ALS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALS Bundle

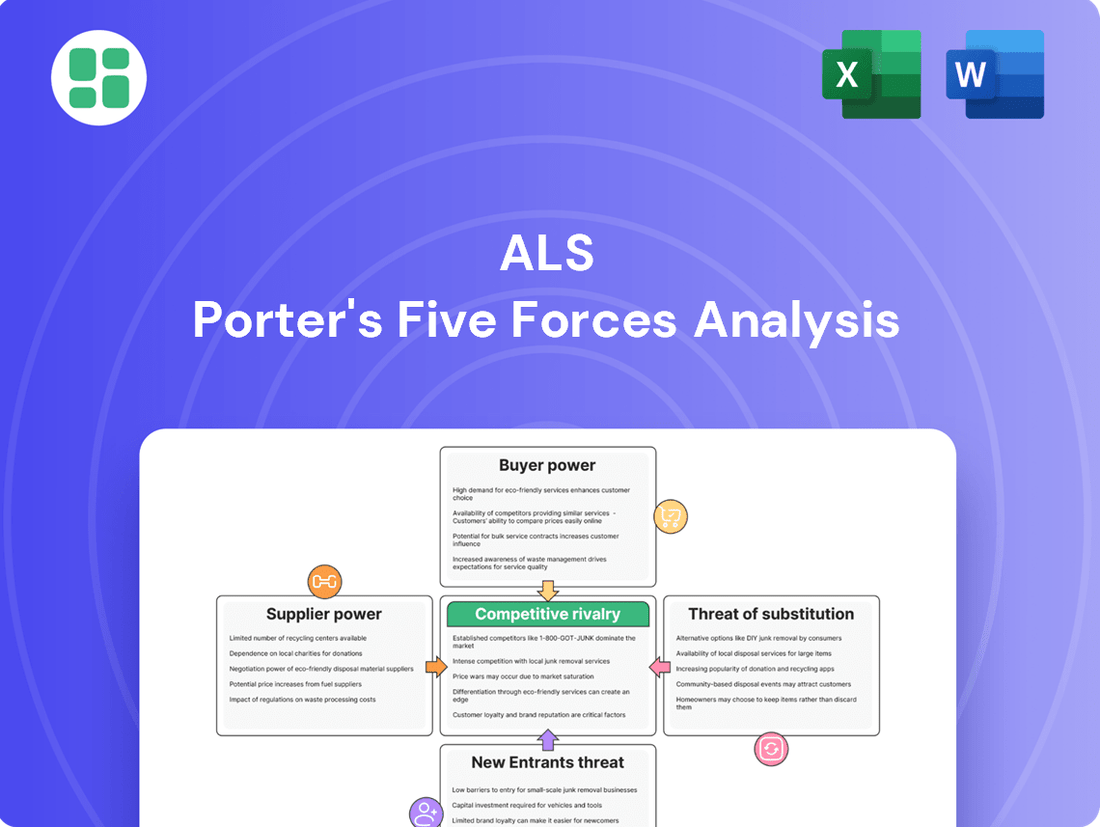

A Porter's Five Forces analysis for ALS reveals the intricate web of competitive pressures shaping its industry. Understanding the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ALS’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of highly specialized analytical equipment and unique chemical reagents possess significant bargaining power. This leverage stems from the proprietary nature and substantial cost associated with these essential inputs, which are critical for ALS's accurate and compliant testing across its broad service spectrum. For instance, in 2023, the global market for analytical instruments saw continued growth, with specialized chromatography and mass spectrometry equipment commanding premium prices due to their advanced capabilities and limited manufacturers.

The availability of highly skilled personnel, such as geochemists and microbiologists, is critical for ALS's operations. Universities and vocational training centers are the main sources for this talent. A scarcity of specialized skills in particular fields can significantly boost the bargaining power of these human capital suppliers.

To attract and retain top talent, ALS must offer competitive salaries and benefits. For instance, in 2024, the average salary for a senior geochemist in Australia, a key market for ALS, ranged from AUD 120,000 to AUD 160,000 annually, reflecting the high demand for these specialized skills.

Accreditation and certification bodies, like ISO and NATA, hold considerable sway over ALS, even though they aren't typical suppliers. These organizations set the benchmarks and conduct the audits that are essential for ALS to operate and maintain its reputation. Their stringent requirements and associated fees represent a fixed cost of business, directly impacting ALS's operational expenses and its need to invest in robust quality management systems.

