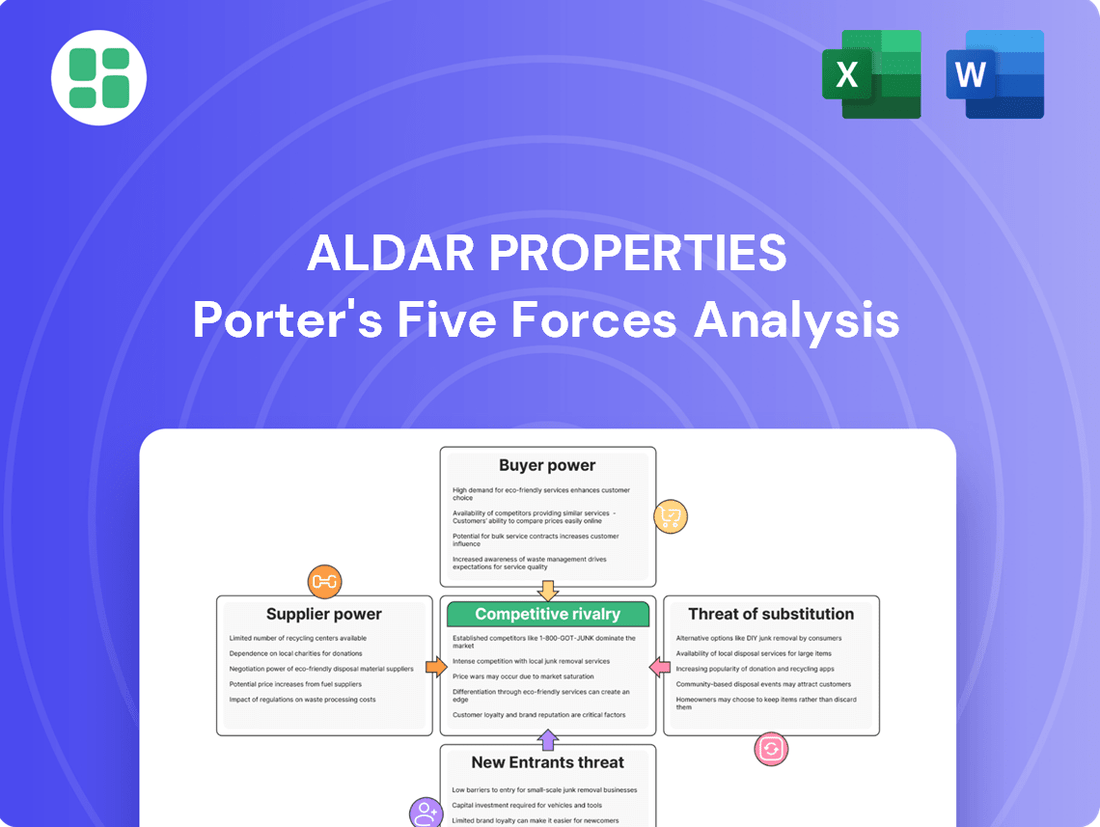

Aldar Properties Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aldar Properties Bundle

Aldar Properties navigates a dynamic real estate landscape, facing considerable buyer power from discerning customers and intense rivalry from established developers. Understanding these forces is crucial for strategic advantage.

This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Aldar Properties’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Aldar Properties, a significant player in the real estate sector, depends on a wide array of suppliers for construction, materials like cement and steel, and specialized services. Even though the broader market may feature many suppliers, a few providers of specialized or premium materials can wield considerable influence if alternatives are scarce or their products are unique.

Aldar's substantial project volumes enable it to leverage bulk purchasing and establish long-term agreements, which can effectively diminish the bargaining power of its suppliers. For instance, in 2023, Aldar secured significant supply chain partnerships, with procurement volumes for major projects exceeding AED 5 billion, demonstrating their ability to negotiate favorable terms due to scale.

