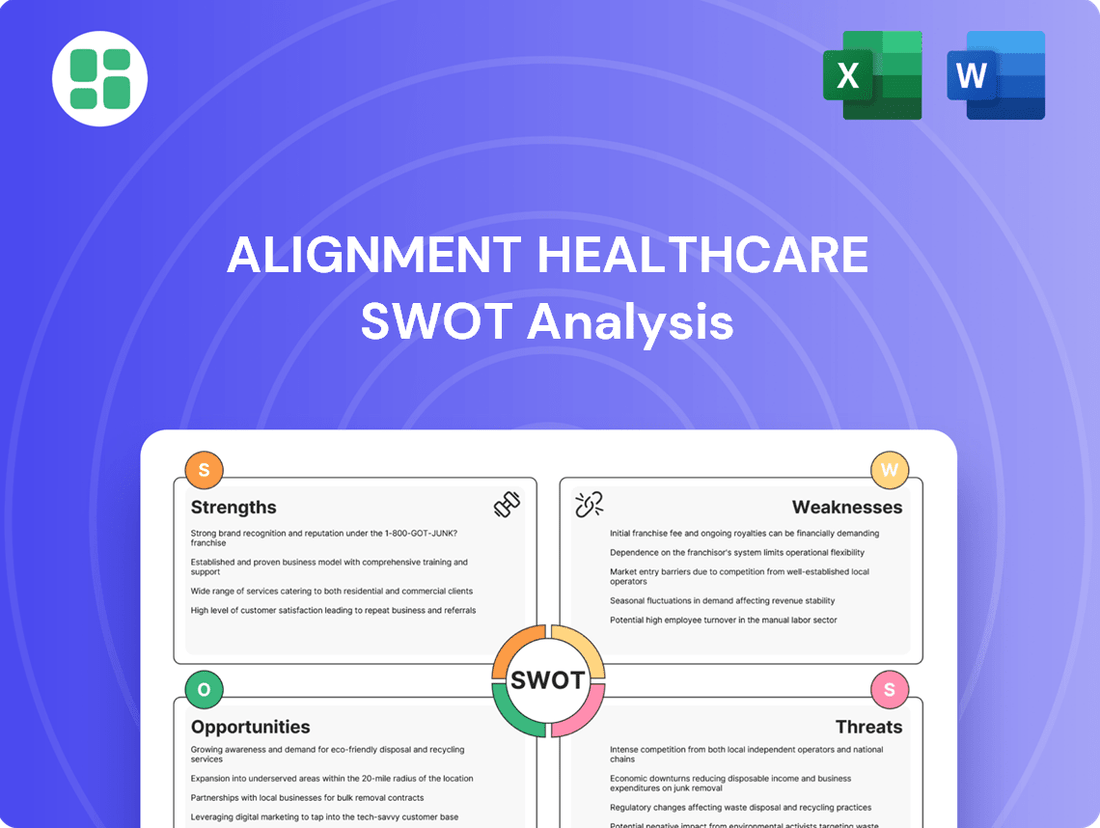

Alignment Healthcare SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alignment Healthcare Bundle

Alignment Healthcare's strengths lie in its innovative care model and strong member engagement, but potential weaknesses in regulatory compliance and market saturation could pose challenges. Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Alignment Healthcare's proprietary technology platform is a significant strength, enabling personalized, data-driven care for its members. This high-tech approach facilitates efficient care coordination and helps identify individuals at higher risk, allowing for tailored interventions. For example, in 2023, the company reported that its technology-enabled care model contributed to a 7% reduction in hospital admissions for its Medicare Advantage members.

Alignment Healthcare's 'high-touch' model, centered around local care teams, offers a distinctly human approach to healthcare delivery. This personalized engagement cultivates deeper patient connections and boosts adherence to prescribed treatment plans.

This emphasis on individual attention significantly elevates the member experience, translating into improved satisfaction and, consequently, higher retention rates for the company. For instance, in 2023, Alignment Healthcare reported a strong member satisfaction score, with a significant portion attributing their positive experience to the proactive support from their care teams.

