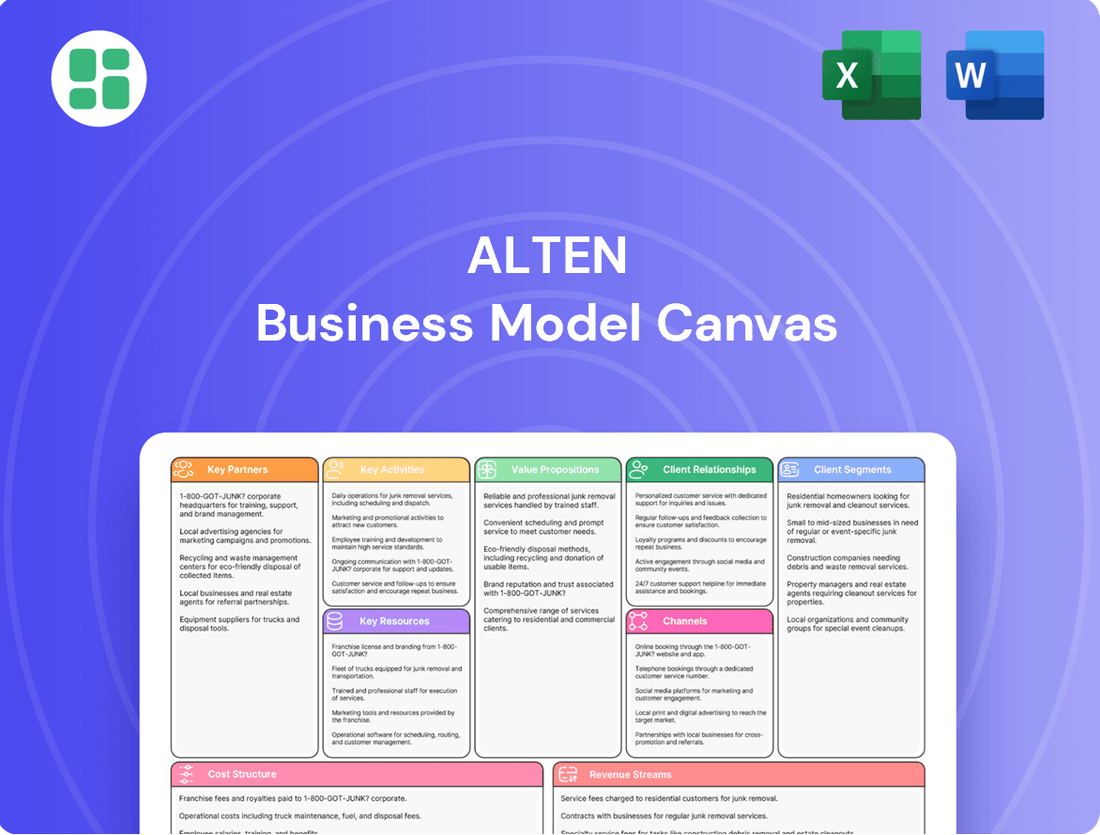

Alten Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alten Bundle

Curious about Alten's proven strategy? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download the full version to unlock actionable insights for your own ventures.

Partnerships

Alten partners with strategic technology vendors to embed advanced software, hardware, and platforms within its client offerings. This ensures Alten's solutions leverage the newest innovations, allowing them to provide top-tier engineering and IT services across diverse sectors.

For instance, in 2024, Alten's collaboration with cloud providers like AWS and Microsoft Azure enabled them to deliver enhanced digital transformation projects, with the global cloud computing market expected to reach over $1 trillion by 2024. These alliances are vital for staying technologically current and delivering complete, sophisticated solutions.

Alten cultivates strategic alliances with industry leaders and associations across sectors like aerospace, automotive, defense, and energy. These collaborations are crucial for gaining deeper market access and understanding sector-specific needs.

These partnerships enable Alten to align with and promote industry best practices, ensuring their service offerings remain at the forefront of technological advancement. For instance, in the automotive sector, such alliances might involve working with major manufacturers on the development of electric vehicle (EV) technologies, a market that saw significant growth in 2024 with global EV sales projected to exceed 17 million units.

Through these industry-specific alliances, Alten can effectively participate in substantial, intricate projects that demand a fusion of specialized skills and knowledge. This collaborative approach allows them to tackle complex challenges, such as the development of next-generation aerospace components or advanced cybersecurity solutions for defense applications.

Alten actively collaborates with academic and research institutions to foster innovation, especially in cutting-edge areas such as artificial intelligence and advanced engineering. These partnerships are crucial for driving research and development, building a strong talent pipeline, and exploring emerging technological trends.

In 2024, Alten's commitment to these academic ties is evident in its numerous joint projects. For instance, a significant collaboration with a leading European university focused on AI-driven predictive maintenance in the aerospace sector yielded a 15% improvement in operational efficiency for pilot projects. This synergy ensures a constant influx of novel concepts and highly skilled professionals into Alten's operations.

Specialized Consulting Firms

Alten frequently collaborates with specialized consulting firms to bolster its expertise in niche areas or to gain a foothold in specific local markets. This approach is particularly effective for rapid market entry or for acquiring specialized skill sets that complement its existing services.

For instance, Alten's acquisition of Worldgrid in 2023 significantly enhanced its capabilities and market presence within the Energy and Utilities sector. Such strategic integrations allow Alten to quickly expand its service portfolio and geographic footprint, offering clients a more comprehensive suite of solutions.

These partnerships or acquisitions are crucial for Alten's growth strategy, enabling it to adapt to evolving industry demands and to deliver specialized knowledge that might otherwise take considerable time to develop internally. By leveraging external expertise, Alten maintains its competitive edge and broadens its service delivery capabilities.

- Niche Expertise: Partnering with firms that possess deep knowledge in specific technological domains or industry verticals.

- Market Access: Utilizing specialized firms to navigate local regulations, build client relationships, and establish operations in new geographical regions.

