Alinma Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alinma Bank Bundle

Alinma Bank's marketing approach is a strategic blend of innovative Sharia-compliant products, competitive pricing, accessible digital channels, and targeted promotional campaigns. Understanding these elements is key to grasping their market impact.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Alinma Bank's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into Islamic banking success.

Product

Alinma Bank's Product strategy emphasizes its Sharia-compliant banking solutions, offering a full spectrum of financial services that strictly adhere to Islamic principles. This commitment distinguishes it as a premier Islamic bank in Saudi Arabia, catering to a diverse clientele with offerings ranging from retail banking and corporate financing to investment products and treasury services.

These solutions are meticulously structured to avoid interest (riba) and uphold Islamic finance ethics, reflecting the bank's core mission to deliver innovative and compliant financial tools. For instance, Alinma Bank's financing products, such as Murabaha and Ijarah, are designed to facilitate transactions without violating Sharia guidelines, attracting a significant customer base seeking ethical financial alternatives.

Alinma Bank's digital banking products, centered around the Alinma App, represent a core element of its marketing mix. This advanced offering allows customers to perform a wide range of banking tasks remotely, from account management and fund transfers to bill payments and new product applications. The bank has been actively enhancing these digital capabilities, with significant updates in 2024 and 2025 introducing features like instant transfers and loyalty program integration, all designed to improve the user experience for personal finance and savings management.

The bank's commitment to digital transformation is evident in its strategy to deliver banking experiences that are not only seamless and user-friendly but also highly secure. This focus on digital product innovation aims to meet the evolving needs of customers who increasingly expect efficient and accessible banking services. For instance, by Q1 2025, Alinma Bank reported a 25% year-over-year increase in the active user base of its Alinma App, highlighting the success of its digital product strategy.

Alinma Bank's diverse financing and investment portfolio is a cornerstone of its offering, catering to a broad client base. For individuals and corporations, it provides essential Islamic finance structures like Murabaha, Ijara, and Musharaka, facilitating needs from personal loans and auto leases to corporate working capital. In 2024, Alinma Bank reported significant growth in its financing activities, with total financing reaching SAR 115 billion, demonstrating strong market penetration.

Beyond traditional financing, the bank actively manages investments and has launched new private funds, notably in growth sectors such as real estate and healthcare. This strategic expansion into investment management underscores Alinma Bank's commitment to providing comprehensive financial solutions. By Q3 2024, the bank's assets under management had grown by 12% year-over-year, reflecting client confidence and market demand.

Cards and Payment Solutions

Alinma Bank's product offering in cards and payment solutions is diverse and Sharia-compliant, featuring credit, purchase, and traveler cards. These cards are designed with competitive benefits and attractive loyalty programs to appeal to a broad customer base. The bank emphasizes innovation by catering to specific market needs, as seen with the introduction of the Freelance Card in April 2025, a collaboration with the Social Development Bank aimed at supporting the gig economy.

Furthermore, Alinma Bank extends its payment solutions to businesses through digital payment gateways and Point of Sale (POS) services. This dual focus on consumer and business needs highlights a comprehensive strategy to capture market share in the evolving digital payment landscape. By April 2025, Saudi Arabia's digital payment transactions had seen significant growth, with e-commerce payments alone reaching SAR 150 billion for the year, indicating a strong market for these offerings.

- Sharia-Compliant Card Portfolio: Offers credit, purchase, and traveler cards with competitive benefits.

- Niche Market Expansion: Launched the first Freelance Card in April 2025, targeting the gig economy.

- Business Payment Solutions: Provides digital payment gateways and POS services for merchants.

- Market Alignment: Capitalizes on Saudi Arabia's growing digital payment adoption, with e-commerce transactions exceeding SAR 150 billion by April 2025.

Tailored Customer Segments Offerings

Alinma Bank strategically crafts distinct product suites for various customer groups, recognizing diverse financial needs. This segmentation spans individuals, small and medium-sized enterprises (SMEs), large corporations, and exclusive private banking clients, demonstrating a commitment to specialized service. The bank also caters to niche markets, such as its Alinma Ladies program, highlighting a broad approach to client engagement.

The bank actively refines the customer experience for its core offerings, focusing on personalization. This involves a deep dive into customer journeys to identify pain points and opportunities for improvement, aiming to deliver hyper-personalized financial solutions. The emphasis on mobile-first strategies reflects a keen understanding of modern consumer behavior and the increasing reliance on digital channels for banking.

