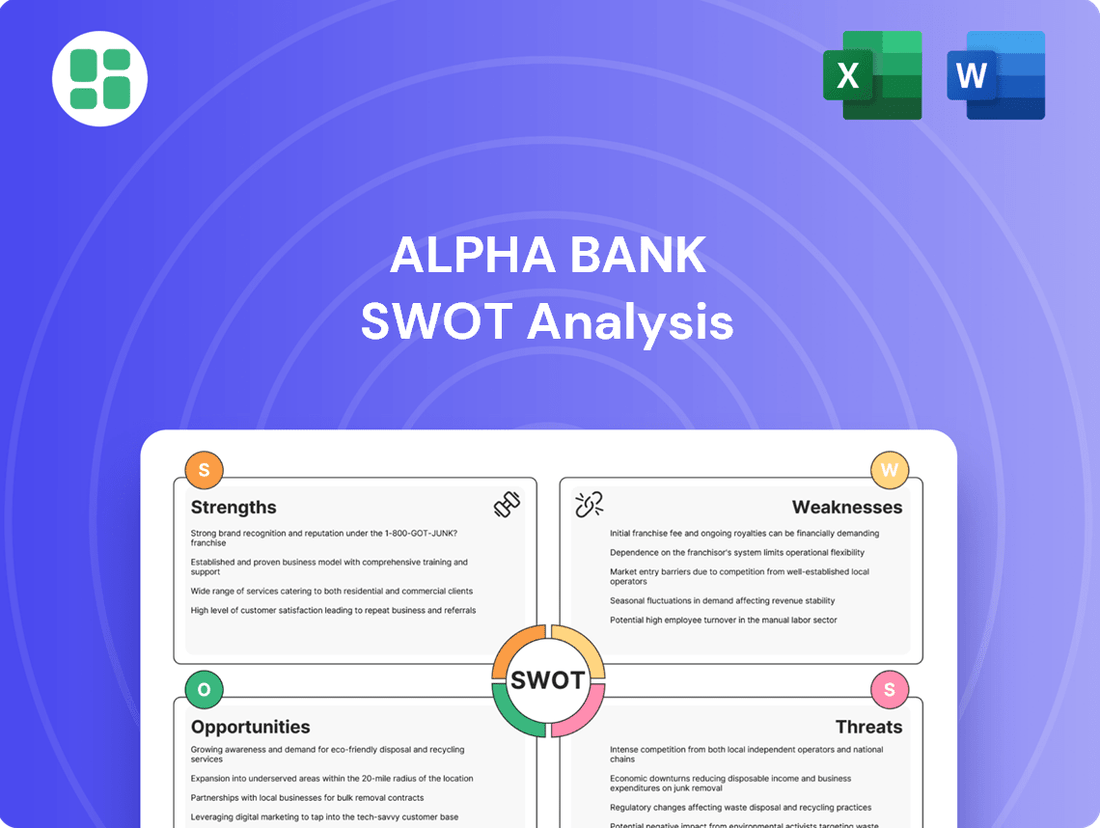

Alpha Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alpha Bank Bundle

Alpha Bank demonstrates robust market presence and digital innovation, but faces increasing competition and evolving regulatory landscapes. Uncover the complete picture behind these dynamics with our full SWOT analysis, providing actionable insights for strategic decision-making.

Want the full story behind Alpha Bank's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning and investment research.

Strengths

Alpha Bank boasts a comprehensive service portfolio, encompassing retail, corporate, and investment banking. This broad offering extends to asset management and insurance, allowing the bank to serve a wide array of client needs. This diversification is a key strength, fostering multiple revenue streams and enhancing its market resilience.

Alpha Bank has demonstrably strengthened its financial foundation through a notable improvement in asset quality. The bank successfully reduced its non-performing exposure (NPE) ratio to a mere 3.8% by the end of December 2024, a significant drop from 6.0% recorded in the previous year. This achievement surpassed its own business plan targets, reaching the goal two years ahead of schedule.

