Alpha Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alpha Bank Bundle

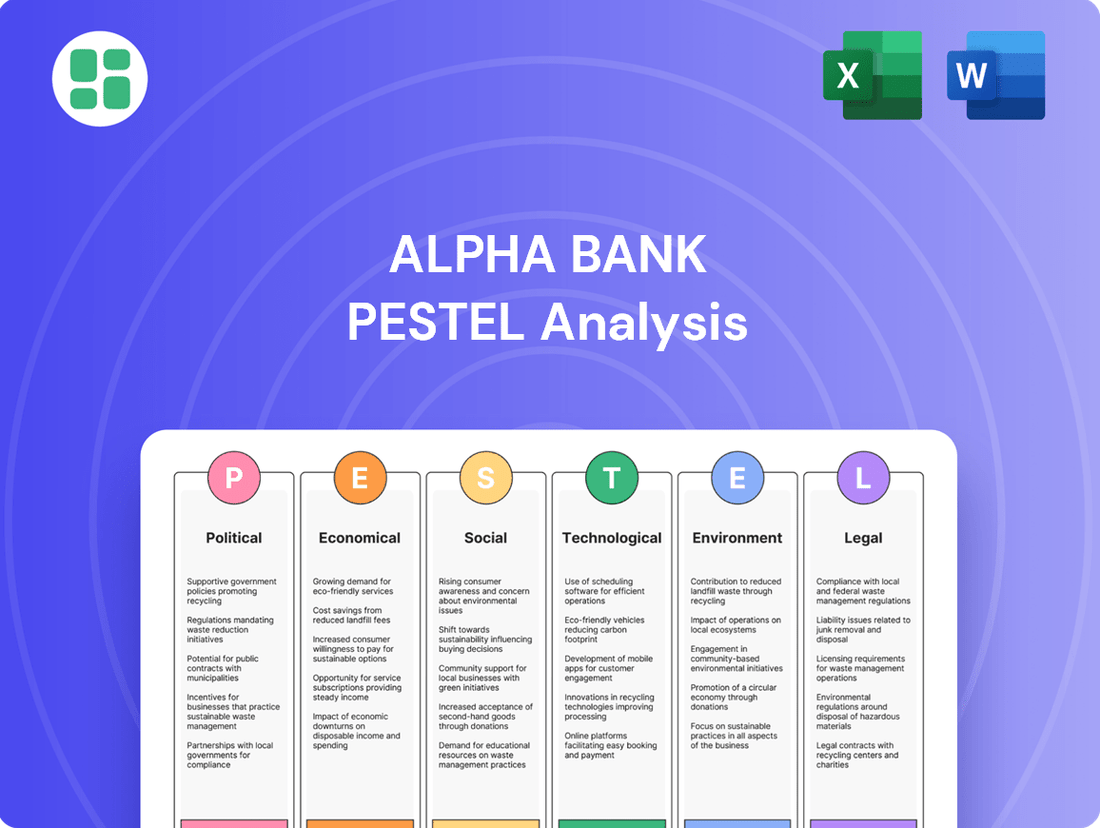

Navigate the complex external forces shaping Alpha Bank's future with our meticulously researched PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the institution. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now to unlock critical insights and make informed decisions.

Political factors

The stability of the Greek government is a cornerstone for Alpha Bank's operational environment. Recent elections in June 2023 saw New Democracy secure a strong majority, indicating a period of potential policy continuity. This stability is crucial as the government's fiscal and economic policies directly shape the banking sector's outlook, influencing lending, investment, and regulatory frameworks.

The government's commitment to economic growth, as evidenced by its focus on attracting foreign investment and continuing privatization initiatives, creates a more favorable climate for Alpha Bank. For instance, the ongoing digital transformation initiatives and efforts to streamline bureaucracy aim to boost overall economic activity, which directly benefits the banking sector through increased demand for financial services and a healthier credit environment.

Conversely, any significant political instability or abrupt policy reversals could introduce considerable risks. Such shifts might impact investor confidence, alter the regulatory landscape, or even affect the government's ability to manage public debt, all of which have direct implications for Alpha Bank's strategic planning and long-term investment decisions.

Alpha Bank, as a key player in the Eurozone, is deeply shaped by EU and ECB directives. For instance, the ECB's monetary policy decisions, such as interest rate adjustments, directly impact Alpha Bank's lending margins and profitability. The ongoing development of the Banking Union, including the Single Resolution Mechanism, continues to refine the regulatory framework Alpha Bank operates within, influencing its capital planning and risk management strategies.

Geopolitical shifts in the Eastern Mediterranean and Balkans present a dynamic landscape for Alpha Bank. For instance, ongoing regional security concerns, such as those impacting Greece's maritime borders or the broader stability in the Balkans, directly influence investor confidence and cross-border investment flows. Alpha Bank’s exposure to these regions means that political instability could disrupt trade finance and affect the economic health of its operating environments.