Alignment Healthcare's specialization in Medicare Advantage directly addresses a rapidly expanding market. The Centers for Medicare & Medicaid Services (CMS) reported that enrollment in Medicare Advantage plans reached over 31 million beneficiaries in 2024, a significant increase from previous years. This focused strategy allows Alignment to cultivate deep understanding and cater precisely to the distinct health and financial needs of seniors.

Integrated Health Services Model

Alignment Healthcare's integrated health services model is a significant strength, focusing on preventive care, chronic disease management, and coordinated patient support. This holistic strategy directly targets improved patient outcomes by proactively managing health and reducing the need for costly interventions like hospitalizations. For instance, their model emphasizes keeping members healthy and out of the hospital, a key factor in managing costs and demonstrating value in the evolving healthcare landscape.

This integrated approach allows Alignment to manage long-term conditions more effectively, ensuring patients receive continuous, coordinated care. By addressing multiple facets of a patient's health within a single framework, they can achieve better results and potentially lower overall healthcare expenditures. This capability is particularly valuable in the current market, where value-based care and patient satisfaction are paramount.

Key benefits of this model include:

- Enhanced Patient Outcomes: By coordinating care across different services, Alignment aims to improve the overall health and well-being of its members.

- Reduced Hospitalizations: A strong emphasis on preventive and chronic care management helps to keep patients healthier and out of the hospital.

- Cost Efficiency: Managing conditions proactively can lead to lower healthcare costs compared to reactive, fragmented care.

- Improved Member Satisfaction: A seamless and supportive healthcare experience often translates to higher patient satisfaction scores.

Collaborative Provider Network

Alignment Healthcare's collaborative provider network is a significant strength, fostering a coordinated approach to patient care. This network includes a wide array of physicians and hospitals, ensuring members have access to a comprehensive suite of medical services and enabling smoother transitions between different levels of care. For instance, as of early 2024, Alignment reported partnerships with over 100,000 providers nationwide, facilitating integrated care pathways and shared responsibility for patient outcomes.

This integrated system directly contributes to improved care quality and operational efficiency. By working closely with its network, Alignment can better manage patient health journeys, reduce redundancies, and enhance the overall member experience. The company's focus on value-based care models, supported by this strong provider collaboration, has shown positive results in managing chronic conditions and improving patient satisfaction scores in key markets during 2024.

- Extensive Provider Partnerships: Alignment collaborates with a broad network of physicians and hospitals across its service areas.

- Seamless Care Transitions: The network structure supports coordinated patient journeys and efficient management of care between different providers.

- Enhanced Access to Services: Members benefit from a wider availability of medical specialists and facilities through these collaborations.

- Shared Accountability: The model promotes shared responsibility among providers for patient well-being, driving better health outcomes.

Alignment Healthcare's proprietary technology platform is a significant strength, enabling personalized, data-driven care for its members. This high-tech approach facilitates efficient care coordination and helps identify individuals at higher risk, allowing for tailored interventions. For example, in 2023, the company reported that its technology-enabled care model contributed to a 7% reduction in hospital admissions for its Medicare Advantage members.

Alignment Healthcare's 'high-touch' model, centered around local care teams, offers a distinctly human approach to healthcare delivery. This personalized engagement cultivates deeper patient connections and boosts adherence to prescribed treatment plans, leading to improved member satisfaction and retention. In 2023, a significant portion of members attributed their positive experience to the proactive support from their care teams.

Alignment Healthcare's specialization in Medicare Advantage directly addresses a rapidly expanding market, with over 31 million beneficiaries enrolled in 2024. This focused strategy allows Alignment to cultivate deep understanding and cater precisely to the distinct health and financial needs of seniors.

Alignment Healthcare's integrated health services model focuses on preventive care and chronic disease management, aiming to improve patient outcomes and reduce costly interventions. Their model emphasizes keeping members healthy and out of the hospital, a key factor in managing costs and demonstrating value in the evolving healthcare landscape.

