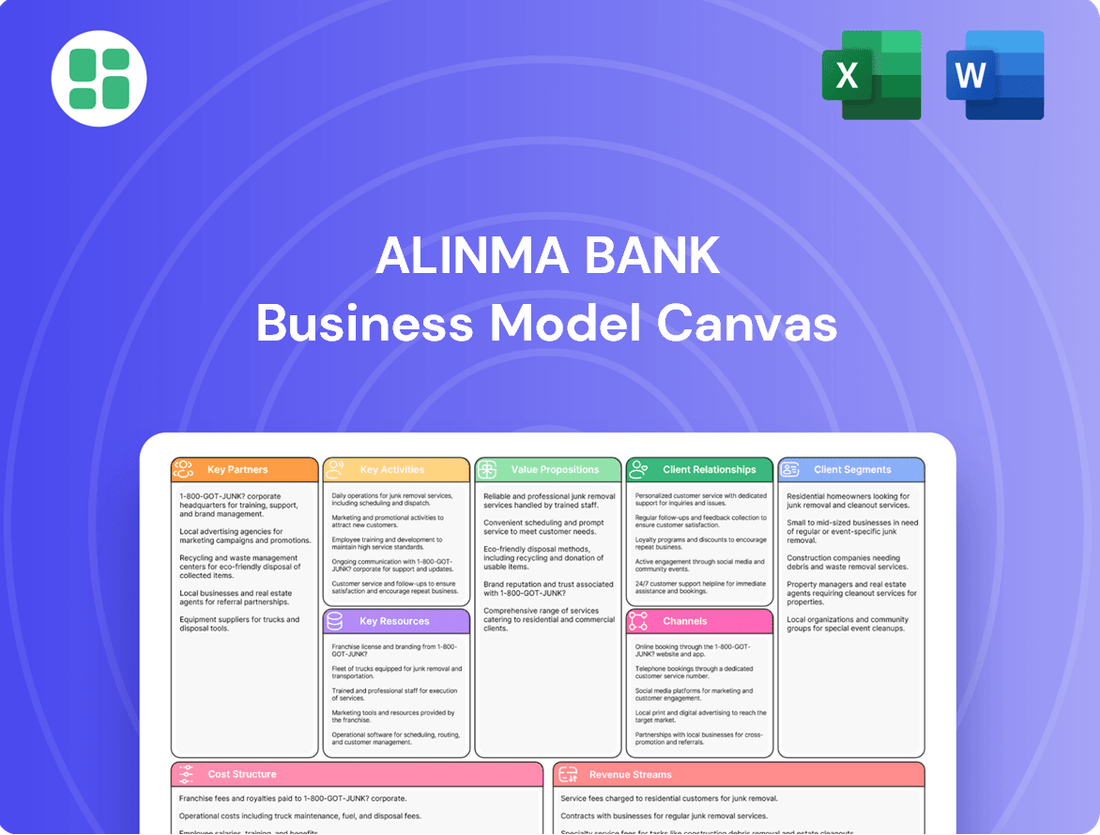

Alinma Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alinma Bank Bundle

Unlock the strategic blueprint behind Alinma Bank's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they attract and retain customers, manage key resources, and generate revenue in the competitive Saudi Arabian market. Gain actionable insights for your own business strategy.

Partnerships

Alinma Bank cultivates strategic alliances with technology giants like Huawei and IBM. These partnerships are instrumental in driving Alinma's digital transformation, aiming to bolster its IT infrastructure and deliver superior customer experiences. For instance, in 2023, Alinma Bank announced expanded collaborations with IBM, focusing on cloud migration and AI-driven solutions to enhance operational efficiency.

Alinma Bank's key partnerships with financial sector regulators, notably the Saudi Central Bank (SAMA) and the Capital Market Authority (CMA), are foundational. These collaborations ensure the bank adheres strictly to Sharia principles and all prevailing financial regulations, which is crucial for its Islamic banking model.

These regulatory relationships are vital for maintaining operational integrity and securing necessary approvals for new products and services. For instance, SAMA's oversight is critical for all banking operations, while the CMA's guidance is essential for capital market activities. In 2024, SAMA continued its focus on digital transformation and cybersecurity, impacting how banks like Alinma operate and innovate.

Alinma Bank actively partners with government and public sector entities, a key element in its business model. This collaboration underscores the bank's dedication to supporting Saudi Arabia's national development agenda, particularly Saudi Vision 2030.

A prime example is Alinma Bank's partnership with the Cultural Development Fund. This initiative specifically aims to bolster micro, small, and medium-sized enterprises (MSMEs) within the cultural sector, directly contributing to the Kingdom's economic diversification efforts.

Fintech Companies and Ecosystem Partners

Alinma Bank strategically partners with fintech companies to accelerate innovation and broaden its digital services. This collaboration allows the bank to integrate cutting-edge solutions and reach new customer segments more effectively.

A key aspect of this strategy is Alinma Bank's centralized API platform. This platform is designed to offer fintech partners secure and streamlined access to essential banking data and functionalities. By enabling these integrations, the bank not only enhances its own digital ecosystem but also opens avenues for new revenue generation, particularly through potential paid API services.

These partnerships are crucial for staying competitive in the rapidly evolving financial landscape. For instance, in 2024, the Saudi Arabian fintech market continued its robust growth, with significant investments pouring into digital banking solutions and payment systems, highlighting the strategic importance of such alliances for institutions like Alinma Bank.

- API Platform: Facilitates seamless integration for fintech partners, enabling access to banking data and digital solutions.

- Revenue Streams: Potential for new income through paid API services offered to fintech collaborators.

- Innovation Focus: Drives the development and expansion of Alinma Bank's digital product and service portfolio.

- Market Growth: Aligns with the expanding Saudi Arabian fintech sector, fostering a collaborative innovation environment.

Correspondent Banks and Financial Institutions

Alinma Bank's key partnerships with correspondent banks and financial institutions are crucial for its global operations. These relationships enable the bank to offer a comprehensive suite of international transaction services, including remittances, trade finance, and foreign exchange. For instance, in 2024, Alinma Bank continued to solidify its network, facilitating millions of cross-border transactions for its retail and corporate clients.