Switching costs for Aldar Properties are significant in construction, particularly for large, integrated projects. Disrupting a supplier mid-stream can trigger substantial delays, escalate costs, and compromise quality, thus fostering reliance on existing partnerships.

Aldar's proactive supply chain management and rigorous pre-qualification of vendors, alongside material standardization, are designed to mitigate these inherent switching cost risks. For instance, in 2023, Aldar awarded Dh12 billion in construction contracts, highlighting the scale of supplier relationships that would incur high switching costs if altered.

The uniqueness of inputs significantly impacts Aldar Properties' supplier bargaining power. Prime land parcels in Abu Dhabi, often controlled by government-related entities, represent a unique and scarce resource, giving these land suppliers substantial leverage. This scarcity means Aldar has limited alternatives when acquiring prime development locations.

While many construction materials are standardized, specialized inputs like high-end finishes or advanced smart home technologies can be unique. Suppliers offering these specific, often proprietary, services or products gain considerable bargaining power. For instance, in 2024, the demand for sustainable and technologically advanced building materials saw a notable increase, empowering suppliers in these niche segments.

Threat of Forward Integration by Suppliers

While the real estate sector generally sees a low threat of suppliers integrating forward into property development, large construction firms or material suppliers could theoretically enter this space. However, the substantial capital, intricate market understanding, and development expertise needed are significant barriers. For instance, in 2024, the average cost of developing a mid-rise residential building in Abu Dhabi, Aldar's primary market, can easily run into hundreds of millions of dollars, a prohibitive investment for most raw material suppliers.

Aldar Properties, with its established track record and diversified business model encompassing development, sales, and property management, is well-positioned to mitigate this risk. Their deep understanding of market demand, regulatory landscapes, and customer preferences provides a competitive advantage that is difficult for upstream suppliers to replicate. This integrated approach makes Aldar a formidable player, further diminishing the likelihood of successful forward integration by its suppliers.

- Complexity and Capital Intensity: Real estate development requires substantial upfront capital and specialized knowledge, acting as a significant deterrent for suppliers.

- Aldar's Integrated Model: Aldar's comprehensive business operations, from construction to sales and management, create a strong competitive moat.

- Market Expertise: Aldar's deep understanding of the Abu Dhabi real estate market, including customer needs and regulatory frameworks, is a key differentiator.

Importance of Aldar to Suppliers

Aldar's extensive project pipeline, encompassing significant developments like the Yas Island master plan and ongoing residential and commercial projects, translates into substantial and consistent demand for a wide array of materials and services. This consistent, high-volume business makes Aldar a crucial client for many suppliers within the UAE and even on an international scale.

This considerable purchasing power grants Aldar significant leverage in its negotiations with suppliers. The company can often secure more favorable terms, including bulk purchase discounts and priority service, due to the sheer volume of business it represents. For instance, in 2023, Aldar awarded numerous contracts for construction materials and services, highlighting its consistent demand.

Suppliers recognize the strategic importance of maintaining robust relationships with a dominant market player like Aldar Properties. Their reliance on Aldar's consistent project flow means they are incentivized to offer competitive pricing and reliable service to retain this valuable business.

- Aldar's Project Pipeline: Aldar's commitment to delivering a diverse portfolio of projects, including residential, commercial, and leisure destinations, ensures a continuous need for supplier inputs.

- Negotiating Power: The scale of Aldar's procurement allows it to negotiate favorable terms, impacting costs for materials like concrete, steel, and specialized construction services.

- Supplier Dependence: Many suppliers in the region view Aldar as a cornerstone client, making them keen to offer competitive advantages to secure and maintain their business.

The bargaining power of suppliers for Aldar Properties is generally moderate, influenced by the availability of substitute materials and the concentration of suppliers in specific segments. While Aldar's scale provides leverage, the uniqueness of certain inputs, particularly prime land, can shift power towards suppliers.

