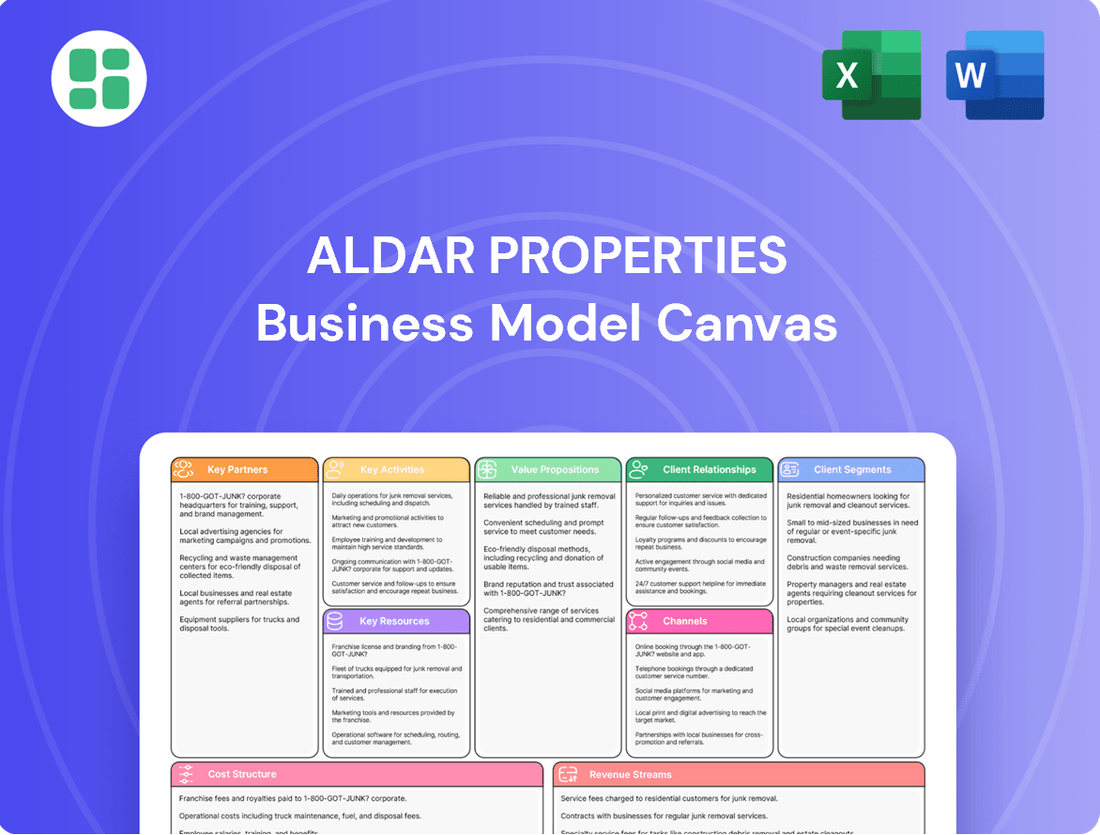

Aldar Properties Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aldar Properties Bundle

Explore the strategic core of Aldar Properties with our comprehensive Business Model Canvas. This detailed breakdown illuminates their approach to customer relationships, revenue streams, and key resources, offering a clear view of their market dominance.

Unlock the full strategic blueprint behind Aldar Properties's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Aldar Properties cultivates vital relationships with government entities and regulators, particularly within Abu Dhabi. These partnerships are fundamental for aligning Aldar's extensive development pipeline with the Emirate's strategic objectives, such as those outlined in Abu Dhabi Vision 2030. For instance, in 2023, Aldar continued to work closely with entities like the Department of Municipalities and Transport to integrate its master-planned communities with existing and future infrastructure, ensuring seamless connectivity and public amenity access.

These collaborations are instrumental in securing access to prime land banks, which is critical for Aldar's large-scale, integrated community developments. Furthermore, regulatory bodies provide essential approvals and oversight, ensuring that Aldar's projects meet stringent environmental, safety, and urban planning standards, thereby fostering trust and enabling the successful execution of its ambitious projects.

Mubadala Investment Company stands as a cornerstone strategic partner for Aldar Properties. Their collaboration extends across a diverse portfolio, encompassing retail, sustainable real estate, waterfront projects, and critical logistics infrastructure.

This significant, long-term alliance is underscored by joint ventures valued at over $8.17 billion (AED 30 billion). This substantial investment not only bolsters Aldar's development capabilities but also actively contributes to elevating Abu Dhabi's profile as a premier global hub for business and lifestyle.

A key aspect of this partnership involves the consolidation of major retail assets, streamlining operations and enhancing the overall value proposition of Aldar's retail segment. This strategic move solidifies Mubadala's role as an integral player in Aldar's growth and market positioning.

Aldar Properties heavily relies on a robust network of construction contractors, engineering firms, and material suppliers to bring its ambitious projects to life. These partnerships are critical for maintaining high standards of quality, adhering to strict timelines, and managing costs across its extensive portfolio of residential, commercial, and mixed-use developments.

In 2023, Aldar continued to foster these relationships, with significant project completions like the Sea Gate development on Yas Island, showcasing the successful execution facilitated by its contractor base. The company's commitment to innovation also means these partnerships often involve adopting cutting-edge construction techniques and sustainable building materials, aligning with global environmental goals.

Financial Institutions and Investors

Aldar Properties' key partnerships with financial institutions and investors are foundational for its growth and project execution. These relationships, including those with major banks and investment funds, are crucial for securing the substantial capital required for Aldar's ambitious development pipeline and strategic acquisitions. For instance, in 2024, Aldar continued to leverage its strong banking relationships to support its ongoing projects and explore new opportunities.

The company actively cultivates these partnerships to ensure efficient capital management and to attract a diverse pool of investors, both domestically and internationally. This broad investor base is essential for underwriting the scale of Aldar's ventures.

Aldar has strategically expanded its investment reach through collaborations in the private credit and private equity spheres. Notably, its partnerships with global firms like Carlyle and Apollo Global Management demonstrate a commitment to accessing diverse funding sources and investment platforms. These alliances are instrumental in identifying and capitalizing on new market opportunities, further diversifying Aldar's investment portfolio.