These collaborations are essential for Alinma Bank's treasury services and investment activities. By partnering with a diverse range of financial entities, the bank can access liquidity, manage currency exposures, and execute complex financial instruments. This network allows Alinma Bank to extend its reach beyond its domestic market, providing its clients with seamless access to global financial markets.

The strategic importance of these partnerships is evident in their ability to support Alinma Bank's diverse client base and corporate banking services. They empower the bank to offer competitive pricing and efficient execution for international payments and capital flows. As of the first half of 2024, Alinma Bank reported a significant increase in its international trade finance volumes, directly attributable to the strength of its correspondent banking relationships.

- Facilitation of International Transactions: Enables seamless cross-border payments and remittances.

- Treasury and Investment Services: Provides access to global liquidity and financial instruments.

- Extended Market Reach: Allows Alinma Bank to serve clients with international needs effectively.

- Support for Corporate Banking: Crucial for trade finance and global cash management solutions.

Alinma Bank strategically partners with fintech companies to accelerate innovation and broaden its digital services, integrating cutting-edge solutions and reaching new customer segments. The bank's centralized API platform offers fintech partners secure access to essential banking data and functionalities, fostering a collaborative innovation environment. This aligns with the robust growth of the Saudi Arabian fintech market in 2024, which saw significant investments in digital banking and payment systems.

| Partnership Type | Key Focus | Impact | 2024 Data/Trend |

|---|---|---|---|

| Fintech Companies | Digital innovation, API integration | Expanded digital services, new customer segments | Continued growth in Saudi fintech market |

| Correspondent Banks | International transactions, treasury services | Global reach, trade finance, FX services | Increased international trade finance volumes |

| Tech Giants (e.g., IBM) | Digital transformation, IT infrastructure | Enhanced operational efficiency, customer experience | Focus on cloud migration and AI solutions |

| Regulators (SAMA, CMA) | Compliance, Sharia adherence | Operational integrity, regulatory approvals | SAMA's continued focus on digital transformation |

| Government/Public Sector | National development agenda (Vision 2030) | Support for MSMEs, economic diversification | Partnerships in cultural and development sectors |

What is included in the product

A detailed Alinma Bank Business Model Canvas outlining its customer segments, value propositions, and channels, with a focus on Sharia-compliant financial solutions and digital banking services.

Alinma Bank's Business Model Canvas acts as a pain point reliever by clearly mapping customer segments and their needs, allowing for targeted value propositions that address specific banking challenges.

This visual tool helps Alinma Bank identify and overcome operational inefficiencies and market gaps, thereby simplifying complex banking processes for its clients.

Activities

Alinma Bank's key activity centers on creating and refining Sharia-compliant banking products. This means every offering, whether it's for individuals needing financing or corporations looking for investment opportunities, must align with Islamic law.

This commitment to ethical development is crucial for attracting and retaining customers who prioritize faith-based financial solutions. For instance, in 2023, Alinma Bank reported significant growth in its retail financing segment, a direct result of its robust Sharia-compliant product suite.

Alinma Bank's key activities revolve around aggressively pursuing digital transformation to streamline operations and elevate customer experiences. This involves a significant focus on digitizing all banking processes, from account opening to transaction management, ensuring a seamless and efficient journey for their clients.

A core component of their digital strategy is the development of a comprehensive super-app, designed to be a one-stop shop for all banking needs. This initiative, coupled with the strategic implementation of Artificial Intelligence and hybrid cloud infrastructure, aims to deliver banking services that are not only faster and easier to access but also more intelligent and personalized, directly supporting their 'One Step Ahead' vision.

In 2024, Alinma Bank continued to report strong digital engagement, with mobile banking transactions showing a substantial year-over-year increase. Their investment in AI is geared towards enhancing fraud detection and personalizing financial advice, further solidifying their commitment to innovation and customer-centricity.

Alinma Bank's key activity in customer relationship management focuses on cultivating robust connections across its retail, corporate, and small and medium-sized enterprise (SME) customer bases. This is crucial for fostering loyalty and driving sustainable growth.

The bank achieves this through tailored services, including assigning dedicated relationship managers who understand individual client needs. For instance, in 2024, Alinma Bank reported a significant increase in customer engagement through its digital channels, highlighting the effectiveness of its personalized digital self-service platforms in enhancing user experience and satisfaction.

Risk Management and Compliance

Alinma Bank's key activities heavily revolve around robust risk management and strict adherence to compliance. This involves actively managing credit risk, which is crucial given the bank's lending activities, as well as operational risks that can arise from daily processes and market risks associated with economic fluctuations. In 2024, Alinma Bank continued to prioritize these areas to ensure stability and trust.

Ensuring all financial activities align with the directives of the Saudi Central Bank (SAMA) and its internal Sharia Supervisory Board is a fundamental operational pillar. This dual compliance framework is essential for maintaining the bank's Islamic banking principles and meeting regulatory requirements. For instance, SAMA's ongoing focus on digital banking security and consumer protection directly influences Alinma Bank's operational procedures.

- Credit Risk Management: Alinma Bank implements rigorous credit assessment processes for all its borrowers to mitigate potential defaults.

- Operational Risk Mitigation: The bank invests in technology and training to prevent errors, fraud, and disruptions in its services.

- Market Risk Monitoring: Continuous analysis of market conditions helps Alinma Bank adjust its investment and hedging strategies.

- Sharia and Regulatory Compliance: Adherence to SAMA regulations and Sharia principles is a non-negotiable activity, ensuring ethical and legal operations.

Investment and Treasury Operations

Alinma Bank's investment and treasury operations are central to its financial strategy. The bank actively manages its financing portfolio, a diverse range of investments, and capital certificates. These core activities are designed to drive income generation and foster robust asset growth.

These operations are a significant contributor to Alinma Bank's financial performance. For instance, in the first quarter of 2025, the bank reported strong net profits, with treasury operations playing a key role. This trend continued into the first half of 2025, demonstrating the sustained impact of these activities on overall profitability and asset expansion.

- Investment Management: The bank oversees a portfolio of investments, aiming for capital appreciation and income generation.

- Treasury Services: This includes managing the bank's liquidity, funding, and foreign exchange operations.

- Financing Portfolio: Alinma Bank actively manages its lending activities and associated risks.

- Capital Certificates: Issuing and managing capital certificates is a key component of its funding and investment strategy.