Complementing this enhanced asset quality is Alpha Bank's robust capital position. As of the first quarter of 2025, the bank maintained a Common Equity Tier 1 (CET1) ratio of an impressive 16.3%. This strong solvency metric underscores the bank's capacity for capital generation and its ability to absorb potential financial shocks, providing a solid base for future growth and stability.

Alpha Bank demonstrates robust profitability, evidenced by a normalized profit after tax of €239 million in Q1 2025, marking an 8% year-over-year increase. This growth is underpinned by a significant 11% rise in fee income to €108 million in the same quarter, signaling effective revenue diversification.

The bank's strategic focus on fee-generating activities is paying off, with fee income climbing 16% for H1 2025. This strong performance in fee income helps to cushion the impact of pressures on net interest income, showcasing a resilient business model.

Advanced Digital Transformation and Innovation

Alpha Bank is making significant strides in its digital transformation, a key strength that positions it well for future growth. The bank's commitment to innovation is evident through its active investment in its Digital Factory, employing Agile and DevOps methodologies to streamline development and deployment processes. This focus on modernizing operations is crucial in today's rapidly evolving financial landscape.

The bank is actively redesigning critical customer journeys, aiming to create a more seamless and intuitive experience for its clients. Partnerships with leading companies for embedded finance solutions further enhance its ability to integrate banking services into everyday customer activities. For instance, Alpha Bank has been exploring collaborations to offer financial products directly at the point of sale or within other platforms, making banking more accessible and convenient.

A tangible example of this digital push is the implementation of a Generative AI chatbot. This advanced technology is designed to improve customer service by providing instant, intelligent responses to inquiries, thereby boosting operational efficiency and customer satisfaction. By leveraging GenAI, Alpha Bank aims to handle a larger volume of customer interactions more effectively, freeing up human resources for more complex tasks.

- Digital Factory Investments: Alpha Bank's ongoing investment in its Digital Factory, utilizing Agile and DevOps, accelerates product development and deployment cycles.

- Customer Journey Redesign: A strategic focus on redesigning key customer touchpoints enhances user experience and operational efficiency.

- Embedded Finance Partnerships: Collaborations with market leaders in embedded finance expand Alpha Bank's reach and service offerings.

- GenAI Implementation: The deployment of a Generative AI chatbot signifies a commitment to leveraging cutting-edge technology for improved customer engagement and operational streamlining.

Strategic Partnerships and M&A Activity

Alpha Bank has actively leveraged strategic partnerships, notably with UniCredit, to bolster its wealth management and wholesale banking operations. This collaboration aims to create a more comprehensive service offering for a wider client base.

The bank’s acquisition strategy has been robust, with key moves like the purchase of Cypriot lender AstroBank PCL and the investment banking group Axia Ventures Group Ltd. These acquisitions are designed to significantly increase market share and broaden the bank's product and service portfolio.

- Strategic Partnerships: Collaboration with UniCredit to enhance wealth management and wholesale banking.

- Acquisition of AstroBank PCL: Strengthened presence in Cyprus, adding to market share and customer base.

- Acquisition of Axia Ventures Group Ltd.: Expanded investment banking capabilities and product suite.

- Market Share Growth: Acquisitions are key drivers for increasing Alpha Bank's competitive position.

Alpha Bank's diversified business model, spanning retail, corporate, and investment banking, along with asset management and insurance, creates multiple resilient revenue streams. This broad service offering allows the bank to cater to a wide spectrum of client needs, enhancing its market stability and growth potential.

The bank's financial health is demonstrably strong, with a non-performing exposure (NPE) ratio reduced to 3.8% by the end of 2024, significantly below the previous year's 6.0% and ahead of its own targets. This improvement in asset quality is complemented by a robust capital position, maintaining a CET1 ratio of 16.3% as of Q1 2025, indicating strong solvency and capacity for future expansion.

Profitability saw a healthy increase, with normalized profit after tax reaching €239 million in Q1 2025, an 8% year-over-year rise, driven by an 11% increase in fee income to €108 million. The strategic emphasis on fee-generating activities, which grew 16% in H1 2025, effectively mitigates pressures on net interest income, showcasing a well-balanced and adaptive revenue strategy.