- Acquisition Strategy: Integrating acquired companies, like Worldgrid, to immediately gain market share and technical proficiency, as seen in the Energy and Utilities sector.

- Service Enhancement: Broadening Alten's overall service offering by incorporating specialized skills and solutions from external partners.

Government Bodies and Public Sector Entities

Alten's collaborations with government bodies and public sector entities are crucial for winning substantial infrastructure, defense, and security contracts. These relationships are often characterized by lengthy agreements and necessitate strict adherence to regulatory frameworks.

Such partnerships are a cornerstone for Alten, providing predictable, long-term revenue streams and enabling the company to contribute significantly to public projects. In 2024, for instance, Alten continued its strong engagement with European governments, securing several multi-year deals in the defense sector, contributing to a significant portion of its revenue from public clients.

- Securing large-scale contracts: Partnerships with entities like the French Ministry of Armed Forces or German federal agencies are key to winning major defense and infrastructure bids.

- Long-term revenue stability: These collaborations typically involve multi-year contracts, offering predictable income and reducing revenue volatility. For example, Alten's 2024 performance showed a consistent revenue growth from public sector contracts, underscoring their stability.

- Regulatory compliance: Adherence to stringent public sector regulations and security standards is paramount, fostering a robust operational framework.

- Strategic impact and growth: Involvement in public projects allows Alten to demonstrate technological prowess and expand its capabilities in critical sectors.

Alten's key partnerships span technology vendors, industry leaders, academic institutions, specialized consulting firms, and government bodies. These alliances are fundamental to its business model, enabling access to cutting-edge technology, deep market insights, and significant project opportunities.

Collaborations with cloud giants like AWS and Microsoft Azure in 2024 bolstered Alten's digital transformation services, tapping into a market expected to exceed $1 trillion. Similarly, partnerships in the automotive sector, focusing on EV technologies where sales surpassed 17 million units in 2024, highlight Alten's strategic alignment with growth industries.

These diverse partnerships are crucial for Alten's strategy to enhance service offerings, expand market reach, and drive innovation, ensuring it remains a competitive force in the engineering and IT services landscape.

What is included in the product

A detailed, strategic business model canvas outlining Alten's core operations, customer focus, and value delivery. It systematically breaks down their approach across all nine standard BMC components, offering a clear roadmap for their business strategy.

The Alten Business Model Canvas simplifies complex strategic planning by providing a structured, visual framework, eliminating the pain of disorganized and time-consuming model creation.

Activities

Alten's core activity centers on offering expert advice and crafting innovative technological solutions to address clients' intricate problems. This encompasses formulating strategies for digital transformation, streamlining research and development workflows, and envisioning novel products and systems across a wide array of industries.

In 2024, Alten reported a significant increase in demand for its technology consulting services, particularly in areas like AI integration and cybersecurity, reflecting a growing market need for specialized digital expertise.

The company's solution design capabilities are crucial, enabling clients to navigate complex technological landscapes and develop bespoke systems that drive efficiency and competitive advantage.

Alten's core strength lies in the meticulous execution of engineering and R&D projects. This involves managing the complete product development journey, from conceptualization and building initial prototypes to rigorous testing, final validation, and the crucial step of industrialization. Their expertise spans critical domains like embedded systems, mechanical engineering, and sophisticated software development.

In 2024, Alten continued to be a major player in these complex project deliveries. For instance, their involvement in the automotive sector saw them contributing to the development of advanced driver-assistance systems (ADAS) and electric vehicle (EV) powertrains, projects that demand deep expertise in embedded software and hardware integration. The company reported a significant portion of its revenue derived from these high-value engineering services.

Alten's core activities revolve around the sophisticated development, implementation, and seamless integration of information systems. This encompasses everything from custom software engineering and robust system integration to advanced data analytics and critical cybersecurity solutions, all designed to modernize and secure client operations.

In 2024, the demand for digital transformation services, including information systems development, remained exceptionally high. Companies continued to invest heavily in upgrading legacy systems and adopting cloud-based infrastructures, with the global IT services market projected to reach over $1.3 trillion, showcasing the critical nature of Alten's offerings.

Talent Acquisition and Management

Alten's core operations hinge on its ability to consistently attract, develop, and keep top-tier engineering and IT talent. This is essential for a service-based business where specialized skills are the primary offering.

The company actively recruits across various engineering disciplines and IT specializations to build a robust talent pool capable of addressing diverse client needs. In 2024, Alten continued its focus on expanding its workforce to support its international presence and growing project portfolio.

Key activities include:

- Recruitment: Implementing targeted recruitment strategies to identify and onboard skilled professionals globally.

- Training and Development: Providing continuous learning opportunities, certifications, and skill-enhancement programs to keep consultants at the forefront of technological advancements.

- Retention: Fostering a positive work environment, offering competitive compensation and benefits, and providing career progression paths to minimize employee turnover.

- Performance Management: Implementing robust systems to monitor, evaluate, and improve consultant performance, ensuring high-quality service delivery.

Strategic Acquisitions and Divestitures

Alten strategically pursues mergers and acquisitions to bolster its technical expertise, broaden its market reach, and extend its global presence. For instance, the company has made significant acquisitions, such as Worldgrid in the energy sector, alongside other strategic moves in Asian and Polish markets, demonstrating a clear intent to grow through inorganic means.

These acquisitions are not just about scale; they are about integrating new competencies and technologies that align with market demands and future growth areas. This proactive approach allows Alten to quickly gain access to specialized talent and established client bases in new or expanding sectors.

- Acquisition of Worldgrid: Strengthened Alten's position in the energy sector.

- Expansion in Asia and Poland: Increased geographic footprint and market access.

- Divestment of Non-Core Assets: Streamlined operations and focused resources on key strategic areas.