In 2024, Alinma Bank reported significant growth in its retail banking segment, with customer deposits increasing by 15% year-over-year, indicating successful product tailoring. Furthermore, the bank's digital transaction volume saw a 22% surge, underscoring the effectiveness of its mobile-first approach in meeting evolving customer expectations.

- Personal Banking: Offering a range of accounts, loans, and credit cards designed for individual financial goals.

- Business Banking: Providing specialized solutions for SMEs and large corporations, including financing, trade services, and treasury management.

- Private Banking: Delivering bespoke wealth management and investment services for high-net-worth individuals.

- Alinma Ladies: A dedicated program offering financial products and advisory services tailored to women.

Alinma Bank's product strategy is deeply rooted in its Sharia-compliant framework, offering a comprehensive suite of financial services from retail and corporate banking to specialized investment products. This adherence to Islamic principles, including the avoidance of interest (riba) through instruments like Murabaha and Ijarah, forms the bedrock of its customer proposition, attracting those seeking ethical financial solutions.

Digital innovation is central to Alinma's product development, spearheaded by the Alinma App. Enhancements in 2024 and 2025 have introduced features like instant transfers and loyalty programs, boosting user engagement. By Q1 2025, the app saw a 25% year-over-year increase in active users, demonstrating the success of its digital-first approach.

The bank's financing and investment portfolio is robust, with total financing reaching SAR 115 billion in 2024. Assets under management grew 12% year-over-year by Q3 2024, highlighting strong client trust in its diverse offerings, including private funds in growth sectors.

Alinma's card and payment solutions are diverse and Sharia-compliant, including credit, purchase, and traveler cards. The introduction of the Freelance Card in April 2025, aimed at the gig economy, showcases its commitment to niche market expansion. The bank also supports businesses with digital payment gateways and POS services, capitalizing on Saudi Arabia's digital payment growth, with e-commerce transactions exceeding SAR 150 billion by April 2025.

| Product Category | Key Offerings | Sharia Compliance | 2024/2025 Highlights | Market Relevance |

|---|---|---|---|---|

| Financing & Investment | Murabaha, Ijarah, Musharaka, Private Funds | Strict Adherence | SAR 115bn total financing (2024); 12% AUM growth (Q3 2024) | Meeting diverse individual and corporate needs |

| Digital Banking | Alinma App, Mobile Transfers, Loyalty Programs | Integrated | 25% app user growth (Q1 2025); Enhanced features | Catering to evolving digital customer expectations |

| Cards & Payments | Credit, Purchase, Traveler Cards; POS Services | Strict Adherence | Freelance Card launch (Apr 2025); SAR 150bn e-commerce (Apr 2025) | Serving consumers and businesses in a growing digital payment landscape |

What is included in the product

This analysis delves into Alinma Bank's marketing mix, examining its product offerings, pricing strategies, distribution channels, and promotional activities to understand its market positioning.

It provides a comprehensive overview of Alinma Bank's approach to the 4Ps, offering insights for strategic planning and competitive benchmarking.

Alinma Bank's 4Ps analysis acts as a pain point reliever by clearly outlining how their product, price, place, and promotion strategies address customer needs and market challenges.

This concise 4Ps overview provides a straightforward solution for understanding how Alinma Bank alleviates customer pain points through its marketing efforts.

Place

Alinma Bank heavily leverages its extensive digital channels, including the Alinma App and Alinma Internet, to reach its customers. These platforms are crucial for distribution, enabling a wide array of banking transactions to be performed remotely, from account management to bill payments. As of Q1 2024, Alinma Bank reported over 2 million active digital users, highlighting the significant role these channels play in their customer engagement strategy.

Alinma Bank strategically balances its digital-first approach with a robust physical network, operating numerous branches and ATMs throughout Saudi Arabia. This ensures that customers across all demographics can access banking services conveniently. As of early 2024, Alinma Bank continues to expand its reach, with recent reports indicating a steady presence of its physical touchpoints nationwide, complementing its digital offerings.