Regulatory and Supervisory Framework Evolution

Alpha Bank operates within a dynamic regulatory environment. Changes in banking laws and capital adequacy requirements, such as Basel III and its upcoming iterations, directly impact its operations. For instance, the European Central Bank's (ECB) ongoing focus on enhancing prudential supervision means Alpha Bank must consistently adapt its risk management practices and capital buffers. These evolving frameworks are crucial for maintaining its license and managing its overall risk profile.

Key regulatory shifts impacting Alpha Bank include:

- Increased Capital Requirements: Ongoing adjustments to capital adequacy ratios, like Common Equity Tier 1 (CET1), necessitate robust capital planning. For example, in 2024, the ECB continued to emphasize strong capital positions for banks operating within the Eurozone.

- Enhanced Stress Testing: Regular stress tests, like those conducted by the ECB, assess Alpha Bank's resilience to adverse economic scenarios, influencing its strategic decision-making.

- Digitalization and Cybersecurity Regulations: New regulations governing digital banking services and data protection, such as updates to PSD2, require significant investment in compliance and security infrastructure.

- Sustainability Reporting: Growing regulatory pressure for environmental, social, and governance (ESG) disclosures means Alpha Bank must integrate sustainability metrics into its reporting and business strategy.

Government Support and Privatization Programs

The Greek government's stance on the banking sector significantly impacts Alpha Bank. While privatization programs can signal reduced state intervention and increased market competition, the potential for state aid or support, especially during economic downturns, remains a key consideration. For instance, in 2023, the Greek government continued its efforts to reduce its footprint in the banking sector, a trend expected to foster a more competitive landscape.

Government-backed initiatives, such as loan guarantee schemes or targeted lending programs, can create both opportunities and constraints for Alpha Bank. These programs might boost lending volumes in specific sectors but could also come with regulatory conditions or impact the bank's risk profile. The European Central Bank's ongoing supervision also plays a role in shaping these dynamics.

- Government's stake in Greek banks: As of early 2024, the Hellenic Financial Stability Fund (HFSF) held significant stakes in major Greek banks, including Alpha Bank, though divestment plans are in progress.

- Privatization efforts: The Greek government has actively pursued privatization of state-owned assets, including potential further reductions in its banking holdings, aiming to enhance efficiency and market discipline.

- Economic support measures: Government policies aimed at stimulating economic growth, such as tax incentives or infrastructure spending, indirectly influence lending demand and credit quality for banks like Alpha Bank.

The political landscape in Greece, characterized by a stable majority for New Democracy following the June 2023 elections, suggests a predictable policy environment for Alpha Bank. This stability is vital as government economic strategies, including fiscal management and investment promotion, directly influence the banking sector's operational conditions and growth prospects. The government's focus on digital transformation and streamlining administrative processes aims to foster economic activity, benefiting banks through increased service demand and a healthier credit environment.

Alpha Bank's operations are intrinsically linked to EU and ECB policies, with monetary decisions like interest rate adjustments in 2024 directly impacting the bank's profitability and lending capacity. The ongoing evolution of the Banking Union, particularly the Single Resolution Mechanism, continues to shape Alpha Bank's capital planning and risk management frameworks, ensuring adherence to Eurozone banking standards.

Geopolitical factors in the Eastern Mediterranean and Balkans present both opportunities and risks for Alpha Bank, influencing regional stability and investment flows. Political developments in neighboring countries can affect trade finance activities and the economic health of markets where Alpha Bank has exposure, necessitating vigilant monitoring of regional dynamics.

Regulatory frameworks, including Basel III and upcoming iterations, are critical for Alpha Bank's strategic planning, with the ECB's continued emphasis on robust capital positions in 2024 reinforcing the need for strong capital buffers. Compliance with evolving digital banking and cybersecurity regulations, alongside increasing demands for ESG reporting, requires ongoing investment and adaptation by Alpha Bank to maintain its competitive edge and operational integrity.

| Political Factor | Description | Impact on Alpha Bank | 2024/2025 Relevance |

|---|---|---|---|

| Government Stability | Majority government in Greece | Policy continuity, predictable economic environment | Supports consistent regulatory and fiscal policies |

| EU/ECB Directives | Monetary policy, Banking Union developments | Impacts interest margins, capital requirements, risk management | Ongoing interest rate decisions and prudential supervision |

| Geopolitical Stability | Eastern Mediterranean & Balkans | Affects regional trade finance, investment flows, economic sentiment | Regional security and economic developments are key |

| Regulatory Framework | Capital adequacy, digital banking, ESG | Requires adaptation in risk management, technology investment, reporting | Continued focus on capital strength and digital transformation |

What is included in the product

This Alpha Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the bank, offering a comprehensive view of its operating landscape.

Alpha Bank's PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, streamlining strategic discussions.