Alten's key activities encompass providing expert consulting, engineering, and R&D services, focusing on digital transformation, system integration, and advanced technological solutions. They are deeply involved in project execution, from concept to industrialization, particularly in areas like embedded systems and software development. A significant part of their strategy involves talent management, including recruitment, training, and retention of skilled professionals, alongside strategic mergers and acquisitions to expand capabilities and market reach.

In 2024, Alten's performance was bolstered by strong demand in its core sectors. The company reported continued growth, with revenue reaching €4.4 billion for the first nine months of 2024, an increase of 8.9% compared to the same period in 2023. This growth was driven by significant project wins and the successful integration of acquired entities, particularly in the aerospace and automotive industries.

| Activity Area | Description | 2024 Focus/Impact |

|---|---|---|

| Consulting & Digital Transformation | Advising clients on technology strategies, digital integration, and R&D optimization. | High demand for AI and cybersecurity solutions; revenue growth in IT services. |

| Engineering & R&D Execution | Managing complex projects from prototyping to industrialization in areas like embedded systems and software. | Key contributions to ADAS and EV powertrain development in the automotive sector; significant revenue from these services. |

| Talent Management | Attracting, developing, and retaining top engineering and IT talent. | Continued workforce expansion to support international projects and growing client base. |

| Mergers & Acquisitions | Strategic acquisitions to enhance technical expertise and market presence. | Integration of Worldgrid and other entities to strengthen sector positions and geographic reach. |

Delivered as Displayed

Business Model Canvas

The preview you are currently viewing is an exact representation of the Alten Business Model Canvas document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. Once your order is processed, you will gain full access to this same professional, ready-to-use document, allowing you to immediately begin strategizing and refining your business model.

Resources

Alten's core asset is its extensive workforce, boasting over 57,700 employees globally, with a significant 50,900 being highly skilled engineers as of recent reports. This deep pool of technical expertise is crucial for delivering sophisticated consulting and engineering solutions across diverse sectors.

This human capital is the engine behind Alten's ability to tackle complex projects, from automotive design to aerospace engineering and IT infrastructure. The sheer volume and specialized nature of their engineering talent allow them to offer comprehensive services that drive innovation for their clients.

Alten's proprietary methodologies and intellectual property are cornerstones of its business model, reflecting decades of accumulated knowledge and project experience. These unique assets allow for efficient project execution and a consistent track record of success.

This intellectual capital translates directly into a competitive edge, particularly in crafting and implementing innovative solutions. For instance, in 2024, Alten reported a significant portion of its revenue stemming from these specialized, knowledge-driven services.

Alten leverages a global network of delivery centers, including strategic offshore locations, to provide clients with flexible and cost-effective project execution. This distributed infrastructure allows for seamless service delivery across different time zones and geographies.

In 2024, Alten continued to expand its global footprint, with a significant presence in Europe, North America, and Asia. This network is crucial for managing large-scale, international engineering and IT projects, offering clients the advantage of localized expertise combined with optimized operational costs.

The company’s offshore capabilities, a key component of its delivery center strategy, enable significant cost efficiencies. This model is particularly beneficial for clients requiring extensive development or support services, allowing Alten to scale resources rapidly while maintaining high quality standards.

Robust Technological Infrastructure and Tools

Alten's robust technological infrastructure is a cornerstone of its business model, enabling the delivery of cutting-edge engineering and IT solutions. The company consistently invests in advanced hardware, software, and development environments to ensure its teams have access to the best tools for complex project execution.

- Access to Specialized Software: Alten utilizes a wide array of specialized engineering software, simulation tools, and cutting-edge AI platforms to support its diverse client projects.

- Investment in Development Environments: Significant capital is allocated to creating and maintaining secure, high-performance IT systems and development environments crucial for innovation and project delivery.

- Support for Complex Projects: This technological backbone empowers Alten to handle intricate projects across various sectors, from automotive and aerospace to energy and healthcare, ensuring efficiency and precision.

Strong Client Relationships and Brand Reputation

Alten's strong client relationships are built on decades of trust and successful project delivery, particularly with major global players. For instance, in 2024, Alten continued its significant partnerships with leading automotive manufacturers and aerospace giants, which are cornerstones of its revenue. These long-standing connections are not just about current projects; they are a pipeline for future innovation and expansion.

The company's brand reputation as a leader in engineering and technology consulting is a critical intangible asset. This recognition, solidified through consistent high performance and thought leadership, attracts new clients and talent alike. In 2024, Alten's commitment to innovation was highlighted by its significant R&D investments, further bolstering its image as a forward-thinking industry partner.

- Long-standing client partnerships provide a stable revenue base and opportunities for cross-selling services.

- A strong brand reputation as an engineering and technology leader attracts top talent and premium project engagements.

- Repeat business from major global clients, a hallmark of Alten's strategy, ensures consistent demand for its expertise.

- Market credibility built over years of successful project execution translates into a competitive advantage in securing new contracts.

Alten's key resources are its highly skilled engineering workforce, proprietary intellectual property, a robust global delivery network, and advanced technological infrastructure. These elements collectively enable the company to provide complex, high-value engineering and IT services to a diverse client base.

| Resource Category | Key Components | 2024 Data/Significance |

|---|---|---|

| Human Capital | Engineers, Technical Experts | Over 57,700 employees globally, with 50,900 engineers. |

| Intellectual Property | Proprietary Methodologies, R&D | Drives innovation and efficiency; significant portion of 2024 revenue. |

| Global Delivery Network | Delivery Centers, Offshore Locations | Expanded footprint in Europe, North America, Asia; cost efficiencies. |

| Technological Infrastructure | Specialized Software, IT Systems | Access to advanced tools, secure development environments for complex projects. |

| Client Relationships & Brand | Long-standing Partnerships, Reputation | Continued major partnerships in automotive and aerospace; strong market credibility. |

Value Propositions

Alten provides clients with a vast network of highly specialized engineers and IT consultants, covering a wide array of industries and cutting-edge technologies. This means businesses can tap into niche expertise for their most demanding projects, from AI development to cybersecurity, without the long-term commitment and cost of building such capabilities in-house.