- Securing Funding: Partnerships with banks and investment funds provide essential capital for Aldar's large-scale real estate developments and portfolio expansions.

- Capital Management: Collaborations facilitate efficient management of Aldar's financial resources, ensuring optimal allocation for strategic initiatives.

- Investor Attraction: Strong relationships with financial entities help attract both local and international investment, broadening the capital base for projects.

- Strategic Investments: Partnerships with global firms like Carlyle and Apollo in private credit and equity platforms enhance Aldar's investment reach and diversification.

International Developers and Operators

Aldar Properties strategically collaborates with international developers and operators to broaden its global reach and enhance its project portfolios. Partnerships with entities like London Square in the UK and SODIC in Egypt are crucial for expanding Aldar's footprint beyond its core markets and diversifying its real estate offerings.

These alliances bring in valuable expertise and access to new customer segments. For instance, Aldar's joint venture with SODIC, a leading Egyptian real estate developer, aims to develop projects in Egypt, leveraging SODIC's established presence. In 2023, Aldar announced a significant expansion into the UK market through a joint venture with London Square, planning to develop over £5 billion of residential projects.

Furthermore, Aldar enhances the appeal of its integrated communities by partnering with renowned luxury hospitality and entertainment brands. Collaborations with names like Mandarin Oriental and Nobu, as well as entertainment operators on Yas Island, significantly elevate the lifestyle and experiential value for residents and visitors alike.

- International Developer Partnerships: Aldar partners with firms like London Square (UK) and SODIC (Egypt) to expand its development pipeline and geographic presence.

- Hospitality & Entertainment Collaborations: Alliances with luxury brands such as Mandarin Oriental and Nobu, alongside entertainment operators on Yas Island, enrich Aldar's integrated community offerings.

- Market Expansion: These partnerships are key to Aldar's strategy for diversifying its revenue streams and accessing new international markets, as evidenced by its significant UK venture.

Aldar Properties' strategic alliances with government bodies and regulators are paramount for navigating the complex landscape of real estate development in Abu Dhabi. These partnerships ensure alignment with the Emirate's long-term vision, facilitating access to prime land and securing necessary approvals. For example, collaborations with entities like the Department of Municipalities and Transport in 2023 were crucial for integrating Aldar's master-planned communities with essential infrastructure.

The company's relationship with Mubadala Investment Company represents a significant cornerstone, with joint ventures valued at over $8.17 billion (AED 30 billion) as of recent reporting. This alliance spans diverse sectors including retail and logistics, bolstering Aldar's development capabilities and contributing to Abu Dhabi's status as a global business hub.

Aldar's operational execution hinges on a strong network of construction contractors, engineering firms, and suppliers, critical for maintaining quality and adhering to project timelines. In 2023, the successful completion of projects like Sea Gate on Yas Island underscored the effectiveness of these partnerships, often incorporating advanced construction techniques and sustainable materials.

Financial partnerships are vital for Aldar's growth, with strong ties to banks and investment funds providing substantial capital for its development pipeline and strategic acquisitions. In 2024, Aldar continued to leverage these relationships, including significant collaborations in private credit and equity with firms like Carlyle and Apollo Global Management, enhancing its investment reach and diversification.

What is included in the product

Aldar Properties' business model focuses on developing, selling, and managing a diversified portfolio of real estate assets, catering to various customer segments through multiple channels to deliver integrated lifestyle and investment value.

Aldar Properties' Business Model Canvas offers a clear, actionable framework to address the complexity of real estate development and management, providing a structured approach to overcome operational hurdles.

It simplifies the intricate process of property lifecycle management, allowing Aldar to efficiently identify and mitigate risks, thus relieving the pain points associated with large-scale projects.

Activities

Aldar Properties' key activities center on identifying prime land parcels and meticulously crafting master plans for integrated communities. This involves a comprehensive approach to designing and constructing diverse properties, including residential, retail, commercial, and leisure spaces, all aimed at creating premier destinations.

The company's strategic focus is on developing world-class destinations that seamlessly blend high-quality real estate with robust infrastructure and desirable amenities. This commitment to holistic community building is a cornerstone of Aldar's operational strategy, ensuring long-term value and resident satisfaction.

In 2024, Aldar continued to advance its development pipeline, with significant progress reported on projects like the Water's Edge and Mayan developments on Yas Island. The company also announced plans for new residential communities and commercial ventures, underscoring its active role in shaping Abu Dhabi's urban landscape.

Aldar Properties actively markets and sells its residential and commercial properties, both during development (off-plan) and upon completion. This involves robust marketing strategies, operating dedicated sales centers, and utilizing digital channels to connect with potential buyers, including a significant international and expatriate customer base.

In 2024, Aldar reported strong sales performance, with AED 13.4 billion in new sales booked, demonstrating robust demand for its diverse property portfolio. A notable portion of these sales, approximately 57%, came from international buyers and expatriate residents, underscoring the global appeal of Aldar's developments.

Aldar Properties actively manages a substantial portfolio of income-generating assets. This includes a diverse range of properties such as commercial offices, bustling retail malls, desirable residential units, and hospitality establishments. This management focus is crucial for generating consistent revenue.

A core activity for Aldar is the continuous pursuit of acquiring and developing new assets. This strategic expansion aims to broaden the company's property base, thereby securing ongoing recurring income streams and fostering long-term capital appreciation for the business.

For instance, in 2024, Aldar Properties continued its aggressive growth strategy, with significant capital deployment towards expanding its recurring income portfolio. The company reported AED 10.4 billion in recurring revenue for the first nine months of 2024, demonstrating the success of its asset management and growth initiatives.

Property and Facilities Management Services

Aldar Properties offers extensive property and facilities management services, looking after its own developments and managing assets for others. This is crucial for keeping properties in top condition, running smoothly, and maintaining their value, which directly impacts how happy residents and tenants are and the overall quality of life in their communities.

These services are a cornerstone of Aldar's business, ensuring operational excellence and asset longevity. For instance, in 2023, Aldar's asset management division reported significant growth, managing a diverse portfolio that includes residential, commercial, and retail spaces, with a strong focus on enhancing the tenant experience and operational efficiency across all managed properties.

