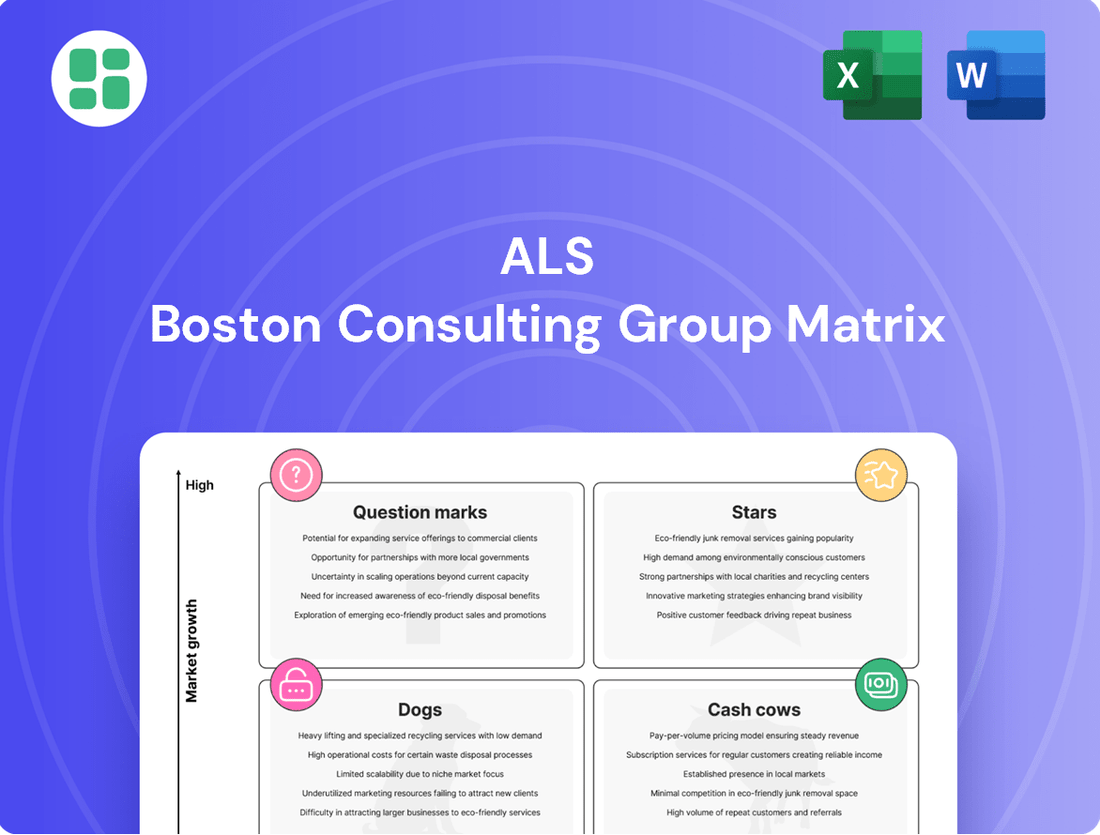

ALS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALS Bundle

The BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing products into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. This allows for informed decisions about resource allocation and strategic planning.

Want to know exactly where each of this company's products fit within the BCG Matrix and what that means for their future? Purchase the full report for a comprehensive breakdown, including actionable strategies for each quadrant.

Stars

ALS is making significant investments in PFAS environmental testing to meet growing demand, utilizing its global lab network and extensive experience. This area is a rapidly expanding market, with its organic growth projected to be more than 2.5 times that of ALS's overall Environmental business in Fiscal Year 2025.

The company's strategic advantage lies in its ability to quickly implement testing methods in new regions. This is further bolstered by strong relationships with key suppliers and clients, which help speed up the expansion of its testing capacity.

Mine-site production testing, a critical component within ALS's Commodities division, is a star performer. The mine-site expansion revenue saw a substantial 24% year-on-year growth in FY25, highlighting its strength. This segment is a key driver for the Minerals business, which consistently achieves EBIT margins exceeding 31%, underscoring its profitability and market dominance.

The Industrial Materials sector, encompassing Oil & Lubricants and Coal testing, showed robust performance in FY25. Oil & Lubricants achieved 11.3% organic growth, while Coal testing saw an even more impressive 17.4% increase, both accompanied by margin expansion. This strong showing is attributed to sustained demand and ALS's strategic efforts to deepen market penetration.