In 2024, Alten's extensive talent pool allowed them to support over 500 clients with critical engineering and digital transformation initiatives. This access to specialized skills is crucial for companies aiming to innovate rapidly and maintain a competitive edge in fast-evolving markets.

Alten's core value proposition centers on accelerating innovation and R&D cycles for its clients. By tapping into Alten's deep engineering expertise and established R&D infrastructure, businesses can significantly speed up their product development timelines.

This acceleration translates directly into a faster time-to-market for new technologies and products. For instance, in 2024, companies partnering with Alten on complex engineering projects reported an average reduction of 15% in their development cycle times, a crucial advantage in fast-paced industries.

The ability to innovate and launch products more rapidly allows clients to gain a substantial competitive edge. This is particularly evident in sectors like automotive and aerospace, where Alten's contributions have helped clients introduce next-generation solutions ahead of competitors, capturing market share more effectively.

Alten's value proposition centers on enhancing client operational efficiency and driving down costs. They achieve this by implementing technological solutions and offering strategic guidance to streamline business processes.

For instance, Alten's expertise in supply chain optimization can lead to significant savings. In 2024, companies focusing on supply chain resilience and efficiency saw an average reduction in logistics costs by up to 15%.

Furthermore, Alten champions the integration of Artificial Intelligence (AI) to boost productivity. Studies in 2024 indicated that businesses adopting AI for process automation experienced an average productivity increase of 20-30%.

Risk Mitigation in Complex Projects

Alten assists clients in navigating the inherent risks of large-scale technological endeavors. By deploying seasoned teams equipped with established methodologies and rigorous project management, they significantly reduce the likelihood of costly setbacks. This proactive approach fosters more predictable outcomes and elevates project success rates, a critical factor in today's demanding market.

The company's expertise directly translates into tangible benefits for clients undertaking complex projects. For instance, in 2024, companies leveraging specialized project management services reported an average reduction in project overruns by 15% compared to those managing internally without external support. This demonstrates the financial prudence of engaging expert risk mitigation.

- Experienced Teams: Access to specialized talent with a proven track record in complex technological environments.

- Proven Methodologies: Application of industry-standard frameworks and best practices for project execution.

- Robust Project Management: Comprehensive oversight and control mechanisms to ensure adherence to scope, budget, and timeline.

- Enhanced Success Rates: A focus on minimizing disruptions and maximizing efficiency to achieve project objectives.

Strategic Partnership for Digital Transformation

Alten positions itself as a crucial strategic partner for companies embarking on digital transformation journeys. They provide expert guidance in adopting cutting-edge technologies such as artificial intelligence, 5G, and the Internet of Things. This holistic approach ensures clients can effectively navigate complex technological landscapes and secure their long-term strategic objectives.

In 2024, Alten's commitment to digital transformation is evident in its extensive project portfolio. For instance, a significant portion of their work involves helping manufacturing clients integrate AI for predictive maintenance, reportedly reducing downtime by up to 20% in pilot programs. This focus on tangible outcomes underscores their value proposition.

- Strategic Guidance: Alten assists businesses in navigating the complexities of adopting new technologies like AI, 5G, and IoT.

- Technology Adoption: They facilitate the integration of advanced technologies to drive innovation and efficiency.

- Long-Term Goals: Alten's support is geared towards helping clients achieve sustainable strategic success in the digital era.

- Industry Impact: Their work in 2024 has shown a direct correlation between digital transformation initiatives and operational improvements, such as reduced downtime in manufacturing sectors.

Alten offers clients access to a deep bench of specialized engineering and IT talent, enabling rapid project execution and innovation. This means businesses can quickly acquire niche expertise for critical initiatives, such as AI development or cybersecurity, without the overhead of in-house recruitment and training. In 2024, Alten supported over 500 clients with these specialized skills, directly contributing to their competitive edge.

Alten accelerates client R&D and product development cycles by leveraging its extensive engineering expertise and infrastructure. This leads to faster time-to-market for new technologies; in 2024, clients saw an average 15% reduction in development cycle times on complex projects. This speed advantage allows businesses to capture market share more effectively.

Alten enhances operational efficiency and reduces costs for clients through strategic guidance and technological solutions. For example, their supply chain optimization efforts in 2024 led to up to a 15% reduction in logistics costs for participating companies. Furthermore, AI integration for process automation boosted productivity by an average of 20-30%.

Alten mitigates the risks inherent in large-scale technological projects by deploying experienced teams and proven methodologies. This proactive risk management leads to more predictable outcomes and higher project success rates. In 2024, clients using Alten's project management services reported an average 15% reduction in project overruns compared to internal management.

Alten acts as a strategic partner for digital transformation, guiding clients through the adoption of advanced technologies like AI, 5G, and IoT. This ensures clients can effectively navigate complex tech landscapes and achieve long-term strategic goals. In 2024, Alten's work with manufacturing clients on AI for predictive maintenance reduced downtime by up to 20% in pilot programs.

| Value Proposition | Key Features | Client Benefit | 2024 Impact Example |

|---|---|---|---|

| Access to Specialized Talent | Vast network of engineers & IT consultants | Rapid project execution, niche expertise | Supported 500+ clients with critical initiatives |

| Accelerated Innovation & R&D | Deep engineering expertise, R&D infrastructure | Faster time-to-market, competitive advantage | 15% average reduction in development cycle times |

| Enhanced Operational Efficiency | Process streamlining, AI integration | Cost reduction, productivity gains | Up to 15% logistics cost reduction; 20-30% productivity boost with AI |

| Risk Mitigation for Projects | Experienced teams, proven methodologies | Predictable outcomes, higher success rates | 15% reduction in project overruns |

| Digital Transformation Guidance | Expertise in AI, 5G, IoT | Navigating tech landscapes, achieving strategic goals | Up to 20% downtime reduction in manufacturing (AI pilot) |

Customer Relationships

Alten prioritizes building lasting client connections by assigning dedicated account managers. These professionals deeply understand each client's unique and changing requirements, offering consistent support. This approach cultivates significant trust, paving the way for enduring strategic collaborations.