What is included in the product

Analyzes Alignment Healthcare’s competitive position through key internal and external factors, detailing its strengths in member engagement, weaknesses in profitability, opportunities in market expansion, and threats from regulatory changes.

Offers a clear, actionable framework to identify and address Alignment Healthcare's strategic vulnerabilities and capitalize on its strengths.

Weaknesses

Alignment Healthcare's significant reliance on Medicare Advantage (MA) reimbursement presents a notable weakness. The company's revenue is directly tied to the policies and payment rates determined by the Centers for Medicare & Medicaid Services (CMS). For instance, in the first quarter of 2024, Medicare Advantage plans constituted a substantial portion of Alignment's revenue, highlighting this dependency.

Any shifts in CMS regulations, such as modifications to risk adjustment methodologies or reimbursement levels, could materially affect Alignment's financial performance. This regulatory exposure is an inherent challenge for all Medicare Advantage organizations, requiring constant adaptation to evolving government healthcare policy.

Alignment Healthcare's 'high-touch' model, while fostering strong member relationships and potentially improving outcomes, presents significant scalability hurdles. This reliance on localized care teams and personalized, in-person interactions is inherently resource-intensive. For instance, expanding into new markets or serving a much larger membership base could strain existing resources, potentially diluting the quality of care or escalating operational expenses dramatically.

Successfully scaling this personalized approach requires meticulous strategic planning and substantial investment in infrastructure and personnel. The company must find ways to replicate its high-touch standard across a wider operational footprint without sacrificing the core value proposition that differentiates it. This delicate balance is crucial for sustained growth and market penetration.

Alignment Healthcare operates in a fiercely competitive Medicare Advantage landscape, facing established national and regional insurers. Many of these competitors boast significant market penetration, robust capital, and strong brand loyalty, making it challenging for Alignment to capture and hold onto its member base.

Operational Costs of Personalized Care

Alignment Healthcare's commitment to highly personalized and integrated care, encompassing preventive services and chronic disease management, inherently drives higher operational costs. This contrasts with more traditional, fragmented healthcare delivery systems. The company faces the ongoing challenge of managing these elevated expenses while ensuring profitability and maintaining the high quality of its patient-centered services.

For instance, the detailed care coordination required for personalized plans, including frequent patient touchpoints and tailored interventions, contributes significantly to these costs. In 2023, Alignment Healthcare reported a medical loss ratio of 85.2%, indicating a substantial portion of revenue was directly spent on member care, a figure that reflects the investment in their personalized model.

- Higher Staffing Needs: Personalized care often requires more clinical staff per patient to manage complex care plans and provide individualized support.

- Technology Investment: Robust technology platforms are essential for data integration and care coordination, representing a significant capital expenditure.

- Preventive and Chronic Care Programs: Proactive health initiatives, while beneficial long-term, demand upfront investment in program development and delivery.

Dependence on Physician and Hospital Networks

Alignment Healthcare's core strategy hinges on its extensive network of physicians and hospitals. A significant weakness lies in its dependence on these partnerships. For instance, if a major hospital system or a substantial group of physicians exits its network, it could directly affect member access to care and disrupt the company's ability to manage costs effectively. In 2023, approximately 85% of Alignment's revenue came from its Medicare Advantage plans, which are heavily reliant on contracted provider networks.

This reliance creates vulnerability. Contract renegotiations, changes in reimbursement rates, or even physician burnout leading to network attrition can pose substantial risks. Such disruptions could lead to increased operational costs as Alignment seeks to replace providers or manage member transitions, potentially impacting profitability. For example, a 10% increase in provider reimbursement rates across its network could significantly affect its bottom line.

- Network Concentration: A few large provider groups may account for a significant portion of Alignment's network, making it susceptible to disruptions if those groups face issues.

- Contractual Leverage: Physicians and hospitals may have significant leverage in contract negotiations, potentially leading to less favorable terms for Alignment.

- Geographic Limitations: If network partners are concentrated in specific regions, it could limit Alignment's ability to expand into new markets or serve members in underserved areas.

- Quality Control Challenges: Maintaining consistent quality of care across a diverse and large network of independent providers can be challenging.

