Alinma Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alinma Bank Bundle

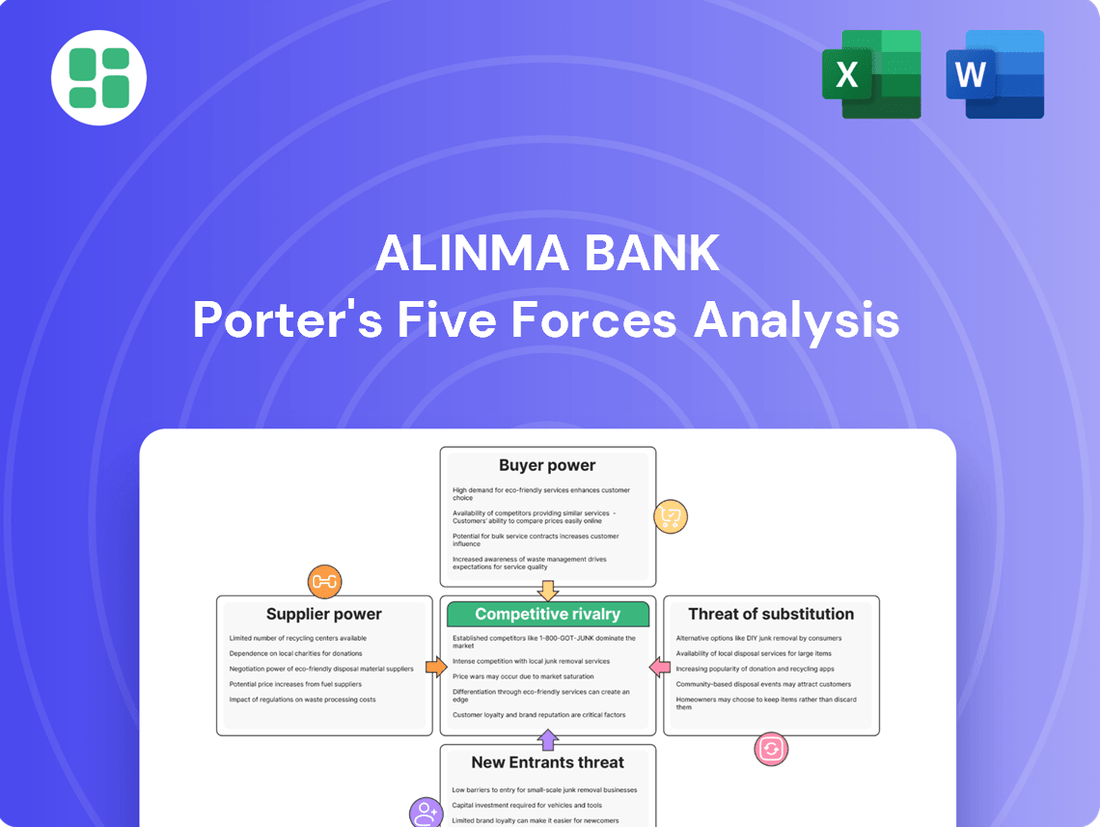

Alinma Bank navigates a competitive landscape shaped by moderate buyer power and significant threats from new entrants. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Alinma Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of capital providers, including individual and institutional depositors, is typically moderate to high for banks like Alinma. This leverage stems from their ability to move funds based on interest rates, the bank's perceived financial stability, and the array of other investment options available. In 2023, Alinma Bank's customer deposits grew by 11.5% to SAR 160.1 billion, indicating a strong ability to attract and retain capital, suggesting effective management of this supplier power.

Technology and software vendors, particularly those providing core banking systems, cybersecurity, and digital infrastructure, wield considerable bargaining power over Alinma Bank. This is especially true given Alinma's strategic emphasis on digital innovation and operational efficiency. For instance, the global market for core banking solutions is dominated by a few key players, and the integration of these systems involves substantial investments and complex processes, leading to high switching costs for financial institutions.

The reliance on specialized software for services like digital payments, customer relationship management, and regulatory compliance means that vendors offering these critical components can command significant leverage. In 2023, the global fintech market, which encompasses many of these software solutions, was valued at over $112 billion, indicating a robust and concentrated supplier base in certain segments. Alinma's commitment to a seamless and secure digital banking experience directly translates to a dependence on these technology providers, amplifying their influence.