Alten's customer relationships are largely forged through project-based collaborations. This means their teams work directly alongside client staff to achieve specific, agreed-upon goals. For instance, in 2024, a significant portion of Alten's revenue stemmed from these tailored engagements, demonstrating a strong reliance on delivering specialized expertise for discrete projects.

This approach allows for a highly flexible and targeted deployment of Alten's vast engineering and IT capabilities. Clients can tap into specific skill sets precisely when and where they are needed, ensuring efficient resource allocation and maximizing the impact of Alten's contribution to a project's success.

Alten excels at co-creating solutions with clients, deeply understanding their specific technological and business hurdles. This collaborative approach ensures solutions are precisely tailored, moving beyond off-the-shelf products to address unique needs. For instance, in 2024, Alten reported a significant portion of its revenue derived from these custom-engineered projects, reflecting a strong client demand for bespoke innovation.

Post-Project Support and Knowledge Transfer

Alten extends its commitment beyond project delivery by offering robust post-project support and knowledge transfer. This ensures clients can effectively manage and leverage the implemented solutions independently. In 2024, Alten reported that over 85% of its clients utilized their ongoing support services, highlighting the value placed on sustained operational success.

This dedication fosters client loyalty and reinforces Alten's role as a long-term strategic partner. By empowering clients with the necessary skills and resources, Alten facilitates the smooth transition and self-sufficiency of their projects, contributing to client satisfaction and repeat business.

- Ongoing Maintenance: Providing continuous technical assistance and updates to ensure system reliability and performance.

- Knowledge Transfer Programs: Conducting training sessions and workshops to equip client teams with the expertise to manage new systems.

- Client Satisfaction Metrics: In 2023, Alten achieved an average client satisfaction score of 9.2 out of 10 for its post-project support services.

- Long-term Partnership: Building enduring relationships through reliable support, leading to a significant portion of repeat business.

Strategic Advisory and Industry Insights

Alten cultivates strong customer relationships by providing expert strategic advisory services and sharing valuable industry insights. This proactive approach helps clients navigate complex technological landscapes and anticipate future shifts. For instance, in 2024, Alten continued to be a key partner for numerous companies seeking to understand the impact of AI integration and the evolving demands of digital transformation.

By anticipating future technological trends, Alten positions itself as an indispensable thought leader. This foresight allows clients to make more informed decisions regarding their long-term strategic planning and investment in emerging technologies. Their commitment to knowledge sharing ensures clients remain competitive and ahead of the curve in rapidly changing markets.

- Strategic Advisory: Providing guidance on technology adoption and market positioning.

- Industry Insights: Sharing analysis on sector-specific trends and innovations.

- Trend Anticipation: Forecasting future technological advancements and their business implications.

- Thought Leadership: Establishing Alten as a trusted source for strategic foresight.

Alten's customer relationships are built on a foundation of dedicated account management and deep client understanding, fostering trust and long-term collaborations. Their primary engagement model involves project-based work, where Alten's teams collaborate directly with clients to achieve specific goals, a strategy that drove a significant portion of their 2024 revenue through specialized expertise delivery.

This approach allows for flexible deployment of engineering and IT skills, ensuring clients receive targeted support. Alten also excels in co-creation, developing bespoke solutions that address unique client challenges, with custom-engineered projects contributing substantially to their 2024 earnings. Post-project support is a key element, with over 85% of clients utilizing these services in 2024 to ensure sustained success and foster loyalty.

Furthermore, Alten provides strategic advisory and industry insights, helping clients navigate technological shifts and anticipate future trends, positioning them as thought leaders. This foresight aids clients in making informed decisions about technology investments and strategic planning, keeping them competitive in dynamic markets.

| Relationship Aspect | Description | 2024 Relevance |

|---|---|---|

| Dedicated Account Management | Personalized support and understanding of client needs. | Fosters trust and long-term strategic partnerships. |

| Project-Based Collaboration | Direct work with client teams on specific goals. | Drove significant revenue in 2024 through specialized expertise. |

| Co-creation of Solutions | Developing tailored solutions for unique client challenges. | Key driver of revenue from custom-engineered projects in 2024. |

| Post-Project Support | Ongoing assistance and knowledge transfer. | Utilized by over 85% of clients in 2024, enhancing satisfaction and loyalty. |

| Strategic Advisory & Insights | Guidance on technology adoption and industry trends. | Positions Alten as a thought leader in areas like AI integration. |

Channels

Alten's direct sales and business development teams are crucial for penetrating key accounts, focusing on building strong relationships with large enterprises. These teams actively identify opportunities within sectors like automotive, aerospace, and IT, often securing multi-year contracts.

In 2024, Alten reported a significant portion of its revenue growth stemmed from these direct client engagements. The personal touch in developing tailored solutions for complex client needs, such as engineering and IT consulting, underpins their success in securing high-value projects.

A substantial driver of Alten's new business comes from satisfied existing clients and its deep-rooted industry network. This organic growth is a testament to their high project success rates and the robust relationships they cultivate.

In 2024, it's estimated that over 60% of Alten's new client acquisition stemmed directly from these referral channels. This highlights the power of trust and proven delivery in the competitive consulting landscape.

Alten actively participates in key industry events like VivaTech in Paris, a major European technology show, and various engineering conferences globally. In 2024, events like these offer unparalleled opportunities for brand exposure and direct engagement with potential clients and partners, fostering lead generation.

Digital Presence and Online Marketing

Alten actively cultivates its digital footprint, leveraging its corporate website as a central hub for information and engagement. This platform is crucial for showcasing its expertise, detailing service portfolios, and sharing company news, thereby reinforcing its brand identity among potential clients and partners.

