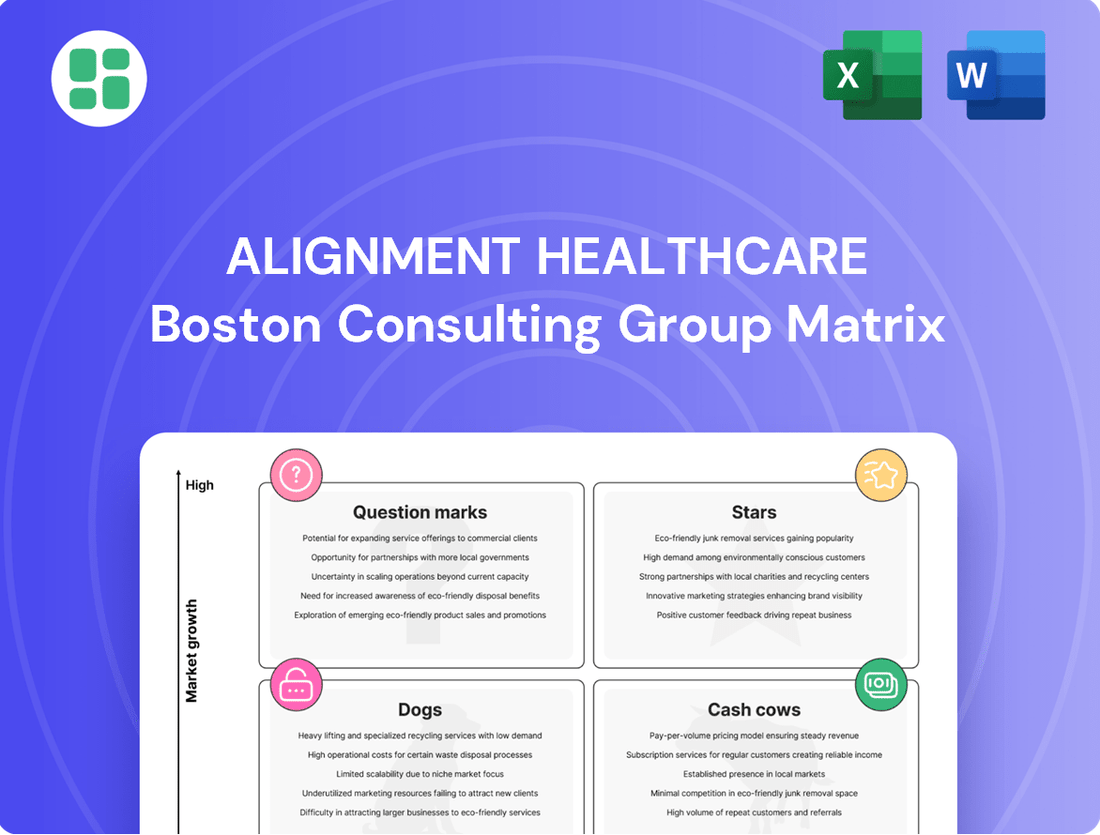

Alignment Healthcare Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alignment Healthcare Bundle

Curious about Alignment Healthcare's strategic product portfolio? This glimpse into their BCG Matrix reveals the potential for growth and where resources are best utilized. Understand if their offerings are Stars, Cash Cows, Dogs, or Question Marks to make informed decisions.

Unlock the full potential of this analysis by purchasing the complete Alignment Healthcare BCG Matrix. Gain detailed quadrant placements and actionable insights to optimize your investment strategy and product development.

Stars

Alignment Healthcare is positioned as a Star in the BCG Matrix due to its strong performance in high-growth Medicare Advantage markets. These markets are characterized by a rapidly expanding senior population, a key demographic for Medicare Advantage plans.

The company's success is underscored by its impressive membership growth. As of January 1, 2025, Alignment Healthcare reported a significant 35% year-over-year increase in health plan membership, reaching 209,900 members. This indicates a substantial market share within a growing sector.

Further reinforcing its Star status, Alignment Healthcare anticipates continued expansion, projecting its membership to reach between 225,000 and 231,000 by the close of 2025. This sustained momentum highlights their strategic advantage in capturing and retaining members in these dynamic markets.

Alignment Healthcare's proprietary AVA® technology platform is a cornerstone of its competitive advantage, facilitating both high quality care and operational efficiency. This platform is crucial for its market leadership aspirations.

In 2024, significant upgrades to AVA® were implemented, focusing on streamlining health risk assessments and enhancing virtual care coordination. These improvements have demonstrably reduced administrative wait times and boosted member satisfaction.