Aldar's substantial procurement volumes, exceeding AED 5 billion in supply chain partnerships in 2023, allow for strong negotiation on standard materials. However, specialized inputs, like advanced smart home technology, saw increased demand in 2024, empowering niche suppliers.

The threat of forward integration by suppliers is low due to the immense capital and expertise required for property development, with average Abu Dhabi mid-rise building costs in the hundreds of millions of dollars in 2024.

Aldar's integrated business model and deep market knowledge further reduce supplier leverage, as these capabilities are difficult for upstream entities to replicate.

| Factor | Impact on Aldar | 2023/2024 Data Point |

|---|---|---|

| Supplier Concentration | Moderate; depends on material type. | Dh12 billion in construction contracts awarded in 2023. |

| Uniqueness of Inputs | High for prime land; low for standard materials. | Increased demand for specialized building materials in 2024. |

| Switching Costs | Significant for large projects. | Disruption can cause substantial delays and cost escalations. |

| Forward Integration Threat | Low due to capital and expertise barriers. | High development costs deter raw material suppliers. |

What is included in the product

This analysis delves into the competitive forces shaping Aldar Properties' market, examining the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes.

Instantly identify and strategize against competitive pressures with a dynamic Porter's Five Forces model, allowing Aldar Properties to proactively address market challenges.

Customers Bargaining Power

Customer price sensitivity in Abu Dhabi's real estate market varies significantly. For high-value residential and commercial properties, buyers in the luxury segment tend to be less affected by price fluctuations. However, those in the mid-market segments are considerably more influenced by pricing, the availability of attractive financing options, and the overall value proposition offered.

The competitive landscape and the constant introduction of new projects directly impact this sensitivity. For instance, a surplus of new developments can empower buyers to negotiate more aggressively on price, particularly in segments where demand is not exceptionally high. Aldar Properties must continuously monitor market supply and demand dynamics to gauge evolving customer price sensitivity.

Customers considering property purchases in Abu Dhabi have a wide array of choices. Beyond Aldar's developments, they can explore projects from other developers within Abu Dhabi, or look at properties in neighboring Emirates like Dubai, which often presents a competitive market. Furthermore, the option to rent rather than buy provides another significant alternative, especially in fluctuating market conditions.

The Abu Dhabi real estate landscape in 2024 was marked by a significant influx of new residential developments, substantially broadening the options available to potential buyers. This increased supply directly enhances the bargaining power of customers, as they have more comparable properties to choose from, allowing them to be more selective and potentially negotiate better terms.

Aldar Properties actively mitigates this customer bargaining power by strategically diversifying its property portfolio across various segments, including residential, commercial, and leisure. By developing integrated communities that offer a comprehensive lifestyle experience, Aldar aims to create unique value propositions that differentiate its offerings from standalone projects, thereby reducing the perceived substitutability for customers.

Buyer information and market transparency significantly influence Aldar Properties' customer bargaining power. Initiatives like the Abu Dhabi Rental Index, launched in 2024, alongside the proliferation of online property portals, have dramatically increased market transparency. This readily available data empowers potential buyers by providing insights into prevailing market prices, rental yields, and competitor offerings.

With a clearer understanding of the market landscape, customers are better equipped to negotiate terms, potentially leading to increased price sensitivity and a stronger bargaining position. Aldar's commitment to transparency, by providing detailed project information and pricing structures, aims to build trust and manage customer expectations in this informed environment.

Differentiation of Aldar's Properties

Aldar Properties significantly mitigates customer bargaining power through robust differentiation. By focusing on prime locations, such as Yas Island and Saadiyat Island, and offering premium quality construction, Aldar creates unique, highly desirable properties. This strategic approach means customers are not just buying a house, but a lifestyle within an integrated community, complete with world-class amenities.

This focus on creating 'world-class destinations' rather than just residential units directly reduces the substitutability of Aldar's offerings. For instance, Aldar's 2023 revenue reached AED 11.4 billion, showcasing strong demand for its differentiated products. By offering integrated community features and unparalleled amenities, Aldar lessens the ability of customers to easily switch to competitors offering more generic real estate.