Economic factors

Greek economic growth is a critical driver for Alpha Bank. The country's GDP growth rate, projected to be around 2.9% for 2024 and 2.5% for 2025, indicates a positive trajectory. This expansion, fueled by recovering domestic demand and continued tourism, directly impacts loan demand and the bank's overall profitability.

Industrial output and consumer spending are key indicators of economic health. In 2024, industrial production saw a modest uptick, and consumer confidence improved, reflecting a more robust economic environment. These trends are beneficial for Alpha Bank, as they tend to reduce the risk of non-performing loans and support growth in its retail and corporate banking operations.

A sustained economic recovery strengthens the foundation for Alpha Bank's business. The reduction in non-performing loan ratios, which have been steadily declining from highs above 40% in previous years to around 8-9% by early 2024, is a direct result of this recovery. This improved asset quality provides Alpha Bank with greater financial stability and capacity for lending.

The European Central Bank's (ECB) monetary policy is a primary driver of the interest rate environment affecting Alpha Bank. As of mid-2024, the ECB has maintained a relatively stable, albeit cautious, approach to rate adjustments following a period of hikes. This environment directly influences Alpha Bank's net interest margin (NIM), the difference between interest income and interest expense. For instance, if benchmark rates remain elevated, banks with a strong deposit base, like Alpha Bank, could see improved NIMs as lending rates adjust upwards more quickly than deposit costs.

Changes in the ECB's key interest rates, such as the deposit facility rate and the main refinancing operations rate, directly impact Alpha Bank's cost of funding and the yields it can achieve on its assets. For example, if the ECB were to lower rates in late 2024 or early 2025, Alpha Bank's funding costs would likely decrease, but this could also lead to lower yields on new loans, potentially compressing NIMs if its deposit rates are sticky downwards.

The prevailing interest rate landscape, influenced by the ECB's stance, shapes lending dynamics for both consumers and businesses. Higher rates generally translate to more expensive borrowing, potentially dampening loan demand. Conversely, a stable or slightly declining rate environment could stimulate lending activity, benefiting Alpha Bank through increased loan volumes and associated interest income, provided its risk management strategies are robust.

Inflation significantly impacts Alpha Bank by altering the real value of its assets and liabilities, and directly affecting customer purchasing power. For instance, with the US annual inflation rate hovering around 3.3% in early 2024, the real return on fixed-income assets diminishes, while the cost of doing business for Alpha Bank, from technology to personnel, can rise.

High inflation erodes the value of savings, potentially discouraging deposits, and can increase operating expenses for Alpha Bank. If customer wages don't rise commensurately with prices, loan defaults might increase, posing a risk to the bank's loan portfolio. For example, a persistent inflation rate above 5% could strain household budgets across many of Alpha Bank's markets.

Effectively managing inflation expectations is paramount for Alpha Bank's financial stability and for sustaining consumer confidence in its banking services. Central bank policies aimed at controlling inflation, such as interest rate adjustments, directly influence Alpha Bank's lending and borrowing costs, making proactive strategy essential.

Unemployment Rates and Household Income

Unemployment rates and household income are critical indicators for Alpha Bank, directly impacting its retail customer base and loan portfolio health. When unemployment is low and household incomes are rising, consumers are more likely to have disposable income for new loans and are better positioned to repay existing ones. This scenario typically translates to increased loan demand and reduced credit risk for the bank.

In the United States, the unemployment rate stood at 3.9% as of April 2024, a slight increase from previous months but still historically low. Household disposable income has shown growth, with real disposable income increasing by 2.1% in the first quarter of 2024 compared to the previous quarter. These positive trends generally support a healthy environment for Alpha Bank's retail lending operations.

Conversely, periods of high unemployment and stagnant or declining household incomes present significant challenges. Such conditions can lead to a rise in loan defaults and a decrease in new credit applications as consumers prioritize essential spending. For Alpha Bank, this translates to heightened credit risk and potentially lower profitability.

- United States Unemployment Rate: 3.9% (April 2024)

- US Real Disposable Income Growth: +2.1% (Q1 2024)

- Impact on Creditworthiness: Lower unemployment and higher incomes improve customer ability to service debt.

- Economic Downturn Effect: High unemployment and falling incomes increase credit risk and loan defaults.

Foreign Direct Investment and Capital Inflows

The level of foreign direct investment (FDI) and overall capital inflows into Greece significantly impacts economic activity and presents opportunities for Alpha Bank. For instance, in 2023, Greece saw a notable increase in FDI, reaching approximately €7.5 billion, a substantial rise from previous years, indicating growing investor confidence.

This influx of foreign capital fuels new business ventures and infrastructure development, directly benefiting Alpha Bank through increased demand for corporate banking services and financing. The expansion of businesses and infrastructure projects translates into greater lending opportunities and fee-based income for the bank.

