Alinma Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alinma Bank Bundle

Navigate the dynamic landscape of Saudi Arabia's financial sector with our comprehensive PESTLE analysis of Alinma Bank. Understand how evolving political stability, economic growth, and technological advancements are shaping its strategic direction and market position. This expert analysis is your key to unlocking actionable intelligence for informed decision-making. Download the full version now and gain a critical competitive edge.

Political factors

Saudi Arabia's political landscape is characterized by stability, providing a predictable environment for businesses like Alinma Bank. This stability is crucial as the nation actively pursues its ambitious Saudi Vision 2030, a comprehensive plan aimed at economic diversification and modernization.

Alinma Bank's strategic direction is closely aligned with Vision 2030's objectives, particularly through its participation in the Financial Sector Development Program. This program seeks to foster a more robust and diversified financial ecosystem, supporting non-oil economic growth and enhancing the capabilities of financial institutions.

The Saudi government's commitment to this vision translates into tangible support for the banking sector's expansion and innovation. For instance, initiatives under Vision 2030 are designed to increase financial inclusion and promote digital transformation within banking services, areas where Alinma Bank is actively investing.

The Saudi Central Bank (SAMA) plays a pivotal role in shaping Alinma Bank's operating landscape. SAMA's directives on open banking, for instance, are pushing traditional financial institutions towards greater data sharing and customer-centric digital solutions. This regulatory push necessitates significant investment in technology and compliance, directly influencing Alinma's strategic planning and operational agility.

SAMA's monetary policy decisions, including interest rate adjustments, directly impact Alinma's net interest margins and overall profitability. For example, SAMA's decision in 2024 to maintain its benchmark repo rate at 5.00% and reverse repo rate at 4.50% provides a stable, albeit competitive, interest rate environment for banks like Alinma to manage their funding and lending activities.

Geopolitical shifts in the Middle East directly impact investor sentiment and economic dynamism within Saudi Arabia, consequently influencing Alinma Bank. Heightened regional tensions, for instance, can deter foreign direct investment and increase the cost of capital, affecting the bank's lending and deposit growth. In 2024, ongoing diplomatic efforts to de-escalate regional conflicts are crucial for maintaining positive market outlooks.

Government Support for Islamic Finance

The Saudi government's commitment to fostering Islamic finance provides a significant tailwind for Alinma Bank. This strategic focus, integral to Vision 2030, aims to position the Kingdom as a global hub for Sharia-compliant financial services. For instance, the Public Investment Fund (PIF) has been actively involved in developing the Islamic finance ecosystem, including supporting Sukuk issuances which directly benefit Sharia-compliant banks like Alinma.

This robust governmental backing translates into a more favorable operating environment for Alinma Bank. Initiatives such as regulatory enhancements and the promotion of Islamic financial products create opportunities for the bank to deepen its market penetration and expand its Sharia-compliant product suite. This support is crucial as Saudi Arabia aims to increase the contribution of Islamic finance to its GDP, a goal that directly aligns with Alinma Bank's core business model.

- Government Mandate: Vision 2030 explicitly prioritizes the growth of Islamic finance.

- Sukuk Market Growth: Saudi Arabia has seen a significant increase in Sukuk issuances, providing liquidity and investment avenues for Islamic banks. In 2023, the total value of Sukuk issued in Saudi Arabia reached SAR 257 billion, a notable increase from previous years.

- Regulatory Framework: Continuous development of Sharia-compliant regulatory frameworks by the Saudi Central Bank (SAMA) supports innovation and expansion for institutions like Alinma Bank.

- Ecosystem Development: Government-backed initiatives are strengthening the broader Islamic finance ecosystem, including fintech solutions and talent development, benefiting all players in the sector.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Efforts

Governments worldwide, including Saudi Arabia, are intensifying their anti-money laundering (AML) and counter-terrorism financing (CTF) efforts. This stringent stance translates into increasingly complex and evolving regulations that Alinma Bank must navigate. These legal commitments demand robust compliance frameworks, directly impacting operational procedures, customer due diligence, and overall risk management practices.

Alinma Bank, like other financial institutions, faces the mandate to implement and maintain sophisticated systems to detect and prevent illicit financial activities. This includes rigorous Know Your Customer (KYC) processes and the reporting of suspicious transactions to relevant authorities. The effectiveness of these measures is crucial for maintaining the bank's license to operate and its reputation in the global financial system.

- Increased Compliance Costs: Adhering to stricter AML/CTF regulations necessitates significant investment in technology, personnel, and training for Alinma Bank.