Alpha Bank is actively enhancing its digital capabilities through significant investments in its Digital Factory, employing Agile and DevOps methodologies to accelerate innovation. The redesign of customer journeys and strategic partnerships for embedded finance solutions, such as integrating financial products at point-of-sale, are making banking more accessible. Furthermore, the implementation of a Generative AI chatbot is set to revolutionize customer service by providing instant, intelligent support, boosting efficiency and customer satisfaction.

| Metric | Value (Q1 2025) | Previous Year (Q1 2024) | Change |

|---|---|---|---|

| Normalized Profit After Tax | €239 million | €221 million | +8% |

| Fee Income | €108 million | €97 million | +11% |

| NPE Ratio (End of 2024) | 3.8% | 6.0% | -2.2 pp |

| CET1 Ratio (Q1 2025) | 16.3% | N/A | N/A |

What is included in the product

Analyzes Alpha Bank’s competitive position through key internal and external factors.

Offers a clear, actionable framework for identifying and addressing Alpha Bank's strategic challenges and opportunities.

Weaknesses

Alpha Bank's stated low sensitivity to interest rate fluctuations appears to be challenged by recent performance. In the first quarter of 2025, the bank reported a 2.6% quarter-over-quarter decline in net interest income. This dip was primarily attributed to a negative calendar days effect and reduced rates on performing loans, though a volume increase offered some mitigation.

Sustained periods of declining interest rates could therefore exert significant pressure on Alpha Bank's net interest margin. This, in turn, could negatively impact its overall profitability, making it a key area to monitor for investors and stakeholders.

Alpha Bank's performance is heavily tied to Greece's economic health, even with positive forecasts for the banking sector. Any deceleration in Greece's projected economic growth could directly affect Alpha Bank's ability to expand its loan portfolio and maintain the quality of its assets.

The Greek banking sector, despite ongoing consolidation, remains a competitive arena. Alpha Bank, alongside three other major players, collectively holds a substantial portion of the market, indicating that aggressive competition is a persistent factor.

This intense rivalry can constrain Alpha Bank's capacity to expand its market share substantially or to sustain elevated lending profit margins, as competition often drives down prices and fees.

For instance, as of Q1 2024, the four largest Greek banks controlled approximately 75% of total banking assets, highlighting a concentrated yet fiercely contested market structure.

Legacy IT Systems and Operational Costs

Alpha Bank's extensive history, spanning over 140 years, while a testament to its resilience, likely means it operates with legacy IT systems. Modernizing these older technologies is a substantial undertaking, often involving significant capital investment and potential disruption to ongoing operations. These systems can also lead to higher maintenance and operational costs compared to contemporary, more efficient platforms.

The ongoing digital transformation efforts at Alpha Bank are crucial, but the underlying legacy infrastructure presents a persistent hurdle. For instance, in 2024, many established financial institutions reported spending upwards of 15-20% of their IT budgets on maintaining legacy systems, hindering investment in new digital capabilities. This can translate into slower service delivery and increased vulnerability to cyber threats.

The challenges associated with legacy IT extend to integration with newer digital solutions.

- High Maintenance Costs: Legacy systems often require specialized, costly maintenance and support, diverting resources from innovation.

- Integration Difficulties: Connecting older systems with modern digital platforms can be complex and expensive, slowing down the rollout of new services.

- Operational Inefficiencies: Outdated technology can lead to manual workarounds and slower processing times, impacting both customer experience and internal efficiency.

Regulatory and Geopolitical Risks

Alpha Bank, like all financial institutions, operates within a heavily regulated environment. Evolving regulations, such as the upcoming implementation of CRD VI and CRR III in 2024/2025, which aim to strengthen capital requirements and risk management, could necessitate adjustments to its operational framework and potentially affect profitability.

Furthermore, the bank is susceptible to broader geopolitical risks. Heightened international tensions in the region present exogenous threats to financial stability in Greece. These tensions can negatively influence investor sentiment, impacting economic growth prospects and, consequently, Alpha Bank's performance.

- Regulatory Shifts: Compliance with new capital adequacy directives (CRD VI, CRR III) from 2024/2025 could increase operational costs.