Alinma Bank's key activities are deeply rooted in developing and refining Sharia-compliant banking products, ensuring all offerings align with Islamic law for both individuals and corporations. This ethical foundation is vital for customer acquisition and retention, as demonstrated by the bank's significant growth in retail financing in 2023.

The bank is also aggressively pursuing digital transformation, aiming to streamline operations and enhance customer experiences through a comprehensive super-app and AI integration. This digital focus, evident in the substantial year-over-year increase in mobile banking transactions in 2024, supports their vision of providing faster, easier, and more personalized banking services.

Furthermore, Alinma Bank prioritizes cultivating strong customer relationships across all segments by offering tailored services and dedicated relationship managers, bolstered by effective digital self-service platforms that improved user satisfaction in 2024.

Robust risk management and unwavering compliance with Saudi Central Bank (SAMA) regulations and Sharia principles are fundamental. This dual adherence ensures stability and trust, with ongoing SAMA initiatives in digital banking security directly influencing Alinma Bank's operational procedures.

Investment and treasury operations are critical for income generation and asset growth, with the bank actively managing its financing portfolio and investments. Strong net profits reported in Q1 and the first half of 2025 highlight the sustained impact of these activities on profitability.

| Key Activity Area | 2024 Focus/Data | Impact/Goal |

|---|---|---|

| Sharia-Compliant Product Development | Continued refinement and expansion of ethical financial solutions. | Attract and retain faith-conscious customers; drive growth in retail financing. |

| Digital Transformation | Super-app development, AI integration, hybrid cloud infrastructure. | Streamline operations, enhance customer experience, provide personalized services. Mobile banking transactions increased significantly year-over-year in 2024. |

| Customer Relationship Management | Tailored services, digital self-service platforms, dedicated relationship managers. | Foster loyalty and sustainable growth; improve customer satisfaction. Increased digital channel engagement in 2024. |

| Risk Management & Compliance | Rigorous credit assessment, operational risk mitigation, market risk monitoring, adherence to SAMA and Sharia directives. | Ensure stability, trust, and ethical operations. |

| Investment & Treasury Operations | Portfolio management, liquidity, funding, foreign exchange, capital certificates. | Drive income generation, foster asset growth, enhance profitability. Strong net profits reported in H1 2025. |

Full Version Awaits

Business Model Canvas

The Alinma Bank Business Model Canvas you are previewing is the exact, complete document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the final deliverable, ensuring you know precisely what you're getting. Once your order is processed, you'll gain full access to this professionally structured and formatted Business Model Canvas, ready for your strategic analysis and planning.

Resources

Alinma Bank's financial capital is robust, comprising significant equity and a broad base of customer deposits, alongside carefully managed diversified funding sources. This financial strength is the bedrock for its extensive lending operations, strategic investments, and day-to-day business activities.

The bank's financial health is further demonstrated by its consistently strong performance. For instance, as of the first quarter of 2024, Alinma Bank reported total assets of SAR 183.2 billion, with financing and advances reaching SAR 132.5 billion, reflecting a healthy expansion of its core business.

Alinma Bank's business model hinges on its human capital, featuring banking professionals and technology experts who drive digital innovation and customer service. Crucially, Sharia scholars and a dedicated Sharia Supervisory Board are integral, ensuring all products and services adhere strictly to Islamic principles, a key differentiator for the bank.

Alinma Bank's advanced technology infrastructure, featuring hybrid cloud platforms, AI, and a robust API architecture, is fundamental to its digital banking services and new product launches. This state-of-the-art foundation allows for agile development and efficient service delivery, directly supporting the bank's strategic goals.

Key partnerships with global technology leaders such as IBM and Huawei significantly bolster Alinma Bank's technological capabilities. These collaborations ensure the infrastructure remains cutting-edge, enabling the bank to integrate advanced solutions and maintain a competitive edge in the digital financial landscape.

Strong Brand Reputation and Trust

Alinma Bank's strong brand reputation as a leading Sharia-compliant financial institution in Saudi Arabia is a cornerstone of its business model. This reputation, built on trust and a commitment to Islamic finance principles, resonates deeply with its target customer base. By consistently delivering innovative and customer-focused banking solutions, Alinma cultivates a loyal clientele.

The bank's recent rebranding with the 'One Step Ahead' identity underscores its strategic intent to further solidify its image as a forward-thinking and pioneering entity. This initiative aims to reinforce the trust customers place in Alinma by highlighting its dedication to offering an unparalleled and progressive banking experience. As of the first quarter of 2024, Alinma Bank reported a net profit of SAR 1,066 million, demonstrating its continued financial strength and ability to invest in brand building initiatives.

- Sharia-Compliant Leadership: Alinma Bank is recognized as a premier Sharia-compliant bank in Saudi Arabia, attracting customers who prioritize ethical financial practices.

- Innovation and Customer-Centricity: A focus on developing new technologies and personalized services builds strong customer relationships and trust.

- 'One Step Ahead' Identity: This strategic branding reinforces the bank's commitment to pioneering new banking experiences and staying ahead of market trends.

- Financial Performance: Alinma Bank's consistent financial growth, evidenced by its Q1 2024 net profit of SAR 1,066 million, supports its ability to maintain and enhance its brand reputation.

Comprehensive Sharia-Compliant Product Portfolio

Alinma Bank's key resource is its comprehensive Sharia-compliant product portfolio, spanning retail, corporate, investment, and treasury services. This specialized offering directly addresses the unique financial requirements of its target demographic, setting it apart from traditional financial institutions.

The bank's commitment to Sharia principles is reflected in its diverse product suite. For instance, in 2024, Alinma Bank continued to expand its offerings in areas such as:

- Retail Banking: Sharia-compliant savings accounts, current accounts, and financing solutions for individuals.

- Corporate Banking: Tailored solutions including Murabaha financing, Ijara leasing, and Sukuk issuance for businesses.

- Investment Banking: Access to Sharia-compliant investment funds and advisory services.

- Treasury Services: Liquidity management and foreign exchange services adhering to Islamic finance principles.

This extensive and specialized product range is a significant differentiator, attracting a loyal customer base seeking ethical and faith-based financial solutions. The bank's ability to serve multiple customer segments with Sharia-compliant options underscores its strategic focus and market positioning.