The bank is also innovating with its Digital Branches and Zones, creating hybrid environments that seamlessly blend physical and digital banking experiences. This multi-channel strategy is designed to enhance customer convenience and cater to a spectrum of preferences, from those who prefer in-person interactions to those who are entirely digital. This approach aims to maximize accessibility and customer satisfaction in the evolving banking landscape.

Alinma Bank's API-driven ecosystem, a strategic initiative launched in collaboration with IBM in 2024-2025, acts as a powerful engine for partnerships. This advanced platform allows for effortless integration with a wide array of fintech innovators and established corporate entities.

By orchestrating this digital ecosystem, Alinma Bank significantly broadens its market penetration. This strategic move ensures the delivery of sophisticated digital banking solutions to a diverse customer base, with a particular focus on empowering Small and Medium Enterprises (SMEs) and microbusinesses. The bank aims to become a central hub for digital financial services, fostering innovation and accessibility.

Focus on Customer Convenience and Efficiency

Alinma Bank's distribution strategy prioritizes making banking easy and fast for customers. They're cutting down on the need for people to visit physical branches by making their digital tools much better. This focus on convenience is key to how they reach their customers.

A great example of this is their digital onboarding process. In 2024, a significant 87% of new customers were acquired through this streamlined digital channel. This clearly shows their dedication to simplifying access to their banking services.

- Digital Onboarding Success: 87% of new customer acquisitions in 2024 were through digital channels.

- Reduced Branch Dependence: Enhanced digital capabilities minimize the necessity for physical branch visits.

- Customer Satisfaction Focus: The strategy aims to boost overall customer satisfaction by improving ease of access.

- Optimized Sales Potential: Streamlined processes are designed to enhance sales opportunities through efficient customer engagement.

Geographic Reach within Saudi Arabia

Alinma Bank, a Saudi Arabian joint stock company, focuses its distribution network exclusively within the Kingdom, aiming to be a premier provider of Sharia-compliant financial solutions nationwide. This strategic concentration allows them to effectively serve their expanding customer base. As of March 2025, Alinma Bank's robust network and digital platforms cater to approximately 5.8 million customers throughout Saudi Arabia.

- Nationwide Presence: Alinma Bank's distribution is geographically concentrated within Saudi Arabia, reinforcing its commitment to serving the Kingdom's market.

- Customer Reach: The bank's extensive network and digital services effectively reach over 5.8 million customers across Saudi Arabia as of March 2025.

- Strategic Deployment: Distribution channels are strategically placed to maximize accessibility and service delivery to its customer base.

Alinma Bank's distribution strategy is deeply rooted in its Saudi Arabian focus, ensuring its extensive network and digital platforms are tailored to the Kingdom's unique market. This geographical concentration allows for optimized service delivery and customer engagement across the nation.

As of March 2025, Alinma Bank effectively serves approximately 5.8 million customers throughout Saudi Arabia, underscoring the breadth and depth of its distribution reach. The bank's commitment to Sharia-compliant financial solutions is central to its nationwide presence.

The bank's distribution channels, a blend of digital prowess and a physical footprint, are strategically deployed to maximize accessibility. This multi-faceted approach ensures that a broad spectrum of customers can conveniently access Alinma Bank's services, reinforcing its position as a premier financial provider in Saudi Arabia.

| Distribution Channel | Key Features | Customer Reach (as of March 2025) | Geographic Focus |

|---|---|---|---|

| Digital Platforms (App, Internet) | 24/7 Accessibility, Remote Transactions, Digital Onboarding | Over 5.8 million customers | Saudi Arabia |

| Physical Branches & ATMs | In-person Services, Customer Support, Wider Accessibility | Nationwide presence | Saudi Arabia |

| Digital Branches/Zones | Hybrid Banking Experience, Seamless Integration | Enhancing customer convenience | Saudi Arabia |

| API Ecosystem | Facilitates Partnerships, Fintech Integration | Expanding market penetration | Saudi Arabia |

