Alignment Healthcare Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alignment Healthcare Bundle

Alignment Healthcare operates in a dynamic healthcare landscape, facing intense competition and evolving regulatory pressures. Understanding the forces shaping its market is crucial for strategic planning.

The complete report reveals the real forces shaping Alignment Healthcare’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The healthcare sector, especially for Medicare Advantage plans like those offered by Alignment Healthcare, features a broad spectrum of suppliers including doctors, hospitals, and specialized clinics. The concentration of these key providers in specific geographic areas can significantly amplify their bargaining power over Alignment. For instance, if a few major hospital systems control a substantial portion of care delivery in a region where Alignment operates, these systems gain considerable leverage in contract negotiations.

Suppliers providing highly specialized medical procedures, advanced medical devices, or unique pharmaceuticals can exert significant influence if Alignment Healthcare struggles to secure comparable alternatives. This is particularly true for critical components of patient care or operational necessity.

Alignment's internal technology, AVA, designed for data integration and care streamlining, could mitigate reliance on external tech vendors for core functions. However, providers of specialized software or hardware crucial for AVA’s advanced capabilities might still retain considerable bargaining leverage.

The costs for Alignment Healthcare to switch its healthcare providers, like integrating new hospital systems or large physician groups, can be substantial. These switching costs, encompassing administrative efforts, technology updates, and contract renegotiations, significantly bolster the bargaining power of its existing suppliers.

For instance, the complex process of onboarding a new provider network could involve extensive data migration and system compatibility checks, potentially leading to temporary disruptions in member services. This complexity makes it less feasible for Alignment Healthcare to switch suppliers frequently, thus enhancing supplier leverage.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers is a key consideration for Alignment Healthcare. If major healthcare providers, such as large hospital systems or influential physician groups, were to establish their own Medicare Advantage plans or directly engage with employers and patients, this would significantly enhance their bargaining power. By cutting out intermediaries like Alignment, these providers could capture more of the value chain.

This move would essentially mean these providers become direct competitors, potentially limiting Alignment's ability to negotiate favorable contracts and access preferred provider networks. While building and managing a health plan is a complex and capital-intensive endeavor, the potential for greater control and profit could incentivize large, integrated health systems to pursue this strategy.

For instance, in 2024, the trend towards value-based care and direct contracting between employers and health systems continued to gain momentum. Some large health systems have already launched or expanded their own insurance offerings, demonstrating the feasibility of this forward integration. This development directly impacts Alignment's competitive landscape by potentially reducing the pool of providers willing to contract exclusively with managed care organizations.

- Forward Integration Risk: Healthcare providers developing their own insurance plans bypass insurers, increasing their leverage.

- Market Impact: Large health systems integrating forward could restrict Alignment's access to vital provider networks.

- Industry Trend: The rise of value-based care and direct contracting in 2024 highlights the growing potential for this threat.

Importance of Alignment Healthcare to Suppliers

Alignment Healthcare's substantial patient volume significantly dilutes the bargaining power of individual suppliers within its network. As Alignment's membership expands, its ability to direct patients to specific providers increases, making those providers more reliant on Alignment for revenue. This dynamic reduces the leverage individual physician groups or hospitals might otherwise wield.

Alignment's commitment to coordinated care models further solidifies its position. By managing patient pathways and emphasizing value-based outcomes, Alignment becomes an indispensable partner for providers. This integrated approach can diminish the bargaining power of suppliers who might otherwise benefit from fragmented patient care and less centralized purchasing decisions.

For instance, in 2023, Alignment Healthcare reported a membership of over 500,000 individuals, demonstrating its significant reach. This scale means that many healthcare providers depend on Alignment for a substantial portion of their patient flow. Consequently, suppliers serving these providers may find their negotiating leverage weakened, as Alignment's influence over patient volume and provider partnerships is paramount.

- Reduced Supplier Leverage: Alignment's large patient base limits the bargaining power of individual healthcare providers and ancillary service suppliers.

- Value-Based Care Influence: The focus on coordinated, value-based care strengthens Alignment's negotiating position with its network partners.

- Membership Growth Impact: Continued membership expansion, reaching over 500,000 in 2023, amplifies Alignment's influence over supplier relationships.