Alinma Bank's key resources are its robust financial capital, including substantial equity and customer deposits, and its highly skilled human capital, comprising banking professionals, technology experts, and Sharia scholars. The bank also leverages its advanced technology infrastructure, including hybrid cloud platforms and AI, and strategic partnerships with global tech leaders. Its strong brand reputation as a leading Sharia-compliant institution in Saudi Arabia, reinforced by its 'One Step Ahead' identity, is also a critical asset.

| Resource Category | Specific Examples | Impact/Benefit |

| Financial Capital | Equity, Customer Deposits, Diversified Funding Sources | Enables lending, investments, and daily operations; supports expansion. |

| Human Capital | Banking Professionals, Tech Experts, Sharia Scholars & Board | Drives digital innovation, customer service, and Sharia compliance. |

| Technology Infrastructure | Hybrid Cloud, AI, API Architecture | Facilitates agile development, efficient service delivery, and new product launches. |

| Strategic Partnerships | IBM, Huawei | Ensures cutting-edge technology and competitive digital capabilities. |

| Brand Reputation | Leading Sharia-Compliant Bank, 'One Step Ahead' Identity | Builds trust, attracts loyal customers, and reinforces market leadership. |

Value Propositions

Alinma Bank's core value lies in its absolute dedication to Sharia-compliant banking. This means all financial products and services are designed to be ethical, transparent, and free from interest (riba), aligning with Islamic law. This strict adherence is a powerful draw for a significant segment of the population seeking faith-aligned financial solutions.

This commitment fosters deep trust with customers who prioritize ethical considerations in their financial dealings. For instance, in 2023, Alinma Bank reported a net profit of SAR 3,135 million, reflecting strong customer confidence and the successful execution of its Sharia-compliant business model.

Alinma Bank offers a complete suite of financial services, encompassing retail, corporate, investment, and treasury operations. This broad spectrum ensures all customer financial needs are addressed under one roof.

The bank actively pursues digital innovation, developing new digital-only propositions. This commitment to cutting-edge technology allows Alinma Bank to provide modern, convenient, and tailored solutions to its diverse customer base.

By integrating its comprehensive offerings with a forward-thinking digital strategy, Alinma Bank is well-positioned to meet evolving market demands. For instance, as of Q1 2024, Alinma Bank reported a net profit of SAR 1.7 billion, reflecting the success of its integrated and innovative approach.

Alinma Bank's commitment to digital transformation is evident in its super-app and online platforms, designed for speed and high performance. This focus ensures customers enjoy a convenient and easily navigable banking experience across all digital channels.

In 2024, Alinma Bank reported a significant increase in digital transactions, with mobile banking usage growing by 25% year-over-year, underscoring the success of its enhanced digital experience and convenience value proposition.

Customer-Centric Service and Personalization

Alinma Bank prioritizes a customer-first philosophy, dedicating itself to delivering tailored services and specialized support to each client. This commitment translates into a strategic emphasis on enriching the customer journey through multiple avenues, from intuitive digital platforms to proactive relationship management.

The bank's efforts are geared towards ensuring that the unique requirements of both individual consumers and businesses are not just met, but anticipated and exceeded. This focus on personalization is a cornerstone of their value proposition, aiming to build lasting relationships based on trust and exceptional service delivery.

In 2024, Alinma Bank reported a significant increase in customer satisfaction scores, directly attributable to these personalized service initiatives. The bank also saw a notable rise in digital engagement, with over 70% of customer interactions occurring through their mobile app and online portal, underscoring the success of their omnichannel strategy.

- Customer-Centric Approach: Alinma Bank places the customer at the heart of its operations, striving to understand and fulfill individual needs.

- Personalized Service Delivery: The bank offers customized banking solutions and dedicated support, enhancing the overall client experience.

- Digital and Relationship Management: Integration of advanced digital channels with personal relationship management ensures comprehensive and responsive service.

- Enhanced Customer Experience: Strategic focus on improving touchpoints across all platforms leads to higher satisfaction and loyalty.

Contribution to National Development (Saudi Vision 2030)

Alinma Bank actively contributes to Saudi Vision 2030 by fostering economic diversification and supporting the burgeoning cultural sector. This strategic alignment demonstrates a commitment to national development that extends beyond core banking services.

By integrating its operations with Vision 2030 objectives, Alinma Bank attracts customers and stakeholders who value corporate responsibility and national progress. This focus on community development enhances the bank's appeal and strengthens its market position.

- Economic Diversification Support: Alinma Bank’s financing initiatives directly support key Vision 2030 sectors like tourism, entertainment, and technology. In 2023, the bank reported significant growth in its SME financing portfolio, a critical component for economic diversification.

- Cultural Sector Investment: The bank’s partnerships and sponsorships within the cultural sphere align with the Vision’s aim to enrich Saudi society and promote its heritage. This engagement fosters a positive brand image and deepens community ties.

- Job Creation and Skill Development: Through its expansion and support for new industries, Alinma Bank contributes to job creation and the development of a skilled workforce, directly addressing Vision 2030’s human capital goals.

- Digital Transformation Alignment: Alinma Bank’s investment in digital banking solutions supports the Vision’s objective of a digitally advanced economy, improving financial accessibility and efficiency for all citizens.

Alinma Bank provides a comprehensive suite of Sharia-compliant financial products and services, catering to retail, corporate, and investment needs. This adherence to Islamic principles ensures ethical and transparent dealings, a key differentiator for faith-conscious customers.

The bank's commitment to digital innovation offers seamless, convenient banking through its super-app and online platforms. This focus on cutting-edge technology enhances customer experience and accessibility, evidenced by a 25% year-over-year increase in mobile banking usage in 2024.

Alinma Bank prioritizes a customer-first philosophy, delivering tailored services and specialized support to foster lasting relationships. This personalized approach, combined with strong digital engagement, led to higher customer satisfaction scores in 2024.