IT Infrastructure and Software Providers

The bargaining power of IT infrastructure and software providers for a company like ALS is significant, especially as data management, digital solutions, and cybersecurity are paramount for global operations and client reporting. ALS relies heavily on these specialized providers for data integrity, operational efficiency, and secure client communication. This reliance can translate into considerable leverage for the suppliers.

The increasing demand for sophisticated enterprise software and cloud services means that ALS's dependence on specific providers can give them a notable degree of power. For instance, in 2024, the global cloud computing market was projected to reach over $1.3 trillion, highlighting the scale of investment and reliance on these services. Switching costs associated with migrating complex IT systems and software can be substantial, further strengthening the suppliers' position.

- High Switching Costs: Migrating enterprise resource planning (ERP) systems or core customer relationship management (CRM) software often involves significant time, expense, and potential disruption to operations, making it difficult for ALS to switch providers easily.

- Specialized Solutions: Many IT infrastructure and software providers offer highly specialized solutions tailored to specific industry needs, such as those in financial services. This specialization can limit the availability of viable alternatives for ALS.

- Criticality of Services: The essential nature of IT infrastructure and software for data integrity, security, and client communication means ALS cannot afford service interruptions, giving providers leverage in negotiations.

Utility and Specialized Service Providers

For laboratory operations, the consistent and reliable access to essential utilities such as electricity, water, and specialized waste disposal services is absolutely critical. Disruptions in these services can halt operations entirely, making companies highly dependent on their providers.

In certain geographical areas, utility providers or specialized service firms may operate as monopolies or oligopolies. This limited competition grants them significant bargaining power, which they can leverage to dictate pricing and service terms, directly impacting a laboratory's operating costs.

Furthermore, the outsourcing of non-core but vital services, like logistics or facility maintenance, can foster supplier dependencies. When a laboratory relies heavily on external entities for these functions, those suppliers gain leverage, potentially influencing contract renewals and service level agreements.

- Critical Reliance: Laboratories depend on uninterrupted utility services like electricity and water, with specialized waste disposal being a non-negotiable requirement for safe operations.

- Regional Monopolies: In some regions, a limited number of utility or waste management providers hold monopolistic or oligopolistic control, enabling them to exert substantial bargaining power on pricing and contract terms.

- Outsourcing Dependencies: The trend of outsourcing non-core functions such as logistics and facility maintenance creates dependencies on these service providers, potentially increasing their leverage.

Suppliers of specialized analytical equipment and chemicals hold significant power due to the proprietary nature and high costs of these critical inputs for ALS's testing services. For example, in 2023, the global analytical instrument market saw premium pricing for advanced chromatography and mass spectrometry equipment from limited manufacturers.

The bargaining power of suppliers is amplified when ALS faces high switching costs for specialized IT solutions or when suppliers operate as regional monopolies for essential utilities. This dependence allows suppliers to influence pricing and service terms, directly impacting ALS's operational expenses and efficiency.

| Supplier Type | Factors Influencing Bargaining Power | Impact on ALS |

|---|---|---|

| Specialized Equipment & Chemicals | Proprietary nature, high costs, limited manufacturers | Increased input costs, potential operational constraints |

| Skilled Personnel | Scarcity of specialized skills (e.g., geochemists) | Higher labor costs, competition for talent |

| IT Infrastructure & Software | High switching costs, specialized solutions, criticality of services | Vendor lock-in, negotiation leverage for providers |

| Utilities & Waste Disposal | Regional monopolies, critical reliance for operations | Vulnerability to price hikes, potential service disruptions |

What is included in the product

Analyzes ALS's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Quickly identify and address competitive threats with a visual breakdown of each of Porter's Five Forces, simplifying complex market dynamics.

Customers Bargaining Power

ALS's diverse customer base, encompassing mining, environmental, food, and pharmaceutical sectors, significantly dilutes individual customer bargaining power. This broad reach means that the loss of any single client, or even a few within a sector, is unlikely to cripple ALS's revenue streams. For instance, in the fiscal year 2024, ALS reported that its largest single customer represented less than 5% of its total revenue, underscoring this diversification.