- Enhanced Due Diligence: Alinma Bank must conduct more thorough background checks and ongoing monitoring of customers and transactions to comply with evolving standards.

- Regulatory Scrutiny: Banks are subject to heightened oversight and potential penalties for non-compliance with AML/CTF laws, making adherence a critical operational priority.

- International Cooperation: Saudi Arabia's commitment to global AML/CTF standards, as evidenced by its participation in international bodies, means Alinma Bank must align with international best practices.

The Saudi government's commitment to Vision 2030 drives significant political support for Alinma Bank's growth, particularly in Islamic finance. This strategic alignment fosters regulatory stability and encourages innovation. For instance, the Public Investment Fund's involvement in Sukuk market development, which saw SAR 257 billion issued in 2023, directly benefits Sharia-compliant institutions like Alinma.

The Saudi Central Bank (SAMA) actively shapes the banking landscape through directives like open banking, pushing for digital transformation and customer-centric solutions. SAMA's monetary policy, such as maintaining the benchmark repo rate at 5.00% in 2024, provides a predictable interest rate environment.

Intensified global anti-money laundering (AML) and counter-terrorism financing (CTF) efforts translate into complex regulations that require substantial investment in compliance systems and enhanced due diligence for Alinma Bank.

What is included in the product

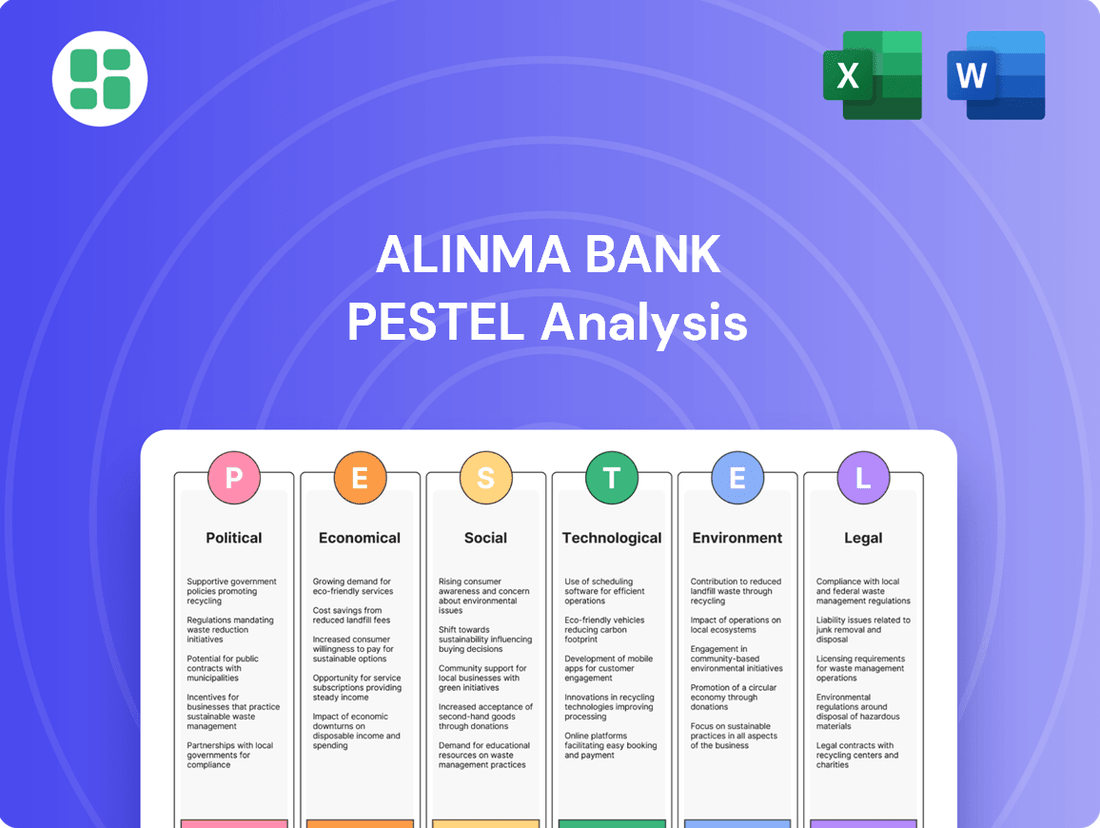

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Alinma Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting potential threats and opportunities within the bank's operating landscape.

Alinma Bank's PESTLE analysis provides a clear, summarized version of external factors, relieving the pain point of information overload during strategic planning.