- Property Upkeep: Ensuring all physical assets are maintained to high standards, from common areas to individual units.

- Operational Efficiency: Streamlining services like security, cleaning, and maintenance to ensure smooth day-to-day operations.

- Value Preservation: Implementing strategies to protect and enhance the long-term value of the properties managed.

- Tenant & Resident Services: Providing responsive support and amenities to foster a positive living and working environment.

Strategic Investments and Diversification

Aldar Properties actively seeks strategic investments, such as acquiring land banks and income-generating properties, to fuel growth and expand its portfolio. This strategy is crucial for diversifying its asset classes and geographical reach.

The company also forms joint ventures to leverage partnerships and enter new markets, enhancing its competitive position. In 2024, Aldar continued to focus on expanding its presence in key sectors.

- Strategic Acquisitions: Aldar acquired a significant land bank in Abu Dhabi during 2024, bolstering its development pipeline.

- Sector Diversification: Expansion into logistics and education sectors through strategic partnerships and acquisitions was a key focus.

- International Ventures: Aldar explored international joint ventures to diversify its geographic footprint beyond the UAE.

- Income-Generating Assets: The company continued to invest in and acquire income-generating assets to provide stable cash flows.

Aldar Properties' key activities encompass the entire property lifecycle, from land acquisition and master planning to development, sales, and ongoing asset and facilities management. This integrated approach ensures comprehensive control and value creation across its diverse portfolio.

The company is actively involved in developing and selling both residential and commercial properties, a process that includes robust marketing and sales operations to engage a broad customer base. Furthermore, Aldar manages a significant portfolio of income-generating assets, focusing on consistent revenue streams and long-term capital appreciation.

Strategic investments and partnerships are also central to Aldar's operations, driving portfolio expansion and market diversification. This includes acquiring land banks, investing in income-generating properties, and exploring international ventures to enhance its competitive edge and secure future growth.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Development & Sales | Identifying land, master planning, construction, and marketing/selling properties. | AED 13.4 billion in new sales booked; 57% from international/expatriate buyers. |

| Asset Management | Managing income-generating assets (commercial, retail, residential, hospitality). | AED 10.4 billion in recurring revenue (first nine months); focus on expanding recurring income portfolio. |

| Property & Facilities Management | Maintaining and operating properties for optimal performance and tenant satisfaction. | Continued growth in asset management division, enhancing tenant experience and operational efficiency. |

| Strategic Investments & Partnerships | Acquiring land banks, income-generating properties, and forming joint ventures. | Acquisition of significant Abu Dhabi land bank; expansion into logistics and education sectors. |

Delivered as Displayed

Business Model Canvas

The Aldar Properties Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. You'll gain immediate access to this comprehensive analysis, ready for your immediate use.

Resources

Aldar Properties boasts an extensive land bank, a critical resource for its business model. This land bank is primarily concentrated in Abu Dhabi's most desirable areas, including Yas Island, Saadiyat Island, and Al Raha Beach. As of early 2024, Aldar continued to strategically expand its footprint, actively pursuing opportunities in Dubai and Ras Al Khaimah, demonstrating a commitment to diversified growth.

This substantial land inventory serves as a robust pipeline for Aldar's future development projects. It ensures a consistent supply of prime real estate for residential, commercial, and leisure offerings, directly supporting the company's long-term growth trajectory and revenue generation capabilities.

Aldar Properties' financial capital is a cornerstone of its business model, providing the necessary fuel for growth and development. This includes substantial liquidity and a proven ability to access diverse funding sources, such as credit facilities and bond issuances. For instance, Aldar's strong financial position, evidenced by its healthy cash reserves and consistent revenue generation, allows it to undertake ambitious, large-scale projects and explore strategic acquisition opportunities.

In 2024, Aldar Properties continued to demonstrate robust financial health, which directly translates to its investment capacity. The company's ability to attract strategic investments further bolsters its capital base, enabling it to pursue a wide range of development and investment activities. This financial strength is crucial for maintaining its competitive edge in the dynamic real estate market.

Aldar Properties has cemented its position as the UAE's premier real estate developer, recognized for its cutting-edge designs, premium properties, and dedication to sustainable practices. This robust brand equity is a significant draw for customers, investors, and strategic partners alike, fostering a distinct competitive edge.

In 2024, Aldar's commitment to quality and innovation continues to resonate. For instance, their Yas Island developments consistently achieve high occupancy rates and strong resale values, reflecting sustained market confidence in their brand. Their ongoing projects, such as the Water's Edge and Mayan residences, showcase their ability to deliver on promises of luxury and lifestyle, further bolstering their market leadership.

Skilled Human Capital and Expertise

Aldar Properties relies heavily on its skilled human capital, a diverse team encompassing master planners, architects, engineers, project managers, sales professionals, and asset managers. This deep well of expertise is fundamental to their ability to navigate and excel in complex real estate development and management, ensuring the delivery of premium projects and services.

The company's workforce is characterized by extensive experience in the real estate sector. For instance, as of late 2023, Aldar continued to invest in talent development, with a significant portion of its leadership team possessing over a decade of experience in the industry. This collective knowledge is critical for innovation and execution.

- Master Planners and Architects: Responsible for envisioning and designing integrated communities and iconic structures.

- Engineers and Project Managers: Crucial for the efficient and high-quality execution of construction and development projects.

- Sales and Marketing Professionals: Drive property sales and build strong customer relationships, a key component in their revenue generation.

- Asset Managers: Oversee the performance and value enhancement of Aldar's extensive property portfolio.

Diversified Property Portfolio

Aldar's diversified property portfolio is a cornerstone of its business model, encompassing a wide array of income-generating assets. This includes residential developments, retail centers, commercial office spaces, hospitality venues, and educational institutions.

These existing assets are crucial resources, providing a foundation of stable, recurring income. This stability allows Aldar to pursue further growth and investment opportunities. In 2023, Aldar reported significant recurring income from its portfolio, underscoring its value.

