ALS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALS Bundle

Uncover the critical strengths and potential challenges facing ALS in the market. Our comprehensive SWOT analysis reveals the internal capabilities and external forces shaping its future. Ready to gain a strategic advantage?

Dive deeper into ALS's market position with our full SWOT analysis. This in-depth report provides actionable insights, competitive context, and strategic takeaways—essential for informed decision-making.

Want the complete picture of ALS's opportunities and threats? Purchase the full SWOT analysis to access a professionally crafted, editable report designed to empower your strategic planning and investment strategies.

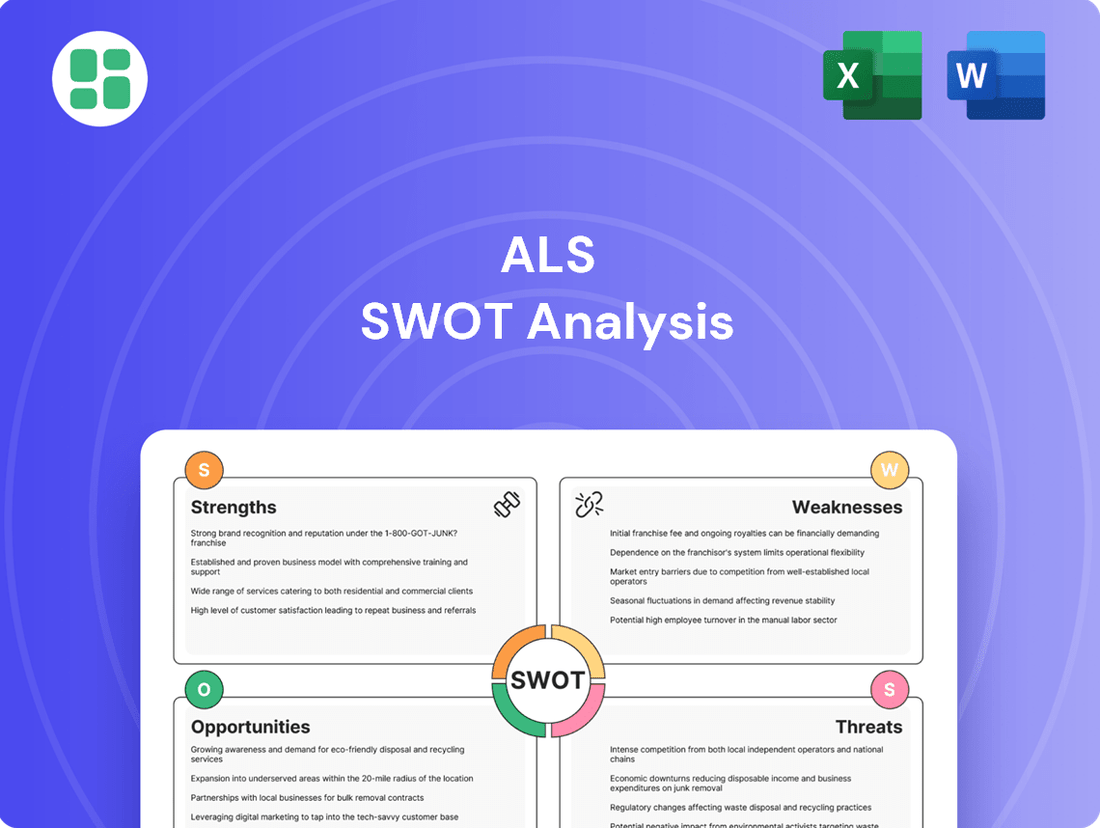

Strengths

ALS Limited stands as a formidable global leader in the Testing, Inspection, and Certification (TIC) industry. Their extensive service offering covers a wide array of analytical testing, crucial for sectors such as mining, environmental monitoring, food safety, and pharmaceuticals. This broad operational scope across multiple industries is a significant strength, providing a buffer against downturns in any single market.

The company's diversified portfolio is further bolstered by its extensive global footprint. With operations spanning over 420 sites across more than 70 countries, ALS effectively taps into diverse markets and client needs. This international presence not only broadens their customer base but also allows for the strategic deployment of local expertise, enhancing service delivery and market penetration.

ALS's critical and essential services are a significant strength, as they are often non-discretionary. This means demand remains relatively stable, even during economic slowdowns, because clients need these services for regulatory compliance, quality assurance, and safety. For instance, in 2023, ALS reported a strong performance in its laboratory services segment, which underpins many of these essential functions, reflecting the consistent need for their expertise.

