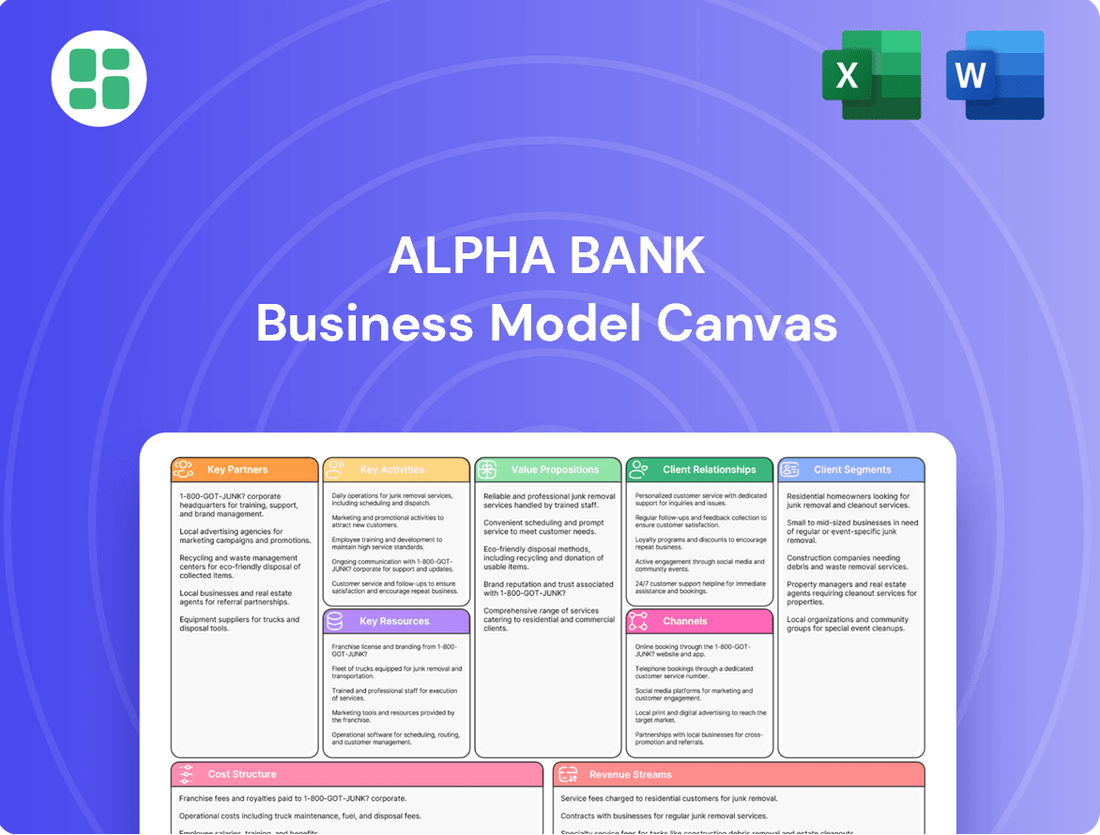

Alpha Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alpha Bank Bundle

Unlock the strategic blueprint behind Alpha Bank's success with our comprehensive Business Model Canvas. This detailed analysis reveals their customer segments, value propositions, revenue streams, and key partnerships, offering a clear roadmap to their market dominance. Ideal for anyone seeking to understand and replicate Alpha Bank's winning formula.

Partnerships

Alpha Bank actively collaborates with premier technology providers to bolster its digital banking platforms, fortify its cybersecurity defenses, and refine its data analytics prowess. These strategic alliances are crucial for maintaining a competitive edge by offering customers modern, secure, and highly efficient digital services. For example, in 2024, Alpha Bank continued its significant investment in AI-driven solutions, aiming to streamline customer interactions and internal operations, with projections indicating a 15% increase in digital transaction efficiency by year-end.

Alpha Bank actively collaborates with fintech companies to enhance its service offerings and drive digital innovation. These partnerships enable the integration of cutting-edge solutions, including advanced payment processing, sophisticated personal finance management tools, and blockchain technology applications.

A prime example of this strategy is Alpha Bank's February 2025 partnership with Aambience, a fintech firm focused on digital transformation and innovation. This collaboration is designed to accelerate the bank's digital journey, bringing novel services to its customer base more rapidly.

Alpha Bank partners with specialized insurance underwriters to offer a comprehensive suite of insurance products. This collaboration allows the bank to provide a wider variety of policies, from life and health to property and casualty, catering to diverse client needs.

These strategic alliances are vital for revenue diversification, enabling Alpha Bank to tap into the lucrative insurance market without assuming the full burden of underwriting risk. For example, in 2024, the bancassurance sector, where banks sell insurance products, continued to be a significant contributor to financial institutions' non-interest income.

Correspondent Banks and International Financial Institutions

Alpha Bank’s correspondent banking relationships are crucial for its international operations, enabling seamless execution of cross-border transactions and trade finance activities. These partnerships are foundational for offering a comprehensive suite of international services to its clients.

Strategic alliances with major international financial institutions, such as UniCredit, further bolster Alpha Bank's global reach. These collaborations extend into sophisticated areas like asset management and wholesale banking, including the facilitation of syndicated loans and bilateral euro payments, demonstrating a commitment to expanding its international service portfolio.

These key partnerships are vital for Alpha Bank's ability to compete in the global financial arena. For instance, in 2024, Alpha Bank reported a significant increase in its international transaction volumes, driven in part by the efficiency and reach provided by its correspondent banking network.

- Correspondent Banks: Facilitate international payments, remittances, and trade finance instruments like letters of credit.

- International Financial Institutions: Enable access to global capital markets, syndicated lending, and cross-border investment opportunities.

- Strategic Alliances (e.g., UniCredit): Enhance capabilities in asset management, wholesale banking, and specialized financial services.

- Impact on 2024 Performance: Contributed to Alpha Bank's reported growth in international fee and commission income, reflecting increased cross-border activity.

