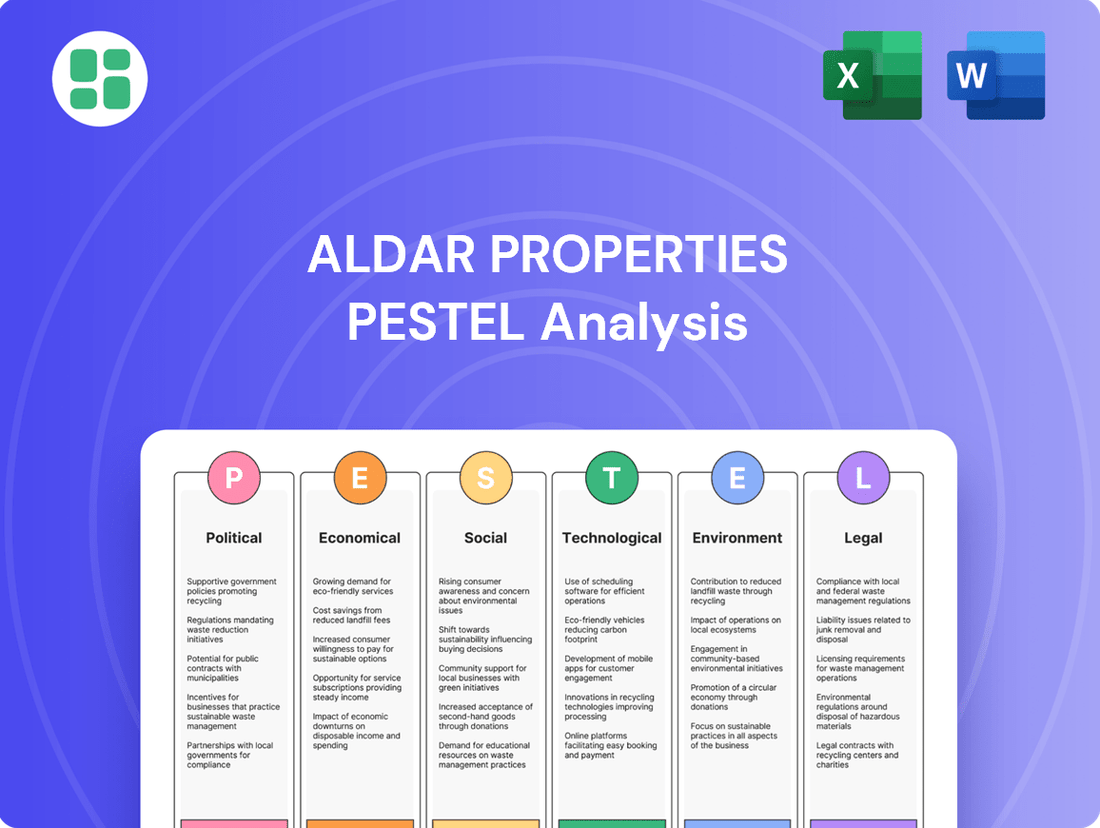

Aldar Properties PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aldar Properties Bundle

Gain a strategic advantage with our comprehensive PESTLE analysis of Aldar Properties. Uncover the political, economic, social, technological, legal, and environmental factors that are shaping its trajectory. Equip yourself with the knowledge to anticipate market shifts and capitalize on emerging opportunities. Download the full analysis now for actionable intelligence.

Political factors

The UAE government's commitment to economic diversification, particularly through its Vision 2030 initiatives, heavily supports the real estate sector. This strategic focus translates into substantial public investment in infrastructure and urban development projects, directly bolstering demand and creating opportunities for developers like Aldar Properties. For instance, Abu Dhabi's infrastructure spending was projected to reach billions of dollars in the lead-up to 2025, creating a fertile ground for real estate growth.

Recent changes to Abu Dhabi's property ownership laws now permit foreign nationals to acquire freehold property within specific investment zones. This move is a significant catalyst for increased foreign direct investment in the real estate sector, broadening Aldar's potential international customer base.

The introduction of the 'Golden Visa' program, which offers long-term residency to property investors, further enhances the appeal of these liberalized ownership rules. This policy aims to attract and retain international talent and capital, directly benefiting developers like Aldar by creating a more stable and attractive market for high-value property purchases.