- Residential: A substantial portion of Aldar's portfolio consists of residential units, offering rental income and capital appreciation.

- Retail: Aldar manages prominent retail destinations, attracting consistent footfall and generating rental revenue.

- Commercial: The company's commercial real estate holdings, including office buildings, contribute to its recurring income streams.

- Hospitality & Education: Aldar's presence in the hospitality and education sectors diversifies its revenue sources and strengthens its market position.

Aldar Properties' extensive land bank, particularly in Abu Dhabi's prime locations like Yas Island and Saadiyat Island, is a fundamental asset. By early 2024, Aldar was actively expanding into Dubai and Ras Al Khaimah, ensuring a robust pipeline for future residential, commercial, and leisure projects. This strategic land acquisition underpins their long-term development plans and revenue generation.

Value Propositions

Aldar Properties crafts integrated communities, blending homes, shops, offices, and entertainment into single, master-planned destinations. This approach ensures residents have everything they need within easy reach, fostering a vibrant and convenient lifestyle.

These developments are distinguished by their cutting-edge design, state-of-the-art amenities, and a strong emphasis on high-quality infrastructure and services. For instance, Aldar's Yas Island development in Abu Dhabi is a prime example, showcasing this commitment to holistic living.

In 2024, Aldar continued to expand its portfolio of high-quality community living projects, with a significant portion of its development pipeline focused on these mixed-use, integrated offerings. This strategy underpins their value proposition of providing a complete and enriching living experience.

Aldar Properties’ prime locations in Abu Dhabi, including Yas Island and Saadiyat Island, are a major draw. In 2024, these areas continued to see strong demand, with properties offering direct access to entertainment, education, and business centers. This strategic placement enhances resident convenience and lifestyle, a key value proposition.

The company's expansion into Dubai, particularly with projects like the Water's Edge development, further solidifies this value. By offering proximity to major attractions and business districts in both emirates, Aldar ensures its residents benefit from unparalleled connectivity and access to world-class amenities, boosting property desirability.

Aldar Properties champions sustainable urban living by embedding eco-conscious practices throughout its developments. This includes utilizing energy-efficient designs and advanced green building techniques in its construction, reflecting a deep commitment to environmental stewardship.

The company's vision extends to fostering communities that not only improve residents' quality of life but also actively contribute to the UAE's ambitious Net Zero 2050 targets. For instance, Aldar's commitment is evident in projects like the sustainable community of Masdar City, which is designed to be a model for future urban development.

Reliable Investment Opportunities and Capital Appreciation

Aldar Properties presents compelling investment prospects, driven by robust demand within Abu Dhabi's dynamic real estate sector. The company's portfolio is designed to deliver significant capital appreciation, alongside attractive rental income streams, making it a prime choice for investors seeking growth and stability.

The company's financial strength and substantial development pipeline offer a high degree of investment security. Aldar’s commitment to delivering high-quality projects in prime locations underpins its potential for sustained capital growth and consistent rental returns.

- Strong Market Demand: Aldar consistently benefits from high demand for its residential, commercial, and retail properties.

- Capital Appreciation Potential: Properties in Aldar's developments have historically shown strong capital appreciation. For instance, in 2023, Aldar's development portfolio achieved record sales, indicating sustained buyer interest and upward price trends.

- Lucrative Rental Yields: The company’s rental properties, particularly in its commercial and hospitality segments, offer attractive and consistent yields.

- Investment Security: Aldar's robust financial performance, exemplified by its strong balance sheet and consistent revenue growth, provides a secure foundation for investment.

Comprehensive Property and Asset Management Services

Aldar Properties extends its value proposition beyond mere property development by offering comprehensive, end-to-end property and asset management services. This ensures the sustained value, meticulous maintenance, and optimal operational efficiency for both its residential communities and commercial investment properties. For instance, Aldar's asset management division actively works to enhance occupancy rates and rental yields, contributing to the overall financial health of its portfolio.

This integrated approach provides significant peace of mind and unparalleled convenience for property owners and tenants alike. By handling all aspects of property upkeep and management, Aldar allows its customers to focus on enjoying their homes or businesses without the burden of day-to-day operational concerns. In 2024, Aldar reported a strong performance in its recurring revenue streams, largely driven by its robust asset and property management operations.

Key aspects of Aldar's value proposition in property and asset management include:

- Proactive Maintenance and Upkeep: Ensuring properties remain in excellent condition, preserving their market value and tenant appeal.

- Operational Efficiency: Streamlining services to ensure smooth functioning of all community amenities and commercial spaces.

- Tenant and Owner Relations: Fostering positive relationships through responsive service and effective communication.

- Investment Value Enhancement: Implementing strategies to maximize rental income and capital appreciation for investment properties.

Aldar Properties offers integrated communities that combine residential, retail, and commercial spaces, creating self-sufficient destinations. This holistic approach enhances convenience and lifestyle for residents, exemplified by their developments on Yas Island and Saadiyat Island. In 2024, Aldar continued to focus on these mixed-use projects, reinforcing their commitment to a complete living experience.

The company's value proposition centers on providing high-quality, well-located properties with strong potential for capital appreciation and attractive rental yields. Aldar's robust financial performance and extensive development pipeline in 2024 underscore its investment security and ability to deliver consistent returns.

Aldar also provides comprehensive property and asset management services, ensuring sustained property value, efficient operations, and positive tenant relations. This end-to-end service model offers owners peace of mind and contributes to the financial health of their investments, with recurring revenue streams showing strong performance in 2024.

| Value Proposition Aspect | Key Benefit | Supporting Data/Example (2024 Focus) |

|---|---|---|

| Integrated Community Living | Enhanced lifestyle and convenience | Continued expansion of mixed-use projects in prime Abu Dhabi locations. |

| Investment Potential | Capital appreciation and rental income | Record sales in development portfolio in 2023 indicating sustained interest; strong recurring revenue from asset management in 2024. |

| Property & Asset Management | Preservation of value and operational efficiency | Active enhancement of occupancy rates and rental yields across managed properties. |

Customer Relationships

Aldar Properties employs specialized sales teams to directly engage with prospective property purchasers, ensuring a personalized approach to inquiries and the buying process. This direct interaction is crucial for understanding buyer needs and guiding them through their investment journey.