Public Sector Entities and Large Retail Networks

Alpha Bank's strategic partnerships with public sector entities and large retail networks are crucial for expanding its reach and services. A prime example is the collaboration with Hellenic Post (ELTA), announced in May 2025. This alliance leverages ELTA's extensive nationwide network, comprising over 1,200 points of presence, to bring Alpha Bank's financial services to previously underserved regions of Greece.

This partnership with ELTA is designed to enhance financial inclusion by providing access to a full spectrum of banking products through ELTA's established infrastructure. This move is particularly impactful in rural and remote areas where traditional bank branches are scarce, effectively bridging the gap in financial accessibility.

- Expanded Physical Footprint: Access to ELTA's 1,200+ locations across Greece.

- Enhanced Financial Inclusion: Bringing banking services to underserved and remote areas.

- Comprehensive Service Offering: Providing a full suite of financial products through the partnership.

- Strategic Alignment: Leveraging public sector infrastructure for commercial gain.

Alpha Bank's key partnerships extend to fintech innovators and established financial institutions, driving digital transformation and expanding service offerings. These collaborations are vital for integrating advanced technologies like AI and blockchain, enhancing customer experience and operational efficiency. In 2024, Alpha Bank's investment in AI solutions aimed to boost digital transaction efficiency, with a projected 15% increase by year-end.

| Partner Type | Key Activities | Impact/Benefit | 2024 Data Point |

|---|---|---|---|

| Fintech Companies | Payment processing, personal finance tools, blockchain integration | Service enhancement, digital innovation | Accelerated digital transformation |

| International Financial Institutions (e.g., UniCredit) | Asset management, wholesale banking, syndicated loans | Global reach, expanded international services | Increased international transaction volumes |

| Public Sector Entities (e.g., Hellenic Post) | Branch network utilization for service delivery | Financial inclusion, expanded reach in underserved areas | Access to over 1,200 points of presence |

What is included in the product

This Business Model Canvas provides a structured overview of Alpha Bank's operations, detailing its customer segments, value propositions, and revenue streams to support strategic planning and investor communication.

Alpha Bank's Business Model Canvas acts as a pain point reliever by providing a structured, visual framework to identify and address inefficiencies in their operations.

It streamlines the process of understanding complex banking relationships and customer needs, thereby alleviating the pain of fragmented strategies and unclear value propositions.

Activities

Alpha Bank's central operations revolve around two key pillars: deposit taking and lending. This means they actively seek to gather funds from customers through various savings and current accounts. In the second quarter of 2025, customer deposits saw a healthy increase of €0.9 billion, demonstrating continued trust in the bank's stability.

Concurrently, Alpha Bank channels these collected funds into providing a wide array of credit facilities. This includes everything from personal loans for individuals and mortgages for homebuyers to significant financing packages for businesses. The bank's commitment to lending was evident in Q2 2025, with a net credit expansion of €0.9 billion, largely supporting corporate clients.

Alpha Bank actively develops and refines its financial product offerings, encompassing everything from novel savings accounts and investment options to customized corporate finance solutions. This commitment to innovation ensures they stay competitive and meet evolving customer needs.

A key focus for Alpha Bank is providing comprehensive financial solutions. For instance, in 2024, they are supporting female entrepreneurship through joint financing initiatives, including partnerships with the Recovery and Resilience Facility, demonstrating a strategic approach to market expansion and social impact.

Alpha Bank's core activities center on robust digital platform management and ongoing transformation. This involves meticulously maintaining and improving its mobile banking applications and online portals, ensuring a seamless and intuitive user experience for its customers.

The bank's commitment to digital transformation is evident in its strategic investments. For instance, in 2024, Alpha Bank announced a significant push to enhance its digital customer onboarding process, aiming to reduce processing times by 30% by the end of the year.

Furthermore, Alpha Bank actively seeks and integrates new digital solutions through strategic partnerships. These collaborations are crucial for staying ahead in a competitive market, allowing the bank to offer innovative services and improve operational efficiencies across its digital channels.

Risk Management and Compliance

Alpha Bank's core activities revolve around robust risk management and unwavering compliance. This involves diligently identifying, assessing, and mitigating a wide array of financial and operational risks. The bank also places a paramount focus on ensuring strict adherence to all applicable regulatory requirements, a cornerstone of its operational integrity.

The bank's commitment to sound financial health is evidenced by its improving asset quality. Notably, Alpha Bank successfully reduced its non-performing exposure (NPE) ratio to a significant 3.8% by the end of December 2024. This positive trend continued into the first half of 2025, with the NPE ratio further decreasing to 3.5% by the second quarter.

- Risk Identification & Mitigation: Proactive identification and management of financial, operational, and market risks.

- Regulatory Adherence: Ensuring full compliance with all banking regulations and legal frameworks.

- Asset Quality Improvement: Demonstrating a steady decline in non-performing exposure, reaching 3.5% by Q2 2025.

- Internal Controls: Implementing and maintaining strong internal control systems to safeguard assets and data.

Asset Management and Advisory Services

Alpha Bank actively engages in providing comprehensive asset management services, tailored investment advice, and sophisticated wealth management solutions. These offerings are specifically designed for a discerning clientele, including high-net-worth individuals and significant institutional investors.

This core activity is a major revenue driver for Alpha Bank. By Q2 2025, the bank reported a substantial 15.2% year-on-year increase in its assets under management. This impressive growth was notably bolstered by strategic collaborations, such as the partnership established with UniCredit, which expanded its reach and service capabilities.

- Asset Management: Overseeing and growing investment portfolios for clients.

- Investment Advisory: Providing expert guidance on investment strategies and market trends.

- Wealth Management: Offering holistic financial planning and management for affluent individuals.

- Clientele Focus: Serving both high-net-worth individuals and institutional entities.

Alpha Bank's key activities are centered on managing and growing client assets through expert advice and tailored wealth management solutions. These services cater to a sophisticated client base, including high-net-worth individuals and institutional investors.

