Alten Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alten Bundle

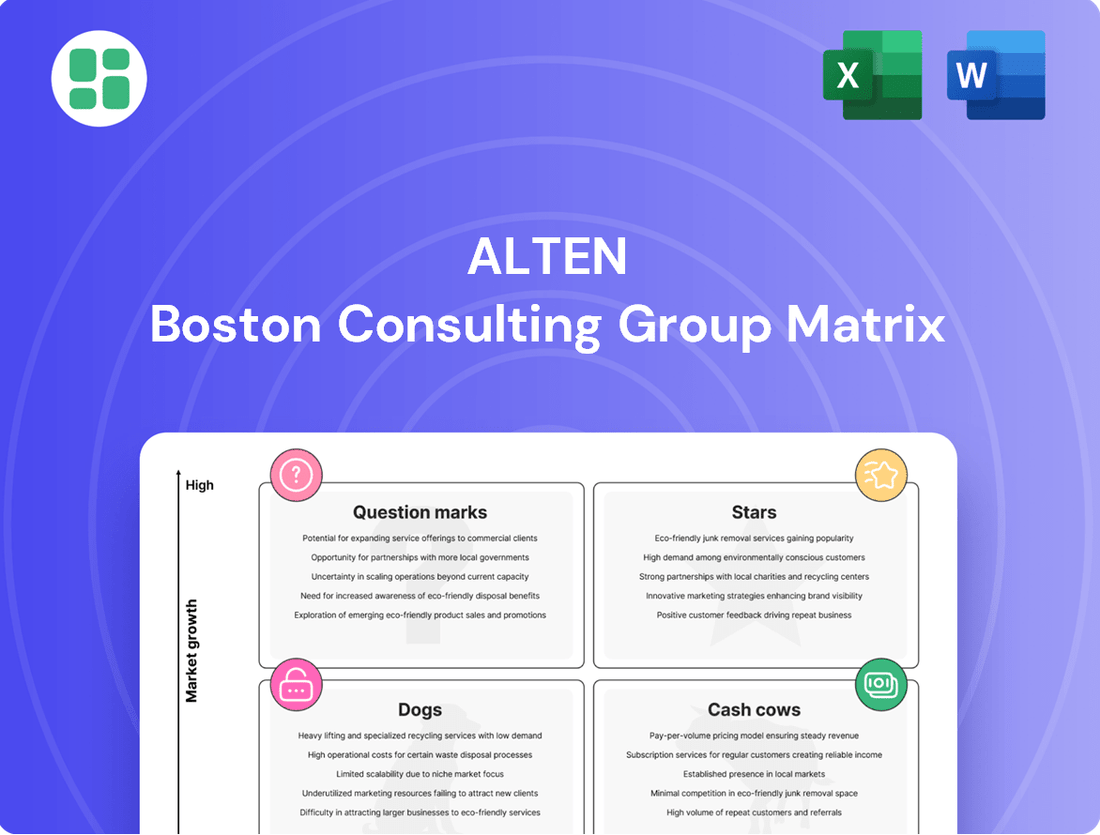

Unlock the secrets to this company's product portfolio with the BCG Matrix! Understand where its offerings fit as Stars, Cash Cows, Dogs, or Question Marks, and identify your next strategic moves. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to drive growth.

Stars

Alten is making substantial investments in Artificial Intelligence and Machine Learning, recognizing its potential to boost competitiveness and productivity. They are actively implementing proofs of concept within their ongoing projects, signaling a commitment to practical application.

This strategic focus aligns with the burgeoning AI market, which is experiencing significant demand for sophisticated analytical and automation solutions across diverse industries. For instance, the global AI market was valued at an estimated $200 billion in 2023 and is projected to grow substantially in the coming years, with some forecasts suggesting it could reach over $1.8 trillion by 2030.

By integrating AI into its service portfolio, Alten is positioning itself to capitalize on this rapid expansion, aiming to secure a more significant market share in this high-growth segment.

Cybersecurity projects represent a strong "Star" in Alten's portfolio, driven by escalating global digital security needs and regulatory mandates like the EU's DORA. Alten's engagement in these critical client projects across diverse industries reflects the high demand for robust cyber defenses.

The cybersecurity market is projected for significant expansion, with global spending expected to reach hundreds of billions of dollars annually. For instance, cybersecurity market size was estimated to be around $217.9 billion in 2023 and is forecasted to grow substantially in the coming years, underscoring the "Star" status of these ventures for Alten.