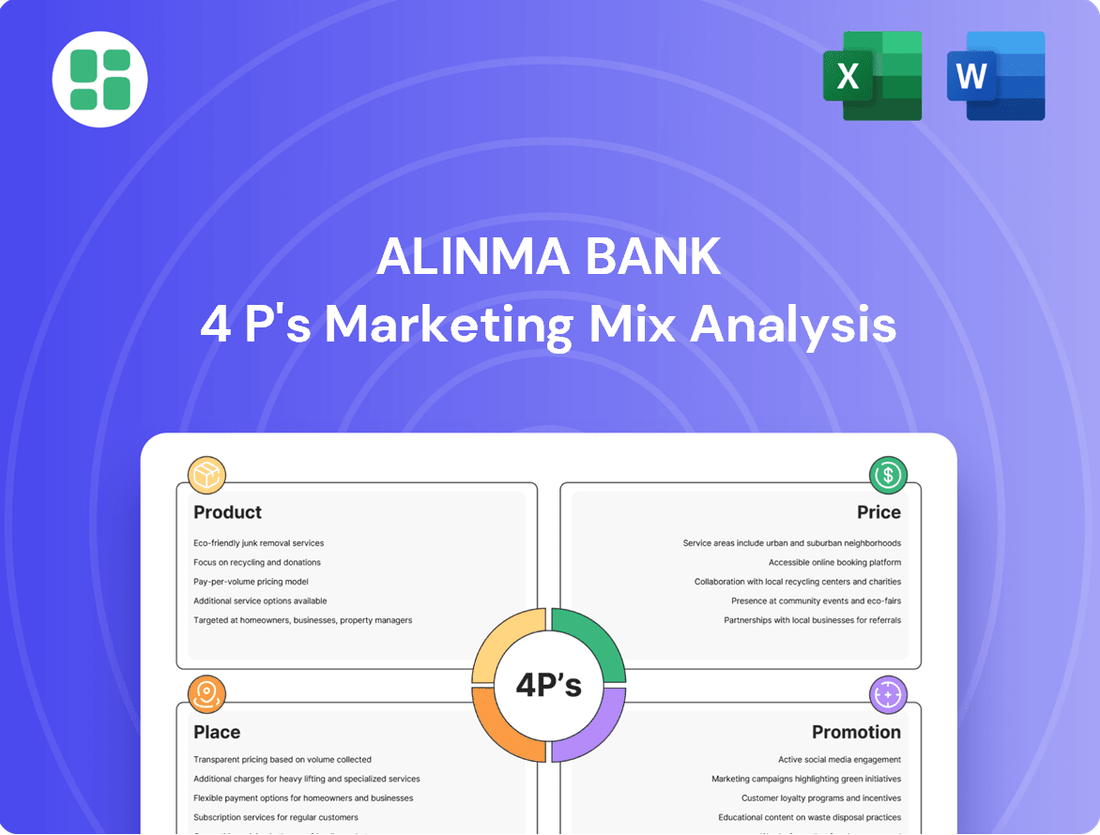

Preview the Actual Deliverable

Alinma Bank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Alinma Bank 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies in detail. You'll gain valuable insights into how Alinma Bank positions its offerings to meet customer needs and achieve its business objectives.

Promotion

Alinma Bank unveiled its forward-looking brand identity, 'One Step Ahead,' in early 2025. This strategic move underscores a significant commitment to innovation and customer-centric development, aiming to solidify its leadership in providing superior Sharia-compliant financial services within Saudi Arabia.

The refreshed visual aesthetic accompanying the 'One Step Ahead' messaging is designed to project a modern and progressive image. This rebranding effort directly supports Alinma Bank's objective to enhance its competitive edge and reinforce its standing as a leading financial institution in the Kingdom's dynamic market.

Alinma Bank leverages digital marketing extensively, showcasing its website, mobile app, and social media presence to connect with customers. They actively promote new app functionalities, streamlined online account opening processes, and a suite of digital services designed to appeal to a modern, digitally-inclined customer base.

In 2024, Alinma Bank continued its digital transformation, with a significant focus on enhancing user experience through its mobile application. This push aims to boost customer engagement by offering innovative digital solutions and making banking more accessible and convenient than ever before.

Alinma Bank actively cultivates strategic partnerships and sponsorships to amplify its brand presence and foster deeper community ties. For instance, their collaboration with the Social Development Bank for the launch of the Freelance Card directly addresses a growing segment of the workforce.

Further demonstrating this commitment, Alinma Bank sponsored the Sports Investment Forum, aligning its image with national development objectives and showcasing support for key economic sectors. These carefully chosen alliances enhance brand visibility and reinforce the bank's role as a community supporter.

Awards and Recognition

Alinma Bank actively uses its awards and recognitions to build trust and showcase its strengths in both Islamic and digital banking. These accolades serve as powerful endorsements of the bank's commitment to innovation and customer service.