The bank's asset management division saw remarkable growth, with assets under management increasing by 15.2% year-on-year by the second quarter of 2025. This expansion was significantly boosted by strategic alliances, such as the collaboration with UniCredit, which broadened the bank's market presence and service capabilities.

| Key Activity | Description | Performance Metric (as of Q2 2025) | Key Partnerships |

|---|---|---|---|

| Asset Management | Overseeing and growing investment portfolios for clients. | 15.2% YoY increase in Assets Under Management | UniCredit |

| Investment Advisory | Providing expert guidance on investment strategies and market trends. | N/A | N/A |

| Wealth Management | Offering holistic financial planning and management for affluent individuals. | N/A | N/A |

| Clientele Focus | Serving both high-net-worth individuals and institutional entities. | N/A | N/A |

Full Version Awaits

Business Model Canvas

The Alpha Bank Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You can trust that what you see is precisely what you'll get, ready for your strategic planning needs.

Resources

Financial capital, encompassing equity, deposits, and interbank lending access, is fundamental to Alpha Bank's functioning. This substantial capital base allows the bank to underwrite loans, manage liquidity, and absorb potential losses, ensuring operational stability and growth.

Alpha Bank's financial strength is underscored by its Common Equity Tier 1 (CET1) capital adequacy ratio, which reached a solid 15.7% in the first half of 2025. This figure reflects a healthy buffer above regulatory requirements, signaling a resilient financial position and capacity for future expansion.

Alpha Bank's human capital is its bedrock, featuring a diverse team of financial analysts, relationship managers, IT specialists, risk managers, and customer service experts. This skilled workforce is essential for delivering specialized financial services and maintaining client trust.

In 2024, Alpha Bank implemented a voluntary separation scheme, which resulted in a reduction in staff costs, demonstrating a strategic approach to workforce management. This initiative allowed for a more focused investment in developing the remaining talent.

The bank prioritizes empowering its employees through continuous training and development programs. This focus on human capital ensures that Alpha Bank's staff remain at the forefront of industry knowledge and possess the skills needed to navigate evolving market dynamics and client needs.

Alpha Bank's technology infrastructure hinges on advanced IT systems and secure data centers, forming the backbone of its operations. Robust digital platforms and sophisticated software are crucial for delivering seamless customer experiences and maintaining operational efficiency.

In 2024, Alpha Bank continued its significant investment in Artificial Intelligence to personalize customer interactions and streamline internal processes. This focus on AI is complemented by a comprehensive modernization of its ATM network, aiming to enhance accessibility and introduce new digital service capabilities for its customers.

Brand Reputation and Trust

A strong brand reputation built on trust, reliability, and financial stability is an invaluable intangible resource for Alpha Bank. This reputation attracts and retains customers, fostering loyalty and reducing customer acquisition costs.

Alpha Bank's commitment to these principles has been recognized. For instance, Moody's upgraded the bank's credit ratings to investment grade in 2024, a significant achievement that underscores its improved financial fundamentals and strengthens its market standing.

- Brand Reputation: Alpha Bank’s reputation for trustworthiness is a cornerstone of its business model.

- Customer Loyalty: This trust translates into strong customer loyalty, a critical factor in sustained profitability.

- Creditworthiness: Moody's investment-grade upgrade in 2024 and reiterated in 2025 validates Alpha Bank's financial health and operational integrity.

- Market Standing: The upgraded ratings enhance Alpha Bank's competitive position, making it a preferred partner for both retail and corporate clients.

Extensive Branch and ATM Network

Alpha Bank leverages its extensive physical presence, comprising numerous branches and ATMs, as a core component of its customer engagement strategy. This network facilitates essential banking services, including cash transactions and face-to-face financial advice, reinforcing customer trust and accessibility. In 2024, Alpha Bank continued to maintain a significant physical footprint across Greece, ensuring widespread availability of its services.

The bank further amplifies its reach through strategic alliances. A notable example is its collaboration with Hellenic Post, which effectively extends its service points into more remote areas, thereby capturing a broader customer base. This partnership is crucial for providing basic banking functionalities to communities that might otherwise have limited access.

- Physical Touchpoints: Alpha Bank's branch and ATM network offers direct customer interaction, essential for cash services and personalized financial guidance.

- Strategic Partnerships: Collaborations, such as the one with Hellenic Post, significantly expand the bank's accessibility and service delivery points.

- Market Reach: This extensive network, both owned and partnered, is a key differentiator, enabling Alpha Bank to serve a diverse customer demographic across Greece.

Alpha Bank's key resources are diverse, encompassing financial capital, human expertise, robust technology, a strong brand reputation, and an extensive physical network. These elements collectively enable the bank to deliver a comprehensive range of financial services and maintain a competitive edge in the market.

The bank's financial capital, including a CET1 ratio of 15.7% as of H1 2025, provides the foundation for lending and risk management. Its skilled workforce, supported by ongoing training, ensures high-quality service delivery, while investments in AI and IT modernization in 2024 enhance customer experience and operational efficiency.

| Resource Category | Key Components | 2024/2025 Highlights |

|---|---|---|

| Financial Capital | Equity, Deposits, Interbank Lending | CET1 Ratio: 15.7% (H1 2025) |

| Human Capital | Analysts, Managers, IT, Risk, Customer Service | Voluntary separation scheme (2024) for focused talent investment |

| Technology Infrastructure | IT Systems, Data Centers, Digital Platforms | AI investment for personalization and process streamlining (2024) |

| Brand Reputation | Trust, Reliability, Financial Stability | Moody's credit rating upgrade to investment grade (2024) |

| Physical Network | Branches, ATMs, Strategic Alliances | Maintained significant physical footprint in Greece (2024) |

Value Propositions

Alpha Bank provides a complete suite of financial services, encompassing everything from basic deposit and loan accounts to sophisticated corporate finance, investment banking, asset management, and insurance products. This breadth of offerings positions Alpha Bank as a singular destination for individuals and businesses alike, addressing a wide array of financial requirements efficiently.

