Aldar Properties Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aldar Properties Bundle

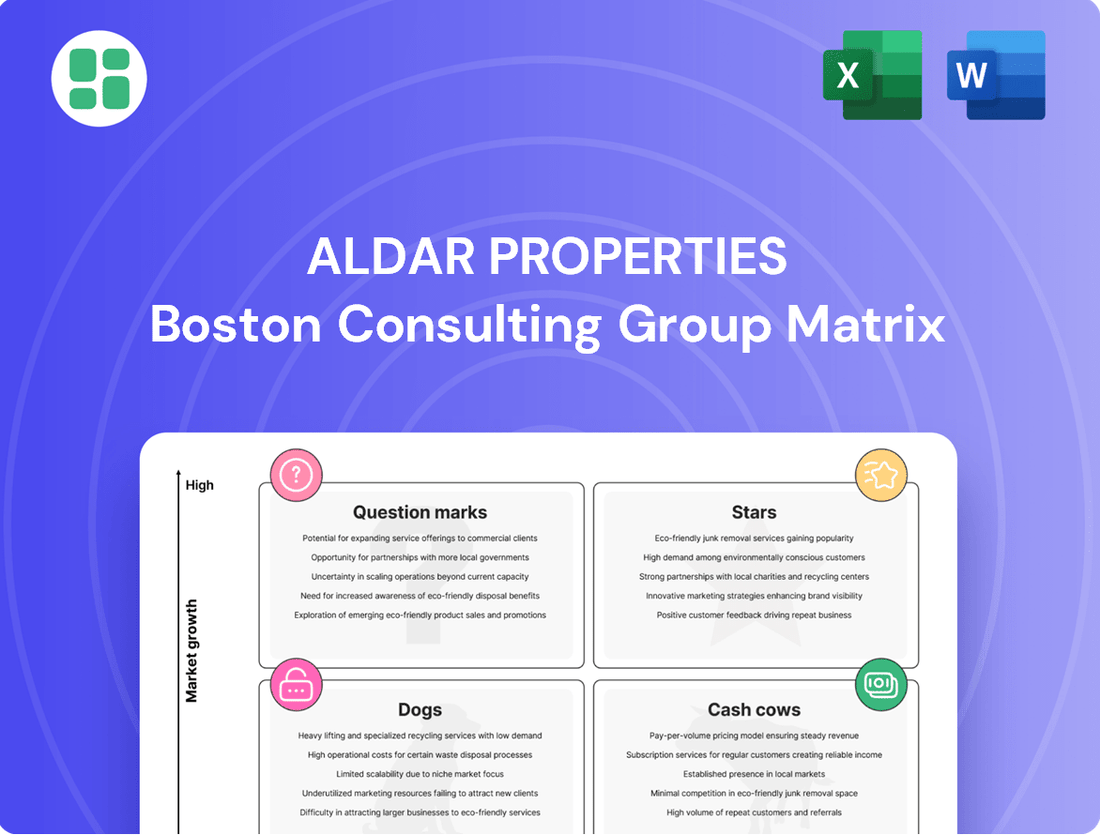

Curious about Aldar Properties' strategic positioning? Our preview offers a glimpse into how their diverse portfolio might be categorized within the BCG Matrix. Understand where their projects might be generating significant returns or requiring substantial investment.

Unlock the full potential of this analysis by purchasing the complete Aldar Properties BCG Matrix report. Gain a definitive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights for optimizing their real estate ventures.

Don't miss out on the comprehensive strategic roadmap. The full report provides quadrant-by-quadrant analysis and data-driven recommendations, empowering you to make informed decisions about Aldar Properties' future investments and product development.

Stars

Aldar's luxury residential launches, particularly those situated in prime Abu Dhabi locations like Saadiyat Island and Fahid Island, are significant growth drivers. These projects, exemplified by the Mandarin Oriental Residences and recent offerings on Fahid Island, are experiencing robust demand and achieving premium pricing, reflecting the strength of Abu Dhabi's real estate sector and contributing to Aldar's impressive sales figures.