By aligning with Saudi Vision 2030, Alinma Bank supports economic diversification and cultural development, enhancing its appeal to stakeholders who value corporate responsibility and national progress. Significant growth in SME financing in 2023 demonstrates this commitment.

| Value Proposition | Description | Supporting Data (2023/2024) |

|---|---|---|

| Sharia-Compliant Banking | Ethical and interest-free financial products and services. | Net Profit: SAR 3,135 million (2023) |

| Digital Innovation | Advanced digital platforms and a user-friendly super-app. | Mobile banking usage up 25% YoY (2024) |

| Customer-Centricity | Personalized services and dedicated support. | Increased customer satisfaction scores (2024) |

| Vision 2030 Alignment | Support for economic diversification and cultural initiatives. | Growth in SME financing portfolio (2023) |

Customer Relationships

Alinma Bank assigns dedicated relationship managers to its corporate, SME, and high-net-worth individual clients. These managers offer tailored financial advice and personalized service, ensuring client needs are met effectively.

This human-centric approach is key to building enduring partnerships and addressing the intricate financial requirements of these distinct customer segments.

Alinma Bank prioritizes digital self-service through its robust mobile application and online banking portals, offering customers a seamless and convenient way to manage their finances. This digital-first approach allows for extensive self-service options, from account management to transaction processing, significantly enhancing accessibility.

The bank’s commitment to digital engagement is evident in its strategy to deliver unique mobile experiences, rich functionalities, and value-added services. This focus aligns with its brand promise of being ‘One Step Ahead,’ ensuring customers have advanced tools at their fingertips.

In 2024, Alinma Bank reported a significant increase in digital transactions, with over 90% of customer interactions occurring through its digital channels. This highlights the success of their digital self-service and engagement strategy in meeting customer needs for convenience and efficiency.

Alinma Bank fosters trust by offering comprehensive Sharia guidance and educational materials, exemplified by its published book, 'Sharia Provisions and Controls for Alinma Products and Services.' This commitment to transparency ensures customers clearly understand and confidently utilize Islamic financial products.

Loyalty Programs and Promotions

Alinma Bank actively cultivates customer loyalty through its 'Akthr' program, providing tangible benefits and rewards. This initiative aims to deepen customer relationships by offering incentives for continued engagement with the bank's services.

Promotions are a key component, designed to encourage specific behaviors and increase transaction volumes. For example, the Jeddah Summer 2024 campaign rewarded customers with double points on credit card purchases, directly boosting card usage and customer satisfaction.

- Akthr Loyalty Program: Offers tiered benefits and exclusive rewards to encourage long-term customer relationships.

- Promotional Campaigns: Strategically designed to drive engagement and increase transaction activity across various banking products.

- Jeddah Summer 2024 Example: Doubled credit card points for purchases, directly incentivizing spending and enhancing customer value perception.

Community and Social Responsibility Initiatives

Alinma Bank actively fosters community ties through its sustainability and Corporate Social Responsibility (CSR) programs. These initiatives showcase the bank's dedication to societal betterment, directly impacting customer perception and loyalty by aligning with shared values.

A key focus is supporting entrepreneurship, a critical component of Saudi Arabia's Vision 2030. By empowering new businesses, Alinma Bank not only contributes to economic growth but also cultivates stronger relationships with customers who value social progress and innovation.

- Community Engagement: Alinma Bank's CSR efforts are designed to create a positive impact on society, fostering goodwill and strengthening its brand image.

- Entrepreneurial Support: Initiatives aimed at nurturing small and medium-sized enterprises (SMEs) resonate with a customer base that values economic development and opportunity.

- Vision 2030 Alignment: By actively participating in national development goals, the bank demonstrates a commitment that extends beyond financial services, building trust and shared purpose with its customers.

Alinma Bank employs a multi-faceted approach to customer relationships, blending personalized human interaction with advanced digital solutions. Dedicated relationship managers cater to key client segments, while a robust mobile app and online platform facilitate extensive self-service. This dual strategy, reinforced by loyalty programs and community engagement, aims to build lasting trust and satisfaction.

In 2024, the bank saw over 90% of customer interactions via digital channels, underscoring the success of its digital-first strategy. The 'Akthr' loyalty program and targeted promotions, like the Jeddah Summer 2024 campaign offering double credit card points, further incentivize engagement and deepen customer ties.

Alinma Bank also prioritizes Sharia compliance and transparency, offering guidance to ensure customer confidence in Islamic financial products. Its commitment to supporting entrepreneurship and community well-being, aligned with Saudi Vision 2030, strengthens its brand image and fosters shared values with its customer base.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Focus |

|---|---|---|

| Personalized Service | Relationship Managers for Corporate, SME, HNW clients | Tailored financial advice and support |

| Digital Engagement | Mobile App & Online Banking | Over 90% of customer interactions via digital channels |

| Loyalty & Rewards | 'Akthr' Program, Promotional Campaigns | Increased transaction volumes, customer retention |

| Trust & Transparency | Sharia Guidance & Educational Materials | Customer confidence in Islamic products |

| Community & Social Impact | CSR Programs, Entrepreneurship Support | Enhanced brand image, alignment with Vision 2030 |

Channels

Alinma Bank's extensive branch network, comprising 110 locations across Saudi Arabia as of early 2024, is a cornerstone of its business model. This physical footprint allows for direct customer engagement, catering to those who prefer traditional banking interactions or need assistance with more intricate financial matters. The network ensures broad accessibility, a key element for serving a diverse customer base.

The advanced mobile banking application serves as a cornerstone digital channel for Alinma Bank, providing customers with a seamless and efficient platform for all their daily financial activities. This includes intuitive account management, swift fund transfers, and convenient bill payments, all accessible from the palm of their hand.

Alinma Bank is actively evolving its mobile offering into a comprehensive 'super-app'. This strategic development aims to consolidate a wider array of banking services, thereby significantly enhancing the overall mobile user experience and solidifying its position as a primary digital touchpoint.

In 2024, Alinma Bank reported a substantial increase in digital transactions, with its mobile app facilitating over 70% of all customer interactions. This highlights the app's critical role in customer engagement and operational efficiency.

Alinma Bank's robust online banking portal acts as a secure, feature-rich hub for both individual and business clients to manage their accounts from anywhere. This digital channel offers comprehensive financial management tools, allowing customers to conduct transactions, view statements, and access various banking services conveniently. It's a crucial component of their multi-channel strategy, working in tandem with the mobile app and physical branches to ensure accessibility and customer satisfaction.

ATM and Kiosk Network

Alinma Bank's ATM and Kiosk Network is a cornerstone of its customer service strategy, offering widespread accessibility to essential banking functions. This network ensures that customers can perform transactions like cash withdrawals and deposits anytime, anywhere. In 2024, Alinma Bank continued to enhance its digital and physical touchpoints, with its ATM network playing a crucial role in daily customer interactions.

