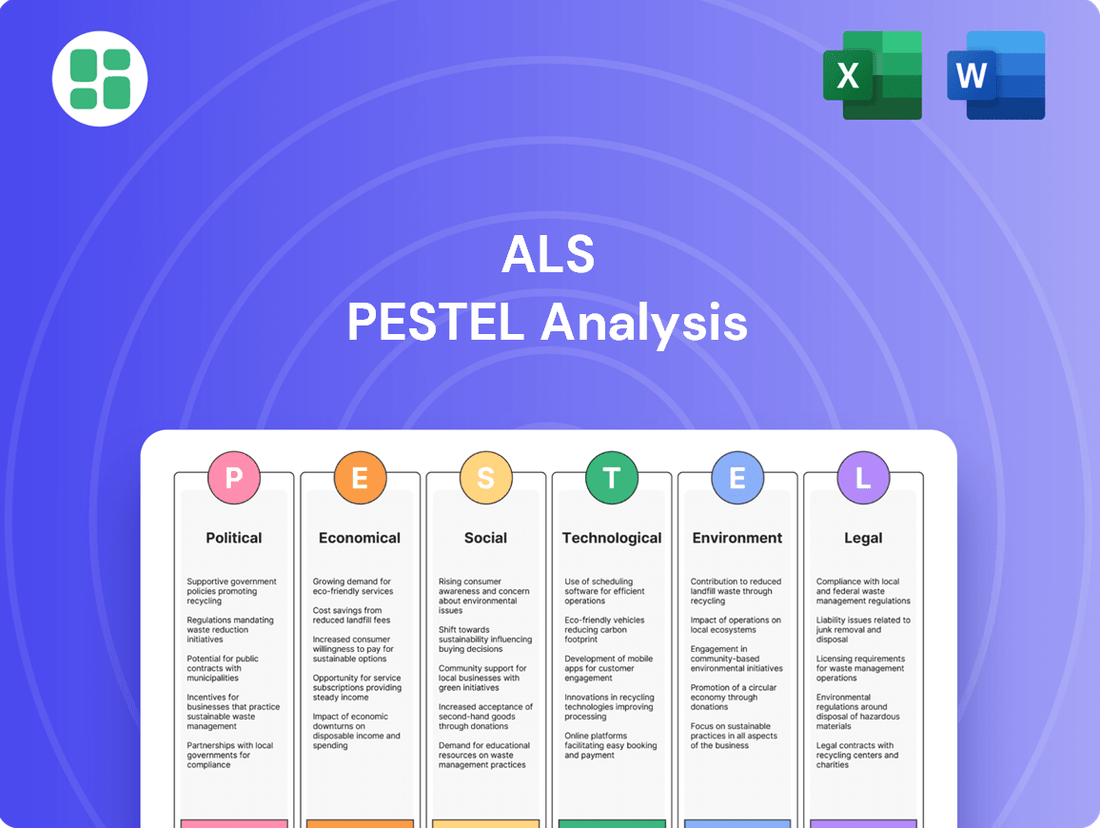

ALS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALS Bundle

Navigate the complex external landscape impacting ALS with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping its future. Gain a critical advantage by leveraging these expert insights for your strategic planning. Download the full version now and unlock actionable intelligence to drive your success.

Political factors

Governments globally are tightening rules in areas like food safety, pharma, and environmental standards, which directly affects companies like ALS Limited. For instance, new FSMA rules expected in 2025 will demand more rigorous testing and certification, creating a need for ALS's specialized services to ensure compliance and sidestep fines.

International trade policies and the push for global harmonization of standards significantly impact ALS's cross-border activities. As supply chains grow more complex, the demand for universally accepted certifications and testing methods rises, compelling ALS to align its services with various national and international regulations.

For instance, the European Union's revised CE marking directives and North America's emphasis on Environmental, Social, and Governance (ESG) compliance illustrate how international collaboration shapes the testing, inspection, and certification (TIC) sector. In 2024, the World Trade Organization (WTO) reported that trade facilitation measures, aimed at streamlining customs procedures, could reduce trade costs by an average of 14.3% globally.

Political stability in regions where ALS operates, especially in mining and commodities, directly influences business continuity and investment. Geopolitical tensions can disrupt client operations and resource access, impacting ALS's service delivery. For instance, in 2024, several African nations with significant mining operations experienced heightened political uncertainty, leading to temporary shutdowns and impacting demand for analytical services.