The bargaining power of suppliers for Alignment Healthcare is moderate, influenced by provider concentration, specialization, and switching costs. While large, concentrated provider networks can exert leverage, Alignment's scale, particularly its membership exceeding 500,000 in 2023, helps to mitigate this. The threat of forward integration by providers is a growing concern, as evidenced by the 2024 trend of health systems launching their own insurance offerings.

| Factor | Impact on Alignment Healthcare | 2023/2024 Data/Trend |

|---|---|---|

| Provider Concentration | High concentration amplifies supplier power. | Regional variations in provider consolidation exist. |

| Specialized Services | Reliance on unique services increases supplier leverage. | Demand for specialized care, e.g., advanced diagnostics, remains high. |

| Switching Costs | High costs to change providers empower existing suppliers. | Integration of new provider systems involves significant administrative and technological investment. |

| Forward Integration | Providers launching own plans reduces Alignment's leverage. | In 2024, value-based care and direct contracting trends are encouraging this. |

| Alignment's Scale | Large membership dilutes individual supplier power. | Over 500,000 members in 2023 increases Alignment's negotiating strength. |

What is included in the product

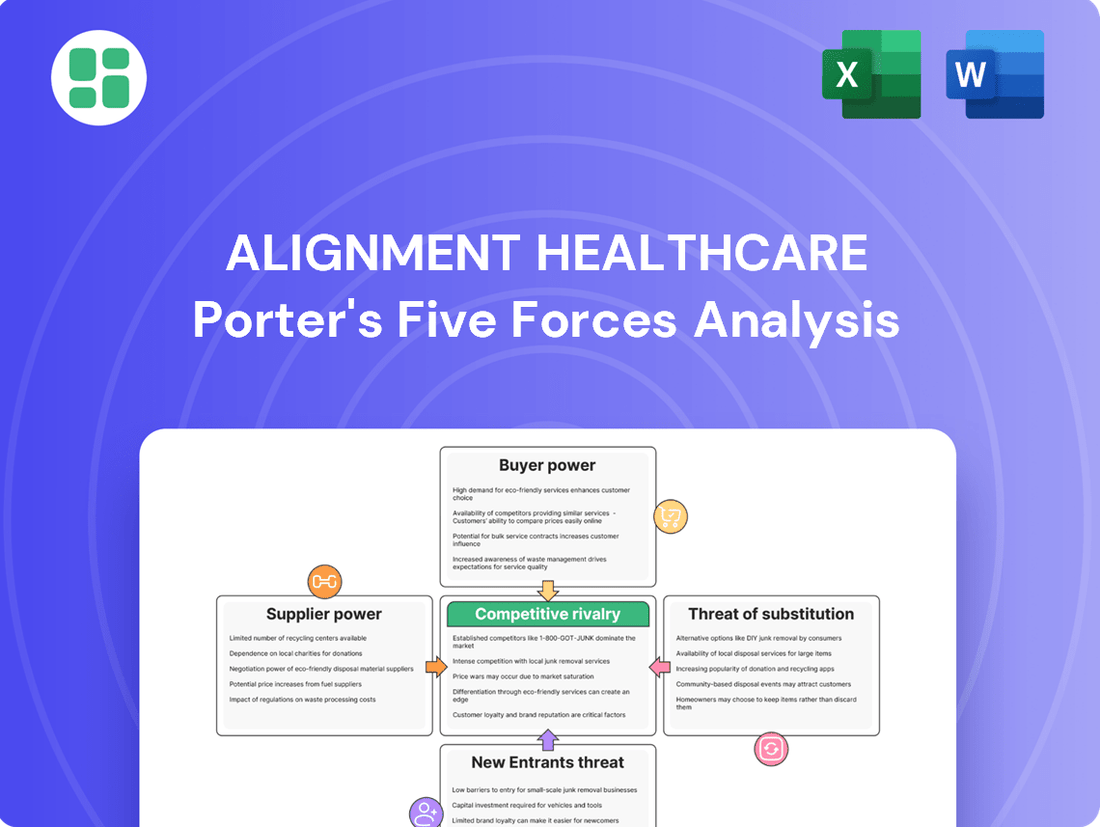

Analyzes the competitive landscape for Alignment Healthcare, examining supplier and buyer power, the threat of new entrants and substitutes, and existing rivalry within the health insurance market.