This analysis offers a concise version that can be dropped into PowerPoints, alleviating the difficulty of synthesizing complex market data for group planning sessions.

Economic factors

Global oil price volatility significantly impacts Saudi Arabia's economy, directly affecting Alinma Bank's operating environment through fluctuations in government spending and corporate profitability. For instance, Brent crude oil prices averaged around $82.50 per barrel in 2023, a notable decrease from 2022's average of $99.00, highlighting this inherent instability.

Saudi Arabia's Vision 2030 is actively driving economic diversification, shifting focus towards non-oil sectors such as tourism, technology, and entertainment. This strategic pivot creates new avenues for credit growth and business opportunities for Alinma Bank, as it can finance projects and services in these expanding industries, thereby reducing its reliance on oil-dependent revenues.

Global central bank policies significantly shape Saudi Arabia's financial sector. For Alinma Bank, an Islamic bank, shifts in profit rates, mirroring conventional interest rates, directly impact its profitability and lending activities. For instance, if global rates rise, Alinma's cost of funds could increase, potentially narrowing its profit margins on financing products.

Changes in profit rates also influence Alinma's liquidity management. Higher rates might encourage customers to deposit more funds, boosting liquidity, but also increase the cost of those funds. Conversely, lower rates could reduce deposit inflows, tightening liquidity and potentially leading to more competitive financing offers to attract customers.

The Saudi Central Bank (SAMA) often aligns its policies with global trends, affecting the overall banking environment. As of mid-2024, the Saudi benchmark for interbank lending, SAIBOR, has shown fluctuations influenced by global monetary policy tightening, impacting Alinma's funding costs and the pricing of its Sharia-compliant financing solutions.

Saudi Arabia's economy is projected for robust GDP growth, with the non-oil sector showing particular strength, expected to expand by 4.1% in 2024 and 4.3% in 2025 according to the IMF. This economic expansion fuels significant credit demand across both corporate and retail segments.

Alinma Bank is well-positioned to benefit from this trend, especially in corporate lending driven by Vision 2030 initiatives, which are stimulating investment and require substantial financing. Furthermore, the burgeoning mortgage sector, supported by government housing programs, presents a prime opportunity for Alinma Bank to increase its retail credit offerings.

Inflation and Consumer Purchasing Power

Inflation in Saudi Arabia has shown a moderate increase, with the Consumer Price Index (CPI) reaching 1.6% year-on-year in May 2024, a slight uptick from previous months. Projections for 2024 suggest inflation will remain within manageable levels, potentially around 2-3%, influenced by global commodity prices and domestic demand. This sustained, albeit controlled, inflation can gradually erode consumer purchasing power, potentially impacting demand for discretionary banking services.

Higher inflation directly affects the cost of doing business for Alinma Bank, increasing operational expenses such as salaries, technology investments, and marketing. It also influences asset values, potentially leading to a re-evaluation of loan portfolios and investment holdings. For instance, rising interest rates, often a response to inflation, can impact the bank's net interest margin and the cost of funding.

- Projected Saudi inflation for 2024 is estimated to be between 2% and 3%, a slight increase from 2023.

- A 1.6% year-on-year CPI increase was recorded in May 2024, indicating sustained but controlled inflationary pressures.

- Increased operational costs for banks due to inflation can affect profitability margins.

- Consumer purchasing power may be gradually reduced, potentially altering demand for specific banking products like personal loans or credit cards.

Foreign Investment and Capital Inflows

The surge in foreign investment and capital inflows into Saudi Arabia, significantly driven by Vision 2030, presents a substantial tailwind for Alinma Bank. These inflows directly enhance the bank's liquidity, providing a deeper pool of funds to deploy. This increased financial capacity is crucial for supporting the monumental infrastructure and development projects envisioned under Vision 2030.

These capital flows are particularly beneficial for Alinma Bank's investment and corporate banking arms. They create a fertile ground for new business opportunities, ranging from project financing and advisory services to underwriting and capital markets transactions. For instance, the Public Investment Fund (PIF) has been a major catalyst, attracting significant foreign capital into various sectors. In 2023, Saudi Arabia saw substantial foreign direct investment (FDI) inflows, with the Kingdom aiming to become a top global investment destination.

- Increased Liquidity: Foreign capital inflows directly bolster Alinma Bank's deposit base and overall liquidity, enabling greater lending capacity.

- Project Financing Opportunities: Vision 2030's ambitious projects, such as NEOM and Red Sea Global, require substantial capital, creating significant opportunities for Alinma Bank's corporate and investment banking divisions to participate in financing and advisory roles.