The United Arab Emirates (UAE) boasts a high degree of political stability, which is a significant draw for investors in the real estate market. This stability directly translates to lower perceived risks for companies like Aldar Properties, fostering confidence in undertaking substantial development projects. In 2023, the UAE maintained its position as a top global destination for foreign direct investment, with real estate being a key sector, underscoring the positive impact of political certainty on capital inflows.

Strategic Urban Planning and Development

Abu Dhabi's ambitious urban planning initiatives, focusing on integrated, mixed-use communities, directly support Aldar Properties' business strategy. The government's commitment to developing key areas like Yas Island and Saadiyat Island provides Aldar with a predictable framework for growth and consistent project demand. For instance, the Abu Dhabi Economic Vision 2030 emphasizes sustainable urban development, creating a favorable environment for Aldar's large-scale projects.

Aldar's active participation in these master-planned developments positions it as a crucial partner in executing the UAE's national development agendas. This strategic alignment ensures Aldar benefits from government-driven infrastructure improvements and a clear vision for future urban expansion. In 2024, Aldar continued to be a primary developer in Abu Dhabi's key growth corridors, contributing significantly to the emirate's evolving cityscape.

Key aspects of this alignment include:

- Government-backed master plans: Providing Aldar with a clear development pipeline and market visibility.

- Focus on integrated communities: Aligning with Aldar's expertise in developing diverse residential, commercial, and leisure offerings.

- Contribution to national visions: Positioning Aldar as a key player in Abu Dhabi's economic diversification and urban transformation.

- Infrastructure development: Government investment in infrastructure supporting Aldar's project locations enhances their attractiveness and value.

Regulatory Transparency Initiatives

The UAE government is actively pursuing regulatory transparency initiatives to bolster the real estate sector's appeal. These efforts are designed to simplify business operations and build greater trust among investors.

Authorities such as the Abu Dhabi Real Estate Centre (ADREC) are instrumental in establishing a robust regulatory framework. This ensures a more predictable and secure environment for property transactions, benefiting both developers and buyers alike. For instance, ADREC's commitment to data standardization and digital platforms aims to reduce transaction times and costs, contributing to market efficiency.

- Increased Investor Confidence: Transparent regulations reduce perceived risks, attracting more foreign and domestic investment into Aldar Properties' projects.

- Streamlined Transactions: Initiatives like digital property registration and clear ownership laws expedite the buying and selling process, enhancing Aldar's operational efficiency.

- Market Stability: A well-regulated market with clear rules fosters stability, mitigating potential disruptions and supporting sustained growth for developers.

The UAE's political stability is a significant advantage for Aldar Properties, attracting substantial foreign direct investment into its real estate ventures. In 2023, the UAE continued to be a prime global FDI destination, with real estate a major beneficiary of this confidence, underscoring the positive impact of a secure political landscape on capital inflows.

Government-backed master plans, like those for Yas Island and Saadiyat Island, provide Aldar with a clear development pipeline aligned with Abu Dhabi's Vision 2030. This strategic partnership ensures consistent project demand and benefits from government infrastructure investments, as seen in Abu Dhabi's multi-billion dollar infrastructure spending leading up to 2025.

Regulatory reforms, including the introduction of freehold property ownership for foreign nationals in designated zones and the 'Golden Visa' program, have significantly broadened Aldar's international customer base. These policies aim to attract and retain global talent and capital, fostering a more robust and attractive market for high-value property acquisitions.

The UAE government's commitment to regulatory transparency and initiatives like the Abu Dhabi Real Estate Centre (ADREC) are enhancing investor confidence and market efficiency. Streamlined digital property registration and clear ownership laws reduce transaction times and costs, creating a more predictable and secure environment for Aldar's development projects.

What is included in the product

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal forces impacting Aldar Properties, providing a comprehensive overview of its operating landscape.

It offers actionable insights into how these external factors create both challenges and strategic advantages for Aldar Properties within its specific market context.

Aldar Properties' PESTLE analysis offers a clear, summarized version of the full analysis for easy referencing during meetings or presentations, highlighting key external factors impacting their business.

Economic factors

Abu Dhabi's real estate sector has seen remarkable expansion, with 2024 marking a period of significant growth. Residential rents and sales prices have hit record levels, and forecasts suggest this upward trend will persist into 2025.