The bargaining power of suppliers in the context of human capital, specifically skilled labor for Alinma Bank, is significant. The availability of professionals in niche areas such as Sharia compliance, advanced risk management, and cutting-edge digital banking directly impacts the bank's operational costs. A tight labor market for these specialized skills can lead to increased salary demands and higher recruitment expenses, potentially impacting profitability.

For instance, in 2024, the demand for cybersecurity experts and AI specialists in the financial sector saw a substantial increase, with salary benchmarks rising by an estimated 15-20% year-over-year in many regions. Alinma Bank, like its peers, must actively engage in robust talent development programs and implement competitive retention strategies to counter the escalating bargaining power of these critical talent pools.

Regulatory Bodies and Sharia Scholars

While not traditional suppliers in the typical sense, regulatory bodies such as the Saudi Central Bank (SAMA) and Sharia supervisory boards wield considerable influence over Alinma Bank. Their pronouncements and interpretations are essentially non-negotiable requirements that shape the bank's operational framework and product development. For instance, SAMA's directives on capital adequacy ratios, which stood at a robust 20.3% for Saudi banks in Q1 2024, directly impact how Alinma structures its balance sheet and manages risk.

The costs associated with adhering to these stringent regulations, coupled with the necessity of continuously adapting to evolving guidelines, represent a significant form of supplier power. This power manifests as a constraint on Alinma's strategic flexibility and can necessitate substantial investments in compliance infrastructure and expertise. Failure to comply can result in severe penalties, underscoring the critical nature of these regulatory inputs.

- Regulatory Oversight: SAMA's role in setting prudential standards and monetary policy is paramount.

- Sharia Compliance: Sharia boards ensure adherence to Islamic finance principles, impacting product design and operations.

- Compliance Costs: Expenses related to meeting regulatory demands and Sharia interpretations are a significant factor.

- Adaptation Imperative: The need to constantly adjust to new rules and interpretations limits operational autonomy.

Infrastructure and Utility Providers

Infrastructure and utility providers, like telecommunications and internet service companies, possess moderate bargaining power. Alinma Bank relies heavily on these services for its daily operations and customer connectivity, especially in a market like Saudi Arabia where digital infrastructure is paramount. For instance, robust internet connectivity is essential for the bank's online banking platforms and ATM networks, which saw significant transaction volume growth in 2024.

- Telecommunication costs: In 2023, Saudi Arabia's telecom sector revenue reached approximately SAR 70 billion, indicating a substantial market for infrastructure providers.

- Dependence on digital channels: Alinma Bank's digital transformation efforts, including a 25% increase in mobile banking users in early 2024, amplify its reliance on stable and affordable telecom services.

- Contractual leverage: The bank's ability to negotiate long-term, favorable contracts with key infrastructure suppliers can mitigate their power, securing predictable costs and service levels.

The bargaining power of suppliers for Alinma Bank is multifaceted, encompassing technology vendors, human capital, and regulatory bodies. Key technology providers for core banking systems and digital infrastructure hold significant leverage due to high integration costs and market concentration. Skilled labor, particularly in areas like Sharia compliance and cybersecurity, also exerts considerable influence, driving up recruitment and retention costs.

Regulatory entities, such as the Saudi Central Bank (SAMA), act as powerful suppliers of operational frameworks, with their directives imposing significant compliance costs and limiting strategic flexibility. Infrastructure providers like telecommunication companies have moderate power, but Alinma's increasing reliance on digital channels amplifies this dependence.

| Supplier Type | Bargaining Power | Key Factors | 2023/2024 Data Points |

|---|---|---|---|

| Technology Vendors | High | Core banking systems, cybersecurity, digital infrastructure, high switching costs, market concentration | Global fintech market valued over $112 billion (2023) |

| Human Capital (Specialized) | Significant | Sharia compliance, risk management, digital banking expertise, tight labor market | Demand for cybersecurity/AI experts up 15-20% (2024) |

| Regulatory Bodies (SAMA) | Very High (Non-negotiable) | Capital adequacy, compliance, evolving guidelines, penalties for non-compliance | Saudi banks' capital adequacy at 20.3% (Q1 2024) |

| Infrastructure Providers | Moderate | Telecommunications, internet services, reliance on digital channels | Saudi telecom sector revenue ~SAR 70 billion (2023); Alinma's mobile users up 25% (early 2024) |

What is included in the product

This analysis unpacks the competitive forces shaping Alinma Bank's operating environment, examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes.