Government Spending on Infrastructure and Environmental Projects

Government investments in infrastructure development, environmental remediation, and public health are creating substantial opportunities for ALS's environmental and life sciences segments. For instance, the United States' Infrastructure Investment and Jobs Act, enacted in 2021, allocates over $550 billion for infrastructure upgrades, with a significant portion dedicated to clean water and environmental protection. This increased public funding for water quality testing, pollution control, and public health surveillance directly fuels demand for ALS's analytical and consulting services, driving growth in these critical areas.

These government priorities are shaping specific avenues for ALS's expansion. For example, in 2024, many nations are increasing budgets for climate resilience and adaptation projects, which often include extensive environmental monitoring and impact assessment requirements. ALS's expertise in these fields positions it to benefit from this trend, with projected growth in its environmental division driven by these governmental initiatives.

- Government spending on infrastructure, particularly in water and environmental projects, directly boosts demand for ALS's analytical services.

- The US Infrastructure Investment and Jobs Act is a key driver, with over $550 billion allocated to infrastructure upgrades, including environmental components.

- Increased national budgets for climate resilience in 2024 are expected to further enhance demand for ALS's environmental monitoring and assessment capabilities.

Consumer Product Safety Commission Priorities

The Consumer Product Safety Commission (CPSC) is ramping up its efforts, with a strong focus on stricter enforcement and new regulations. For instance, eFiling requirements for imported goods are set to become mandatory in 2026, signaling a significant shift in compliance for many businesses.

This increased attention to product safety, covering areas like chemical testing and child-resistant packaging, means companies must invest in more thorough testing and certification processes. For 2025, the CPSC's agenda highlights consistent enforcement, particularly targeting e-commerce platforms.

- Increased CPSC Enforcement: Expect more rigorous checks and penalties for non-compliance in 2025 and beyond.

- E-Filing Mandate (2026): Companies importing products will need to adapt to new electronic filing procedures.

- Focus on Chemical Safety and Child Resistance: Regulations in these areas are tightening, requiring enhanced product development and testing.

- E-commerce Platform Scrutiny: Online retailers face heightened oversight regarding the safety of the products they sell.

Governmental regulatory shifts significantly influence ALS Limited's operational landscape, particularly in food safety and environmental compliance. For example, new FSMA rules anticipated in 2025 will necessitate more stringent testing, directly benefiting ALS's specialized services.

International trade policies and the drive for harmonized standards are crucial for ALS's global operations. The increasing complexity of supply chains amplifies the need for universally recognized certifications, pushing ALS to adapt its services to diverse regulations.

Political stability in key operating regions, especially those with substantial mining activities, directly impacts ALS's business continuity and investment climate. Geopolitical instability can disrupt client operations, affecting demand for analytical services, as seen with heightened political uncertainty in some African mining nations during 2024.

Government investments in infrastructure and environmental initiatives present significant growth opportunities for ALS. The US Infrastructure Investment and Jobs Act, with over $550 billion allocated for upgrades including environmental protection, is a prime example of how public spending fuels demand for ALS's environmental and life sciences segments.

| Policy Area | Impact on ALS | Example/Data Point |

|---|---|---|

| Food Safety Regulations | Increased demand for testing and certification | FSMA rules expected 2025 |

| Environmental Standards | Growth in environmental monitoring services | US Infrastructure Act ($550B+) |

| Trade Facilitation | Streamlined cross-border operations | WTO estimates 14.3% reduction in trade costs |

| Political Stability (Mining) | Risk to service delivery in unstable regions | African mining nations faced uncertainty in 2024 |

What is included in the product

This comprehensive PESTLE analysis systematically examines the external macro-environmental factors impacting the ALS across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and data-driven evaluations to identify strategic opportunities and mitigate potential risks for the ALS.

Provides a clear, actionable framework to identify and address external threats and opportunities, reducing the anxiety of navigating an unpredictable business landscape.

Economic factors

Global economic growth is a significant driver for ALS, as its services are crucial for industries like mining, manufacturing, and construction. When economies expand, these sectors tend to increase their output and investment, directly boosting demand for ALS's testing, inspection, and certification (TIC) services. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight uptick from 2023, signaling a potentially more robust environment for ALS's client industries.

Industrial activity, a key indicator for ALS, is closely tied to this global economic health. Higher industrial production often translates to more demand for raw materials, requiring exploration and quality control, areas where ALS excels. In 2024, manufacturing PMIs in many developed economies showed signs of stabilization or modest recovery, which bodes well for ALS's revenue streams from these sectors.

Fluctuations in global commodity prices, especially for minerals and metals, directly impact ALS's substantial commodities division. For instance, the price of copper, a key metal for electrification, saw significant upward movement in early 2024, reaching over $9,000 per tonne, which benefits companies involved in its extraction and processing, and by extension, their need for analytical services.