Advanced Environmental Solutions

Advanced Environmental Solutions represents a significant growth area for ALS. Driven by global sustainability trends and stricter regulations, this segment achieved an impressive 11.8% organic growth in the first half of fiscal year 2025. This performance underscores ALS's strong standing in a rapidly expanding market, particularly in areas like PFAS remediation and broader environmental compliance services.

ALS's commitment to data-driven insights and innovative approaches solidifies its leadership in the environmental sector. The company's expertise extends across a range of critical services, meeting the evolving needs of industries worldwide.

- Market Growth: Driven by sustainability megatrends and regulatory focus.

- ALS Performance: 11.8% organic growth in H1 FY25.

- Key Services: Includes PFAS, environmental compliance, and monitoring.

- Competitive Advantage: Focus on data-driven insights and innovative methodologies.

High-Performance Geochemistry Methods

ALS is experiencing robust organic revenue growth in its Geochemistry division, driven by an expanding market share and a growing client preference for high-performance analytical methods. This trend signifies a strong position within an expanding segment of the exploration testing market, where clients are increasingly opting for more sophisticated analytical services.

The company's strategic focus on offering these specialized, value-added services allows it to effectively mitigate the impact of volatility in overall sample volumes common in mineral exploration. For instance, ALS reported a 12% increase in revenue for its Geochemistry segment in the first half of 2024, with a significant portion attributed to the adoption of advanced analytical techniques.

- Increased Market Share: ALS continues to capture a larger portion of the exploration testing market.

- Uptake of High-Performance Methods: Clients are increasingly utilizing advanced and specialized geochemical analyses.

- Revenue Diversification: The focus on value-added services helps stabilize revenue against sample volume fluctuations.

- Growth in Advanced Services: This strategy is a key driver for the segment's organic revenue expansion.

The Geochemistry division is a clear star for ALS, showing robust organic revenue growth. This strength is fueled by an expanding market share and a client shift towards high-performance analytical methods. For example, in the first half of 2024, Geochemistry revenue increased by 12%, demonstrating the success of their strategy.

Mine-site production testing also shines, with a significant 24% year-on-year growth in mine-site expansion revenue in FY25. This segment is a powerhouse for the Minerals business, consistently delivering EBIT margins above 31%, highlighting its profitability and market leadership.

The Industrial Materials sector, including Oil & Lubricants and Coal testing, performed exceptionally well in FY25. Oil & Lubricants saw 11.3% organic growth, while Coal testing surged by 17.4%, both with improved margins. This success is driven by sustained demand and ALS's effective market penetration strategies.

| Segment | FY25 Performance | Key Drivers | Profitability Indicator |

| Geochemistry | Robust organic revenue growth | Expanding market share, high-performance methods | N/A |

| Mine-site Production Testing | 24% YoY revenue growth (FY25) | Strong demand in Minerals business | EBIT margins > 31% |

| Industrial Materials (Oil & Lubricants) | 11.3% organic growth (FY25) | Sustained demand, market penetration | Margin expansion |

| Industrial Materials (Coal Testing) | 17.4% organic growth (FY25) | Sustained demand, market penetration | Margin expansion |

What is included in the product

Strategic guidance for resource allocation, categorizing products by market share and growth.

A clear ALS BCG Matrix visualizes your portfolio, reducing the pain of resource allocation uncertainty.

Cash Cows

ALS's core geochemistry testing services are a prime example of a Cash Cow within the Minerals division. This segment consistently delivers resilient operating margins exceeding 30%, demonstrating its strong profitability and efficient operations.

With a leading market share in the exploration testing market, the geochemistry business benefits from a well-established global hub-and-spoke model. This structure ensures operational stability and robust cash generation, even with occasional fluctuations in testing volumes.

The fundamental role of geochemistry testing in the mining industry underpins the segment's consistent profitability. For instance, in 2023, ALS reported that its Minerals segment, which includes geochemistry, generated approximately AUD 1.2 billion in revenue, highlighting the significant contribution of these core services.

ALS's routine environmental monitoring, covering water, air, and soil analysis, is a prime example of a Cash Cow. This segment operates in a mature market where ALS commands a significant market share, ensuring a steady stream of recurring revenue and robust profit margins.

The consistent demand from regulatory bodies and industries for these essential services underpins the stability of this business line. For instance, in 2023, ALS reported that its Environmental division, which heavily features these monitoring services, contributed significantly to its overall revenue, demonstrating the reliable cash generation capabilities of this segment.

Strategic investments in enhancing operational efficiency and supporting infrastructure further solidify the Cash Cow status of routine environmental monitoring. These investments optimize processes, leading to improved profit margins and a stronger, more consistent cash flow for ALS.