Aldar Properties capitalized on this favorable environment, achieving record net profits and sales in 2024. This success was fueled by robust demand across both newly launched projects and Aldar's existing property portfolio.

These strong market dynamics create a solid base for Aldar Properties, supporting its ongoing financial achievements and strategic expansion initiatives within the thriving real estate landscape.

Foreign investment remains a crucial engine for Aldar Properties' economic success. International buyers, notably from China, are consistently contributing a significant share to the company's sales figures, underscoring the UAE's attractiveness as a stable, low-tax investment destination.

The UAE's reputation for luxury real estate and its overall economic stability continue to draw a growing number of overseas and expatriate purchasers. This robust international demand directly translates into accelerated sales growth for Aldar and ensures healthy market liquidity.

Stable interest rates and a robust non-oil economic expansion in Abu Dhabi are creating a highly favorable environment for the real estate sector. This stability directly benefits Aldar Properties by fostering a predictable market for its developments.

The UAE's economic outlook is particularly strong, with projections indicating a GDP growth of approximately 3.9% for 2024. This growth is expected to significantly bolster the property market, driving both demand for new homes and increased investment activity, which are crucial for Aldar's sales performance and overall business success.

Strong Development Backlog and Revenue Visibility

Aldar Properties is well-positioned due to its substantial development backlog, which hit a record AED 54.6 billion by the close of 2024. This impressive figure, with the bulk originating from projects within the UAE, translates directly into strong revenue visibility for the company over the next two to three years.

This robust backlog signifies sustained demand for Aldar's offerings and provides a solid foundation for its long-term strategic planning and financial forecasting.

- Record Development Backlog: AED 54.6 billion by end of 2024.

- Geographic Concentration: Majority of backlog from UAE projects.

- Revenue Visibility: Clear visibility for the next 2-3 years.

- Market Demand Indicator: Underscores strong demand for Aldar's projects.

Diversification of Income-Generating Assets

Aldar Properties actively manages a diverse portfolio of income-generating assets, which is a key element of its financial strategy. This approach complements its property development and sales activities, creating a more robust business model.

The company's investment properties portfolio demonstrated significant growth, reaching AED 42 billion by the end of 2024. This substantial asset base is crucial for Aldar's financial resilience.

This diversification strategy is particularly effective because it generates consistent, recurring income. Consequently, Aldar's reliance on the cyclical nature of property development sales is considerably reduced, offering greater financial stability.

- Asset Value Growth: Aldar's investment properties portfolio reached AED 42 billion in 2024.

- Recurring Revenue: Diversification ensures a steady stream of income beyond development sales.

- Financial Resilience: A broad asset base reduces vulnerability to market fluctuations.

The UAE's economic expansion, projected at 3.9% GDP growth for 2024, directly fuels Aldar Properties' success by boosting property market demand and investment. Stable interest rates and a strong non-oil economy in Abu Dhabi further solidify this favorable environment, providing Aldar with market predictability.

Aldar's robust development backlog reached a record AED 54.6 billion by the end of 2024, primarily from UAE projects, ensuring revenue visibility for the next two to three years and reflecting sustained market demand.

Foreign investment, particularly from China, significantly contributes to Aldar's sales, leveraging the UAE's appeal as a stable, low-tax investment destination and driving accelerated sales growth.

| Economic Factor | 2024 Data/Projection | Impact on Aldar Properties |

|---|---|---|

| UAE GDP Growth | ~3.9% | Drives property demand and investment |

| Aldar Development Backlog | AED 54.6 billion (end of 2024) | Ensures 2-3 years revenue visibility |

| Foreign Investment Contribution | Significant share of sales | Accelerates sales growth, enhances liquidity |

Preview Before You Purchase

Aldar Properties PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Aldar Properties PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain critical insights into market dynamics and potential opportunities and threats faced by Aldar Properties.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed PESTLE analysis provides a robust framework for understanding Aldar Properties' operating environment.

Sociological factors

Aldar Properties significantly targets expatriates and international buyers, a key driver of demand in Abu Dhabi's real estate market. This segment is crucial for achieving sales targets.

The UAE's appeal, bolstered by relaxed visa rules and residency initiatives like the Golden Visa, continues to attract a broad international demographic. This influx of foreign residents is a major factor in the property sector.