For many of ALS's clients, the testing, inspection, and certification services are absolutely critical for meeting regulatory compliance, ensuring product safety, and managing significant risks. This means the consequences of inaccurate results are very high.

Because of these high stakes, customers are less likely to switch to a different provider just because of a small price difference. They often prioritize the perceived quality and trustworthiness of the service over minor cost savings.

This fundamental need for validated, dependable data significantly limits the bargaining power of customers. For example, in the food testing sector, a single compliance failure can lead to massive recalls and reputational damage, making ALS's established reputation for accuracy a key differentiator.

While switching basic testing providers might involve moderate costs, transitioning critical or highly specialized analytical services can present significant switching costs for customers. These costs include the expense and time associated with re-validating new laboratories, updating internal processes and software, and establishing new trust relationships. For instance, in industries like pharmaceuticals or environmental monitoring where regulatory compliance is paramount, the cost of re-validating a new analytical service provider for critical testing can run into tens of thousands of dollars, impacting project timelines and requiring extensive documentation updates.

Client In-House Testing Capabilities

The bargaining power of customers is significantly influenced by their ability to conduct testing in-house. Large clients, especially in sectors like pharmaceuticals and high-volume manufacturing, can establish their own testing laboratories. This capability directly constrains ALS's pricing power, particularly for routine analytical services. For instance, a major pharmaceutical company might invest in its own QC labs, reducing its reliance on external providers for standard assays.

The threat of clients performing testing internally acts as a natural ceiling on ALS's pricing power for less specialized or high-volume tests. This means ALS needs to consistently prove its value proposition beyond mere execution. Clients will only outsource if ALS can offer demonstrable advantages in efficiency, specialized expertise, or overall cost-effectiveness compared to their own internal operations. This competitive pressure requires ALS to remain agile and innovative in its service offerings and pricing structures.

- Client In-House Testing Capabilities: Large clients, particularly in pharmaceuticals and high-volume manufacturing, may possess or develop their own testing labs.

- Pricing Power Constraint: This internal capability limits ALS's ability to raise prices, especially for routine or less specialized tests.

- Value Justification: ALS must demonstrate superior efficiency, specialized expertise, or cost-effectiveness to justify outsourcing over in-house testing.

- Market Dynamics: The ongoing trend in some industries towards greater vertical integration can increase the intensity of this customer bargaining power.

Price Sensitivity vs. Value Proposition

Customer bargaining power at ALS is significantly influenced by price sensitivity, which in turn is tied to the nature of the testing services required. For routine, high-volume tests, customers often exhibit greater price sensitivity and actively seek competitive pricing, which can increase their bargaining power.

Conversely, for specialized, urgent, or complex analytical needs, ALS's value proposition becomes a more dominant factor. The company's expertise, rapid turnaround times, and extensive global network can mitigate price sensitivity, thereby diminishing customer bargaining power.

- Price Sensitivity in Commoditized Testing: For standard analytical tests, customers frequently compare prices across providers, making them more susceptible to price-based decisions.

- Value Proposition for Specialized Services: In cases requiring advanced scientific knowledge or critical, time-sensitive results, the perceived value of ALS's capabilities often overrides minor price differences.

- Impact on ALS's Pricing Strategy: This dynamic allows ALS to potentially command premium pricing for its specialized services while remaining competitive in more commoditized segments.

The bargaining power of ALS's customers is generally low to moderate. This is primarily due to the critical nature of the services provided, high switching costs for specialized testing, and ALS's diversified client base. While price sensitivity exists for routine tests, the need for accuracy and reliability in regulatory-driven sectors limits customers' ability to solely negotiate on price.

| Factor | Impact on Customer Bargaining Power | ALS's Mitigation Strategy |

|---|---|---|

| Diversified Customer Base | Lowers impact of any single customer | Broad industry reach reduces reliance on any one sector |

| Criticality of Services | Reduces price sensitivity | Emphasis on accuracy, compliance, and risk management |

| Switching Costs (Specialized Services) | Increases costs for customers to change providers | Investment in specialized equipment and expertise |

| In-house Testing Capabilities | Potential for increased bargaining power | Focus on value-added services beyond basic testing |

| Price Sensitivity (Routine Tests) | Increases bargaining power for standard services | Competitive pricing for commoditized offerings |

What You See Is What You Get

ALS Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive ALS Porter's Five Forces Analysis provides a detailed examination of the competitive landscape, including threats of new entrants, bargaining power of buyers and suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors, all presented in a professionally formatted and ready-to-use file.