Alignment Healthcare's substantial dependence on Medicare Advantage (MA) reimbursement, which accounted for approximately 85% of its revenue in 2023, represents a significant weakness. Changes in CMS regulations or reimbursement rates directly impact its financial stability. Furthermore, the company's high-touch care model, while beneficial for member engagement, presents considerable scalability challenges and higher operational costs compared to more traditional models.

The company also faces intense competition within the MA market from established national and regional insurers with greater market share and resources. This competitive pressure, coupled with the inherent costs of its personalized care approach, creates a delicate balance for maintaining profitability. For instance, Alignment's medical loss ratio was 85.2% in 2023, indicating a large portion of revenue is dedicated to care delivery.

Alignment's reliance on its physician and hospital network is another critical vulnerability. Disruptions such as provider exits or unfavorable contract renegotiations could impede member access and cost management. For example, a significant increase in provider reimbursement rates could negatively impact the company's profitability.

| Weakness | Description | Impact | Supporting Data (2023/2024) |

| MA Reimbursement Dependency | High reliance on Medicare Advantage payments. | Financial performance tied to CMS policy changes. | ~85% of revenue from MA plans. |

| Scalability of High-Touch Model | Resource-intensive personalized care delivery. | Challenges in expanding services and controlling costs. | Medical Loss Ratio of 85.2%. |

| Competitive Landscape | Operating in a crowded MA market. | Difficulty in member acquisition and retention. | Facing established national insurers. |

| Network Reliance | Dependence on contracted providers. | Vulnerability to provider network disruptions or cost increases. | Network attrition can increase operational costs. |

What You See Is What You Get

Alignment Healthcare SWOT Analysis

This is the actual Alignment Healthcare SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine preview of the comprehensive report, ready for immediate download after checkout.

Opportunities

The United States is experiencing a significant demographic shift, with the senior population rapidly expanding. This trend directly benefits Alignment Healthcare, as more individuals become eligible for Medicare Advantage (MA) plans. By 2030, all Baby Boomers will be 65 or older, a substantial increase in the eligible population.

This growing pool of seniors represents a prime opportunity for Alignment Healthcare to expand its reach and customer base. The company's focus on specialized MA plans caters directly to the needs of this demographic, positioning it for increased enrollment and revenue growth in the coming years.

Alignment Healthcare has a significant opportunity to expand geographically, particularly into states with growing Medicare Advantage populations. For instance, states like Florida and Texas have shown consistent increases in Medicare-eligible individuals, presenting fertile ground for Alignment's proven model.

By strategically entering these new markets, Alignment can replicate its successful 'high-tech, high-touch' approach, which has driven strong member engagement and retention in existing territories. This expansion allows for increased market penetration and a diversified revenue base, reducing reliance on any single region.

Alignment Healthcare has a significant opportunity to boost its proprietary technology platform by integrating cutting-edge analytics, artificial intelligence (AI), and machine learning. This strategic move could unlock deeper predictive capabilities for patient care, streamline operations, and deliver more tailored health advice.

By leveraging AI, Alignment Healthcare can anticipate patient needs, optimize resource allocation, and personalize treatment plans, thereby enhancing member satisfaction and clinical outcomes. For instance, advancements in AI could allow for earlier detection of chronic disease progression, leading to proactive interventions and reduced healthcare costs.

The company's investment in technology is already paying off; in Q1 2024, Alignment reported a 16% increase in revenue year-over-year, partly driven by its technology-enabled care model. Further AI integration is projected to improve operational efficiency by an estimated 10-15% in the next two years, as stated in their latest investor reports.

Strategic Partnerships and Acquisitions

Alignment Healthcare can significantly boost its market reach and service capabilities through strategic alliances. Partnering with technology firms could integrate advanced data analytics into its care model, enhancing patient outcomes. For instance, collaborations in 2024 with AI-driven diagnostic companies could streamline patient management.

Acquisitions offer a rapid pathway to geographic expansion and talent acquisition. By acquiring smaller, regional health plans in 2025, Alignment Healthcare could quickly establish a presence in new, underserved markets. This strategy also allows for the integration of valuable intellectual property and experienced healthcare professionals.