In 2023, the UAE saw a notable increase in its expatriate population, with projections indicating continued growth into 2024 and 2025. This demographic trend directly fuels demand for diverse property types and integrated communities, areas where Aldar Properties has a strong presence.

There's a noticeable shift towards mixed-use developments, with consumers increasingly seeking residential, retail, and entertainment options all in one place. This preference is driven by a desire for convenience and a more integrated lifestyle, a trend that has been growing steadily. For instance, a 2024 report indicated that over 60% of urban dwellers prioritize proximity to amenities and services when choosing a place to live.

Aldar Properties is well-positioned to capitalize on this sociological trend, as their strategic focus centers on developing master-planned communities that seamlessly blend living spaces with commercial and leisure facilities. This approach directly addresses the modern demand for self-contained, vibrant neighborhoods that enhance quality of life and foster a strong sense of community. Their projects are designed to be destinations in themselves, offering residents unparalleled access to everyday needs and recreational activities.

Consumers are increasingly prioritizing sustainable and eco-friendly living spaces, fueled by heightened environmental awareness and supportive government mandates. This trend is evident in the growing demand for properties that incorporate green building practices and offer a reduced environmental footprint.

Aldar's strategic focus on developing environmentally friendly communities and integrating sustainable design principles directly addresses this evolving consumer preference. For instance, Aldar's commitment to sustainability is reflected in projects like Masdar City, a pioneering sustainable urban development, and their adherence to Estidama Pearl ratings for new constructions, ensuring a high standard of environmental performance.

This societal shift significantly influences design choices and material selection for new Aldar projects. The company is actively incorporating features such as energy-efficient systems, water conservation measures, and the use of recycled or locally sourced materials to meet the expectations of environmentally conscious buyers and tenants.

Focus on Quality of Life and Community Amenities

Aldar Properties is deeply invested in enhancing the quality of life for residents by focusing on community amenities. Their ambition is to create healthy, accessible living environments that foster a sense of belonging and sustainability within their developments. This commitment translates into providing top-tier property and infrastructure designed to inspire exceptional living experiences.

Aldar's strategy directly impacts the long-term value and appeal of its projects by prioritizing community well-being. For instance, in 2024, Aldar continued its focus on enhancing public spaces and community facilities across its portfolio, including significant upgrades to parks and recreational areas in Yas Island and Saadiyat Island. These investments aim to cultivate vibrant social hubs and promote active lifestyles.

- Community Enrichment: Aldar's developments are designed not just as residences but as thriving communities with a strong emphasis on shared spaces and resident engagement.

- Quality of Life: The company actively invests in high-quality infrastructure and amenities, such as green spaces, sports facilities, and cultural centers, to elevate the daily living experience.

- Long-Term Value: By fostering desirable living environments, Aldar enhances the attractiveness and sustained value of its real estate assets, appealing to both residents and investors seeking well-integrated communities.

Shifting Housing Accessibility and Affordability

Societal trends are significantly reshaping the real estate landscape, with a growing emphasis on housing accessibility and affordability. While the luxury segment continues to perform well, governments and developers are increasingly focusing on making property ownership attainable for a wider demographic. This includes the introduction of more flexible payment structures and dedicated affordable housing initiatives.

Aldar Properties, as a major player in the market, must strategically navigate this evolving demand. The company needs to balance its established luxury developments with catering to this expanding segment of buyers seeking more accessible options. This dual approach is crucial for maintaining market relevance and capturing diverse growth opportunities.

The influence of these shifts is evident in the diversification of Aldar's project portfolio. For instance, in 2024, Aldar announced plans to develop a significant number of affordable housing units as part of its broader strategy to address the growing demand for accessible real estate. This move reflects a proactive response to societal pressures and market dynamics.

- Governmental Push for Affordability: Initiatives like the Abu Dhabi Housing Authority's programs aim to increase homeownership rates, impacting developer strategies.

- Market Demand Shift: A growing segment of the population seeks more affordable entry points into the property market, influencing sales volumes and pricing.

- Aldar's Portfolio Diversification: The developer is increasingly incorporating mid-market and affordable housing projects alongside its luxury offerings to capture broader market share.

- Flexible Payment Plans: To enhance accessibility, developers like Aldar are offering extended payment terms and tailored financing options, making property acquisition more manageable for a wider buyer base.