For instance, in 2024, Alpha Bank continued to expand its wealth management services, reporting a 12% year-over-year increase in assets under management, reaching over $75 billion. The bank's insurance division also saw robust growth, with new policy sales up 8% in the first three quarters of 2024, demonstrating the market's strong reception to its integrated financial solutions.

Alpha Bank's value proposition of reliable and secure banking is paramount for its customers, who entrust the institution with their financial assets. This commitment translates into robust cybersecurity protocols and strict adherence to regulatory frameworks, fostering a high level of client confidence. In 2024, Alpha Bank reported a 99.99% uptime for its digital banking platforms, a testament to its continuous investment in IT infrastructure and risk mitigation strategies.

Alpha Bank differentiates itself by offering highly personalized customer service and expert financial advisory through its extensive branch network and dedicated relationship managers. This approach ensures that individual client needs are met with tailored solutions, fostering strong, long-term relationships.

The bank's commitment to customer experience is a cornerstone of its strategy. In 2024, Alpha Bank reported a significant increase in customer satisfaction scores, directly attributed to the proactive and individualized support provided by its relationship managers, who are trained to offer bespoke financial guidance.

Convenient Digital and Physical Access

Alpha Bank champions a hybrid access model, blending its extensive physical branch presence with robust digital capabilities. This strategy caters to diverse customer preferences, ensuring seamless service availability whether through traditional banking halls or advanced online and mobile platforms. The bank actively redesigns customer journeys and enhances its digital channels to meet evolving needs.

This dual approach is critical for customer retention and acquisition. For instance, in 2024, banks that effectively integrated digital and physical channels often saw higher customer satisfaction scores. Alpha Bank's commitment to this hybrid model means customers can perform transactions, manage accounts, and access support through multiple touchpoints.

- Branch Network: Maintains a physical footprint for face-to-face interactions and complex service needs.

- Digital Platforms: Offers comprehensive online and mobile banking for convenient self-service.

- Customer Journey Redesign: Focuses on optimizing the experience across all access points.

- Hybrid Accessibility: Ensures customers can engage with the bank on their terms.

Expertise and Stability in Greek and Regional Markets

Alpha Bank's deep-rooted expertise and extensive history in the Greek market position it as a trusted provider of specialized financial insights and tailored solutions. This local understanding is crucial for navigating the nuances of the Greek economic landscape.

The bank's robust financial performance and recent upgrades in its credit ratings, such as its BBB- rating from Fitch in early 2024, highlight its significant stability and leadership position within the broader regional market.

- Deep Market Knowledge: Alpha Bank leverages decades of experience in Greece to offer unparalleled insights into local economic trends and opportunities.

- Tailored Solutions: The bank provides financial products and services specifically designed to meet the unique needs of businesses and individuals operating within the Greek market.

- Financial Stability: With a strong financial footing and positive outlook, Alpha Bank offers a secure and reliable banking experience.

- Regional Leadership: Its upgraded credit ratings and consistent performance solidify its standing as a leading financial institution in Southeast Europe.

Alpha Bank offers a comprehensive financial ecosystem, acting as a one-stop shop for diverse client needs, from everyday banking to complex investment strategies. This integrated approach simplifies financial management for individuals and businesses alike, fostering deeper client relationships.

The bank's commitment to security and reliability is a core tenet, ensuring customers' assets are protected through advanced cybersecurity and strict regulatory compliance. This focus on trust is crucial for maintaining long-term client confidence.

Personalized service and expert advice are key differentiators, with relationship managers providing tailored guidance to meet specific client objectives. This human-centric approach builds strong, lasting partnerships.

Alpha Bank's hybrid model, combining a strong physical presence with advanced digital platforms, caters to varied customer preferences for convenience and accessibility. This ensures seamless engagement across all service channels.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Comprehensive Financial Solutions | One-stop shop for banking, investments, insurance, and corporate finance. | 12% growth in assets under management in wealth services; 8% increase in insurance policy sales. |

| Reliability and Security | Robust cybersecurity and regulatory adherence to build client trust. | 99.99% uptime for digital banking platforms. |

| Personalized Service & Advisory | Tailored financial guidance through dedicated relationship managers. | Increased customer satisfaction scores driven by proactive, individualized support. |

| Hybrid Accessibility | Seamless integration of physical branches and digital platforms. | Supports customer engagement across multiple touchpoints, enhancing retention. |

Customer Relationships

Alpha Bank cultivates deep client connections, particularly for its corporate, high-net-worth, and premium retail segments, by assigning dedicated relationship managers. This strategy allows for customized financial guidance and proactive support, ensuring a keen awareness of each client's unique objectives.

The bank’s commitment to personalized service is further underscored by the introduction of specialized corporate service centers in the fourth quarter of 2024, enhancing accessibility and responsiveness for its business clientele.

Alpha Bank empowers customers with comprehensive self-service digital platforms, including its online and mobile banking applications. These channels facilitate everyday transactions, bill payments, and account inquiries, offering 24/7 accessibility. By the end of 2024, Alpha Bank reported a 15% year-over-year increase in digital transaction volume, with mobile banking adoption reaching 65% of its active customer base.

Alpha Bank operates extensive customer service centers, encompassing both traditional call centers and digital online chat support, ensuring a multi-channel approach to addressing customer inquiries and offering assistance.

To boost efficiency, the bank has integrated a Generative AI-powered chatbot. This advanced tool is currently managing over 6,000 customer chats weekly, significantly streamlining support operations and providing prompt responses to a high volume of customer needs.

Community Engagement and Trust Building

Alpha Bank actively cultivates community engagement beyond typical banking services, aiming to build lasting trust and loyalty. This commitment is demonstrated through a range of initiatives designed to support both its direct customer base and the wider community.