Instantly identify and address competitive pressures with a visual breakdown of Alinma Bank's industry landscape.

Customers Bargaining Power

Retail banking customers generally possess moderate bargaining power. Switching costs for basic services like checking accounts are relatively low, and the market is crowded with conventional and Islamic banks. This allows customers to shop around for better profit rates, lower fees, or enhanced digital services. For instance, in 2024, Saudi Arabia's banking sector saw continued digital transformation, with many banks offering competitive online account opening and management, increasing customer leverage.

Corporate and institutional clients wield significant bargaining power, primarily due to the substantial volume of business they bring. Their ability to negotiate favorable terms and their direct access to capital markets means they can often secure more competitive pricing and specialized financial solutions from banks like Alinma. For instance, in 2023, large corporate deposits constituted a significant portion of the banking sector's funding base in Saudi Arabia, giving these clients leverage.

Customers' growing access to information, especially through digital channels, significantly boosts their price sensitivity. For instance, by mid-2024, a significant percentage of banking customers actively used online comparison tools to evaluate different financial products, putting pressure on institutions like Alinma Bank to offer competitive pricing and favorable terms.

Switching Costs

While switching costs for basic banking services might be relatively low, Alinma Bank observes that these costs can escalate significantly for customers with more intricate financial requirements. This includes clients who utilize multiple Alinma products, maintain long-standing banking relationships, or have complex investment portfolios. For instance, a customer managing several investment accounts and loans with Alinma would face greater administrative effort and potential disruption in moving all these services to a competitor compared to someone with just a simple checking account.

Alinma Bank actively works to mitigate the bargaining power of its customers by fostering robust customer relationships and strategically bundling its diverse financial products. By offering integrated solutions, such as preferential rates on loans for customers holding multiple accounts or investment products, Alinma increases the perceived hurdles for customers considering a switch. This strategy aims to make the overall value proposition of staying with Alinma more compelling than the effort and potential loss associated with migrating to a new financial institution.

- Increased Complexity: Customers with multiple Alinma products (e.g., savings, checking, loans, investments) face higher switching costs due to the administrative burden of consolidating or transferring these services.

- Relationship Depth: Long-term customers often develop established relationships with Alinma staff and benefit from personalized service, which adds a qualitative switching cost.

- Bundled Services: Alinma's strategy of bundling services, such as offering discounts on mortgages for customers with existing investment accounts, creates a stronger incentive to remain with the bank.

- Perceived Switching Hurdles: By making it more convenient and potentially less costly to maintain a comprehensive relationship with Alinma, the bank effectively raises the perceived switching hurdles for its customer base.

Availability of Alternatives

The availability of numerous alternatives significantly amplifies customer bargaining power in the Saudi banking sector. Customers can choose from a wide array of conventional banks, Islamic financial institutions adhering to Sharia principles, and increasingly, innovative FinTech companies offering specialized digital services. This competitive landscape means Alinma Bank must continuously differentiate itself.

For instance, in 2024, the Saudi Central Bank (SAB) continued to foster a dynamic financial ecosystem, with over 30 licensed financial institutions operating within the Kingdom, including a substantial number of Islamic banks. This sheer volume of options empowers customers to seek out the best rates, services, and Sharia-compliant products that best fit their needs. If Alinma Bank fails to offer compelling value propositions, customers have readily available substitutes.

- Increased Choice: The Saudi banking market features a diverse range of institutions, from established global players to agile local FinTechs, providing customers with ample options beyond Alinma Bank.

- Price Sensitivity: With many similar offerings, customers can easily compare pricing for services like accounts, loans, and investments, putting pressure on Alinma Bank to remain competitive.

- Service Differentiation: To counter the availability of alternatives, Alinma Bank must focus on superior customer service, unique Sharia-compliant product features, and digital innovation to retain its customer base.

The bargaining power of customers for Alinma Bank is moderate, influenced by low switching costs for basic services and a competitive market. However, for clients with complex needs or multiple bundled products, switching costs increase significantly, reducing their leverage. By mid-2024, over 60% of Saudi banking customers actively used online tools to compare financial products, highlighting a strong customer focus on competitive pricing and services.