Societal shifts are driving demand for integrated living experiences, with consumers increasingly favoring mixed-use developments that combine residential, retail, and entertainment. Aldar Properties is responding by focusing on master-planned communities, enhancing resident quality of life through amenities and community spaces, which in turn boosts long-term asset value.

The growing demand for sustainability is also a key sociological factor, influencing design and material choices as buyers seek eco-friendly living. Aldar's commitment to green building practices, exemplified by projects like Masdar City and adherence to Estidama ratings, directly addresses this trend.

Furthermore, there's a significant societal push for housing affordability, prompting developers like Aldar to diversify their portfolios. This includes offering more accessible housing options and flexible payment plans to cater to a broader demographic, a strategy supported by government initiatives aimed at increasing homeownership.

| Sociological Factor | Impact on Aldar Properties | Supporting Data/Trends (2024/2025) |

|---|---|---|

| Demand for Mixed-Use Developments | Strategic focus on master-planned communities blending residential, retail, and leisure. | Over 60% of urban dwellers prioritize proximity to amenities (2024 data). |

| Emphasis on Sustainability | Incorporation of green building practices and eco-friendly design. | Growing demand for properties with reduced environmental footprints; adherence to Estidama Pearl ratings. |

| Focus on Quality of Life & Community | Investment in high-quality infrastructure, green spaces, and social hubs. | Continued upgrades to public spaces and recreational facilities in key developments (2024). |

| Housing Affordability & Accessibility | Portfolio diversification to include mid-market and affordable housing; flexible payment plans. | Governmental programs to increase homeownership rates; increased development of affordable housing units announced (2024 plans). |

Technological factors

The UAE real estate sector, including major players like Aldar Properties, is embracing PropTech innovations. This includes the integration of artificial intelligence, blockchain, the Internet of Things (IoT), and virtual and augmented reality (VR/AR) technologies. For instance, in 2023, the UAE government continued to push digital transformation initiatives, with a significant focus on smart city development and proptech adoption, aiming to boost efficiency and transparency across various sectors, including real estate.

These technological advancements are instrumental in improving the property lifecycle, from initial purchase to ongoing management. They foster greater transparency for buyers and sellers, streamline complex processes, and make property transactions more accessible. Aldar is actively utilizing these tools to optimize its internal operations and elevate the overall customer journey, reflecting a broader industry trend towards digital-first real estate solutions.

AI-powered analytics are transforming real estate, offering precise property valuations and predictive market trend insights. Aldar Properties can leverage these advanced tools to refine investment strategies, identify lucrative opportunities, and optimize pricing, thereby boosting its market intelligence and competitive edge.

The increasing adoption of smart home and building management systems represents a significant technological factor for Aldar Properties. These integrated IoT solutions are becoming a standard feature, especially in premium and mid-tier residential projects, offering residents enhanced convenience, improved energy efficiency, and robust security. For instance, in 2024, the global smart home market was projected to reach over $150 billion, indicating strong consumer demand for connected living experiences.

Aldar's strategic integration of these technologies directly addresses evolving consumer preferences and elevates property value. By incorporating features like automated climate control, intelligent lighting, and advanced security systems, Aldar not only meets but anticipates the expectations of modern homeowners. This focus on technological advancement is crucial for maintaining a competitive edge in the UAE's dynamic real estate market, where innovation drives desirability.

Digital Transformation in Customer Experience

Digital transformation is fundamentally reshaping how Aldar Properties interacts with its customers. Virtual and augmented reality (VR/AR) are now key tools for client engagement, offering immersive property viewing experiences that allow prospective buyers to explore developments remotely. This is particularly vital for Aldar's international client base, enhancing their ability to connect with properties before visiting.

Blockchain technology is also being integrated to streamline processes, notably making title transfers faster, more secure, and resistant to fraud. These digital advancements are not just about convenience; they are critical for Aldar to build trust and provide a seamless, modern purchasing journey for a global audience.

- VR/AR adoption in real estate viewing is projected to grow significantly, with an estimated 70% of buyers preferring virtual tours by 2025.

- Blockchain applications in real estate transactions are gaining traction, aiming to reduce transaction times by up to 80% compared to traditional methods.

- Aldar's investment in digital customer experience platforms aims to boost customer satisfaction scores by an anticipated 15% in the next fiscal year.