The indispensable nature of ALS's offerings, particularly in ensuring client compliance and providing vital data for decision-making, creates a resilient business model. This resilience is a key advantage, as industries across the globe rely on ALS for critical testing and analysis to operate safely and legally. Their role in supporting these fundamental operational requirements translates into a dependable revenue stream.

ALS has cultivated a formidable brand and reputation for quality, service, and technical prowess over 45 years, underpinned by advanced technology and innovative approaches. This deep-seated trust and recognition are vital in the Testing, Inspection, and Certification (TIC) sector, where precision and dependability are non-negotiable. For instance, in 2023, ALS reported a revenue of AUD 2.2 billion, reflecting the significant market trust in their services.

Strategic Acquisitions and Growth Initiatives

ALS actively pursues strategic acquisitions to bolster its market position and service portfolio. This proactive approach has seen them expand into key growth sectors like environmental testing and life sciences. For instance, in 2024, ALS completed the acquisitions of York Analytical Laboratories and Wessling Holding GmbH & Co. KG, significantly broadening their geographic footprint and technical expertise.

These strategic moves are designed to enhance revenue streams and integrate new capabilities. The company's focus on high-growth markets, coupled with a consistent acquisition strategy, positions ALS for sustained expansion and increased market share.

- Geographic Expansion: Acquisitions like Wessling Holding GmbH & Co. KG in Germany enhance ALS's European presence.

- Service Portfolio Enhancement: The acquisition of York Analytical Laboratories in 2024 strengthens their environmental testing capabilities in North America.

- Revenue Growth Contribution: These strategic acquisitions are directly contributing to ALS's overall revenue growth trajectory.

Commitment to Sustainability and Innovation

ALS is demonstrating a strong commitment to sustainability, aiming to achieve Net Zero emissions by 2040. This dedication is reflected in their ongoing initiatives to minimize their environmental footprint across operations. For instance, in 2023, they reported a 5% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2022 baseline.

Their investment in innovation is a key strength, with significant capital allocated to integrating advanced technologies like artificial intelligence and machine learning. These advancements are specifically designed to boost the efficiency and precision of their analytical testing services. By the end of 2024, ALS anticipates these technologies will contribute to a 10% improvement in sample turnaround times.

This dual focus on sustainability and technological advancement positions ALS favorably within a market increasingly prioritizing ESG factors. Their proactive approach to reducing environmental impact and enhancing service delivery through cutting-edge technology aligns with major global trends, supporting their long-term growth trajectory and competitive advantage.

- Net Zero Target: ALS committed to achieving Net Zero emissions by 2040.

- Emission Reduction: Achieved a 5% reduction in Scope 1 and 2 emissions in 2023.

- AI/ML Investment: Significant capital allocated to AI and machine learning for testing efficiency.

- Efficiency Gains: Expected 10% improvement in sample turnaround times by end of 2024 due to new technologies.

ALS's extensive global reach, with over 420 sites in more than 70 countries, allows them to serve diverse markets and clients effectively. Their critical and essential services, such as mining, environmental, food, and pharmaceutical testing, ensure stable demand even during economic downturns due to regulatory and safety requirements. The company's strong brand reputation, built over 45 years on quality and technical expertise, fosters significant market trust.

ALS actively strengthens its market position and service offerings through strategic acquisitions, as seen with the 2024 additions of York Analytical Laboratories and Wessling Holding GmbH & Co. KG, enhancing their environmental testing and European presence. Furthermore, their commitment to sustainability, targeting Net Zero by 2040 and having already reduced Scope 1 and 2 emissions by 5% in 2023, aligns with growing market preferences. Investments in advanced technologies like AI and machine learning are projected to improve testing efficiency by 10% by the end of 2024.

| Strength | Description | Supporting Data/Examples |

|---|---|---|

| Global Footprint | Extensive international operations providing market diversification. | Over 420 sites in more than 70 countries. |

| Essential Services | Demand for testing, inspection, and certification is consistently high due to regulatory needs. | Strong performance in laboratory services segment reported in 2023. |

| Brand Reputation | Long-standing trust built on quality, service, and technical capabilities. | Revenue of AUD 2.2 billion in 2023 reflects market confidence. |

| Strategic Acquisitions | Growth through acquiring companies to expand service portfolios and geographic reach. | Acquisitions of York Analytical Laboratories and Wessling Holding GmbH & Co. KG in 2024. |

| Sustainability Focus | Commitment to environmental responsibility and emission reduction targets. | Net Zero target by 2040; 5% reduction in Scope 1 & 2 emissions in 2023. |

| Technological Innovation | Investment in AI and machine learning to enhance operational efficiency. | Expected 10% improvement in sample turnaround times by end of 2024. |

What is included in the product

Analyzes ALS’s competitive position through key internal and external factors, identifying strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable framework for identifying and addressing ALS challenges, easing the burden of complex strategic planning.