Aldar Properties is actively developing new Grade A office towers and business parks situated in prime Abu Dhabi locations such as Yas Island, Saadiyat Island, and Al Maryah Island. These projects are designed to cater to robust corporate demand, anticipating high occupancy rates and significant rental income growth.

These strategic commercial developments are set to substantially increase Aldar's net leasable area. For instance, the company has been expanding its portfolio with projects like The John F. Kennedy (JFK) Center, a new business park on Yas Island, which aims to attract a diverse range of businesses, further solidifying Aldar's position in the commercial real estate sector.

The Wilds in Dubai, Aldar Properties' latest luxury villa community, is positioned as a Star in the BCG Matrix. Its innovative concept, prime Dubai location, and substantial investment potential within a booming market contribute to this classification. This project, representing Aldar's third venture in Dubai, is designed to set new benchmarks for luxury living and is anticipated to garner considerable attention from buyers.

International Development Platforms (London Square & SODIC)

Aldar Properties' international development platforms, specifically London Square and SODIC, are crucial growth engines. London Square, Aldar's wholly-owned UK developer, and SODIC, an Egyptian developer where Aldar holds a majority stake, are significantly boosting Aldar's international revenue streams.

These ventures are instrumental in expanding Aldar's presence in key, high-growth overseas markets. For example, in 2023, SODIC reported revenues of EGP 7.8 billion (approximately USD 160 million), showcasing its substantial contribution to Aldar's consolidated financial performance and its role in diversifying the group's development pipeline.

- London Square: Aldar's wholly-owned UK subsidiary, focused on high-quality residential developments in London and the South East.

- SODIC: A leading Egyptian developer with a strong track record in residential, commercial, and mixed-use projects, contributing significantly to Aldar's international revenue.

- International Revenue Contribution: Both subsidiaries are key drivers of Aldar's overseas revenue, demonstrating a successful international expansion strategy.

- Diversified Development Backlog: Their projects add depth and variety to Aldar's overall development portfolio, mitigating geographic concentration risks.

Strategic Mixed-Use Community Developments

Aldar Properties' strategic mixed-use community developments, such as Mamsha Palm and Mamsha Gardens, represent significant players in their BCG Matrix. These large-scale, integrated projects are characterized by a strong emphasis on residential offerings in desirable, high-demand locations. Aldar's established expertise in master planning allows them to cultivate vibrant, self-sustaining communities, capturing substantial market share within rapidly expanding real estate segments.

These developments benefit from Aldar's extensive track record, enabling them to command premium pricing and attract consistent buyer interest. The integrated nature of these communities, often incorporating retail, leisure, and hospitality components alongside residences, fosters a unique value proposition. For instance, Aldar's commitment to creating well-rounded living environments contributes to their strong market position.

- Mamsha Palm and Mamsha Gardens: Key examples of Aldar's successful large-scale, mixed-use developments.

- High Market Share: These projects are designed to capture significant market share in growing residential segments.

- Integrated Ecosystems: Aldar leverages master development expertise to build thriving communities with diverse amenities.

- Strategic Focus: Emphasis on high-demand areas and strong residential components drives their strategic positioning.

The Wilds in Dubai is positioned as a Star within Aldar Properties' BCG Matrix. This luxury villa community in a prime Dubai location is experiencing high demand and significant investment potential, aligning with Aldar's expansion into the UAE's second-largest emirate.

Aldar's luxury residential projects, including those in Abu Dhabi like the Mandarin Oriental Residences, are also considered Stars due to robust demand and premium pricing. These developments capitalize on Abu Dhabi's strong real estate market and contribute significantly to Aldar's sales figures.

The company's strategic commercial developments, such as new Grade A office towers and business parks in prime Abu Dhabi locations, are also strong contenders for Star status. These projects anticipate high occupancy and rental income growth, expanding Aldar's net leasable area.