The Defense & Security sector is a significant growth area for Alten, fueled by increasing global military expenditures and the demand for advanced intelligent equipment, seamless weapon system integration, and the digitization of warfare. For instance, in 2024, defense spending globally is projected to reach new heights, with many nations prioritizing modernization and technological upgrades.

Alten's active participation in flagship projects such as Barracuda and Pang underscores its robust standing and expertise within this demanding market. This sector offers a consistent and expanding opportunity for specialized engineering and IT solutions, reflecting a stable, high-growth trajectory.

Energy and Utilities Solutions (Nuclear & Renewables)

Alten's strategic acquisition of WORLDGRID, a prominent European player in Energy and Utilities solutions, significantly bolsters its presence, especially within the nuclear energy domain. This move taps into a sector poised for substantial expansion, driven by advancements in nuclear technology and grid modernization efforts.

The energy and utilities landscape is undergoing a period of robust growth, fueled by significant governmental and industry initiatives. Projects such as the development of EPR2 reactors and Small Modular Reactors (SMRs) are driving innovation and investment in nuclear power. Simultaneously, the essential renovation and expansion of electricity networks are critical for integrating these new energy sources and ensuring grid stability.

- Nuclear Renaissance: Global investment in nuclear power is projected to reach hundreds of billions of dollars by 2030, with a focus on new reactor designs and life extensions of existing plants.

- Renewable Energy Surge: The renewable energy sector continues its rapid expansion, with solar and wind power installations seeing record growth year-over-year. In 2024, global renewable capacity additions are expected to exceed 500 GW.

- Grid Modernization: Significant investments are being made in upgrading and expanding electricity transmission and distribution networks to accommodate the influx of renewable energy and enhance grid resilience.

- Alten's Enhanced Capabilities: The WORLDGRID acquisition provides Alten with deeper expertise in nuclear engineering, project management, and grid infrastructure, positioning it as a key partner for major energy transition projects.

Digital Transformation & IoT Implementation

The digital transformation market, a vast landscape including the Internet of Things (IoT), cloud migration, and advanced data analytics, is on a significant upward trajectory. Projections indicate this market could reach an impressive USD 10.76 trillion by 2034, showcasing immense potential. Alten is actively engaged in assisting clients with their digital transformation initiatives, positioning itself favorably within the competitive IoT sector.

This expansive service domain, fueled by relentless technological innovation and evolving industry demands, clearly marks it as a star for Alten. The company's involvement in these critical areas reflects a strategic alignment with major market trends.

- Market Growth: The digital transformation market, including IoT, is projected to reach USD 10.76 trillion by 2034.

- Alten's Role: Alten is actively supporting clients in their digital transformation projects.

- Competitive Positioning: Alten is progressing well among key players in the IoT space.

- Strategic Importance: This broad service area, driven by technology and industry needs, is a star for Alten.

Stars in the BCG Matrix represent high-growth, high-market-share business units or product lines. For Alten, Artificial Intelligence and Machine Learning, Cybersecurity, Defense & Security, Energy & Utilities, and Digital Transformation are identified as Stars. These areas are characterized by strong market demand and Alten's significant engagement and investment.

| Sector/Technology | Market Growth Driver | Alten's Position/Activity | Market Data Point (Approx.) |

|---|---|---|---|

| AI & Machine Learning | Demand for analytical & automation solutions | Implementing proofs of concept | Global AI market ~$200 billion (2023) |

| Cybersecurity | Escalating digital security needs, regulations | Engaged in critical client projects | Cybersecurity market ~$217.9 billion (2023) |

| Defense & Security | Increasing global military expenditures, modernization | Active in flagship projects (e.g., Barracuda) | Global defense spending projected to rise in 2024 |

| Energy & Utilities (Nuclear focus) | Nuclear tech advancements, grid modernization | Acquisition of WORLDGRID, EPR2/SMR projects | Nuclear investment projected to reach hundreds of billions by 2030 |

| Digital Transformation (IoT, Cloud) | Technological innovation, evolving industry demands | Assisting clients, competitive in IoT | Digital transformation market projected to reach USD 10.76 trillion by 2034 |

What is included in the product

Strategic guidance on investing in Stars, holding Cash Cows, developing Question Marks, and divesting Dogs.

Visualizes portfolio health, simplifying strategic decisions and resource allocation.

Cash Cows

Alten's established engineering consulting in automotive and aerospace acts as a strong Cash Cow. Despite some project slowdowns, their deep expertise in these mature sectors, which still demand R&D and ongoing product support, ensures consistent revenue. For instance, in 2024, the automotive sector alone saw significant investment in electric vehicle (EV) development, a key area for Alten's consulting services, with global EV sales projected to reach over 17 million units.