Furthermore, robust capital inflows bolster liquidity within the Greek financial system. This enhanced liquidity supports Alpha Bank's lending capacity, allowing it to extend more credit and potentially improve its net interest margins. For example, total capital inflows in the first half of 2024 were reported to be robust, contributing to a healthier financial ecosystem.

- FDI Growth: Greece's FDI reached around €7.5 billion in 2023, signaling increased foreign investor interest.

- Corporate Banking Opportunities: New business ventures and infrastructure projects driven by FDI boost demand for Alpha Bank's lending and advisory services.

- Liquidity Enhancement: Strong capital inflows improve overall financial system liquidity, supporting Alpha Bank's lending activities.

- Economic Stimulation: FDI contributes to job creation and economic expansion, indirectly benefiting Alpha Bank through a more vibrant economy.

Government fiscal policy, including taxation and public spending, directly influences the economic environment in which Alpha Bank operates. For instance, the Greek government's commitment to fiscal consolidation and targeted public investments, as seen in the 2024 budget, aims to foster sustainable growth. This can lead to increased business confidence and investment, creating more lending opportunities for Alpha Bank.

Changes in public debt levels and government borrowing costs also have an impact. A manageable debt-to-GDP ratio, which Greece has been working to improve, generally leads to lower sovereign risk premiums, benefiting the entire financial sector. For example, Greece's debt-to-GDP ratio was projected to decrease to around 165% in 2024, down from higher levels in prior years, indicating a positive trend.

Government spending on infrastructure projects and social programs can stimulate economic activity, indirectly boosting demand for banking services. Conversely, austerity measures or significant increases in public debt could dampen economic prospects and potentially increase credit risk for banks like Alpha Bank.

| Indicator | Value | Period | Impact on Alpha Bank |

|---|---|---|---|

| Greek GDP Growth Projection | 2.9% | 2024 | Positive for loan demand and profitability |

| Greek Non-Performing Loan Ratio | ~8-9% | Early 2024 | Improved asset quality, greater lending capacity |

| US Unemployment Rate | 3.9% | April 2024 | Supports retail lending, lower credit risk |

| Greek FDI Inflow | ~€7.5 billion | 2023 | Boosts corporate banking and liquidity |

Full Version Awaits

Alpha Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Alpha Bank PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank.

What you’re previewing here is the actual file—fully formatted and professionally structured. It provides a detailed breakdown of Alpha Bank's strategic landscape, offering valuable insights for informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis is designed to be a practical tool for understanding Alpha Bank's external environment.

Sociological factors

Consumers, especially younger demographics, increasingly prioritize digital channels for banking, demanding intuitive mobile apps and seamless online platforms. A significant portion of transactions, estimated to be over 70% by late 2024 for many leading banks, now occur digitally. This shift necessitates Alpha Bank's investment in robust digital infrastructure and personalized customer journeys to remain competitive.

Greece's demographic landscape is marked by a significant aging population, with the median age projected to continue rising. This trend directly impacts Alpha Bank's customer base, increasing demand for services catering to retirement planning, wealth preservation, and estate management. For instance, by 2024, a substantial portion of the Greek population is over 65, indicating a growing market for pension funds and investment advisory services tailored to seniors.

Concurrently, shifts in population distribution, including potential rural-to-urban migration, will shape banking needs. Urban centers may see higher demand for digital banking solutions, quick credit access, and transaction-focused accounts from younger demographics. Alpha Bank must adapt its product offerings to serve both the established needs of an older generation and the evolving preferences of a younger, digitally-savvy segment, perhaps through tailored digital platforms or micro-financing options.

The general level of financial literacy in Greece directly influences the types of financial products Alpha Bank can effectively market. A population with higher financial understanding is more likely to engage with complex investment vehicles and tailored banking solutions.

Efforts to boost financial literacy, such as those supported by the Hellenic Financial Literacy and Responsible Banking Committee, can unlock new market segments for Alpha Bank. For instance, improved understanding of digital banking and investment tools could increase uptake of these services among younger demographics.

Financial inclusion initiatives are crucial for Alpha Bank's growth, particularly in bringing unbanked populations into the formal financial system. As of late 2024, approximately 15% of Greek adults remained outside the traditional banking sector, representing a significant opportunity for expansion.

Trust in Financial Institutions

Public trust in financial institutions, especially after economic downturns, significantly impacts banking operations. Alpha Bank's commitment to transparency, ethical conduct, and superior customer service is paramount for rebuilding and sustaining this trust. For instance, a 2024 survey indicated that only 45% of consumers expressed high confidence in their primary bank, a figure Alpha Bank aims to improve.

Maintaining high public trust is fundamental for Alpha Bank to attract deposits, cultivate enduring customer loyalty, and contribute to the broader financial system's stability. This trust is a key driver for customer retention and new customer acquisition, directly influencing deposit growth and lending capacity.