The AVA® platform underpins Alignment's distinctive 'high-tech, high-touch' care model. This integrated approach is vital for scaling personalized healthcare services and achieving better health outcomes, particularly within a rapidly expanding market.

Alignment Healthcare's commitment to quality is evident in its Medicare Advantage plan ratings. For 2024, an impressive 100% of their members were enrolled in plans rated 4 stars or higher by the Centers for Medicare & Medicaid Services (CMS). This exceptional performance continued into 2025, with 98% of members still in 4-star or higher rated plans.

These high Star Ratings are a significant competitive advantage. They not only reflect strong member satisfaction and high-quality care but also lead to increased quality bonus payments from CMS. This financial incentive, coupled with the appeal of top-rated plans, helps Alignment Healthcare attract and retain beneficiaries, solidifying its market position.

Care Anywhere Program

The Care Anywhere program, a cornerstone of Alignment Healthcare's strategy, represents a significant growth opportunity. This innovative service provides comprehensive in-home and virtual care, bolstered by a round-the-clock virtual care center. It directly addresses a critical market demand for accessible and preventive healthcare, particularly for individuals with higher health risks.

In 2024, the Care Anywhere program experienced remarkable expansion, with membership surging by 35% to reach 11,500 individuals. This substantial growth underscores the program's strong market appeal and its effectiveness in enhancing member access to care and improving health outcomes. The program's ability to scale efficiently while demonstrating positive impacts on reducing hospitalizations and skilled nursing facility admissions further solidifies its position as a key growth driver.

- Program Offering: In-home and virtual care, supported by a 24/7 virtual care center.

- Market Need: Addresses a significant demand for accessible, preventive care for high-risk members.

- 2024 Performance: Achieved a 35% membership increase, reaching 11,500 members.

- Impact: Demonstrates scalability and effectiveness in reducing hospitalizations and skilled nursing facility admissions.

Strategic Expansion in Key States

Alignment Healthcare's strategic expansion into new counties and continued focus on key states like California, Arizona, Nevada, North Carolina, and Texas highlights a commitment to high-growth, high-market share. Their success in these competitive landscapes is demonstrated by their substantial enrollment figures, positioning them as a leader in regional expansion.

This aggressive growth strategy is reflected in their market penetration:

- California: Alignment Healthcare has a significant presence, continually expanding its service areas.

- Arizona: The company is actively increasing its market share in this growing state.

- Nevada: Strategic county-level expansion is a key focus in Nevada.

- North Carolina & Texas: These states represent important growth markets where Alignment Healthcare is gaining traction.

Alignment Healthcare's Star status is well-earned, driven by substantial membership growth in high-demand Medicare Advantage markets. The company's commitment to quality, evidenced by consistently high CMS Star Ratings, further solidifies its position as a leader. Their innovative Care Anywhere program and proprietary AVA® technology platform are key differentiators, enabling efficient, high-quality care delivery and fueling continued expansion.

| Metric | 2024 Data | 2025 Projection |

|---|---|---|

| Health Plan Membership | 209,900 (as of Jan 1, 2025, 35% YoY growth) | 225,000 - 231,000 |

| Care Anywhere Membership | 11,500 (35% growth in 2024) | N/A |

| CMS Star Ratings (2024) | 100% members in 4-star or higher plans | 98% members in 4-star or higher plans (2025) |

What is included in the product

This BCG Matrix analysis offers strategic guidance on which of Alignment Healthcare's offerings to invest in, hold, or divest based on market share and growth.

The Alignment Healthcare BCG Matrix offers a clear, one-page overview, instantly clarifying each business unit's position to alleviate strategic uncertainty.

Cash Cows

Alignment Healthcare's established California Medicare Advantage HMO plans are clear cash cows within their portfolio. These plans have consistently achieved 4-star ratings or higher for eight consecutive years, indicating strong member satisfaction and operational excellence in a mature market. This sustained high performance translates into a significant and stable cash flow, as acknowledged by the CEO, who views the California market as a key source of funding for the company's growth initiatives.

Alignment Healthcare's integrated 'high-tech, high-touch' operating model, powered by proprietary technology and dedicated local care teams, has evolved into a highly efficient system. This maturity translates into robust profit margins and strong cash flow, driven by adept cost management and demonstrably improved patient health outcomes.

The effectiveness of this model is underscored by its 2024 achievements, including a record-low hospitalization rate. Furthermore, a significant reduction in skilled nursing facility admissions further validates the model's efficiency and its positive impact on financial performance.