Alten's traditional IT services, encompassing system integration, software development, and IT infrastructure management, form a foundational pillar of their business. These offerings are critical for clients' day-to-day operations, often secured through stable, long-term agreements.

While the growth rate in these established IT segments may not match that of cutting-edge technologies, their consistent demand and the nature of long-term contracts contribute significantly to Alten's predictable revenue streams. For example, in 2024, the IT and Digital Services segment, which includes these traditional offerings, continued to be a substantial contributor to the group's overall performance, demonstrating resilience and steady demand.

Alten's rail sector engineering services are a classic cash cow, benefiting from consistent demand driven by global infrastructure upgrades and a push towards greener transportation. The company's deep involvement in advanced signaling and high-speed rail projects solidifies its strong market standing.

In 2024, the rail industry saw significant investment, with many governments prioritizing rail modernization. For instance, European rail infrastructure spending was projected to reach hundreds of billions of euros through the decade, creating a stable, predictable revenue environment for established players like Alten.

French Market Operations

Alten's French market operations are a prime example of a cash cow within the BCG matrix. These operations consistently deliver strong financial results, underpinning the company's overall profitability and stability.

In the first quarter of 2025, revenue from the French market saw a healthy increase of 4.2%. This growth, within a mature and established market, highlights Alten's strong competitive positioning and its ability to generate consistent cash flows.

The consistent performance in France provides a reliable source of funds that can be reinvested in other areas of the business, such as supporting growth in question mark segments or funding research and development.

- Dominant Market Position: Alten holds a significant share in the French IT and engineering consulting market.

- Consistent Revenue Growth: Q1 2025 saw a 4.2% revenue increase in France, demonstrating market resilience.

- Stable Cash Generation: The mature French market provides a predictable and substantial cash flow for Alten.

- Foundation for Investment: Profits from French operations support strategic investments in other business units.

Product Development and System Integration

Alten's foundation lies in product development and system integration, services that are critical for their clients' ongoing operations and future innovation. This consistent demand, stemming from the essential nature of these offerings, positions them as a stable revenue source.

With a deep well of experience and proven methodologies in these core areas, Alten can deliver efficiently, which translates into robust profit margins. These factors solidify their product development and system integration services as reliable cash cows within their business portfolio.

- Recurring Revenue: Clients rely on Alten for continuous product evolution and system upkeep, ensuring a steady income stream.

- Profitability: Established expertise allows for efficient project execution, leading to healthy profit margins.

- Market Position: Alten's long-standing presence in product development and system integration signifies a strong, established market share.

Alten's established engineering consulting in automotive and aerospace, alongside its traditional IT services and rail sector expertise, represent key Cash Cows. These segments benefit from consistent demand, deep market penetration, and long-term contracts, ensuring predictable revenue streams. The French market operations, in particular, demonstrate strong, stable cash generation, providing a solid financial foundation for the company.

| Business Segment | Market Maturity | Revenue Stability | Growth Potential |

| Automotive & Aerospace Engineering | Mature | High | Low to Moderate |

| Traditional IT Services | Mature | High | Low |

| Rail Sector Engineering | Mature | High | Moderate |

| French Market Operations | Mature | Very High | Low |

Preview = Final Product

Alten BCG Matrix

The comprehensive Alten BCG Matrix you are currently previewing is precisely the final, unwatermarked document you will receive immediately after your purchase. This means you're getting the full, professionally formatted analysis ready for strategic decision-making, without any demo content or limitations. Once bought, this detailed report will be directly accessible for your business planning needs, offering clear insights into your product portfolio.

Dogs

Services tied to very specific, outdated technologies or systems, like legacy mainframe support, fall into this category. These areas often see declining demand as industries migrate to newer platforms. For instance, while the exact market size for all legacy system maintenance is hard to pinpoint, specific sectors like COBOL programming, essential for many older financial systems, saw a resurgence in demand in 2023-2024 due to a shortage of skilled professionals, though the overall trend for many such technologies remains downward.

Alten's strategy here would focus on managing these services for existing clients while minimizing new investment. The goal is to avoid becoming a cash trap, where ongoing maintenance costs outweigh the revenue generated. Companies in this space might see their market share shrink as their niche technologies become obsolete, making significant growth unlikely.

Alten experienced a challenging 2024 in key European regions like the UK and Germany. These mature markets saw an organic decline, forcing the company to incur goodwill impairments and restructuring costs. This underperformance significantly weighed on overall profitability.

The UK and German segments, characterized by low market share and dim growth prospects for Alten, are now being viewed as potential question marks within the BCG matrix. Without a substantial strategic shift and improvement in performance, their future contribution to Alten's portfolio is uncertain.