Rivalry Among Competitors

ALS faces fierce competition from major diversified players like SGS, Bureau Veritas, Intertek, and Eurofins Scientific. These companies, with extensive global reach, directly vie for market share across similar service offerings, intensifying the rivalry.

The Testing, Inspection, and Certification (TIC) market, where ALS operates, is seeing consolidation but remains highly competitive. This dynamic involves not only the large global entities but also numerous regional and specialized players, creating a complex competitive landscape.

For instance, the global TIC market was valued at approximately $220 billion in 2023 and is projected to grow, indicating significant revenue pools that attract and sustain numerous competitors. This scale allows for intense head-to-head competition for contracts and clients.

Competitive rivalry in the ALS sector extends far beyond mere pricing. Companies vie for market share based on their reputation, the accreditations they hold, the speed of their service delivery, the breadth of their global network, their specialized technical skills, and the quality of their customer support. ALS, for instance, leverages its profound expertise in niche areas such as mining and environmental analysis to stand out.

ALS further distinguishes itself by providing holistic, integrated solutions rather than isolated tests. This capability to offer a complete package, from initial sample collection to final reporting, strengthens its market position. The capacity to perform unique or highly specialized tests acts as a significant deterrent to direct competitive attacks, as rivals may lack the necessary technology or expertise.

The overall Testing, Inspection, and Certification (TIC) market is experiencing robust growth, projected to reach approximately $290 billion by 2025, up from an estimated $240 billion in 2022. This expansion is fueled by increasingly stringent global regulations and a growing emphasis on product safety and quality, which can temper intense rivalry by widening the market. For instance, new EU regulations on sustainable products are creating new service opportunities within the TIC sector.

Mergers and Acquisitions Activity

The TIC (Testing, Inspection, and Certification) industry is experiencing robust merger and acquisition (M&A) activity. Larger entities are consistently acquiring smaller, specialized firms or expanding their reach into new geographical markets and service offerings. This consolidation trend highlights a highly competitive environment where companies are actively pursuing market power, enhanced capabilities, and the removal of rivals.

ALS, a prominent player in this sector, has itself been a participant in strategic acquisitions. This proactive approach to M&A underscores the company's commitment to strengthening its competitive position and adapting to evolving market demands. For instance, in 2024, ALS announced several key acquisitions aimed at bolstering its laboratory network and expanding its service portfolio in high-growth regions.

- Increased Consolidation: M&A activity leads to fewer, larger competitors, potentially increasing pricing power and reducing the bargaining power of customers.

- Capability Enhancement: Acquisitions allow companies to quickly gain new technologies, expertise, and market access that would be time-consuming to develop internally.

- ALS's Strategic Moves: ALS's own acquisition history demonstrates a strategy of inorganic growth to complement organic expansion and maintain a competitive edge.

Regional and Niche Players

Beyond the major global players, ALS contends with a multitude of regional and niche laboratories. These smaller entities often compete by offering more attractive pricing, quicker local turnaround times, or highly specialized expertise within particular geographic regions or technical fields. For instance, in 2024, many smaller environmental testing labs in Australia, a key market for ALS, were observed to offer pricing up to 15% lower for standard soil analysis compared to larger, more broadly focused competitors.

These agile, localized competitors can represent a substantial threat within their specific markets. Their ability to be more responsive to local client needs and leverage deeper, established relationships within their communities allows them to capture market share, particularly for routine testing or in areas where specialized local knowledge is paramount. This dynamic was evident in the European market in early 2024, where several boutique food safety testing labs gained traction by focusing on specific regional allergens, a niche ALS also serves but with a broader global approach.

- Cost Advantage: Regional labs often have lower overheads, enabling them to undercut larger competitors on price for standard services.

- Turnaround Time: Proximity to clients allows for faster sample processing and reporting, crucial in time-sensitive industries.

- Specialized Expertise: Niche players focus on specific analytical techniques or industry sectors, offering deep knowledge that can be highly valued.

- Local Relationships: Strong ties with local businesses and regulatory bodies can provide a competitive edge in specific markets.