- Market Expansion: Partnerships can open doors to new customer segments and geographic areas.

- Service Enhancement: Collaborations with tech companies can introduce innovative solutions, like telehealth platforms.

- Talent Acquisition: Strategic acquisitions can bring in specialized expertise and management teams.

- Geographic Footprint: Buying regional players allows for swift entry into new markets, potentially adding millions in new revenue streams based on industry averages.

Evolution of Value-Based Care Models

The healthcare industry's continuous move towards value-based care strongly supports Alignment Healthcare's core mission. This shift emphasizes patient outcomes and integrated support, areas where Alignment Healthcare excels.

Alignment Healthcare is well-positioned to capitalize on these evolving payment structures. The company can actively participate in new models, showcasing its ability to deliver high-quality, cost-effective care. This allows for greater potential to earn incentives by achieving superior health results for its members.

- Increased Revenue Potential: Alignment Healthcare can secure higher reimbursements by meeting and exceeding quality benchmarks in value-based arrangements.

- Market Differentiation: Demonstrating success in value-based care can set Alignment Healthcare apart from competitors focused on traditional fee-for-service models.

- Improved Patient Engagement: The focus on outcomes naturally encourages deeper patient involvement, leading to better adherence and satisfaction.

- Partnership Opportunities: As more providers and payers adopt value-based care, Alignment Healthcare can forge strategic partnerships to expand its reach and impact.

Alignment Healthcare can leverage the growing senior population, with all Baby Boomers expected to be 65 by 2030, to expand its Medicare Advantage offerings. Geographic expansion into states with increasing Medicare-eligible individuals, like Florida and Texas, presents a significant growth avenue.

Further integration of AI and machine learning into its technology platform offers opportunities to enhance predictive patient care and operational efficiency, with projections of 10-15% efficiency gains in the next two years.

Strategic alliances and acquisitions in 2024 and 2025 can accelerate market penetration, talent acquisition, and the integration of innovative solutions, potentially adding millions in new revenue streams.

The industry-wide shift towards value-based care aligns perfectly with Alignment Healthcare's model, allowing for increased revenue potential through quality outcome incentives and market differentiation.

Threats

Regulatory changes and policy uncertainty represent a significant threat to Alignment Healthcare. As a major player in the Medicare Advantage market, the company is directly impacted by decisions from the Centers for Medicare & Medicaid Services (CMS). For instance, shifts in risk adjustment models or changes to encounter data reporting requirements can alter reimbursement levels and increase operational complexity.

Unfavorable policy shifts could lead to reduced revenue or higher compliance costs. In 2024, CMS's final rule for the Medicare Advantage program introduced adjustments to the risk adjustment model, moving to the CMS-Hierarchical Condition Category (HCC) model. While Alignment Healthcare has adapted, such changes inherently create a degree of uncertainty regarding future revenue streams and the need for ongoing investment in compliance infrastructure.

The Medicare Advantage (MA) landscape is seeing increased interest from major national insurers. These large players are actively expanding their MA product lines, leveraging their substantial financial backing and established brand presence.

Alignment Healthcare faces intensified competition from these well-resourced entities. Competitors often boast broader existing provider networks and greater brand recognition, posing a challenge to Alignment's ability to capture or retain market share in the growing MA segment.

For instance, by the end of 2024, the MA market is projected to cover over 33 million beneficiaries, a significant increase from previous years, highlighting the attractiveness and competitive intensity of this sector.

Economic downturns pose a significant threat to Alignment Healthcare by potentially decreasing overall healthcare utilization and impacting member enrollment, especially in government-sponsored programs. For instance, a widespread economic contraction in 2024 or 2025 could lead individuals to delay elective procedures or seek less comprehensive coverage options, directly affecting Alignment's revenue streams.

Inflationary pressures present another considerable challenge, as they drive up the cost of essential healthcare services, pharmaceuticals, and operational expenses like staffing and technology investments. If reimbursement rates from Medicare and Medicaid do not adequately adjust to these rising costs, Alignment's profit margins could be squeezed, potentially impacting its financial stability and ability to invest in growth initiatives.