- Geopolitical Sensitivity: Regional instability can dampen foreign investment into Greece, impacting loan demand and asset values.

- Economic Interdependence: Greece's economic performance is closely tied to regional stability, creating a direct link to Alpha Bank's risk exposure.

Alpha Bank's profitability is vulnerable to interest rate changes, as evidenced by a 2.6% drop in net interest income in Q1 2025 due to falling rates on loans. This sensitivity poses a risk to its net interest margin and overall earnings. The bank's performance is also intrinsically linked to Greece's economic trajectory; any slowdown in the country's growth could hinder loan portfolio expansion and asset quality. Intense competition within the Greek banking sector, where the top four banks held about 75% of assets in Q1 2024, limits Alpha Bank's ability to gain significant market share or maintain high lending margins.

Same Document Delivered

Alpha Bank SWOT Analysis

The preview you see is the same Alpha Bank SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

This is a real excerpt from the complete Alpha Bank SWOT analysis. Once purchased, you’ll receive the full, editable version, offering an in-depth understanding of the bank's strategic position.

You’re viewing a live preview of the actual Alpha Bank SWOT analysis file. The complete version, detailing all strategic factors, becomes available after checkout.

Opportunities

Alpha Bank has a significant opportunity to deepen its digital transformation by broadening its network of partners and incorporating advanced technologies such as artificial intelligence and robotic process automation. This strategic move is poised to boost operational efficiency, elevate the customer experience, and foster the creation of novel financial products and services.

For instance, by integrating AI-powered chatbots, Alpha Bank could handle a larger volume of customer inquiries, potentially reducing call center wait times by an estimated 20% based on industry benchmarks. Furthermore, RPA implementation in back-office processes, like data entry and reconciliation, could free up human resources for more complex, value-added tasks.

The bank's commitment to digital channels is already evident, with digital transactions accounting for a substantial portion of its overall customer interactions. Expanding fintech collaborations will allow Alpha Bank to tap into specialized expertise, accelerating the development and deployment of cutting-edge solutions that cater to evolving customer demands in 2024 and beyond.

The ongoing economic recovery in Greece, with forecasts pointing to continued GDP expansion, offers a fertile ground for Alpha Bank to bolster its lending activities. This positive economic climate is expected to fuel demand for corporate financing, allowing the bank to significantly grow its loan book.

Alpha Bank has already demonstrated robust performance in this area, reporting a 13% year-over-year increase in performing loans as of the first quarter of 2025. This momentum positions the bank favorably to capitalize on the broader market trend.

With Greek banks collectively aiming to issue approximately €13 billion in new loans throughout 2025, Alpha Bank is well-placed to capture a substantial share of this market, further enhancing its revenue streams and market position.

Alpha Bank's strategic commitment to sustainability, including a €4.4 billion allocation to sustainable financing by 2026 and a net-zero target by 2050, positions it favorably to capitalize on the burgeoning market for ESG-compliant investments. This focus opens significant avenues for growth in green finance products and services, attracting environmentally conscious investors and businesses.

Strategic Acquisitions and Regional Consolidation

Alpha Bank's strategic acquisition of AstroBank in Cyprus in 2023 for €145 million exemplifies its commitment to regional consolidation. This move not only expanded its footprint but also bolstered its deposit base and loan portfolio in a key market.

Further strategic acquisitions and regional consolidation present significant opportunities for Alpha Bank. By pursuing bolt-on acquisitions, the bank can enhance its scale, achieve greater geographic diversification, and broaden its product and service offerings, especially in higher-margin, fee-generating business lines. This approach is particularly relevant as the Greek banking sector continues its consolidation trend, offering avenues for synergistic growth and improved market positioning.

- AstroBank Acquisition: Completed in 2023, this €145 million deal expanded Alpha Bank's presence in Cyprus, adding €2.7 billion in deposits and €2.1 billion in loans as of year-end 2022.

- Scale Enhancement: Further acquisitions can increase Alpha Bank's total assets and market share, potentially reaching over €50 billion in assets under management if similar-sized targets are integrated.

- Geographic Diversification: Expanding into new regional markets can mitigate risks associated with over-reliance on the Greek economy, improving overall stability.