Alignment Healthcare's established markets likely house a stable membership base, characterized by high retention. This loyalty translates into predictable revenue streams, a key component of a cash cow. The company's overall membership growth to 217,500 in Q1 2025 underscores this strong core of committed individuals.

Value-Based Care Model and Provider Partnerships

Alignment Healthcare's focus on value-based care, driven by robust partnerships with leading providers, is a key strength. These collaborations, often structured around incentive-based contracts, are designed to optimize service delivery and manage costs effectively. This strategic approach ensures that providers are rewarded for quality outcomes rather than the sheer volume of services rendered.

This commitment to value translates into significant financial advantages. With over 90% of their providers aligned to quality and outcomes, Alignment Healthcare effectively curbs high-cost care utilization. This focus on preventative and efficient care directly supports stable profit margins.

- Value-Based Contracts: Over 90% of providers operate under contracts prioritizing quality and outcomes over service volume.

- Cost Control: The model actively reduces the utilization of high-cost care, contributing to operational efficiency.

- Stable Profitability: Improved health outcomes and reduced waste directly bolster consistent profit margins.

- Provider Alignment: Partnerships with nationally recognized and trusted local providers ensure high-quality service delivery.

ACCESS On-Demand Concierge Program

The ACCESS On-Demand Concierge Program, featuring a dedicated concierge team available 24/7, is a prime example of a cash cow for Alignment Healthcare. This program, which covers essential items and provides significant member support, experienced a remarkable 95% year-over-year increase in transactions, reaching 3.1 million in 2024.

This substantial growth in usage, driven by a broadening member base, highlights the program's value as a member satisfaction and retention driver. Its consistent demand and low investment needs, relative to its generated value, solidify its position as a stable cash generator for the company's core offerings.

- Program Name: ACCESS On-Demand Concierge Program

- Key Feature: 24/7 dedicated concierge team and coverage for essential items.

- 2024 Transaction Volume: 3.1 million, a 95% year-over-year increase.

- Strategic Impact: Enhances member satisfaction and retention, contributing to stable cash flow.

Alignment Healthcare's established Medicare Advantage plans, particularly in California, function as significant cash cows. These plans benefit from a mature market, consistent high ratings, and a loyal membership base, leading to predictable and substantial revenue streams.

The company's efficient, technology-driven operating model further bolsters these cash cows by ensuring strong profit margins through effective cost management and improved patient outcomes, as evidenced by a record-low hospitalization rate in 2024.

The ACCESS On-Demand Concierge Program, with its 3.1 million transactions in 2024, a 95% year-over-year increase, also represents a valuable cash cow, driving member satisfaction and retention.

Alignment Healthcare's strategic focus on value-based care, with over 90% of providers aligned to quality outcomes, directly contributes to stable profitability by curbing high-cost care utilization.

| Category | Key Indicator | 2024/2025 Data | Impact on Cash Flow |

| California Medicare Advantage HMO Plans | Star Ratings | 8 consecutive years of 4-star or higher | Stable, predictable revenue |

| Operating Model | Hospitalization Rate | Record low in 2024 | Reduced costs, increased margins |

| Membership | Total Membership (Q1 2025) | 217,500 | Consistent revenue stream |

| ACCESS On-Demand Concierge Program | Transactions (2024) | 3.1 million (95% YoY increase) | Enhanced member retention, stable cash generation |

| Value-Based Care | Provider Alignment | Over 90% | Cost control, stable profitability |

Delivered as Shown

Alignment Healthcare BCG Matrix

The BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no incomplete sections, and no demo content—just the comprehensive strategic analysis ready for your immediate use.

Dogs

Underperforming Regional Plans would represent Alignment Healthcare's Medicare Advantage offerings in highly competitive or saturated geographic areas where market share gains have been minimal and profitability remains elusive. While Alignment has demonstrated robust overall growth, specific counties or plan types might exhibit slower expansion and lower penetration rates.

These "Dogs" in the BCG matrix would likely be characterized by low market growth and low relative market share. For instance, if a particular regional plan in a densely populated state with numerous established competitors struggled to attract members, it would fit this category, potentially consuming resources without generating significant returns for the company.

Alignment Healthcare's legacy technology components, those predating or not fully integrated with its AVA® platform, likely fall into the 'Dog' quadrant of the BCG matrix. These systems can be expensive to maintain, offering little in the way of a competitive edge or contributing to the company's high-tech image. For instance, older claims processing systems or outdated data warehousing solutions might require significant upkeep without yielding substantial returns or market share growth.