A robust mining sector, fueled by the escalating demand for critical minerals essential for the green energy transition and the burgeoning electronics market, translates into greater exploration activities, increased production volumes, and consequently, a higher demand for ALS's crucial analytical testing services. The global market for battery metals like lithium and cobalt is projected to expand considerably through 2030, indicating sustained demand for related testing.

While 2024 presented difficulties for mining companies focused on commodities other than gold, the long-term forecast for critical minerals remains exceptionally positive. The International Energy Agency’s 2024 report highlighted that demand for minerals like cobalt could increase by over 20 times by 2040 in clean energy technologies, underscoring the sector's enduring importance and the related opportunities for analytical service providers.

Rising inflation presents a significant challenge for ALS, potentially increasing expenses for essential inputs like energy, laboratory materials, and employee compensation. For instance, the US Producer Price Index (PPI) for chemicals, a key input for many lab services, saw a notable increase in early 2024, impacting operational costs.

Effectively navigating these cost pressures requires ALS to implement robust strategies. This includes optimizing supply chain management, exploring energy efficiency measures, and carefully considering price adjustments for its services to maintain healthy profit margins amidst rising inflation.

A critical factor for ALS's profitability will be its capacity to pass on these increased operational costs to its clients through adjusted service fees. The competitive landscape and client sensitivity to price hikes will heavily influence the success of such pricing strategies throughout 2024 and into 2025.

Client Industry Investment Cycles

ALS's revenue is closely linked to the investment patterns within its client industries. When sectors like pharmaceutical research and development, infrastructure projects, or the introduction of new consumer products see increased spending, ALS benefits from a greater demand for its analytical testing, consulting, and certification services. For instance, the global pharmaceutical analytical testing market is expected to expand considerably, with projections indicating a compound annual growth rate (CAGR) of around 7.5% through 2034, fueled by robust R&D activities and evolving regulatory landscapes.

This correlation means that economic upturns or specific industry-driven growth spurts directly translate into higher business volumes for ALS. Conversely, economic slowdowns or reduced investment in these key sectors can dampen demand for ALS's offerings.

- Pharmaceutical R&D Spending: Increased funding for drug discovery and development directly boosts demand for analytical services.

- Infrastructure Investment: Government and private sector spending on new construction and upgrades drives demand for materials testing and environmental analysis.

- New Product Launches: Companies investing in bringing new products to market require extensive testing and quality assurance.

- Regulatory Compliance: Stricter regulations in client industries often necessitate more sophisticated and frequent analytical testing.

Currency Fluctuations and Exchange Rates

Currency fluctuations present a significant challenge for ALS Limited, a global player. As of late 2024, the Australian Dollar (AUD) has shown volatility against major trading currencies like the US Dollar and the Euro. This means that revenue earned in foreign currencies might translate into fewer AUD when reported, impacting the company's bottom line. For instance, if the AUD strengthens considerably, ALS's overseas earnings, when converted back, will appear smaller.

These exchange rate movements also directly affect the competitiveness of ALS's services. A stronger AUD can make its offerings more expensive for international clients, potentially leading to a loss of business to local competitors. Conversely, a weaker AUD could make ALS's services more attractive abroad. The company's financial statements for the fiscal year ending June 30, 2024, indicated a notable impact from foreign exchange on its reported profits, with specific figures detailed in its annual report.

ALS's exposure is further amplified by its debt. Holding debt in various currencies means that changes in exchange rates can alter the real cost of servicing that debt. For example, if ALS has significant debt denominated in a currency that appreciates against the AUD, the cost of repaying that debt in AUD terms will increase, adding to financial pressure.

- Impact on Reported Earnings: ALS's reported profits are directly affected by the translation of foreign currency revenues and expenses.

- Competitive Positioning: Exchange rate shifts can make ALS's services more or less expensive for international customers, influencing market share.

- Debt Servicing Costs: Fluctuations in currency values alter the AUD equivalent cost of servicing debt held in foreign currencies.

- 2024 Financial Impact: ALS's FY24 financial results highlighted the tangible effects of currency movements on its performance.

Global economic expansion fuels demand for ALS's services, particularly in mining and construction, as seen in the IMF's 2024 global growth projection of 3.2%. Industrial activity, a direct indicator for ALS, showed stabilization in manufacturing PMIs across developed economies in 2024, supporting revenue streams. Commodity prices, especially for key metals like copper, which reached over $9,000 per tonne in early 2024, positively impact ALS's commodities division.

The mining sector's reliance on critical minerals for green energy is a strong growth driver, with battery metals demand projected to rise significantly through 2030. Despite challenges in some commodity sub-sectors in 2024, the long-term outlook for minerals like cobalt, potentially seeing a twenty-fold increase in demand by 2040 according to the IEA, remains robust.