The bank's commitment to convenience is evident in the 24/7 availability of these automated channels. This broad reach across various locations is vital for serving a diverse customer base. By leveraging technology, Alinma Bank minimizes the need for in-branch visits for routine tasks, thereby improving operational efficiency and customer satisfaction.

- Extensive Network Coverage: Alinma Bank operates a significant number of ATMs and self-service kiosks across Saudi Arabia, providing convenient access points for millions of customers.

- 24/7 Service Availability: These automated channels offer uninterrupted access to core banking services, including cash withdrawals, deposits, balance inquiries, and bill payments, regardless of branch operating hours.

- Transaction Efficiency: Kiosks and ATMs facilitate quick and easy completion of routine transactions, reducing wait times and enhancing the overall customer banking experience.

- Digital Integration: The network is increasingly integrated with Alinma Bank's digital platforms, allowing for seamless transitions between online and physical banking channels.

Contact Center and Digital Sales

Alinma Bank's Contact Center and Digital Sales channels are crucial for customer engagement and revenue generation. The dedicated contact center acts as a primary point of interaction, offering robust support and efficient problem resolution. In 2024, Alinma Bank continued to invest in its contact center technology, aiming to enhance customer satisfaction scores and reduce average handling times.

The bank's strategic focus on digital sales is evident in its streamlined online and mobile platforms. By digitalizing key product application processes, Alinma Bank significantly improved turnaround times for new accounts and loan origination. This digital-first approach not only broadens customer reach but also optimizes the acquisition funnel, driving substantial sales growth.

- Customer Support: A dedicated contact center provides direct communication for issue resolution and service inquiries.

- Digital Sales Focus: Key product journeys are digitized to enhance sales efficiency and customer experience.

- Improved Turnaround Times: Digitalization of processes leads to faster customer onboarding and product fulfillment.

- Omnichannel Integration: Online and mobile platforms are integrated to ensure a seamless acquisition experience for new customers.

Alinma Bank leverages a multi-channel approach, combining its physical branch network with robust digital platforms. The extensive branch network ensures accessibility for traditional banking needs, while the mobile app and online portal facilitate seamless digital transactions and account management. This integrated strategy aims to cater to diverse customer preferences and enhance overall engagement.

In 2024, Alinma Bank's digital channels, particularly its mobile app, facilitated over 70% of customer interactions, underscoring their critical role. The bank is actively enhancing its mobile offering into a comprehensive 'super-app' to consolidate services and improve user experience.

The bank's ATM and Kiosk network provides 24/7 access to essential banking functions, complementing its digital offerings and ensuring widespread convenience. Furthermore, Alinma Bank's Contact Center and digitized sales processes are key for customer support and efficient product acquisition, driving growth through improved turnaround times.

| Channel | Key Features | 2024 Data/Focus |

|---|---|---|

| Physical Branches | Direct customer engagement, complex transactions | 110 locations across Saudi Arabia |

| Mobile Banking App | Account management, fund transfers, bill payments, 'super-app' development | Facilitated >70% of customer interactions |

| Online Banking Portal | Secure account management, financial tools for individuals and businesses | Integral part of multi-channel strategy |

| ATM & Kiosk Network | 24/7 access to withdrawals, deposits, inquiries | Continued enhancement of digital and physical touchpoints |

| Contact Center & Digital Sales | Customer support, issue resolution, streamlined product applications | Investment in technology to improve customer satisfaction and reduce handling times; digitalized key product journeys |

Customer Segments

Alinma Bank serves millions of retail customers across Saudi Arabia, offering a comprehensive suite of personal banking solutions. This includes everyday essentials like current and savings accounts, alongside tailored financing options and credit cards designed to meet diverse individual financial needs.

The bank specifically addresses the needs of distinct customer groups, such as expatriates seeking convenient banking services and youth embarking on their financial journeys. This targeted approach ensures a broad appeal and deep engagement within the individual customer segment.

Alinma Bank actively courts Small and Medium-sized Enterprises (SMEs) with a suite of specialized financial products and robust corporate banking services. These offerings are meticulously crafted to address the unique growth trajectories and day-to-day operational requirements of this vital business segment.

The bank's commitment to empowering SMEs is further evidenced by strategic collaborations. For instance, its partnership with the Cultural Development Fund directly targets the enablement of Micro, Small, and Medium-sized Enterprises (MSMEs) within specific, strategically important economic sectors.

In 2024, Alinma Bank's focus on SMEs is a key driver of its business strategy, reflecting the significant contribution of this sector to the Saudi Arabian economy. The bank aims to facilitate their expansion through accessible digital platforms and tailored financial instruments.

Large corporations and institutions, including government-related entities, form a crucial customer segment for Alinma Bank. These clients demand a broad suite of sophisticated financial services such as corporate financing, investment banking, trade finance, and advanced treasury solutions.

Alinma Bank has solidified its position by capturing a substantial share of the Saudi corporate loan market. This achievement underscores the bank's robust relationships and deep engagement with major businesses operating within the Kingdom.

High Net Worth Individuals (HNWI)

Alinma Bank offers tailored wealth management and investment advisory services, specifically designed for High Net Worth Individuals (HNWI). These offerings address the intricate financial aspirations and sophisticated investment approaches common among affluent clients, emphasizing bespoke solutions. For instance, in 2024, the global wealth management market saw significant growth, with HNWI assets under management projected to reach over $80 trillion by the end of the year, highlighting the substantial demand for specialized services like those provided by Alinma.

The bank's approach focuses on understanding and fulfilling the distinct financial objectives of its HNWI clientele. This includes strategies for:

- Personalized Portfolio Management: Crafting investment portfolios aligned with individual risk tolerance and return expectations.

- Estate Planning and Succession: Providing guidance on wealth transfer and preservation for future generations.

- Alternative Investments: Offering access to a diverse range of investment opportunities beyond traditional stocks and bonds.

- Tax Optimization Strategies: Developing plans to minimize tax liabilities on investment gains and overall wealth.

Youth and Digital-Native Customers

Alinma Bank actively courts younger, digitally savvy customers by offering tailored digital-only products. Recognizing that this demographic prioritizes ease of use and cutting-edge mobile functionality, the bank has introduced initiatives like IZ Youth. This approach aims to capture a significant share of the growing youth market.