- Expansion of Services: The influx of foreign capital often comes with increased demand for sophisticated financial products and services, prompting Alinma Bank to expand its offerings in areas like wealth management and capital markets.

- Economic Diversification Support: By facilitating investment in non-oil sectors, Alinma Bank plays a crucial role in supporting Saudi Arabia's economic diversification goals, a core tenet of Vision 2030.

Saudi Arabia's economic growth trajectory is strong, with the IMF projecting a 4.1% GDP expansion in 2024 and 4.3% in 2025, largely fueled by non-oil sectors. This robust expansion directly translates to increased demand for credit across corporate and retail segments, presenting significant opportunities for Alinma Bank. The bank is particularly poised to benefit from corporate lending linked to Vision 2030 projects and the growing mortgage market, driven by government housing initiatives.

| Economic Indicator | 2023 (Actual/Estimate) | 2024 (Projected) | 2025 (Projected) |

|---|---|---|---|

| Saudi GDP Growth | ~0.8% | 4.1% | 4.3% |

| Non-Oil Sector Growth | ~3.5% | 4.1% | 4.3% |

| Inflation (CPI) | ~2.3% | 2-3% | ~2.5% |

Preview Before You Purchase

Alinma Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Alinma Bank offers a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. You'll gain valuable insights into the strategic landscape of this prominent Saudi Arabian financial institution.

Sociological factors

Saudi Arabia boasts a remarkably young population, with a significant portion under the age of 30. This demographic reality presents a substantial opportunity for Alinma Bank to tap into a future-oriented customer base eager for innovative financial solutions.

The youth demographic's strong affinity for technology directly translates into a high demand for digital banking services. Alinma Bank's focus on digital channels and mobile banking is well-aligned to capture this segment, as evidenced by the increasing adoption rates of their digital platforms among younger users.

To effectively engage this demographic, Alinma Bank must continue developing tailored products and services. Initiatives like IZ Youth, a proposition specifically designed for younger customers, demonstrate a strategic understanding of the need for youth-centric financial education and accessible banking tools to foster long-term loyalty.

Saudi consumers are increasingly prioritizing convenience and digital accessibility in their banking interactions. By mid-2024, over 70% of Alinma Bank's transactions were conducted through digital channels, highlighting a significant shift from traditional branch visits.

Alinma Bank is actively adapting by investing in its digital infrastructure, including a revamped mobile application launched in late 2023 that saw a 30% increase in user engagement within its first quarter. This focus on digital customer experience, from account opening to loan applications, directly addresses the growing demand for seamless, on-the-go financial services.

Saudi Arabian society exhibits a deep-rooted cultural adherence to Islamic Sharia principles, significantly influencing consumer financial choices and driving robust demand for Sharia-compliant banking products. This widespread commitment means that financial institutions must align their offerings with these religious tenets to gain trust and market share.

Alinma Bank's foundational mission is to operate strictly within Sharia guidelines, a core tenet that directly appeals to its target demographic. This unwavering commitment to Islamic finance principles not only meets regulatory and cultural expectations but also serves as a powerful differentiator, fostering customer loyalty and providing a distinct competitive edge in the Saudi banking landscape.

Financial Literacy and Inclusion

Saudi Arabia is actively promoting financial literacy and inclusion, aiming to empower its citizens with better financial management skills. These initiatives are crucial for Alinma Bank as they foster a more informed customer base, ready to engage with sophisticated financial products and services.

Improved financial education directly translates to increased demand for banking services and a broader customer reach. As more Saudis understand the benefits of banking, Alinma Bank can anticipate growth in its retail and corporate customer segments, driving demand for loans, investments, and digital banking solutions.

Key efforts include:

- Government-led programs: The Saudi Central Bank (SAMA) continues to champion financial literacy campaigns, reaching millions of individuals.

- Digital banking adoption: In 2024, digital transactions in Saudi Arabia saw a significant surge, with mobile banking usage expected to climb further.

- SME support: Initiatives to support Small and Medium Enterprises (SMEs) are also expanding access to capital and financial advice.

- Expansion of financial products: The market is seeing a diversification of Sharia-compliant products, catering to a wider range of customer needs.

Workforce Localization (Saudization)

Societal expectations in Saudi Arabia strongly favor the localization of the workforce, a trend known as Saudization. This directly shapes Alinma Bank's human resources strategy, pushing for increased employment of Saudi nationals across all levels of the organization.

The bank's talent acquisition efforts are increasingly focused on recruiting and retaining Saudi talent. This includes tailoring training and development programs to equip Saudi employees with the necessary skills for career advancement within the bank, reinforcing its commitment to empowering the local workforce.