Competitive rivalry within the Testing, Inspection, and Certification (TIC) sector is intense, driven by a mix of global giants and specialized regional players. ALS faces direct competition from major diversified companies like SGS, Bureau Veritas, Intertek, and Eurofins Scientific, all of whom offer similar services across a wide geographic reach.

The market's projected growth, estimated to reach around $290 billion by 2025, attracts numerous competitors, leading to fierce competition not just on price but also on reputation, accreditations, and service breadth. For instance, in 2024, smaller Australian environmental labs offered pricing up to 15% lower for standard soil analysis compared to larger competitors.

Mergers and acquisitions are a significant feature of this competitive landscape, with larger firms acquiring smaller ones to enhance capabilities and market access, as seen with ALS's own strategic acquisitions in 2024 to bolster its laboratory network.

Regional and niche laboratories also pose a threat by offering cost advantages, faster turnaround times, and specialized expertise, particularly in local markets where they can leverage established relationships and cater to specific client needs.

| Competitor | Market Presence | Key Differentiators | 2024 Strategic Focus Example |

|---|---|---|---|

| SGS | Global Diversified | Extensive network, broad service portfolio | Acquisition of specialized compliance firms |

| Bureau Veritas | Global Diversified | Strong in certification, industrial services | Expansion in digital testing solutions |

| Intertek | Global Diversified | Consumer goods testing, quality assurance | Investment in AI-driven analytics |

| Eurofins Scientific | Global Diversified | Life sciences, food and environmental testing | Opening new advanced genomics labs |

| Regional/Niche Labs | Local/Specialized | Cost-effectiveness, faster local turnaround, niche expertise | Focus on specific regional regulations (e.g., EU sustainable products) |

SSubstitutes Threaten

The most significant substitute for ALS's external testing services is a client's decision to build or enhance their own in-house laboratory facilities. This is especially true for large companies with steady, high-volume testing requirements or those needing extremely fast turnaround times.

Companies might invest in their own labs to achieve better control, lower long-term costs, or safeguard sensitive information. For instance, a major mining operation might find it more cost-effective to set up its own geochemical analysis lab if its annual testing volume exceeds 50,000 samples, a threshold where in-house operational costs could potentially undercut external provider fees.

Advancements in sensor technology and portable analytical devices present a growing threat of substitutes for traditional laboratory services. For instance, the global market for IoT sensors, which enable real-time monitoring, was projected to reach over $115 billion in 2024, indicating a significant shift towards decentralized data collection.

These technologies, while often complementary, can reduce the need for external laboratory testing in areas like environmental monitoring and quality control. Companies are increasingly adopting on-site testing solutions, potentially decreasing the volume of samples sent to labs.

The increasing sophistication and accessibility of these alternative monitoring methods pose a long-term substitute threat, as they offer faster results and potentially lower costs for certain analytical needs.

The threat of substitutes for ALS's testing, inspection, and certification (TIC) services is growing, particularly through self-certification and internal audits. In sectors with less stringent regulations, companies may opt for internal quality assurance processes over independent third-party verification. This trend could reduce the demand for external TIC services, especially for less critical parameters. For example, a 2024 survey indicated that over 30% of small to medium-sized enterprises in the manufacturing sector are increasing their reliance on internal quality control mechanisms to manage costs.

Reduced Scope or Frequency of Testing

Clients might reduce their reliance on ALS's testing services if they perceive lower risks, experience a relaxation of regulatory requirements, or face pressure to cut costs. This isn't a direct replacement for the testing itself but a decrease in the demand for it. For instance, if a major industry client facing economic headwinds in 2024 decides to cut its annual environmental monitoring program by 20%, this directly impacts ALS's service volume.

ALS counters this by highlighting the ongoing importance of its services for risk management, ensuring regulatory compliance, and supporting crucial data-driven business decisions. Even with reduced testing, the quality and insights provided remain paramount. For example, ALS’s 2023 annual report noted that while some clients adjusted testing frequencies, the demand for specialized analytical services, critical for compliance, remained robust.

- Reduced Testing Scope: Clients may opt for less frequent or less comprehensive testing to save costs.

- Perceived Lower Risk: A decrease in perceived environmental or safety risks can lead clients to scale back testing programs.

- Regulatory Easing: Changes in regulations that reduce mandatory testing requirements directly impact demand.