- Fee Income Growth: Focus on acquiring businesses with strong fee-generating capabilities, such as wealth management or investment banking services, can diversify revenue streams and improve profitability.

Increased Shareholder Returns and Investor Confidence

Alpha Bank's enhanced profitability and robust capital positions it to deliver greater value to its shareholders. The bank distributed €111 million in dividends in Q1 2025, a payout representing 50% of its profits. This move, coupled with positive analyst sentiment towards Greek banking, signals a promising investment environment.

This financial strength can indeed attract new investors and contribute to a higher stock valuation for Alpha Bank.

- Improved Profitability: Directly translates to enhanced capacity for shareholder distributions.

- Q1 2025 Dividend: €111 million paid out, signaling commitment to shareholder returns.

- Analyst Outlook: Favorable view on Greek banks suggests potential for increased investor confidence and stock appreciation.

Alpha Bank can leverage its digital transformation to expand its service offerings and improve customer engagement through AI and RPA. Capitalizing on Greece's economic recovery presents a significant opportunity to grow its loan portfolio, with Greek banks targeting €13 billion in new loans for 2025. The bank's focus on sustainability aligns with growing ESG investment trends, opening doors for green finance products.

Furthermore, strategic acquisitions, like the 2023 AstroBank deal, can enhance scale, geographic diversification, and fee income streams. The bank's strong capital position and commitment to shareholder returns, evidenced by a €111 million dividend in Q1 2025, are likely to attract investors and boost its valuation.

| Opportunity Area | Key Action/Trend | Supporting Data/Fact |

| Digital Transformation | AI & RPA Integration | Potential 20% reduction in call center wait times (industry benchmark) |

| Economic Recovery | Loan Growth | Greek banks targeting €13 billion in new loans for 2025; Alpha Bank saw 13% YoY loan growth in Q1 2025. |

| Sustainability | ESG Investments | €4.4 billion allocated to sustainable financing by 2026 |

| Regional Consolidation | Strategic Acquisitions | €145 million acquisition of AstroBank in 2023; added €2.7B deposits, €2.1B loans. |

| Shareholder Value | Dividend Payouts | €111 million dividend in Q1 2025 (50% of profits) |

Threats

A potential slowdown in global and European economic growth, or a domestic recession, could significantly dampen loan demand for Alpha Bank. This economic contraction might also lead to an increase in non-performing loans, directly impacting the bank's profitability. For instance, if GDP growth in the Eurozone, a key market for many European banks, slows to below 1% in 2024, as some forecasts suggest, this could translate to reduced borrowing activity and higher default rates.

Such an economic downturn could reverse the positive trends in asset quality and credit expansion that Alpha Bank may have experienced. A recessionary environment often sees a rise in unemployment and business failures, which directly correlates with a deterioration in loan portfolios. For example, historical data from past recessions indicates a sharp uptick in NPL ratios, potentially putting pressure on Alpha Bank's capital buffers and overall financial stability.

Alpha Bank faces a significant threat from non-traditional players like fintech startups and neobanks. These agile competitors are rapidly innovating in digital services, payments, and lending, often with lower overheads. For instance, in 2024, the global fintech market was valued at over $2.4 trillion and is projected to grow substantially, indicating the scale of this disruption.

These new entrants can quickly capture market share by offering user-friendly digital experiences and specialized services that traditional banks may be slower to adopt. This can lead to a gradual erosion of Alpha Bank's customer base and profitability, particularly in high-growth digital segments. By mid-2025, it's estimated that fintechs will handle a significant portion of global digital payment transactions, directly impacting incumbent banks.

As Alpha Bank continues to grow its digital offerings, the threat of cyberattacks and data breaches becomes a significant concern. These sophisticated threats can compromise sensitive customer information and disrupt operations.

A successful cyber incident could result in substantial financial penalties, as seen with other financial institutions; for instance, in 2023, data breaches cost companies an average of $4.45 million globally. Beyond direct financial impact, Alpha Bank faces the risk of severe reputational damage and a loss of customer confidence, which can be harder to recover from.