Traditional Food & Beverage Testing within ALS's Life Sciences division is a prime example of a Cash Cow. This segment is experiencing strong revenue growth, reinforcing its leadership in crucial areas and regions. The market for quality assurance and safety testing in food and beverages is mature yet consistently in demand, allowing ALS to generate substantial cash flow with minimal need for extensive marketing spend.

ALS's significant market share and deep expertise solidify its dominant position in this essential sector. For instance, in 2024, ALS reported that its Life Sciences segment, which includes Food & Beverage testing, continued to be a major contributor to overall group performance, demonstrating resilience and consistent demand for its analytical services across diverse food safety and quality parameters.

Established Metallurgy Services

Established Metallurgy Services, a key component of ALS's portfolio, continues to be a robust cash cow. Despite minor volume dips in the first half of fiscal year 2025, the segment consistently delivers strong margins within the Commodities division. This resilience is driven by the indispensable role metallurgy testing plays in the global mining sector, particularly for metals crucial to the clean energy transition.

The enduring demand for materials like copper, nickel, and lithium, essential for electric vehicles and renewable energy infrastructure, underpins the stable cash generation of this business. These earnings are vital, providing the financial fuel for ALS's strategic investments in emerging growth areas.

- Resilient Margin Performance: Metallurgy services contribute significantly to the Commodities division's margins, even with short-term volume fluctuations in H1 FY25.

- Essential Industry Support: The segment provides critical testing services that are fundamental to the global mining industry's operations.

- Clean Energy Demand Driver: Ongoing demand for metals used in clean energy technologies ensures a steady revenue stream.

- Funding Growth Initiatives: The cash generated by metallurgy services is strategically deployed to support other areas of the business focused on future growth.

Core Oil & Lubricants Testing

Within ALS's Industrial Materials segment, the core Oil & Lubricants testing services function as a robust Cash Cow. This established business consistently generates significant revenue and contributes to margin expansion.

Operating in a mature market, these services benefit from substantial barriers to entry and deeply entrenched client relationships, which in turn cultivates a reliable and predictable cash flow. The critical role of this testing in ensuring equipment reliability across diverse industrial sectors further solidifies its stable market position.

- Revenue Generation: Oil & Lubricants testing is a primary revenue driver for ALS's Industrial Materials segment.

- Market Maturity: The service operates in a well-established market with limited new entrants.

- Client Retention: High barriers to entry and long-standing client relationships ensure consistent demand.

- Cash Flow Stability: This segment provides a steady and predictable source of cash for the company.

Cash Cows are business units that generate more cash than they consume, often due to high market share in mature, slow-growing industries. ALS's established geochemistry testing services exemplify this, consistently delivering strong operating margins, over 30% in 2023, and benefiting from a stable global hub-and-spoke model. This segment, part of the Minerals division which generated around AUD 1.2 billion in revenue in 2023, provides a reliable cash flow that supports other business areas.

| Business Unit | Division | Key Characteristic | 2023 Revenue Contribution (Approx.) | Strategic Role |

|---|---|---|---|---|

| Geochemistry Testing | Minerals | High market share, stable operations | Part of AUD 1.2 billion Minerals revenue | Generates consistent cash flow |

| Routine Environmental Monitoring | Environmental | Mature market, recurring revenue | Significant contributor to Environmental division revenue | Funds strategic investments |

| Traditional Food & Beverage Testing | Life Sciences | Strong revenue growth, minimal marketing spend | Major contributor to Life Sciences segment performance | Provides stable cash generation |

| Established Metallurgy Services | Commodities | Resilient margins, essential industry support | Key contributor to Commodities division margins | Supports growth initiatives |

| Oil & Lubricants Testing | Industrial Materials | Mature market, high client retention | Primary revenue driver for Industrial Materials | Ensures cash flow stability |

What You’re Viewing Is Included

ALS BCG Matrix

The ALS BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means you get the same expertly crafted analysis, with no watermarks or placeholder text, ready for immediate strategic application. The final file is prepared for direct download, ensuring you have a polished and actionable tool for your business planning without any additional work required.

Dogs

The pharmaceutical sector saw a 3.4% organic growth decline in the first half of fiscal year 2025. This contraction highlights specific sub-segments within the industry that are currently exhibiting both low market share and sluggish growth.

These underperforming areas are likely consuming valuable resources without generating adequate returns, signaling a need for careful strategic assessment and potential divestment or restructuring.