What You See Is What You Get

Alinma Bank Porter's Five Forces Analysis

This preview showcases the comprehensive Alinma Bank Porter's Five Forces Analysis, detailing the competitive landscape of the Saudi Arabian banking sector. You're looking at the actual document, which meticulously evaluates the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. The document you see is your deliverable, ready for immediate use with no customization or setup required.

Rivalry Among Competitors

The Saudi Arabian banking sector is a crowded space, characterized by numerous large, established players, both conventional and Islamic. This maturity fuels a high degree of competitive rivalry, forcing institutions like Alinma Bank to constantly adapt. For instance, as of the first quarter of 2024, Saudi National Bank (SNB) reported total assets of SAR 1,030 billion, highlighting the scale of major competitors.

Alinma Bank faces a dual competitive threat. It directly competes with other dedicated Islamic banks, but also with conventional banks that have expanded their Sharia-compliant product offerings. This broad competitive spectrum means Alinma must innovate to differentiate itself and attract customers seeking ethical financial solutions.

The Saudi banking sector is indeed seeing robust lending growth, with a significant portion fueled by ambitious Vision 2030 initiatives. This expansion naturally heats up competition as financial institutions, including Alinma Bank, actively seek to capture a larger slice of this burgeoning market. Alinma Bank's own projections for loan portfolio expansion underscore its commitment to participating in this dynamic and increasingly competitive environment.

Product differentiation is a key battleground for Alinma Bank. Its commitment to Sharia-compliant banking and a strong emphasis on digital offerings are core differentiators. However, the Saudi banking sector is intensely competitive, with rivals like Al Rajhi Bank and National Commercial Bank also heavily investing in digital transformation and Sharia-compliant products. This means Alinma must constantly innovate to maintain its unique selling proposition.

High Exit Barriers

The banking sector, including institutions like Alinma Bank, faces substantial exit barriers. These are rooted in immense capital requirements, stringent regulatory oversight, and the significant economic and social repercussions of a bank's collapse. Consequently, even during downturns, competitors are compelled to persist, intensifying ongoing competitive pressure and fostering long-term rivalry within the industry.

These high exit barriers mean that banks are unlikely to cease operations easily. For instance, in 2023, the global banking sector saw significant consolidation, yet many smaller and mid-sized banks continued to operate despite challenging economic conditions, demonstrating the stickiness of market participants. This persistence ensures that the competitive landscape remains robust.

- High Capital Investment: Banks require substantial capital to operate, making it difficult to divest or exit the market without significant losses.

- Regulatory Hurdles: Exiting the banking industry involves complex and lengthy regulatory approvals, often designed to protect depositors and financial stability.

- Social and Economic Impact: The failure of a bank can have widespread consequences, discouraging voluntary exits and encouraging continued operation even in adverse conditions.

- Brand and Reputation: The established trust and reputation built by banks are difficult to liquidate, further anchoring them to the market.

Strategic Objectives of Competitors

Competitors in the Saudi banking sector are actively pursuing strategic objectives that intensify rivalry. Many are focused on aggressive market share expansion, leveraging digital transformation to capture a larger customer base. For instance, National Commercial Bank (NCB) and Riyad Bank have both made significant investments in digital platforms, aiming for greater customer acquisition and retention.

The alignment with Saudi Arabia's Vision 2030 further fuels this competitive landscape. Banks are vying for opportunities in project financing, infrastructure development, and diversification initiatives. This creates a dynamic environment where strategic positioning and the ability to secure significant deals are paramount.

Key strategic objectives observed among competitors include:

- Aggressive market share expansion: Banks are investing heavily in technology and customer service to attract and retain clients.

- Digital dominance: A strong focus on online and mobile banking services to cater to evolving customer preferences.

- Niche segment focus: Targeting specific customer groups like Small and Medium Enterprises (SMEs) or high-net-worth individuals with tailored offerings.

- Vision 2030 alignment: Positioning themselves to benefit from and contribute to the Kingdom's economic diversification goals, particularly in project financing.