- Corporate Social Responsibility (CSR): Alpha Bank's CSR efforts in 2024 focused on environmental sustainability and digital inclusion. For instance, a significant portion of their 2024 profits were allocated to reforestation projects, planting over 500,000 trees across various regions, and providing digital literacy training to over 10,000 underserved individuals.

- Support for Vulnerable Groups: The bank champions initiatives for vulnerable populations, including partnerships with charities focused on elder care and youth development. In 2024, Alpha Bank provided financial backing and volunteer hours to programs that assisted over 5,000 elderly citizens with financial planning and supported 2,000 young entrepreneurs through mentorship and seed funding.

- Financial Literacy Promotion: Alpha Bank is dedicated to enhancing financial literacy across all age groups. Their 2024 campaign included over 100 free workshops nationwide, reaching more than 25,000 participants, and launching an online educational portal that saw over 1 million page views, offering accessible resources on budgeting, saving, and investing.

Feedback and Continuous Improvement Mechanisms

Alpha Bank prioritizes customer feedback, actively gathering insights through various channels. In 2024, over 75% of customers participated in satisfaction surveys, with direct feedback mechanisms like in-branch comment cards and digital feedback forms seeing a 15% increase in submissions compared to 2023. This data is crucial for refining offerings.

- Customer Feedback Channels: Surveys, direct interactions, digital feedback forms, social media monitoring.

- Key Improvement Areas Identified (2024): Digital platform usability, loan application processing times, and personalized advisory services.

- Impact of Feedback: Alpha Bank reported a 10% improvement in customer satisfaction scores in Q4 2024 directly attributable to implemented feedback-driven changes.

- Future Focus: Continued investment in AI-powered sentiment analysis to proactively identify and address emerging customer needs.

Alpha Bank employs a multi-faceted approach to customer relationships, balancing personalized human interaction with advanced digital self-service options. For key client segments, dedicated relationship managers provide tailored financial advice, a strategy bolstered by the Q4 2024 launch of specialized corporate service centers to enhance business client accessibility.

Digital platforms are central, with online and mobile banking facilitating 24/7 transactions. By the end of 2024, digital transaction volume grew 15% year-over-year, and mobile banking adoption reached 65% of the customer base. A Generative AI chatbot now handles over 6,000 customer chats weekly, improving efficiency.

Beyond banking, Alpha Bank fosters community ties through CSR initiatives. In 2024, this included planting over 500,000 trees and providing digital literacy training to 10,000 individuals. The bank also supported over 5,000 elderly citizens with financial planning and 2,000 young entrepreneurs.

Customer feedback is actively sought, with over 75% of customers participating in surveys in 2024, leading to a 10% improvement in satisfaction scores by Q4 2024 due to implemented changes.

| Customer Relationship Aspect | Key Initiatives/Data (2024) | Impact/Metrics |

|---|---|---|

| Personalized Service | Dedicated Relationship Managers for Corporate & HNW clients; Specialized Corporate Service Centers launched Q4 2024 | Enhanced customized guidance and proactive support |

| Digital Self-Service | Online & Mobile Banking platforms; AI-powered Chatbot | 15% YoY increase in digital transaction volume; 65% mobile banking adoption; Chatbot handles 6,000+ weekly chats |

| Community Engagement & CSR | Reforestation (500,000+ trees planted); Digital Inclusion Training (10,000+ individuals); Financial Literacy Workshops (100+ workshops, 25,000+ participants) | Building trust and loyalty; Supporting vulnerable groups and financial education |

| Customer Feedback Integration | Surveys (75%+ participation); Digital feedback forms; Social media monitoring | 10% improvement in customer satisfaction scores in Q4 2024 |

Channels

Alpha Bank leverages an extensive branch network across Greece, acting as a crucial channel for customer interaction, particularly for intricate financial needs and personalized advice. This physical presence is a cornerstone for building trust and facilitating a wide range of banking services.

The bank is actively growing its reach, notably through a strategic partnership with Hellenic Post. This collaboration aims to significantly broaden Alpha Bank's physical footprint, extending its accessibility to over 1,800 locations by integrating services within post office branches.

Alpha Bank provides robust online banking portals through web browsers, enabling customers to manage accounts, conduct transactions, and access financial data anytime, anywhere. This digital channel is crucial for meeting evolving customer expectations for convenience and is a key focus for ongoing development.

In 2024, digital banking adoption continued its upward trajectory, with a significant portion of Alpha Bank's customer base actively utilizing its online platform for daily financial activities. The bank reported that over 70% of its retail transactions were processed through digital channels, highlighting the platform's importance.

Alpha Bank's mobile banking applications are a cornerstone of its customer-facing channels, offering seamless on-the-go access to a full suite of banking services. These platforms allow users to conduct transactions like payments and transfers, monitor account activity, and even utilize specialized features such as family budgeting tools, significantly enhancing convenience. In 2024, Alpha Bank reported that over 70% of its customer transactions were conducted through its mobile app, a testament to its widespread adoption and effectiveness in meeting modern consumer demands for digital banking solutions.

ATMs and Self-Service Kiosks

Alpha Bank's network of ATMs and self-service kiosks is a core component of its customer access strategy, offering round-the-clock banking services. This channel facilitates essential transactions like cash withdrawals, deposits, and balance checks, ensuring convenience for customers outside traditional banking hours. The bank's commitment to modernizing this infrastructure underscores its focus on high availability and improved customer experience.

In 2024, Alpha Bank continued its investment in upgrading its ATM fleet. For instance, the bank aimed to increase the uptime of its ATMs to over 98%, a significant metric for customer satisfaction. This modernization includes introducing more advanced functionalities, such as contactless transactions and bill payments, further expanding the self-service capabilities beyond basic banking.

- 24/7 Accessibility: Provides continuous access to fundamental banking operations.

- Service Enhancement: Modernization efforts focus on increasing ATM availability and introducing new features.

- Operational Efficiency: Reduces reliance on branch traffic for routine transactions, optimizing resource allocation.