Inflation poses a cost challenge for ALS, with US PPI for chemicals showing increases in early 2024, impacting operational expenses. ALS must manage these costs through supply chain optimization and potential price adjustments, with success depending on client sensitivity and competitive pressures in 2024-2025.

Pharmaceutical R&D spending, projected to grow at a CAGR of around 7.5% through 2034, directly boosts demand for ALS's analytical testing services, alongside infrastructure investment and new product launches. Currency fluctuations, particularly the volatility of the AUD against currencies like the USD in late 2024, directly impact ALS's reported earnings and competitive positioning.

What You See Is What You Get

ALS PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive ALS PESTLE Analysis covers all key external factors influencing the ALS sector, providing valuable strategic insights.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll get a detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental aspects impacting ALS, ensuring you have a complete understanding.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis is designed to be a practical tool for strategic planning and decision-making within the ALS landscape.

Sociological factors

Consumers are increasingly demanding safe, high-quality, and traceable products, particularly in sectors like food and pharmaceuticals. This heightened awareness means companies must invest more in testing and certification to build trust. For instance, a 2024 survey indicated that 78% of consumers consider product safety a top priority when making purchasing decisions.

This societal shift directly fuels the demand for Testing, Inspection, and Certification (TIC) services. Manufacturers and retailers are compelled to demonstrate product integrity to meet public expectations and regulatory requirements. The global TIC market is projected to reach $295 billion by 2027, up from $240 billion in 2022, largely driven by these consumer-led quality demands.

Furthermore, increased consumer scrutiny necessitates transparent and verifiable product claims. Companies are responding by seeking third-party certifications to validate their quality and safety assurances. This trend is visible in the growing number of eco-labeling and organic certifications sought by businesses, with a reported 15% year-over-year increase in demand for such verifications in 2024.

Growing public awareness of environmental health, particularly concerning pollution's impact on well-being and the push for sustainability, is fueling a significant rise in demand for environmental testing and monitoring services. This heightened scrutiny extends to critical areas like water and air quality, soil contamination, and the detection of substances such as PFAS in both consumer goods and natural environments.

ALS Limited, a key player in this sector, is well-positioned to capitalize on this trend. As industries face increasing pressure to prove their environmental stewardship and regulatory compliance, the need for reliable testing and analysis, which ALS provides, becomes paramount. For instance, in 2023, ALS reported strong growth in its Environmental segment, driven by these very demands.

The availability of skilled laboratory professionals, scientists, and technical experts is a critical sociological factor for ALS. For instance, in 2024, the demand for specialized analytical chemists and microbiologists in the testing, inspection, and certification (TIC) sector continued to outpace supply, creating a competitive talent landscape.

Labor shortages and talent retention challenges within the specialized TIC industry can significantly impact ALS's operational capacity and service delivery timelines. Reports from early 2025 indicate that the average tenure for highly skilled laboratory technicians in the sector has decreased, necessitating increased investment in recruitment and training.

To address some of these workforce challenges, ALS, like many in the industry, is exploring automation and AI. These technologies are being implemented to alleviate stress on existing staff and improve efficiency in laboratory testing processes, with pilot programs in 2024 showing potential to reduce sample processing times by up to 15%.

Corporate Social Responsibility (CSR) and ESG Reporting

Societal expectations are increasingly shaping corporate behavior, particularly concerning Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) performance. Investors, consumers, and regulators are demanding greater accountability, influencing how companies operate and disclose their impacts. ALS's client base reflects this shift, with a growing need for services that facilitate adherence to ESG reporting standards and showcase genuine commitments to sustainability and ethical conduct.

The regulatory landscape is also evolving rapidly to mandate more robust ESG disclosures. For instance, the first wave of European Union Corporate Sustainability Reporting Directive (CSRD) reports are due in 2025, underscoring the critical need for accurate and verifiable ESG data. This regulatory push means that companies must not only report on their ESG efforts but also ensure the credibility of that information.

- Investor Demand: A 2024 survey by Morgan Stanley found that 75% of investors consider ESG factors in their investment decisions, up from 60% in 2022.

- Consumer Preference: Nielsen data from 2023 indicates that 60% of consumers are willing to pay more for products from sustainable brands.

- Regulatory Mandates: The CSRD in the EU will require approximately 50,000 companies to report on sustainability, with the first reports due in 2025 for companies already subject to non-financial reporting obligations.

- ALS's Role: ALS is positioned to assist clients in navigating these complex reporting requirements, providing the data assurance and analytical tools necessary to meet evolving ESG standards.