Instantly visualize competitive pressures with a dynamic, interactive dashboard that highlights key threats and opportunities for Alignment Healthcare.

Customers Bargaining Power

Customers, primarily seniors eligible for Medicare, wield considerable bargaining power. This is largely due to the widespread availability of numerous Medicare Advantage plans from a variety of competing providers. For instance, the average Medicare beneficiary in 2024 had access to an average of 43 Medicare Advantage plans, a number that is expected to grow with three new firms entering the market in 2025, further amplifying consumer choice.

This robust competition directly translates to increased bargaining power for these customers. They can readily compare benefits, costs, and provider networks during annual enrollment periods. The ease with which beneficiaries can switch plans if they find more attractive offerings elsewhere compels providers like Alignment Healthcare to offer competitive pricing and comprehensive benefits to retain their membership.

Seniors, a core demographic for Alignment Healthcare, exhibit significant price sensitivity. Their bargaining power is amplified by a keen focus on premiums, deductibles, and out-of-pocket medical expenses. This makes them more likely to switch providers if costs increase or benefits decrease.

While many Medicare Advantage plans boast $0 premiums, the landscape is shifting. For 2025, anticipated changes in Centers for Medicare & Medicaid Services (CMS) regulations and rising medical costs could necessitate higher out-of-pocket maximums or reductions in supplemental benefits for some plans. This increased cost-consciousness empowers beneficiaries to scrutinize plan offerings more closely.

Customers in the Medicare Advantage market, like those served by Alignment Healthcare, possess significant bargaining power, largely due to readily available information and the ease of switching plans. The Centers for Medicare & Medicaid Services (CMS) offers extensive data on Medicare Advantage plans, allowing beneficiaries to meticulously compare benefits, out-of-pocket costs, and crucially, quality ratings. This transparency empowers consumers to make informed decisions, driving competition among providers.

Furthermore, the annual enrollment period provides a clear window for beneficiaries to switch plans if they find better value or service elsewhere. Regulatory frameworks are also increasingly designed to protect beneficiaries and facilitate plan switching, further amplifying customer leverage. For instance, in 2024, Medicare Advantage enrollment continued its upward trend, with over 31 million beneficiaries opting for these plans, highlighting the importance of customer satisfaction and competitive offerings.

Impact of Alignment's 'High-Tech, High-Touch' Model on Retention

Alignment Healthcare's 'high-tech, high-touch' strategy, which combines its proprietary AVA technology with dedicated local care teams, is designed to boost patient satisfaction and health results. This approach focuses on delivering personalized care, directly addressing a key factor in customer retention.

Features such as the Care Anywhere program and the ACCESS On-Demand Concierge Card are crafted to elevate the member experience. By offering convenient and responsive services, Alignment aims to foster greater loyalty among its members, making them less inclined to seek alternative providers. This can serve as a moderating force against the bargaining power of customers.

- Enhanced Patient Engagement: Alignment's technology-driven platform aims to keep patients more involved in their own healthcare journey.

- Personalized Care Delivery: The combination of technology and local teams allows for tailored health plans and support.

- Improved Accessibility: Services like ACCESS On-Demand Concierge Card aim to make healthcare more accessible and convenient for members.

- Increased Loyalty: By focusing on a superior member experience, Alignment seeks to build strong relationships that reduce churn.

Customer Concentration and Influence

While individual Alignment Healthcare customers, primarily Medicare beneficiaries, are not concentrated, their collective voice, amplified by senior advocacy groups and consumer protection agencies, can significantly sway policy and plan designs. These entities exert influence by lobbying for improved benefits and greater access to care, directly impacting how plans like Alignment Healthcare operate and what services they offer.

The Centers for Medicare & Medicaid Services (CMS) plays a crucial role in shaping customer power. By implementing regulations designed to bolster beneficiary protections and expand access to essential services, such as behavioral health care, CMS reflects and reinforces the collective influence of customers on the healthcare market. For example, in 2024, CMS continued its focus on enhancing member experience and ensuring equitable access to care, which directly affects the competitive landscape for health plans.

- Customer Concentration: Individual Medicare beneficiaries have low concentration, but organized advocacy groups for seniors and consumer protection agencies represent a significant collective bargaining power.

- Regulatory Influence: CMS regulations, such as those aimed at strengthening beneficiary protections and promoting behavioral health access, directly empower customers and influence plan offerings.