- Public Trust Metrics: Surveys in late 2024 revealed varying levels of confidence in the banking sector, with a significant portion of the population expressing caution.

- Impact on Deposits: Increased trust correlates with higher customer deposits, as seen in Alpha Bank's 2024 financial reports, which showed a 3.5% increase in retail deposits attributed to enhanced customer engagement initiatives.

- Reputation Management: Alpha Bank's proactive approach to addressing customer concerns and ensuring data security directly influences its reputation and, consequently, public trust.

Workforce Dynamics and Talent Attraction

Changes in workforce demographics and expectations are reshaping the financial sector. For instance, by 2025, it's projected that millennials and Gen Z will constitute a significant majority of the global workforce, bringing with them a strong preference for digital integration and flexible work arrangements. This shift necessitates that institutions like Alpha Bank focus on attracting and retaining talent adept in digital skills, data analytics, and customer-centric service delivery.

Alpha Bank's success hinges on its ability to adapt to evolving work models, such as hybrid and remote setups, which have become increasingly prevalent since 2020. Offering competitive compensation and benefits packages is also paramount to securing and keeping employees with in-demand expertise. A recent survey indicated that over 60% of finance professionals consider flexible work options a key factor when choosing an employer.

Key considerations for Alpha Bank include:

- Attracting digitally native talent: Focusing recruitment on individuals with proven proficiency in digital banking platforms, AI, and cybersecurity.

- Developing data analytics capabilities: Investing in training and hiring professionals skilled in leveraging big data for strategic decision-making and personalized customer experiences.

- Embracing flexible work environments: Implementing robust remote and hybrid work policies to broaden the talent pool and enhance employee satisfaction.

- Competitive remuneration: Ensuring salary and benefits packages align with industry benchmarks to retain top performers in a competitive market.

Sociological factors significantly influence Alpha Bank's operational landscape, driven by evolving consumer behaviors and demographic shifts. The increasing reliance on digital channels for banking, with over 70% of transactions occurring online by late 2024, necessitates robust digital infrastructure. Greece's aging population, where a substantial portion of the population is over 65, creates a growing demand for retirement planning and wealth preservation services.

Technological factors

Alpha Bank's digital transformation is a critical technological factor, necessitating ongoing investment in advanced mobile banking platforms and secure online services. By 2024, over 80% of banking transactions in many developed markets are conducted digitally, highlighting customer preference for convenient, remote financial management.

This shift means a seamless digital customer onboarding process and efficient internal automation are no longer optional but essential for competitive survival. Alpha Bank's ability to innovate in these areas directly impacts its market share and operational efficiency.

As Alpha Bank increasingly digitizes its operations, the risk of cyberattacks and data breaches escalates significantly. The bank needs to allocate substantial resources towards advanced cybersecurity solutions to safeguard customer information, financial transactions, and its internal systems. For instance, in 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the critical need for robust defenses.

Maintaining customer trust and avoiding hefty fines hinges on stringent data privacy measures and adherence to regulations such as GDPR. Failure to comply can result in substantial penalties; under GDPR, fines can reach up to 4% of annual global turnover or €20 million, whichever is higher. Alpha Bank's commitment to data protection is therefore not just a technical necessity but a fundamental business imperative for its reputation and financial stability.

Alpha Bank's embrace of Artificial Intelligence (AI) and Machine Learning (ML) is unlocking substantial operational advantages. These technologies are proving invaluable in bolstering fraud detection systems, offering highly personalized financial guidance, and refining credit risk assessments. For instance, AI algorithms can process vast datasets in real-time, identifying suspicious transactions with greater accuracy than traditional methods.

The strategic implementation of AI and ML is directly contributing to enhanced operational efficiency and more informed decision-making processes within Alpha Bank. By automating routine tasks and providing deeper analytical insights, the bank can allocate resources more effectively. This allows for the development of bespoke financial products and services, catering precisely to individual customer needs and strengthening Alpha Bank's competitive standing in an increasingly data-centric financial sector.

Fintech Collaboration and Competition

The burgeoning Fintech sector is a dual-edged sword for Alpha Bank, presenting both avenues for innovation through collaboration and significant competitive pressures. Fintech firms, known for their agility, often introduce specialized services that can quickly erode traditional banking market share. For instance, by late 2024, over 70% of European banks were exploring partnerships with Fintechs to enhance their digital offerings, according to industry reports.

Alpha Bank faces a strategic decision: either embrace Fintechs as partners, integrating their cutting-edge solutions to expand its service portfolio, or invest heavily in its own digital transformation to directly counter these disruptive forces. The global Fintech market was projected to reach over $300 billion in 2024, highlighting the scale of this evolving landscape.

- Fintech Disruption: Niche Fintechs are rapidly capturing market segments like payments, lending, and wealth management.