Weaknesses

While ALS has diversified, its Commodities segment, especially minerals, is still subject to the ups and downs of global exploration and commodity prices. This means that when commodity prices drop, sample volumes can decrease, directly affecting ALS's revenue and profits. For example, in the first half of 2024, the company noted that slower client spending in the mining sector, driven by commodity price uncertainty, impacted its Commodities segment's performance.

ALS's recent strategic acquisitions, though aimed at expanding its market reach, have presented a short-term challenge to its operating margins. For instance, the integration of the large diagnostics business in late 2023 incurred significant restructuring expenses, which contributed to a 150-basis point decline in operating margin for the first half of 2024 compared to the previous year.

Furthermore, the debt financing for these acquisitions has led to increased interest expenses, impacting earnings per share. In Q2 2024, interest costs rose by approximately $15 million year-over-year, directly reducing net income and making the acquisitions earnings dilutive in the immediate aftermath.

ALS Limited faces significant financial hurdles due to the demanding capital expenditure required to operate its global network of advanced testing laboratories. Maintaining cutting-edge equipment, implementing new technologies, and ensuring facilities are up to par are ongoing, substantial costs.

This continuous investment in infrastructure directly impacts operational costs, potentially constraining immediate cash flow that could otherwise be allocated to growth initiatives or shareholder distributions. For instance, in fiscal year 2023, ALS reported capital expenditure of AUD 209.4 million, highlighting the scale of these ongoing financial commitments.

Intense Competition in the TIC Market

The Testing, Inspection, and Certification (TIC) market is incredibly crowded, featuring a mix of large global companies and many smaller, specialized firms. This means ALS faces constant pressure from established giants like SGS, Bureau Veritas, and Intertek, all vying for the same business. Such intense rivalry can lead to price wars, squeezing profit margins and making it harder to grow market share without significant investment in differentiation and operational efficiency.

Key competitors in the global TIC sector include:

- SGS: A Swiss multinational corporation providing a broad range of services including inspection, verification, testing and certification.

- Bureau Veritas: A French company offering services in quality, health, safety, and environmental (QHSE) and social responsibility.

- Intertek: A British multinational assurance, inspection, product testing and certification company.

The fragmented nature of the market, with many regional and local players, further intensifies competition. This requires ALS to not only compete on a global scale but also to adapt to diverse local market dynamics and regulatory landscapes, demanding agility and a deep understanding of specific regional needs to maintain a competitive edge and secure profitable contracts.

Regulatory and Compliance Complexity

Operating globally, ALS faces the significant challenge of navigating a patchwork of international regulations and industry-specific compliance standards. This complexity demands substantial resources for monitoring and adherence, creating a constant risk of penalties or reputational harm if not managed diligently. For instance, in 2024, the global regulatory compliance market was valued at an estimated $50.7 billion, highlighting the scale of this challenge.

The need to comply with diverse rules, from data privacy in Europe (GDPR) to environmental standards in Asia, strains operational budgets and requires specialized legal and compliance expertise. Failure to keep pace with evolving legislation, such as the anticipated updates to financial reporting standards in 2025, could lead to significant fines or operational disruptions.

- Navigating diverse international regulations poses a significant operational and financial burden.

- Resource allocation for compliance monitoring and adaptation is a constant challenge.

- Risk of penalties and reputational damage due to non-compliance is a persistent threat.

- Keeping abreast of evolving global compliance landscapes, like upcoming financial reporting changes in 2025, requires continuous investment.

ALS operates in a highly competitive Testing, Inspection, and Certification (TIC) market, facing pressure from global giants like SGS, Bureau Veritas, and Intertek, as well as numerous smaller, specialized firms. This intense rivalry can lead to price wars and hinder market share growth, demanding continuous investment in differentiation and efficiency. The need to adapt to diverse local market dynamics and regulatory landscapes further complicates global operations and requires significant resources.