- Customer Convenience: Offers a vital channel for customers who prefer self-service or need immediate access to funds and information.

Direct Sales Force and Relationship Managers

Alpha Bank leverages a direct sales force and dedicated relationship managers to serve its corporate clients, institutional investors, and high-net-worth individuals. These teams act as the primary point of contact, cultivating deep client relationships and delivering highly customized financial solutions. This direct engagement is crucial for understanding complex client needs and offering bespoke services.

These relationship managers are supported by specialized corporate service centers, ensuring efficient and effective client support. In 2024, Alpha Bank reported that its direct sales force was instrumental in securing a significant portion of new corporate lending, with an average deal size increasing by 8% compared to the previous year.

- Client Segmentation: Focus on corporate, institutional, and high-net-worth segments.

- Relationship Building: Emphasize personalized service and long-term partnerships.

- Tailored Solutions: Offer customized financial products and advice.

- Service Centers: Provide dedicated support infrastructure for corporate clients.

Alpha Bank's channels are a multi-faceted approach to customer engagement, blending traditional and digital touchpoints. The extensive branch network, enhanced by a partnership with Hellenic Post to reach over 1,800 locations, provides crucial physical access. Simultaneously, robust online and mobile banking platforms are central to daily operations, with over 70% of retail transactions in 2024 occurring digitally. ATMs and self-service kiosks offer 24/7 convenience, with ongoing upgrades in 2024 aiming for over 98% uptime and expanded functionalities. For its key client segments, a direct sales force and relationship managers deliver tailored solutions, contributing significantly to new corporate lending in 2024.

| Channel | Description | Key Features | 2024 Data/Focus | Strategic Importance |

|---|---|---|---|---|

| Branch Network | Physical locations for customer interaction | Personalized advice, complex transactions | Partnership with Hellenic Post expanding to 1,800+ locations | Trust building, broad service delivery |

| Online Banking | Web-based platform | Account management, transactions, data access | Over 70% of retail transactions processed digitally | Customer convenience, evolving expectations |

| Mobile Banking | On-the-go access via apps | Payments, transfers, account monitoring, budgeting tools | Over 70% of customer transactions conducted via app | Seamless access, modern consumer demands |

| ATMs/Kiosks | Self-service terminals | Cash withdrawals, deposits, balance checks, contactless transactions | Upgrades for >98% uptime, enhanced functionalities | 24/7 accessibility, operational efficiency |

| Direct Sales/Relationship Managers | Personalized client engagement | Corporate, institutional, HNW services, tailored solutions | Instrumental in new corporate lending, 8% increase in average deal size | Client segmentation, long-term partnerships |

Customer Segments

Individual retail customers form a cornerstone of Alpha Bank's operations, encompassing a wide demographic looking for essential banking services. This includes everyday needs like checking and savings accounts, alongside significant life events requiring personal loans, mortgages, and credit cards. By offering tailored solutions, Alpha Bank aims to cater to the diverse financial journeys of these individuals.

Alpha Bank's commitment to financial inclusion is evident in its efforts to reach a broad base of the population. In 2024, the bank continued its focus on making banking services accessible to all, successfully engaging over 1 million Greek citizens. This initiative highlights a strategic effort to serve not just traditional banking customers but also those who may have previously been underserved, ensuring a wider reach within the Greek market.

Small and Medium-sized Enterprises (SMEs) are a cornerstone of Alpha Bank's customer base, demanding a suite of financial products. These include essential business loans for expansion, flexible working capital solutions to manage day-to-day operations, efficient payment processing services, and comprehensive treasury management tools.

Alpha Bank demonstrates a strong commitment to fostering the growth of Greek businesses through targeted support. This includes specialized workshops designed to equip entrepreneurs with valuable knowledge and strategic guidance, alongside a proactive approach to credit expansion. In 2023, Alpha Bank saw significant growth in its Greek business loans, reflecting its dedication to empowering this vital economic sector.

Large corporations and institutions, including major domestic and international companies, financial powerhouses, and government bodies, represent a core customer segment for Alpha Bank. These clients typically require a broad spectrum of complex financial services.

Their needs often encompass corporate finance advisory, intricate investment banking operations, the arrangement of syndicated loans for large-scale projects, and robust trade finance solutions to support global commerce. Alpha Bank plays a crucial role in facilitating international syndications for these entities.

In 2024, Alpha Bank's focus on this segment is underscored by its participation in significant syndicated loan deals. For instance, the bank was involved in arranging a €500 million syndicated facility for a leading European manufacturing firm in Q1 2024, highlighting its capacity to manage substantial cross-border financing.

High-Net-Worth Individuals (HNWIs)

High-Net-Worth Individuals (HNWIs) represent a crucial customer segment for Alpha Bank, demanding sophisticated wealth management, private banking, and tailored investment advisory services. These clients, characterized by substantial liquid assets, typically exceeding $1 million, seek personalized attention and expert guidance to preserve and grow their wealth. For instance, in 2024, the global HNWI population reached an estimated 6.3 million individuals, controlling over $26 trillion in wealth, highlighting the significant market opportunity.

Alpha Bank caters to HNWIs by offering exclusive financial products and comprehensive estate planning solutions. The bank's revenue from this segment is significantly driven by asset management fees, which are charged as a percentage of the assets under management. This approach aligns with the HNWI's need for professional management of their complex financial portfolios.

- Target Clientele: Individuals with investable assets exceeding $1 million.

- Service Offerings: Wealth management, private banking, investment advisory, estate planning, and access to exclusive financial products.

- Revenue Generation: Primarily through asset management fees, typically ranging from 0.5% to 1.5% of assets under management.

- Market Size: The global HNWI segment is substantial, with millions of individuals managing trillions of dollars in assets as of 2024.