- Collaboration Potential: Partnerships can accelerate Alpha Bank's digital transformation and service innovation.

- Competitive Threat: Failure to adapt could lead to market share erosion as Fintechs offer more tailored and efficient digital experiences.

- Investment in Digital: Developing proprietary advanced digital platforms is a key strategy to maintain competitiveness.

Blockchain and Distributed Ledger Technology

Blockchain and Distributed Ledger Technology (DLT) are steadily advancing, promising significant changes in banking. These technologies could reshape core functions like payment processing, trade finance, and the settlement of securities. For Alpha Bank, staying abreast of these innovations is crucial for identifying opportunities to boost efficiency, cut operational expenses, and strengthen security measures, thereby positioning the bank for future industry transformations.

By 2025, the global market for blockchain in financial services is projected to reach substantial figures, with estimates suggesting it could exceed $10 billion. This growth underscores the increasing adoption and potential impact of DLT. Alpha Bank should consider pilot programs in areas like cross-border payments, where DLT can reduce transaction times from days to minutes and significantly lower fees compared to traditional correspondent banking models.

Specifically, DLT offers enhanced transparency and immutability, which are vital for regulatory compliance and fraud prevention. For instance, in trade finance, smart contracts built on blockchain can automate processes, reducing manual intervention and the risk of errors. Alpha Bank could explore integrating DLT for digital identity verification, streamlining Know Your Customer (KYC) processes and improving customer onboarding experiences.

Key areas for Alpha Bank to explore include:

- Payments: Investigating DLT for faster, cheaper domestic and international remittances, potentially leveraging central bank digital currencies (CBDCs) as they become more prevalent.

- Trade Finance: Implementing blockchain-based platforms to digitize letters of credit and bills of lading, increasing transparency and reducing settlement cycles.

- Securities Settlement: Exploring DLT for the issuance and trading of digital assets, aiming for near-instantaneous settlement and reduced counterparty risk.

- Regulatory Compliance: Utilizing DLT for immutable audit trails and streamlined reporting, enhancing data integrity and compliance efficiency.

Alpha Bank's technological trajectory is heavily influenced by the rapid advancement of AI and machine learning, which are crucial for enhancing fraud detection, personalizing customer experiences, and improving credit risk assessments. The bank's strategic adoption of these tools directly impacts its operational efficiency and decision-making capabilities, allowing for more tailored financial products.

The increasing prevalence of Fintechs presents both opportunities for strategic partnerships and significant competitive challenges, as these agile firms often introduce specialized, user-friendly digital services. By late 2024, over 70% of European banks were actively exploring collaborations with Fintechs to bolster their digital offerings, indicating a broad industry trend towards integration.

Furthermore, the ongoing evolution of blockchain and Distributed Ledger Technology (DLT) offers Alpha Bank avenues to streamline payment processing, trade finance, and securities settlement, potentially reducing transaction times and costs. The global market for blockchain in financial services is expected to surpass $10 billion by 2025, signaling substantial growth and adoption.

Legal factors

Alpha Bank navigates a robust regulatory landscape, encompassing both European Union directives like CRD VI and specific national banking laws. Meeting stringent capital requirements, such as those being finalized under the Basel IV framework, is paramount for the bank's ongoing financial health and to satisfy supervisory bodies. For instance, as of early 2024, European banks are preparing for the full implementation of Basel IV, which is expected to increase risk-weighted assets by an average of 15% for the sector, impacting capital ratios and potentially lending strategies.

Alpha Bank faces significant legal obligations under Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws. These regulations demand rigorous adherence to prevent financial crime, necessitating robust internal controls and thorough customer due diligence. For instance, in 2023, global AML fines reached an estimated $5.7 billion, highlighting the financial risks of non-compliance.

Failure to meet these stringent AML/CTF requirements can lead to severe penalties for Alpha Bank, including substantial fines, significant reputational damage, and serious legal repercussions. These consequences directly impact the bank's operational integrity and financial stability, underscoring the critical importance of proactive compliance measures.

Alpha Bank must navigate a complex web of consumer protection and data privacy laws, such as the EU's General Data Protection Regulation (GDPR). These regulations mandate stringent controls over how the bank collects, stores, and utilizes customer data, requiring transparency in all dealings. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the financial implications of non-compliance. Adherence to these rules is not just a legal obligation but a crucial element in fostering customer trust and safeguarding the bank's reputation.

Competition Law and Market Conduct Rules

Alpha Bank operates under stringent competition laws designed to prevent monopolistic practices and ensure a level playing field in the financial sector. These regulations, enforced by bodies like the Hellenic Competition Commission, target anti-competitive behaviors such as price-fixing and market manipulation. For instance, in 2023, the European Commission continued its scrutiny of banking sector practices across the EU, emphasizing the need for fair competition.