Ethical Sourcing and Supply Chain Transparency

Societal pressure for ethical sourcing and supply chain transparency is a significant driver for businesses today. Consumers and regulators alike are demanding greater assurance that products are made responsibly, free from issues like forced labor and with respect for human rights. This trend directly fuels the demand for specialized inspection and certification services, such as those offered by ALS, to verify these ethical standards throughout complex global supply chains.

The growing emphasis on corporate social responsibility means companies are actively seeking ways to demonstrate their commitment to ethical practices. For instance, a 2024 report indicated that over 70% of consumers are more likely to purchase from brands that are transparent about their supply chains and ethical sourcing practices. This translates into a need for robust auditing and verification services to provide that crucial client assurance.

Regulatory pressures, particularly in areas like human rights and environmental due diligence, are also accelerating this shift. Laws enacted in recent years, such as the Modern Slavery Act in the UK and similar legislation in the EU and US, mandate greater transparency and accountability for companies regarding their supply chains. These legal requirements mean that businesses must actively engage in verifying the ethical conduct of their suppliers, creating a substantial market for ALS's expertise in auditing and certification.

- Consumer Demand: A significant majority of consumers (over 70% in 2024 surveys) prioritize brands with transparent and ethical supply chains.

- Regulatory Landscape: Evolving legislation globally, including modern slavery acts and due diligence laws, mandates supply chain transparency.

- Business Imperative: Companies are increasingly integrating ethical sourcing into their core strategies to mitigate risk and enhance brand reputation.

Societal values are increasingly prioritizing health and safety, driving demand for rigorous testing and certification across various industries. Consumers are more informed and vocal, expecting transparency regarding product origins and quality, as evidenced by a 2024 survey showing 78% of consumers ranking product safety as a top purchase consideration.

This heightened public awareness directly translates into a greater need for Testing, Inspection, and Certification (TIC) services, with the global TIC market projected to reach $295 billion by 2027. Companies are responding by seeking third-party validations, with demand for eco-labeling and organic certifications seeing a 15% year-over-year increase in 2024.

The demand for skilled laboratory professionals remains a critical factor, with specialized roles in analytical chemistry and microbiology experiencing talent shortages in 2024. To counter this, companies like ALS are investing in automation and AI, with pilot programs in 2024 demonstrating potential reductions in sample processing times by up to 15%.

ESG performance is now a key societal expectation, with 75% of investors in 2024 considering ESG factors in their decisions. Regulatory mandates, such as the EU's CSRD, are further pushing companies towards robust ESG reporting, with initial reports due in 2025.

Technological factors

The integration of automation and robotics in laboratory testing is a significant technological shift, boosting efficiency and accuracy while cutting down on human error and labor expenses. For ALS, this means faster sample processing and quicker reporting, directly improving client service.

By adopting these advanced systems, ALS can scale its capacity to manage increased sample volumes, a crucial factor in maintaining a competitive edge. For instance, automated liquid handling systems can process hundreds of samples per hour, a stark contrast to manual methods.

The impact on turnaround times is substantial; automation can reduce the time from sample receipt to final report generation by as much as 50% in some analytical processes, a transformation that directly benefits ALS's operational agility and client satisfaction.

Artificial Intelligence and Machine Learning are revolutionizing data analysis within the Testing, Inspection, and Certification (TIC) sector. These technologies enable predictive maintenance, sophisticated fault detection, and enhanced diagnostic precision, significantly boosting operational efficiency and reliability. For instance, by 2024, AI is projected to drive a 15% increase in efficiency for predictive maintenance tasks in industrial settings.

ALS can leverage AI to sift through massive datasets, uncovering subtle patterns and delivering profound insights to clients. This capability directly supports more informed decision-making and robust risk management strategies. Examples include the deployment of AI-powered inspection systems and continuous, real-time compliance monitoring, which are becoming critical for industries navigating complex regulatory landscapes.

Continuous scientific progress is yielding more advanced testing methods, especially in bioanalysis and personalized medicine. For instance, the global bioanalytical testing market was valued at approximately USD 6.5 billion in 2023 and is projected to grow significantly, driven by the increasing complexity of drug development.

ALS needs to channel resources into research and development, integrating these novel techniques to stay competitive. This allows them to provide thorough solutions for intricate drug compounds, biologics, and biosimilars, keeping ALS at the leading edge of analytical science.

Digitalization of Laboratory Operations and Data Management

The ongoing digitalization of laboratory operations, propelled by advancements like Laboratory Information Management Systems (LIMS) and cloud-based data platforms, is fundamentally reshaping how companies like ALS manage their scientific data. This digital transformation directly enhances data integrity, making results more reliable and accessible, while also streamlining client communication through digital reporting. ALS can leverage this by offering clients real-time access to their test results, improving transparency and efficiency. This move towards smart laboratories fosters a more connected, adaptable, and data-driven approach to scientific research and analysis.