Aldar's international ventures, including London Square in the UK and SODIC in Egypt, are crucial growth engines, contributing significantly to international revenue streams and diversifying the company's development pipeline.

| Project/Segment | BCG Category | Key Drivers | Recent Performance Indicator |

|---|---|---|---|

| The Wilds, Dubai | Star | Prime location, luxury offering, high demand | Significant investment potential in a booming market |

| Luxury Residential (Abu Dhabi) | Star | Premium locations, strong demand, high pricing | Robust sales figures, e.g., Mandarin Oriental Residences |

| Commercial Developments (Abu Dhabi) | Star | Prime locations, corporate demand, expansion of leasable area | Anticipated high occupancy and rental income growth |

| International Platforms (London Square, SODIC) | Star | International expansion, diversified revenue streams | SODIC 2023 Revenue: EGP 7.8 billion (approx. USD 160 million) |

What is included in the product

Aldar Properties' BCG Matrix offers a tailored analysis of its portfolio, highlighting which units to invest in, hold, or divest.

Aldar Properties' BCG Matrix offers a clear, actionable overview, relieving the pain of strategic uncertainty by pinpointing growth opportunities.

Cash Cows

Aldar's established residential communities, like those found in Al Raha Beach and earlier sections of Yas Acres, are prime examples of Cash Cows within its portfolio. These developments are typically fully occupied, meaning they generate substantial and consistent rental income with very little need for additional marketing or development expenditure. This mature status allows them to contribute stable, high-margin cash flow to Aldar Properties, underscoring their role as reliable income generators.

Aldar Properties' core retail assets, such as Yas Mall and The Mall at World Trade Centre, are strong performers. These key destinations boast high occupancy rates, contributing significantly to stable, recurring revenue streams for the company. Their established market presence means they don't require substantial new investment to grow, solidifying their role as reliable income generators.

Aldar Properties' prime commercial office portfolios, especially those situated in Abu Dhabi's financial hubs like the Abu Dhabi Global Market (ADGM), represent significant cash cows. These assets consistently boast high occupancy rates, underscoring their desirability and stability within the market.

The substantial rental income generated from these prime office towers is a testament to their strong performance. In 2023, Aldar reported a robust performance across its investment properties, with rental income contributing significantly to its overall revenue, reflecting the sustained demand for quality office spaces in key economic zones.

Aldar Investment Properties Portfolio

Aldar Investment Properties Portfolio, valued at AED 42 billion as of early 2024, represents a significant Cash Cow for Aldar Properties.

This portfolio is characterized by its substantial holdings of income-generating assets, primarily focused on a develop-to-hold strategy. These assets are mature, providing consistent recurring income streams and contributing to long-term capital appreciation.

The diversification within this portfolio, encompassing various asset classes, underpins its stable performance and its role as a reliable generator of cash flow for the broader Aldar organization.

- Portfolio Value: AED 42 billion (early 2024)

- Strategy: Develop-to-hold assets

- Key Benefit: Significant recurring income and long-term capital appreciation

- Function: Cash Cow within Aldar Properties' BCG Matrix

Aldar Education's Established Schools

Aldar Education's established schools are a prime example of a Cash Cow within Aldar Properties' portfolio. These institutions consistently generate predictable fee-based revenue, bolstering the company's diversified income. This segment benefits from a growing student population, ensuring stable returns and a solid market position.

The established schools within Aldar Education are key contributors to Aldar Properties' financial stability. They represent mature businesses with a strong market presence, offering reliable revenue streams. In 2023, Aldar Education reported a significant contribution to Aldar Properties' overall revenue, with its education segment showing robust performance.

- Consistent Fee Revenue: The established schools generate predictable income through tuition fees.

- Diversified Income Streams: This segment adds a stable element to Aldar Properties' broader revenue mix.