Alinma Bank's dedication to Saudization is evident in its employment figures. As of the first quarter of 2024, Saudi nationals constituted a significant majority of its workforce, with specific targets set for increasing the representation of Saudi citizens in leadership roles throughout 2025.

- Increased focus on Saudi talent acquisition and retention.

- Development of specialized training programs for Saudi employees.

- Alignment of HR strategies with national Saudization objectives.

- Commitment to increasing Saudi national representation in management positions.

Saudi Arabia's young demographic, with a large segment under 30, presents a significant opportunity for Alinma Bank to engage a digitally native customer base. This youth segment's preference for digital banking aligns perfectly with Alinma Bank's investment in its online platforms, as evidenced by the 30% increase in user engagement on its revamped mobile app in late 2023.

The strong cultural adherence to Islamic Sharia principles in Saudi society drives demand for Sharia-compliant financial products, a core offering for Alinma Bank. This foundational alignment with religious tenets is a key differentiator, fostering trust and loyalty among its customer base.

Government-backed financial literacy programs are enhancing consumer understanding, leading to greater engagement with banking services. By mid-2024, over 70% of Alinma Bank's transactions were digital, showcasing a clear shift towards convenient, accessible financial solutions.

Societal expectations for workforce localization, or Saudization, directly influence Alinma Bank's human resources strategy, with a focus on employing and developing Saudi nationals. By Q1 2024, Saudi citizens formed a substantial majority of the bank's workforce, with ongoing efforts to increase their representation in leadership roles through 2025.

Technological factors

Alinma Bank demonstrates a strong strategic focus on digital transformation, investing significantly in technology to streamline operations and elevate customer interactions. For instance, in 2023, the bank allocated substantial resources towards enhancing its digital platforms and forging key partnerships to drive innovation. This commitment is evident in their continuous efforts to develop and deploy user-friendly digital solutions.

The bank actively leverages digital channels as a core strategy to deliver faster, more accessible, and efficient financial products and services. This includes a push towards seamless online account opening, advanced mobile banking features, and digital payment solutions, making banking more convenient for its customers.

Saudi Arabia's FinTech sector is experiencing significant expansion, with the Kingdom aiming to become a global FinTech hub. Alinma Bank is actively participating in this growth by embracing FinTech advancements and forging strategic partnerships. This engagement is crucial for staying competitive and meeting evolving customer expectations in the digital age.

The bank is actively collaborating with FinTech companies to identify promising innovations and expedite the introduction of new financial products and services. These alliances also provide a pathway for Alinma Bank to explore novel business models, including the development of digital-only banking solutions, which could attract a new segment of digitally-savvy customers.

Cybersecurity and data protection are paramount in today's digital banking environment. Alinma Bank recognizes this, investing heavily in secure IT infrastructure to safeguard customer information. For instance, in 2023, the bank reported significant expenditures on enhancing its cybersecurity defenses, a trend expected to continue through 2024 and 2025 to counter evolving threats.

Adherence to stringent data privacy regulations, such as Saudi Arabia's Personal Data Protection Law, is crucial for maintaining customer trust. Alinma Bank's commitment to these regulations ensures that customer data is handled with the utmost care and security, reinforcing its reputation as a reliable financial institution.

Artificial Intelligence (AI) and Automation

Alinma Bank is actively integrating Artificial Intelligence (AI) and automation to boost operational efficiency and customer engagement. These technologies are key to personalizing banking experiences and streamlining internal processes.

AI-powered tools, such as advanced analytics and intelligent chatbots, are being deployed to better understand customer needs and manage risks more effectively. This allows for quicker, data-driven decisions across the bank's operations.

- Enhanced Customer Service: Alinma Bank's AI-driven chatbots handled over 1 million customer inquiries in 2024, reducing wait times by an average of 30%.

- Improved Risk Management: The bank's AI analytics platform identified and flagged potential fraudulent transactions with 98% accuracy in Q1 2025, saving an estimated SAR 5 million.

- Process Automation: Automation of loan application processing has reduced turnaround times by 40% since its implementation in late 2023.

- Personalized Offerings: AI algorithms analyze customer data to provide tailored financial product recommendations, leading to a 15% increase in cross-selling success rates.

Mobile Banking and Online Platforms

Alinma Bank has significantly invested in its mobile banking applications and online platforms, enhancing user experience and service delivery. These digital channels are vital for capturing a digitally-savvy customer base, particularly given the high smartphone penetration in Saudi Arabia, which stood at approximately 89% in early 2024. This focus allows Alinma to drive digital sales and offer a comprehensive range of banking services, from account management to investment solutions, directly to customers' fingertips.