In 2024, the global LIMS market was valued at approximately $7.1 billion, with projections indicating continued robust growth, underscoring the industry's commitment to digitalization. ALS's strategic adoption of these technologies allows for improved turnaround times and a superior client experience. For instance, by providing clients with immediate digital access to reports, ALS can reduce administrative overhead and accelerate decision-making for its partners.

- Enhanced Data Integrity: Digital systems minimize manual errors, ensuring the accuracy and reliability of laboratory results.

- Improved Accessibility: Cloud-based platforms allow authorized personnel and clients to access data from anywhere, anytime.

- Streamlined Client Communication: Digital reports and real-time updates foster better collaboration and faster feedback loops.

- Operational Efficiency: Automation of workflows through LIMS reduces processing times and resource utilization.

Cybersecurity and Data Security

Cybersecurity and data security are critical technological factors for ALS, given its role as a data-intensive business handling sensitive client information and test results. Protecting against data breaches and ensuring the integrity and confidentiality of this data is paramount for maintaining client trust and adhering to stringent regulatory compliance standards.

ALS's commitment to robust cybersecurity measures is essential for mitigating the inherent risks associated with its digital transformation initiatives. For instance, in 2023, the global average cost of a data breach reached $4.45 million, highlighting the significant financial and reputational damage that can result from security failures. Companies like ALS must therefore prioritize investments in advanced threat detection, data encryption, and secure data storage solutions.

- Data Protection Investments: ALS is expected to continue investing in advanced cybersecurity solutions, including AI-powered threat intelligence and zero-trust architecture, to safeguard its extensive client data.

- Regulatory Compliance: Adherence to global data privacy regulations such as GDPR and CCPA remains a key focus, requiring ongoing updates to security protocols and data handling practices.

- Client Trust: Maintaining client confidence hinges on demonstrating a strong commitment to data security, which is a significant competitive differentiator in the analytical services sector.

- Risk Mitigation: Proactive cybersecurity measures are vital to prevent costly data breaches, which can lead to significant financial losses, reputational damage, and potential legal liabilities.

Technological advancements are reshaping ALS's operational landscape, driving efficiency and accuracy through automation and AI. The adoption of advanced laboratory systems, like automated liquid handlers, significantly accelerates sample processing, reducing turnaround times by up to 50% in certain analyses. AI and machine learning are enhancing data analysis, predictive maintenance, and fault detection, with AI projected to boost efficiency in these areas by 15% by 2024.

The increasing complexity of drug development fuels growth in bioanalytical testing, a sector valued at approximately USD 6.5 billion in 2023, necessitating ALS's investment in novel testing methods. Digitalization, through LIMS and cloud platforms, is improving data integrity and accessibility, with the LIMS market valued at around $7.1 billion in 2024. Robust cybersecurity is also paramount, with data breaches costing an average of $4.45 million in 2023, underscoring the need for ALS to prioritize data protection and regulatory compliance.

| Technological Factor | Impact on ALS | Supporting Data/Examples |

| Automation & Robotics | Increased sample processing speed, reduced errors, lower labor costs. | Automated systems can process hundreds of samples per hour; turnaround time reduction up to 50%. |

| Artificial Intelligence (AI) & Machine Learning (ML) | Enhanced data analysis, predictive maintenance, improved diagnostics. | AI to drive 15% efficiency increase in predictive maintenance by 2024; uncovering subtle data patterns. |

| Advanced Testing Methods | Expansion into complex analysis (e.g., biologics, personalized medicine). | Global bioanalytical testing market ~USD 6.5 billion (2023), driven by drug development complexity. |

| Digitalization (LIMS, Cloud) | Improved data integrity, accessibility, client communication. | Global LIMS market ~USD 7.1 billion (2024); real-time digital reporting. |

| Cybersecurity & Data Security | Protection of sensitive data, client trust, regulatory compliance. | Average cost of data breach $4.45 million (2023); investment in AI threat detection and zero-trust architecture. |

Legal factors

ALS navigates a stringent regulatory landscape, including critical food safety mandates like the Food Safety Modernization Act (FSMA) in the US, which saw significant updates and enforcement actions throughout 2024. Compliance with pharmaceutical quality standards, such as Good Manufacturing Practices (GMP), is also paramount, with ongoing audits and evolving guidelines impacting laboratory testing services.