- Market Impact: This collective influence can lead to changes in plan benefits, pricing, and service delivery, forcing providers like Alignment Healthcare to adapt to customer demands and regulatory requirements.

Customers, primarily Medicare beneficiaries, hold substantial bargaining power due to the vast array of available Medicare Advantage plans. In 2024, beneficiaries had access to an average of 43 plans, a number projected to rise with new market entrants in 2025, intensifying competition and empowering consumers to switch for better value.

This ease of switching, facilitated by annual enrollment periods and transparent plan comparison tools provided by CMS, forces providers like Alignment Healthcare to offer competitive premiums and comprehensive benefits. Seniors, a key demographic, are particularly price-sensitive, making them responsive to changes in costs and benefits.

Alignment Healthcare's focus on enhancing member experience through technology and personalized care aims to mitigate this customer power by fostering loyalty. However, the collective influence of senior advocacy groups and CMS regulations continues to shape plan offerings, demanding providers adapt to evolving customer expectations and regulatory mandates.

| Factor | Description | Impact on Alignment Healthcare | Data Point (2024/2025) |

| Availability of Plans | Numerous competing Medicare Advantage plans | Increases customer choice and leverage | Avg. 43 Medicare Advantage plans available per beneficiary in 2024 |

| Ease of Switching | Annual enrollment periods and transparent data | Drives competition and provider responsiveness | Continued upward trend in Medicare Advantage enrollment (over 31 million in 2024) |

| Price Sensitivity | Focus on premiums, deductibles, and out-of-pocket costs | Makes customers prone to switching for cost savings | Anticipated shifts in out-of-pocket maximums for 2025 |

| Collective Influence | Advocacy groups and regulatory bodies (CMS) | Shapes plan design, benefits, and service delivery | CMS focus on beneficiary protections and behavioral health access in 2024 |

Preview Before You Purchase

Alignment Healthcare Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Alignment Healthcare details the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. Understanding these forces is crucial for strategic decision-making within the healthcare sector.

Rivalry Among Competitors

The Medicare Advantage market is intensely competitive, featuring a multitude of national and regional companies all striving for a larger share of beneficiaries. Major insurers such as UnitedHealthcare and Humana hold substantial market dominance.

While Alignment Healthcare has demonstrated impressive membership growth, it navigates a landscape where many beneficiaries are concentrated within markets featuring a limited number of dominant plans, intensifying the competitive pressure.

The Medicare Advantage (MA) market is experiencing robust growth, with enrollment projected to reach over 30 million beneficiaries by the end of 2024. This expansion, fueled by an aging U.S. population and a preference for MA plans' comprehensive benefits, creates fertile ground for companies like Alignment Healthcare. However, this attractive market also intensifies competitive rivalry as insurers vie for market share.

Alignment Healthcare stands out by blending advanced technology with personalized member support, a strategy evident in its proprietary AVA platform. This tech-forward approach, coupled with a focus on integrated care, allows them to offer distinct value propositions that go beyond typical health plan benefits, directly impacting competitive rivalry.

The company's commitment to innovation is further showcased through programs like Care Anywhere and the ACCESS On-Demand Concierge Card. These initiatives provide members with convenient access to care and support, creating a differentiated experience that strengthens Alignment Healthcare's competitive position in the market.

Exit Barriers for Competitors

Alignment Healthcare, like many in the managed care sector, faces intensified rivalry stemming from high exit barriers. Significant fixed costs associated with building and maintaining provider networks, coupled with long-term contracts with healthcare providers, make it economically challenging for competitors to withdraw from markets easily. This forces less profitable entities to remain operational, thereby sustaining competitive pressure within the industry.

The inherent complexity of healthcare operations, including compliance with numerous regulations and the established relationships within provider ecosystems, further entrenches competitors. These factors create substantial switching costs and operational hurdles, making a swift exit impractical. Consequently, even underperforming rivals often persist, contributing to a more crowded and competitive landscape for Alignment Healthcare.

- High Fixed Costs: Significant investments in technology, administrative infrastructure, and member services create substantial sunk costs for health insurers.

- Long-Term Provider Contracts: Agreements with hospitals and physician groups often span multiple years, creating financial and operational commitments that discourage rapid market exit.