The company's reliance on commodity prices, particularly in its minerals segment, exposes it to revenue volatility. Fluctuations in global exploration and commodity prices directly impact sample volumes and, consequently, ALS's financial performance. For instance, slower client spending in the mining sector during the first half of 2024, attributed to commodity price uncertainty, negatively affected the Commodities segment.

ALS faces substantial capital expenditure requirements to maintain its global network of advanced testing laboratories. These ongoing investments in equipment, technology, and facilities, exemplified by the AUD 209.4 million capital expenditure in fiscal year 2023, impact operational costs and can constrain immediate cash flow for other strategic initiatives.

The integration of recent acquisitions, while expanding market reach, has temporarily impacted operating margins and profitability. Significant restructuring expenses from the late 2023 diagnostics business acquisition led to a 150-basis point decline in operating margin in the first half of 2024. Furthermore, debt financing for these acquisitions increased interest expenses by approximately $15 million year-over-year in Q2 2024, diluting earnings per share.

Preview Before You Purchase

ALS SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

Stricter regulations worldwide are a major tailwind for Testing, Inspection, and Certification (TIC) services. For instance, in 2024, the global TIC market was valued at approximately $230 billion, with a projected compound annual growth rate of over 5% through 2029, largely fueled by these evolving compliance needs.

This increasing regulatory burden, especially in critical sectors like food safety and automotive emissions, directly translates into sustained demand for ALS's expertise. Heightened consumer awareness about product quality and safety further amplifies this trend, creating consistent opportunities for ALS to leverage its core competencies.

Emerging markets in Asia-Pacific, Africa, and Latin America are experiencing significant industrialization and developing regulatory landscapes, creating a fertile ground for ALS's testing, inspection, and certification (TIC) services. This growth translates to increased demand for quality assurance and compliance solutions.

ALS's established global footprint provides a strategic advantage for penetrating these burgeoning economies. By leveraging existing infrastructure and expertise, ALS can effectively tap into new client segments and secure a strong market position in these high-growth regions.

For instance, the Asia-Pacific region alone is projected to see a compound annual growth rate of over 6% in the TIC market through 2025, driven by stricter environmental regulations and rising consumer demand for product safety. This presents a substantial opportunity for ALS to expand its service offerings and client base.

The integration of AI, ML, IoT, and blockchain is transforming the TIC sector, boosting efficiency and precision. ALS can leverage these technologies to create new testing methods, streamline operations, and provide clients with valuable data-driven insights. For instance, AI-powered predictive maintenance in industrial testing can reduce downtime by an estimated 20-30%.

By adopting these advanced tools, ALS can enhance its service offerings, potentially increasing its market share in specialized testing segments. The global TIC market was valued at approximately $220 billion in 2023 and is projected to grow significantly, with technological innovation being a key driver.

Increased Focus on ESG and Sustainability Testing

The global push for sustainability, environmental responsibility, and ethical business practices is a significant opportunity for ALS. This trend fuels a rising demand for ESG certifications, environmental impact assessments, and testing for products marketed as eco-friendly.

ALS is strategically positioned to capitalize on this by broadening its service offerings. Areas such as verifying carbon footprints, ensuring sustainable supply chains, and conducting crucial PFAS testing, a market experiencing rapid growth, represent key expansion avenues. For instance, the global ESG reporting software market was valued at USD 1.2 billion in 2023 and is projected to grow significantly, indicating a strong demand for the services ALS can provide.

- Growing Demand for ESG: Increased investor and consumer focus on environmental, social, and governance factors drives demand for related testing and certification services.

- Expansion in Environmental Audits: ALS can leverage its expertise to offer more comprehensive environmental audits and impact assessments for businesses seeking to demonstrate sustainability.

- PFAS Testing Growth: The market for testing chemicals like PFAS, due to increasing regulatory scrutiny and public awareness, presents a substantial growth opportunity for ALS's analytical capabilities.

- Carbon Footprint Verification: As companies commit to net-zero targets, the need for independent verification of their carbon footprints will rise, directly benefiting ALS's services.

Strategic Mergers and Acquisitions (M&A)

The testing, inspection, and certification (TIC) market remains quite fragmented, particularly in specific niches. This presents a continuous avenue for ALS to pursue strategic bolt-on acquisitions. These acquisitions are key to broadening ALS's service offerings, growing its footprint in important geographical areas, and bringing in new technologies or specialized knowledge, all of which reinforce its leading market position.