Environmental regulations, particularly concerning emissions and waste disposal, directly affect ALS's operational footprint and testing methodologies, with tightening standards in major markets like the EU and North America demanding continuous investment in sustainable practices and advanced monitoring equipment. Failure to adapt to these evolving legal frameworks, including proposed changes to chemical safety regulations in late 2024, poses substantial risks to ALS's market access and reputation.

Global data privacy regulations like GDPR and CCPA significantly impact ALS. These laws mandate stringent controls over data collection, storage, processing, and sharing, directly affecting ALS's data management strategies and cross-border data transfer capabilities. Failure to comply can result in substantial fines, with GDPR penalties reaching up to 4% of global annual revenue or €20 million, whichever is higher.

Product liability and consumer protection laws are crucial for ensuring product safety and quality, making companies like ALS, which offers testing and certification, vital partners for businesses. These regulations hold manufacturers accountable, and by extension, the testing bodies that verify compliance. For instance, the U.S. Consumer Product Safety Commission (CPSC) has implemented measures like eFiling for imported products, demonstrating a trend toward heightened oversight and risk for non-compliant goods.

Anti-Bribery and Corruption Laws

As a global player in the testing, inspection, and certification (TIC) sector, ALS Limited faces significant legal obligations regarding anti-bribery and corruption. Compliance with international legislation such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act is paramount. These laws mandate stringent adherence to ethical conduct across all operations, from client interactions to supplier agreements.

Maintaining a strong reputation for integrity is crucial for ALS, especially within the highly regulated TIC industry. This necessitates the implementation of robust internal controls and thorough due diligence processes for all business dealings and partnerships. Failure to comply can result in severe penalties, including substantial fines and reputational damage, impacting investor confidence and market access. For instance, in 2023, global enforcement actions related to bribery and corruption continued to be a significant concern for multinational corporations, with billions in fines levied worldwide.

- Global Compliance: ALS must adhere to international anti-bribery and corruption laws like the FCPA and UK Bribery Act.

- Ethical Business Practices: Maintaining integrity through ethical conduct is essential for preventing legal issues.

- Internal Controls: Robust internal systems are vital to detect and prevent corrupt practices.

- Due Diligence: Thorough vetting of partners and transactions is a key risk mitigation strategy.

Intellectual Property Rights and Confidentiality

Intellectual property (IP) protection is a critical legal factor for ALS. Safeguarding its own proprietary testing methods and client-specific data is paramount, especially given the highly competitive nature of industries like pharmaceuticals and advanced materials. For instance, in 2024, the global pharmaceutical market, a key sector for ALS, was valued at over $1.5 trillion, underscoring the immense value of the confidential information ALS handles.

Maintaining strict confidentiality through robust agreements and advanced data security is essential. This legal framework prevents the unauthorized disclosure of sensitive client information, such as novel product formulations or proprietary research data. Failure to do so could lead to significant financial penalties and reputational damage.

- Protecting proprietary testing methodologies and client data.

- Implementing strong confidentiality agreements.

- Ensuring robust data security measures.

- Mitigating risks in competitive sectors like pharmaceuticals.

ALS operates within a complex web of international and domestic legal frameworks that significantly influence its operations and strategic decisions. Key areas include stringent food and pharmaceutical safety regulations, such as the FDA's Food Safety Modernization Act (FSMA) with ongoing enforcement and updates, and Good Manufacturing Practices (GMP) for laboratory services, which are subject to continuous auditing and evolving guidelines.

Environmental laws, particularly those concerning emissions and waste management, directly impact ALS's operational footprint and testing methods. For example, the European Union's REACH regulation, which governs chemical substances, saw continued implementation and potential amendments in 2024, requiring significant adaptation from companies handling various materials.

Data privacy laws like GDPR and CCPA impose strict requirements on how ALS handles sensitive client information, with non-compliance leading to substantial fines, up to 4% of global annual revenue under GDPR. Additionally, product liability and consumer protection laws make testing and certification bodies like ALS vital for ensuring product safety and regulatory adherence, with agencies like the U.S. Consumer Product Safety Commission increasing oversight on imported goods.

Environmental factors

Global climate change regulations are intensifying, with many nations establishing ambitious carbon emission reduction targets. For ALS, this translates into increased demand for environmental testing and carbon footprint verification services, especially from clients in energy-intensive industries like mining and manufacturing. For example, many mining companies are now aiming for net-zero emissions by 2050, a goal that necessitates robust monitoring and verification of their environmental impact.

The increasing global emphasis on sustainability and circular economy models presents a substantial opportunity for ALS. Businesses are actively seeking testing and certification services for their environmentally friendly products, waste management strategies, and sustainable supply chains. This demand is evident in the growing market for green certifications and environmental audits, with the global green building market alone projected to reach $171.9 billion in 2024, indicating a strong underlying trend.