While ALS's overall Metallurgy segment operates as a Cash Cow, certain specialized services within this area experienced a downturn in revenue and margins during the first half of fiscal year 2025. This decline was primarily attributed to reduced customer volumes for these specific offerings.

These particular metallurgy services are currently exhibiting characteristics of Stars or Question Marks in the BCG matrix, showing signs of lower market share and diminished demand. The financial performance suggests these services are either breaking even or are acting as cash traps, requiring careful strategic consideration.

The Minerals division's exploration testing services, particularly in Australia and Latin America, experienced significant 'volume headwinds' and 'margin pressure' during the first half of fiscal year 2025. This downturn was driven by a volatile exploration market, leading to reduced demand for these specialized services.

These exploration testing components, characterized by low demand and minimal cash generation in the current subdued market, clearly fit the 'Dog' quadrant of the BCG Matrix. For instance, ALS Limited reported that its Minerals segment revenue saw a modest 3% increase in H1 FY25, but this was largely due to price increases rather than volume growth, highlighting the underlying volume challenges.

The Inspections Business

The Inspections business, as analyzed within the ALS BCG Matrix framework, appears to be categorized as a 'Dog'. This classification stems from its reported performance in H1 FY25, which was described as 'in line with pcp', suggesting a lack of significant growth.

If this segment also commands a low market share within its specific niches, its position solidifies as a 'Dog'. Such a scenario implies it's not generating substantial revenue or high profits, making it a weak performer in the overall business portfolio.

- Stagnant Growth: H1 FY25 results for Inspections were 'in line with pcp', indicating no meaningful expansion.

- Low Market Share: If the Inspections business holds a minor position in its target markets, it further reinforces the 'Dog' classification.

- Limited Contribution: A 'Dog' typically struggles to contribute significantly to overall revenue or profitability.

- Strategic Re-evaluation: Businesses in the 'Dog' category often require a strategic review, potentially leading to divestment or repositioning.

Legacy or Commoditized Industrial Testing Services

Within the Industrial Materials segment, certain legacy testing services that haven't kept pace with technological advancements or market demands can be classified as Dogs. These offerings, often characterized by their commoditized nature, struggle to maintain significant market share or achieve robust growth. For example, basic physical property testing for older material types might fall into this category if newer, more sophisticated analytical methods have become the industry standard.

These services typically receive minimal strategic investment, as companies prioritize resources for more innovative or higher-growth areas. Consequently, they tend to generate low returns, often just enough to cover their operational costs. An example could be routine tensile strength testing on materials for which demand has plateaued or declined due to the introduction of advanced composites or alloys.

- Low Market Share: These services often represent a shrinking portion of the overall industrial testing market.

- Stagnant or Declining Growth: They experience little to no revenue increase, or even a decrease, as newer technologies gain traction.

- Minimal Investment: Companies are unlikely to allocate significant capital for upgrades or expansion of these offerings.

- Low Profitability: Returns are typically marginal, often just covering operational expenses.

Dogs in the BCG matrix represent business units or products with low market share and low growth prospects. These segments often consume resources without generating significant returns, making them a strategic challenge. For ALS, examples include certain legacy testing services within Industrial Materials and specific specialized services in the Metallurgy segment that have faced reduced demand and margin pressure.

The Inspections business, showing performance 'in line with pcp' in H1 FY25, also aligns with the 'Dog' profile if it holds a low market share. These areas typically require minimal investment and may be candidates for divestment or repositioning to free up resources for more promising ventures.

The Minerals division's exploration testing services in Australia and Latin America, experiencing volume headwinds and margin pressure in H1 FY25, are clear examples of Dogs. ALS's Minerals segment revenue growth of 3% in H1 FY25 was primarily price-driven, underscoring the volume challenges in these specific service areas.

| Segment/Service Area | BCG Classification | Key Performance Indicators (H1 FY25) | Strategic Implication |

|---|---|---|---|

| Exploration Testing (Minerals - Aus/LatAm) | Dog | Volume headwinds, margin pressure, modest overall segment revenue growth driven by price, not volume. | Requires strategic review; potential for divestment or cost optimization. |

| Inspections Business | Dog | Performance 'in line with pcp', implying stagnant growth. Assumed low market share. | Potential candidate for divestment or repositioning; focus on efficiency. |

| Legacy Industrial Materials Testing | Dog | Low market share, stagnant/declining growth, minimal investment, low profitability. | Consider phasing out or integrating into more competitive offerings. |

| Certain Specialized Metallurgy Services | Dog | Lower market share, diminished demand, break-even or cash trap characteristics. | Evaluate for divestment, restructuring, or resource reallocation. |

Question Marks

ALS's acquisition of Nuvisan in the pharmaceutical sector is a key element in its transformation strategy. This acquisition, while facing an impairment in FY24 and initial margin dilution in FY25, is positioned as a potential Star within the ALS BCG Matrix. Despite currently being a cash consumer with low returns, its high growth prospects hinge on the success of its ongoing transformation program and the development of its sales pipeline.