Complementing the sales force, a comprehensive customer service department actively supports both new residents and existing investors. Their role is vital in managing post-sale queries, addressing concerns, and fostering long-term relationships, thereby enhancing the overall ownership experience.

In 2023, Aldar reported significant sales momentum, with over AED 30 billion in sales across its various developments, underscoring the effectiveness of its dedicated customer engagement strategies in driving transaction volumes and customer satisfaction.

Aldar Properties actively cultivates robust community ties through diverse engagement efforts, including tailored resident programs and vibrant events across its portfolio. For instance, in 2024, Aldar hosted over 150 community events, ranging from cultural festivals to wellness workshops, designed to foster a strong sense of belonging among residents.

These initiatives are crucial for enhancing the overall living experience and promoting sustained resident retention. By creating engaging environments, Aldar aims to build loyalty, as evidenced by a 10% year-over-year increase in resident satisfaction scores reported in late 2024, directly linked to these community-focused programs.

Aldar Properties places a high value on open communication with its investors. This is achieved through regular investor presentations, comprehensive annual reports, and timely financial disclosures.

This commitment to transparency fosters trust and ensures stakeholders have access to detailed financial data. It keeps everyone informed about Aldar's performance and its strategic path forward.

For instance, Aldar's 2024 interim results showed a significant increase in recurring revenue, highlighting the success of its long-term strategy and providing concrete data for investor confidence.

Digital Platforms and Self-Service

Aldar Properties heavily leverages digital platforms to enhance customer relationships through self-service options. Online portals and mobile applications provide convenient access for property management, viewing available units, and accessing important information.

This digital-first approach streamlines interactions and empowers customers to manage their property needs independently. For instance, in 2024, Aldar continued to expand its digital offerings, aiming to reduce response times and improve overall customer satisfaction by providing 24/7 access to services.

- Digital Portals: Aldar's online platforms facilitate property viewing, booking, and transaction management.

- Self-Service Features: Customers can access maintenance requests, payment options, and community updates through these digital channels.

- Enhanced Convenience: The focus on digital interaction offers customers greater flexibility and control over their property-related activities.

- Streamlined Processes: Digital tools simplify administrative tasks, leading to a more efficient customer experience.

Long-Term Partnerships with Institutional Clients

Aldar Properties cultivates enduring strategic alliances with its institutional clientele, encompassing investors, commercial tenants, and governmental bodies. These collaborations are built on a foundation of customized service delivery, ensuring that the unique needs of each partner are met. For instance, Aldar's commitment to long-term relationships was evident in its 2023 financial reports, which highlighted a significant portion of recurring revenue derived from its diversified portfolio, underscoring the stability provided by these key partnerships.

These partnerships often feature bespoke solutions and dedicated account management, fostering a sense of trust and mutual benefit. Aldar actively engages in collaborative development and asset management agreements, aligning its strategic objectives with those of its institutional partners. This approach has proven successful, contributing to Aldar's robust financial performance and its reputation as a reliable developer and manager of prime real estate assets in Abu Dhabi.

- Strategic Alliances: Aldar prioritizes long-term partnerships with institutional investors, commercial tenants, and government entities.

- Tailored Solutions: These relationships are characterized by customized offerings designed to meet specific partner requirements.

- Collaborative Frameworks: Aldar engages in joint development and asset management initiatives, fostering shared success.

- Revenue Stability: The strength of these long-term relationships contributes significantly to Aldar's consistent revenue streams, as demonstrated in its financial disclosures.

Aldar Properties prioritizes personalized engagement through dedicated sales teams and a robust customer service department for both new and existing clients. This direct interaction and post-sale support are key to fostering loyalty and enhancing the ownership experience.

The company also cultivates strong community ties through resident programs and events, aiming to build a sense of belonging and improve satisfaction. In 2024 alone, Aldar organized over 150 community events, contributing to a reported 10% year-over-year increase in resident satisfaction scores.

Furthermore, Aldar leverages digital platforms for self-service options, offering customers convenience and control over their property needs. This digital-first approach streamlines interactions and ensures efficient management of customer relationships.

Aldar also fosters enduring strategic alliances with institutional clients, offering tailored solutions and collaborative frameworks that contribute to revenue stability. These partnerships are crucial for the company's consistent financial performance.

Channels

Aldar Properties leverages strategically located direct sales offices and showrooms, acting as vital physical touchpoints for potential buyers. These centers allow prospective customers to experience properties firsthand, engage directly with sales representatives, and facilitate the purchase process, reinforcing Aldar's commitment to customer interaction and a tangible property viewing experience. In 2023, Aldar reported significant sales growth, with off-plan sales reaching AED 13.3 billion, underscoring the effectiveness of these physical sales channels in driving demand and closing deals.

Aldar Properties heavily leverages its official website and social media platforms as key channels to connect with a broad customer base. These digital avenues are crucial for generating interest, providing detailed property information, and facilitating initial customer interactions. In 2023, Aldar reported a significant increase in website traffic and engagement across its social media channels, reflecting the growing importance of digital outreach in the real estate sector.

Online portals and digital marketing efforts allow Aldar to offer immersive experiences like virtual tours, streamlining the property inquiry and even transaction initiation process. This digital-first approach not only enhances customer convenience but also expands Aldar's reach beyond traditional geographical limitations. The company's digital marketing spend in 2024 is projected to further support these initiatives, aiming to capture a larger share of online property searches.

Aldar Properties leverages a robust network of local and international real estate agencies and brokers. This extensive partnership ecosystem is crucial for expanding Aldar's market presence and connecting with a diverse clientele, including a significant portion of international buyers and expatriates seeking property in the UAE.

These collaborations are instrumental in driving sales and achieving deeper market penetration. For instance, in 2024, Aldar reported strong off-plan sales, with a notable contribution from its international broker network, highlighting the effectiveness of these partnerships in reaching global investors.

Investor Roadshows and Industry Events

Aldar Properties actively engages in investor roadshows and industry events to connect with key stakeholders. These gatherings are crucial for Aldar to present its development pipeline and strategic vision to a targeted audience. In 2024, Aldar continued its participation in major global real estate forums, aiming to attract significant capital for its expanding portfolio.