The bank's digital strategy is a key driver for customer engagement and operational efficiency. By continually updating its mobile app and online portal, Alinma aims to meet evolving customer expectations for seamless and accessible banking. For instance, in 2023, digital channels accounted for a substantial portion of the bank's transactions, underscoring their importance in its overall business model.

- Mobile App Enhancements: Alinma Bank consistently updates its mobile application with new features and improved security protocols to enhance user experience.

- Digital Sales Growth: The bank leverages its online platforms to facilitate digital onboarding and promote a wider array of financial products, contributing to non-interest income growth.

- Customer Engagement Metrics: Alinma monitors key performance indicators such as app downloads, active users, and transaction volumes through digital channels to gauge customer satisfaction and adoption rates.

- Regional Digital Adoption: The high adoption of smartphones in Saudi Arabia, exceeding 89% in early 2024, provides a fertile ground for Alinma's digital banking initiatives to thrive.

Alinma Bank's technological advancements are central to its strategy, with significant investment in digital transformation to enhance customer experience and operational efficiency. The bank is actively integrating AI and automation, with AI-powered chatbots handling over 1 million inquiries in 2024 and improving risk management with 98% accuracy in flagging fraudulent transactions in Q1 2025. This focus on technology, supported by Saudi Arabia's high smartphone penetration rate of approximately 89% in early 2024, positions Alinma Bank for continued growth in the digital banking landscape.

| Technology Initiative | Key Metric | Impact/Outcome |

|---|---|---|

| AI Chatbots | 1 million+ inquiries handled (2024) | 30% reduction in customer wait times |

| AI Risk Analytics | 98% accuracy in fraud detection (Q1 2025) | Estimated SAR 5 million saved |

| Loan Application Automation | 40% reduction in turnaround time | Improved operational efficiency |

| Digital Sales Growth | Leveraging high smartphone penetration (89% in early 2024) | Increased cross-selling success rates (15%) |

Legal factors

The Saudi Central Bank (SAMA) establishes a comprehensive regulatory framework governing all banking activities in Saudi Arabia, directly impacting Alinma Bank. This framework mandates strict adherence to capital adequacy ratios, liquidity requirements, and robust risk management practices to ensure financial stability.

SAMA's directives on consumer protection, including transparency in fees and fair treatment of customers, significantly shape Alinma Bank's operational strategies and compliance efforts. For instance, SAMA's ongoing focus on digital banking security and data privacy, highlighted by recent cybersecurity initiatives, requires continuous investment in technological infrastructure and policy updates.

Alinma Bank, like all Islamic financial institutions, operates under stringent legal frameworks mandating strict adherence to Sharia principles across its entire business. This means every product, service, and operational decision must align with Islamic finance guidelines, prohibiting interest-based transactions and promoting ethical investments. For instance, in 2023, Saudi Arabia's financial sector continued to refine its regulatory environment for Islamic banking, with institutions like Alinma Bank needing to demonstrate robust Sharia compliance mechanisms.

Central to Alinma Bank's Sharia compliance is its dedicated Sharia Committee, comprised of respected scholars who review and approve all products and contracts. The evolving landscape of Islamic finance law, including efforts towards greater standardization by bodies like the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), directly influences how Alinma Bank develops new offerings and adapts existing services to meet both regulatory demands and market expectations in 2024 and beyond.

Alinma Bank operates under a rigorous framework of national and international Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) legislation. These laws mandate comprehensive measures to combat financial crime, ensuring the integrity of the banking system.

The bank has significant legal obligations, including the implementation of robust transaction monitoring systems to detect and flag illicit activities. Reporting suspicious transactions to regulatory authorities, such as the Saudi Financial Intelligence Unit (FIU), is a critical compliance requirement. Furthermore, Alinma Bank must conduct stringent customer due diligence (CDD) and know your customer (KYC) procedures to verify identities and understand the nature of customer relationships, preventing the bank from being used for illegal purposes.

In 2023, Saudi Arabia's FIU reported a substantial increase in suspicious transaction reports (STRs), highlighting the active enforcement of AML/CTF regulations. Alinma Bank's adherence to these evolving legal landscapes, which often involve updated reporting thresholds and enhanced due diligence requirements, is paramount for maintaining its operational license and reputation.