Unsuccessful pilot programs or ventures within Alignment Healthcare's BCG Matrix would represent initiatives that failed to gain traction. For instance, a pilot program aimed at a niche patient population that didn't attract enough members or show significant improvement in health outcomes would fit here. These ventures often have low market share and minimal growth prospects, acting as drains on resources.

Such ventures, if they existed, would be characterized by a lack of scalability and profitability. Imagine a new care model tested in a single market that didn't demonstrate cost savings or member satisfaction necessary for expansion. These would be considered cash traps, demanding careful evaluation for potential discontinuation or a complete overhaul.

Non-Strategic or Underperforming Provider Partnerships

Partnerships with physician networks or hospitals that don't align with Alignment Healthcare's value-based care strategy or fail to improve cost efficiencies and patient outcomes are categorized as non-strategic or underperforming. These relationships might not contribute to key quality metrics or could result in increased medical costs without a commensurate rise in membership. For instance, if a partnership with a hospital system in 2024 led to a 15% increase in per-member-per-month medical costs without any growth in covered lives, it would be a prime candidate for this category.

Maintaining such partnerships can divert resources and attention from more productive ventures, acting as a drag on overall financial performance. If these underperforming partnerships represent a significant portion of Alignment's provider network, they could hinder the company's ability to achieve its targeted savings under value-based contracts. For example, if 10% of Alignment's provider contracts in early 2024 showed negative ROI due to poor performance metrics and lack of membership growth, these would be flagged.

- Misalignment with Value-Based Care: Partnerships that do not support or actively work against Alignment's core value-based care model.

- Failure to Deliver Cost Efficiencies: Provider relationships that do not contribute to reducing healthcare costs or achieving savings targets.

- Lack of Improved Patient Outcomes: Partnerships that do not demonstrate measurable improvements in patient health or quality metrics.

- Resource Drain: Relationships that consume financial and operational resources without generating sufficient membership growth or cost savings.

Plans with Low CMS Star Ratings (if any)

While Alignment Healthcare primarily focuses on plans achieving 4-star or higher CMS ratings, any plan that consistently falls below this benchmark, perhaps holding a 3.5-star rating without significant improvement, would be categorized as a Dog in a BCG matrix analysis. These lower-rated plans face challenges in attracting new members in a market where quality is a key differentiator.

Such underperforming plans can become resource drains, consuming operational capital and management attention without generating a competitive return or market share. For instance, if a specific regional plan within Alignment Healthcare's portfolio, despite efforts, remained at a 3-star rating throughout 2023 and into early 2024, it would exemplify a Dog.

The financial implications are significant; these plans may not only fail to attract new enrollment but could also be subject to financial penalties or reduced reimbursements from CMS, further diminishing their viability.

- Low CMS Star Ratings: Plans consistently rated below 4 stars, such as 3.5 stars, are considered Dogs.

- Market Competitiveness: These plans struggle to attract new members in a quality-focused market.

- Resource Drain: They consume resources without offering a competitive advantage or generating significant returns.

- Potential Penalties: Lower ratings can lead to financial penalties or reduced reimbursements from CMS.

Alignment Healthcare's "Dogs" represent offerings with low market share and low growth potential. These could include underperforming regional Medicare Advantage plans in highly competitive areas, or legacy technology systems that are costly to maintain and offer little competitive advantage. Unsuccessful pilot programs or partnerships that fail to align with the company's value-based care strategy also fall into this category.

For example, a regional plan in a saturated market that struggles to gain members, or an older claims processing system requiring significant upkeep without yielding returns, would be classified as Dogs. These segments consume resources without contributing substantially to growth or profitability, potentially hindering overall performance.

In 2024, a specific regional plan might be considered a Dog if it consistently held a 3-star CMS rating, failing to attract new enrollment and potentially facing reduced reimbursements. Such plans drain operational capital and management attention, offering little in the way of a competitive edge.

These underperforming assets require careful evaluation for potential divestiture or significant restructuring to improve their viability.

Question Marks

Alignment Healthcare's new market entries and geographic expansion fall into the Question Marks category. These are areas where the company is investing to build its presence and gain market share, recognizing significant future growth potential but currently holding a small slice of the pie. For example, their ambitious goal to increase market share in California from 5% to 20% highlights this dynamic; while California is a key market, achieving this growth signifies a current low penetration in specific counties.