These events serve as vital platforms for Aldar to:

- Showcase new and upcoming projects, highlighting their potential for attractive returns.

- Discuss investment opportunities directly with institutional investors and high-net-worth individuals.

- Network with industry leaders and potential partners, fostering strategic relationships.

- Gain market intelligence and feedback on current real estate trends and investor sentiment.

Strategic Partnerships and Joint Ventures

Aldar Properties actively leverages strategic partnerships and joint ventures to expand its reach and capabilities. By collaborating with major entities such as Mubadala, Dubai Holding, DP World, and Expo City Dubai, Aldar taps into diverse customer bases and new geographical markets. These alliances are crucial for co-developing projects and utilizing integrated sales channels, thereby enhancing market penetration and revenue streams.

These strategic alliances are not just about market access; they also facilitate shared risk and capital investment in large-scale projects. For instance, Aldar's collaboration with Dubai Holding on the Ras Al Khor development exemplifies this, combining expertise and resources to create significant urban regeneration projects. This approach allows Aldar to undertake more ambitious ventures than it might alone.

The benefits of these joint ventures are evident in Aldar's project pipeline and financial performance. In 2024, Aldar continued to announce and progress several key joint venture developments, contributing significantly to its revenue growth and asset diversification. These partnerships are a cornerstone of Aldar's strategy for sustained growth and market leadership in the UAE real estate sector.

- Expanded Market Access: Partnerships provide entry into new customer segments and markets through co-development and sales initiatives.

- Risk Sharing and Capital Efficiency: Joint ventures allow Aldar to share the financial burden and risks associated with large-scale development projects.

- Synergistic Expertise: Collaborations enable Aldar to combine its development expertise with the unique strengths of its partners, leading to more innovative and successful projects.

- Enhanced Sales and Distribution: Integrated sales channels through partners amplify Aldar's reach and customer engagement, driving sales performance.

Aldar Properties utilizes a multi-faceted channel strategy, encompassing both direct and indirect sales approaches to maximize market reach and customer engagement. This includes physical sales offices, digital platforms, real estate agencies, and strategic partnerships, all contributing to a comprehensive customer journey and sales funnel.

The company's digital presence, including its website and social media, plays a crucial role in lead generation and information dissemination, complemented by immersive online experiences like virtual tours. In 2024, Aldar's digital marketing investment is expected to further enhance its online visibility and customer interaction capabilities.

Furthermore, Aldar's extensive network of local and international real estate brokers, alongside strategic joint ventures with entities like Mubadala and Dubai Holding, significantly amplifies its market access and sales distribution, driving substantial off-plan sales, which reached AED 13.3 billion in 2023.

| Channel | Description | Key Benefit | 2023 Performance Indicator |

|---|---|---|---|

| Direct Sales Offices/Showrooms | Physical locations for property viewing and sales interaction. | Tangible customer experience, direct engagement. | Significant contributor to AED 13.3 billion off-plan sales. |

| Official Website & Social Media | Digital platforms for information, lead generation, and engagement. | Broad reach, detailed information, initial customer contact. | Increased website traffic and social media engagement. |

| Online Portals & Digital Marketing | Virtual tours, online inquiries, and digital advertising. | Customer convenience, expanded geographical reach. | Projected increased digital marketing spend in 2024. |

| Real Estate Agencies/Brokers | Partnerships with external sales professionals. | Expanded market presence, access to international buyers. | Notable contribution to international off-plan sales in 2024. |

| Strategic Partnerships/Joint Ventures | Collaborations with other developers and entities. | New market access, risk sharing, synergistic expertise. | Continued announcement and progress of JV developments in 2024. |

Customer Segments

Individual Homebuyers, both UAE nationals and expatriate residents, represent a core customer segment for Aldar Properties. This group is actively looking for primary residences, spanning a wide spectrum from more affordable housing options to premium luxury villas and apartments.

Aldar's strategy involves catering to these diverse needs by offering a broad range of property types and fostering various community living experiences. For instance, in 2024, the Abu Dhabi real estate market saw continued demand, with Aldar reporting strong sales performance across its residential communities, reflecting the ongoing interest from this buyer demographic.

Aldar Properties attracts a diverse range of institutional and private investors, including global investment funds, significant high-net-worth individuals, and family offices. These investors are primarily drawn to Aldar's portfolio for its potential for stable income generation and long-term capital appreciation within the real estate sector.

This investor base shows a keen interest in Aldar's established income-generating assets, such as its leased properties and recurring revenue streams. They also actively seek opportunities in Aldar's pipeline of new development projects, recognizing the potential for growth and value creation.

Aldar Properties caters to a broad spectrum of retail and commercial tenants. This includes major international brands and local small to medium-sized enterprises (SMEs) looking for prime locations within Aldar's diverse portfolio, which encompasses shopping malls, contemporary office towers, and integrated mixed-use communities.

These businesses prioritize high-traffic areas, state-of-the-art facilities, and the synergistic benefits of being part of a well-established community. In 2024, Aldar continued to enhance its retail offerings, with its flagship Yas Mall attracting millions of visitors, underscoring the appeal of its prime locations for commercial success.

Government and Semi-Government Entities

Aldar Properties collaborates extensively with government and semi-government entities, particularly in Abu Dhabi, to drive significant urban development and infrastructure projects. These partnerships are crucial for realizing the emirate's strategic vision.

These government bodies are key customers for Aldar, engaging the company for its expertise in developing large-scale projects that align with national objectives. This includes infrastructure development, national housing programs, and the creation of essential public facilities.

For instance, Aldar's role in the Reem Mall project, a significant retail and entertainment destination, involved close coordination with Abu Dhabi government entities to ensure its integration into the city's master plan. Furthermore, Aldar's commitment to Abu Dhabi's Economic Vision 2030 is exemplified through its participation in various government-led initiatives aimed at diversifying the economy and enhancing quality of life.

- Strategic Partnerships: Aldar frequently partners with government entities for major infrastructure and urban planning projects, aligning with Abu Dhabi's long-term development goals.