- Growing Demand: The increasing population in their operating regions supports sustained student enrollment.

- Market Share: Aldar Education's established schools hold a significant and stable market share.

Aldar's established residential communities, such as those in Al Raha Beach and earlier phases of Yas Acres, are prime examples of Cash Cows. These fully occupied developments generate substantial, consistent rental income with minimal need for further investment or marketing. This maturity translates into stable, high-margin cash flow, solidifying their role as reliable income generators for Aldar Properties.

Aldar's core retail assets, including Yas Mall and The Mall at World Trade Centre, are strong performers. They boast high occupancy rates, contributing significantly to stable, recurring revenue streams. Their established market presence means they require minimal new investment to maintain their performance, reinforcing their status as dependable income sources.

Aldar's prime commercial office portfolios, particularly those in Abu Dhabi's financial districts like ADGM, are significant cash cows. These assets consistently maintain high occupancy rates, demonstrating their desirability and market stability. The substantial rental income from these towers reflects sustained demand for quality office spaces. In 2023, Aldar's investment properties, including these offices, contributed significantly to overall revenue through rental income.

| Asset Type | Key Characteristics | Contribution to Aldar |

| Established Residential Communities | High occupancy, consistent rental income, low capex | Stable, high-margin cash flow |

| Core Retail Assets (e.g., Yas Mall) | High occupancy, recurring revenue, established market presence | Reliable income generation |

| Prime Commercial Office Portfolios (e.g., ADGM) | High occupancy, strong rental income, sustained demand | Significant contribution to revenue |

What You’re Viewing Is Included

Aldar Properties BCG Matrix

The Aldar Properties BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no incomplete sections, and no demo content—just a comprehensive strategic analysis ready for immediate application. You can confidently assess the quality and depth of our work, knowing the final product will be identical and prepared for your business planning needs.

Dogs

Underperforming legacy assets within Aldar Properties' portfolio might include older, smaller, or less strategically positioned properties. These assets likely contribute minimally to overall returns and hold a low market share in mature or declining sub-markets.

For instance, if Aldar divested a portfolio of older residential units in a less sought-after district in 2023, these could be classified as legacy assets. Such a move would align with their strategic focus on high-value, high-growth segments of the real estate market.

Outdated retail units situated in non-prime locations represent Aldar Properties' potential 'Dogs' in the BCG Matrix. These assets, often individual units or smaller centers in less frequented areas, typically experience low customer traffic and persistent vacancies, hindering their revenue generation capabilities.

These underperforming retail spaces may demand significant investment in upkeep relative to the minimal returns they provide. For instance, in 2024, while prime retail assets in Abu Dhabi saw occupancy rates exceeding 90%, these secondary locations might struggle to maintain even 60% occupancy, significantly impacting their contribution to Aldar's overall portfolio performance.

Non-Core, Low-Margin Property Management Contracts within Aldar Properties' portfolio, specifically those managed by Aldar Estates, are categorized as Dogs in the BCG Matrix. These contracts often involve routine maintenance and basic tenant services, characterized by intense competition and minimal profit margins.

For example, Aldar Estates might manage a portfolio of smaller, non-integrated residential buildings where the focus is on operational efficiency rather than value enhancement. These contracts typically generate modest revenue but require consistent resource allocation for day-to-day operations, offering little in the way of strategic advantage or future growth prospects for the company.

Undeveloped, Non-Strategic Land Banks

Undeveloped, non-strategic land banks within Aldar Properties' portfolio might represent Question Marks or potentially Dogs in a BCG matrix analysis if their low demand and lack of immediate development potential tie up capital without generating returns or future growth.

These land parcels, while part of an extensive land bank, could be candidates for reassessment or potential divestiture if they do not align with Aldar's future strategic development plans. For instance, if a significant portion of Aldar's land bank is located in regions experiencing economic slowdown or facing regulatory hurdles for development, these areas could be classified as underperforming assets.