Market conduct rules are equally critical, dictating how Alpha Bank interacts with its customers to ensure transparency and fairness. These rules cover areas like product disclosure, complaint handling, and responsible lending, aiming to protect consumers. The European Banking Authority (EBA) regularly updates guidelines on consumer protection, with a focus on digital banking services and preventing unfair treatment of vulnerable customers throughout 2024.

- Adherence to EU and national competition laws

- Compliance with market conduct rules for customer protection

- Focus on preventing monopolistic practices and price fixing

- Ensuring transparency and fairness in all banking operations

Taxation Laws and Fiscal Policy Changes

Changes in national and international taxation laws directly impact Alpha Bank's profitability and financial planning. For instance, adjustments to corporate tax rates, such as the potential for revisions in the EU's minimum corporate tax rate discussions throughout 2024 and 2025, could alter the bank's net earnings. Similarly, new or altered taxes on financial transactions, a common consideration in many European economies, would necessitate careful management of operational costs and revenue streams.

Alpha Bank must remain vigilant in monitoring shifts in fiscal policy to maintain tax efficiency and ensure full compliance. The treatment of deferred tax assets, for example, is often subject to evolving tax regulations. By proactively adapting to these changes, the bank can optimize its financial structure and mitigate potential risks associated with non-compliance or unfavorable tax treatment.

- Corporate Tax Rate Impact: A hypothetical 1% increase in corporate tax rates could reduce Alpha Bank's net profit by tens of millions of Euros, depending on its taxable income in 2024-2025.

- Financial Transaction Taxes: The introduction of a financial transaction tax in a key operating market could add significant costs to trading activities, potentially impacting fee and commission income.

- Deferred Tax Assets: Changes in accounting standards or tax laws regarding the recognition and valuation of deferred tax assets can affect the bank's balance sheet and regulatory capital ratios.

Alpha Bank faces a dynamic legal environment shaped by evolving financial regulations and consumer protection laws. Compliance with directives like CRD VI and upcoming Basel IV capital requirements remains a core focus, with Basel IV potentially increasing risk-weighted assets by an average of 15% for European banks as implementation progresses through 2024-2025.

Strict adherence to Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws is critical, especially given that global AML fines reached approximately $5.7 billion in 2023, underscoring the significant financial and reputational risks of non-compliance.

The bank must also navigate consumer protection mandates, such as GDPR, where non-compliance can result in fines up to 4% of global annual turnover, emphasizing the need for robust data privacy practices to maintain customer trust.

Furthermore, Alpha Bank operates under competition and market conduct rules, with regulatory bodies like the European Commission and the European Banking Authority actively monitoring the sector for fair practices and transparency in customer interactions throughout 2024.

Environmental factors

Alpha Bank faces growing pressure to quantify and mitigate climate-related financial risks. This includes physical risks like severe weather damaging properties used as collateral and transition risks arising from shifts away from carbon-intensive sectors. For instance, the European Central Bank (ECB) has emphasized climate risk integration for banks under its supervision, with stress tests in 2024 and 2025 expected to further highlight these vulnerabilities.

Regulatory bodies are mandating more transparent reporting on these climate exposures, compelling Alpha Bank to embed climate considerations directly into its existing risk management systems and public disclosures. This means not just identifying risks but also developing strategies to manage them, aligning with evolving global standards for climate-related financial disclosures.

Alpha Bank's strategic direction is increasingly shaped by evolving Environmental, Social, and Governance (ESG) regulations. These new mandates require rigorous reporting on ESG performance, pushing the bank to actively develop robust sustainable finance frameworks and meticulously assess the ESG impact across its extensive loan portfolios.

Compliance with these ESG reporting requirements directly influences Alpha Bank's reputation and its ability to access capital markets. For instance, as of early 2025, a significant portion of European financial institutions are facing stricter disclosure requirements under the Sustainable Finance Disclosure Regulation (SFDR), with penalties for non-compliance becoming more pronounced.

This regulatory landscape necessitates Alpha Bank to transparently communicate its own environmental footprint, a move that can enhance investor confidence and attract a growing pool of ESG-focused capital. The bank's proactive engagement in these areas is crucial for maintaining a competitive edge and ensuring long-term financial stability in a market prioritizing sustainability.

Alpha Bank can capitalize on the growing demand for sustainable finance by actively participating in green lending. This involves financing projects like solar farms and wind energy installations, which are seeing substantial investment. For instance, the global green bond market reached an estimated $1.2 trillion in 2023, showcasing a significant appetite for environmentally conscious investments.

The bank can also offer specialized green loans for energy-efficient retrofits in residential and commercial properties. Such initiatives not only contribute to environmental goals but also tap into a market segment increasingly focused on ESG (Environmental, Social, and Governance) principles. By developing a robust sustainable finance portfolio, Alpha Bank can attract environmentally aware clients and enhance its corporate reputation.