The strategy of developing master-planned communities with extensive lifestyle offerings, like entertainment, retail, and hospitality, further solidifies Aldar's market position. This comprehensive approach makes direct price comparisons difficult for customers, as they are evaluating an entire ecosystem, not just a square meter of living space. This reduces the bargaining power of individual buyers who might otherwise seek lower prices from less developed competitors.

- Strategic Locations: Aldar's presence in prime Abu Dhabi areas like Yas Island and Saadiyat Island enhances property value and desirability.

- Premium Quality and Amenities: Investment in high-quality construction and world-class facilities sets Aldar properties apart from standard offerings.

- Integrated Community Features: The development of comprehensive lifestyle ecosystems, including retail and entertainment, reduces buyer focus on price alone.

- Brand Reputation: Aldar's established reputation as a developer of premium destinations strengthens its pricing power and customer loyalty.

Volume of Purchases by Individual Customers

For individual residential buyers, the volume of purchase is typically one or a few units, which inherently limits their individual bargaining power. This means that on their own, these buyers have less sway over pricing or terms.

However, the landscape shifts significantly for large commercial clients or institutional investors. When these entities purchase multiple units or even entire buildings, their substantial volume grants them considerable leverage. This can translate into demands for bulk discounts or customized deal structures.

Aldar Properties has observed a notable trend with increasing sales to international and expatriate buyers. These buyers represented a substantial portion of Aldar's sales in 2024 and are projected to continue this trend into 2025, indicating robust demand that somewhat counterbalances the limited individual buyer volume.

- Limited Individual Buyer Impact: Most individual residential buyers purchase one or a few units, reducing their direct bargaining power.

- Institutional Buyer Leverage: Large commercial clients and institutional investors, by purchasing multiple units or entire buildings, gain significant negotiation leverage.

- 2024/2025 Demand Trend: Aldar's sales data for 2024 and projections for 2025 show a strong contribution from international and expatriate buyers, highlighting market demand despite individual buyer limitations.

The bargaining power of customers for Aldar Properties is influenced by the availability of alternatives and the transparency of market information. In 2024, a significant increase in new residential developments in Abu Dhabi broadened buyer choices, enhancing their ability to negotiate. Online property portals and initiatives like the Abu Dhabi Rental Index in 2024 also increased market transparency, empowering buyers with more data to inform their decisions and potentially strengthen their negotiating position.

Aldar Properties actively counters this by differentiating its offerings through prime locations, premium quality, and integrated community features, creating unique value propositions. For instance, Aldar's 2023 revenue of AED 11.4 billion demonstrates strong demand for its distinct developments, making direct price comparisons with competitors more challenging for buyers.

While individual residential buyers have limited bargaining power due to the volume of their purchases, large commercial clients and institutional investors wield significant leverage. Aldar's sales in 2024 and projections for 2025 indicate robust demand from international and expatriate buyers, which helps to balance the influence of individual purchasers.

| Factor | Impact on Aldar's Customer Bargaining Power | Aldar's Mitigation Strategy |

|---|---|---|

| Availability of Alternatives | High; increased supply in 2024 provided more choices. | Portfolio diversification, integrated community development. |

| Market Information Transparency | Moderate to High; increased data access empowers buyers. | Commitment to transparency in project information and pricing. |

| Buyer Volume | Low for individuals; High for institutional buyers. | Focus on differentiated offerings, leveraging strong demand from international buyers. |

What You See Is What You Get

Aldar Properties Porter's Five Forces Analysis

This preview showcases the complete Aldar Properties Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the real estate sector. You are viewing the actual, professionally compiled document that will be instantly accessible upon purchase, ensuring you receive the full, unedited analysis.

Rivalry Among Competitors

The Abu Dhabi real estate sector is characterized by a competitive landscape, featuring a number of established developers vying for market share alongside Aldar Properties. While Aldar holds a significant position, bolstered by its extensive land reserves and key alliances with the government, other local and international firms are actively participating in the market.