- Land Bank Value: Aldar Properties reported a substantial land bank, with a focus on activating it for future growth. In 2024, the company continued to emphasize efficient land utilization.

- Strategic Alignment: Portions of the land bank not aligned with current market demand or strategic growth initiatives would be considered for re-evaluation.

- Capital Allocation: Holding undeveloped land in low-demand areas represents a drag on capital, impacting return on equity and overall asset turnover.

Divested Non-Core Holdings

Divested non-core holdings represent Aldar Properties' strategic pruning of assets or business units that are not contributing significantly to growth or profitability. These are typically candidates for divestiture, signaling a move to exit underperforming ventures and focus on core, high-potential areas.

For instance, Aldar Properties has been actively managing its portfolio. While specific divestitures of non-core assets are not always publicly detailed in the context of a BCG matrix analysis, the company's strategy often involves optimizing its asset base. In 2024, Aldar continued its focus on its core real estate development and investment segments, which include residential, commercial, and hospitality. Any assets that no longer align with these strategic priorities or are not meeting expected returns would be considered for divestment. This approach allows Aldar to reallocate capital to more promising opportunities, such as its expansion into new markets or development of innovative projects.

- Strategic Divestment: Aldar Properties identifies and exits business units or assets that are underperforming or no longer align with its core strategic objectives.

- Focus on Core Strengths: This move allows the company to concentrate resources and capital on its most profitable and growth-oriented segments, such as prime real estate development and management.

- Portfolio Optimization: By divesting non-core holdings, Aldar aims to enhance overall portfolio efficiency and financial performance, ensuring capital is deployed where it generates the highest returns.

Aldar Properties' 'Dogs' category likely includes outdated retail units in secondary locations, characterized by low foot traffic and high vacancies. These assets require significant maintenance relative to their minimal returns. For example, while prime Abu Dhabi retail saw over 90% occupancy in 2024, these secondary spots might struggle to reach 60%.

Non-core, low-margin property management contracts, particularly those managed by Aldar Estates for smaller, non-integrated buildings, also fall into this category. These contracts offer modest revenue but demand consistent operational resources without strategic advantage.

Undeveloped, non-strategic land banks not aligned with current market demand or future development plans can also be considered 'Dogs' if they tie up capital without generating returns. Aldar's substantial land bank requires efficient utilization, and portions not fitting strategic growth initiatives are candidates for re-evaluation or divestiture.

The company's strategic pruning of non-core holdings, divesting underperforming assets or business units, signifies an exit from ventures not contributing to growth. This allows Aldar to reallocate capital to core, high-potential areas like prime real estate development, optimizing portfolio efficiency.

Question Marks

Aldar Properties' early-stage sustainability initiatives, like the 34-megawatt solar PV project and the Ecoloop circular waste management facility, represent significant investments in the burgeoning green economy. These ventures, while holding substantial growth potential, are currently in their formative stages, meaning their market impact and ultimate profitability are yet to be fully realized. For instance, the Ecoloop facility aims to divert a substantial portion of waste from landfills, a key metric for its environmental impact, but its financial returns are still under evaluation.

Aldar Properties' investment in smart city components and prop-tech solutions positions them in a high-growth potential sector. These innovative digital platforms for property management and development represent Aldar's move into shaping the future of real estate. For instance, their ongoing development of integrated smart city features in projects like Yas Island signifies a commitment to this evolving market.

Aldar Properties' ventures into new, smaller-scale geographic markets represent its Question Marks in the BCG matrix. These are strategic moves into regions where the company is establishing a foothold, aiming for future growth but facing significant initial investment and market uncertainty. Think of it as dipping a toe in the water before a full plunge.

These new market entries, distinct from established operations like London Square or SODIC, are characterized by a nascent brand presence and a need to build market share from the ground up. While the potential for high returns exists, these initiatives also demand substantial capital outlay and carry a higher risk profile due to unproven market receptiveness and competitive landscapes.