- Regulatory Obligations: Healthcare is a heavily regulated industry, and exiting a market may involve complex legal and regulatory procedures, adding to the difficulty and cost of departure.

- Established Networks: The value of a health plan is often tied to its network of providers; dismantling or divesting these networks can be a protracted and costly process.

Switching Costs for Customers

While Medicare Advantage beneficiaries can switch plans annually, Alignment Healthcare works to cultivate loyalty by fostering strong relationships between members and their care teams. This continuity of care, coupled with satisfaction derived from specific benefits or the company's technology platforms, acts as a subtle but significant switching cost.

Alignment's strategic focus on delivering superior health outcomes through its integrated care model is designed to make the prospect of switching to a competitor less attractive for its existing members. For instance, in 2024, Alignment continued to emphasize its member-centric approach, aiming to reduce churn by providing a demonstrably better healthcare experience.

- Established Care Team Relationships: Members often develop trust and familiarity with their doctors and care coordinators, making them hesitant to rebuild these connections.

- Benefit and Technology Satisfaction: Positive experiences with specific plan benefits, such as dental or vision coverage, or user-friendly digital health tools, can deter switching.

- Focus on Outcomes: Alignment's success in improving member health and satisfaction directly correlates to reduced perceived value in switching to a potentially less effective provider.

The competitive rivalry in the Medicare Advantage market is intense, with numerous national and regional players vying for market share. Alignment Healthcare operates within this dynamic environment, facing established giants like UnitedHealthcare and Humana. While Alignment has shown strong membership growth, many markets are dominated by a few key plans, amplifying competitive pressures.

Alignment differentiates itself through its technology-driven, member-centric approach, exemplified by its AVA platform and initiatives like Care Anywhere. This focus on integrated care and enhanced member experience creates a distinct value proposition, aiming to retain members in a market where beneficiaries can switch plans annually. The company's success in 2024 was marked by continued efforts to deepen member loyalty through superior health outcomes and personalized support.

High exit barriers, including significant fixed costs for infrastructure and long-term provider contracts, keep many competitors active even if less profitable. These factors, combined with regulatory complexities and established provider networks, contribute to a crowded competitive landscape. Consequently, Alignment must consistently innovate and deliver value to maintain its competitive edge.

| Competitor | Estimated 2024 Medicare Advantage Enrollment (Millions) | Key Differentiator |

|---|---|---|

| UnitedHealthcare | ~8.5 | Extensive national network, broad product offerings |

| Humana | ~6.5 | Strong focus on integrated care, home health services |

| Elevance Health (Anthem) | ~3.2 | Regional strength, diversified health solutions |

| Alignment Healthcare | ~0.2 (estimated) | Technology-driven care, personalized member support (AVA platform) |

SSubstitutes Threaten

Traditional Medicare, encompassing Parts A and B, stands as the most significant substitute for Medicare Advantage plans. While Medicare Advantage plans often bundle extra benefits such as dental, vision, and prescription drug coverage (Part D), Original Medicare offers a foundational level of coverage that certain beneficiaries find more appealing due to its broader provider choice. In 2024, approximately 31 million individuals were enrolled in Medicare Advantage plans, while a substantial number continued with traditional Medicare, highlighting its persistent appeal as a substitute.

Medigap policies, which supplement Original Medicare, directly compete with Medicare Advantage plans. These plans offer beneficiaries the freedom to see any doctor who accepts Medicare, a significant advantage for those who value broad access over potentially more limited network options. In 2024, approximately 30% of Medicare beneficiaries were enrolled in Medicare Advantage, leaving a substantial portion still utilizing Original Medicare, many of whom may consider Medigap as a preferred alternative for its flexibility.

Employer-sponsored retiree health plans can act as a substitute for Medicare Advantage plans for some seniors. These plans might offer a different cost structure or a more comprehensive benefit package compared to what's available through Medicare. For instance, if a retiree's former employer continues to subsidize a significant portion of their health insurance premiums, it could present a more financially attractive option than a Medicare Advantage plan with higher out-of-pocket expenses.

Direct Primary Care or Concierge Medicine Models

While not a direct replacement for comprehensive Medicare Advantage (MA) plans, direct primary care (DPC) and concierge medicine models present a potential threat of substitutes, particularly for a segment of the senior population seeking highly personalized primary care. These models allow individuals to pay a direct fee for enhanced access and tailored services, potentially reducing their reliance on traditional insurance for routine primary care needs.