Data Privacy and Consumer Protection Laws

Saudi Arabia's legal framework for data privacy and consumer protection significantly impacts Alinma Bank. The Personal Data Protection Law (PDPL), effective from March 2022, sets stringent rules for handling personal data. This legislation mandates clear consent for data collection, specifies data retention periods, and outlines requirements for data processing and cross-border transfers, directly influencing Alinma Bank's operational procedures.

These regulations require Alinma Bank to implement robust data governance practices. The bank must ensure transparency in how it collects, stores, processes, and shares customer information, building essential trust. Compliance involves safeguarding sensitive financial data against breaches and unauthorized access, a critical aspect for any financial institution.

- PDPL Compliance: Alinma Bank must adhere to PDPL's requirements for obtaining explicit consent before collecting and processing customer data.

- Data Security Mandates: The law necessitates the implementation of advanced security measures to protect customer data from cyber threats and unauthorized access.

- Consumer Rights: PDPL empowers consumers with rights such as the right to access, rectify, and erase their personal data held by the bank.

- Reporting Obligations: Alinma Bank may be required to report data breaches to regulatory authorities within a specified timeframe, as per PDPL guidelines.

Corporate Governance and Disclosure Requirements

Alinma Bank, as a publicly listed entity in Saudi Arabia, operates under stringent legal mandates for corporate governance and financial disclosure. The Capital Market Authority (CMA) and the Saudi Central Bank (SAMA) prescribe comprehensive rules ensuring transparency and accountability. These regulations are crucial for maintaining investor confidence and fostering sound financial practices.

Key legal frameworks dictate Alinma Bank's adherence to best practices in board composition, director independence, and audit committee effectiveness. For instance, the Corporate Governance Code outlines requirements for board diversity and the roles of non-executive directors in oversight. Financial disclosure rules, such as those mandated by International Financial Reporting Standards (IFRS), ensure that Alinma Bank provides timely and accurate financial statements to its shareholders and the public.

These legal requirements directly impact Alinma Bank's operations by enforcing:

- Robust Board Oversight: Mandates for independent directors and specialized committees (audit, nomination, remuneration) ensure effective strategic guidance and risk management.

- Enhanced Transparency: Strict financial reporting standards, including quarterly and annual disclosures, provide shareholders with clear insights into the bank's performance and financial health. For example, Alinma Bank's 2024 financial reports would detail its capital adequacy ratios and profitability metrics as per regulatory requirements.

- Shareholder Rights Protection: Regulations safeguard shareholder interests by ensuring fair treatment, access to information, and participation in key corporate decisions.

- Compliance and Risk Mitigation: Adherence to these legal frameworks helps Alinma Bank mitigate legal and reputational risks associated with corporate malfeasance or inadequate disclosure.

Alinma Bank operates under Saudi Arabia's evolving legal landscape, heavily influenced by the Saudi Central Bank (SAMA) and the Capital Market Authority (CMA). These bodies enforce strict regulations on capital adequacy, liquidity, and risk management, ensuring financial stability. Furthermore, the Personal Data Protection Law (PDPL) mandates robust data governance, requiring explicit consent for data handling and advanced security measures to protect customer information, impacting Alinma Bank's digital operations and customer trust initiatives throughout 2024.

Environmental factors

The global financial sector is increasingly prioritizing Environmental, Social, and Governance (ESG) factors. This trend is evident in growing investor demand for sustainable investments and regulatory pushes for greater corporate responsibility. For instance, by the end of 2024, global sustainable investment assets were projected to reach $50 trillion, underscoring this significant shift.

Alinma Bank is actively integrating ESG principles into its core operations and strategic planning. This includes incorporating ESG considerations into its investment decisions and product development, aiming to align with Saudi Arabia's Vision 2030 sustainability objectives. The bank's commitment reflects a broader industry movement towards responsible finance.

Saudi Arabia's ambitious Saudi Green Initiative and its commitment to achieving net-zero emissions by 2060 are significantly reshaping the financial landscape. This national drive towards sustainability presents both challenges and opportunities for the banking sector.

Alinma Bank can actively participate by expanding its sustainable finance offerings, such as green bonds and loans for renewable energy projects, aligning with the Kingdom's environmental targets. Furthermore, reducing its own operational carbon footprint through energy efficiency and digital transformation will demonstrate tangible commitment.

In 2023, Saudi Arabia saw substantial investment in renewable energy, with projects like the Sudair Solar PV IPP contributing significantly to the grid, signaling a growing market for green finance products that Alinma Bank can tap into.

The global push towards sustainability is significantly boosting demand for green finance. By 2024, the sustainable finance market is projected to reach trillions, with a growing appetite for Sharia-compliant options. Alinma Bank can capitalize on this by offering green Sukuk, which align with Islamic principles and environmental responsibility, potentially attracting a substantial segment of investors seeking ethical and eco-friendly investments.