Stricter national and international standards for water and air quality are driving increased demand for environmental testing services. For instance, the US Environmental Protection Agency (EPA) continues to update regulations on particulate matter and ozone, impacting industries nationwide. This trend necessitates more frequent and thorough environmental analysis.

ALS's proficiency in identifying and quantifying pollutants in water and air emissions is crucial for businesses aiming to adhere to these evolving environmental protection laws and public health mandates. Their services help industries avoid penalties and maintain operational compliance.

This focus on environmental compliance represents a significant growth avenue for ALS's environmental division. In 2024, the global environmental testing market was valued at approximately $30 billion and is projected to grow at a compound annual growth rate (CAGR) of over 6% through 2030, underscoring the expanding opportunities in this sector.

Waste Management and Pollution Control

Stricter environmental regulations worldwide are significantly boosting the need for waste management and pollution control services. For instance, the European Union's Circular Economy Action Plan, updated in 2020 and continuing to influence policy through 2025, pushes for better waste reduction and recycling, directly benefiting companies like ALS that offer testing and analysis for compliance. This regulatory push, coupled with growing public awareness about environmental impact, means industries must invest more in characterizing hazardous waste, remediating contaminated sites, and conducting thorough environmental impact assessments.

Industries are actively seeking to minimize their environmental footprint. This trend is evident in the increasing adoption of sustainability reporting frameworks, with many companies aiming to reduce emissions and waste by 2025. For example, a significant portion of Fortune 500 companies have set ambitious ESG (Environmental, Social, and Governance) targets, which necessitate specialized environmental testing services for monitoring and verification. This creates a robust demand for ALS's expertise in areas like industrial effluent analysis and soil contamination testing.

The market for environmental testing services is experiencing substantial growth, driven by these factors. Projections for the global environmental testing market indicate continued expansion through 2025, with a compound annual growth rate (CAGR) of around 6-7%. This growth is fueled by increased government spending on environmental protection and private sector investment in sustainable practices. Key areas driving this demand include:

- Water and wastewater testing: Essential for monitoring industrial discharge and ensuring compliance with water quality standards.

- Air quality monitoring: Crucial for assessing industrial emissions and public health impacts.

- Soil and hazardous waste analysis: Vital for site remediation and safe disposal of industrial byproducts.

- Environmental impact assessments: Required for new projects to understand and mitigate potential ecological damage.

ESG Reporting and Environmental Disclosures

The global push for robust ESG reporting is intensifying, compelling businesses to offer clear insights into their environmental impact, associated risks, and potential opportunities. ALS is instrumental in furnishing the essential, verifiable data and certifications that underpin these crucial disclosures.

This demand is directly linked to evolving regulatory landscapes; for instance, the first Corporate Sustainability Reporting Directive (CSRD) reports in the European Union are slated for submission in 2025, highlighting the growing imperative for transparency and accountability in environmental performance.

ALS's services directly support clients in navigating these complex disclosure requirements, ensuring they can meet the heightened expectations of investors and regulators alike.

- Increased Investor Scrutiny: Over 70% of investors consider ESG factors when making investment decisions, driving demand for detailed environmental data.

- Regulatory Compliance: The CSRD mandates detailed environmental reporting for a significant number of companies operating within the EU, effective from 2025.

- Supply Chain Transparency: Businesses are increasingly required to report on the environmental performance of their entire value chain, a task ALS helps facilitate.

Environmental factors are increasingly shaping business operations and strategic planning, driven by a global commitment to sustainability and stricter regulations. ALS's expertise in environmental testing and analysis is therefore critical for companies navigating these evolving demands. The growing emphasis on ESG reporting, for instance, means businesses must provide verifiable data on their environmental impact, a need ALS directly addresses.

The global environmental testing market, valued at around $30 billion in 2024, is projected to grow at over 6% annually through 2030, reflecting the significant opportunities arising from these environmental shifts.

Stricter regulations on water and air quality, such as those updated by the EPA, necessitate more frequent and thorough environmental analysis. Companies must adhere to these standards to avoid penalties and maintain compliance, further increasing demand for ALS's services.

The push for a circular economy and waste reduction, exemplified by initiatives like the EU's Circular Economy Action Plan, also creates demand for testing and certification of environmentally friendly products and waste management. This trend is supported by the projected growth of the global green building market, which is expected to reach $171.9 billion in 2024.

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable market research firms, and leading economic indicators. This ensures that each insight into political, economic, social, technological, legal, and environmental factors is grounded in verifiable data.