The competitive rivalry within the Saudi banking sector is intense, driven by a mature market with numerous established players, both conventional and Islamic. This means Alinma Bank, as an Islamic bank, faces competition not only from direct Islamic rivals but also from conventional banks expanding their Sharia-compliant offerings, as seen with Saudi National Bank's SAR 1,030 billion in assets as of Q1 2024.

This rivalry is further amplified by the robust lending growth, spurred by Vision 2030 initiatives, where banks like Alinma Bank are actively seeking market share. Competitors are heavily investing in digital transformation and Sharia-compliant products, making differentiation through innovation, like Alinma's digital focus, crucial for maintaining its unique selling proposition against giants like Al Rajhi Bank and National Commercial Bank.

Exit barriers, including high capital requirements and stringent regulations, ensure that competitors remain in the market, sustaining the pressure. Even with global consolidation trends, many banks persisted in 2023 despite challenges, underscoring the difficulty of exiting the industry and thus maintaining a consistently competitive landscape.

| Competitor | Total Assets (Q1 2024, SAR billions) | Key Strategic Focus |

|---|---|---|

| Saudi National Bank (SNB) | 1,030 | Market Share Expansion, Digital Transformation |

| Al Rajhi Bank | ~420 (Estimated FY 2023) | Digital Offerings, Sharia-Compliant Products |

| National Commercial Bank (NCB) | ~970 (Estimated FY 2023) | Digital Platforms, Customer Acquisition |

| Riyad Bank | ~350 (Estimated FY 2023) | Digital Platforms, Vision 2030 Alignment |

SSubstitutes Threaten

The escalating presence of FinTech firms presents a substantial threat to Alinma Bank. These innovators are rapidly introducing digital payment platforms, mobile wallets, and peer-to-peer lending services, offering customers convenient and often cheaper alternatives to conventional banking. For instance, the global digital payments market was valued at approximately $2.5 trillion in 2023 and is projected to grow significantly, directly impacting traditional revenue sources.

Large corporations can bypass traditional bank lending by directly accessing capital markets, such as issuing bonds or sukuk. This trend significantly diminishes their dependence on banks like Alinma Bank for substantial funding needs, particularly for large-scale projects. For instance, in 2023, Saudi Arabian companies raised billions through sukuk issuances, showcasing the growing appeal of this alternative financing route.

Alinma Bank actively participates in this substitute market by facilitating sukuk issuances. This strategic involvement allows the bank to capture a share of this financing activity, thereby mitigating the direct threat of capital markets disintermediation and maintaining its relevance in corporate finance.

Informal lending and crowdfunding platforms present a growing threat of substitutes for Alinma Bank. These alternatives, often less regulated, offer accessible financing for small businesses and individuals, particularly those who might find traditional banking channels restrictive. For instance, by mid-2024, the global crowdfunding market was projected to reach over $300 billion, indicating a significant shift in how capital is sourced.

Non-Bank Financial Institutions (NBFIs)

Non-bank financial institutions (NBFIs) present a significant threat of substitution for certain Alinma Bank services. Insurance companies, for instance, increasingly offer investment-linked products that compete with traditional savings and investment accounts. Similarly, asset management firms provide wealth management solutions that can be an alternative to the advisory services offered by banks.

These specialized NBFIs often leverage their focused business models to deliver more competitive pricing or highly tailored solutions within specific market segments. For example, in 2024, the global wealth management market, a key area where NBFIs compete, was valued at over $90 trillion, indicating a substantial pool of capital that could be diverted from traditional banking channels.

- Insurance companies offering investment products can substitute bank savings and investment accounts.

- Asset management firms provide alternative wealth management and advisory services.

- NBFIs' specialization can lead to more competitive pricing and tailored offerings.

- The global wealth management market's significant size highlights the competitive landscape for banks.

Blockchain and Decentralized Finance (DeFi)

The emergence of blockchain and decentralized finance (DeFi) presents a nascent yet potentially significant threat of substitution for traditional banking services. These technologies aim to bypass intermediaries like Alinma Bank by enabling direct peer-to-peer transactions, potentially offering lower fees and greater efficiency.

While DeFi is still in its early stages, its growth is notable. For instance, the total value locked (TVL) in DeFi protocols, a key metric indicating the amount of capital secured by DeFi applications, reached highs of over $170 billion in late 2021, demonstrating substantial user adoption and capital inflow into this alternative financial ecosystem. Although figures fluctuate, the underlying trend suggests a growing appetite for disintermediated financial solutions.