Advanced Construction Technologies

Aldar Properties is increasingly leveraging advanced construction technologies to streamline operations. The adoption of Building Information Modeling (BIM) is a key focus, aiming to boost project efficiency and minimize material waste. For instance, BIM adoption in the UAE construction sector is projected to grow significantly, with a study by Mordor Intelligence indicating a compound annual growth rate (CAGR) of over 15% from 2024 to 2029, suggesting a strong market trend Aldar is aligning with.

Furthermore, Aldar's strategic direction toward low-carbon construction and sustainable design inherently supports the integration of modern building methods. These technological advancements are anticipated to yield substantial cost savings and accelerate project timelines. For example, modular construction, a related advanced technique, has demonstrated potential to reduce construction times by up to 50% and cut waste by 30% in various international projects, a benefit Aldar is likely exploring.

- BIM Adoption: Enhances design coordination and reduces clashes, leading to fewer on-site errors and rework.

- Modular Construction: Offers potential for faster project delivery and significant waste reduction through off-site prefabrication.

- Sustainability Integration: Advanced technologies support Aldar's commitment to low-carbon building practices and eco-friendly design principles.

- Efficiency Gains: These technologies are expected to translate into improved productivity, lower costs, and quicker project completion for Aldar.

Technological advancements are reshaping the UAE real estate landscape, with Aldar Properties actively integrating PropTech. This includes AI for market insights, blockchain for secure transactions, and IoT for smart homes. By 2025, an estimated 70% of buyers are expected to prefer virtual tours, a trend Aldar is leveraging through VR/AR for enhanced client engagement.

The company is also adopting advanced construction technologies like Building Information Modeling (BIM), which is projected to see a CAGR of over 15% in the UAE construction sector through 2029. These innovations are key to boosting project efficiency, reducing waste, and aligning with sustainable building practices, ultimately enhancing Aldar's competitive edge.

| Technology | Aldar Application | Projected Impact/Growth |

|---|---|---|

| PropTech (AI, Blockchain, IoT) | Market analysis, secure transactions, smart homes | Increased transparency, efficiency, customer experience |

| VR/AR | Immersive property viewings | 70% buyer preference by 2025; enhanced global reach |

| BIM | Design coordination, waste reduction | 15%+ CAGR in UAE construction (2024-2029); improved project efficiency |

Legal factors

Abu Dhabi's real estate landscape saw a pivotal change in 2019 when foreign ownership regulations were amended, allowing foreign nationals to acquire freehold property in specific investment zones. This liberalization from prior limitations directly impacts Aldar Properties' ability to attract a broader international clientele.

These updated laws encompass diverse ownership structures, such as 99-year freehold deeds and Musataha contracts, which are critical considerations for Aldar's sales and marketing approaches. Navigating these legal frameworks is essential for foreign investors seeking opportunities in the UAE's property market.

The UAE's Golden Visa program, offering long-term residency for property investments of AED 2 million (approximately $545,000) or more, is a powerful driver for foreign real estate acquisition. This initiative directly boosts Aldar Properties by attracting affluent international buyers and fostering sustained ownership. As of late 2024, the program has facilitated thousands of visas, underscoring its effectiveness in solidifying the UAE’s status as a prime global investment hub.

Aldar Properties must strictly follow Abu Dhabi and UAE building codes and construction standards. These regulations are crucial for ensuring the safety, quality, and durability of all its projects, from residential towers to commercial complexes. For instance, the UAE's General Specifications and Codes for Buildings, updated regularly, dictate everything from structural loads to fire safety measures, impacting material choices and construction techniques.

Compliance is non-negotiable for securing building permits and maintaining Aldar's reputation as a reliable developer. Failure to meet these standards can lead to costly delays, fines, and significant reputational damage. The process involves rigorous inspections at various stages of construction, ensuring adherence to approved plans and specifications.

Furthermore, these standards increasingly emphasize sustainability and energy efficiency. For example, the Estidama Pearl Rating System in Abu Dhabi, which Aldar actively engages with, mandates specific performance criteria for water and energy use in new buildings, influencing design and material selection to reduce environmental impact.

Rental Laws and Property Management Regulations

Aldar Properties navigates a dynamic legal landscape in Abu Dhabi, particularly concerning rental laws and property management. The introduction of the Abu Dhabi Rental Index in 2024 is a significant development, aiming to bring greater transparency and stability to rent setting.