Within the automotive sector, certain segments heavily reliant on discretionary consumer spending, like luxury vehicle components or advanced infotainment systems, may face significant budget cuts. For instance, if Q1 2025 data for Alten shows a more than 10% revenue decline specifically from automotive sub-segments tied to new model launches that are now postponed, these areas would be candidates for the 'Dogs' category.

Similarly, in telecommunications, areas such as the rollout of non-essential 5G features or upgrades to legacy infrastructure might be deferred by clients facing economic headwinds. If Alten's Q1 2025 financial reports indicate a substantial drop in revenue from these specific telecom sub-segments, it signals a need to re-evaluate their strategic importance and potential for future growth.

Services with Low Differentiation or High Competition

These are services where Alten faces a crowded marketplace, making it tough to stand out. Think of basic IT support or general engineering tasks; many companies offer them, leading to a race to the bottom on price. This often results in squeezed profits and makes it hard to gain significant market traction.

In 2024, the global IT services market, particularly for commoditized offerings, continued to see intense competition. Companies in this space often operate with gross margins in the 10-20% range, reflecting the pressure from numerous providers. For instance, basic cloud migration or managed IT services can attract hundreds of vendors, diluting the market share for any single entity.

- Commoditization: Generic IT and engineering services lack unique value propositions, leading to price-based competition.

- Low Growth Segments: These services often reside in mature or slow-expanding market areas.

- Diminishing Margins: Intense competition drives down profitability, making these offerings less attractive for investment.

- Low Market Share: The high number of competitors prevents any single player from dominating, resulting in fragmented market share.

Divested or Non-Strategic Subsidiaries

Alten's strategic review in late 2024 led to the divestiture of a subsidiary in Asia, specifically China. This move aligns with the concept of divested or non-strategic subsidiaries within the BCG matrix, typically characterized by low market share and low growth prospects. Such actions signal a focus on optimizing the company's portfolio by shedding underperforming or non-core assets.

This divestiture, likely involving a unit with limited growth potential and a small market footprint, allows Alten to redirect capital and management attention towards more promising business segments. For instance, if the divested Asian unit represented less than 5% of Alten's overall revenue and had a projected annual growth rate below 3%, it would fit the profile of a divested subsidiary. This strategic pruning aims to improve overall profitability and resource allocation efficiency.

The decision to divest highlights a proactive approach to portfolio management, ensuring that Alten concentrates on areas offering higher returns and strategic alignment. This is crucial for maintaining a competitive edge in the dynamic IT consulting and engineering sectors.

- Divestiture Rationale: Alten divested a subsidiary in China at the end of 2024, signaling a strategic decision to exit markets or business units deemed non-core or underperforming.

- BCG Matrix Alignment: This action categorizes the divested unit as a 'Dog' or a non-strategic asset, typically exhibiting low market share and low growth potential.

- Resource Reallocation: Such divestitures enable Alten to cut losses and reallocate valuable resources, including capital and management expertise, to more profitable and strategically important ventures.

- Financial Impact: While specific financial details of the divestiture are not public, such moves generally aim to improve overall profitability and streamline operations by shedding units with limited future prospects.

Dogs represent business units or services with low market share in slow-growing industries. These offerings typically generate just enough revenue to cover their costs, offering little to no profit. For Alten, this could include niche legacy system support or highly commoditized IT services where competition is fierce and margins are thin. For example, in 2024, basic IT support services, a crowded market, often saw gross margins between 10-20%, highlighting the profitability challenges.

Question Marks

Emerging technologies like quantum computing and metaverse applications represent potential future growth areas for Alten, but they currently fall into the Question Marks category of the BCG matrix. While Alten is actively investing in AI, these other nascent technologies are still in their infancy regarding widespread client adoption.

Alten likely has specialized teams or is conducting pilot projects in these domains, acknowledging their high-growth potential. However, their current market share in these sectors is minimal, demanding significant investment to achieve scalability and broader market penetration.

Alten's strategic push into new, untapped geographic markets in Asia and Africa by 2025 positions these ventures as potential Stars or Question Marks within the BCG framework. The company's ambition to open 20 new offices underscores a significant investment in these regions.

These emerging markets, while brimming with high growth potential, present a challenge for Alten due to its currently low market share. This scenario aligns with the characteristics of Question Marks, where substantial investment is needed to build a stronger market position.

By 2024, emerging markets in Asia and Africa are projected to contribute significantly to global GDP growth, with some regions experiencing double-digit expansion rates. For instance, sub-Saharan Africa's digital economy is expected to reach $712 billion by 2050, highlighting the vast untapped potential Alten is targeting.