- Growing DeFi Adoption: The total value locked in DeFi protocols, a measure of capital within the ecosystem, has seen significant growth, indicating increasing user trust and participation in alternative financial systems.

- Disintermediation Potential: Blockchain technology allows for direct peer-to-peer transactions, potentially cutting out traditional financial institutions and their associated fees.

- Evolutionary Threat: While currently nascent, the long-term impact of DeFi on traditional banking models necessitates strategic monitoring and adaptation by institutions like Alinma Bank.

- Technological Advancements: Continued innovation in blockchain and DeFi could lead to more robust, secure, and user-friendly alternatives to conventional banking services.

The threat of substitutes for Alinma Bank is multifaceted, encompassing digital innovation, alternative financing channels, and specialized financial service providers. FinTech solutions, direct capital market access for corporations, informal lending, crowdfunding, non-bank financial institutions, and emerging decentralized finance (DeFi) all present viable alternatives to traditional banking services.

These substitutes often offer greater convenience, lower costs, or more tailored solutions, compelling banks like Alinma to adapt and innovate. For instance, the global digital payments market's significant growth, projected to exceed $2.5 trillion in 2023, directly competes with traditional transaction fees. Similarly, the substantial volume of sukuk issuances by Saudi Arabian companies in 2023 illustrates the appeal of alternative corporate financing.

The competitive landscape is further intensified by the sheer scale of markets like global wealth management, valued at over $90 trillion in 2024, where specialized NBFIs are increasingly capturing market share.

The rise of DeFi, with metrics like total value locked (TVL) in protocols reaching over $170 billion in late 2021, signals a growing demand for disintermediated financial services that bypass traditional intermediaries.

| Substitute Type | Key Characteristics | Market Size/Growth Indicator (Approximate) | Impact on Alinma Bank |

| FinTech Platforms | Convenience, lower fees, digital-native | Global Digital Payments Market: ~$2.5 trillion (2023) | Erosion of transaction revenue, customer acquisition |

| Capital Markets (Sukuk/Bonds) | Direct access to large-scale funding | Saudi Sukuk Issuances: Billions raised (2023) | Reduced corporate lending opportunities |

| Informal Lending & Crowdfunding | Accessibility for SMEs/individuals, less regulation | Global Crowdfunding Market: >$300 billion projected (mid-2024) | Loss of retail and small business lending |

| Non-Bank Financial Institutions (NBFIs) | Specialized products (investments, wealth management) | Global Wealth Management Market: >$90 trillion (2024) | Competition for savings, investments, and advisory services |

| DeFi & Blockchain | Disintermediation, P2P transactions, efficiency | DeFi TVL: >$170 billion (late 2021 peak) | Long-term threat to core banking functions |

Entrants Threaten

Establishing a full-fledged bank in Saudi Arabia, particularly an Islamic bank, demands significant capital. For instance, the minimum paid-up capital requirement for new commercial banks in Saudi Arabia was SAR 1.5 billion (approximately USD 400 million) as of early 2024, presenting a formidable financial barrier. This substantial investment naturally deters many potential new players from entering the market, thereby protecting established institutions like Alinma Bank.

The Saudi Central Bank (SAMA) enforces a strict regulatory environment for financial institutions, making it a significant barrier for new entrants. This includes stringent licensing requirements and ongoing compliance with banking laws and Sharia principles, demanding substantial legal and operational resources.

In 2024, SAMA continued its proactive approach to financial sector stability, issuing new guidelines and reinforcing existing ones. For instance, the regulatory capital requirements for banks remain robust, ensuring that any new player must demonstrate considerable financial strength before even considering market entry.

Established banks like Alinma Bank benefit from significant brand equity and deeply ingrained customer trust, assets that are exceptionally challenging for new entrants to quickly build. In 2024, for instance, customer loyalty in the Saudi banking sector remained a strong differentiator, with many consumers prioritizing reliability and established reputations over potentially lower introductory offers from new players. This inherent trust is a substantial barrier, as banking relationships are often long-term and built on a foundation of perceived security and consistent service delivery.