- Cost Optimization: In challenging economic periods, testing services can be a target for budget reductions, impacting ALS's revenue streams.

Digital Platforms and Data Analytics

The rise of digital platforms offering predictive analytics and data aggregation presents a potential, albeit niche, substitute for certain aspects of traditional physical testing. These platforms can provide alternative methods for risk assessment and quality assurance by leveraging historical data, potentially reducing the perceived necessity for some physical evaluations.

For instance, in 2024, the global market for business analytics software was projected to reach over $34 billion, indicating a significant shift towards data-driven decision-making. While these digital tools can offer valuable insights, they do not fully replace the empirical validation provided by physical testing, which remains crucial for confirming real-world performance and safety.

In specific sectors, such as certain material science applications or product development cycles, digital simulations and AI-driven forecasting might offer preliminary insights that could offset the need for extensive initial physical trials. However, final validation and regulatory compliance often still necessitate rigorous physical testing protocols.

- Digital platforms offer predictive analytics as a potential substitute for some physical testing insights.

- These platforms can provide alternative risk assessment and quality assurance methods.

- The business analytics software market was projected to exceed $34 billion in 2024.

- Physical testing remains critical for empirical validation and regulatory compliance.

The threat of substitutes for ALS's services is multifaceted, primarily stemming from clients' inclination towards in-house capabilities and the growing adoption of advanced digital and portable testing technologies. While these substitutes may not entirely replicate the breadth and depth of ALS's offerings, they can erode demand for specific services, particularly in cost-sensitive or high-volume scenarios.

Clients building their own labs or utilizing on-site monitoring solutions can reduce their reliance on external providers like ALS. For instance, in 2024, the increasing affordability and accuracy of portable spectrometers allow some field service companies to conduct basic material identification on-site, bypassing the need for laboratory analysis for preliminary checks.

Furthermore, the expansion of digital platforms offering predictive analytics presents an alternative for risk assessment, potentially diminishing the perceived necessity for some physical testing. The global market for business analytics software, projected to exceed $34 billion in 2024, highlights this shift towards data-driven insights that can, in some cases, supplement or preempt traditional lab work.

The decision to reduce testing scope or frequency due to cost pressures or perceived lower risks also acts as a substitute threat. For example, if a client cuts their annual environmental monitoring program by 15% in 2024 due to budget constraints, this directly impacts the volume of work available for ALS.

| Substitute Type | Key Drivers | Impact on ALS | Example (2024 Data) |

|---|---|---|---|

| In-house Laboratories | Cost control, faster turnaround, data security | Reduced demand for routine testing | Large mining firms investing in own geochemical labs for >50,000 annual samples |

| Portable/On-site Tech | Real-time data, convenience, cost savings | Decreased need for sample dispatch | Field service companies using portable spectrometers for basic material ID |

| Digital Analytics/AI | Predictive insights, risk assessment | Potential reduction in preliminary testing | Business analytics software market projected >$34 billion |

| Reduced Testing Scope | Cost optimization, perceived lower risk | Lower service volumes | Client cutting environmental monitoring by 15% due to budget cuts |

Entrants Threaten

Entering the Technical, Inspection, and Certification (TIC) industry, particularly for a company aiming for a comprehensive service portfolio like ALS, demands a significant capital outlay. This includes acquiring specialized laboratory equipment, cutting-edge analytical instruments, and sophisticated information technology systems.

The substantial upfront investment required to establish a presence in the TIC sector, especially for a broad service provider, acts as a major deterrent to potential new competitors. For instance, setting up a single advanced materials testing lab can cost millions of dollars, and a company like ALS operates numerous such facilities globally.

The necessity for multiple, highly specialized laboratories across different disciplines further escalates the capital expenditure. This high barrier to entry, driven by the sheer cost of infrastructure and technology, effectively limits the number of new players capable of competing directly with established firms.

New entrants confront a formidable challenge in securing necessary accreditations, such as ISO 17025 for testing and calibration laboratories or Good Laboratory Practice (GLP) and Good Manufacturing Practice (GMP) for life sciences. These certifications are not merely optional; they are fundamental for establishing credibility and gaining client trust, particularly in highly regulated sectors. The process demands substantial investment in time, financial resources, and specialized expertise, effectively acting as a significant deterrent.