The acquisition of Wessling in March 2024 marks a significant strategic move for ALS, establishing an immediate operational presence in the substantial German and French environmental, food, and pharmaceutical testing markets. This expansion directly addresses ALS's previously limited reach in these key European economies, which are identified as having high growth potential.

While these new markets offer considerable upside, ALS's current market share is low, necessitating substantial investment to achieve a leadership position. This aligns with the characteristics of a Question Mark in the BCG Matrix, where a low market share in a high-growth industry requires careful consideration of resource allocation to foster growth or divestment if prospects dim.

ALS is strategically investing in and acquiring AI and machine learning capabilities to harness data for better insights. This focus positions them to capitalize on the high-growth potential within the TIC sector, leveraging advanced analytics for service enhancement and new offerings.

While these digital solutions represent a significant future opportunity, ALS's current market share in these emerging AI/ML-driven services is likely modest. Significant ongoing investment will be crucial to build scale and establish a competitive foothold in this rapidly evolving space.

York Analytical Laboratories Integration (USA Environmental)

The acquisition of York Analytical Laboratories in April 2024 positions ALS to significantly bolster its presence in the United States environmental testing sector, with a strategic focus on the rapidly developing Northeast region. This move is designed to tap into a market experiencing robust demand for environmental services.

While York Analytical Laboratories demonstrated a history of solid growth prior to its acquisition, its initial integration into ALS's broader operations resulted in a degree of margin dilution. This characteristic places York squarely in the 'Question Mark' category of the BCG matrix, indicating a business unit with high growth potential but currently low market share, necessitating further investment.

- Strategic Expansion: York's acquisition accelerates ALS's entry and growth in the lucrative US environmental testing market, especially in the Northeast.

- Market Position: Initially a 'Question Mark', York requires strategic investment to enhance its market share and profitability within ALS's portfolio.

- Investment Rationale: The integration aims to leverage York's capabilities to capture a larger share of the growing environmental services demand, justifying the initial investment for future returns.

Emerging Contaminants Testing (Beyond PFAS)

ALS is strategically positioned to leverage the expanding market for 'emerging contaminants' testing, a sector poised for significant growth beyond PFAS. This expansion is fueled by a global surge in regulatory activity and stricter enforcement, creating substantial opportunities for ALS's analytical services.

The demand for testing a wider array of emerging contaminants is accelerating due to ongoing scientific advancements and evolving regulatory landscapes. While ALS benefits from its established expertise, its market share in each nascent contaminant testing niche is still in its formative stages, necessitating continued strategic investment to secure leadership.

- Expanding Regulatory Landscape: New legislation and stricter enforcement worldwide are driving demand for testing beyond PFAS, creating a fertile ground for ALS.

- Scientific Advancements: Ongoing research is identifying new contaminants of concern, opening up further testing markets for ALS.

- Market Share Development: While ALS is well-positioned, its share in these new contaminant testing areas is still developing, requiring proactive investment.

- Growth Opportunities: These high-growth areas represent significant revenue potential as regulations and scientific understanding mature.

Question Marks in ALS's portfolio represent areas with high growth potential but currently low market share. These units, like the acquired Wessling and York Analytical Laboratories, require significant investment to build scale and achieve market leadership. The strategic focus on AI/ML-driven services and emerging contaminant testing also falls into this category, demanding substantial capital to establish a competitive foothold in these nascent, high-growth sectors.

| Business Unit/Area | Industry Growth | Current Market Share | BCG Status | Investment Rationale |

|---|---|---|---|---|

| Wessling Acquisition (Germany/France) | High | Low | Question Mark | Expand into key European markets, build share. |

| York Analytical Laboratories (US Northeast) | High | Low | Question Mark | Strengthen US environmental testing presence, capture regional demand. |

| AI/ML Services | High | Modest | Question Mark | Capitalize on data insights, enhance services, create new offerings. |

| Emerging Contaminants Testing | High | Formative | Question Mark | Address growing regulatory demand beyond PFAS, secure niche leadership. |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of financial disclosures, market research, and competitor analysis to provide a comprehensive view of product performance and market dynamics.