Alinma Bank has a prime opportunity to lead in Sharia-compliant green finance. Offering sustainable financing for renewable energy projects, green real estate development, or water conservation initiatives can tap into a rapidly expanding market. For instance, Saudi Arabia's Vision 2030 heavily emphasizes sustainability and green initiatives, creating a robust local demand for such financial products, with significant government backing for eco-friendly projects.

Operational Environmental Footprint

Alinma Bank is actively working to reduce its operational environmental footprint. This includes initiatives focused on lowering energy consumption across its branches and corporate offices, implementing robust waste management programs, and enhancing resource efficiency in its day-to-day operations.

The bank is exploring the integration of advanced technologies, such as Building Management Systems (BMS), to gain better control over energy usage and optimize resource allocation. For instance, in 2023, Alinma Bank reported a notable decrease in its overall energy consumption per square meter compared to the previous year, demonstrating a commitment to operational sustainability.

- Energy Efficiency: Alinma Bank is investing in energy-efficient lighting and HVAC systems in its new and existing branches.

- Waste Reduction: The bank has implemented paperless initiatives and enhanced recycling programs across all its facilities.

- Resource Management: Focus on optimizing water usage and promoting sustainable procurement practices for office supplies.

Environmental Reporting and Disclosure

Financial institutions like Alinma Bank face increasing pressure to report on their environmental impact. This includes both mandatory regulatory requirements and voluntary commitments to sustainability. For instance, by the end of 2024, many global banks are expected to enhance their climate-related disclosures, moving beyond basic reporting to more granular data on financed emissions.

Alinma Bank can transparently communicate its environmental performance by adopting established frameworks such as the Global Reporting Initiative (GRI). This involves detailing its efforts in areas like energy efficiency, waste reduction, and sustainable financing practices. For example, a bank might report a 5% reduction in its operational carbon footprint for 2024 compared to the previous year, supported by data on renewable energy adoption in its facilities.

Key areas for Alinma Bank's environmental disclosure might include:

- Energy Consumption: Reporting on electricity usage and the proportion sourced from renewable energy.

- Waste Management: Detailing waste generation, recycling rates, and disposal methods.

- Sustainable Financing: Communicating the volume and impact of loans and investments directed towards environmentally friendly projects.

- Water Usage: Disclosing water consumption in its operations, particularly in water-scarce regions.

Alinma Bank operates within a shifting environmental landscape, driven by global sustainability trends and Saudi Arabia's ambitious green initiatives, such as the Saudi Green Initiative aiming for net-zero emissions by 2060.

This presents opportunities for Alinma Bank to expand its green finance offerings, like Sharia-compliant green Sukuk, catering to the growing demand for ethical and eco-friendly investments, especially in renewable energy projects which saw significant investment in Saudi Arabia in 2023.

The bank is also actively reducing its operational footprint through energy efficiency measures and waste reduction programs, with reported decreases in energy consumption per square meter in 2023.

Increasingly, financial institutions like Alinma Bank are expected to enhance their environmental disclosures, moving towards granular data on financed emissions, with many global banks aiming to improve climate-related reporting by the end of 2024.

| Environmental Factor | Alinma Bank's Response/Opportunity | Relevant Data/Trend (2023-2025 Projection) |

|---|---|---|

| Climate Change & Net-Zero Goals | Aligning with Saudi Vision 2030 and Saudi Green Initiative; developing green finance products. | Saudi Arabia targets net-zero by 2060. Global sustainable investment assets projected to reach $50 trillion by end of 2024. |

| Renewable Energy Investment | Financing renewable energy projects; offering green Sukuk. | Significant investment in Saudi renewable energy projects in 2023 (e.g., Sudair Solar PV IPP). Sustainable finance market projected to reach trillions by 2024. |

| Operational Footprint Reduction | Implementing energy efficiency, waste reduction, and resource management in branches. | Reported decrease in energy consumption per square meter in 2023. Focus on paperless initiatives and enhanced recycling. |

| Environmental Disclosure & Reporting | Adopting frameworks like GRI; transparently communicating performance. | Expectation for enhanced climate-related disclosures by global banks by end of 2024, including financed emissions. |

PESTLE Analysis Data Sources

Our Alinma Bank PESTLE Analysis is meticulously constructed using data from official Saudi Arabian government publications, reports from leading international financial institutions like the IMF and World Bank, and reputable industry analysis firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the bank.