For instance, ALS completed several acquisitions in 2023 and early 2024, including the acquisition of a specialized environmental testing laboratory in Europe, which expanded its capabilities in PFAS analysis. The global TIC market was valued at approximately USD 220 billion in 2023 and is projected to grow at a CAGR of around 5% through 2028, according to industry reports. This growth underscores the potential for consolidation.

- Expand Service Portfolio: Acquisitions can integrate niche testing services, like advanced materials characterization or specialized food safety testing, into ALS's existing framework.

- Geographic Market Share Growth: Acquiring regional players allows ALS to quickly gain traction and market share in underserved or high-growth geographies.

- Technology and Expertise Integration: Targeted acquisitions can bring in cutting-edge analytical technologies or deep expertise in emerging fields such as AI-driven quality control or advanced cybersecurity testing.

- Synergistic Operational Efficiencies: Merging operations can lead to cost savings through economies of scale and the optimization of laboratory networks and administrative functions.

The increasing global demand for environmental, social, and governance (ESG) compliance and verification services presents a significant growth avenue for ALS. As companies worldwide prioritize sustainability and ethical practices, the need for independent assessment of carbon footprints, supply chain integrity, and eco-friendly product claims is escalating. This trend is further amplified by growing consumer and investor pressure for transparency and accountability in corporate environmental impact.

The market for specialized testing, such as PFAS analysis, is experiencing rapid expansion due to heightened regulatory scrutiny and public awareness. ALS is well-positioned to capitalize on this by broadening its service offerings in these critical areas, including verifying carbon footprints and ensuring sustainable supply chains. For example, the global ESG reporting software market was valued at USD 1.2 billion in 2023, indicating a strong demand for the services ALS can provide to help companies meet these reporting requirements.

ALS's strategic approach to acquisitions in the fragmented Testing, Inspection, and Certification (TIC) market allows for expansion of its service portfolio, geographic reach, and technological capabilities. By integrating niche testing services and acquiring regional players, ALS can quickly enhance its market share and operational efficiencies. For instance, the global TIC market, valued at approximately USD 220 billion in 2023, continues to offer opportunities for consolidation that align with ALS's growth strategy.

| Opportunity Area | Market Driver | ALS Relevance |

|---|---|---|

| ESG Compliance & Verification | Investor/Consumer Demand for Sustainability | Broadening service offerings in carbon footprint verification and supply chain audits. |

| PFAS Testing | Regulatory Scrutiny & Public Awareness | Expanding analytical capabilities in high-growth specialized testing segments. |

| Emerging Market Growth | Industrialization & Developing Regulations | Leveraging global footprint for expansion in Asia-Pacific, Africa, and Latin America. |

| Technological Integration | Efficiency & Precision in TIC | Adopting AI, ML, IoT for new testing methods and data-driven insights. |

| Strategic Acquisitions | Market Fragmentation | Integrating niche services, expanding geographic presence, and acquiring new technologies. |

Threats

Economic downturns pose a significant threat to ALS. A global or regional economic slowdown can directly impact client spending on testing and inspection services. Industries like mining and manufacturing, which are sensitive to economic cycles, may reduce their demand for ALS's services, leading to lower sample volumes and revenue. For instance, a projected slowdown in global GDP growth for 2024-2025 could translate into reduced capital expenditure by mining companies, a key customer segment for ALS.

The rapid evolution of testing technologies presents a significant threat. If ALS doesn't adopt advanced methodologies or digital solutions at the same pace as competitors, it risks falling behind. For instance, the global laboratory information management systems (LIMS) market, which supports such advancements, was projected to reach approximately $1.3 billion in 2024, indicating substantial investment in this area by the industry.

Competitors leveraging new automation or AI-driven diagnostic tools could gain a substantial edge, potentially eroding ALS's market share. Failure to invest in and integrate these innovations could result in a loss of competitive advantage, forcing costly catch-up investments later.

The testing, inspection, and certification (TIC) market is intensely competitive, with established giants like SGS, Bureau Veritas, and Eurofins Scientific actively pursuing aggressive strategies. These major players, along with emerging entrants, can exert significant price pressure, potentially squeezing ALS's profit margins. For instance, in 2023, the TIC market was valued at approximately $220 billion, highlighting the scale of competition.

Regulatory Changes or Reduced Compliance Requirements

Changes in regulatory landscapes, particularly any significant deregulation or simplification of testing and certification requirements within ALS's key operating sectors, pose a notable threat. For instance, a reduction in the stringency of environmental standards or product safety laws could directly decrease the demand for the specialized analytical services ALS provides.