For instance, Aldar's expansion into markets beyond its core UAE and MENA presence, as well as its European ventures, would fall into this category. These efforts are crucial for long-term diversification and growth, but they are inherently cash-intensive and require careful monitoring as Aldar works to build brand recognition and secure a sustainable market position.

The Logistics Platform Expansion

Aldar Properties' expansion into the logistics platform, notably through its strategic alliance with DP World, positions this venture as a Question Mark within the BCG Matrix. This classification stems from the high-growth nature of the logistics sector, where Aldar is currently investing heavily to establish and grow its market presence and operational capabilities.

The company's commitment is evident in its substantial investments aimed at scaling this segment. For instance, Aldar has been actively developing and acquiring logistics assets, signaling a clear intent to capture a larger share of this burgeoning market. This aggressive build-out phase requires significant capital expenditure, characteristic of Question Mark businesses seeking to solidify their competitive standing.

- High-Growth Market: The global logistics market is projected to experience robust growth, driven by e-commerce expansion and supply chain optimization trends.

- Active Market Share Building: Aldar is in a phase of actively acquiring and developing logistics facilities to increase its footprint and operational scale.

- Strategic Partnerships: The collaboration with DP World, a global leader in port infrastructure and logistics services, underscores Aldar's ambition to leverage expertise and expand reach.

- Investment Focus: Significant capital is being deployed to build out the logistics platform, indicating a strategic bet on future returns in a competitive landscape.

New Hospitality Concepts (e.g., Aldhafra Resort repositioning)

Aldar Properties' strategic repositioning of hospitality assets, exemplified by the Aldhafra Resort's launch under IHG's Vignette Collection, signals a move into high-growth, niche luxury segments. This initiative, which commenced in 2024, is designed to capture premium market share.

These new hospitality concepts are positioned as potential stars in Aldar's portfolio, requiring substantial investment for development and market penetration. The focus on luxury and unique experiences aims to drive significant revenue growth once established, though initial cash outflows are expected to be considerable as they build brand recognition and operational scale.

- Strategic Repositioning: Aldhafra Resort, now part of IHG's Vignette Collection, targets the luxury segment.

- Market Focus: Aims for high growth in niche luxury hospitality markets.

- Cash Consumption: Initial phases likely require significant cash investment for establishment and market adoption.

- Growth Potential: Expected to become a strong performer as it gains traction in its target market.

Aldar Properties' ventures into new, smaller-scale geographic markets represent its Question Marks in the BCG matrix. These are strategic moves into regions where the company is establishing a foothold, aiming for future growth but facing significant initial investment and market uncertainty.

These new market entries are characterized by a nascent brand presence and a need to build market share from the ground up, demanding substantial capital outlay and carrying a higher risk profile due to unproven market receptiveness. For instance, Aldar's expansion into markets beyond its core UAE and MENA presence, as well as its European ventures, would fall into this category.

The logistics platform, developed through its alliance with DP World, also fits this classification. Aldar is actively investing to scale this segment, acquiring and developing assets to increase its footprint, a strategy characteristic of Question Mark businesses seeking to solidify their competitive standing in a high-growth market.

Similarly, the strategic repositioning of hospitality assets, like the Aldhafra Resort's launch under IHG's Vignette Collection in 2024, targets high-growth, niche luxury segments. These initiatives require substantial investment for development and market penetration, with significant initial cash outflows expected.

| Business Unit | Market Growth | Market Share | Cash Flow | BCG Category |

|---|---|---|---|---|

| New Geographic Markets | High | Low | Negative | Question Mark |

| Logistics Platform | High | Low to Medium | Negative | Question Mark |

| Niche Luxury Hospitality | High | Low | Negative | Question Mark |

BCG Matrix Data Sources

Our Aldar Properties BCG Matrix leverages comprehensive data, including Aldar's financial reports, UAE real estate market analysis, and competitor performance metrics, to accurately position its business units.