The need for specialized expertise presents a significant hurdle for new entrants in the TIC (Testing, Inspection, and Certification) industry. Building a team of highly skilled scientists, chemists, geologists, and other technical specialists is a complex and costly endeavor. This human capital requirement is a substantial barrier because the industry's success hinges on deep domain knowledge and technical proficiency to ensure accurate results and foster client confidence.

Established Reputation and Client Trust

In the Testing, Inspection, and Certification (TIC) sector, client trust and a proven track record are paramount, especially for critical services where accuracy and reliability are non-negotiable. Established players like ALS have built strong reputations over decades, making it difficult for new entrants to quickly gain credibility and win over risk-averse clients. Building this trust requires a significant investment of time and consistent performance.

Newcomers face substantial hurdles in replicating the deep-seated client relationships and brand loyalty that companies like ALS have cultivated. For instance, ALS's extensive history, dating back to 1987, has allowed it to embed itself within various industries, becoming a go-to provider for essential compliance and quality assurance. This established reputation acts as a significant barrier, as clients often prioritize proven reliability over the potentially lower costs or novel approaches offered by new entrants.

- Reputation as a Barrier: Decades of consistent, high-quality service have cemented ALS's position, making it challenging for new firms to gain immediate market acceptance.

- Client Risk Aversion: In critical sectors, clients are hesitant to switch from trusted providers to unproven entities, even for potential cost savings.

- Time and Investment: Building a comparable level of trust and a verifiable track record for a new entrant would require substantial time and capital investment.

- Industry Integration: ALS's long-standing presence means it is deeply integrated into client operations and regulatory frameworks, a position difficult to displace.

Economies of Scale and Scope

Incumbent laboratories like ALS benefit significantly from economies of scale, which allows them to spread fixed costs over a larger volume of testing. For instance, bulk purchasing of essential reagents and consumables in 2024 could reduce per-unit costs by as much as 15-20% compared to a smaller, new entrant. This cost advantage is further amplified by optimized, high-throughput laboratory processes and centralized administrative functions.

Economies of scope also provide a substantial barrier. ALS can cross-sell its environmental, food and pharmaceutical testing services to existing clients, leveraging established relationships and infrastructure. A new entrant would need to invest heavily to replicate this diverse service offering, making it difficult to compete on breadth and convenience from the outset.

- Economies of Scale: Bulk purchasing of reagents can lead to cost savings of 15-20% for established players like ALS in 2024.

- Process Optimization: High-throughput workflows and centralized management reduce operational costs for incumbents.

- Economies of Scope: Cross-selling across environmental, food, and pharmaceutical sectors leverages existing client bases and infrastructure.

- New Entrant Disadvantage: New companies face higher per-unit costs and lack the immediate service diversity to compete effectively.

The threat of new entrants in the Testing, Inspection, and Certification (TIC) sector is significantly mitigated by high capital requirements and the need for specialized accreditations. Establishing advanced laboratories and obtaining certifications like ISO 17025 demands millions in investment and considerable time, creating a substantial barrier. Furthermore, the necessity of building a skilled workforce and cultivating client trust over years makes it difficult for newcomers to challenge established players like ALS, who benefit from economies of scale and scope.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | Acquisition of specialized lab equipment, IT systems | High upfront cost, limits market entry | Setting up a single advanced materials testing lab can exceed $5 million. |

| Accreditations & Certifications | ISO 17025, GLP, GMP | Time-consuming and costly to obtain, essential for credibility | Gaining ISO 17025 accreditation can take 12-18 months and cost tens of thousands of dollars. |

| Expertise & Human Capital | Skilled scientists, chemists, geologists | Difficult and expensive to recruit and retain | Salaries for experienced TIC professionals can range from $70,000 to $150,000+ annually. |

| Reputation & Client Trust | Established track record, brand loyalty | Challenging for new entrants to build quickly | ALS, founded in 1987, has cultivated decades of client relationships. |

| Economies of Scale/Scope | Bulk purchasing, process optimization, cross-selling | Cost advantage for incumbents, difficult for new firms to match | Incumbents can achieve 15-20% lower per-unit costs on reagents due to bulk buying. |

Porter's Five Forces Analysis Data Sources

Our ALS Porter's Five Forces analysis leverages data from industry-specific market research reports, financial statements of leading ALS providers, and regulatory filings to gauge competitive intensity and industry attractiveness.