Insurance Customers

Insurance customers, encompassing both individuals and businesses, represent a vital segment for Alpha Bank. These clients actively seek a comprehensive range of insurance products, from life and health coverage to property and casualty policies. Their continued reliance on Alpha Bank underscores the institution's role as a provider of dependable protection and efficient claims handling.

This customer base often integrates their insurance needs with broader banking relationships, viewing Alpha Bank as a holistic financial partner. The premiums paid by these policyholders are a significant and consistent revenue stream for the bank, contributing directly to its financial stability and growth.

- Customer Needs: Life, health, property, and casualty insurance.

- Customer Expectations: Reliable coverage and efficient claims processing.

- Value Proposition: Bundled insurance with other banking services.

- Revenue Stream: Insurance premiums from policyholders.

Alpha Bank also serves institutional investors, such as pension funds, mutual funds, and asset managers. These clients require sophisticated investment solutions, including portfolio management, custodial services, and access to capital markets.

The bank's ability to offer tailored strategies and robust execution capabilities is key to attracting and retaining these large-scale financial players. In 2024, Alpha Bank continued to expand its institutional client base by providing specialized research and market insights, crucial for their investment decisions.

Government entities and public sector organizations form another significant customer segment. Their needs often involve public finance management, project financing for infrastructure development, and treasury services. Alpha Bank's expertise in navigating public sector requirements and its strong financial standing make it a preferred partner for these bodies.

| Customer Segment | Key Needs | Alpha Bank's Role | 2024 Data/Focus |

|---|---|---|---|

| Institutional Investors | Portfolio management, custodial services, capital markets access | Sophisticated investment solutions, market insights | Expansion of institutional client base |

| Government & Public Sector | Public finance management, project financing, treasury services | Navigating public sector requirements, financial stability | Supporting infrastructure development financing |

Cost Structure

Personnel costs represent a substantial segment of Alpha Bank's operational expenditures. These costs encompass salaries, comprehensive benefits packages, and ongoing training programs for a diverse and widespread employee base, covering branch networks, central headquarters, and the evolving digital service channels.

In the first quarter of 2025, Alpha Bank observed a stabilization in its overall operating expenses. This financial outcome was notably influenced by strategic staff cost reductions, a direct result of a voluntary separation scheme implemented during 2024, which aimed to optimize workforce size and associated expenses.

Alpha Bank's commitment to staying competitive in the digital age means significant investment in technology and digital transformation. This includes the ongoing maintenance and upgrading of its core IT systems, ensuring they are robust and capable of handling increasing transaction volumes and evolving customer needs. For instance, in 2023, the bank allocated a substantial portion of its operational budget towards modernizing its infrastructure and enhancing its digital banking platforms.

Furthermore, a critical component of these costs involves bolstering cybersecurity measures. Protecting customer data and financial assets from increasingly sophisticated cyber threats is paramount. This expenditure covers advanced threat detection, prevention systems, and regular security audits. The bank's investment in AI and data analytics also falls under this umbrella, aiming to improve operational efficiency and personalize customer experiences.

Alpha Bank's commitment to a physical presence means substantial costs for its branch network. These include rent for prime locations, ongoing utility bills, regular maintenance, essential security measures, and the administrative staff needed to keep these operations running smoothly. In 2024, managing these overheads while adapting to digital trends is a key financial consideration.

Despite the rise of digital banking, Alpha Bank recognizes the continued importance of its physical branches for customer engagement and service delivery. The bank actively seeks to optimize these expenditures. For instance, strategic partnerships, such as the one with ELTA for postal services, help to streamline certain operational costs and enhance customer convenience without the full expense of dedicated branch infrastructure.

Marketing and Sales Expenses

Alpha Bank dedicates significant resources to marketing and sales to acquire and retain customers, a crucial element for growth in the financial services sector. These expenditures cover a broad range of activities designed to increase brand awareness and drive product adoption.

In 2024, Alpha Bank continued its robust investment in marketing and sales, recognizing their importance for market share expansion. These efforts are strategically deployed across various channels to reach a diverse customer base, including targeted campaigns focused on enhancing financial literacy among underserved communities.

- Digital Marketing: Significant allocation towards online advertising, social media engagement, and search engine optimization to attract new clients and promote digital banking services.

- Traditional Advertising: Investment in television, print, and radio advertisements to maintain broad brand visibility and reach a wider demographic.

- Sales Force and Commissions: Costs associated with maintaining a skilled sales team and incentive programs to drive product sales and customer acquisition.

- Promotional Campaigns: Funding for special offers, discounts, and loyalty programs to encourage customer engagement and product uptake.

Regulatory Compliance and Risk Management Costs

Alpha Bank dedicates significant resources to regulatory compliance and risk management, recognizing these as essential for operational integrity and stakeholder trust. These costs are not merely expenses but strategic investments to mitigate potential losses and ensure adherence to evolving financial landscapes. For instance, in 2024, global financial institutions saw compliance costs rise, with many reporting that these expenditures represented a notable percentage of their operating budgets, often ranging from 5% to 15% or more, depending on the institution's size and complexity.

These substantial outlays are driven by the need to implement and maintain robust risk management frameworks, which include sophisticated systems for detecting and preventing fraud, managing credit risk, and ensuring cybersecurity. Regular internal and external audits further contribute to these costs, providing an independent assessment of the bank's financial health and operational procedures. The objective is to proactively reduce the overall cost of risk, thereby safeguarding the bank's financial stability and reputation.

- Regulatory Adherence: Costs associated with meeting stringent financial regulations, including Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

- Risk Management Investment: Expenditures on technology, personnel, and processes for credit, market, operational, and liquidity risk management.

- Audit and Assurance: Fees for internal audit functions and external auditors to ensure financial transparency and compliance.

- Penalties Mitigation: Proactive spending to avoid fines and sanctions that could arise from non-compliance.

Alpha Bank's cost structure is multifaceted, encompassing significant investments in its people, technology, physical infrastructure, marketing, and regulatory compliance. These elements are critical for maintaining operations, driving growth, and ensuring stability in a competitive financial landscape.