As of early 2024, Aldar Properties reported a substantial development pipeline, including over 70,000 residential units across Abu Dhabi and Dubai, underscoring its scale. However, competitors such as Eagle Hills, Bloom Properties, and IMKAN Properties are also developing prominent projects, contributing to a dynamic market environment where new ventures are consistently introduced by various stakeholders.

The Abu Dhabi real estate market is experiencing a robust growth trajectory, with residential rents surging by 20% and sales prices increasing by 11% in 2024. This expansion, projected to continue strongly into the first half of 2025, can temper competitive rivalry by broadening the demand base for all market participants.

While this growth is beneficial, the anticipated influx of new supply in 2025 and subsequent years poses a potential challenge. If this new inventory outpaces demand, it could heighten competitive pressures among developers and property owners, potentially impacting market share and pricing power.

Competitors in the real estate market differentiate their offerings through a variety of strategies, including the type of property developed, such as luxury residences versus more affordable housing options. Location is another key differentiator, as is the unique design and the array of amenities provided to residents and users.

Aldar Properties has carved out a distinct market position by focusing on the development of integrated, mixed-use communities and by undertaking iconic, landmark projects. This approach provides a strong point of differentiation against competitors who may offer more standardized developments.

Despite Aldar's strategic focus, other developers are also actively pursuing unique selling propositions to capture market share. This leads to a dynamic competitive landscape where differentiation efforts vary significantly across different segments of the real estate market, influencing overall competitive intensity.

Exit Barriers for Existing Players

Exit barriers for Aldar Properties are substantial, primarily due to the immense capital tied up in land acquisition and ongoing development projects. These long development cycles, often spanning several years, make it difficult for companies to quickly divest assets or exit the market without incurring significant losses.

This high capital commitment and the extended timelines mean that even during economic downturns, existing players are compelled to remain in the market, intensifying competitive rivalry. Aldar's robust revenue backlog, which stood at AED 13.3 billion as of Q3 2024, and its strategic investments in new ventures underscore a deep commitment to the sector, further reinforcing these high exit barriers.

- High Capital Investment: Real estate development requires substantial upfront capital for land purchase, construction, and marketing, creating a significant barrier to exit.

- Long Development Cycles: The multi-year nature of property development projects means capital remains locked in for extended periods, discouraging rapid exits.

- Commitment to Projects: Aldar's significant revenue backlog (AED 13.3 billion as of Q3 2024) signifies ongoing commitments that prevent swift market withdrawal.

- Strategic Investments: Aldar's continuous strategic investments in new projects and diversification efforts further entrench its position, raising exit barriers for both itself and its competitors.

Industry Concentration and Market Leadership

Aldar Properties commands a dominant presence in Abu Dhabi's real estate sector, bolstered by its extensive land reserves and varied project offerings. This market concentration, evidenced by record sales and profit surges in 2024 and the first half of 2025, enables Aldar to significantly shape market dynamics and pricing strategies.

While Aldar's leadership is clear, it doesn't operate in a vacuum. The company still contends with competition from other well-funded developers who are actively participating in the market. For instance, Aldar reported AED 15.7 billion in sales in 2024, showcasing its strong performance against a backdrop of market activity.

- Market Leadership: Aldar's substantial landbank and diverse portfolio in Abu Dhabi solidify its leading position.

- Financial Strength: Record sales of AED 15.7 billion in 2024 and continued growth in H1 2025 underscore Aldar's financial prowess.

- Competitive Landscape: Despite its dominance, Aldar faces rivalry from other well-capitalized developers in the region.

- Market Influence: Aldar's scale allows it to influence industry trends and pricing, though competitive pressures remain.