This shift, though currently less prevalent among the broader senior demographic, could subtly impact the demand for certain aspects of MA plans. For instance, if a growing number of seniors opt for DPC for their primary care, they might perceive less value in the primary care benefits offered within their MA plans.

The market for DPC is growing, with projections indicating continued expansion. For example, the DPC market size was estimated to be around $10.7 billion in 2023 and is expected to grow at a compound annual growth rate of over 10% in the coming years. This growth suggests an increasing willingness among consumers to pay out-of-pocket for direct access to healthcare providers.

- Direct Primary Care (DPC) offers enhanced access to primary care services for a monthly fee.

- Concierge medicine models provide similar personalized care, often with higher membership fees.

- These models can reduce reliance on traditional insurance for primary care, impacting MA plan demand.

- The DPC market is projected for significant growth, indicating increasing consumer interest in direct payment models.

Self-Pay for Certain Services

For specific services not covered by Medicare Advantage plans, or when seniors opt for care outside their plan's network, the option to self-pay emerges. While this doesn't replace comprehensive health insurance, it represents a marginal threat of substitution. For instance, elective procedures or services deemed non-essential by a plan might be paid for directly by the individual.

This self-pay option becomes more relevant as healthcare costs continue to rise, potentially pushing individuals to make out-of-pocket decisions for certain treatments. In 2024, out-of-pocket healthcare spending for individuals aged 65 and older in the US saw continued increases, with some sources indicating a rise in elective procedure costs not fully covered by standard plans.

- Self-Pay as a Substitute: Seniors may opt to pay directly for services not covered by their Medicare Advantage plans or for care received outside their network.

- Marginal Threat: This represents a limited substitution threat, as it typically applies to specific services rather than a complete replacement for insurance.

- Driving Factors: Rising healthcare costs and the desire for non-essential or elective procedures can encourage out-of-pocket spending.

- 2024 Context: Continued increases in out-of-pocket healthcare expenses for seniors in 2024 highlight the potential for this substitution.

The threat of substitutes for Medicare Advantage plans is primarily represented by traditional Medicare (Parts A and B) and Medigap policies. While Medicare Advantage plans offer bundled benefits, Original Medicare provides broader provider choice, a key draw for some beneficiaries. In 2024, roughly 31 million people were in Medicare Advantage, but a significant portion remained in traditional Medicare, underscoring its substitute appeal.

Employer-sponsored retiree health plans also serve as a substitute, particularly if they offer better cost structures or more comprehensive benefits than MA plans. Direct primary care and concierge medicine models present a more niche but growing threat, as they appeal to seniors seeking personalized primary care and potentially reducing reliance on MA for these services. The DPC market, valued at approximately $10.7 billion in 2023, is expected to grow significantly, indicating a rising consumer willingness for direct healthcare payments.

| Substitute Type | Key Features | 2024 Relevance/Data |

| Traditional Medicare (Parts A & B) | Broader provider choice, foundational coverage | Significant portion of Medicare beneficiaries still enrolled, acting as a primary substitute. |

| Medigap Policies | Supplements Original Medicare, offers provider flexibility | Approximately 30% of Medicare beneficiaries are in MA, implying a large segment uses Original Medicare, potentially with Medigap. |

| Employer Retiree Plans | Potentially better cost structure or benefits due to employer subsidies | Attractive for retirees whose employers subsidize premiums, offering a competitive alternative. |

| Direct Primary Care (DPC) / Concierge Medicine | Personalized primary care, direct payment model | Growing market (est. $10.7B in 2023), indicates increasing consumer interest in direct access, potentially impacting MA value perception for primary care. |

Entrants Threaten

Entering the Medicare Advantage market demands immense financial resources. Companies need significant capital to secure necessary licenses, establish robust provider networks, and build the administrative backbone required for operations. Marketing efforts to attract members also represent a substantial upfront investment.

Alignment Healthcare's financial standing underscores this barrier. For instance, in the first quarter of 2024, the company reported revenue of $3.7 billion, demonstrating the scale of operations necessary to compete. This financial muscle and operational infrastructure are difficult for newcomers to replicate, acting as a deterrent.