- National Initiatives: The company plays a vital role in government-backed housing programs and the development of public amenities, contributing to social infrastructure.

- Key Stakeholders: Government bodies are instrumental in approving and facilitating large-scale developments, making them critical customers and collaborators for Aldar.

International Buyers and Foreign Investors

International buyers and foreign investors represent a significant and expanding customer segment for Aldar Properties, especially in the luxury property market. This group is drawn to the UAE by its advantageous business environment, robust investment security, and attractive lifestyle. Aldar strategically engages this demographic through targeted international marketing campaigns and collaborations with global real estate broker networks.

In 2024, the UAE's real estate market, particularly in Abu Dhabi where Aldar is a dominant player, continued to see strong interest from overseas investors. For instance, Abu Dhabi's real estate sector recorded robust transaction volumes in early 2024, with foreign investment playing a notable role. Aldar's focus on this segment is underscored by its participation in international property expos and partnerships with international agencies to showcase its premium developments.

- Growing Demand: International interest in UAE luxury real estate is a key driver for Aldar.

- Key Attractors: Business-friendly policies, investment security, and lifestyle quality are primary draws.

- Targeted Approach: Aldar utilizes global marketing and broker networks to reach this segment.

- Market Performance: Early 2024 data indicates sustained foreign investment interest in Abu Dhabi's property market.

Aldar Properties serves a dual customer base in the residential sector: individual homebuyers seeking primary residences and institutional investors looking for portfolio growth. The individual segment spans UAE nationals and expatriates, from first-time buyers to those seeking luxury properties, reflecting a broad market appeal. In 2024, Aldar's robust sales performance in Abu Dhabi's thriving real estate market highlights the consistent demand from these diverse homebuyer profiles.

Institutional investors, including global funds and high-net-worth individuals, are drawn to Aldar for its stable income-generating assets and development pipeline. They prioritize Aldar's established properties and new projects for their capital appreciation potential. This segment's interest underscores Aldar's ability to attract significant capital through its diversified real estate offerings.

Commercial tenants, ranging from international brands to local SMEs, are key customers for Aldar's retail and office spaces. These businesses seek prime locations within Aldar's mixed-use developments, such as Yas Mall, which saw millions of visitors in 2024. High foot traffic and modern facilities are critical for their success, making Aldar's strategically located properties highly desirable.

Government and semi-government entities are crucial partners and customers for Aldar, particularly for large-scale urban and infrastructure projects. These collaborations are vital for realizing Abu Dhabi's development vision, including national housing programs and public facility creation. Aldar's role in projects aligned with Abu Dhabi's Economic Vision 2030 demonstrates this critical relationship.

International buyers represent a growing segment, attracted by the UAE's business environment and lifestyle. Aldar targets this demographic through global marketing and partnerships, capitalizing on strong foreign investment trends observed in Abu Dhabi's real estate market in early 2024. This international focus is supported by Aldar's participation in global property events.

Cost Structure

Aldar Properties dedicates a substantial portion of its capital to acquiring prime land parcels for its extensive development projects. These land acquisition costs are a critical component of their overall expense structure, directly impacting project feasibility and profitability.

In 2024, Aldar continued its strategic land acquisition, notably securing a significant plot in Abu Dhabi's Al Falah area for AED 1.1 billion. This investment underscores the company's commitment to expanding its development pipeline in key growth corridors.

Construction and Development Expenses are a significant component of Aldar Properties' cost structure, encompassing all direct outlays for bringing projects to fruition. These costs include essential elements like raw materials, skilled labor, payments to sub-contractors, and the rental or purchase of specialized machinery and equipment.

These expenditures are particularly substantial for Aldar, given their extensive portfolio of residential, commercial, and mixed-use developments across the UAE. For instance, Aldar's 2024 financial reports highlight substantial investments in ongoing construction projects, reflecting the capital-intensive nature of property development.

Aldar Properties incurs significant costs in sales, marketing, and administration to drive property transactions and maintain operations. These include expenses for extensive marketing campaigns, sales commissions paid to agents, and the operational costs of maintaining sales centers. In 2024, Aldar continued to invest heavily in digital marketing and brand building to reach a wider audience.

General administrative expenses are also a crucial component, encompassing salaries for a large workforce, office rent for multiple locations, and essential utilities. These overheads are vital for the smooth functioning of the company, supporting the sales and marketing efforts and ensuring overall business efficiency.

Operational and Maintenance Costs for Investment Properties

Aldar Properties incurs significant operational and maintenance costs to ensure its income-generating properties, such as malls, offices, and hotels, remain attractive and functional. These expenses are critical for tenant retention and maximizing rental income, directly impacting profitability. In 2024, Aldar continued to focus on efficient property management to control these outflows.

Key expenditures include:

- Utilities: Costs associated with electricity, water, and HVAC systems for all managed properties.

- Staffing: Salaries for property management teams, including leasing agents, maintenance personnel, and administrative staff.

- Maintenance & Repairs: Regular upkeep, preventative maintenance, and necessary repairs to building structures, systems, and amenities.

- Security & Cleaning: Services to ensure the safety and cleanliness of all commercial and residential spaces.

Financing Costs and Debt Servicing

Aldar Properties incurs significant financing costs related to its substantial debt portfolio. These costs primarily include interest payments on loans and bonds used to fund development projects and acquisitions. In 2024, the company's financial strategy involves managing this debt effectively to support its growth initiatives.

The company's commitment to expansion means a continuous need for capital, which is often secured through various financial instruments. This necessitates careful management of interest expenses to maintain profitability.

- Interest Expenses: Payments made on outstanding loans and issued bonds are a core component of financing costs.

- Debt Servicing: Costs associated with managing and repaying the principal and interest on borrowed funds.

- Capital Structure Management: Aldar actively manages its debt levels and types of financing to optimize its cost of capital.

Aldar Properties' cost structure is heavily influenced by land acquisition, construction, and development expenses. These are significant capital outlays, as seen in their 2024 acquisition of land in Al Falah for AED 1.1 billion. Marketing, sales, and administrative overheads are also substantial, supporting their broad operational reach and brand presence.