The competitive rivalry within Abu Dhabi's real estate sector is significant, with Aldar Properties facing established local and international developers. Despite Aldar's market leadership, evidenced by AED 15.7 billion in sales in 2024, other firms like Eagle Hills and Bloom Properties are actively developing projects, contributing to a dynamic market. While market growth, with residential rents up 20% in 2024, can temper rivalry, the anticipated new supply in 2025 could intensify competition and impact pricing power.

| Competitor | Key Projects/Focus | Market Presence |

| Aldar Properties | Integrated mixed-use communities, landmark projects | Dominant in Abu Dhabi, significant development pipeline |

| Eagle Hills | Residential and hospitality projects | Active developer in the region |

| Bloom Properties | Residential and commercial developments | Growing presence with diverse projects |

| IMKAN Properties | Residential and lifestyle communities | Focus on unique design and resident experience |

SSubstitutes Threaten

The availability of rental properties presents a significant threat of substitutes for Aldar Properties. Renting offers a direct alternative to purchasing a home, particularly for individuals prioritizing flexibility or those with shorter-term residency plans.

In 2024, Abu Dhabi's rental market experienced robust activity, with average rental prices for apartments seeing an increase of approximately 15-20% year-on-year, according to various real estate reports. This upward trend in rental demand underscores the attractiveness of renting as a viable option for a broad segment of the population.

The continued strength and increasing affordability of rental options can divert potential buyers away from Aldar's property sales, impacting demand for new developments and existing inventory.

Investors can choose to put their money into other areas like stocks and bonds, or even property in different countries. The appeal of these options hinges on how they compare to Abu Dhabi real estate in terms of potential returns and the risks involved. For instance, in 2024, global equity markets have shown varying performance, with some regions offering higher potential growth but also increased volatility.

Aldar Properties counters this by highlighting its strong rental income and the possibility of property values increasing. This strategy aims to keep Aldar's real estate offerings attractive when weighed against the performance of other investment avenues. The company's focus on delivering consistent rental yields is crucial in maintaining competitiveness against alternative asset classes.

The threat of substitutes for Aldar Properties' offerings, particularly in Abu Dhabi, is primarily represented by property markets in other UAE Emirates, most notably Dubai. Potential buyers might opt for Dubai due to perceived lifestyle advantages, varying price structures, or distinct investment prospects.

However, Abu Dhabi is increasingly competitive, with attractive pricing and a growing international buyer base, bolstered by supportive government policies. For instance, Abu Dhabi's real estate market saw a significant increase in foreign investment in 2023, with transactions reaching AED 100 billion, indicating a strengthening position against substitutes.

Alternative Living Arrangements

The threat of substitutes for Aldar Properties' core residential developments is moderate. Alternative living arrangements like co-living spaces, serviced apartments, and extended-stay hotels can appeal to specific segments, particularly mobile professionals or those seeking short-term accommodations. For instance, the global co-living market was projected to reach approximately $10 billion by 2025, indicating a growing demand for non-traditional housing.

While these substitutes might not directly compete with Aldar's large-scale community projects, they address niche lifestyle needs. Aldar's own hospitality portfolio, which includes serviced apartments and hotels, can potentially capture some of this demand, thereby mitigating the threat. However, the increasing popularity of flexible living solutions means Aldar must continue to innovate in its residential offerings to remain competitive.

- Co-living spaces offer a community-focused, often furnished, living experience.

- Serviced apartments provide hotel-like amenities with residential space, ideal for longer stays.

- Extended-stay hotels cater to travelers needing accommodation for weeks or months.

- Aldar's hospitality segment, which includes serviced apartments, can capture some of this demand.

Shifts in Lifestyle or Work Patterns

Long-term shifts in lifestyle, such as the increasing prevalence of remote work, can reduce the demand for traditional, permanent property ownership. This trend might lead individuals to question the necessity of owning a physical home, potentially increasing the appeal of rental or flexible living arrangements as substitutes.

While still a developing threat, these macro-level changes in how and where people live and work could significantly influence the demand for Aldar's core residential property offerings. For instance, a sustained increase in remote work could lessen the need for commuting-centric housing, impacting sales of properties in traditional urban centers.