Furthermore, shifts in industry-specific compliance mandates could negatively impact ALS's revenue streams. For example, if a major industry served by ALS sees a rollback of its mandatory testing protocols, this could lead to a substantial contraction in business. In 2024, the global regulatory compliance market was valued at approximately $73.5 billion, with potential for shifts based on governmental policy changes.

- Reduced Demand: Deregulation in sectors like environmental testing or food safety could lessen the need for ALS's core services.

- Impact on Revenue: Changes in product safety laws or industry-specific certifications might directly reduce the volume of testing contracts.

- Market Volatility: Evolving compliance requirements create uncertainty, potentially affecting long-term revenue projections for ALS.

Reputational Risk from Testing Errors or Data Breaches

ALS's reputation, crucial for its role as a data and certification provider, is vulnerable to testing errors or data breaches. A single significant mistake in testing, inspection, or certification could erode client confidence. For instance, in 2024, the cybersecurity firm Mandiant reported a 20% increase in data breaches compared to the previous year, highlighting the pervasive threat across industries.

Such failures can lead to severe consequences, including financial penalties and a substantial loss of existing and future business. Clients rely on ALS for accuracy and security; any lapse jeopardizes this trust. In 2023, the average cost of a data breach globally reached $4.45 million, according to IBM's Cost of a Data Breach Report, a figure that underscores the financial implications of security failures.

- Reputational Damage: Errors in testing or data breaches can irrevocably harm ALS's standing in the market.

- Client Trust Erosion: Clients depend on the integrity of ALS's data and certifications; breaches undermine this fundamental reliance.

- Financial Repercussions: Beyond direct financial penalties, lost business and remediation costs from breaches can be substantial.

- Increased Scrutiny: A significant incident could lead to heightened regulatory oversight and more rigorous auditing processes for ALS.

Geopolitical instability and supply chain disruptions present a significant threat to ALS's global operations. Trade wars, regional conflicts, or natural disasters can impede the movement of samples, equipment, and personnel. For example, ongoing geopolitical tensions in key resource-rich regions could impact the mining sector's exploration activities, a vital client base for ALS's analytical services. The World Bank's projections for 2024-2025 indicate continued global economic uncertainty, which can exacerbate these supply chain vulnerabilities.

The increasing prevalence of cyber threats poses a substantial risk to ALS. As a data-intensive business, the integrity and security of client information are paramount. A successful cyberattack could lead to data breaches, service interruptions, and significant reputational damage. In 2024, cybersecurity firm Mandiant noted a continued rise in sophisticated ransomware attacks targeting critical infrastructure and service providers, underscoring the heightened risk environment.

| Threat Category | Specific Risk | Potential Impact on ALS | Example Data/Context (2024-2025) |

|---|---|---|---|

| Economic Factors | Global/Regional Economic Downturns | Reduced client spending, lower sample volumes, decreased revenue from cyclical industries (e.g., mining). | Projected slowdown in global GDP growth for 2024-2025 impacting capital expenditure. |

| Technological Advancements | Failure to adopt new testing technologies/digital solutions | Loss of competitive advantage, reduced efficiency, potential market share erosion. | Global LIMS market projected to reach ~$1.3 billion in 2024, indicating rapid technological investment. |

| Competitive Landscape | Aggressive strategies from major TIC players | Price pressure, margin erosion, difficulty in retaining market share. | TIC market valued at ~$220 billion in 2023, signifying intense competition. |

| Regulatory Environment | Deregulation or rollback of compliance mandates | Decreased demand for specialized analytical services, reduced revenue streams. | Global regulatory compliance market valued at ~$73.5 billion in 2024, subject to policy shifts. |

| Operational Risks | Testing errors, data breaches, cybersecurity incidents | Reputational damage, loss of client trust, financial penalties, increased operational costs. | Average cost of a data breach globally reached $4.45 million in 2023; 20% increase in reported breaches in 2024. |

| Geopolitical/Supply Chain | Trade wars, regional conflicts, natural disasters | Disruptions to sample/equipment movement, increased logistics costs, reduced client activity. | Continued global economic uncertainty projected for 2024-2025. |

SWOT Analysis Data Sources

This ALS SWOT analysis is built upon a robust foundation of data, drawing from financial reports, comprehensive market research, and expert opinions to ensure a well-rounded and strategic assessment.