Operational and maintenance costs for their income-generating assets, including utilities, staffing, and repairs, are crucial for sustained revenue. Financing costs, particularly interest on debt used for expansion, represent another key expenditure area that Aldar actively manages.

| Cost Category | Description | 2024 Impact (Illustrative) |

| Land Acquisition | Costs for securing development sites. | AED 1.1 billion (Al Falah acquisition) |

| Construction & Development | Materials, labor, sub-contractors, equipment. | Significant, reflecting ongoing projects. |

| Sales, Marketing & Admin | Advertising, commissions, salaries, office costs. | Ongoing investment in digital marketing and brand. |

| Operations & Maintenance | Utilities, staff, repairs, security for managed properties. | Focus on efficiency to control outflows. |

| Financing Costs | Interest on loans and bonds. | Managed to support growth initiatives. |

Revenue Streams

Aldar Properties' main income source is selling properties they've built. This covers everything from apartments and villas for people to live in, to office buildings and shops for businesses. They make money both when a project is still being planned and when it's all finished and ready to move into.

In 2023, Aldar reported significant property sales, with AED 12.7 billion in revenue from their development segment. This highlights the strong demand for their residential and commercial offerings in the UAE market.

Aldar Properties generates recurring revenue through its extensive portfolio of investment properties, which are leased out to generate consistent cash flow. These assets include prominent retail destinations like Yas Mall, prime commercial office spaces, and a substantial number of residential rental units.

In 2024, Aldar's rental income segment is a cornerstone of its financial stability, demonstrating the value of its diversified real estate holdings. The company's commitment to maintaining high occupancy rates across its retail, commercial, and residential segments directly translates into predictable and reliable revenue streams, underscoring the strength of this business model component.

Aldar Properties generates significant revenue through property and facilities management fees. These fees are collected for overseeing both Aldar's own portfolio of residential communities, commercial properties, and infrastructure, as well as for managing assets on behalf of third-party clients. This dual approach allows Aldar to leverage its expertise across a wider range of properties.

In 2024, Aldar's commitment to enhancing its recurring revenue streams, including management fees, was evident. The company continued to expand its managed portfolio, reflecting strong demand for its services. This segment of their business model is crucial for stable, predictable income, underpinning their overall financial performance and strategic growth.

Hospitality and Leisure Operations

Aldar Properties generates revenue from its hospitality and leisure operations, which include hotels, golf courses, marinas, and beach clubs situated within its master-planned communities. This segment plays a crucial role in diversifying Aldar's income sources beyond just property development and sales.

In 2024, Aldar continued to focus on enhancing its hospitality offerings, aiming to capture a larger share of the tourism and leisure market. The company’s integrated approach ensures that these leisure assets complement its residential and retail developments, creating a holistic lifestyle experience for residents and visitors alike.

- Diversified Income: Revenue from hotels, golf courses, marinas, and beach clubs provides a stable and recurring income stream, reducing reliance on cyclical property sales.

- Integrated Community Value: These leisure facilities enhance the desirability and value of Aldar's residential communities, attracting a premium customer base.

- Operational Performance: In the first half of 2024, Aldar's hospitality segment reported strong performance, driven by increased occupancy rates and average daily rates across its hotel portfolio.

- Strategic Expansion: Aldar is strategically expanding its leisure portfolio, with new projects and enhancements planned to cater to growing demand in Abu Dhabi's tourism sector.

Development and Advisory Fees

Aldar Properties generates revenue through development and advisory fees, offering its extensive expertise to government entities and strategic partners. This income stream is generated by providing services such as development management, project management, and specialized advisory support, extending Aldar's reach beyond its proprietary projects.

These fees are a testament to Aldar's established reputation and deep knowledge within the real estate development sector. For instance, in 2023, Aldar continued to secure and execute significant government-related projects, contributing to this revenue segment. The company's ability to manage complex, large-scale developments for third parties underscores its value proposition.

- Development Management: Fees earned for overseeing the entire lifecycle of a development project, from conception to completion, on behalf of clients.

- Project Management: Income generated from managing specific aspects of construction and development, ensuring projects are delivered on time and within budget.

- Advisory Services: Revenue derived from providing strategic guidance, feasibility studies, and market analysis to partners and government bodies.

Aldar Properties diversifies its revenue through a robust portfolio of recurring income streams, primarily from its investment properties. These include prime retail spaces, commercial offices, and a substantial residential leasing segment, all contributing to stable cash flow. The company's strategic focus on enhancing these recurring revenue sources, including management fees for both its own and third-party assets, underscores its commitment to predictable financial performance.

Aldar's hospitality and leisure operations, encompassing hotels, golf courses, and marinas, further diversify its income. These leisure assets not only generate direct revenue but also enhance the appeal of Aldar's residential communities. In the first half of 2024, Aldar's hospitality segment saw strong performance, with increased occupancy and average daily rates contributing positively to its overall financial results.

Additionally, Aldar leverages its extensive expertise by earning development and advisory fees from government entities and strategic partners. This segment, which includes development and project management services, highlights Aldar's established reputation and its capacity to manage large-scale projects for third parties. In 2023, the company continued to secure and execute significant government-related projects, bolstering this revenue stream.

| Revenue Stream | Description | 2023/2024 Data Point |

| Property Sales | Revenue from selling residential and commercial properties. | AED 12.7 billion in development revenue (2023). |

| Rental Income | Recurring revenue from leased investment properties (retail, office, residential). | Strong performance and high occupancy rates across segments (2024). |

| Management Fees | Fees for managing Aldar's and third-party properties and infrastructure. | Continued expansion of managed portfolio (2024). |

| Hospitality & Leisure | Income from hotels, golf courses, marinas, and beach clubs. | Strong performance with increased occupancy and ADR (H1 2024). |

| Development & Advisory Fees | Fees for development management, project management, and advisory services. | Continued execution of government-related projects (2023). |

Business Model Canvas Data Sources

The Aldar Properties Business Model Canvas is built upon a foundation of robust market research, internal financial reports, and strategic analyses of the real estate sector. These diverse data sources ensure each component of the canvas accurately reflects current market conditions and Aldar's strategic positioning.