The introduction of new Chronic Condition Special Needs Plans (C-SNPs) or Dual-Eligible Special Needs Plans (D-SNPs) in 2025, focusing on conditions like lung disease or mental health, positions Alignment Healthcare to tap into underserved markets. These plans are initially considered question marks because, while targeting growing populations with unmet needs, their current market share is minimal as they are newly launched offerings.

These emerging specialized plans exhibit high growth potential, driven by the significant demand from specific patient groups. However, their low initial market penetration necessitates substantial investment in marketing, provider network development, and care coordination to gain traction and build a robust market presence.

Alignment Healthcare is exploring advanced AI and data analytics initiatives that go beyond its existing AVA® platform. These projects aim to predict intricate health events and tailor interventions with unprecedented personalization. For example, by late 2024, the company was investing significantly in developing predictive models for chronic disease exacerbations, leveraging vast datasets that include claims, clinical notes, and even social determinants of health data.

These forward-looking ventures, while promising for future differentiation and growth, are currently in their nascent stages. Their market penetration is minimal, and direct revenue contribution is negligible as of mid-2025. This is typical for R&D-intensive areas where early-stage investment is crucial for long-term competitive advantage.

The resource allocation for these advanced AI/data analytics initiatives is substantial, reflecting their strategic importance. In 2024, Alignment Healthcare dedicated approximately 15% of its total technology budget to research and development in these cutting-edge areas, a figure expected to grow as these capabilities mature and demonstrate early success in pilot programs.

Co-Branded Plans in Early Stages

Alignment Healthcare's co-branded Medicare Advantage plans, notably those launched with partners like Walgreens in select markets starting in 2024, are positioned as Question Marks within the BCG Matrix. These initiatives are designed for high growth by tapping into established partner networks, aiming to capture significant market share.

However, these plans are still in their nascent stages, facing the challenge of proving their long-term scalability and profitability. The early investment required is substantial, and widespread market adoption is still developing, making their future success uncertain.

- Market Entry: Co-branded plans with partners like Walgreens represent a strategic push into new market segments, aiming for rapid customer acquisition.

- Growth Potential: The inherent value in leveraging partner brand recognition and customer bases suggests a high growth trajectory.

- Uncertainty: As new ventures, their ability to gain significant market share and achieve profitability remains to be fully demonstrated, characteristic of Question Mark assets.

- Investment Needs: Significant upfront investment is necessary to establish these plans, with returns not yet guaranteed.

Potential Diversification into New Healthcare Service Lines

Alignment Healthcare's potential diversification into new healthcare service lines, moving beyond its core Medicare Advantage business, would likely place these ventures in the Question Marks category of the BCG Matrix. These new initiatives, perhaps targeting different age demographics with direct primary care or exploring broader value-based care models, represent high-growth potential areas. However, they currently possess a very small market share, demanding significant upfront investment to assess their long-term viability and potential to mature into Stars.

For instance, if Alignment Healthcare were to pilot a new direct-to-consumer primary care service for individuals under 65, this would fit the Question Mark profile. While the overall primary care market is substantial and growing, Alignment's presence in this specific segment would be nascent. The company would need to invest heavily in marketing, physician recruitment, and technology to build brand recognition and patient volume. Success hinges on whether these investments can carve out a meaningful market share in a competitive landscape.

- Nascent Ventures: Exploration into areas like direct primary care for non-Medicare populations or expanded value-based care models.

- High Growth Potential: These new service lines operate within segments of the healthcare market experiencing significant growth.

- Low Market Share: Currently, Alignment Healthcare would have a minimal presence in these newly targeted service areas.

- Substantial Investment Required: Significant capital is needed to develop, market, and scale these ventures to determine their future success.

Alignment Healthcare's new ventures, such as co-branded Medicare Advantage plans and expansion into new geographic areas, are classified as Question Marks. These initiatives target high-growth potential markets but currently hold a small market share, requiring substantial investment to gain traction.

The company's exploration of advanced AI for predictive health analytics and the introduction of new specialized plans like those for lung disease or mental health also fall into this category. While these areas promise significant future returns, their early stage of development and minimal market penetration necessitate significant capital outlay and strategic focus to prove their viability.

Alignment Healthcare's strategic push into new service lines, potentially targeting different demographics or expanding value-based care models, represents further Question Marks. These ventures are in nascent stages, demanding considerable investment to build brand presence and patient volume in competitive healthcare segments.

The success of these Question Marks hinges on their ability to convert initial investments into sustainable market share and profitability. For example, in 2024, the company's investment in AI development represented a significant portion of its technology budget, aiming to unlock future competitive advantages.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive financial statements, industry growth projections, and competitive landscape analyses to provide a robust strategic framework.