Resource Scarcity and Operational Footprint

Concerns regarding resource scarcity, especially for water and energy, directly influence Alpha Bank's operational expenses and its commitment to sustainability. For instance, the increasing cost of energy, with wholesale electricity prices in Europe experiencing significant volatility, directly impacts the bank's utility bills for its extensive branch network and data centers.

Alpha Bank must actively manage its environmental footprint, encompassing energy consumption, waste generation, and water usage across all its facilities. In 2023, the EU saw a notable increase in energy efficiency investments by businesses, a trend Alpha Bank can leverage.

Adopting eco-efficient practices presents a dual benefit: driving cost savings through reduced resource consumption and enhancing the bank's public image and brand reputation. Banks that prioritize sustainability often find they attract both environmentally conscious customers and investors.

Key areas for Alpha Bank's environmental focus include:

- Energy Efficiency: Upgrading lighting, HVAC systems, and server infrastructure in branches and data centers to reduce electricity consumption.

- Waste Management: Implementing robust recycling programs and reducing paper usage through digitalization initiatives.

- Water Conservation: Installing water-saving fixtures in facilities, particularly in regions facing water stress.

- Supply Chain Sustainability: Encouraging or requiring vendors to adopt sustainable practices, impacting the bank's indirect environmental footprint.

Reputational Risk from Environmental Incidents

Alpha Bank, like many financial institutions, navigates significant reputational risks tied to its environmental footprint. Public and investor pressure is mounting, with a growing demand for transparency regarding the environmental impact of financed projects. A 2024 survey indicated that 68% of retail investors consider a company's environmental record when making investment decisions, a figure that has steadily climbed.

Financing industries with a high environmental impact, even indirectly, can expose Alpha Bank to severe backlash. Negative publicity, potential customer boycotts, and a decline in investor confidence are tangible consequences. For instance, in late 2023, a major European bank faced significant criticism and a dip in its stock price after allegations surfaced regarding its substantial financing of new fossil fuel projects.

To counter these threats, Alpha Bank must prioritize robust environmental due diligence. This proactive approach is crucial for identifying and mitigating potential reputational damage.

- Increased Investor Scrutiny: A growing number of institutional investors, managing trillions in assets globally, are integrating ESG (Environmental, Social, and Governance) factors into their investment strategies, directly impacting Alpha Bank's access to capital if environmental concerns are not addressed.

- Consumer Activism: Public awareness campaigns and social media activism can quickly amplify negative perceptions of financial institutions involved in environmentally questionable practices, leading to direct customer attrition.

- Regulatory and Legal Risks: Evolving environmental regulations and potential litigation for contributing to environmental damage can also create significant financial and reputational liabilities for the bank.

Alpha Bank faces increasing regulatory pressure to integrate climate risk into its operations, with the ECB's stress tests in 2024 and 2025 highlighting these vulnerabilities. The bank must enhance transparency in reporting climate exposures and develop strategies to manage them, aligning with global disclosure standards.

The bank's strategic direction is significantly influenced by ESG regulations, necessitating robust reporting and assessment of ESG impacts across its loan portfolios. Compliance with these mandates, such as the SFDR by early 2025, directly affects Alpha Bank's reputation and capital market access, with penalties for non-compliance becoming more pronounced.

Alpha Bank can leverage the growing demand for sustainable finance by actively participating in green lending, capitalizing on the global green bond market which reached an estimated $1.2 trillion in 2023. Offering specialized green loans for energy-efficient projects also taps into a market segment prioritizing ESG principles.

Resource scarcity, particularly concerning energy costs with significant European wholesale electricity price volatility, directly impacts Alpha Bank's operational expenses. The bank must manage its environmental footprint, including energy consumption and waste generation, a trend where EU businesses increased energy efficiency investments in 2023.

Alpha Bank faces reputational risks tied to its environmental footprint, with 68% of retail investors in a 2024 survey considering a company's environmental record. Financing environmentally impactful industries can lead to backlash, as seen with a major bank facing criticism in late 2023 for financing fossil fuel projects.

| Environmental Factor | Impact on Alpha Bank | Key Data/Trend |

| Climate Risk Integration | Regulatory mandate, risk management necessity | ECB stress tests in 2024-2025 |

| ESG Reporting | Reputational impact, capital market access | SFDR compliance by early 2025 |

| Sustainable Finance Demand | Opportunity for green lending | Global green bond market ~$1.2 trillion (2023) |

| Resource Scarcity (Energy) | Increased operational costs | European wholesale electricity price volatility |

| Reputational Risk (Environmental Footprint) | Investor and consumer scrutiny | 68% of retail investors consider environmental record (2024) |

PESTLE Analysis Data Sources

Our Alpha Bank PESTLE Analysis is built on comprehensive data from reputable sources including central bank reports, financial market data providers, and economic forecasting agencies. Each insight into political stability, economic trends, and social shifts is meticulously gathered from these trusted institutions.