Cybersecurity Risks and Data Breaches

Alignment Healthcare, as a technology-forward company managing protected health information, is inherently exposed to cybersecurity threats. A successful cyberattack could result in substantial fines and damage to its reputation, potentially eroding member confidence and leading to operational disruptions. For instance, the healthcare sector experienced a significant increase in cyberattacks, with the U.S. Department of Health and Human Services reporting over 700 large-scale breaches affecting millions of individuals in 2023 alone, highlighting the pervasive nature of these risks.

The consequences of a data breach extend beyond immediate financial penalties and legal liabilities. Alignment Healthcare could face a loss of member trust, which is critical for sustained growth and market position. Such an event would not only impact current enrollment but also deter prospective members, directly affecting revenue streams and the company's ability to execute its care model effectively.

- Cybersecurity Risks: Handling sensitive patient data makes Alignment Healthcare a target for cyberattacks.

- Financial Penalties: Breaches can lead to significant fines under regulations like HIPAA.

- Reputational Damage: Loss of member trust can severely impact enrollment and brand loyalty.

- Operational Disruption: Cyberattacks can halt essential services and data access, impacting patient care.

Provider Shortages and Network Disruptions

The healthcare sector is grappling with significant provider shortages and burnout, a trend that directly impacts organizations like Alignment Healthcare. These shortages are particularly acute in specialized medical fields and in underserved rural areas, creating a challenging environment for network expansion and maintenance.

These industry-wide pressures could hinder Alignment Healthcare's capacity to secure and retain the necessary medical professionals, potentially compromising its service delivery and limiting its geographic reach. For instance, the American Association of Medical Colleges projected a shortage of between 37,800 and 124,000 physicians by 2034, underscoring the systemic nature of this threat.

- Physician Shortage Impact: Difficulty in staffing clinics and ensuring timely patient access to care.

- Network Strain: Increased reliance on a smaller pool of providers could lead to network disruptions.

- Rural Access Challenges: Expansion into or maintenance of services in rural areas is particularly vulnerable.

- Operational Costs: Potential for higher compensation demands to attract and retain providers.

Increased competition from large national insurers expanding their Medicare Advantage offerings presents a significant threat, as these well-resourced entities often have established brand recognition and broader provider networks. Furthermore, economic downturns and inflationary pressures can reduce healthcare utilization and increase operational costs, potentially squeezing profit margins if reimbursement rates do not keep pace. Cybersecurity risks are also a major concern, with the healthcare sector experiencing a high volume of breaches, which could lead to substantial financial penalties, reputational damage, and operational disruptions for Alignment Healthcare.

| Threat Category | Specific Threat | Impact on Alignment Healthcare | Relevant Data/Context (2024-2025) |

|---|---|---|---|

| Competition | Intensified competition in Medicare Advantage | Loss of market share, pressure on pricing and margins | Medicare Advantage enrollment projected to exceed 33 million beneficiaries by end of 2024. |

| Regulatory/Policy | Changes in CMS risk adjustment models and reimbursement policies | Revenue uncertainty, increased compliance costs | CMS's 2024 final rule introduced adjustments to the risk adjustment model. |

| Economic Factors | Economic downturns and inflation | Reduced healthcare utilization, increased operational expenses | Inflationary pressures impacting healthcare service costs and staffing. |

| Cybersecurity | Data breaches and cyberattacks | Financial penalties (e.g., HIPAA fines), reputational damage, operational disruption | Over 700 large-scale healthcare data breaches reported in 2023 affecting millions of individuals. |

| Operational/Workforce | Healthcare provider shortages and burnout | Challenges in network expansion, service delivery, and increased operational costs | Projected physician shortage between 37,800 and 124,000 by 2034. |

SWOT Analysis Data Sources

This analysis is built upon a foundation of credible data, including Alignment Healthcare's official financial filings, comprehensive market intelligence reports, and expert industry evaluations to ensure a robust and accurate SWOT assessment.