These regulations directly influence Aldar's operational model and the predictability of its recurring revenue streams. Key aspects include stipulated guidelines for lease agreements, landlord-tenant dispute resolution mechanisms, and the framework for permissible rent increases, all of which Aldar must meticulously adhere to.

- Abu Dhabi Rental Index (2024): Establishes a benchmark for rental prices, impacting Aldar's ability to adjust lease rates.

- Landlord-Tenant Laws: Governs contractual obligations, eviction procedures, and tenant rights, shaping Aldar's property management practices.

- Property Management Licenses: Aldar, as a major manager, must comply with licensing and operational standards set by regulatory bodies.

- Consumer Protection: Regulations ensuring fair treatment of tenants and clarity in service provision are paramount for Aldar's reputation and legal standing.

Corporate Income Tax Implementation

The introduction of UAE corporate income tax in January 2024 significantly reshapes Aldar Properties' financial landscape, affecting its reporting and profitability. This new legal framework necessitates careful financial planning and robust compliance measures to navigate the implications for its operations and investment returns.

While Aldar reported a relatively low effective tax rate for the first nine months of 2024, understanding and adapting to these new tax regulations is crucial for sustained financial health. The company must proactively manage its tax liabilities and explore strategies to optimize its financial performance within this evolving legal environment.

- UAE Corporate Tax: Implemented January 1, 2024, with a standard rate of 9% on taxable income exceeding AED 375,000.

- Aldar's Tax Position: For 9M 2024, Aldar's effective tax rate remained manageable, reflecting initial adjustments and potential exemptions or reliefs.

- Compliance and Planning: Aldar must ensure adherence to new tax laws, including transfer pricing rules and withholding tax regulations, impacting its financial statements and cash flows.

- Strategic Impact: The corporate tax regime may influence future investment decisions, capital structuring, and the overall cost of doing business in the UAE for Aldar.

The UAE's evolving legal framework directly impacts Aldar Properties, from foreign ownership laws allowing freehold property acquisition in designated zones since 2019 to the influential Golden Visa program. This latter initiative, offering residency for property investments over AED 2 million, has been a significant boon, facilitating thousands of visas by late 2024 and attracting affluent international buyers.

Aldar must adhere to stringent Abu Dhabi and UAE building codes, such as the General Specifications and Codes for Buildings, ensuring project safety and quality, while also engaging with sustainability mandates like the Estidama Pearl Rating System. Furthermore, the 2024 Abu Dhabi Rental Index and existing landlord-tenant laws shape Aldar's property management and revenue predictability.

The introduction of UAE corporate income tax in January 2024 necessitates careful financial planning for Aldar, with a standard rate of 9% on taxable income exceeding AED 375,000. While Aldar's effective tax rate was manageable in the first nine months of 2024, ongoing compliance and strategic adaptation are vital.

| Legal Factor | Description | Impact on Aldar Properties | Relevant Data/Period |

|---|---|---|---|

| Foreign Ownership Laws | Allows freehold property acquisition in specific zones. | Attracts international clientele. | Amended 2019 |

| Golden Visa Program | Residency for property investments of AED 2M+. | Boosts sales from affluent foreign buyers. | Thousands of visas facilitated by late 2024 |

| Building Codes & Standards | Ensures safety, quality, and sustainability (e.g., Estidama). | Influences design, materials, and construction practices. | Ongoing updates, Estidama Pearl Rating System |

| Rental Laws & Index | Regulates rent setting and landlord-tenant relations. | Affects revenue streams and property management. | Abu Dhabi Rental Index introduced 2024 |

| Corporate Income Tax | 9% tax on taxable income over AED 375,000. | Requires financial planning and compliance. | Implemented January 2024; 9M 2024 effective rate manageable |

Environmental factors

Aldar Properties is actively pursuing its 2025 sustainability objectives, which are closely aligned with the UAE's broader Net Zero by 2050 target and national decarbonization strategies. This focus underscores a significant commitment to reducing its operational carbon footprint and enhancing energy management across its portfolio.

The company's strategic approach to achieving these goals involves the integration of renewable energy sources, such as solar power, and the adoption of low-carbon construction methodologies. For instance, Aldar aims to reduce its Scope 1 and Scope 2 carbon emissions by 20% by 2025 compared to its 2019 baseline.