The Medicare Advantage market is a minefield of regulations, with the Centers for Medicare & Medicaid Services (CMS) dictating everything from how plans are designed to how they're marketed and how quality is measured. New companies entering this space must be prepared to tackle these intricate rules, especially considering the recent 2025 CMS final rules which further refine operational requirements.

Navigating this complex regulatory environment is a significant barrier. For instance, compliance with the Health Insurance Portability and Accountability Act (HIPAA) alone requires substantial investment in data security and privacy protocols, a hurdle that can deter less-resourced entrants.

Alignment Healthcare's distinctive 'high-touch' approach hinges on robust relationships with physicians and hospitals. Establishing and nurturing these extensive, quality provider networks presents a substantial hurdle for potential newcomers. This process demands significant investment in time, intricate negotiations, and the cultivation of trust within the complex healthcare ecosystem.

Brand Recognition and Customer Loyalty

Established players like Alignment Healthcare leverage significant brand recognition, including positive star ratings from the Centers for Medicare & Medicaid Services (CMS) and high member satisfaction, fostering strong customer loyalty. For instance, Alignment Healthcare has consistently aimed for high CMS star ratings, which directly influence member choice. In 2024, the average Medicare Advantage plan rating was around 4.1 stars, highlighting the importance of these scores in a competitive landscape.

New entrants find it difficult to build the necessary trust and attract members in a market where beneficiaries often prioritize established reputations and proven positive experiences. This loyalty means newcomers must invest heavily in marketing and service to overcome the inertia of existing member relationships.

- Brand Recognition: Alignment Healthcare benefits from established brand equity, making it a trusted name among potential members.

- CMS Star Ratings: Positive ratings from CMS serve as a crucial indicator of quality, directly impacting member acquisition and retention. In 2023, plans with 4 or more stars generally saw higher enrollment.

- Customer Loyalty: High member satisfaction translates into repeat business and positive word-of-mouth, creating a barrier for new companies.

- Trust Factor: New entrants must overcome a significant trust deficit, as beneficiaries are often hesitant to switch from familiar and reliable providers.

Proprietary Technology and Data Analytics

Alignment Healthcare's proprietary AVA technology platform is a significant barrier to new entrants. This platform facilitates advanced data analytics for care coordination and personalized member experiences, requiring substantial upfront investment and specialized expertise to replicate.

The high cost and complexity associated with developing and maintaining such a sophisticated technology infrastructure deter many potential competitors. For instance, in 2024, the healthcare technology sector saw continued heavy investment, with companies focusing on AI and data analytics, underscoring the capital intensity required to compete.

- Proprietary Technology: Alignment's AVA platform offers a distinct advantage through its data-driven capabilities.

- High Investment Barrier: Replicating AVA's sophisticated analytics and predictive modeling demands considerable financial resources and technical know-how.

- Data Analytics Expertise: The need for specialized data science and healthcare informatics talent further complicates entry for new players.

The threat of new entrants into the Medicare Advantage market, where Alignment Healthcare operates, is moderate. Significant capital requirements for licensing, provider networks, and marketing, coupled with a complex regulatory landscape, present substantial initial hurdles.

Established brand recognition, strong CMS star ratings, and cultivated member loyalty create a sticky customer base that new companies must work hard to penetrate. For example, in 2024, Medicare Advantage plans with 4 or more stars generally experienced higher enrollment, indicating the importance of quality perception.

Furthermore, proprietary technology platforms like Alignment's AVA, which enhance care coordination and member experience through advanced data analytics, represent a high investment barrier requiring specialized expertise to replicate.

| Factor | Impact on New Entrants | Alignment Healthcare's Position |

|---|---|---|

| Capital Requirements | High (licensing, networks, marketing) | Significant financial resources to compete |

| Regulatory Complexity | Challenging (CMS rules, HIPAA) | Established compliance infrastructure |

| Brand & Loyalty | Low (requires building trust) | Strong brand recognition and member retention |

| Technology Investment | High (data analytics, platforms) | Proprietary AVA platform provides competitive edge |

Porter's Five Forces Analysis Data Sources

Our Alignment Healthcare Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Alignment Healthcare's annual reports and SEC filings, industry-specific market research from firms like IBISWorld, and insights from healthcare sector trade publications.