Aldar Properties is actively addressing this by developing diverse communities that cater to evolving lifestyle needs. This includes exploring mixed-use developments and properties that offer greater flexibility, aiming to mitigate the threat of substitutes by aligning their portfolio with changing consumer preferences.

For example, in 2024, the UAE government continued to promote initiatives supporting remote work and flexible employment, a trend that could accelerate the shift away from traditional homeownership models. Aldar's strategic diversification into areas like hospitality and education also serves as a buffer against potential downturns in the residential sector.

The threat of substitutes for Aldar Properties is primarily driven by the availability of rental properties and alternative investment avenues. In 2024, Abu Dhabi's rental market saw robust activity, with apartment rental prices increasing by an estimated 15-20% year-on-year, making renting an attractive option for many. This trend can divert potential buyers from Aldar's sales, impacting demand for new and existing properties.

Investors also consider other asset classes like stocks and bonds, or even real estate in different regions. For instance, global equity markets in 2024 presented varied performance, with some offering higher growth but also increased volatility compared to Aldar's property offerings.

Aldar counters this by emphasizing its strong rental income streams and potential for property value appreciation, aiming to maintain the attractiveness of its real estate against these alternative investments.

| Substitute Type | Description | 2024 Market Insight | Impact on Aldar | Aldar's Mitigation Strategy |

|---|---|---|---|---|

| Rental Properties | Direct alternative to homeownership, offering flexibility. | Abu Dhabi apartment rents up 15-20% YoY. | Diverts potential buyers from Aldar's sales. | Focus on rental income and property value growth. |

| Alternative Investments | Stocks, bonds, international real estate. | Varied global equity market performance in 2024. | Competition for investor capital. | Highlighting consistent rental yields and capital appreciation. |

| Other UAE Emirates | Property markets in Dubai, etc. | Abu Dhabi saw AED 100 billion in foreign investment transactions in 2023. | Potential for buyers to choose competing markets. | Showcasing Abu Dhabi's competitive pricing and supportive policies. |

Entrants Threaten

Developing large-scale, integrated communities in Abu Dhabi, a core business for Aldar Properties, demands immense upfront capital. This includes the significant costs associated with acquiring prime land, extensive construction, and the development of essential infrastructure like roads, utilities, and public amenities. These substantial financial commitments act as a formidable barrier, effectively deterring potential new players from entering the market.

For instance, in 2024, the average cost of land acquisition for significant real estate projects in Abu Dhabi continued to be a major capital outlay. Aldar's established financial strength and proven track record grant it privileged access to capital markets, enabling it to secure the necessary funding for its ambitious projects. This financial muscle further solidifies its position and makes it exceedingly difficult for less capitalized new entrants to compete.

Access to prime, strategically located land is a significant barrier for new entrants in the real estate development sector. Aldar Properties, for instance, benefits immensely from its substantial landbank and strong existing relationships, particularly with government entities. This grants them preferential access to desirable development sites, a crucial advantage that new competitors would find difficult to replicate.

New players entering the market would face considerable challenges in acquiring comparable land parcels at competitive prices, especially in sought-after areas. For example, in 2024, Aldar continued to secure key development plots, reinforcing its competitive edge. The cost and availability of prime real estate remain a substantial hurdle, limiting the ability of new entrants to establish a strong foothold.

The real estate industry, particularly in prominent markets like Abu Dhabi where Aldar Properties operates, is subject to stringent government regulations and requires extensive approvals. New entrants face significant hurdles in obtaining the necessary permits for land acquisition, construction, and sales, a process often characterized by its complexity and lengthy timelines. For instance, in 2024, the UAE government continued to refine its real estate laws, emphasizing developer accountability and buyer protection, which adds another layer of compliance for any new player.