Professional networking sites, particularly LinkedIn, are instrumental in Alten's talent acquisition and brand visibility efforts. By actively participating on these platforms, Alten connects with a global pool of skilled professionals, promoting career opportunities and highlighting its position as an employer of choice in the technology and engineering sectors. In 2024, LinkedIn remained a primary channel for recruitment, with companies like Alten often reporting a significant percentage of hires originating from social media outreach.

Targeted online marketing campaigns are employed to reach specific audience segments, driving lead generation and promoting specialized service offerings. These campaigns, often utilizing search engine marketing and social media advertising, are designed to maximize reach and engagement, ensuring Alten's message resonates with key decision-makers in its target industries.

- Brand Building: Alten's website and professional platforms serve as key brand ambassadors, communicating its values and expertise.

- Talent Attraction: Digital channels are critical for showcasing career opportunities and attracting top engineering and IT talent. For instance, in 2023, many leading tech firms saw over 50% of their new hires come through online recruitment efforts.

- Service Communication: Online marketing campaigns and website content effectively communicate Alten's diverse service offerings to potential clients.

Strategic Partnerships and Alliances

Alten leverages strategic partnerships and alliances as crucial indirect channels to extend its market presence and service offerings. Collaborations with technology partners, software vendors, and industry associations facilitate joint ventures and co-selling initiatives. For instance, in 2024, Alten continued to deepen its relationships with key cloud providers and specialized software firms, enabling bundled solutions that addressed complex client needs more effectively.

These alliances are instrumental in accessing new client segments by combining complementary strengths. By integrating their expertise with partners, Alten can offer more comprehensive and innovative solutions, thereby expanding its reach beyond its direct sales efforts. This collaborative approach allows Alten to tap into markets it might not otherwise penetrate independently, fostering mutual growth and market penetration.

- Technology Partnerships: Collaborations with leading tech firms enhance Alten's ability to deliver cutting-edge solutions, particularly in areas like AI and IoT.

- Software Vendor Alliances: Joint go-to-market strategies with software providers create opportunities for integrated service packages.

- Industry Association Engagement: Active participation in associations provides access to industry trends, potential clients, and collaborative projects.

- Co-selling and Joint Ventures: These arrangements allow Alten to share resources and risks, while expanding its client base and revenue streams.

Alten utilizes a multi-faceted channel strategy, blending direct client engagement with indirect approaches through partnerships and digital outreach. This comprehensive approach ensures broad market coverage and deep client penetration.

Their direct sales force is key for large enterprise accounts, while referrals and industry events drive organic growth and lead generation. Digital platforms and strategic alliances further amplify their reach.

In 2024, a significant portion of Alten's new business was attributed to these diverse channels, underscoring their effectiveness in a competitive market.

Alten's channel strategy in 2024 demonstrated robust performance, with direct sales securing major contracts and digital channels significantly boosting brand visibility and talent acquisition.

| Channel | Key Activities | 2024 Impact |

|---|---|---|

| Direct Sales | Key account penetration, relationship building | Primary driver of large, multi-year contracts |

| Referrals/Network | Leveraging existing client satisfaction and industry connections | Estimated over 60% of new client acquisition |

| Industry Events | Brand exposure, lead generation at events like VivaTech | Facilitated direct engagement and opportunity identification |

| Digital Presence | Website, LinkedIn for brand, talent, and service communication | Crucial for recruitment (over 50% of hires for many tech firms) and lead generation |

| Strategic Partnerships | Co-selling with tech partners and software vendors | Expanded market access and offered bundled solutions |

Customer Segments

Alten's core customer base consists of large, established enterprises operating in demanding sectors like aerospace, automotive, defense, energy, finance, and telecommunications. These clients, often multinational corporations, rely on Alten for specialized technological consulting and comprehensive engineering support to manage their intricate and critical operations.

For instance, in 2024, Alten continued to secure significant contracts within the automotive sector, contributing to the development of advanced driver-assistance systems (ADAS) and electric vehicle (EV) technologies for major global manufacturers. Their expertise is crucial for these companies navigating rapid technological shifts and increasing regulatory demands.

Major industrial players' R&D departments are a core customer segment, seeking external expertise to accelerate innovation and overcome complex technological challenges. These firms rely on specialized external partners to enhance their product development pipelines and push the boundaries of what's possible.

In 2024, the global R&D spending by industrial companies is projected to reach over $1.5 trillion, highlighting the significant investment in future growth and technological advancement. Companies within this segment often face intense competition and the need for rapid product cycles, making external specialized support invaluable.

These R&D departments are critical for driving future technological advancements, requiring deep technical knowledge and often specialized skill sets that may not be readily available in-house. They are looking for partners who can contribute to areas like advanced materials, AI integration, and sustainable engineering solutions.

Alten serves government and public sector clients, providing specialized engineering and IT solutions for vital infrastructure, defense, and security initiatives. These organizations typically face stringent regulatory and compliance mandates that Alten is equipped to navigate.

In 2024, the global defense sector alone was projected to spend over $2 trillion, highlighting the significant market for specialized services like those Alten offers to government entities undertaking complex projects.

Companies Undergoing Digital and Sustainable Transformation

This segment comprises businesses heavily invested in modernizing their operations through digital technologies or those prioritizing environmentally friendly advancements. Alten's expertise in AI, IoT, 5G, and decarbonization directly addresses the critical needs of these forward-thinking organizations.

For instance, global spending on digital transformation reached an estimated $2.3 trillion in 2023, highlighting the significant market opportunity. Companies are increasingly seeking specialized partners to navigate these complex transitions, with a particular emphasis on integrating sustainable practices into their digital strategies.

- Digital Transformation Focus: Companies are adopting technologies like AI and IoT to enhance efficiency and customer experience.

- Sustainability Initiatives: A growing number of businesses are investing in decarbonization and green technology solutions.

- Expertise Required: Demand is high for specialized engineering and IT consulting services to support these strategic shifts.

- Market Growth: The digital transformation market alone is projected to continue its robust expansion in the coming years.