The bank's dedication to excellence was highlighted in 2024 when it secured significant industry awards. These included being named 'Best Islamic Digital Bank in Saudi Arabia 2024' and 'Best SME Bank in Saudi Arabia' by MEED in April 2025. Such recognition confirms Alinma Bank's leading position and the effective implementation of its strategic objectives.

- Industry Recognition: Alinma Bank leverages awards to enhance its brand image and market standing.

- Digital Leadership: The 'Best Islamic Digital Bank in Saudi Arabia 2024' award underscores its advanced digital offerings.

- SME Focus: Recognition as 'Best SME Bank in Saudi Arabia' highlights its commitment to supporting small and medium-sized enterprises.

- Strategic Validation: These awards validate the success of Alinma Bank's strategic initiatives in Islamic and digital banking.

Sustainability and Community Initiatives

Alinma Bank's commitment to sustainability and community is a core element of its marketing strategy, particularly through its 'AMAD' program. This initiative actively promotes environmental awareness and supports entrepreneurial ventures, directly contributing to social and community development. By aligning with Saudi Vision 2030, the bank positions itself as a responsible financial institution.

The bank's sustainability reports and related activities serve as crucial promotional tools, highlighting their dedication to responsible finance. This focus on CSR not only builds brand reputation but also resonates with a growing segment of socially conscious consumers and investors.

- AMAD Program Focus: Promotes sustainability awareness and supports entrepreneurs.

- Alignment with Vision 2030: Contributes to Saudi Arabia's national development goals.

- Promotional Value: Sustainability reports and initiatives act as key marketing assets.

Alinma Bank's promotional efforts are multifaceted, focusing on digital engagement, strategic partnerships, and industry recognition. Their 'One Step Ahead' brand identity, launched in early 2025, signifies a commitment to innovation and customer-centric Sharia-compliant services. The bank actively promotes its digital platforms, including its mobile app and website, to enhance customer accessibility and engagement. In 2024, Alinma Bank received accolades such as 'Best Islamic Digital Bank in Saudi Arabia 2024' and 'Best SME Bank in Saudi Arabia,' validating its strategic direction and market leadership.

Strategic sponsorships, like the one with the Social Development Bank for the Freelance Card, and participation in events such as the Sports Investment Forum, amplify brand visibility and community ties. These initiatives align with national development objectives and support key economic sectors. Furthermore, Alinma Bank's 'AMAD' program promotes sustainability and entrepreneurship, reinforcing its commitment to corporate social responsibility and aligning with Saudi Vision 2030.

| Promotional Activity | Key Focus | Impact/Outcome (2024-2025) |

|---|---|---|

| Brand Identity Refresh ('One Step Ahead') | Innovation, Customer-centricity, Sharia-compliance | Positioning as a modern, progressive leader in Saudi financial services. |

| Digital Marketing & App Enhancement | User experience, Digital solutions, Accessibility | Increased customer engagement and convenience; promotion of streamlined online services. |

| Strategic Partnerships & Sponsorships | Community ties, Niche market access, Brand visibility | Launch of Freelance Card (with Social Development Bank); support for economic sectors (Sports Investment Forum). |

| Awards & Recognition | Trust building, Strength showcasing (Islamic & Digital Banking) | 'Best Islamic Digital Bank in Saudi Arabia 2024', 'Best SME Bank in Saudi Arabia' (MEED, April 2025). |

| Sustainability Initiatives (AMAD Program) | Environmental awareness, Entrepreneurial support, CSR | Contribution to social development and alignment with Saudi Vision 2030. |

Price

Alinma Bank structures its pricing around competitive profit rates, such as Murabaha profit rates and Ijara rentals, ensuring strict adherence to Sharia principles instead of traditional interest. This approach allows them to offer attractive and accessible pricing for their diverse financing and investment products. For instance, in Q1 2024, Alinma Bank reported a net special commission income of SAR 2.3 billion, reflecting the market's demand for their Sharia-compliant financial solutions.

Alinma Bank champions transparent pricing, ensuring customers fully grasp the costs associated with their financial products and services. This commitment extends to clearly outlining administrative fees and profit margins on financing, fostering trust and adherence to Islamic finance principles. For instance, in 2024, Alinma Bank's published financial statements detailed a net profit margin of 17.5%, a figure readily accessible to all stakeholders.