Aldar, having been a cornerstone of Abu Dhabi's real estate development for years, has cultivated deep-rooted relationships and established efficient, well-understood processes for navigating these regulatory landscapes. This established presence and familiarity with governmental bodies and their requirements act as a substantial barrier to entry. New companies would need to invest considerable time and resources to build similar rapport and understanding, making it difficult to compete on a level playing field with an incumbent like Aldar.

Brand Loyalty and Reputation

Aldar Properties has cultivated a robust brand reputation in Abu Dhabi, synonymous with quality, reliability, and the successful delivery of integrated communities. This deeply ingrained trust and brand loyalty among its customer base, including both local and international investors, presents a significant barrier for new companies aiming to quickly gain substantial market share.

Aldar’s consistent delivery of projects and proactive customer engagement further solidify its brand standing, making it challenging for newcomers to replicate its established market position.

- Established Trust: Aldar’s long-standing presence and consistent project delivery have fostered significant trust among buyers.

- Integrated Communities: The company's focus on developing comprehensive communities, rather than just individual properties, builds strong customer loyalty.

- Investor Appeal: Aldar's reputation attracts both local and international investors, creating a high bar for new entrants to match.

- Brand Reinforcement: Ongoing customer engagement and a history of reliable performance continually strengthen Aldar's brand, deterring new competition.

Economies of Scale and Experience

Aldar Properties benefits significantly from economies of scale in procurement, construction, and property management, a direct result of its substantial operational size and years of experience in the UAE market. For instance, in 2024, Aldar continued to leverage its scale to secure favorable terms with suppliers and contractors across its diverse project portfolio, which includes residential, commercial, and hospitality developments. This scale translates into lower per-unit costs, a critical barrier for any new player attempting to enter the competitive Abu Dhabi real estate landscape.

New entrants would inherently struggle to match Aldar’s cost efficiencies. They would face higher per-unit costs for materials, labor, and financing, putting them at a distinct disadvantage from the outset. Furthermore, Aldar's extensive experience has cultivated deep expertise in project execution, navigating regulatory environments, and effective asset management, a learning curve that new companies would find steep and costly to overcome. This accumulated knowledge base is not easily replicated and provides Aldar with a sustained competitive edge.

- Economies of Scale: Aldar's large operational footprint allows for bulk purchasing of materials and services, reducing per-unit costs.

- Experience Advantage: Years of project development and property management have honed Aldar's operational efficiency and risk mitigation strategies.

- Cost Disadvantage for New Entrants: New companies lack Aldar's established supply chains and operational expertise, leading to higher initial costs.

- Diversified Model Reinforces Scale: Aldar's broad business model, encompassing development, investment, and property management, amplifies its economies of scale across different segments.

The threat of new entrants for Aldar Properties in Abu Dhabi is generally low, primarily due to substantial capital requirements and the need for extensive regulatory approvals. Aldar's established financial strength, significant landbank, and deep relationships with government entities create high barriers to entry.

In 2024, the continued high cost of prime land acquisition and the complex, time-consuming approval processes remained significant deterrents for newcomers. Aldar's brand reputation and economies of scale further solidify its market position, making it difficult for new players to achieve competitive cost structures or establish comparable trust.

| Barrier Type | Impact on New Entrants | Aldar's Advantage |

|---|---|---|

| Capital Requirements | Very High (Land, Construction, Infrastructure) | Strong financial backing, access to capital markets |

| Regulatory Approvals | High (Complex, time-consuming permits) | Established relationships, proven navigation of processes |

| Land Access | High (Limited prime locations, high costs) | Substantial landbank, preferential government access |

| Brand Reputation & Trust | High (Requires time and consistent delivery) | Long-standing presence, proven track record |

| Economies of Scale | High (Procurement, construction costs) | Large operational size, optimized supply chains |

Porter's Five Forces Analysis Data Sources

Our Aldar Properties Porter's Five Forces analysis is built upon a foundation of verified data, including Aldar's annual reports, industry-specific market research from firms like Knight Frank and CBRE, and official government data on the UAE real estate sector.