Adverse Regulatory Changes and Compliance Costs

Evolving regulatory frameworks, especially at the EU level, present a significant threat. For instance, the ongoing implementation of Basel III standards, which aim to strengthen bank resilience, could necessitate higher capital requirements for Alpha Bank. This might directly impact its ability to lend and generate profits.

These regulatory shifts translate into tangible compliance costs. Alpha Bank, like its peers, faces increased expenses related to data reporting, risk management systems, and legal counsel to ensure adherence to new directives. For example, the European Banking Authority's (EBA) ongoing work on the finalization of Basel III reforms (often referred to as Basel IV) will likely lead to adjustments in risk-weighted assets and capital ratios across the sector.

The cumulative effect of these changes can constrain operational flexibility. Banks may need to restructure operations or limit certain business activities to comply with new rules, potentially impacting strategic growth initiatives. This could also affect profitability if new capital requirements lead to a lower return on equity.

- Increased Capital Requirements: Basel III finalization (Basel IV) may necessitate higher Common Equity Tier 1 (CET1) ratios, impacting lending capacity.

- Higher Compliance Expenses: Investments in technology and personnel to meet evolving data and reporting standards are ongoing.

- Reduced Operational Flexibility: New regulations could limit the scope of certain banking products or services.

- Potential Impact on Profitability: Stricter capital rules can reduce a bank's return on equity if not managed effectively.

Geopolitical Instability and Market Volatility

Heightened geopolitical tensions, particularly in Eastern Europe and the Middle East, along with increasing trade protectionism globally, represent significant exogenous risks to financial stability in Greece. This instability directly impacts Alpha Bank by potentially increasing market volatility, dampening investor sentiment, and disrupting broader economic activity.

For instance, the ongoing conflict in Ukraine and evolving trade policies have contributed to elevated commodity prices and supply chain disruptions throughout 2024, impacting corporate earnings and consumer spending, which in turn affects loan demand and asset quality for banks like Alpha Bank. The IMF's projections for 2024 and 2025 highlight the sensitivity of emerging markets, including Greece, to these global shocks, with potential for capital outflows and currency depreciation.

- Increased Market Volatility: Geopolitical events can trigger sharp fluctuations in stock markets and bond yields, impacting Alpha Bank's trading revenues and the valuation of its investment portfolio.

- Deterioration in Investor Sentiment: Uncertainty stemming from global instability can lead investors to reduce risk appetite, potentially slowing down capital inflows and impacting Alpha Bank's ability to raise funds or attract new investment.

- Disruption of Economic Activity: Trade disputes and geopolitical conflicts can hinder international trade and investment, negatively affecting the performance of Greek businesses and, consequently, their ability to service loans held by Alpha Bank.

- Impact on Tourism and Exports: Greece's economy, and by extension Alpha Bank's operating environment, is sensitive to global tourism flows and export demand, both of which can be severely curtailed by geopolitical instability.

Alpha Bank faces a significant threat from intensifying competition, particularly from agile fintech companies and neobanks. These digital-first entities are rapidly capturing market share by offering streamlined customer experiences and innovative payment solutions. For instance, by mid-2025, fintechs are projected to handle a substantial portion of global digital payment transactions, directly impacting traditional banks.

Cybersecurity risks are a growing concern as Alpha Bank expands its digital footprint. A successful cyberattack could lead to severe financial penalties and reputational damage, as evidenced by the average global cost of data breaches reaching $4.45 million in 2023.

Evolving regulatory landscapes, especially within the EU, pose ongoing challenges. The finalization of Basel III standards, often termed Basel IV, could necessitate higher capital requirements for Alpha Bank, potentially impacting its lending capacity and profitability. For example, these reforms aim to strengthen bank resilience but will likely increase compliance costs and reduce operational flexibility.

Geopolitical instability and trade protectionism introduce significant exogenous risks. Heightened global tensions can increase market volatility and dampen investor sentiment, negatively affecting Alpha Bank's trading revenues and the broader Greek economy, which is sensitive to tourism and exports.

SWOT Analysis Data Sources

This Alpha Bank SWOT analysis is built upon a foundation of robust data, drawing from the bank's official financial statements, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate strategic assessment.