Alten's presence across the life sciences, excluding medical R&D, positions it to capitalize on the growing trend of R&D outsourcing and digitization. Niche areas with high market growth potential but a smaller current footprint for Alten represent strategic opportunities for focused investment to capture market share.

Within specialized R&D outsourcing in non-medical life sciences, areas like agricultural biotechnology and industrial biotechnology are experiencing significant expansion. For instance, the global agricultural biotechnology market was valued at approximately USD 46.6 billion in 2023 and is projected to grow substantially, driven by demand for sustainable farming practices and enhanced crop yields.

Advanced Mobility Solutions Beyond Traditional Automotive

Alten's expansion into advanced mobility solutions beyond traditional automotive engineering, such as ADAS, EV R&D, and hydrogen technology, positions it for future growth. While these are high-potential areas, they also represent segments where Alten may currently be a challenger rather than a market leader, facing established specialized players. Significant investment in specialized expertise and innovative solutions will be crucial for Alten to solidify its leadership in these evolving sectors.

- ADAS Development: Focus on expanding capabilities in sensor fusion, AI-driven perception, and control systems to enhance safety and autonomy.

- EV Technology: Deepen expertise in battery management systems, powertrain optimization, and charging infrastructure integration.

- Hydrogen Mobility: Invest in fuel cell technology development, hydrogen storage solutions, and the integration of hydrogen powertrains into various vehicle types.

- Market Share Growth: Strategically target key automotive manufacturers and emerging mobility providers to capture market share in these specialized domains.

New Service Offerings in Response to Regulatory Changes (e.g., specific ESG standards)

The increasing focus on Environmental, Social, and Governance (ESG) criteria, driven by regulatory shifts like the EU's Sustainable Finance Disclosure Regulation (SFDR), is opening up significant new market opportunities. Alten, recognizing this, is likely developing specialized consulting services to help clients navigate these complex requirements and integrate ESG principles into their operations. This positions them in a nascent but rapidly expanding sector.

- New Regulatory Landscape: Regulations such as the SFDR, implemented in phases starting in 2021 and continuing through 2024, mandate enhanced disclosure of sustainability risks and impacts for financial market participants.

- Market Opportunity: The global ESG consulting market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 15% through 2030, creating a high-growth potential area.

- Alten's Potential Position: While Alten may currently hold a relatively small market share in this specific niche, their ability to effectively market and scale these new ESG-focused offerings could lead to substantial growth and market penetration.

- Service Offerings: These new services could include ESG strategy development, data collection and reporting frameworks, supply chain sustainability assessments, and green finance advisory.

Question Marks represent areas with high growth potential but low current market share, requiring significant investment to capture a larger piece of the market. For Alten, these include emerging technologies like quantum computing and metaverse applications, as well as new geographic markets in Asia and Africa.

The company's strategic expansion into these nascent sectors, such as agricultural and industrial biotechnology, and advanced mobility solutions like ADAS, EV R&D, and hydrogen technology, signifies their recognition of future growth opportunities. Effectively navigating these segments, which often involve specialized R&D and a competitive landscape with established players, will be key to transforming them from Question Marks into Stars.

Alten's foray into ESG consulting, driven by evolving regulations like the EU's SFDR, also fits the Question Mark profile. The global ESG consulting market is expanding rapidly, projected to grow at over 15% CAGR through 2030. While Alten's current share in this niche may be small, strategic investment in these services could lead to substantial market penetration and future success.

| Category | Alten's Position | Market Growth Potential | Investment Need | Strategic Focus |

|---|---|---|---|---|

| Emerging Technologies (Quantum, Metaverse) | Low Market Share, Nascent Adoption | High | Significant Investment | R&D, Pilot Projects |

| New Geographic Markets (Asia, Africa) | Low Market Share | High (e.g., Sub-Saharan Africa digital economy to reach $712B by 2050) | Substantial Investment | Market Penetration, Office Expansion |

| Specialized Life Sciences (Agri/Industrial Biotech) | Niche Focus, Growing Demand | High (Global Agri-Biotech market ~$46.6B in 2023) | Focused Investment | Capture Market Share |

| Advanced Mobility (ADAS, EV, Hydrogen) | Challenger Position, Evolving Sector | High | Specialized Expertise Investment | Solidify Leadership |

| ESG Consulting | Small Current Share, Rapidly Expanding Sector | Very High (15%+ CAGR projected) | Scalability Investment | Service Development, Market Scaling |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitor analysis, to accurately position business units.