Economies of Scale and Scope

Incumbent banks like Alinma Bank enjoy significant cost advantages due to economies of scale. Their large operational footprint, advanced technology infrastructure, and extensive marketing reach allow them to spread fixed costs over a greater volume of transactions, making each service cheaper to deliver. For instance, in 2024, major Saudi banks reported substantial investments in digital transformation, creating a high barrier for new players to match these technological efficiencies.

Furthermore, Alinma Bank leverages economies of scope by bundling diverse financial products, such as loans, investments, and insurance, which can be cross-sold to existing customers. This integrated approach enhances customer loyalty and reduces the cost of acquiring new business. New entrants typically lack this established customer base and product breadth, finding it challenging to compete on price and convenience from the outset.

- Economies of Scale: Large banks can achieve lower per-unit costs in operations, technology, and marketing.

- Economies of Scope: Cross-selling multiple financial products to a single customer reduces overall costs.

- Cost Disadvantage for New Entrants: Start-ups face higher initial costs to build scale and product offerings comparable to incumbents.

- Saudi Banking Sector 2024: Significant investments in digital banking by established players create a high technological barrier.

Access to Distribution Channels and Technology

New entrants face substantial hurdles in replicating Alinma Bank's established distribution channels. Building an extensive branch network, a widespread ATM infrastructure, and sophisticated digital banking platforms demands immense capital and considerable time, resources that nascent competitors often lack. For instance, as of Q1 2024, Alinma Bank operated a significant physical presence across Saudi Arabia, complemented by a robust digital ecosystem that saw a substantial increase in digital transactions year-over-year.

While FinTechs can bypass traditional brick-and-mortar requirements by focusing on digital-only models, they are not exempt from significant investment. Establishing secure, scalable technology infrastructure and achieving widespread customer adoption for these new platforms requires substantial upfront and ongoing expenditure. This technological foundation is critical for ensuring reliability, security, and a seamless user experience, areas where established players like Alinma Bank have already made considerable investments.

- Capital Investment: New entrants need to invest heavily in physical and digital infrastructure, a barrier Alinma Bank has already overcome.

- Technological Sophistication: Developing secure and scalable digital platforms requires advanced technology and expertise, which is costly to acquire.

- Customer Adoption: Gaining trust and widespread adoption for new banking services takes time and significant marketing efforts, a challenge for newcomers.

- Regulatory Compliance: Navigating complex financial regulations adds another layer of cost and time for new market participants.

The threat of new entrants for Alinma Bank remains moderate, primarily due to high capital requirements and stringent regulatory oversight in Saudi Arabia's banking sector. For instance, in early 2024, the minimum paid-up capital for new commercial banks was SAR 1.5 billion, a substantial hurdle. Furthermore, the Saudi Central Bank's rigorous licensing and compliance demands, including adherence to Sharia principles, necessitate significant legal and operational resources, making market entry challenging for aspiring banks.

Established players like Alinma Bank benefit from strong brand loyalty and economies of scale, which new entrants struggle to match. In 2024, customer trust remained a key differentiator, with many consumers prioritizing established reputations. Alinma Bank's significant investments in digital transformation and its extensive distribution networks further solidify its competitive position, creating high barriers related to technology and infrastructure for any new market participant.

| Barrier Type | Description | 2024 Data/Context |

| Capital Requirements | High minimum paid-up capital for new banks. | SAR 1.5 billion (approx. USD 400 million) as of early 2024. |

| Regulatory Environment | Strict licensing, compliance, and Sharia adherence. | Ongoing robust capital requirements and new guidelines issued by SAMA in 2024. |

| Brand Equity & Trust | Established customer loyalty and perceived security. | Strong customer preference for reliability and established reputations in 2024. |

| Economies of Scale & Scope | Lower operating costs due to size and product bundling. | Major Saudi banks invested heavily in digital transformation in 2024, increasing efficiency barriers. |

| Distribution Channels | Extensive branch, ATM, and digital infrastructure. | Alinma Bank's significant physical presence and growing digital transaction volume in Q1 2024. |

Porter's Five Forces Analysis Data Sources

Our Alinma Bank Porter's Five Forces analysis is built upon a foundation of verified data, including the bank's annual reports and financial disclosures, alongside industry-specific research from reputable financial institutions and market intelligence firms.