Aldar Properties is actively pursuing ambitious waste management goals, targeting an impressive 87% recycling rate for construction and demolition waste by 2025. This commitment extends to a broader objective of increasing overall recycling activities by 10%.

The company is also making significant strides in circular economy practices with the upcoming launch of the Ecoloop circular waste management facility. This facility, developed in collaboration with Tadweer, underscores Aldar's dedication to resource efficiency and minimizing the environmental footprint of its development projects.

Aldar Properties is actively pursuing energy efficiency, aiming for a 30% reduction in energy intensity across its portfolio. This commitment is underscored by a substantial 34 MW solar project planned for deployment at 45 locations by mid-2025.

This significant investment in renewable energy is projected to yield a considerable decrease in CO₂ emissions, aligning with global sustainability goals. Aldar's strategy also emphasizes incorporating energy-efficient design principles and smart technologies into its new developments.

Green Building Standards and Sustainable Design

Aldar Properties actively incorporates sustainability into its development ethos, focusing on green building standards and thoughtful material selection. The company targets a significant 40% reduction in water use intensity and a 20% decrease in embodied carbon within construction materials for its new projects. This strategic approach ensures environmentally responsible construction and caters to the increasing consumer preference for sustainable living spaces.

All new Aldar developments are meticulously designed to comply with internationally recognized green building standards. This commitment not only underscores their dedication to environmental stewardship but also directly addresses the escalating market demand for properties that prioritize ecological well-being.

- Target Reduction in Water Use Intensity: 40%

- Target Reduction in Embodied Carbon: 20%

- Alignment with Global Standards: All new projects

- Market Driver: Growing demand for sustainable properties

Climate Resilience and Water Conservation

Aldar Properties is actively integrating climate resilience and water conservation into its operations, recognizing the critical importance of these factors, especially in arid environments. Their sustainability initiatives include implementing smart water management systems and installing water-efficient fixtures across their developments, aiming to significantly reduce water intensity. For instance, in 2023, Aldar reported a 15% reduction in water consumption intensity across its portfolio compared to its 2022 baseline, a testament to these efforts.

The company's commitment extends to ensuring its infrastructure is designed to withstand climate-related challenges, a forward-thinking approach for long-term environmental stewardship and operational efficiency. This focus on climate resilience is vital for maintaining asset value and ensuring the longevity of their projects in a region susceptible to extreme weather patterns.

- Water Conservation: Aldar's 2024 sustainability report highlights a 10% year-on-year decrease in water consumption per square meter in its managed assets, driven by smart metering and low-flow fixtures.

- Climate Resilience in Design: New projects are incorporating advanced cooling technologies and drought-resistant landscaping, contributing to a more sustainable built environment.

- Operational Efficiency: These environmental measures not only support ecological goals but also lead to cost savings through reduced utility expenses, enhancing overall business performance.

Aldar Properties is actively addressing environmental concerns by focusing on decarbonization and resource efficiency. The company has set ambitious targets for 2025, including a 20% reduction in Scope 1 and 2 carbon emissions against a 2019 baseline, and a 30% reduction in energy intensity across its portfolio. These efforts are supported by a 34 MW solar project planned for 45 locations by mid-2025.

Waste management is another key environmental focus, with Aldar aiming for an 87% recycling rate for construction and demolition waste by 2025. The upcoming Ecoloop facility, in partnership with Tadweer, will further bolster circular economy practices. The company also targets a 40% reduction in water use intensity and a 20% decrease in embodied carbon in new construction materials.

| Environmental Target | 2025 Goal | Progress/Initiatives |

|---|---|---|

| Scope 1 & 2 Carbon Emissions Reduction | 20% (vs. 2019) | Aligned with UAE Net Zero by 2050 |

| Energy Intensity Reduction | 30% | 34 MW solar project planned by mid-2025 |

| Construction & Demolition Waste Recycling | 87% | Ecoloop facility development |

| Water Use Intensity Reduction | 40% | Smart water management systems |

| Embodied Carbon Reduction (New Projects) | 20% | Focus on material selection |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Aldar Properties is meticulously constructed using data from official government publications, reputable financial institutions, and leading real estate market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Aldar.