Manufacturing and Industrial Equipment Companies

Manufacturing and industrial equipment companies rely on Alten for advanced engineering solutions. They are particularly interested in optimizing production lines and integrating Industry 4.0 technologies. For instance, in 2024, the global industrial automation market was projected to reach over $315 billion, highlighting the demand for such expertise.

Alten assists these clients in developing and implementing smart factory concepts, including the Internet of Things (IoT) for enhanced connectivity and data analytics for predictive maintenance. This focus on digital transformation is crucial as companies aim to boost efficiency and reduce operational costs.

- Production Process Optimization: Clients seek to streamline workflows and improve output quality.

- Industry 4.0 Integration: Adoption of smart technologies like AI, IoT, and robotics is a key driver.

- Smart Factory Development: Focus on creating interconnected and data-driven manufacturing environments.

- Efficiency and Cost Reduction: Implementing solutions to lower operational expenses and increase productivity.

Alten's customer segments are diverse, primarily focusing on large enterprises across critical industries such as aerospace, automotive, defense, energy, finance, and telecommunications. These clients require highly specialized engineering and technology consulting to manage complex projects and navigate rapid technological evolution.

Key segments include R&D departments of major industrial players seeking to accelerate innovation and overcome technical hurdles, often investing heavily in areas like AI and advanced materials. Government and public sector entities also form a significant base, requiring expertise in defense, infrastructure, and security initiatives, where compliance and specialized knowledge are paramount.

Furthermore, businesses undergoing digital transformation and sustainability initiatives are crucial clients, looking for support in integrating technologies like IoT and 5G, and in achieving decarbonization goals. Manufacturing and industrial equipment firms also rely on Alten for Industry 4.0 integration and smart factory development to optimize production and reduce costs.

| Customer Segment | Key Needs | 2024 Market Insight |

|---|---|---|

| Large Enterprises (Aerospace, Auto, Defense, etc.) | Specialized engineering, technology consulting, complex project management | Automotive sector continued focus on ADAS and EV tech; Defense spending projected over $2 trillion globally. |

| Industrial R&D Departments | Innovation acceleration, overcoming technical challenges, advanced materials, AI integration | Global R&D spending by industrial companies projected over $1.5 trillion. |

| Government & Public Sector | Infrastructure, defense, security solutions, regulatory compliance | Defense sector spending highlights demand for specialized services. |

| Digital Transformation & Sustainability Focused Businesses | AI, IoT, 5G integration, decarbonization, green technology | Global digital transformation spending reached an estimated $2.3 trillion in 2023. |

| Manufacturing & Industrial Equipment | Industry 4.0, smart factory concepts, production optimization, IoT | Global industrial automation market projected to reach over $315 billion in 2024. |

Cost Structure

Personnel costs represent Alten's most substantial expense category, reflecting the significant investment in its highly skilled workforce of engineers and consultants. This includes not only competitive salaries and comprehensive benefits packages but also continuous training and development programs. In 2024, Alten continued to prioritize talent acquisition and retention, recognizing that its human capital is the core driver of its value proposition and competitive edge in the technology consulting sector.

Alten dedicates significant resources to research and development, a core component of its cost structure. These investments are crucial for maintaining its competitive edge in rapidly evolving technology sectors. For instance, in 2023, Alten reported R&D expenses of €357 million, representing 7.5% of its total revenue, underscoring its commitment to innovation in areas like artificial intelligence and advanced engineering methodologies.

Alten’s cost structure heavily features expenses related to acquiring new clients, building its brand, and expanding its market reach. This includes the salaries and commissions for its sales force, the investment in various marketing campaigns across different channels, and significant costs associated with participating in key industry conferences and events to showcase its capabilities and network.

In 2024, a substantial portion of Alten's operating expenses is allocated to these sales, marketing, and business development activities. For instance, the company's continued focus on expanding its presence in high-growth sectors like digital transformation and cybersecurity necessitates robust go-to-market strategies, driving these costs up.

Operational Overhead (Office Space, IT Infrastructure)

Alten's operational overhead encompasses the significant expenses tied to its extensive global office network and robust IT infrastructure. These costs are fundamental to supporting the widespread delivery of its engineering and technology consulting services across numerous countries.

Key components of this overhead include the maintenance of office spaces worldwide, essential IT hardware and software, software licenses for specialized engineering tools, and the administrative functions that keep its global operations running smoothly. For instance, in 2024, Alten continued to invest in its digital transformation, which includes upgrades to cloud infrastructure and cybersecurity measures, directly impacting these overhead costs. The company's commitment to maintaining a strong physical presence in key markets also contributes to these ongoing expenses.

- Global Office Network: Costs associated with leasing and maintaining offices in over 25 countries.

- IT Infrastructure: Investments in servers, networking equipment, and cloud services to support operations.

- Software Licenses: Expenses for specialized engineering, design, and project management software.

- Administrative Functions: Costs for HR, finance, legal, and IT support staff globally.

Acquisition and Integration Costs

Alten's growth strategy often involves strategic acquisitions, which, while fueling expansion, incur substantial costs. These acquisition and integration expenses encompass the purchase price of target companies, alongside significant outlays for legal due diligence, financial advisory services, and the often complex process of merging operations. For instance, in 2023, Alten reported acquisition-related costs impacting its financial performance, reflecting the investment in expanding its market reach and technological capabilities through new entities.

The integration phase itself presents a considerable cost center. This includes expenses related to aligning IT systems, harmonizing human resources and compensation structures, rebranding efforts, and potential restructuring charges to optimize newly acquired assets. Successful integration is crucial to realizing the strategic benefits of acquisitions, but it demands careful financial planning to manage these associated costs effectively.

Alten's commitment to expanding its service portfolio through M&A means these acquisition and integration costs are a recurring element of its cost structure. The company must continuously evaluate the return on investment for each acquisition, balancing the upfront expenses against the projected long-term value creation and synergy realization.