Alinma Bank's pricing strategy is deeply rooted in its commitment to Sharia-compliant financial solutions. This means pricing is not just about competitive rates but also about offering ethical value that resonates with its target audience. For instance, their personal finance products in 2024 and early 2025 have been structured to reflect fair profit margins, ensuring transparency and adherence to Islamic principles, differentiating them from conventional banking offerings.

Dividend Distribution and Shareholder Value

Alinma Bank's commitment to shareholder value is evident in its dividend distribution strategy. The bank's financial performance directly impacts its ability to reward investors. For instance, Alinma Bank announced proposed cash dividends for both Q4 2024 and Q2 2025, underscoring its financial health and dedication to returning profits to shareholders.

This consistent approach to dividends reflects a strong financial footing, supported by robust net profits reported throughout 2024 and into Q1 2025. Such distributions are a key component of the bank's overall value proposition to its investors.

- Strong Net Profits: Alinma Bank reported significant net profits in 2024 and Q1 2025.

- Proposed Cash Dividends: The bank proposed cash dividends for Q4 2024 and Q2 2025.

- Shareholder Returns: These dividends demonstrate a clear commitment to shareholder value.

- Financial Stability: The dividend payouts signal a robust and stable financial position.

Strategic Pricing for Digital Services and APIs

Alinma Bank's strategic pricing for its digital services, particularly its new API platform, is a key element in its 4Ps marketing mix, focusing on turning technological infrastructure into a revenue generator. This move aligns with Saudi Arabia's Vision 2030, which emphasizes digital transformation and financial innovation. By offering paid API services, Alinma Bank aims to foster a more robust fintech ecosystem, providing valuable tools for small and medium-sized enterprises (SMEs) and other financial institutions.

The pricing strategy for these API services will likely consider factors such as transaction volume, data access levels, and the complexity of the services offered. This approach allows Alinma Bank to monetize its digital investments while simultaneously supporting the growth of the digital economy in the Kingdom. For instance, tiered pricing models could be implemented, offering basic access at a lower cost and premium features or higher usage limits at a premium price point.

- Monetization of Digital Assets: Alinma Bank is leveraging its API platform as a direct revenue stream, moving beyond traditional banking services.

- Ecosystem Enhancement: Providing accessible APIs supports the growth of fintech startups and SMEs in Saudi Arabia, fostering innovation.

- Strategic Market Positioning: This initiative positions Alinma Bank as a forward-thinking financial institution actively contributing to the Kingdom's digital transformation goals.

- Potential Revenue Growth: The global API management market was valued at approximately $3.2 billion in 2023 and is projected to grow significantly, indicating a substantial opportunity for Alinma Bank.

Alinma Bank's pricing strategy is built on Sharia-compliant profit rates and rentals, ensuring ethical financial solutions. This approach, as seen in their Q1 2024 net special commission income of SAR 2.3 billion, appeals to a market seeking faith-aligned banking. Transparency in administrative fees and profit margins, with a 2024 net profit margin of 17.5%, further builds customer trust.

The bank also strategically prices its digital offerings, like its API platform, to generate revenue and support Saudi Arabia's digital transformation. This involves tiered pricing for API services, reflecting usage and complexity, a move that aligns with the projected growth of the global API management market, valued at $3.2 billion in 2023.

| Product/Service | Pricing Basis | Key Feature | 2024/2025 Data Point |

|---|---|---|---|

| Financing Products | Murabaha Profit Rates | Sharia-compliant | Net Special Commission Income: SAR 2.3 billion (Q1 2024) |

| Digital Services (APIs) | Tiered Pricing (Volume, Complexity) | Monetization of digital assets | Global API Management Market: $3.2 billion (2023) |

| Shareholder Returns | Dividend Distribution | Commitment to shareholder value | Proposed cash dividends (Q4 2024, Q2 2025) |

4P's Marketing Mix Analysis Data Sources

Our Alinma Bank 4P's Marketing Mix Analysis is built upon a foundation of official corporate disclosures, including annual reports and investor presentations, alongside insights from their official website and industry-specific financial reports. This ensures our analysis is grounded in verifiable data regarding their product offerings, pricing structures, distribution channels, and promotional activities.