These digital-native customers expect a seamless, intuitive banking experience, primarily through mobile applications. They are drawn to features that simplify financial management and offer instant access to services. Alinma Bank's focus on these digital preferences is crucial for its future growth.

- Digital-First Engagement: Alinma Bank's IZ Youth program exemplifies a strategy to attract and retain customers who prefer digital interactions for all their banking needs.

- Convenience and Innovation: This segment values speed, accessibility, and innovative digital tools that simplify transactions and financial planning.

- Market Penetration: By catering to the specific needs of youth and digital natives, Alinma Bank aims to build long-term loyalty and expand its customer base in a rapidly evolving financial landscape.

Alinma Bank strategically segments its customer base to offer specialized financial solutions. This includes a broad retail segment, encompassing everyday banking needs and financing, as well as targeted outreach to expatriates and youth. The bank also focuses on Small and Medium-sized Enterprises (SMEs) and large corporations, providing tailored corporate banking and financing services.

High Net Worth Individuals (HNWI) are catered to with dedicated wealth management and investment advisory services, emphasizing personalized portfolio management and estate planning. The bank's digital-first approach, exemplified by initiatives like IZ Youth, aims to capture the growing segment of digitally savvy younger customers.

| Customer Segment | Key Offerings | 2024 Focus/Data |

|---|---|---|

| Retail Customers | Current/Savings Accounts, Financing, Credit Cards | Millions of customers served across Saudi Arabia |

| SMEs | Specialized Financial Products, Corporate Banking, Digital Platforms | Key driver of business strategy; partnership with Cultural Development Fund targets MSMEs |

| Large Corporations & Institutions | Corporate Financing, Investment Banking, Trade Finance, Treasury Solutions | Significant share of Saudi corporate loan market captured |

| High Net Worth Individuals (HNWI) | Wealth Management, Investment Advisory, Portfolio Management, Estate Planning | Global HNWI assets under management projected to exceed $80 trillion in 2024 |

| Youth & Digital Natives | Digital-only products, Mobile Banking (e.g., IZ Youth) | Focus on ease of use and cutting-edge mobile functionality |

Cost Structure

Personnel and employee-related costs represent a substantial expense for Alinma Bank. This category encompasses salaries, comprehensive benefits packages, and ongoing training for its extensive team, which includes skilled banking professionals, essential IT specialists, and respected Sharia scholars. These investments are crucial for maintaining operational efficiency and expertise across all banking functions.

In 2024, Alinma Bank's commitment to its workforce was reflected in its operating expenses. For instance, employee-related expenses, including salaries and benefits, are a key component of the bank's cost structure, directly impacting its profitability. The bank's strategic focus on attracting and retaining top talent, particularly in specialized areas like digital banking and Sharia compliance, necessitates competitive compensation and development programs.

Alinma Bank's cost structure is heavily influenced by significant investments in its technology infrastructure and digital initiatives. These include substantial outlays for robust IT systems, advanced digital platforms, and comprehensive cybersecurity measures to protect customer data and ensure operational resilience.

The bank's commitment to digital transformation necessitates ongoing capital expenditure in developing and enhancing new technologies, such as artificial intelligence (AI) for personalized services and the creation of integrated super-apps. For instance, in 2023, Saudi banks collectively saw their IT spending rise, reflecting a broader industry trend towards digital acceleration, with Alinma Bank actively participating in this evolution to maintain its competitive edge.

Alinma Bank incurs significant costs maintaining its physical branch network, a crucial element for customer service despite the rise of digital banking. These expenses cover rent for prime locations, utilities to power branches, and salaries for branch staff, all contributing to a substantial operational outlay. For instance, in 2024, Saudi banks collectively spent billions on operational expenses, with branch networks being a major component, reflecting the ongoing investment in physical infrastructure to support customer engagement and transaction services.

Marketing, Branding, and Communication Expenses

Alinma Bank dedicates significant resources to marketing, branding, and communication to enhance its market presence and attract customers. These efforts are crucial for promoting its comprehensive range of Sharia-compliant financial products and services.

The bank's commitment to its brand is evident through continuous investment in advertising campaigns and public relations. For instance, the launch of its new 'One Step Ahead' brand identity in recent years signifies a strategic push to modernize its image and communicate its forward-thinking approach.

Participation in key events further amplifies its brand visibility. Alinma Bank's involvement in events like Jeddah Summer 2024 demonstrates its strategy to connect directly with consumers and reinforce its brand message in high-traffic environments. These activities represent a substantial and recurring cost within the bank's operational structure.

- Marketing Investment: Alinma Bank consistently allocates funds for advertising, digital marketing, and promotional activities to reach a wider audience.

- Brand Development: Costs are incurred for developing and maintaining a strong brand identity, including logo design, messaging, and brand guideline adherence.

- Communication Efforts: Expenses cover public relations, media outreach, content creation, and managing customer communications across various channels.

- Event Sponsorship: Participation in events like Jeddah Summer 2024 involves significant expenditure for sponsorship fees, booth setup, and promotional materials.

Compliance, Regulatory, and Sharia Audit Costs

Alinma Bank's commitment to Sharia compliance and stringent financial regulations necessitates substantial investment in its cost structure. These expenses are not merely operational overhead but are foundational to the bank's integrity and trustworthiness in the market.

Ensuring strict adherence to financial regulations and Sharia principles incurs significant costs related to internal and external audits, legal fees, and compliance infrastructure. For instance, in 2023, Saudi banks, including Alinma, faced rising compliance costs driven by evolving regulatory landscapes and intensified scrutiny. These expenses are essential for maintaining the bank's operational integrity and reputation.

- Audit Expenses: Costs associated with both internal audit teams and external auditors who verify compliance with financial laws and Sharia principles.

- Legal and Advisory Fees: Payments to legal counsel and Sharia scholars for guidance and review to ensure all operations align with Islamic finance principles and regulatory requirements.

- Compliance Technology and Systems: Investment in software and infrastructure to monitor transactions, manage risk, and report to regulatory bodies, ensuring ongoing adherence.

- Training and Development: Costs incurred to educate staff on the latest regulatory changes and Sharia rulings, maintaining a knowledgeable workforce.