In 2024, Alpha Bank continued to manage its cost base strategically. While personnel costs remained a significant expenditure, the voluntary separation scheme implemented in 2024 helped to optimize these outlays. Simultaneously, investments in digital transformation and cybersecurity were prioritized to enhance service delivery and security.

The bank also focused on optimizing its branch network costs through initiatives like strategic partnerships, balancing the need for a physical presence with the efficiency gains from digital channels.

Marketing and sales expenditures were robust in 2024, supporting market share expansion and customer acquisition. Regulatory compliance and risk management costs remained substantial, reflecting the bank's commitment to operational integrity and the avoidance of penalties.

| Cost Category | 2024 Focus/Activity | Impact/Rationale |

|---|---|---|

| Personnel Costs | Optimization via voluntary separation scheme | Reduced workforce size and associated expenses |

| Technology & Digital Transformation | Core IT system upgrades, platform enhancement | Ensuring robustness, handling transaction volumes, meeting customer needs |

| Cybersecurity | Advanced threat detection, prevention, audits | Protecting customer data and financial assets |

| Branch Network | Rent, utilities, maintenance, security, staff; strategic partnerships (e.g., ELTA) | Managing overheads while adapting to digital trends and enhancing convenience |

| Marketing & Sales | Digital and traditional advertising, sales force, promotional campaigns | Market share expansion, customer acquisition and retention |

| Regulatory Compliance & Risk Management | KYC/AML, risk management systems, audits | Ensuring operational integrity, stakeholder trust, mitigating losses |

Revenue Streams

Alpha Bank's core revenue engine is net interest income, reflecting the spread between its lending and borrowing costs. This vital income stream was reported at €395 million for the first quarter of 2025, demonstrating the bank's ability to manage its interest-earning assets and interest-bearing liabilities effectively. The bank saw a slight increase to €399.3 million in net interest income for the second quarter of 2025, indicating continued operational strength in its primary revenue generation.

Alpha Bank generates substantial revenue through fees and commissions tied to its banking services. This includes income from account maintenance, transaction processing, credit card usage, and various payment solutions.

The bank saw robust growth in this segment, with fee income increasing by 11% year-over-year in the first quarter of 2025 and an impressive 13% in the second quarter of 2025. A notable driver of this expansion was the strong performance in asset management fees.

Alpha Bank generates substantial revenue through asset management fees. These fees are earned by expertly managing investment portfolios and offering crucial advisory services to a diverse client base, encompassing both individual investors and large institutional entities.

The bank experienced robust growth in its managed assets. By the second quarter of 2025, assets under management had increased by an impressive 15.2% compared to the previous year, directly translating into significant fee income for the bank.

Insurance Premiums and Commissions

Alpha Bank generates revenue through insurance premiums, reflecting the payments made by customers for various insurance policies. This revenue stream is bolstered by commissions earned on the sale of these insurance products, both directly and through partnerships. In 2024, the insurance segment of major European banks like Alpha Bank typically contributes a significant portion to their non-interest income, often representing 10-20% of total fee and commission income, showcasing its importance in diversifying revenue beyond traditional lending.

This dual approach of premiums and commissions allows Alpha Bank to capitalize on its extensive customer relationships. By offering insurance alongside banking services, the bank not only provides a more comprehensive financial solution but also taps into a valuable fee income source. For instance, a substantial portion of the fee income reported by large banking groups in 2024 often originates from their insurance and asset management arms, highlighting the strategic advantage of cross-selling.

- Premiums: Direct income from policyholders for coverage.

- Commissions: Revenue earned from facilitating insurance sales.

- Diversification: Reduces reliance on interest income.

- Customer Leverage: Utilizes existing client base for cross-selling opportunities.

Investment Banking and Advisory Fees

Alpha Bank earns significant income from its investment banking and advisory services. These include helping companies raise capital by underwriting stocks and bonds, advising on mergers and acquisitions (M&A), and offering strategic financial guidance to businesses and institutions.

The bank's commitment to expanding these offerings is evident. For instance, the recent acquisition of Akcea Ventures is designed to enhance Alpha Bank's capabilities in corporate finance and M&A advisory, directly feeding into this revenue stream.

- Corporate Finance Advisory: Providing strategic financial advice to clients.

- Underwriting Securities: Assisting companies in issuing stocks and bonds.

- Mergers & Acquisitions (M&A): Facilitating deals for businesses looking to merge or acquire others.

- Other Investment Banking Activities: Including restructuring and capital raising.

Alpha Bank also generates income from trading activities, including proprietary trading and market-making services. This segment benefits from market volatility and the bank's expertise in financial instruments.

In the first half of 2025, Alpha Bank reported a 7% increase in trading income compared to the same period in 2024, driven by active participation in foreign exchange and fixed-income markets. This demonstrates the bank's ability to capitalize on market opportunities.

| Revenue Stream | Q1 2025 (€ million) | Q2 2025 (€ million) | Year-over-Year Growth (Q2 2025 vs Q2 2024) |

|---|---|---|---|

| Net Interest Income | 395.0 | 399.3 | N/A (Reported for Q1 & Q2 2025) |

| Fees and Commissions | 11% increase | 13% increase | N/A (Growth rates provided) |

| Asset Management Fees | Significant contributor | Significant contributor | 15.2% increase in AUM |

| Insurance Premiums & Commissions | Component of Fee Income | Component of Fee Income | 10-20% of total fee & commission income (Industry benchmark 2024) |

| Investment Banking & Advisory | Growing | Growing | Acquisition of Akcea Ventures to enhance |

| Trading Income | N/A | N/A | 7% increase (H1 2025 vs H1 2024) |

Business Model Canvas Data Sources

The Alpha Bank Business Model Canvas is built upon a foundation of comprehensive financial reports, extensive market research, and internal strategic planning documents. These diverse data sources ensure each component of the canvas accurately reflects the bank's current operations and future trajectory.