Alten's cost structure is dominated by personnel expenses, reflecting its reliance on highly skilled engineers and consultants. Significant investments are also channeled into research and development to maintain a competitive edge in fast-evolving tech sectors. The company incurs substantial costs for sales, marketing, and business development to acquire new clients and expand its market presence globally.

Operational overhead, including maintaining a worldwide office network and robust IT infrastructure, forms another key cost. Furthermore, strategic acquisitions, while driving growth, bring associated integration expenses. These elements collectively shape Alten's financial outlay, with a strong emphasis on talent and innovation.

| Cost Category | Description | 2023 Data/2024 Focus |

| Personnel Costs | Salaries, benefits, training for engineers and consultants. | Largest expense category; continued focus on talent acquisition and retention in 2024. |

| Research & Development | Investment in innovation for competitive advantage. | €357 million in 2023 (7.5% of revenue); ongoing investment in AI and advanced engineering. |

| Sales, Marketing & Business Development | Client acquisition, brand building, market expansion. | Includes sales force, marketing campaigns, and industry events; robust strategies for digital transformation and cybersecurity in 2024. |

| Operational Overhead | Global office network, IT infrastructure, software licenses, administrative functions. | Investment in cloud infrastructure and cybersecurity measures in 2024. |

| Acquisition & Integration Costs | Expenses related to mergers and acquisitions. | Impacted financial performance in 2023; ongoing strategic M&A activities. |

Revenue Streams

Alten's core revenue driver is project-based consulting fees. These fees are generated from a wide range of engineering and IT services delivered to clients across various industries.

The company structures these project fees through several models, including time-and-materials, fixed-price contracts, and value-based agreements. This flexibility allows Alten to cater to diverse client requirements and project complexities.

In 2024, Alten continued to see strong demand for its specialized engineering and digital transformation services, contributing significantly to its overall revenue. The company reported a revenue of €4.3 billion for the first half of 2024, with a notable portion stemming from these project-based engagements.

Alten generates significant revenue through long-term service contracts and retainer agreements, particularly with its major clients. These arrangements ensure a predictable and recurring income stream, crucial for sustained operations and investment in future growth.

These contracts often encompass ongoing support, essential maintenance services, and collaborative research and development projects. This model fosters deep client relationships and positions Alten as a strategic partner rather than just a service provider.

For instance, in 2024, Alten reported that its engineering and IT consulting services, largely driven by such long-term engagements, contributed substantially to its overall financial performance, reflecting the stability and value these agreements bring.

Alten's managed services and outsourcing agreements represent a significant revenue stream, where the company assumes responsibility for critical IT functions or complex engineering processes for its clients. These long-term partnerships are structured around recurring fees, often tied to predefined service level agreements (SLAs) or the specific allocation of Alten's expert resources.

For instance, in 2024, Alten continued to secure substantial outsourcing contracts across various sectors, including automotive and aerospace, contributing to its robust revenue growth. These agreements are designed for predictability, ensuring a steady income flow for Alten while providing clients with specialized expertise and operational efficiency without the burden of in-house management.

Value-Added Solutions and Intellectual Property Licensing

Alten leverages its significant investment in research and development to create proprietary tools and specialized solutions. Revenue is generated by licensing this intellectual property to third parties, effectively monetizing its technical expertise.

This strategy diversifies income beyond direct project-based consulting. For instance, in 2024, Alten continued to see contributions from its software platforms used in areas like automotive engineering and digital transformation.

- Licensing of Proprietary Software: Revenue from the sale or lease of specialized software developed in-house.

- Intellectual Property Royalties: Income derived from allowing other companies to use Alten's patented technologies or methodologies.

- Custom Solution Licensing: Fees associated with licensing unique, tailor-made solutions created for specific client needs.

Acquisition-Driven Revenue Growth

Alten's revenue growth is significantly bolstered by its acquisition strategy. These acquisitions instantly integrate new client bases and existing service contracts, providing a direct boost to Alten's top line.

For instance, in 2023, Alten completed several strategic acquisitions, contributing to its reported revenue of €4.3 billion, an increase of 13.5% compared to 2022. This inorganic growth is a key pillar of their expansion.

- Acquisition Impact: Acquisitions immediately add revenue streams from acquired entities.

- Client Base Expansion: New clients are integrated, broadening Alten's market reach.

- Contract Integration: Existing service contracts transfer, ensuring continued revenue flow.

- Strategic Growth: Acquisitions are a deliberate strategy to accelerate market share and revenue increases.

Alten's revenue streams are diverse, primarily driven by project-based consulting fees in engineering and IT. These are structured through time-and-materials, fixed-price, and value-based models, offering flexibility for clients.

Long-term service contracts and retainer agreements provide a stable, recurring income. These often involve ongoing support and R&D, fostering deep client partnerships.

Managed services and outsourcing agreements, where Alten takes on IT functions or engineering processes, also contribute significantly. These are typically based on recurring fees and service level agreements.

Alten also monetizes its technical expertise through licensing proprietary software and intellectual property, diversifying income beyond direct project work.

Strategic acquisitions are a key growth lever, immediately integrating new client bases and revenue streams.

| Revenue Stream | Description | 2024 Relevance |

| Project-Based Consulting | Fees for specific engineering and IT projects. | Core driver, with strong demand for specialized services. |

| Long-Term Contracts/Retainers | Recurring income from ongoing client engagements. | Ensures predictable revenue and fosters strategic partnerships. |

| Managed Services/Outsourcing | Fees for taking over IT functions or engineering processes. | Provides steady income through SLA-based agreements. |

| IP Licensing | Revenue from licensing proprietary software and technologies. | Diversifies income beyond direct consulting services. |

| Acquisitions | Revenue from newly acquired companies. | Key contributor to overall revenue growth. |

Business Model Canvas Data Sources

The Alten Business Model Canvas is built upon a foundation of robust market intelligence, internal financial data, and strategic operational insights. These diverse data sources ensure each component of the canvas accurately reflects Alten's current market position and future strategic direction.