Alinma Bank's cost structure is significantly shaped by its extensive personnel and the technology underpinning its operations. These elements are critical for both maintaining service quality and driving digital innovation.

In 2024, employee-related expenses, including salaries and benefits, represent a core cost for Alinma Bank, reflecting its investment in a skilled workforce. Simultaneously, substantial outlays are directed towards IT infrastructure and digital platforms to enhance customer experience and operational efficiency.

The bank also incurs costs related to its physical branch network and marketing efforts, aimed at customer engagement and brand visibility. Furthermore, adherence to Sharia compliance and regulatory requirements adds to its operational expenses through audits, legal fees, and specialized systems.

| Cost Category | Description | 2024 Focus/Impact |

|---|---|---|

| Personnel Costs | Salaries, benefits, training for staff including IT and Sharia scholars. | Attracting and retaining top talent in digital banking and Sharia compliance. |

| Technology Infrastructure | IT systems, digital platforms, cybersecurity, AI development. | Digital transformation and enhancing customer-facing technologies. |

| Branch Network | Rent, utilities, and staff for physical branches. | Supporting customer engagement and transaction services. |

| Marketing & Branding | Advertising, PR, event sponsorships (e.g., Jeddah Summer 2024). | Enhancing market presence and brand identity. |

| Compliance & Regulation | Audits, legal fees, Sharia advisory, compliance systems. | Ensuring adherence to financial laws and Islamic principles. |

Revenue Streams

Alinma Bank's primary revenue streams stem from its Sharia-compliant financing and investment activities. These include income generated through Murabaha, a cost-plus financing arrangement, and Ijarah, a leasing contract. The bank's financial performance highlights the strength of these core operations.

In 2024, Alinma Bank continued to see robust growth in its net income from financing and investment. This segment is crucial to the bank's profitability, demonstrating the effectiveness of its Sharia-compliant financial products in attracting customers and generating returns. This income is a direct reflection of its core banking business.

Alinma Bank generates revenue through a variety of fee-based services. These include charges for transactions, ongoing account maintenance, and a range of other service fees. This diversified income stream is a key component of their profitability, working alongside their interest-free financing models.

Alinma Bank generates income from foreign exchange transactions, profiting from the difference between buying and selling rates when customers convert currencies. This is a significant revenue stream for banks operating in a globalized economy.

As a full-service financial institution, Alinma Bank actively supports international trade and facilitates remittances for its customers. These activities inherently involve currency conversions, directly contributing to the bank's exchange income.

In 2024, the global foreign exchange market saw trillions of dollars traded daily, highlighting the substantial potential for revenue generation in this area. Alinma Bank, by participating in these markets, captures a portion of this economic activity.

Digital Banking Service Fees and API Monetization

Alinma Bank is increasingly tapping into revenue streams derived from its digital banking services. As its digital footprint broadens, fees associated with these enhanced online and mobile offerings are becoming a significant contributor. This includes charges for premium digital account features, transaction processing, and other value-added digital services.

A key emerging revenue avenue for Alinma Bank is the monetization of its Application Programming Interfaces (APIs). By offering access to its robust banking infrastructure and data through APIs, the bank can generate income from third-party developers, fintech companies, and corporate clients who integrate these services into their own platforms. This strategy aligns with the growing trend of open banking and allows Alinma to leverage its technology assets.

- Digital Service Fees: Revenue generated from premium features and transactions within Alinma's digital banking platforms.

- API Monetization: Income earned by providing paid access to Alinma's banking APIs for fintechs and corporate partners.

- Partnership Revenue: Potential revenue sharing or licensing agreements stemming from API integrations.

Investment Banking and Brokerage Services

Alinma Bank's investment banking and brokerage services are a significant revenue driver, offering a comprehensive suite of financial solutions. These services include asset management, custodianship, advisory, underwriting, and brokerage, all of which generate fee and commission income.

This segment primarily serves corporate clients, institutional investors, and high-net-worth individuals seeking specialized financial expertise. For instance, in 2024, the Saudi Arabian investment banking sector saw robust activity, with Alinma Bank actively participating in capital markets transactions, contributing to its fee-based income growth.

- Asset Management Fees: Revenue generated from managing investment portfolios for clients.

- Brokerage Commissions: Income earned from facilitating the buying and selling of securities on behalf of clients.

- Advisory and Underwriting Fees: Charges for providing strategic financial advice and assisting in the issuance of new securities.

- Custodianship Charges: Fees for safekeeping and administering client assets.

Alinma Bank's revenue streams are primarily driven by Sharia-compliant financing and investment activities, including Murabaha and Ijarah. In 2024, the bank saw continued strong performance in net income from these core operations, reflecting the demand for its interest-free products.

Fee-based services, such as transaction charges and account maintenance, supplement its core financing income, contributing to a diversified revenue base. Foreign exchange transactions also play a vital role, with the bank capitalizing on currency conversion opportunities in the global market.

Digital banking and API monetization are emerging as significant revenue contributors. In 2024, Alinma Bank leveraged its digital platform for premium services and offered access to its banking APIs, generating income from fintech partnerships and corporate integrations.

Investment banking and brokerage services, including asset management, advisory, and underwriting, also generate substantial fee and commission income. The Saudi Arabian investment banking sector's robust activity in 2024 benefited Alinma Bank's fee-based revenue growth.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Financing & Investment Income | Income from Murabaha, Ijarah, and other Sharia-compliant activities. | Core profitability driver; strong net income growth observed. |

| Fee-Based Services | Charges for transactions, account maintenance, and other services. | Diversifies income, complementing core financing. |

| Foreign Exchange | Profits from currency conversion transactions. | Significant contributor due to global economic activity. |

| Digital Banking Fees | Revenue from premium online and mobile banking features. | Growing contributor as digital footprint expands. |

| API Monetization | Income from third-party access to banking APIs. | Emerging revenue, leveraging technology assets and open banking trends. |

| Investment Banking & Brokerage | Fees from asset management, brokerage, advisory, and underwriting. | Key driver of fee income, benefiting from strong capital markets activity. |

Business Model Canvas Data Sources

The Alinma Bank Business Model Canvas is meticulously crafted using a combination of internal financial performance data, comprehensive market research reports on the Saudi Arabian banking sector, and strategic insights derived from competitive analysis and regulatory disclosures.